TIMELINE PART 14

- CLICK HERE FOR TIMELINE PART 1

- CLICK HERE FOR TIMELINE PART 2

- CLICK HERE FOR TIMELINE PART 3

- CLICK HERE FOR TIMELINE PART 4

- CLICK HERE FOR TIMELINE PART 5

- CLICK HERE FOR TIMELINE PART 6

- CLICK HERE FOR TIMELINE PART 7

- CLICK HERE FOR TIMELINE PART 8

- CLICK HERE FOR TIMELINE PART 9

- CLICK HERE FOR TIMELINE PART 10

- CLICK HERE FOR TIMELINE PART 11

- CLICK HERE FOR TIMELINE PART 12

- CLICK HERE FOR TIMELINE PART 13

6/12/18 :

- Milwaukee Business Journal: Green Bay Packaging Inc. to invest $500 Million for new recycled paper mill, expansion

Green Bay Packaging Inc. [GBPI] is planning to spend more than $500 million to build a new recycled paper mill in Green Bay and expand its shipping container division in a project that’s expected to create 200 jobs throughout the state.

The Wisconsin Economic Development Corp. [WEDC] is working with the Green Bay-based company on a state tax credit award of about $60 million to support the investment, Wisconsin Gov. Scott Walker and company officials said Tuesday. …

In addition to building the new mill, the company will invest $25 million in the expansion of its Green Bay Shipping Container Division. In May, Green Bay Packaging announced the acquisition of Wisconsin Packaging Corp., a Fort Atkinson manufacturer of corrugated packaging and displays. Green Bay Packaging plans to continue to operate and grow the Fort Atkinson facility in the future.

Green Bay Packaging [Inc. / GBPI] has announced plans to build a new $500 million facility, the largest business development project in Brown County’s history. …

Groundbreaking is scheduled for September 2018 at the site on North Quincy Street. The goal is to finish the mill within two years.

The plan must first pass the Green Bay City Council. …

It’s also the first new paper mill in Wisconsin in over 30 years.

“Huge project for us, by far the biggest thing we’ve ever done in the history of our company,” said William Kress, Green Bay Packaging [Inc.]President/CEO. “It’s kind of a leap of faith. I will tell you that it makes me a little nervous, it’s a lot of money, but we are fortunate to have a lot of good bankers on our side to help us through this, and we will carry on.” …

The company is also touting the new facility’s environmental upgrades. The coal boiler will be replaced with two natural gas boilers to reduce fuel emissions. The plant will also use a reclaimed water system that will not put wastewater into the Fox River or the Bay, according to Green Bay Packaging [Inc. / GBPI].

- USA TODAY / Green Bay Press-Gazette: Green Bay Packaging Inc. to expand local operation, add up to 200 jobs, invest over $580M

[GBPI President/CEO William] Kress announced the expansion Tuesday morning. He was joined by Gov. Scott Walker, Brown County Executive Troy Streckenbach and Green Bay Mayor Jim Schmitt, who announced government incentives totaling almost $90 million for the project.

“This is a big risk for them and we’re going to share some of it with them,” Schmitt said. …

Wisconsin Economic Development [Corp. / WEDC] CEO Mark Hogan said the state will provide $60 million in enterprise zone tax credits tied to job retention and creation. Streckenbach said the county will spend $5.3 million on infrastructure to create a Fox River papermaking corridor in the area.

Green Bay Economic Development Director Kevin Vonck said the city will create a new tax incremental financing district for the project that’s projected to rebate up to $23 million in property taxes to the company once the new mill is built. Schmitt said the city also would deed its evidence storage building, located near Green Bay Packaging’s Quincy Street mill, to the company as well.

[Green Bay Packaging Inc. Executive Vice President Bryan] Hollenbach said the 2½-year construction phase means time is of the essence. The city, county and state all expect to review funding requests by the end of June, and Hollenbach said the company hopes Miron Construction will begin construction in September.

The company says it will replace its facility-wide coal boiler with two natural gas boilers, reducing fuel emissions of sulfur dioxide and particulate matter emissions by more than 90%.

Green Bay Packaging [Inc.] says it will also partner with NEW Water, Green Bay’s local metropolitan water treatment facility, to construct a reclaimed water system that utilizes treated wastewater for production and does not discharge any wastewater back into the Fox River or Bay of Green Bay.

06/14/18 :

In the joint committee meeting, Brown County supervisors agreed a $5.3 million investment is worth it to keep Green Bay Packaging [Inc.] and its 1,100 jobs in the area. The full county board is expected to vote on the deal next week. …

One concern a couple supervisors expressed was the timing of the project. They say it would have helped to have more notice to have some of their questions answered and to hear from constituents.

“I was disappointed and really would have preferred that they at least allowed a month’s time to pass,” said [Brown County Supervisor James] Kneiszel. …

Bryan Hollenbach, Executive Vice President of Green Bay Packaging [Inc.], says negotiations between the company and the county started in March.

In addition to Brown County’s contribution, the city of Green Bay plans to kick in $23 million in TIF assistance. The state plans to provide $60 million in tax credits.

Green Bay Packaging [Inc.] says it is vital for all three groups to pass the incentive deals before June 30th.

“We have to look at it from a business point of view,” said Hollenbach. “We have to move very fast. If we don’t get this paper machine on order, this project is going to be delayed significantly.”

Company leaders say the paper machine order is nearly half of the $500 million investment it is making, and the order won’t happen until the incentive deals are secured. …

The goal is to break ground in September and start operations in the new facility in 2021.

- USA TODAY / Green Bay Press-Gazette –

Brown County supervisors recommend OK on $5.3M in aid to $580M Green Bay Packaging Inc. expansion

A group of Brown County supervisors on Thursday recommended approval of $5.3 million in in-kind contributions to a $580 million expansion proposed by Green Bay Packaging Inc.

[S]everal supervisors complained that they were voting on a project for which they had been given only two days’ notice, and one they must give final approval next week.

…De Pere Supervisor Jim Kneiszel [said] “I don’t understand why we couldn’t have at least a month.”

“We just have to trust in the administration,” said Wrightstown Supervisor John Van Dyck. …

Aid package

• COUNTY: Brown County would spend $5.3 million on infrastructure to create a Fox River papermaking corridor.

• CITY: Green Bay would create a tax-incremental-financing district that would return up to $23 million in property taxes to the company once the new mill opens. The city also will deed its evidence-storage building, near the company’s Quincy Street mill, to the company.

• STATE: Wisconsin would provide $60 million in enterprise zone tax credits.Approvals needed

• Green Bay Packaging [Inc.] has asked local and state government to fast-track the project so it can order machinery, and break ground in September. That means there will be several meetings in the coming days to seek approvals.

• Green Bay’s Redevelopment Authority will meet at 1:30 p.m. Friday to review the development agreement. City Council will vote on the agreement Tuesday night.

• The 26-member Brown County Board will be asked to approve the county’s $5.3 million in-kind contribution on Wednesday night.

• The Wisconsin Economic Development Corp. [WEDC] board of directors will be asked to act on the state’s $60 million in incentives at its board meeting on June 29.

06/19/18 :

- June 19, 2018 Opinion and Decision, Wisconsin Court of Appeals District III Appeal No. 2018-AP-2527-FT, Tissue Technology LLC, Plaintiff-Respondent v. ST Paper LLC, Defendant-Third Party Plaintiff-Appellant

06/20/18 :

- Plastics Recycling Update: Plastics-to-oil fraudster & Envion executive Michael Han convicted for tax evasion

A former plastics-to-oil CEO has been convicted of tax evasion for failing to pay taxes on $14 million he obtained by defrauding investors, according to prosecutors.

A federal jury found Michael Sang Han guilty of two counts of tax evasion in U.S. District Court for the District of Columbia last month. Han served as president and CEO of Envion, a plastics-to-oil (PTO) company launched in 2004.

“Han convinced two individuals to invest nearly $40 million in his company, then used more than $14 million of that money to fund a lavish personal lifestyle,” according to a release from the U.S. Department of Justice.

Envion, which was active in Washington, D.C., Virginia and Florida over the years, claimed to have a patent for a machine dubbed the “EZ Oil Generator,” capable of converting plastics to oil. The company was profiled by several media outlets when Envion unveiled its pilot equipment in 2009. …

In subsequent years, investors grew dubious of the company’s claims, according to a grand jury indictment originally filed in 2015 and updated in 2017. The investors had put money into the company based on its claims that it owned the PTO patent and technology, according to the indictment. But they later learned Envion did not have such a patent, and it did not have the capacity to produce its technology during the period they were investing.

Envion is no longer operating (an unrelated company now operates using that name).

Prosecutors said Han used the money from investors to purchase a house in Palm Beach, Fla. complete “extravagant renovations and internal decorations,” take flights on private jets and acquire luxury cars. …

High-profile investor

One of the investors was former U.S. Secretary of Defense Frank Carlucci, who served in the Reagan Administration. Carlucci began investing in Envion in 2004, and over the years invested $32 million into the company, according to a lawsuit he later filed against Han and the company.According to the suit, Han told Carlucci that high-profile investors including former presidents Bill Clinton and George W. Bush, Warren Buffett and Bill Gates were interested in the company. …

Carlucci was awarded $37 million in a 2013 judgment. Some of Han’s assets were sold in response to the judgment, including the home in Palm Beach that sold for $5.35 million. Carlucci died earlier this month at 87.

