TIMELINE PART 6

- CLICK HERE FOR TIMELINE PART 1

- CLICK HERE FOR TIMELINE PART 2

- CLICK HERE FOR TIMELINE PART 3

- CLICK HERE FOR TIMELINE PART 4

- CLICK HERE FOR TIMELINE PART 5

Eric R. Decator – Generation Clean Fuels, LLC aka Arland Clean Fuels. Fmr. Astt. Atty. Gen. of COLORADO. (The guy OSGC Managing Agent Pete King III gave undisclosed millions of GTC’s dollars to for … reasons.)

05/03/13 : According to the April 6, 2015 Plaintiffs–Appellants’ Brief in Cook. Co. Case No. 2014-L-2768, Generation Clean Fuels, ACF Leasing & ACF Services v. Oneida Nation in Wisconsin, Oneida Seven Generations Corp., Green Bay Renewable Energy LLC, et al. w/ Exhibits:

On or about May 3, 2013, Kevin Cornelius informed ACF that 4 out of 5 OSGC Board members approved the commitment letter.

Kevin:

Did you sign the commitment letter yet?

Eric

_______________

3:54 PM – MAY 3, 2013 Email reply from Kevin Cornelius to Eric Decator; Subjet: Commitment Letter

We are still waiting for one more board member to give us a yes. We have 4 yes votes, but we’d like to have all 5 votes.

We have two options. First, we will talk with Craig at the bank and if he needs it by today then we will sign the commitment letter since we have the votes.

Second, if we wait till Monday [May 6] then we will work with the board member to get his vote by Monday. He is not opposed, but he had a few questions and we have sent him the answers, but he has not gotten back to us.

05/05/13 : MAY 5, 2013 GENERAL TRIBAL COUNCIL SPECIAL MEETING

05/05/13 : MAY 5, 2013 GENERAL TRIBAL COUNCIL SPECIAL MEETING

GTC Petitioner Leah Sue Dodge

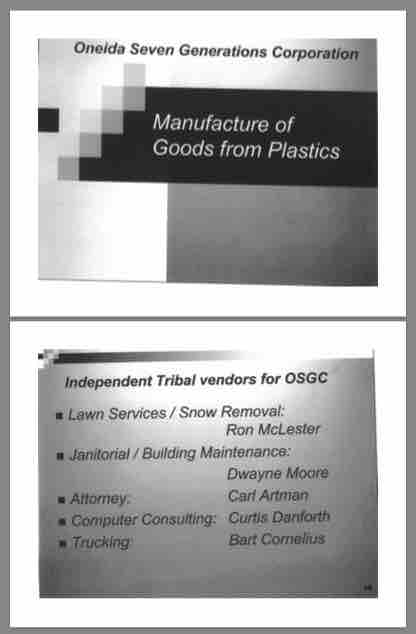

- MAY 5, 2013 SLIDESHOW Presentation by GTC Petitioner Leah Sue Dodge re: Opposition to Oneida Seven Generations Corp. [OSGC]’s DIOXIN-Emitting ‘Waste-to-Energy’ Proposals on the Oneida Nation of Wisconsin’s Reservation, including PYROLYSIS, GASIFICATION, and ‘PLASTICS-TO-OIL’ (which OSGC falsely labelled ‘plastics recycling’)

- MAY 5, 2013 General Tribal Council Meeting TRANSCRIPT, including GTC’s vote to prohibit OSGC & its subsidiaries from engaging in ‘pyrolysis,’ ‘waste-to-energy’ and ‘plastics-to-oil’ anywhere on the Oneida Nation of Wisconsin reservation

- FULL AUDIO – MAY 5, 2013 GTC Meeting AUDIO re: OSGC wherein GTC votes to prohibit OSGC from conducting gasification on the Oneida Nation of Wisconsin reservation

- AUDIO EXCERPT – Leah Sue Dodge’s Presentation to GTC, often interrupted by Fmr. OBC Chair Ed Delgado for mentioning public information about family ties and conflicts of interest that GTC needs to be aware of in order to make good decisions

- VIDEO – FILE NOT FOUND!! Fmr. OSGC Board member Mike Metoxen [who also works for his family member’s audio/video company, PM Productions, LLC, which is contracted and paid to record GTC Meetings] told Oneida Eye’s Publisher that the Video of the May 5, 2013 GTC Meeting had been stolen in a ‘burglary.’

![]()

4. Petitions …

b. Petitioner Leah Sue Dodge: General Tribal Council directs the Oneida Business Committee to stop Oneida Seven Generations Corporation (OSGC) from building any “gasification” or “waste-to-energy” or “plastics recycling” plant at N7329 Water Circle Place, Oneida, WI or any other location within the Oneida Tribal reservation boundaries

Motion by Karen Skenandore, seconded by Tammy Skenandore, to end discussion. Motion approved by show of hands.

Motion by Leah Sue Dodge, seconded by Cathy L. Metoxen, to direct the Oneida Business Committee to stop Oneida Seven Generations Corporation (OSGC) from building any ‘gasification’ or ‘waste-to-energy’ or ‘plastics recycling’ plant at N7329 Water Circle Place, Oneida, Wisconsin or any other location within the Oneida Tribal boundaries.

Motion by Loretta V. Metoxen, seconded by Larry Smith, to table [the petition submitted by Leah Sue Dodge]. Motion to table failed by hand count: Yes—755, No—814, Abstentions–18, Total votes–1,587

Motion by Leah Sue Dodge, seconded by Cathy L. Metoxen, to direct the Oneida Business Committee to stop Oneida Seven Generations Corporation (OSGC) from building any ‘gasification’ or ‘waste-to-energy’ or ‘plastics recycling’ plant at N7329 Water Circle Place, Oneida, Wisconsin or any other location within the Oneida Tribal boundaries.

Motion approved by a show of hands.

GENERAL

TRIBAL

COUNCIL

FOUGHT BACK

IN SELF-DEFENSE

ASHWAUBENON, WI – A petition prohibiting any type of waste-to-energy plant being built on Oneida tribal lands has been approved.

The vote from the General Tribal Council happened Sunday during a special meeting at the Radisson Hotel in Ashwaubenon.

A circulated petition seeking to block the construction of any type of waste-to-energy facility by the Oneida Seven Generations Corporation was on the agenda. OSGC officials was looking at building a plastics-only gasification plant at Water Tower Place off of Highway 54.

The petition received the required amount of signatures to be put before the tribe Sunday.

“They made their decision, and I believe they made the right decision,” Oneida Business Committee Chairman Ed Delgado told FOX 11 after the meeting.

Outside of the meeting room were signs of opposition to the hot-button issue of construction of a waste-to-energy plant on tribal land.

Delgado says the decision by tribe was the right one.

“The General Tribal Council, made up of almost 2,000 people, today made their decision and I believe they made the right decision,” said Delgado.

The issue was whether the tribe was willing to direct its business committee to stop Oneida Seven Generations Corporation – from building a gasification, waste-to-energy or plastics recycling plant on tribal land.

Meantime, the OSGC continues to wage a legal battle to get a conditional-use permit back from the city of Green Bay to build a waste-to-energy facility on the city’s east side.

Delgado wouldn’t say if this would be the last time this specific issue would come before the tribe, as all members have the right to the petition process.

- ONWI’s Kalihwisaks newspaper: Leah Sue Dodge statement –

I’m proud of GTC for defending itself against OBC and OSGC which is a first step in showing the world that GTC isn’t buying what OSGC is selling, and the next steps are to divest the Tribe of the incineration business and dissolve some corporations, while setting and enforcing higher standards for corporate behavior. …

Some officials seem to think they simply need to better explain OSGC’s projects because GTC just doesn’t understand how wonderful their incineration plans are, but I’ll continue to work with other GTC members to make it clear: We understand perfectly well what they’re up to, and we plan to stop them.

05/06/13 : According to the April 6, 2015 Plaintiffs–Appellants’ Brief in Cook. Co. Case No. 2014-L-2768, GCF/ACF v. ONWI & OSGC, et al., and Exhibits:

On or about May 6, 2013, Michael Galich held a conference with Kevin Cornelius and Bruce King to discuss financing, the agreements and the Project. …

Around the same time, OSGC’s attorney, Joseph Kavan advised Eric Decator that he needed in-house legal and Board approval before the Master Lease Agreement and the Operations Maintenance Agreement … could signed.

WHO WAS OSGC’s “IN-HOUSE COUNSEL”?

WAS IT STILL CARL ARTMAN…

AS IT WAS IN FY2011 & FY2012?

OBC & OSGC REFUSE TO SAY FOR SURE,

AS DOES the ONEIDA LAW OFFICE UNDER…

OBC CHIEF COUNSEL JO ANNE HOUSE…

CARL ARTMAN’S FIRST COUSIN.

OBC Chief Counsel

Jo Anne House

05/08/13 : May 8, 2013 OBC Regular Meeting Minutes, pg. 8:

05/08/13 : May 8, 2013 OBC Regular Meeting Minutes, pg. 8:

E. Additions

1. Recommendation to retain Godfrey & Kahn legal services

Sponsor: Vince DelaRosa

Motion by [Fmr. OBC Member] Vince DelaRosa to defer recommendation to retain Godfrey & Kahn legal services for two weeks, seconded by [Fmr. OBC Member] Paul Ninham.

Motion carried unanimously

JUST FIVE DAYS

AFTER GTC

VOTED ‘NO!’

to ‘P2O’ SCAMS of…

Oneida Business Committee

Chief Counsel / Oneida Law Office

Oneida Seven Generations Corp.

Green Bay Renewable Energy, LLC

Oneida Energy, Inc. / OE Blocker

Alliance Construction & Design

P 2 0 Technologies, LLC

Generation Clean Fuels

Arland Clean Fuels

ACS Services

ACF Leasing

…

and let’s not forget…

THIS HAPPENED…

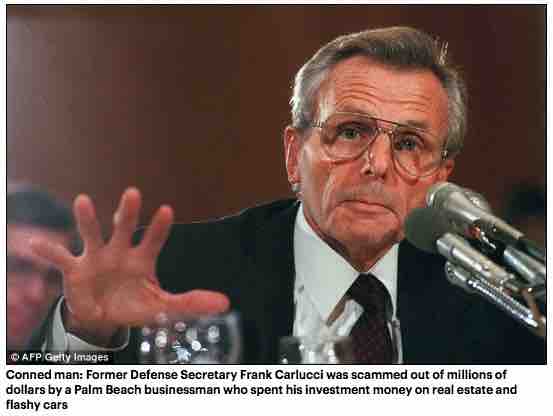

05/10/13 : FINAL JUDGMENT Against Defendants MICHAEL S. HAN – ENVION INC. – LYF HOLDING INC. – AND HAMMON AVENUE PARTNERSHIP LLC on Counts I, III, IV, VI, VIII, AND IX of the Second Amended Complaint, United States District Court in the Eastern District of Virginia, Alexandria Division, Case No. 1:12-cv-451-JCC-TCB, Frank C. Carlucci III v. Michael S. Han, ENVION Inc., et al.

(1) For which execution shall issue immediately, Final Judgment is entered in favor of Plaintiff Frank C. Carlucci III and against Defendants Michael S. Han and Envion, Inc., jointly and severally, on Counts I, III, and IV of the Second Amended Complaint (ECF No. 128) in the amount of $32,743,000, comprised of $32,393,000 due as damages for violations of the federal Securities Act (Count I), actual fraud (Count III), and constructive fraud (Count IV); and $350,000 in punitive damages (Count III and Count IV). The Court retains jurisdiction to determine the amount of attorneys’ fees and costs to which Plaintiff is entitled [incl. attorney’s fees]. …

Based upon the record in this action, the Court specifically finds that Michael S.

(5) Han, Envion, Inc., Lyf Holdings, Inc., and Hammon Avenue Partnership LLC have committed material violations of each of the specific common law and statutory duties alleged in the Second Amended Complaint, which include: violation of the Florida Uniform Fraudulent Transfer Act, Fla. Stat. §726.101 et seq.

(6) Defendants also are enjoined from transferring or otherwise encumbering the Palm Beach Properties, the Virginia Property, or any other property, real or personal, obtained with Mr. Carlucci’s investment funds, and ordered to disgorge all of the funds obtained via fraudulent transfers.

(7) This Court retains jurisdiction with respect to all remaining claims, matters, and parties in this action (including without limitation claims against other Defendants and the determination of attorneys’ fees and costs to which Plaintiff is entitled) and to enforce this Final Judgment.

(8) The Clerk of Court is directed to enter this Final Judgment and shall forward copies hereofto all counsel ofrecord.

Signed this 10th day of May, 2013.

United States District Judge Liam O’Grady

05/24/13 : Cheyboygan Energy & Biofuels, LLC registered w/ WDFI for a scheme in Cheboygan, Michigan; Change of Registered Agent on 06/29/15 to Ron Van Den Heuvel

05/24/13 : Cheyboygan Energy & Biofuels, LLC registered w/ WDFI for a scheme in Cheboygan, Michigan; Change of Registered Agent on 06/29/15 to Ron Van Den Heuvel

According to the May 22, 2014 Complaint w/ Exhibit ‘Master Lease Agreement’ filed in U.S. District Court, Middle District of Florida, Fort Meyers Division, Case No. 2:14-cv-283, Generation Clean Fuels v. Veterans Capital Corp. [Joseph E. Wold Jr., President]:

According to the May 22, 2014 Complaint w/ Exhibit ‘Master Lease Agreement’ filed in U.S. District Court, Middle District of Florida, Fort Meyers Division, Case No. 2:14-cv-283, Generation Clean Fuels v. Veterans Capital Corp. [Joseph E. Wold Jr., President]:

14. Pursuant to an Equipment Manufacture and Purchase Agreement, dated August 15, 2012 (the “Purchase Agreement”), between GCF and Spartan, Spartan agreed to manufacture the Machine, which was to be located in Cheboygan, Michigan. A true and complete copy of the Purchase Agreement is attched hereto as Exhibit B.

- May 24, 2013 Master Lease Agreement between Green Bay Renewable Energy LLC and ACF Leasing, ACF Services, Generation Clean Fuels LLC, signed by GBRE Chairman & OSGC CEO Kevin Cornelius resulting in Cook County IL Case # 14-L2768, ACF Leasing LLC, ACF Services LLC & Generation Clean Fuels LLC v. Green Bay Renewable Energy, LLC, Oneida Energy Inc. & Oneida Energy Blocker Corp.

According to the April 6, 2015 Plaintiffs–Appellants’ Brief in Cook. Co. Case No. 2014-L-2768, GCF/ACF v. ONWI & OSGC, et al., and Exhibits:

Louis Stern and Kevin Cornelius signed the [GCF] Agreements in May and June, 2013.

From the beginning, the proposed agreements with the Tribe and OSGC contained choice of law and jurisdictional clauses waiving sovereign immunity. …

The Master Lease Agreement provides, “THIS AGREEMENT SHALL BE DEEMED TO BE MADE IN ILLINOIS AND SHALL BE GOVERNED AND CONSTRUED IN ACCORDANCE WITH ILLINOIS LAW. LESSEE AND LESSOR AGREE THAT ALL LEGAL ACTIONS SHALL TAKE PLACE IN THE FEDERAL OR STATE COURTS SITUATED IN COOK COUNTY, ILLINOIS.” … Similarly, the Operations and Maintenance Agreement provides, “Any disputes pertaining to this Agreement shall be determined exclusively in a court of competent jurisdiction in the County of Cook, State of Illinois.” …

Throughout the negotiations of the Agreements, OSGC and the Tribe representatives repeatedly represented to ACF that they are acting on behalf of the Tribe/OSGC and referred to the Tribe, OSGC and GBRE as though they were one and the same. … Kevin Cornelius and Bruce King repeatedly corresponded with ACF regarding the Project, utilizing OSGC email addresses and OSGC letterhead and utilized OSGC’s office. … Kevin Cornelius and Bruce King represented to ACF that GBRE was only a vehicle for tax purposes, that the Agreements were with the Tribe/OSGC and that Kevin Cornelius had authority to enter into the Agreements and waive sovereign immunity on behalf of the Tribe, OSGC and GBRE. …

In reliance on the representations of Kevin Cornelius, Bruce King, and William Cornelius that they had they permission of the Tribe and OSGC to enter into the Agreements, ACF continuously performed a variety of tasks to meet its obligations under the Agreements once they were executed. … In fact, Kevin Cornelius and Bruce King sent numerous documents related to the Project to Eric Decator in Illinois, but none of these documents referred to GBRE, which was consistent with ACF’s understanding that the actual parties to the Project were OSGC/the Tribe.

- Louis Stern was President of Spartan, Inc. of Bakersfield, CA, which was supposed to build a poly conversion liquefaction machine for Veterans Capital Corp. to lease to Louis Stern’s and Atty. Eric Decator’s Generation Clean Fuels, LLC, which would then sublease the machine to OSGC & GBRE, but the machine was never built.

_____________________

Spartan, Inc. was incorporated in California in 2002, and is affiliated with Spartan Technical Services, Inc.; Principial Office Bakersfield, CA

Spartan, Inc. was incorporated in California in 2002, and is affiliated with Spartan Technical Services, Inc.; Principial Office Bakersfield, CA

Key People:

• Louis Stern, Fmr. President

• John Haskell Wood, President

• Teresa Wood

• Charles Hinson

• Greg Fry

• Archie Allison DOCUMENTATION: Mr. Allison has over 44 years of experience in various aspects of the petroleum industry in Western & Southern US, Arctic Alaska, Colombia, Ecuador, Venezuela, Qatar, UAE, Indonesia, Syria, Oman, and Western Siberia.

_____________________

See also:

• PART 1: July 17, 2014 Deposition of Fmr. Oneida Business Committee Secretary Patricia Ninham Hoeft PART 1 (pages 1-54) in Cook County IL Case # 14-L2768, ACF Leasing LLC, ACF Services LLC & Generation Clean Fuels LLC v. Oneida Tribe of Indians of Wisconsin, Oneida Seven Generations Corp., Green Bay Renewable Energy LLC. Oneida Energy Inc. & Oneida Energy Blocker Corp.