06/26/18 :

June 26, 2018 Letter from Phil Reinhart, Brown Co. Case No. 18-CV-245, Ronald Van Den Heuvel v. Philip Reinhart, Steve Smith [Stephen Smith] & Ed Kolasinski

June 26, 2018 Letter from Phil Reinhart, Brown Co. Case No. 18-CV-245, Ronald Van Den Heuvel v. Philip Reinhart, Steve Smith [Stephen Smith] & Ed Kolasinski

06/28/18 :

07/02/18 :

July 2, 2018 Status Report re Bankruptcy of Defendant American Combustion Technologies of California, Inc., U.S. District Court / Nevada Case No. 2:15-cv-694, CH2E Nevada LLC v. [Abdul] Latif Mahjoob and American Combustion Technologies of California Inc. [ACTI / aka American Combustion Technologies Inc. / aka American Renewable Technologies Inc. / ARTI ]

July 2, 2018 Status Report re Bankruptcy of Defendant American Combustion Technologies of California, Inc., U.S. District Court / Nevada Case No. 2:15-cv-694, CH2E Nevada LLC v. [Abdul] Latif Mahjoob and American Combustion Technologies of California Inc. [ACTI / aka American Combustion Technologies Inc. / aka American Renewable Technologies Inc. / ARTI ]

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

07/03/18 :

- July 3, 2018 Order lifting stay as to Defendant ACTI, U.S. District Court / Nevada Case No. 2:15-cv-694, CH2E Nevada LLC v. [Abdul] Latif Mahjoob and American Combustion Technologies of California Inc. [ACTI]

July 3, 2018 Ron Van Den Heuvel’s Motion for Extension of Time to File Defendant-Appellant’s Brief to August 9, 2018, U.S. 7th Circuit Court of Appeals, Appellate Case No. 18-1147, United States of America, Plaintiff-Appellee v. Ronald H. Van Den Heuvel, Defendant-Appellant

July 3, 2018 Ron Van Den Heuvel’s Motion for Extension of Time to File Defendant-Appellant’s Brief to August 9, 2018, U.S. 7th Circuit Court of Appeals, Appellate Case No. 18-1147, United States of America, Plaintiff-Appellee v. Ronald H. Van Den Heuvel, Defendant-Appellant

- July 3, 2018 Order Granting Ron Van Den Heuvel’s Motion for Extension of Time to File Defendant-Appellant’s Brief to August 9, 2018, U.S. 7th Circuit Court of Appeals, Appellate Case No. 18-1147, United States of America, Plaintiff-Appellee v. Ronald H. Van Den Heuvel, Defendant-Appellant

July 3, 2018 USA’s Motion for Revocation or Modification of Release Order of Defendant Ronald Van Den Heuvel w/ Exhibits, U.S. District Court, Eastern District of Wisconsin, Cases No. 16-CR-64 and 17-CR-160, United States of America v. Ronald H. Van Den Heuvel [27 pages]

July 3, 2018 USA’s Motion for Revocation or Modification of Release Order of Defendant Ronald Van Den Heuvel w/ Exhibits, U.S. District Court, Eastern District of Wisconsin, Cases No. 16-CR-64 and 17-CR-160, United States of America v. Ronald H. Van Den Heuvel [27 pages]

UNITED STATES’ MOTION FOR REVOCATION OR MODIFICATION OF RELEASE ORDER

The United States of America, by and through its attorney, Matthew D. Krueger, United States Attorney for the Eastern District of Wisconsin, respectfully moves the Court to revoke its order releasing defendant Ronald Van Den Heuvel and to order detention pending appeal in Case No. 16-CR-64 and trial in Case No. 17-CR-160. In the alternative, the United States respectfully moves the Court to modify its release order to impose additional conditions of release.

BACKGROUND

Van Den Heuvel has been under court supervision since April 2016 when he was indicted for bank fraud in Case No. 16-CR-64. In that case, Van Den Heuvel was convicted of conspiracy to commit bank fraud in violation of 18 U.S.C. § 371. In advance of the sentencing, Van Den Heuvel moved to withdraw his guilty plea. 16-CR-64, Doc. 171. The Court denied that motion and sentenced Van Den Heuvel to three years of imprisonment on January 5, 2018. 16-CR-64, Doc. 184. The Court ordered Van Den Heuvel to pay restitution of $316,445.47 to Horicon Bank, which to date he has not paid. Id.

In September 2017, Van Den Heuvel was indicted on wire fraud and money laundering charges in Case No. 17-CR-160. These charges allege that Van Den Heuvel pursued a scheme to defraud lenders and investors by making false representations about his “Green Box” business plan, and then used much of the lenders’ and investors’ funds for other purposes. 17-CR-160, Doc. 1. Trial is scheduled for November 13, 2018. 17-CR-160, Doc. 41.

Van Den Heuvel appealed his conviction in Case No. 16-CR-64. For the appeal, Van Den Heuvel obtained new, appointed counsel who has submitted three motions to extend the deadline to file the opening brief. See Case No. 18-1147, Doc. 12, 14, 16. The opening brief is currently due on August 9, 2018.

At sentencing in Case No. 16-CR-64, the Court ordered Van Den Heuvel to report to Bureau of Prisons (“BOP”) custody. But BOP subsequently declined to designate a report date until Van Den Heuvel’s pending charges are resolved. See 16-CR-64, Doc. 207. At a February 20, 2018 hearing, the Court decided to “take no action and allow the sentence to be essentially stayed pending the appeal and pending the resolution of the remaining criminal case so long as it does not appear there is unreasonable delay.” Id. Consistent with the plea agreement in Case No. 16-CR-64, the government did not object to Van Den Heuvel remaining out of custody to face the charges in Case No. 17-CR-160 for six months from sentencing. 16-CR-64, Doc. 151 ¶ 34. That the six-month period elapses on July 5, 2018.

In April 2018, the government presented information to the Court showing that Van Den Heuvel engaged in, and attempted to engage in, financial transactions that carried indicia of fraud. See 17-CR-160, Doc. 40. The Court conducted a bond hearing and imposed three additional conditions of release:

• “Defendant shall seek approval by U.S. Probation for any transactions involving $500.00 or more, either personally or on behalf of his business entities.”

• “Defendant must provide full disclosure to any party he is attempting or soliciting to conduct business with that he” (a) was convicted of bank fraud and faces a 3-year sentence; (b) faces 14 additional counts of wire fraud and money laundering; and (c) has court-appointed counsel because he is indigent.

• “Defendant must submit monthly financial reports to Pretrial Services to include (a) any amount and source of monthly income received; (b) current assets and disposal of assets which are in his name, or over which he has control or is able to convey; (c) provide copies of account statements from any bank or financial institution held in his name or over which he has control.”

17-CR-160, Doc. 42.

On June 18, 2018, the United States provided information to Pretrial Services regarding Van Den Heuvel’s activities that appear to violate his release conditions. This information is summarized below and in Docket No. 46’s Release Status Report. In recent days, the United States has obtained further information, which is being presented here directly to the Court so that it can be considered at the upcoming July 6, 2018 hearing. The underlying records and reports of interview related to this additional information are being submitted to defense counsel by email today.

A. Payments to Oneida Country Club

On May 11, 2018, Van Den Heuvel paid $3,500 in cash to Oneida Golf and Country Club (“Oneida Country Club”) without Pretrial Services’ approval. See Doc. 46. According to the Oneida employee who received the payment, Van Den Heuvel remarked that the Court had lifted restrictions on his bank accounts, and that his wife Kelly was the signer on the accounts and could use funds without repercussions, making it easier for Van Den Heuvel to obtain cash. Van Den Heuvel also paid an additional $14,781 to Oneida Country Club between September 20, 2017 and February 23, 2018, and incurred charges of $2,3228.59 during May 2018. Id.

When questioned by Pretrial Services, Van Den Heuvel claimed the $3,500 cash payment came from Tissue Technology because the Oneida Country Club membership was used for business purposes. 17-CR-160, Doc. 46. But the release condition requires Pretrial Services’ approval not only for personal transactions but also transactions done for Van Den Heuvel’s businesses. Moreover, his claim of business purposes is doubtful. 17-CR-160, Doc. 42. Records from Oneida Country Club show numerous charges for pro shop purchases, lessons, and meals for Van Den Heuvel’s wife and family. These include a charge of $915.60 on September 14, 2017, for new golf clubs and a charge of $834.51 that Kelly Van Den Heuvel incurred on June 5, 2018, for new clubs for herself. See Ex. A (Oneida Country Club records for Sept. 2017); Ex. B (Email with Oneida Country Club and receipt for clubs in June 2018).