• PART 2: July 17, 2014 Deposition of Fmr. OBC Sec. Patricia Ninham Hoeft PART 2 (pages 54-108) in Cook County IL Case # 14-L2768, ACF Leasing LLC, ACF Services LLC & Generation Clean Fuels LLC v. Oneida Tribe of Indians of Wisconsin, Oneida Seven Generations Corp., Green Bay Renewable Energy LLC. Oneida Energy Inc. & Oneida Energy Blocker Corp.

• July 17, 2014 Deposition of Gene Keluche, Sagestone Management LLC / Managing Agent of Oneida Seven Generations Corp. Cook County IL Case # 14-L2768, ACF Leasing LLC, ACF Services LLC & Generation Clean Fuels LLC v. Oneida Tribe of Indians of Wisconsin, Oneida Seven Generations Corp., Green Bay Renewable Energy LLC. Oneida Energy Inc. & Oneida Energy Blocker Corp.

05/28/13 : May 28, 2013 Brief of Plaintiffs-Appellants, WI Court of Appeals Case No.2013AP591, Oneida Seven Generations Corp./OSGC & Green Bay Renewable Energy LLC/GBRE vs. City of Green Bay

- May 28, 2013 Plaintiff’s Brief in Opposition to Motion to Vacate Default Judgment, Jefferson Co. Case No. 12CV906, David J. Wolf vs. Arland Clean Fuels, LLC

- May 28, 2013 Affidavit of Travis James West in Support of Plaintiff’s Brief in Opposition to Defendant’s Motion to Vacate Judgment, David J. Wolf vs. Arland Clean Fuels, LLC

-

- May 28, 2013 Affidavit of Jacob Osojnak in Support of Plaintiff’s Brief in Opposition to Defendant’s Motion to Vacate Judgment, David J. Wolf vs. Arland Clean Fuels, LLC

05/30/13 : Courthouse News Service,

Carlucci Demands His $37 Million

WEST PALM BEACH (CN) – Former CIA executive and Defense Secretary Frank Carlucci asked a Florida court to enforce a $37 million judgment against a man who induced him to invest in a bogus technology.

Carlucci, 82, was Secretary of Defense from 1987 to 1989 under President Ronald Reagan. He also served in senior-level government positions under Presidents Nixon and Carter, including Deputy Director of the CIA and Director of the Office of Economic Opportunity.

Carlucci sued Michael Han and his company Envion last year in Federal Court, to recover more than $32 million he had invested based on Han’s allegedly fraudulent and misleading statements.

Han, the founder and CEO of West Palm Beach-based Envion, claimed the company had developed an efficient technology that could turn waste plastic back into crude oil, according to the April 2012 complaint.

Han told Carlucci that Envion had patented its technology, major investors lined up, and a backlog of orders for its so-called oil generators, the complaint states.

Carlucci claimed Han first approached him in 2004, asking him to invest in Envion. In March 2004, Carlucci gave Han the first $500,000, relying on his false promises that Envion had patented its oil generators,

…was run by “seasoned and highly regarded executives with extensive track records of success in the energy, technology, and finance industries, as well as the public sector,”

…and was negotiating business agreements with major waste management companies, according to the complaint.

Carlucci claimed Han also lied to him that investors such as Warren Buffet, Bill Gates and Morgan Stanley were interested in Envion.

He claimed Han continued to “paint a very rosy picture” of Envion over the next years, persuading Carlucci to pour millions into the company.

Han told Carlucci that Envion had deals with Russia’s Gazprom, one of the world’s largest gas companies, and with Brazilian energy company Petrobas, which would invest millions in Envion, according to the complaint.

He promised that “‘Envion would be the best return Mr. Carlucci would receive on any investment,’ possibly up to ’50 times’ the amount Mr. Carlucci had invested,” according to the lawsuit.

“During these same meetings, Mr. Han also falsely represented that former President Bill Clinton had agreed to become affiliated with Envion, possibly as a member of its board of directors, and that he had communicated with former President George W. Bush, who was interested in investing in Envion as well,” the complaint states.

Carlucci claimed that after he invested more than $32 million in Envion, Han closed the company’s Washington D.C. headquarters and moved it to Florida, where he bought himself a $3.5 million home with Carlucci’s money. Han also paid himself a $5 million annual salary without Carlucci’s knowledge, according to the complaint.

In early 2012, Carlucci began to suspect Han’s promises were empty, after an energy consultant revealed that there was no deal with Petrobas, the complaint states.

Carlucci investigated and concluded that Envion did not own any patent, had no deals with major companies, no “all-star list” of investors, and no backlog of orders for its oil generators. He also realized Han had used his money for personal expenses and had drained the company nearly to insolvency, according to the complaint.

Carlucci said Han denied his request to audit the company’s books and records.

He sought compensatory and punitive damages for federal and Virginia State securities fraud, negligent misrepresentation and breach of contract.

A federal judge in Alexandria, Va. granted Carlucci a $37 million judgment in April. The judgment covers violations of the Virginia Securities Act, breach of contract damages, interest, attorneys’ fees and costs.

Carlucci seeks to enforce the judgment in Han’s home state, Florida.

He is represented by Peter Bernhardt with McDonald Hopkins.

Carlucci was second secretary at the U.S. Embassy in the Congo – an undercover CIA post – during the

Congo Crisis of 1961, when President Dwight Eisenhower ordered the CIA to assassinate Congolese independence leader Patrice Lumumba.He was chairman of the Carlyle Group from 1992 to 2003, a former director of Wackenhut, which runs private prisons, and had a wide range of other business interests.

05/31/13 : AOL.com, by Rich Smith

Ex-CIA Deputy Director

Frank C. Carlucci III

Fell for This

‘Plastics-to-Oil’ Scam.

WOULD YOU?

Intelligence: To most of us it means smarts, wisdom, cleverness — but when the word sits at the heart of the name “Central Intelligence Agency,” it stands for vital information, and the special methods used to gather those key facts.

Surprisingly, it turns out that even someone who once was the No. 2 man at the CIA can forget to pay attention to both of those versions of intelligence when it comes to investing.

In Florida this week, former Deputy CIA Director (and former Secretary of Defense under President Reagan) Frank Carlucci walked into court and demanded that a Florida judge enforce judgment against a huckster who Carlucci says defrauded him out of $32 million.

The huckster in question, Michael Han, and his company, West Palm Beach-based Envion, had offered the prospect of taking scraps of plastic waste, originally manufactured from oil, and converting the stuff back into oil for use as a fuel source. Basically, it was promising a form of 21st-century alchemy — except the base material in this case was plastic instead of lead, and the product it would supposedly would be turned into wasn’t real gold but “black gold.”

According to Carlucci’s complaint, originally filed in April 2012, Han had assured Carlucci that Envion had a patent on this plastic-to-oil technology, a stable of “highly regarded directors” running the shop, a bevy of orders in backlog for sale of the “oil generator” machines that would do the conversions, and plenty of heavy-hitter investors lined up to finance the project.

Unfortunately, none of that was true.

More unfortunately still, Carlucci was unaware that it was not true. He got duped.

In for a Penny, In for a Pound

First approached by Han in 2004, Carlucci happily anted up $500,000 as his first investment in Envion — apparently doing no due diligence, instead accepting Han’s statements at face value.

Further happy-talk from Han about the great strides the company was making, and Carlucci’s own prospects of earning a return 50 times greater than his investment, enticed the former CIA Deputy Director to hand over millions of dollars more in subsequent years.

It was not until eight years later – 2012 — that Carlucci began to suspect that something was up. This was after Han closed down the Washington, D.C., office of his supposedly hyper-growing company and moved the firm’s headquarters to Florida. It also apparently took Carlucci those eight years to begin asking around, and investigating Han’s assertions that he had such luminaries as Bill Gates, Warren Buffett, Bill Clinton, and George W. Bush investing alongside him — with corporations Morgan Stanley, Petrobras, and Russia’s Gazprom beating down the door to invest as well.

(Hint: He didn’t, and they weren’t.)

Of course, by that point Carlucci was $32 million in the hole, with much of his wealth having gone to pay Han a $5 million salary, and to buy Han a $3.5 million home — in Florida’s soon-to-implode real estate market, no less.

Last month, Carlucci won a judgment for $37 million in Virginia to try to collect what he could out of whatever money Han has left — nine years too late.

What’s the Lesson Here for You?

Now, for small investors there are a couple of possible takeaways to this story. One possible interpretation: If the former second-in-command of the CIA, and a former honest-to-goodness spy (in the early 1960s, Carlucci held an undercover CIA posting in the Congo) couldn’t figure out that the company he was investing in was a fraud, what hope can we little guys, we small-fry investors, ever have?

If you ask me, though, the real moral of this story is much more simple: Use your common sense.

First and most obviously, if some guy walks up to you and offers you an easy way to turn your money into a 5,000 percent profit, ask yourself: If this idea is so great, then why is this guy giving it to me, instead of keeping it to himself?

Second, do some due diligence. Before committing $32 million, or $32,000, or $320 to a project, do a bit of research. You don’t need the resources of the Department of Defense or CIA for this. The SEC will suffice. If some guy named “Han” tells you he’s got investors from Petrobras and Morgan Stanley investing in a plastic-to-oil scheme, look up Petrobras or Morgan Stanley on the SEC’s website, and see if their filings say anything about their involvement in it.