B. Transfer of Conversion Van Without Pretrial Services’ Approval

According to knowledgeable witnesses, Van Den Heuvel had control of a 2005 Chevrolet conversion van that was titled in Kelly Van Den Heuvel’s name. Until recently, Van Den Heuvel permitted employees of Patriot Tissue in De Pere, Wisconsin, to use the van. Van Den Heuvel recently transferred the title and keys to the van to an individual named [Tony Hayes] who had come to own equipment known as after-dryers that Van Den Heuvel was seeking to purchase. T.H.’s understanding was that the van was worth $2,500. A records search corroborated that, on June 8, 2018, registration of the van was changed from Kelly Van Den Heuvel to the girlfriend of T.H. U.S. Probation Officer Brian Koehler states that Van Den Heuvel did not seek approval from Pretrial Services before transferring the van.

C. Failure to Provide Complete Monthly Financial Reports

U.S. Probation Officer Brian Koehler reports that in late June 2018, Van Den Heuvel submitted documentation as his required monthly financial report. According to Mr. Koehler, Van Den Heuvel did not submit any account statements from any bank or financial institution.

This omission is concerning because Van Den Heuvel appears to keep bank accounts and assets out of his name to avoid detection. First, the government’s investigation has found numerous bank accounts that Van Den Heuvel controlled but titled in the names of entities or other individuals, often with his wife Kelly Van Den Heuvel having signatory authority. Second, as noted, Van Den Heuvel told the Oneida Country Club employee said that because Kelly was the signer on his bank accounts, she could use funds without repercussions, and he could obtain cash. Third, according to another Oneida Country Club employee, Kelly Van Den Heuvel recently asked to set up an automatic payment of the family’s account from their son’s trust account. (Oneida Country Club denied the request; the government does not have information about the son’s trust account.) Fourth, as noted, the 2005 Chevrolet conversion van was titled in Kelly Van Den Heuvel’s name, even though Van Den Heuvel allowed it to be used primarily for Patriot Tissue employees.

This pattern suggests that Van Den Heuvel is likely using bank accounts in others’ names without disclosing the accounts to Pretrial Services. It seems highly implausible that the Van Den Heuvels could maintain their high-end lifestyle without using any bank accounts.

D. Additional Attempts to Sell Kool Machine

The government recently learned that Van Den Heuvel attempted to persuade a company located in Boise, Idaho – [Dynamis Energy] referred to herein as Company A—to purchase a pyrolysis machine manufactured by Kool Manufacturing. Van Den Heuvel had purchased the Kool machine with funds from victim Cliffton Equities and EB-5 investors, as well as other entities. 17-CR-160, Doc. 40, at 3-4. The Kool machine remains in a warehouse in De Pere, Wisconsin, today. Those victims and other creditors have claims against the Kool machine, which became subject to the Green Box NA Green Bay bankruptcy case. Id. Despite those claims, from early 2016 through as recently as June 26, 2018, Van Den Heuvel periodically contacted Company A in attempts to persuade Company A to purchase the Kool machine.

E. Inappropriate Contacts with Witnesses

In recent weeks, Van Den Heuvel has contacted individuals after learning that they made statements to investigating agents. In several cases, Van Den Heuvel apparently had no legitimate reason to contact the witnesses but rather made the contact for the purpose of conveying his awareness of their cooperation with law enforcement.

First, on June 18, 2018, the United States submitted to Pretrial Services the report of interview of Oneida Country Club employee M.J. The United States also provided Van Den Heuvel’s counsel with a copy of the report. That same day, Van Den Heuvel called M.J. to “thank” her and express apologies for her having to speak with the investigative agent, whom he described as an “asshole.”

Second, that same day, June 18, 2018, Van Den Heuvel sent a text message to a witness [Mason Kashat] whose statement had been disclosed to Van Den Heuvel in discovery. They spoke by phone the next day and Van Den Heuvel claimed he had nearly closed a deal and would be able to repay Ma.K. soon. Van Den Heuvel also added that he had read Ma.K.’s “testimony” and was “not mad” at Ma.K. or his partner, who had also made a statement to investigators.

Third, also on June 18, 2018, Van Den Heuvel called [Brian Glimes], who previously worked for Van Den Heuvel at a sorting and pulping facility. Van Den Heuvel claimed he called to relay that he planned to purchase the facility. But then Van Den Heuvel went on to say he got a “cute note” from the FBI, which reflected that B.G. had used his own money to pay for business expenses at Van Den Heuvel’s request. This apparently referred to a statement that Van Den Heuvel read in a report of interview that B.G. had given.

Fourth, in April 2018, very shortly after receiving information in discovery about A.K.’s cooperation with the government, Van Den Heuvel called A.K. According to A.K., Van Den Heuvel screamed and cursed at him because A.K. had forwarded an email from Van Den Heuvel to the government.

DISCUSSION

I. Van Den Heuvel Should Be Detained for Violating Conditions of Release Pursuant to 18 U.S.C. § 3148(b)

The consequences for violating a condition of release are governed by 18 U.S.C. § 3148(b), which provides that the Court “shall enter an order of revocation and detention if, after a hearing,” the Court:

(1) finds that there is —

(A) probable cause to believe that the person has committed a Federal, State, or local crime while on release; or

(B) clear and convincing evidence that the person has violated any other condition of release; and

(2) finds that —

(A) based on the factors set forth in section 3142(g) of [Title 18], there is no condition or combination of conditions of release that will assure that the person will not flee or pose a danger to the safety of any other person or the community; or

(B) the person is unlikely to abide by any condition or combination of conditions of release.

Thus, detention is required upon findings that (1) Van Den Heuvel either committed a crime or violated a condition of release, and (2) Van Den Heuvel poses a risk of flight or dangerousness, or is unlikely to comply with conditions of release. 18 U.S.C. § 3148(b). The government bears the burden of proof under § 3148(b).

A. Clear and Convincing Evidence Shows That Van Den Heuvel Violated Conditions of Release

The government has carried its burden under § 3148(b)(1)(B) because there is clear and convincing evidence that in at least two recent instances, Van Den Heuvel has violated the condition that he seek Pretrial Services’ approval for financial transactions exceeding $500. First, Van Den Heuvel admitted that he paid $3,500 to Oneida Country Club on May 11, 2018, and the payment is corroborated by the associated business records. Van Den Heuvel’s representation that the payment was a business expense is no defense because the release condition requires approval for business expenditures. 17-CR-160, Doc. 46. More importantly, his representation is false, as evidenced by the inherently personal nature of many of the expenses that led to the Oneida Country Club bills, such as new golf clubs.

Second, Van Den Heuvel did not obtain Pretrial Services’ approval before transferring title of the 2005 Chevrolet van, which T.H. believed to be worth $2,500. He may claim the transfer was not subject to Pretrial Services’ approval because it was titled in Kelly Van Den Heuvel’s name or because it was used for business purposes. But, again, the condition applies to business transactions and to any asset over which he has control, if not title. 17-CR-160, Doc. 46. Precisely because Van Den Heuvel routinely plays games with how he titles assets and comingles personal and business expenses, these violations are serious.

Third, as detailed above, Van Den Heuvel has not provided meaningful disclosure of his finances to Pretrial Services. He and his family must be using some bank accounts, but he has not disclosed any account records. It appears that the only financial records Van Den Heuvel has produced are records he generated himself. Given his bank fraud conviction and the pending charges in this case, the Court should be highly skeptical of records he produces. That is why obtaining records from third-party financial instiutions is so important. The government’s investigation has identified dozens of bank accounts opened by the Van Den Heuvels at numerous banks over the years. Because they switch accounts so frequently, however, Pretrial Services has no effective way to monitor Van Den Heuvel if he does not disclose his financial records. The three foregoing violations are supported by clear and convincing evidence.

B. There Is Probable Cause to Find that Van Den Heuvel Has Committed Additional Crimes While on Release

The government has also carried its burden under § 3148(b)(1)(A) because there is probable cause to find that Van Den Heuvel committed additional crimes while on release. The government incorporates here its April 3, 2018 Motion to Amend Conditions of Release (17-CR- 160, Doc. 40) and summarizes below facts that constitute probable cause that Van Den Heuvel committed, or attempted to commit, wire fraud in violation of 18 U.S.C. § 1343, similar to conduct at issue in Case No. 17-CR-160.

1. Transactions with J.L.

From summer 2016 through early 2018, Van Den Heuvel negotiated with J.L., seeking funding for various projects and equipment. 17-CR-160, Doc. 40, at 2-4. Van Den Heuvel sent J.L. information that was false. Id. For example, Van Den Heuvel sent an “Executive Summary” of the “Great Lakes Tissue” project in Cheboygan, Michigan, claiming that $7.7 million in “EB5 Funds were paid” for equipment in the project. Doc. 40-1, Ex. A. In truth, Van Den Heuvel received substantially less than $7.7 million in EB-5 funds; moreover, most of the funds were not used for equipment for the Cheboygan, Michigan project. Doc. 40, at 3. Van Den Heuvel also sent a resume claiming that “Green Box has partnered with Cargill, Inc.,” Doc. 40-2, Ex. B, when in truth, Cargill never had an agreement with Green Box and had terminated its agreement with a different Van Den Heuvel-controlled entity back in 2013.