Third, if your suspicions are already up, you may be able to get by on even more basic research. For example, a Google search for “plastic + into oil + machine + hoax” might have turned up a link to this 2010 post on the snopes.com website – two years before Carlucci finally caught on to his goof, and filed his lawsuit.

06/01/13 :

- According to the April 10, 2014 Letter from Ty Willihnganz to Wisconsin Office of Lawyer Regulation re: Answer to Complaint Against Ty Willihnganz

First of all, I want to point out that the client [Ron Van Den Heuvel / Green Box NA] who I allegedly failed to keep informed has not lodged a complaint against me, and has in fact fought any complaints about my conduct because [Green Box] knows that it created conditions that made it extremely difficult for me to fulfill my legal duties. With that said, let me explain my relationship to the client and what took place.

MY RELATIONSHIP TO THE CLIENT

The client in question is an environmental “waste-to-energy” start-up company [Green Box NA]. I worked for [Green Box NA] as a contractor doing performing tasks that would traditionally be handled by an in-house counsel. In exchange for my legal services, the Company agreed to provide me with office space, a monthly fee, and full coverage of all bar fees and CLE course tuition. The present problems emerged as a direct result of [Green Box NA]’s defaulting upon its promises. For many months of last year I went without payment of any kind and the client did not produce either my bar fees or my CLE tuition.

The failure to pay me or to cover any of the promised professional costs directly resulted in a suspension of my license in June of 2013 for failure to meet CLE requirements (later [Green Box NA] would also default on my Wisconsin State Bar annual fees, despite TELLING ME that the fees had been paid). [Green Box NA] was immediately aware of my suspension when it took place, and I informed [Green Box NA] owners at that time that I could no longer represent the Company in any litigation and that I specifically needed to be removed from the Marco Araujo case immediately. [Ron Van Den Heuvel] promised me repeatedly that I would be removed from the Araujo case, but this never happened, and I was forced to file a Motion for Withdrawal on August 15th.

MY REQUEST FOR REMOVAL FROM THE ARAUJO CASE AND THE DISCOVERY REQUEST

Between the time of my suspension and the filing of my motion, I performed no acts of legal representation for [Green Box NA], but I did constantly remind [Green Box NA] officials that I needed to be replaced as counsel in the Araujo matter, and that there was an outstanding discovery request in the matter and that [Green Box NA] needed to produce all of the documents requested by the Plaintiff. “Indeed, [Green Box NA] had known about the document request since the time it was made (I believe in April of 2013 – though [Green Box NA] disputes this), and I informed all of the relevant [Green Box NA] personnel that the documents needed to be gathered together and sent to Plaintiff’s counsel, but no one at [Green Box NA] took any action in response. It is my belief [Green Box NA] staff simply categorized the matter as “legal” and therefore expected me to assemble the necessary documents. But the staff knew fully well that I lacked access to, of knowledge of, the records that were being asked for and that I could not possibly comply with the document request without their assistance.

RESIGNATION OF COMPANY STAFF

In the first few weeks of June of 2013, the situation became even more difficult. Not only was I suspended, but shortly thereafter nearly the entire [Green Box NA] staff quit their jobs in response to non-payment of their wages. So [Green Box NA] was being run by two people, neither of whom had the knowledge necessary to comply with the Plaintiff’s document request. So the document demand went unanswered despite my persistent reminders that it needed to be complied with.MY LOSS OF OFFICE PRIVILEGES

On top of that, after my license was suspended, I lost my office privileges. I was still asked to perform administrative duties and writing assignments for [Green Box NA] (which I agreed to do only because I knew if I resigned altogether I would never be paid any of the money owed to me) but I no longer had an office. And since I had not received any money for several months, I had no transportation (as it happens the right wheel fell off of my Mercedes – due to shoddy work by AAA, and I was without the means to repair the damage and thus had no vehicle for a substantial period of time – pictures of damage are enclosed) and could only come into work on an irregular basis (it’s a 10 mile hike round trip from where I live). Thus, after removing all non-[Green Box NA] related files from my office I had no control over my office nor access to it. Yet despite this I believe someone may have been placing mail in that office and then someone else may have been removing or may have removed it during the transition period (this is speculation – no one can tell me what happened to the correspondence).

06/03/13 : June 3, 2013 Complaint with Exhibit in Jefferson Co. Case No. 13CV322, David J. Wolf v. Arland Clean Fuels, LLC / Generation Clean Fuels, LLC

06/03/13 : June 3, 2013 Complaint with Exhibit in Jefferson Co. Case No. 13CV322, David J. Wolf v. Arland Clean Fuels, LLC / Generation Clean Fuels, LLC

A former Secretary of Defense has been awarded $37million after being defrauded out of his fortune by a scam businessman who claimed he could turn plastic into oil.

Former Secretary of Defense Frank Carlucci, who served from 1987 to 1989 under President Ronald Reagan, invested $32 million in Envion Inc, a business owned by Michael Han which claimed to have discovered a way to convert plastic into oil.

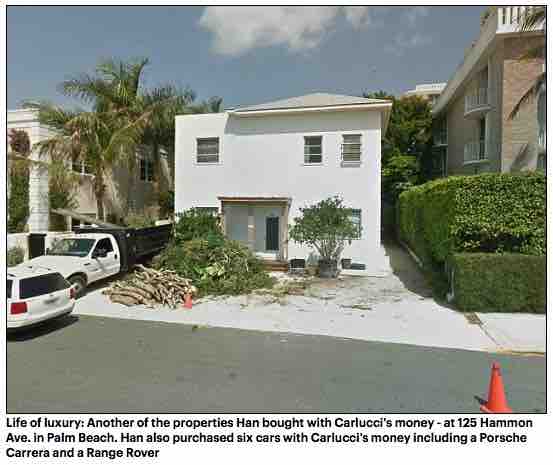

However, instead he was duped and the fraudster used his millions to build a personal life of luxury for himself in Palm Beach.

In 2011 he went on a real estate shopping spree, picking up two houses, $3.3 and $1.2 million respectively, in addition to a $300,000 condo.

He also bought six cars with Carlucci’s money – including a Porsche Carrera and a 2011 Range Rover.

A federal court has now ruled Han must turn over the properties and cars in order to settle his debt to Carlucci – paying a total of $37million to the former politician.

The scam started in 2004, when Carlucci was approached by Han who pitched him on investing in his company.

Envion would be producing oil from old plastic products which were originally produced with the chemical.

In his complaint, Carlucci explains why Han’s business seemed legitimate.

Han said the oil generators were already patented and run by ‘seasoned and highly regarded executives with extensive track records of success in the energy, technology, and finance industries, as well as the public sector,’ and was in the process of setting up business with waste management companies.

Han also said that Warren Buffett, Bill Gates and Morgan Stanley were interested in the company. Russia’s Gazprom and Brazil’s Petrobras were all set to buy the oil Envion produced, Han promised.

According to the lawsuit: ‘Envion would be the best return Mr Carlucci would receive on any investment, possibly up to ’50 times’ the amount Mr Carlucci had invested.’

‘During these same meetings, Mr. Han also falsely represented that former President Bill Clinton had agreed to become affiliated with Envion, possibly as a member of its board of directors, and that he had communicated with former President George W. Bush, who was interested in investing in Envion as well,’ the complaint states.

Carlucci initially invested $500,000 in the company, but over the years would come to invest millions.

It wasn’t until 2012, when Carlucci found out that Petrobras was not involved in the company, that he got suspicious.

He investigated the company and found that Envion didn’t even have a patent, let alone any deals with major companies and certainly no ‘all-star list’ of backers.

Carlucci sought compensatory and punitive damages in federal and Virginia States securities fraud, negligent misrepresentation and breach of contract.

In April the federal judge granted Carlucci a $37million judgement.

He has not spoken publicly on the ruling.

In addition to heading the defense department, Carlucci also served as the U.S. Ambassador to Portugal, Deputy Director of the CIA, National Security Adviser and Director of the Office of Economic Opportunity.

06/04/13 : June 4, 2013 Motion Hearing Court Transcript, Jefferson Co. Case No. 12CV906, David J. Wolf v. Arland Clean Fuels, LLC / Generation Clean Fuels, LLC

06/04/13 : June 4, 2013 Motion Hearing Court Transcript, Jefferson Co. Case No. 12CV906, David J. Wolf v. Arland Clean Fuels, LLC / Generation Clean Fuels, LLC

06/07/13 : FILED – July 7, 2013 Complaint in Brown Co. Case No. 13CV927, Oneida Nation of Wisconsin-owned Bay Bank v. Ronald H. Van Den Heuvel

• $20,168.89 DEFAULT MONEY JUDGMENT AGANIST RON VAN DEN HEUVEL on 10/14/13

06/10/13 : According to the September 20, 2016 Superseding Indictment, Docket No. 16-CR-064, USA v. Ron & Kelly Van Den Heuvel and Paul J. Piikkila

06/10/13 : According to the September 20, 2016 Superseding Indictment, Docket No. 16-CR-064, USA v. Ron & Kelly Van Den Heuvel and Paul J. Piikkila

COUNT FOURTEEN

THE GRAND JURY FURTHER CHARGES:

From on or about June 10, 2013 through on or about July 2, 2013, in the state of and Eastern District of Wisconsin,

RONALD H. VAN DEN HEUVEL

devised and participated in a scheme to defraud federally insured financial institutions and to obtain money under the custody and control of those financial institutions by means of false and fraudulent pretenses and representations.

The scheme was as follows:

a. In June 2013, Ronald H. Van Den Heuvel desired and needed to obtain funds for himself and his business entities.

b. In order to obtain funds, Ronald H. Van Den Heuvel persuaded his employee [AND SON-IN-LAW PATRICK R. HOFFMAN] to apply for loans from financial institutions in his own name although the loaned funds were to be used by Ronald H. Van Den Heuvel and his business entities.

c. In order to help [Patrick R. Hoffman, owner of The Creamery Cafe] qualify for the loans, Ronald H. Van Den Heuvel took the following steps.

1 . Ronald H. Van Den Heuvel caused the titles on a 2013 Cadillac Escalade and a 2010 Cadillac Escalade to be transferred from one of his business entities, EARTH [Environmental Advanced Reclamation Technology HQ LLC / recently renamed Reclamation Technology Systems LLC], to [Ron’s son-in-law Patrick Hoffman] although [Pat Hoffman] was not given custody or control of the Escalades.

2 . Ronald H. Van Den Heuvel caused false and fraudulent pay stubs to be created for [Patrick Hoffman] which reflected that [Pat Hoffman’s] income was substantially higher than it actually was.

3 . Ronald H. Van Den Heuvel caused [Patrick R. Hoffman, Registered Agent of PRH Enterprises, LLC] to falsely represent his job title, responsibilities, and income with EARTH [/ Reclamation Technology Systems LLC / RTS].

d. Ronald H. Van Den Heuvel caused [Patrick Hoffman] to apply for loans at financial institutions offering the two Cadillac Escalades as security for those loans and providing those institutions with false and fraudulent information about his duties and income while employed with EARTH [ / Reclamation Technology Systems LLC / RTS].

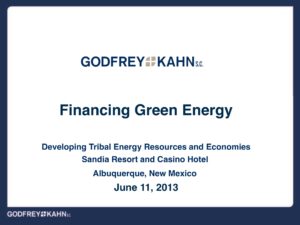

06/11/13–06/13/13 : Native American Finance Officers Association [NAFOA] Energy Summit at the Sandia Resort & Casino Hotel in Albuquerque, New Mexico

- June 11, 2013 ‘Green Energy: Developing Tribal Energy Resources and Economies’ PowerPoint by John Clancy & Brian Pierson of Godfrey & Kahn – Click to view Godfrey & Kahn’s presentation encouraging tribes to FINANCE & FLIP ‘Green Energy’ schemes like those of Ron Van Den Heuvel’s various Green Box NAs / EcoHub / EARTH / RTS, and Oneida Seven Generations Corporation and OSGC subsidiaries Oneida Energy, Inc. & Green Bay Renewable Energy, LLC

9:00 a.m. Round-Table Discussion: Economic and Energy Challenges and Opportunities for Indian Country – Tex G. Hall, Mandan, Hidatsa & Arikara, Chairman-Mandan, Hidatsa & Arikara Nation; …Ernie Stevens [Jr.], Oneida Nation, Board-Chairman National Indian Gaming Association; …Tina Danforth, Delegate-Native American Finance Officers Association and Treasurer-Oneida Tribe of Indians of Wisconsin…

9:00 a.m. Round-Table Discussion: Economic and Energy Challenges and Opportunities for Indian Country – Tex G. Hall, Mandan, Hidatsa & Arikara, Chairman-Mandan, Hidatsa & Arikara Nation; …Ernie Stevens [Jr.], Oneida Nation, Board-Chairman National Indian Gaming Association; …Tina Danforth, Delegate-Native American Finance Officers Association and Treasurer-Oneida Tribe of Indians of Wisconsin…

1:30 p.m. Session 3: Funding Development on Tribal Lands: EB-5 Foreign Investment, New Market Tax Credits, DOE Programs and Equity and Debt Partners…

OBC Treasurer Cristina Delgado-Danforth’s Report to the OBC re: her presentation pitching OSGC’s waste energy scheme at the Native American Finance Officers Association/NAFOA Energy Summit in Albuquerque, New Mexico; OBC Chair Cristina Danforth is the President of the NAFOA Board as well as a member of the Board of Directors of both the Native American Bank NA & Native American Bancorporation Co. [NABNA] in the State of Colorado:

OBC Treasurer Cristina Delgado-Danforth’s Report to the OBC re: her presentation pitching OSGC’s waste energy scheme at the Native American Finance Officers Association/NAFOA Energy Summit in Albuquerque, New Mexico; OBC Chair Cristina Danforth is the President of the NAFOA Board as well as a member of the Board of Directors of both the Native American Bank NA & Native American Bancorporation Co. [NABNA] in the State of Colorado:

I was asked to be a speaker at the NAFOA Energy Summit to talk about renewable energy sources. The source of my inspiration was the Oneida Seven Generations Corporation Gasification Plant. Converting recycled food grade plastics into base oil, char ash and vapor gas is the basic model for this energy source. The base oil would be sold to oil refineries or a reseller of synthetic oil. With many of the newer cars requiring synthetic oil, the use of this oil is increasing. Char ash which is high in carbon would be sold to paving companies for driveways, parking lots, and roads. The vapor gas burns cleaner than propane gas and could be sold as a replacement for propane. The concept of using recycled food grade plastics and converting it to a renewable energy source not only keeps items from landfills but would provide a more economical product to the general population.

Despite our own trials and tribulations with the OSGC project, many of the other Tribes in attendance were eager to learn more. It was a great opportunity to highlight a project OSGC has been working on for some time and to get people to start thinking about how important it is to recycle our waste products. …

Even though our own [Oneida Seven Generations] Corporation has been the target of negative press and conversations, they are the only entity connected to our Tribe that thought outside the box and did their best to make something happen that would generate additional revenues for our Tribe. Even though we all do not see the value in their work, they did the best they could with what they had. Their project may not be welcome on our reservation but other Tribes liked the idea and wanted to learn more. It is just unfortunate for us that we were unable to bring this technology to light.

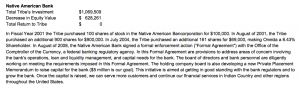

ALLOW US TO REPEAT…

Cristina Danforth is now President of the Native American Finance Officers Association Board [NAFOA] as well as a member of the Board of Directors of the Native American Bank NA [NABNA] and the Native American Bancorporation Co. in the State of Colorado.

According the FY2017 GTC Annual Meeting Packet, the Oneida Nation of Wisconsin has so far LOST 70% of its $1,000,00 investment in 8% ownership of NABNA.

Tina Danforth misses ~50% of OBC and GTC Meetings due to her travel for NABNA and the Native American Finacce Officers Association [NAFOA], work for which she is presumably paid even as her incompetence leads to MILLIONS OF DOLLARS IN LOSSES TO GTC.

MEANWHILE, the Native American Bank NA makes money when tribes borrow millions from the BIA for boondoggles like Ron Van Den Heuvel’s & OSGC’s ‘renewable energy’ fruad schemes, and the Native American Bank NA Annual Report 2015 says:

2014 … We became a dominant institution in the utilization of BIA loan guarantees, accounting for nearly 30% of all dollars under this type of guarantee in the country.

For the second year in a row we received a Bank Enterprise Award in the amount of $265,496 and a Performance Lending Award from the US Department of Interior, Office of Indian Energy and Economic Development Division of Capital Investment.

06/14/13 : FILED – Sauk Co. Case No. 13CF208, State of Wisconsin v. [Oneida Housing Authority Employee] Spencer A. Cornelius

06/14/13 : FILED – Sauk Co. Case No. 13CF208, State of Wisconsin v. [Oneida Housing Authority Employee] Spencer A. Cornelius

• Substantial Battery-Intend Bodily Harm, Felony I

• REPEATER

• GUILTY PLEA on 01/21/14

According to the September 20, 2016 Superseding Indictment, Docket No. 16-CR-064, USA v. Ron & Kelly Van Den Heuvel and Paul J. Piikkila

According to the September 20, 2016 Superseding Indictment, Docket No. 16-CR-064, USA v. Ron & Kelly Van Den Heuvel and Paul J. Piikkila

On or about June 14, 2013, in the state and Eastern District of Wisconsin

RONALD H. VAN DEN HEUVEL

in order to execute the scheme described in this count, caused [Patrick R. Hoffman] to apply to Community First Credit Union, a credit union with accounts insured by the National Credit Union Share Insurance Fund, for a loan of $50,000. In an attempt to obtain the loan, Ronald H. Van Den Heuvel caused [Pat Hoffman] to falsely represent that he was the borrower, that the was the Director of Sales for EARTH [RTS], and that his annual income from EARTH [RTS] was more than $92,000 when, as Ronald H. Van Den Heuvel well knew, the loan proceeds would be used by Ronald H. Van Den Heuvel’s business entities and [Patrick Hoffman] worked for Ronald H. Van Den Heuvel as an office assistanct earning $12 an hour. ….