2. Attempts to Sell Kool Machine

In November 2017, Van Den Heuvel worked with J.L. in an attempt to sell the Kool machine that is in De Pere, Wisconsin. Doc. 40, at 3-4. As noted, the Kool machine is subject to claims by multiple victims and creditors. Van Den Heuvel nonetheless attempted to sell unit through J.L. and even attempted to charge $5,000 for giving a demonstration of the Kool machine. Id. (As detailed above, Van Den Heuvel also attempted to sell the Kool machine to Company A without disclosing that his ownership of the Kool machine was, at best, clouded by numerous creditors’ claims.) Although the government is not aware of evidence showing that Van Den Heuvel ultimately received any funds from or through J.L., these facts amount to probable cause to find at least attempted wire fraud. That is, Van Den Heuvel made false and misleading representations regarding his business plans and the Kool machines in an attempt to induce payment of funds.

3. Transactions with A.K., Ma.K., and Mi.K.

Van Den Heuvel persuaded [Alex Knapp] and Ma.K. of New York to make three loans, totaling $87,500, sent through interstate wires, to Van Den Heuvel-controlled entities Cotton, Tissue Techonology, Inc., and PCDI MI, from June 2017 through December 2017. Doc. 40, at 5. Among the collateral pledged by Van Den Heuvel for the loans were equipment known as after-dryers. Id. Yet, according to a knowledgeable witness, Van Den Heuvel no longer owned or controlled the after-dryers. Id. These facts constitute probable cause that Van Den Heuvel committed wire fraud. He made fraudulent representations about the nature of the collateral supporting the loans in order to induce payments, which were sent by interstate wire transfer.

In addition, Van Den Heuvel sent Ma.K. and a broker named [Mike Kalet] information in mid- 2017 in an attempt to obtain further funding. Id. at 5. The information contained false information, including that Kelly Van Den Heuvel was the President of Tissue Technology, LLC and PCDI Michigan and had a net worth of $29 million. Id. Van Den Heuvel also told Mi.K. that he had prevailed in a lawsuit against Sharad Tak when, in fact, Tak had prevailed in a federal suit against Van Den Heuvel. Id. The government has no information that indicates Van Den Heuvel successfully obtained funds through Mi.K., but Mi.K. relied on Van Den Heuvel to send misleading information to potential investors. Id. Although this scheme appears to have been less developed, it arguably still constitutes attempted wire fraud.

C. Van Den Heuvel Is Unlikely to Abide by Conditions of Release

Given the evidence that Van Den Heuvel violated release conditions and committed additional crimes, detention is warranted on the ground that Van Den Heuvel is “unlikely to abide by any condition or combination of conditions of release.” 18 U.S.C. § 3148(b)(2)(B). Van Den Heuvel has demonstrated his inability to comply with even simple conditions of release, such as seeking Pretrial Services’ approval for financial transactions. The evidence suggest this inability flows from intractable dishonesty. Van Den Heuvel admitted to the Oneida Country Club employee that he has moved bank accounts out of his name to avoid detection. And when confronted with his Oneida Country Club payment, Van Den Heuvel obfuscated and lied to Pretrial Services. These patterns are longstanding with Van Den Heuvel, who was convicted of defrauding Horicon Bank and now faces charges for another convoluted fraud scheme in Case No. 17-CR-160.

Van Den Heuvel has displayed no sign of stopping his fraudulent conduct. In addition to the post-indictment conduct described above, it bears mentioning that Van Den Heuvel presented information to Pretrial Services on March 23, 2018, regarding multiple additional financial transactions that he claimed to be pursuing. See Doc. 40, at 6-8. First, Van Den Heuvel proposed selling 5% of stock in Tissue Technology for $5 million, even though he represented in his presentence report in Case No. 16-CR-64 that Tissue Technology shares were held in a trust controlled by other individuals, and that the stock had no ascertainable value. Id. at 7. Second, Van Den Heuvel proposed selling stock in Purely Cotton to Great Lakes Tissue in exchange for $2 million in patent royalties, even though the owner of Great Lakes Tissue informed government agents that he had no intention of buying Purely Cotton stock, nor did he have reason to think Purely Cotton had any assets. Id. Third, Van Den Heuvel proposed selling stock in PCDI to a man in Ghana for $6 million, even though Van Den Heuvel represented in his presentence report that PCDI shares were held in a trust controlled by others and had no ascertainable value. Id. at 8. Fourth, Van Den Heuvel proposed entering into a consulting agreement with Great Lakes Tissue and a royalty agreement with PC Fibre Box for intellectual property, even though, again, the ownership structure and value of any intellectual property is highly doubtful. See id. at 8-9.

The government does not yet have sufficient evidence to contend that these transactions amounted to wire fraud, but the proposed transactions remain highly questionable. What may be most striking about these are their sheer number. This reinforces the conclusion that [Ron] Van Den Heuvel is a persistent, unrepentant fraudster, even after being convicted of bank fraud and sentenced to three years of imprisonment.

In sum, the Court cannot find that Van Den Heuvel would comply with new release conditions. The defense will likely propose home confinement or restrictions on Van Den Heuvel’s ability to communicate with witnesses or engage in financial transactions. His track-record, however, provides no basis to believe he would comply with those conditions. In addition, the burden on Pretrial Services to try to monitor his compliance would be unreasonable.

D. No Conditions Can Assure that Van Den Heuvel Will Not Flee or Pose a Danger to Others’ Safety

In addition, the Court can find that detention is required because, based upon the factors set forth in § 3142(g), no condition or combination of conditions will assure that Van Den Heuvel will not flee or pose a danger to the safety of another person or the community. See 18 U.S.C. § 3148(b)(2).

The nature and circumstance of the offense charged, although not a violent crime, is very serious, with fraud loss amounts exceeding $9 million. If convicted of the whole scheme, Van Den Heuvel would be exposed to the potential of lengthy incarceration. This creates an increased likelihood of flight and of Van Den Heuvel engaging in extreme actions, as he has already shown a willingness to contact witnesses inappropriately.

The second § 3142(g) factor is the weight of the evidence. The United States proffers that the evidence is very strong. Numerous witnesses, both victims and individuals who worked with Van Den Heuvel, will testify that Van Den Heuvel made false representations about the Green Box process and how lenders and investors’ funds would be used. Representations about how the funds would be used were also reduced to writing in agreements. Financial records and receipts of expenditures show, in concrete and undisputable fashion, how Van Den Heuvel quickly diverted huge sums of investors’ and lenders’ funds to unauthorized purposes to fuel his lavish lifestyle. This overwhelming evidence increases the risk that Van Den Heuvel will flee or act dangerously towards others.

Next, the history and characteristics of Van Den Heuvel are mixed. Without question, Van Den Heuvel has deep family ties and a long history in the community, and he has appeared consistently at court hearings in these two cases. At the same time, Van Den Heuvel has demonstrated increasingly erratic behavior, as shown by his inappropriate contacts with witnesses. Further, Van Den Heuvel is relatively sophisticated and well-traveled with an uncanny ability to persuade people to lend him large sums of money. His wife and children recently visited the Cayman Islands. Doc. 46. As the trial in this case approaches and Van Den Heuvel runs out of ways to delay incarceration, there is a significant risk that he may seek to flee.

Finally, the Court must assess the nature and seriousness of the danger to any person or the community if Van Den Heuvel remained released. 18 U.S.C. § 3142(g)(4). Van Den Heuvel’s persistent track record of fraudulent conduct creates a real risk that he will continue to seek to defraud others around him, pressuring people to loan funds and invest in his fraudulent business plans. In addition, although Van Den Heuvel does not have a criminal history of violence, witnesses have stated that Van Den Heuvel can become verbally aggressive and that he physically assaulted one witness. Specifically in August 2011, former business partner [Howard Bedford] confronted Van Den Heuvel regarding his fraudulent misuse of funds, and Van Den Heuvel responded by punching [Howard Bedford] in the head. H.B. states that he took himself to a hospital afterwards and was diagnosed with a concussion. More recently, Van Den Heuvel was verbally abusive towards A.K., and he has engaged in subtle intimidation of witnesses in recent contacts.

Taken together, the Court could also base detention on the finding that no condition or combination of conditions will assure that Van Den Heuvel will not flee or pose a danger to the safety of another person or the community. 18 U.S.C. § 3148(b)(2).

II. Van Den Heuvel Should Be Detained Pending Appeal in Case No. 16-CR-64 Pursuant to 18 U.S.C. § 3143

The Court should also detain Van Den Heuvel pending appeal in Case No. 16-CR-64. Release or detention pending appeal is governed by 18 U.S.C. § 3143(b), which creates a presumption of detention unless the Court makes findings that support release. The Court has not expressly make such findings in deciding whether to permit Van Den Heuvel to remain released. Section 3143(b)(1) provides that the Court “shall order that a person who has been found guilty of an offense and sentenced to a term of imprisonment, and who has filed an appeal . . . , be detained,” unless the Court finds:

(A) by clear and convincing evidence that the person is not likely to flee or pose a danger to the safety of any other person or the community if released under section 3142(b) or (c) of this title; and

(B) that the appeal is not for the purpose of delay and raises a substantial question of law or fact likely to result in —

(i) reversal,

(ii) an order for a new trial,

(iii) a sentence that does not include a term of imprisonment, or

(iv) a reduced sentence to a term of imprisonment less than the total of the time already served plus the expected duration of the appeal process.