COUNT FIFTEEN

…The false statements were that:

a. [Patrick Hoffman] was to be the borrower on a loan of $50,000 when, as defendant well knew, [Pat Hoffman] was a straw borrower whose name was being put on the loan even though the loan proceeds were actually going to be used by the defendant and his business entities.

b. [Pat Hoffman] was the Director of Sales for EARTH [now RTS] earning a salary of over $92,000 per year when, as defendant well knew, [Pat Hoffman] was an office assistant earning approximately $12 an hour.

06/17/13 : According to the September 20, 2016 Superseding Indictment, Docket No. 16-CR-064, USA v. Ron & Kelly Van Den Heuvel and Paul J. Piikkila

06/17/13 : According to the September 20, 2016 Superseding Indictment, Docket No. 16-CR-064, USA v. Ron & Kelly Van Den Heuvel and Paul J. Piikkila

COUNT SIXTEEN

On or about June 17, 2013, at DePere, in the state and Eastern District of Wisconsin,

RONALD H. VAN DEN HEUVEL

in order to execute the scheme described in Count Fourteen, caused [son-in-law Patrick Hoffman] to apply to Nicolet National Bank, whose accounts are insured by the Federal Deposit Insurance Corporation, for a loan of $50,000. In an attempt to obtain the loan, Ronald H. Van Den Heuvel caused [Pat Hoffman] to offer the 2013 Cadillac as security for the loan. …

COUNT EIGHTEEN

On or about June 17, 2013, at Green Bay, in the state and Eastern District of Wisconsin,

RONALD H. VAN DEN HEUVEL

in order to execute the scheme described in Count Fourteen, caused [Patrick R. Hoffman] to apply to Pioneer Credit Union…for two loans: one of $60,000 and one of $25,000. In an attempt to obtain these loans, Ronald H. Van Den Heuvel caused [Pat Hoffman] to offer the 2013 Cadillac Escalade and the 2010 Cadillac Escalade as security for the loans and caused [Patrick Hoffman] to falsely represent that the was the borrower, that he was the Director of Tissue Converting for EARTH [now Reclamation Technology Systems, LLC], and that his annual income from EARTH [RTS] was more than $92,000 when, as Ronald H. Van Den Heuvel well knew, the loan proceeds would be used by Ronald H. Van Den Heuvel and his business entities and [Pat Hoffman] worked for Ronald H. Van Den Heuvel as an office assistant earning approximately $12 an hour.

According to the July 2, 2015 Brown County Sheriff’s Dept. Search Warrants for Ronald Van Den Heuvel / Green Box NA Green Bay, LLC:

g. Both [CPA Steven] Huntington and [CPA Guy J.] LoCascio stated that [RVDH] transferred the titles of two company vehicles, 2010 Cadillac Escalade, black in color, with WI license plate 727VKL and 2013 Cadillac Escalade, white in color, with WI license plate 729VKL which were registered under E.A.R.T.H., to his son-in-law, Patrick Hoffman. Ronald H. Van Den Heuvel did this because he was unable to obtain financing from any local bank. [Ron Van Den Heuvel] instructed Hoffman to use two Cadillac Escalades, which were now registered to Hoffman, as collateral. Both Huntington and LoCascio stated they warned [Ron Van Den Heuvel] about transferring both vehicles to [son-in-law Patrick] Hoffman, as then Hoffman would have to show the acquisition of the vehicles as taxable income. Hoffman was shown as the registered owner of the two Cadillac Escalades for one year before the vehicles were registered again by E.A.R.T.H. [formerly NATURE’S CHOICE TISSUE LLC, now doing business as RECLAMATION TECHNOLOGY SYSTEMS LLC / RTS]. The two Escalades are still used as company vehicles, and your affiant has seen Ronald H. Van Den Heuvel getting out of the black Escalade at 2077 Lawrence Drive, City of De Pere, Brown County, Wisconsin.

h. Both Huntington and LoCascio stated that [RVDH] never took a salary from Green Box because his wages would have been garnished by the IRS and other creditors.

i. Huntington heard [RVDH] claim to potential investors that [RVDH] had tax returns when Huntington knew [RVHD] had not filed income taxes in years and he owed back taxes for employee withholding.

- June 17, 2013 Voluntary Statement by EMHS Director Marty Antone re: Stolen Confidential Division of Land Management files found in Oneida Gaming Commission dumpsters

06/25/13 : June 25, 2013 Reply by Fmr. OBC Sec. Patty Hoeft re: Oneida Eye Publisher’s request as an enrolled ONW-member, Tribal employee, and GTC Member to review OSGC’s Disclosure Reports

06/25/13 : June 25, 2013 Reply by Fmr. OBC Sec. Patty Hoeft re: Oneida Eye Publisher’s request as an enrolled ONW-member, Tribal employee, and GTC Member to review OSGC’s Disclosure Reports

- Zero Waste World: Oneida Nation & Green Bay Ban the Burning of Waste

06/26/13 : June 26, 2013 Illinois Attorney Registration & Disciplinary Commission Synopsis of Board Review & Recommendation re: Fmr. Menominee Tribe of Indians of Wisconsin [MTIW] Supreme Court Justice Joseph Henry Martin

[Joe Martin is the brother of current MITW Judge Mercedes M. Martin, and they are a nephew & niece of Fmr. MITW Tribal Attorney Rita Keshena]

06/27/13 : WGBA: Oneida Tribe members Leah Sue Dodge and Frank Cornelius Sr. organize GTC Petition to dissolve Oneida Seven Generations Corp. [OSGC]

- FILED – July 1, 2013 Complaint in Brown Co. Case No. 13CV1065, Tina Fritsch v. Arland Clean Fuels, LLC / Generation Clean Fuels, LLC / ACF / GCF [Eric Decator; Louis Stern; Gaylen LaCrosse; Michael Flaherty]

07/08/13 : U.S. Securities & Exchange Commission Form-D, Organic Energy Corp., Delaware; Principal Place of Business: 700 Louisiana St., Ste. 3950, Houston, TX, 77002; Ph. 832-390-2755; George Gitschel, Executive Officer, Director, Promoter; Issuer Size: NO REVENUES; New Notice; Total Offering Amount: $2,000,000; Total Amount Sold: $1,250,000; Remaining to be Sold: $750,000; Minimum investmet: $125,000

Atty. Joseph Camilli

-

-

- ACF Services, LLC registered w/ WDFI as a Foreign LLC out of Delaware; Registered Agent Joseph A. Camilli, Esq.

-

-

-

- ACFS – like ACF Leasing, LLC / ACFL – is affiliated with Arland Clean Fuels, aka Generation Clean Fuels, and a variety of entities owned by Eric Decator and Louis Stern.

-

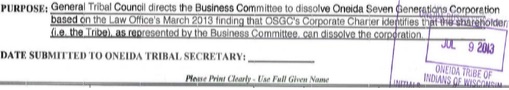

07/09/13 : GTC Petition with 364 signatures of enrolled ONWI members delivered to the Oneida Business Committee Secretary’s Office to require a General Tribal Council Meeting be held re: Consideration of the Dissolution of Oneida Seven Generations Corp. [OSGC]

07/15/13 : July 15, 2013 Brief of Respondent WI Appeals Court Case 13AP591, Oneida Seven Generations Corporation & Green Bay Renewable Energy, LLC v. City of Green Bay

07/15/13 : July 15, 2013 Brief of Respondent WI Appeals Court Case 13AP591, Oneida Seven Generations Corporation & Green Bay Renewable Energy, LLC v. City of Green Bay

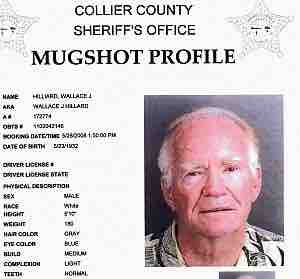

According to the Court Record of Events, Oneida Co. Case No. 13FA85, DIVORCE in re: the marriage of Wallace James Hilliard and Patricia Ann Hilliard

According to the Court Record of Events, Oneida Co. Case No. 13FA85, DIVORCE in re: the marriage of Wallace James Hilliard and Patricia Ann Hilliard

“Petitioner Wallace James Hilliard in court with attorney Todd R. McEldowney. Respondent Patricia Ann Hilliard in court with attorney Scott A. Cirilli. Issues are possession of the vehicle and payment of the mortgage on the bed & breakfast, which is also the prior marital residence and current residence of wife. Parties have a prenuptial agreement indicating that maintenance is specifically waived in all instances. Husband indicates current income is limited to about $4,000 per month before expenses. Wife earns minimal income operating bed & breakfast. Neither party has current regular income sufficient to maintain the $3,250 mortgage. Husband may have access to fluctuating additional investment/trust income. Husband will be awarded use of parties’ vehicle and keep loan current. Husband shall also be responsible for keeping the mortgage on the bed & breakfast out of foreclosure, although he will not necessarily have to keep the payments current. Any payments made towards that can be characterized at a later date, perhaps as an advance on the property division. Parties both indicate that it is likely that the wife will receive a substantial property division. Attorney Cirilli will draft.”

07/16/13 : OSGC President & Chair William ‘Bill’ Cornelius, Esq., gave a presentation on Commercial-Scale Renewable Energy Project Development & Finance Workshop at the National Renewable Energy Laboratory [NREL]

07/16/13 : OSGC President & Chair William ‘Bill’ Cornelius, Esq., gave a presentation on Commercial-Scale Renewable Energy Project Development & Finance Workshop at the National Renewable Energy Laboratory [NREL]

07/17/13 : July 17, 2013 Criminal Complaint including 3 counts against Defendant Stephanie Ortiz, Brown Co. Case No. 13-CF-948, State of Wisconsin v. Stephanie M. Ortiz

07/24/13 : VIDEO – July 24, 2013 Oneida Business Committee Regular Meeting excerpt re: OBC’s Attempts to stop paying stipends to attend GTC Meetings as directed by General Tribal Council, and despite General Tribal Council voting several times to retain their measly $100 stipend while OSGC received $200 per person for each of their meetings, and $250 for officers.

Watch Haskell Indian Nations University Board of Regents member Brandon Stevens explain why he deserves “preferential treatment” above General Tribal Council:

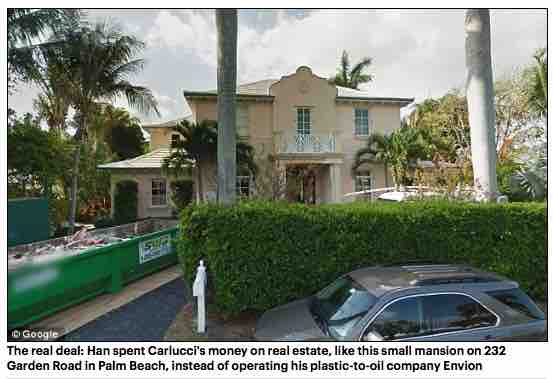

08/01/13 : Palm Beach Daily Mail, North End house sells in wake of court judgment; Seller Michael Han lost fraud suit by former defense chief

A house at 232 Garden Road has sold privately for a recorded $5.35 million in the wake of a $37-million civil-suit judgment issued last spring against seller Michael S. Han, who co-owned the property with his wife, Dorothy Kyle Harkrader Han.

Former U.S. Defense Secretary Frank C. Carlucci III had filed the suit last year in a Virginia federal circuit court, claiming that Michael Han had scammed him into investing $32 million in a fraudulent business venture over seven years beginning in 2003. The Hans’ house was one of three Palm Beach properties — along with other items, including six cars — that Michael Han bought with money that Carlucci had invested in Envion Inc., the court ruled. Han had claimed Envion’s patented “oil generator technology” could turn waste plastic into crude oil, according to the suit.

The judgment granted Carlucci restitution, including assets that Michael Han or his related businesses acquired with the funds. The defendants are appealing the ruling.

But Carlucci isn’t the new owner of the Garden Road house, nor is he linked to the Delaware limited liability company that bought it, said agent Paulette Koch of the Corcoran Group. She was on the buyer’s side of the negotiating table opposite agent W. Ted Gossett of Sotheby’s International Realty.

The deed lists the buyer, Three Cups LLC, as having a mailing address in care of West Palm Beach attorney Francis X.J. Lynch. He could not be reached for comment.

Koch would not identify anyone associated with Three Cups LLC, and public records did not offer any clue. Koch did say the five-bedroom, Mediterranean-style house — built in 2004 with 6,412 square feet of living space, inside and out — strongly appealed to her clients.

“They liked it immediately. Despite the fact that it was a challenging transaction, they were amenable to seeing it through,” said Koch, who handled her side of the deal with her son, Corcoran agent Dana Koch.

It was unclear this week how the proceeds from the sale would transfer to Carlucci to satisfy the May 10 judgment. West Palm Beach attorney Peter M. Bernhardt, who was among the attorneys representing Carlucci in the suit, declined to comment, and the Hans and their attorneys also could not be reached. None of the real estate agents involved would discuss specifics details of the transaction.

The Hans had paid $3.348 million for the house in early 2011. That was the same year Michael Han acquired two other Palm Beach properties using a limited liability company named Hammon Avenue Partnership LLC.

Mentioned in District Judge Liam O’Grady’s judgment, the properties include a multi-family building with a rear single-family house at 125 Hammon Ave., which was acquired for $1.2 million; and a one-bedroom condominium at 220 Atlantic Ave., which was bought for $300,000. Neither property has been listed for sale in the local multiple listing service, a search this week showed. Gossett and Paulette Koch said they did not have any knowledge of plans for the two properties.

The judgment “enjoined” Han and the other defendants in the lawsuit “from transferring or otherwise encumbering the Palm Beach properties.” Court-approved liens were placed on the properties, preventing their sale.

But in a document recorded Monday, Carlucci released the lien on the Garden Road house, allowing its sale to proceed.

Carlucci, who served under President Ronald Reagan, is former chairman of The Carlyle Group, a private-equity firm; he could not be reached for comment.

Carlucci filed the lawsuit in Virginia because that’s where his business dealings with Han took place.

Michael Han made headlines in 2011 when he announced he was moving Envion and Lyf Brands, a vitamin manufacturer, to West Palm Beach from Washington, D.C. West Palm Beach and the state offered Lyf Brands $364,000 to create 91 jobs, but the business never met the criteria for collecting any incentives, according to the Business Development Board.

The Hans also own a home in Nag’s Head, N.C., according to court documents. Kyle Han filed for divorce in February, records show.

08/08/13 : Kalihwisaks ‘Chairman’s Report’

08/08/13 : Kalihwisaks ‘Chairman’s Report’

Having 2000 Oneidas making the decisions for the Oneida Tribe is not only good governance, but also, protects our members and our resources by making more responsible decisions than 9 members could possibly make.

Case in point: In May of this year, the GTC said “No” to a Waste to Energy plant on the Reservation. Hopefully, further costs on that project will be stopped and if they truly are stopped because of GTC’s actions, I believe that the GTC will have paid for itself in Tribal savings to cover GTC meetings for the next 20 years, just from that one meeting.

I caution GTC about approving any initiative which might diminish its effectiveness.

08/09/13 : JUDGMENT entered against Artley Skenandore and his company Swakweko LLC, and Indigenous Games USA Inc., in the amount of $275,653.60.

08/09/13 : JUDGMENT entered against Artley Skenandore and his company Swakweko LLC, and Indigenous Games USA Inc., in the amount of $275,653.60.

It seems Artley Skenandore booked an entire hotel facility under his company’s name…

(a) before he had officially established the company in any capacity, and

(b) without actually having the money to pay for booking an entire hotel facility.

The 2011 Form 990 for Indigenous Games USA which lists Artley Skenandore Jr. as Executive Director and lists his salary as $75,960/year:

Former OBC Chair and Tribal Financial Advisors‘ Tribal Board of Advisors Chairman Richard ‘Rick’ Hill was also the Vice-Chair of Indigenous Games USA in 2011.

Artley Skenandore’s legal counsel was Atty. Andrew S. Oettinger of Godfrey & Kahn, where Rick Hill’s wife – Donsia Strong-Hill – is a shareholder.

Artley Skenandore’s legal counsel was Atty. Andrew S. Oettinger of Godfrey & Kahn, where Rick Hill’s wife – Donsia Strong-Hill – is a shareholder.

08/12/13 : August 12, 2013 Reply Brief of Appeallants 2013AP591, Oneida Seven Generations Corporation & Green Bay Renewable Energy, LLC v. City of Green Bay

08/12/13 : August 12, 2013 Reply Brief of Appeallants 2013AP591, Oneida Seven Generations Corporation & Green Bay Renewable Energy, LLC v. City of Green Bay

- Order for Judgment in Brown Co. Case No. 09CV439, Glory LLC v. Ron Van Den Heuvel & Tissue Technology LLC [and dismissed defendants: Partners Concepts Development Inc; Custom Paper Products Inc; Natures Choice Tissue LLC; Purely Cotton Products Corp; Eco Fibre Inc; ReBox Packaging Inc; Tissue Products Technology Corp; Patriot Project Services LLC; Chat LLC; Patriot Investments LLC; Patriot Services Inc; RVDH Inc; Waste Fiber Technology Inc; Recovering Aqua Resources Inc; RV Jet Inc; KYHKJG LLC; Patriot Paper Services Inc; Fibre Solutions LLC; Doc-U-Mince LLC; and dismissed third-party defendants: Ross J. Nova; Godfrey & Kahn.]

• $1,227,880.01 MONEY JUDGMENT AGAINST TISSUE TECHNOLOGY, LLC on 09/06/13

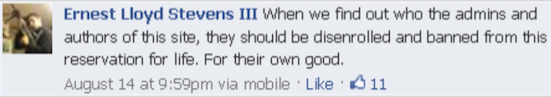

08/14/13 : ONWI Communications Specialist Ernest ‘Ernie’ Stevens III – Brandon’s half-brother and Ernie Jr.’s son – posted his review of Oneida Eye on Facebook:

When we find out who the admins and authors of this site, they should be disenrolled and banned from the reservation for life. For their own good.

At the time he made that statement on Facebook holding a weapon, Ernest Stevens III was on a deferred prosecution program for Domestic Violence.

Ernie Stevens III was later made Director Native American Tourism of Wisconsin [NATOW].