18 U.S.C. § 3143(b)(1). The burden to show, by clear and convincing evidence, that the requirements for release have been met lies with Van Den Heuvel. See United States v. Bilanzich, 771 F.2d 292, 298 (7th Cir. 1985) (holding that § 3143 “requires the defendant, not the government, to shoulder ‘the burden of showing the merit of the appeal’”); see also, e.g., United States v. Hanhardt, 173 F. Supp. 2d 801, 805 (N.D. Ill. 2001) (holding that the defendant bears the burden of proof on each element of § 3143, citing United States v. Holzer, 848 F.2d 822, 824 (7th Cir. 1988)).

Thus, to avoid detention pending appeal, Van Den Heuvel must show both that he is unlikely to flee or cause danger to others, and also that his appeal raises a substantial question of law or fact. The above discussion of the § 3142(g) factors shows why Van Den Heuvel cannot show that he is unlikely to flee, given the significant incarceration he faces, his ability to access funds, and his familiarity with international travel. Nor can he show he is unlikely to be dangerous to others, given his persistent fraud schemes and aggressive behavior to individuals who have been confronted him and cooperated with the government.

Van Den Heuvel also cannot carry his burden regarding the merits of his appeal. Although his opening brief has not yet been filed, it is anticipated that Van Den Heuvel will challenge the denial of his motion to withdraw his plea. The Court issued a detailed, thorough written order on that issue, and there is no apparent question of law or fact, let alone a substantial one by which Van Den Heuvel could carry his burden under § 3143(b). 16-CR-64, Doc. 183. Accordingly, detention under § 3143(b) is required.

Detention under this provision makes sense for the additional reason that the Court had ordered at sentencing that Van Den Heuvel should report to BOP custody. Given Van Den Heuvel’s disregard for his conditions of release, it is appropriate for the Court to follow through with its initial plan of having him begin to serve his sentence in Case No. 16-CR-64.

Defense counsel may contend that detention will prevent Van Den Heuvel from being able to prepare for trial in Case No. 17-CR-160, given the complexity of the case and volume of discovery. Without meaning to minimize the difficulty of preparing for trial while detained, numerous defendants must do so. Working with the U.S. Marshals Service, the Court is likely able to ensure that the Brown County officials provide Van Den Heuvel with reasonable access to counsel and discovery. To date, he has had well over six months to review discovery and confer with counsel, which is far more than many defendants receive.

III. In the Alternative, the Court Should Modify the Conditions of Release

In the alternative that the Court decides not to detain Van Den Heuvel, the Court should modify the release conditions to require Van Den Heuvel to provide meaningful financial information and to limit Van Den Heuvel’s ability to contact witnesses or pursue business plans. Specifically, the government would recommend these additional conditions:

(a) home confinement with GPS monitoring;

(b) a prohibition on communicating in any manner with potential witnesses in this case; and

(c) a prohibition on soliciting, proposing, or considering any transactions that involved any business investments or loans or transfer or leases of equipment, including but not limited to any transactions related to any pyrolysis units (a/k/a Kool Units) or after-dryers.

Additionally, if the Court does not order Van Den Heuvel detained or subject to home confinement, the United States respectfully requests that Van Den Heuvel be required to seek full-time employment with an employer that would pay him wages, subject to approval of Pretrial Services. Theoretically, working full-time for wages would limit the amount of time that Van Den Heuvel could spend trying to pursue new fraud schemes and would help Van Den Heuvel earn legitimate wages for the payment of restitution and the reimbursement of appointed counsel fees.

CONCLUSION

For the reasons stated above, the United States respectfully requests that Van Den Heuvel be detained pending trial in Case No. 17-CR-160 and appeal in Case No. 16-CR-64. In the alternative, the United States respectfully requests that the conditions of Van Den Heuvel’s release be modified as described above.

Dated this 3rd day of July, 2018 at Milwaukee, Wisconsin.

Respectfully submitted,

/s/ Matthew D. Krueger

United States Attorney

Eastern District of Wisconsin

07/05/18 :

- July 5, 2018 Brief and Required Short Appendix of Plaintiffs-Appellants Tissue Technology LLC, Partners Concepts Development Inc., Oconto Falls Tissue Inc., & Tissue Products Technology Corp., U.S. 7th Circuit Court of Appeals, Appellate Case No. 18-1835, Tissue Technology LLC, Partners Concepts Development Inc., Oconto Falls Tissue Inc., and Tissue Products Technology Corp., Plaintiffs-Appellants v. TAK Investments LLC and Sharad Tak, Defendants-Appellees

07/06/18 :

- July 6, 2018 Bond Review Hearing Minutes re: Government’s Motion for Revocation or Modification of Release Order of Ron Van Den Heuvel, U.S. District Court, Eastern District of Wisconsin, Case Nos. 17-CR-160 and 16-CR-64, United States of America v. Ronald H. Van Den Heuvel

Green Bay Press-Gazette / USA TODAY –

Green Bay Press-Gazette / USA TODAY –

Green Box owner

Ron Van Den Heuvel jailed

for witness intimidation and

unauthorized spending

by Jonathan Anderson

[original version]

[Ron] Van Den Heuvel has been convicted of conspiracy to commit bank fraud for using straw borrowers to obtain loans under false pretenses for personal use and to keep his business, Green Box NA, and associated businesses afloat. He was sentenced in January to three years in prison, but he was allowed to remain free under certain conditions while additional federal charges — wire fraud and money laundering — remain pending.

U.S. District Court Judge William Griesbach had required Van Den Heuvel to notify the government of any financial transactions larger than $500, file monthly reports disclosing income and bank statements and disclose his legal and financial troubles to potential investors.

Prosecutors alleged that Van Den Heuvel in May paid $3,500 in cash to Oneida Golf and Country Club without the government’s approval and had previously paid nearly $15,000 to the club between September 2017 and February 2018.

The government also alleged that Van Den Heuvel failed to submit bank account statements as required, even though prosecutors believe that Van Den Heuvel has numerous accounts under his control but not in his name. …

Van Den Heuvel also was accused of engaging in “subtle intimidation of witnesses in recent contacts,” selling a van without authorization and attempting to sell a pyrolysis machine that is the subject of claims from multiple creditors.

Van Den Heuvel is charged in federal court with 14 counts of wire fraud and money laundering related to $9 million collected from investors in his now-bankrupt Green Box recycling business. The case is scheduled to go to trial on November 13.

[updated version]

Ron Van Den Heuvel, the De Pere businessman accused of bilking millions from investors, was jailed Friday after authorities alleged he committed more fraud and intimidated witnesses while free on bond.

“Fraud has continued,” U.S. District Court Judge William Griesbach said. “He’s continued to commit crimes.”

Van Den Heuvel was sentenced to three years in prison in January for conspiracy to commit bank fraud and, in a second case, also faces 14 counts of wire fraud and money laundering for allegedly deceiving investors out of $9 million in his now-bankrupt Green Box recycling business. …

Court records show Van Den Heuvel and his family spent more than $18,000 in total at the club between September and May — all while he claimed to be indigent and in need of a public defender.

Van Den Heuvel, who took the witness stand to testify, said he told the lender the $20,000 loan would be used for business expenses.

Receipts show most if not all of the money was used to buy equipment, golf lessons and food such as shrimp cocktails and tacos for Van Den Heuvel’s wife and children.

Van Den Heuvel’s wife also transferred the title of a van worth $2,500 to help pay down a debt.

Krueger said Van Den Heuvel also failed to submit bank account statements as required. Investigators believe that Van Den Heuvel has numerous accounts under his control even though not all are in his name.

#LockedHimUp

07/09/18 :

- ABC 2 WBAY – “Fraud has continued”: WEDC funding recipient Ron Van Den Heuvel’s release revoked in fraud case

On July 6, the court ordered a bond hearing. There was testimony that Van Den Heuvel had received a $20,000 loan and spent thousands of dollars at Oneida Golf and Country Club.

“The Court is satisfied that fraud has continued and the defendant has shown disregard for the orders of this Court,” reads the federal court records. “The Court finds the temptation to flee or take steps to avoid responsibility of facing trial is strong.”

Van Den Heuvel still faces prosecution for a federal indictment on 14 counts of wire fraud and money laundering.

Prosecutors say he fraudulently obtained more than $9 million in loans and investments for his eco-friendly “Green Box” business plan.

The indictment alleges that Van Den Heuvel claimed that Green Box could turn post consumer waste into usable consumer products and energy. …

Van Den Heuvel allegedly defrauded a range of victims, including individual acquaintances, the Wisconsin Economic Development Corporation (WEDC), a Canadian private investment firm, and Chinese investors in the EB-5 immigrant investor program.

In October of 2011, WEDC provided Green Box NA Green Bay, LLC with a loan of $1,116,000 to purchase equipment to create 116 jobs in the “Green Box” operation.

Instead, the indictment says he submitted false certifications claiming to have spent the funds properly.

In January of 2012, WEDC also awarded Green Box with a $95,000 grant to reimburse the company for costs to train new workers. Van Den Heuvel is accused of submitting fraudulent time records for training that never happened.

Counts 1-10 of the indictment charge Van Den Heuvel with executing the scheme to defraud by use of interstate wire communications. Maximum penalty on each count includes not more than 20 years in prison, a fine of $250,000 or both, plus a mandatory $100 special assessment and a period of supervised release.

Counts 11-14 charge Van Den Heuvel with unlawful financial transactions involving the ill-gotten gains. The maximum penalty for each individual count includes not more than 5 years in prison a fine of $250,000 or both. Plus a mandatory $100 special assessment and a term of supervised release not to exceed three years.

07/11/18 :

Wisconsin State Journal – WEDC writes off $1.1 million loan to convicted De Pere businessman Ron Van Den Heuvel

Wisconsin State Journal – WEDC writes off $1.1 million loan to convicted De Pere businessman Ron Van Den Heuvel

- Milwaukee Journal Sentinel / USA TODAY – Wisconsin jobs agency WEDC writes off $1.1 million loan owed by De Pere businessman Ron Van Den Heuvel jailed for defrauding investors

- FOX 11 WLUK – WEDC to write off loan to failed De Pere business Green Box NA Green Bay LLC owned by Ron Van Den Heuvel

See also:

• July 11, 2018 WI State Senator Dave Hansen Press Release,

WEDC’s Continued Failure, Green Box Edition

• July 11, 2018 WI State Senator Jennifer Shilling Press Release,

Can’t pay back $1 million loan? WEDC says ‘No worries’; Walker’s troubled job agency leaves taxpayers with the bill, again

• July 11, 2018 Democratic Party of Wisconsin Press Release,

Walker’s WEDC foots taxpayers with $1 million loan given to conman in exchange for zero jobs; WEDC’s mismanagement casts more doubt on Foxconn deal

07/12/18 :

07/13/18 :

July 13, 2018 Order re: Withdrawal of Atty. James Kawahito, U.S. District Court / Nevada Case No. 2:15-cv-694, CH2E Nevada LLC v. Abdul Latif Mahjoob & American Combustion Technologies, Inc. / American Combustion Technologies of California, Inc. / ACTI

July 13, 2018 Order re: Withdrawal of Atty. James Kawahito, U.S. District Court / Nevada Case No. 2:15-cv-694, CH2E Nevada LLC v. Abdul Latif Mahjoob & American Combustion Technologies, Inc. / American Combustion Technologies of California, Inc. / ACTI

07/16/18 :

July 16, 2018 Defendant Ronald Van Den Heuvel’s Motion to File Under Seal, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

July 16, 2018 Defendant Ronald Van Den Heuvel’s Motion to File Under Seal, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

- July 16, 2018 Order, U.S. Tax Court Docket No. 21583-15, VHC Inc. and Subsidiaries v. Commissioner of Internal Revenue Service [IRS]

07/18/18 :

July 18, 2018 Order re: Withdrawal of Atty. Hector Carbajal, U.S. District Court / Nevada Case No. 2:15-cv-694, CH2E Nevada LLC v. Abdul Latif Mahjoob & American Combustion Technologies, Inc. / American Combustion Technologies of California, Inc. / ACTI

July 18, 2018 Order re: Withdrawal of Atty. Hector Carbajal, U.S. District Court / Nevada Case No. 2:15-cv-694, CH2E Nevada LLC v. Abdul Latif Mahjoob & American Combustion Technologies, Inc. / American Combustion Technologies of California, Inc. / ACTI

07/19/18 :

- July 19, 2018 Order to Show Cause, U.S. District Court / Nevada Case No. 15-cv-694, CH2E Nevada LLC v. [Abdul] Latif Mahjoob and American Combustion Technologies of California Inc. [ACTI]

On July 19, 2018, Defendant ACTI’s corporate representative failed to appear, despite the Court’s clear orders, at the hearing on its counsels’ motions. …

In light of the above, Defendant ACTI is hereby ORDERED to show cause in writing, by August 20, 2018, why the Court should not issue sanctions against it for violating Court orders, up to and including a Court fine of up to $500 and/or case-dispositive sanctions. …

Failure to respond to this order will result in a recommendation that judgment be entered against Defendant ACTI.

July 19, 2018 Plaintiff Oneida Nation of WI Memorandum of Law in support of its motion for summary judgment, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 16-CV-1217, Oneida Nation of Wisconsin v. Village of Hobart, Wisconsin

July 19, 2018 Plaintiff Oneida Nation of WI Memorandum of Law in support of its motion for summary judgment, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 16-CV-1217, Oneida Nation of Wisconsin v. Village of Hobart, Wisconsin- July 19, 2018 Oneida Nation of WI Motion for Summary Judgment, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 16-CV-1217, Oneida Nation of Wisconsin v. Village of Hobart, Wisconsin

July 19, 2018 Defendant Village of Hobart WI Memorandum of Law in support of its motion for summary judgment, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 16-CV-1217, Oneida Nation of Wisconsin v. Village of Hobart, Wisconsin

July 19, 2018 Defendant Village of Hobart WI Memorandum of Law in support of its motion for summary judgment, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 16-CV-1217, Oneida Nation of Wisconsin v. Village of Hobart, Wisconsin- July 19, 2018 Village of Hobart WI Motion for Summary Judgment, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 16-CV-1217, Oneida Nation of Wisconsin v. Village of Hobart, Wisconsin

07/20/18 :

July 20, 2018 Defendant Ronald Van Den Heuvel’s Notice of Motion and Motion to Dismiss the Use of Defendant’s Court Appointed Counsel, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

July 20, 2018 Defendant Ronald Van Den Heuvel’s Notice of Motion and Motion to Dismiss the Use of Defendant’s Court Appointed Counsel, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

Defendant’s counsel and the late attorney, Mike Fitzgerald had on multiple occasions requested the return of over 290,000 pages of documents and the defendant’s server which were both taken 2077A and 2077B offices in the raid. To date, the server has not been returned. Through due diligence, the defendant located the PCDI server. Failure by the defendant’s counsel to report the email hacking incident allowed for the breach to continue unchecked. The 1,700 pages presented by the DOJ is clear proof that this theft of emails and delivery of them to the DOJ and the Oneida Eye did occur.

![]()

- July 20, 2018 Defendant Ronald Van Den Heuvel’s Memorandum of Law, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

The Department of Justice and prosecution know for certain that millions of illegally gained private documents from the general search have been given to the Oneida Eye. This allows Google to pick them up for the social media.

![]()

- July 20, 2018 USA’s Unopposed Motion for Status Conference, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

07/23/18 :

July 23, 2018 Letter from Oneida Indian Nation of NY re the July 18, 2018 decision of the U.S. Trademark Trial and Appeals Board, U. S. District Court for the Northern District of New York, Case No. 5:17-CV-913, Oneida Indian Nation of New York v. United States Department of the Interior

July 23, 2018 Letter from Oneida Indian Nation of NY re the July 18, 2018 decision of the U.S. Trademark Trial and Appeals Board, U. S. District Court for the Northern District of New York, Case No. 5:17-CV-913, Oneida Indian Nation of New York v. United States Department of the Interior

- July 23, 2018 Plaintiffs-Appellants Brief on appeal of March 2, 2018 Order by Judge Thomas J. Walsh in Brown County WI Circuit Court Case No. 2014-CV-1664, Wisconsin Court of Appeals District III – IV Appeal No. 2018-AP-761, Scott J. Brauer, Adam Kilgas, Duane A. McVane, Matt J. Vandehey & Paul Weyers, Plaintiffs-Appellants v. Veripure LLC, Badger Sheet Metal Works of Green Bay Inc., Gregory A. DeCaster, Greg A. DeCaster & Judith A. DeCaster Revocable Trust, GADJAD Properties LLC, Richard Chernick, Badger Capital Investments LLC & David Conard, Defendents-Respondents

07/24/18 :

July 24, 2018 Docket Entry Notification of July 26, 2018 Status Hearing reset to September 26, 2018, U.S. District Court, Northern District of Illinois, Eastern Division, Docket No. 17-CV-108, RNS Servicing LLC v. Spirit Construction Services Inc., Steven Van Den Heuvel, ST Paper LLC & Sharad Tak

July 24, 2018 Docket Entry Notification of July 26, 2018 Status Hearing reset to September 26, 2018, U.S. District Court, Northern District of Illinois, Eastern Division, Docket No. 17-CV-108, RNS Servicing LLC v. Spirit Construction Services Inc., Steven Van Den Heuvel, ST Paper LLC & Sharad Tak

![]()

![]()

![]()

![]()

07/25/18 :

- FILED – July 25, 2019 Summons & Complaint, Brown Co. Case No. 18-CV-902, Vos Electric Inc. v. GlenArbor Partners Inc.

07/27/18 :

July 27, 2018 USA’s Unopposed Motion to Take the Video Deposition of Steven Granoff, U.S. District Court for the Eastern District of Pennsylvania, Case No. 15-CR-398, United States of America v. Troy Wragg, Amanda Knorr & Wayde McKelvy

July 27, 2018 USA’s Unopposed Motion to Take the Video Deposition of Steven Granoff, U.S. District Court for the Eastern District of Pennsylvania, Case No. 15-CR-398, United States of America v. Troy Wragg, Amanda Knorr & Wayde McKelvy

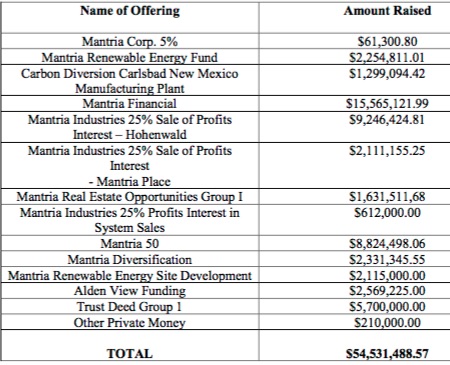

The witness at issue here, Steven Granoff, was Mantria’s in-house accountant. Granoff prepared Mantria’s internal financial reports, such as Mantria’s internal profit and loss statements. Granoff is expected to testify that Mantria was a start-up company and did not earn any profits and had little revenue, contrary to the defendants’ assertions to investors. Granoff will testify that almost all new funds coming into Mantria came from new investors. Granoff will also testify that any “earnings” used to pay earlier investors came from the new investor funds – corroborating the government’s allegation that Mantria was a Ponzi scheme. As such, Granoff is a critical witness for the government.

07/31/18 :

July 31, 2018 USA’s Response to Defendant Ron Van Den Heuvel’s motion and memorandum to dismiss the use of defendant’s court appointed counsel, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

July 31, 2018 USA’s Response to Defendant Ron Van Den Heuvel’s motion and memorandum to dismiss the use of defendant’s court appointed counsel, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

U.S. Exhibit A

Transcript of a Jail Telephone Call of the Defendant

Calling Party: Ron Van Den Heuvel (“RVDH”), BCSO Inmate # 930000020204

Called Party: M.G. [Oneida Eye believes this is Michael Garsow]

Call #: 8127338

Date: Tuesday, July 17, 2018

Time: 2:35 p.m.

Transcript By: FBI SA T. Ryan Austin

[Automated Recording]

RVDH [Ron Van Den Heuvel]: Hey, [First name redacted].

M.G. [Michael Garsow]: Hey.

RVDH: Did you get out of court?

M.G.: Yeah, I did. I sat there for about four and a half hours. [feedback]

RVDH: You what?

M.G.: I sat there for about four and a half hours this morning.

RVDH: Unbelievable.

M.G.: Yep…

RVDH: How long… how long were you on the stand?

M.G.: Actually that’s the best part. They never even called me in.

RVDH: They never even called you in?

M.G.: Yeah, wasted my fucking time.

RVDH: Wow. Was it for a buddy?

M.G.: Yeah, it was for a really good friend, I used to live with him and his ex, his daughter’s mom. So, anyway.

RVDH: Oh. How’d he… how did he fare, okay? Hey, can I put you in charge of one thing? Ty [Willihnganz].

M.G.: What’s up?

RVDH: Ty [Willihnganz]. Just get him here once in the morn – even if his dad brings him – get him here once in the morning and once in the afternoon. Gotta have him here [inaudible], I gotta get him here twice a day. Did you get a chance to go through any of them lists yet or work with Kelly [Van Den Heuvel]? Not today because you were in court, ay?

M.G.: Ah, no, actually I talked to them a little bit… ah, is there echoing on your end?

RVDH: You what?

M.G.: Is my… is me talking echoing on your end?

RVDH: Go, go slower. Yes, this is being recorded. Yes.

M.G.: No. Is it recording? My voice. Is it, or um, sorry, is it echoing?

RVDH: No, no. No, it’s not.

M.G.: Okay. It is on my end, so I’ll do my best.

RVDH: Okay.

M.G.: I’ll talk to Ty and Kelly.

RVDH: Yeah.

M.G.: I’m helping them with the legal document you’re doing.

RVDH: Yeah, good.

M.G.: We have a question on that.

RVDH: Okay.

M.G.: So there’s two separate documents.

RVDH: Yep.

M.G.: One is the memorandum.

RVDH: Yep.

M.G.: And one is the motion.

RVDH: Yep.

M.G.: Now we’re looking at this, is the memorandum just that one page?

RVDH: It’s just that one page. Make it be two. You’ll have the case number in on it, you’ll have all the things you gotta do. It’ll end up, maybe, being three. But that’s it. And then the memorandum follows right behind it with case number and everything there also. Okay?

M.G.: Yeah, they were a little confused, ah, but that makes total sense. That clears it up.

RVDH: The memorandum will be about 19 paragraphs. Okay?

M.G.: Okay.

RVDH: And the page 1 is just the reason for what we’re doing and now remember we’re not… we’re dismissing [court appointed attorney Robert] LeBell from being a court-appointed attorney. Okay? We’re not dismissing him from, from the case but he will not be lead counsel. Okay?

M.G.: Okay. Uh, the other thing is, I talked to Don…

RVDH: Yeah.

M.G.: And he said at three o’clock he’s calling you to try to do a conference call.

RVDH: Oh, good. Good, good, good. Good, good. Thank you. That’s what I needed to know. Okay?

M.G.: Okay. Ty’s been visiting you, right? I thought he’s been coming there two or three times a day.

RVDH: He, he has. He has. It’s just I want him to, I want him to be predictable and have it now. He says he’s not coming up; he can come up til eight o’clock at night. So, he says he’s not coming up until Kelly and you get done with that back (?). That would be good though. Okay?

M.G.: Yeah. Because I figure you’d… they said you needed that by tomorrow.

RVDH: I need, I need that, I need that thing so bad that I got a couple, a couple people think that it’ll get me 12-14 weeks out of here. So…

M.G.: Oh, wow.

RVDH: Yep.

M.G.: Yeah, their delay was just the confusion between the two but that clears it up.

RVDH: Okay. Go ahead and get her done. Thank you, pal.

M.G.: Yeah; talk to you later.

RVDH: Bye.

08/06/18 :

- Green Bay Press-Gazette / USA TODAY – WEDC CEO Mark Hogan talks jobs, Foxconn, Ron Van Den Heuvel

Van Den Heuvel’s company [Green Box NA Green Bay] has “gone off the rails. We will continue to pursue whatever (recourse) we can,” [WEDC CEO Mark] Hogan said. “I don’t like to write off dollars from any loan, but at some point you have to follow accounting rules.”

August 6, 2018 Memorandum Opinion and Order, Northern District of Illinois, Eastern Division, Docket No. 17-CV-108, RNS Servicing LLC v. Spirit Construction Services Inc., Steven Van Den Heuvel, ST Paper LLC & Sharad Tak

August 6, 2018 Memorandum Opinion and Order, Northern District of Illinois, Eastern Division, Docket No. 17-CV-108, RNS Servicing LLC v. Spirit Construction Services Inc., Steven Van Den Heuvel, ST Paper LLC & Sharad Tak

08/07/18 :

- August 7, 2018 Docket Entry Notification of September 6, 2018 Status Hearing reset to September 4, 2018, U.S. District Court, Northern District of Illinois, Eastern Division, Docket No. 17-CV-108, RNS Servicing LLC v. Spirit Construction Services Inc., Steven Van Den Heuvel, ST Paper LLC & Sharad Tak

- Green Bay Press-Gazette / USA TODAY– Ron Van Den Heuvel wants to dismiss court-appointed attorney Robert LeBell, federal prosecutors claim it’s a stall tactic

[Ron] Van Den Heuvel filed a motion to dismiss attorney Robert LeBell as his counsel on July 20.

Federal prosecutors responded that Van Den Heuvel’s motion to dismiss his attorney is another attempt to delay the proceedings. The government asked [Judge William] Griesbach to keep the case on track for Nov. 13 jury trial.

LeBell was appointed to represent Van Den Heuvel when he was charged with bank fraud in 2016 and claimed he did not have money to pay for his own attorney. LeBell tried to withdraw as Van Den Heuvel’s lawyer during a January sentencing hearing after Van Den Heuvel tried to refute terms of his plea agreement. Van Den Heuvel was sentenced to three years in jail in the case.

In his request, Van Den Heuvel said LeBell did not pursue Van Den Heuvel’s claims that federal investigators illegally obtained documents, that LeBell was working with federal prosecutors without disclosing the details to Van Den Heuvel, and that LeBell took vacations and had back surgery instead of helping Van Den Heuvel prepare his defense.

“Defendant’s counsel had a duty to prepare defendant for trial, not for a plea bargain,” Van Den Heuvel wrote to the court. “Mr. LaBell (sic), during the course of defendant’s cases took a vacation to Europe, hurt his back, went to China, went to South America, had back surgery and had his office relocated. The loss of time 12 weeks or more has prevented the defendant from preparing adequately for his case. …“

1.2 Million Tax Bill

Wisconsin Department of Revenue records indicate Van Den Heuvel, his wife Kelly, and three companies registered in his name owe more than $1.2 million in delinquent taxes.

Ron Van Den Heuvel owes $533,961 in income tax, witholding tax and fees. Kelly Van Den Heuvel owes $307,469.55 in income taxes. Oconto Falls Tissue Inc. owes $246,406.79 in withholding taxes. Tissue Products Technology Corp. owes $105,324.52 in withholding, sales and business registration taxes. Eco Fibre Inc. owes $33,158.11 in withholding, corporation and business taxes.

The combined total of the five individuals and entities is roughly 26 percent of all delinquent taxes De Pere residents and businesses owe, according to the state’s list.

![]() 08/09/18 :

08/09/18 :

- August 9, 2018 Brief of Defendant-Appellee TAK Investments LLC, U.S. 7th Circuit Court of Appeals, Appellate Case No. 18-1835, Tissue Technology LLC, Partners Concepts Development Inc., Oconto Falls Tissue Inc. & Tissue Products Technology Corp., Plaintiffs-Appellants v. TAK Investments LLC & Sharad Tak, Defendants-Appellees [44 pages]

- August 9, 2018 Supplemental Appendix of Defendant-Appellee TAK Investments LLC w/ Exhibits, U.S. 7th Circuit Court of Appeals, Appellate Case No. 18-1835, Tissue Technology LLC, Partners Concepts Development Inc., Oconto Falls Tissue Inc., and Tissue Products Technology Corp., Plaintiffs-Appellants v. TAK Investments LLC and Sharad Tak, Defendants-Appellees [61 pages, including excerpts of 09/18/17 Trial Transcript in Case No. 14-CV-1203]

Excerpt:

[Atty. Jonathan Smies / Godfrey & Kahn SC for Sharad Tak] Q: So as you sit here today it’s your view, at least, that [Ron] Van Den Heuvel or his companies in some way owe you or more precisely [Van Den Heuvel siblings-owned] VHC [Inc.] 150 million dollars approximately?

[David Van Den Heuvel] A: Roughly.

[Atty. Smies] Q: Do your companies owe [Ron] Van Den Heuvel anything?

[David Van Den Heuvel] A: We do not. He does have some shares at VHC, but they’re pledged to us against his personal debt that he owes us. The personal debt is more than the value of the shares.

[Atty. Smies] Q: What are the value of the shares?

[David Van Den Heuvel] A: A million 7.

The Court: Say that again?

[David Van Den Heuvel] A: I think a million 7.

The Court: Okay.

August 9, 2018 Motion by Thomas W. Patton to Withdraw as Defendant-Appellant Ron Van Den Heuvel’s Appointed Counsel on Appeal of 16-CR-64, U.S. 7th Circuit Court of Appeals, Appellate Case No. 18-1147, United States of America, Plaintiff-Appellee v. Ronald H. Van Den Heuvel, Defendant-Appellant

August 9, 2018 Motion by Thomas W. Patton to Withdraw as Defendant-Appellant Ron Van Den Heuvel’s Appointed Counsel on Appeal of 16-CR-64, U.S. 7th Circuit Court of Appeals, Appellate Case No. 18-1147, United States of America, Plaintiff-Appellee v. Ronald H. Van Den Heuvel, Defendant-Appellant

Based upon his thorough and conscientious review of the entire record of the proceedings in the district court below, and from communications with the Defendant-Appellant, the undersigned attorney has concluded that there exists no non-frivolous issue that can be raised in this appeal on behalf of the Defendant-Appellant. …

Wherefore, Thomas W. Patton respectfully requests the entry of an order granting him leave to withdraw as the Defendant-Appellant’s appointed counsel on appeal in the above-entitled cause.

![]()

- August 9, 2018 Brief in Support of Motion by Thomas W. Patton to Withdraw as Defendant-Appellant Ron Van Den Heuvel’s Appointed Counsel on Appeal w Exhibit of 16-CR-64, U.S. 7th Circuit Court of Appeals, Appellate Case No. 18-1147, United States of America, Plaintiff-Appellee v. Ronald H. Van Den Heuvel, Defendant-Appellant [152 pages w/ Exhibits including 01/05/18 Sentencing Hearing transcript]

SUMMARY OF ARGUMENT

[Ron] Van Den Heuvel cannot raise any argument regarding the motion to suppress because it has been waived for direct appeal in this case. He waived the issue by withdrawing the motion in the district court and by entering into a unconditional guilty plea.

Any argument challenging Van Den Heuvel’s conviction would be frivolous where he entered into an unconditional, knowing, and voluntary plea of guilty, pursuant to a plea agreement, and the district court substantially complied with Federal Rule of Criminal Procedure 11 when accepting his plea. The Rule 11 colloquy in this case was thorough and adequately advised Van Den Heuvel. Furthermore, the district court did not err by denying Van Den Heuvel’s motion to withdraw the guilty plea. He was not coerced into the plea because it contained an agreement to dismiss charges against his wife and he did not provide any evidence that he was actually innocent of the conspiracy he pled guilty to.

The district court did not abuse its discretion by denying Van Den Heuvel’s motion to adjourn the sentencing hearing and did not err in denying counsel’s motion to withdraw as attorney. Both motions were made a few days prior to sentencing and were not supported by evidence or adequate reasons for granting.

Any argument challenging Van Den Heuvel’s sentence would be frivolous where his sentence was not imposed in violation of the law, was not the result of an incorrect application of the guidelines, and was not unreasonable. The district court did not err by imposing a term or the conditions of supervised release.

- August 9, 2018 Notice: Counsel for the defendant has filed a motion for leave to withdraw under Circuit Rule 51(b), U.S. 7th Circuit Court of Appeals, Appellate Case No. 18-1147, United States of America, Plaintiff-Appellee v. Ronald H. Van Den Heuvel, Defendant-Appellant

On August 9, 2018, your attorney filed a brief stating that your appeal is frivolous and requesting permission to withdraw from the case.

1. You have 30 days from the date at the top of this notice to present any argument that you believe shows that your conviction or sentence is invalid. …

- August 9, 2018 Defendant Ronald Van Den Heuvel’s Local Rule 12c Statement, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

08/10/18 :

- August 10, 2018 Defendant Ronald Van Den Heuvel’s Motion to Suppress Physical Evidence, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

- August 10, 2018 Memorandum in Support of Defendant Ronald Van Den Heuvel’s Motion to Suppress Physical Evidence, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

- August 10, 2018 Motion Hearing Minutes, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

- Evidentiary Hearing scheduled for 09/04/18

- Final Pretrial Conference rescheduled to 10/25/18

- Trial scheduled to begin 11/13/18

1:59 pm – Court resumes. [Atty. Robert] LeBell states defendant wishes to hire private counsel and also retain Mr. LeBell. [Defendant Ron] Van Den Heuvel informs the Court he intends to engage the following attorneys: Mr. LeBell, Eric Hart, Ed Kraemer, Jeff Morgan, Timothy Hansen, John Petitjean and David Matias. The Court will continue to operate under the assumption the defendant does not have the funds to obtain counsel until the time that funds are produced to show otherwise.

2:03 pm – Motion to dismiss court appointed counsel is DENIED. If defendant’s intention to hire additional counsel falls through the case will not be delayed.

![]() 08/15/18 :

08/15/18 :

- August 15, ORDER, U.S. 7th Circuit Court of Appeals, Appellate Case No. 18-1835, Tissue Technology LLC, Partners Concepts Development Inc., Oconto Falls Tissue Inc., and Tissue Products Technology Corp., Plaintiffs-Appellants v. TAK Investments LLC and Sharad Tak, Defendants-Appellees

Appellants claim that the district court’s jurisdiction is based on diversity under 28 U.S.C. § 1332. Appellants, however, fail to identify the citizenship of all the parties and the amount in controversy. Appellants must provide this information.

IT IS ORDERED that appellants file a paper captioned “Amended Jurisdictional Statement” no later than August 27, 2018, that provide the omitted information noted above and otherwise complies with all the requirements of Circuit Rule 28(a).

- August 15, 2018 Order for IRS Draft by Sept. 7, U.S. Tax Court Docket No. 21583-15, VHC Inc. and Subsidiaries v. Commissioner of Internal Revenue Service [IRS]

August 15, 2018 Letter to Judge D’Agostino from Oneida Indian Nation of New York w/ Exhibits, U.S. District Court for the Northern District of New York, Case No. 5:17-CV-913, Oneida Indian Nation of New York v. United States Department of the Interior

August 15, 2018 Letter to Judge D’Agostino from Oneida Indian Nation of New York w/ Exhibits, U.S. District Court for the Northern District of New York, Case No. 5:17-CV-913, Oneida Indian Nation of New York v. United States Department of the Interior