Ernie Stevens III is also a host of Native Report produced by PBS station WDSE:

While IMDB.com no longer lists Ernie Stevens III as a Co-Producer for native youth lacrosse movie Crooked Arrows …

IMDB.com says that Ernie Stevens III was Director & Producer of the 2008 film AlexExtreme: Philosophy of Pain, and is currently Producer for the film Neon Buffalo: An American Story about the history of tribal bingo and casino business.

-

Louis Stern, ACF/GCF owner with Eric Decator, Gaylen LaCrosse, and Michael Flaherty

August 14, 2013 Pressure Letter from Atty. Louis Stern of Generation Clean Fuels [GCF] to OSGC Board re: Waste to Energy Project

As you know, you and we have devoted substantial amounts of time, effort and money to developing the Project. We understand that you have devoted in excess of $5.8 million to the Project. We have also devoted thousands of hours and over $3.0 million to the Project. Now that the Project is about to be financed, it would be a horrible waste of all those hours and dollars to abandon it at this point. …

Because of the close working relationship we have developed with your team, we have made many concessions, which have increased your potential benefit and reduced (if not eliminated) your risks with respect to this Project.

• Leasing the equipment for the Project to you at a substantial discount to its market price.

• Agreeing to defer almost half of the Project cost owed to us for as long as 9 years.

• Lending GBRE $870,000 to fund half of the required debt service reserve fund.

• Guaranteeing the entire amount of the loan. In addition, I am personally guaranteeing $3.0 million of the loan.

• Providing OSGC with a royalty of 11% of gross revenues off the top.

• Providing OSGC with a $250,000 development fee at Closing.

• Depositing $2.2 million in cash as additional collateral for the loan.

We need to know as soon as possible whether you plan to complete the Project. We have many other customers who would like to acquire equipment from us. We have been deferring these customers because of our commitment to you. However, if you do not tell us by August 23, 2013, that you are planning to complete the Project, we will need to divert our assets and attention to servicing our other customers. At this point, even if you decided to complete the Project, we would need to reconsider whether we would still be willing to do the Project on the same basis (including all of the concessions outlined above).

We hope to hear from you soon and look forward to a long and mutually beneficial relationship.

08/28/13 : VIDEO – August 28, 2013 Oneida Business Committee Regular Meeting excerpt re: Analysis of Frank Cornelius Sr.’s Petition for GTC to Direct the OBC to Dissolve OSGC.

08/28/13 : VIDEO – August 28, 2013 Oneida Business Committee Regular Meeting excerpt re: Analysis of Frank Cornelius Sr.’s Petition for GTC to Direct the OBC to Dissolve OSGC.

Also, an OSGC Report by ONWI Legislative Affairs Director & OSGC Board Member Nathan King announcing a ‘Mutual Separation Agreement’ with former OSGC CEO Kevin Cornelius, and falsely claiming OSGC was not involved in pyrolysis nor gasification on the ONWI Reservation WHEN IN FACT ‘open flame’ waste incineration was illegally occurring in violation of zoning & ordinance laws at OSGC’s 1201 O’Hare Boulevard, Hobart, WI commercial building, and the OBC refused to acknowledge & admit that OSGC’s plan was still to market pyrolysis & gasification incinerators to other tribes and municipalities as stated in Exhibit B of the 11/09/09 WI Dept. of Commerce Contract #LEG-FY10-19812.

Also, an OSGC Report by ONWI Legislative Affairs Director & OSGC Board Member Nathan King announcing a ‘Mutual Separation Agreement’ with former OSGC CEO Kevin Cornelius, and falsely claiming OSGC was not involved in pyrolysis nor gasification on the ONWI Reservation WHEN IN FACT ‘open flame’ waste incineration was illegally occurring in violation of zoning & ordinance laws at OSGC’s 1201 O’Hare Boulevard, Hobart, WI commercial building, and the OBC refused to acknowledge & admit that OSGC’s plan was still to market pyrolysis & gasification incinerators to other tribes and municipalities as stated in Exhibit B of the 11/09/09 WI Dept. of Commerce Contract #LEG-FY10-19812.

08/30/13 : According to the April 6, 2015 Plaintiffs–Appellants’ Brief in Cook. Co. Case No. 2014-L-2768, GCF/ACF v. ONWI & OSGC et al., and Exhibits:

08/30/13 : According to the April 6, 2015 Plaintiffs–Appellants’ Brief in Cook. Co. Case No. 2014-L-2768, GCF/ACF v. ONWI & OSGC et al., and Exhibits:

On August 30, 2013, Bruce King (CFO of OSGC/Treasurer of GBRE), Cathy Delgado (OSGC Board member), William Cornelius (OSGC Board President), Brandon Stevens (Tribe Business Committee member) and Michael Galich went to ACF’s plant in Bakersfield, California to examine the type of machines that would be utilized in the Project. …Based on all of the foregoing meetings, telephone conferences and visits to ACF’s plant by the Tribe and OSGC, ACF believed it was negotiating the Project with the Tribe and OSGC. …ACF relied upon the representations of the Tribe/OSGC that they were acting on behalf of the Tribe/OSGC.

09/03/13: Green Box NA Georgia Macon Ethanol LLC registered w/ WDFI; Registered Agent listed as Environmental Advanced Reclamation Technology HQ, LLC [a/k/a EARTH; f/k/a Nature’s Choice Tissue Corp., renamed Reclamation Technology Systems / RTS]; GBNAGME was Administratively Dissolved 09/14/15

- NBC 26 WGBA: Oneida Seven Generations Corp. CEO Kevin Cornelius steps down

09/06/13 : Judgment, Brown Co. Case No. 09CV439, Glory LLC v. Ron Van Den Heuvel & Tissue Technology LLC [and dismissed defendants: Partners Concepts Development Inc; Custom Paper Products Inc; Natures Choice Tissue LLC; Purely Cotton Products Corp; Eco Fibre Inc; ReBox Packaging Inc; Tissue Products Technology Corp; Patriot Project Services LLC; Chat LLC; Patriot Investments LLC; Patriot Services Inc; RVDH Inc; Waste Fiber Technology Inc; Recovering Aqua Resources Inc; RV Jet Inc; KYHKJG LLC; Patriot Paper Services Inc; Fibre Solutions LLC; Doc-U-Mince LLC; and dismissed third-party defendants: Ross J. Nova; Godfrey & Kahn.]

09/06/13 : Judgment, Brown Co. Case No. 09CV439, Glory LLC v. Ron Van Den Heuvel & Tissue Technology LLC [and dismissed defendants: Partners Concepts Development Inc; Custom Paper Products Inc; Natures Choice Tissue LLC; Purely Cotton Products Corp; Eco Fibre Inc; ReBox Packaging Inc; Tissue Products Technology Corp; Patriot Project Services LLC; Chat LLC; Patriot Investments LLC; Patriot Services Inc; RVDH Inc; Waste Fiber Technology Inc; Recovering Aqua Resources Inc; RV Jet Inc; KYHKJG LLC; Patriot Paper Services Inc; Fibre Solutions LLC; Doc-U-Mince LLC; and dismissed third-party defendants: Ross J. Nova; Godfrey & Kahn.]

• MONEY JUDGMENT AGAINST TISSUE TECHNOLOGY, LLC: $1,227,880.01

Glory, LLC changed Registered Agent w/ WDFI

Glory, LLC changed Registered Agent w/ WDFI

- Oneida-Kodiak Construction, LLC changed Registered Agent w/ WDFI

09/11/13 : From the September 11, 2013 OBC Regular Meeting Agenda

09/11/13 : From the September 11, 2013 OBC Regular Meeting Agenda

X. General Tribal Council

4. Schedule special GTC meeting 1 p.m. Sunday, Dec. 15, 2013: Petition to dissolve Oneida Seven Generations Corporation

09/25/13 : VIDEO – September 25, 2013 Oneida Business Committee Regular Meeting excerpts re:

• OSGC Dissolution process:

Part 1 – Click to view on YouTube

• Fmr. OBC Chair Ed Delgado rejecting Atty. Carl J. Artman’s nomination for the OSGC Board:

Part 2 – Click to view on YouTube

• The expensive incompetence of Alliance Construction & Design and OSGC partnership Oneida–Kodiak Construction, LLC:

Part 3 – Click to view on YouTube

10/14/13: Default Judgment, Brown Co. Case No. 13CV927, [ONWI-owned] Bay Bank v. Ronald H. Van Den Heuvel

• $20,168.89 MONEY JUDGMENT AGAINST RON VAN DEN HEUVEL

10/23/13 : William C. Bain gave $1,500 contribution to Scott Walker; Employer VOS Electric

10/23/13 : William C. Bain gave $1,500 contribution to Scott Walker; Employer VOS Electric

![]()

- October 23, 2013 OBC Regular Meeting re: failure of OBC and ONVAC [Oneida Nation Veterans Affairs Committee] to provide transporation to families of Code Talker medal recipients

10/25/13 : According to the Court Record of Events in Sauk Co. Case No. 13CF208, State of Wisconsin v. [Oneida Housing Authority Employee] Spencer A. Cornelius

10/25/13 : According to the Court Record of Events in Sauk Co. Case No. 13CF208, State of Wisconsin v. [Oneida Housing Authority Employee] Spencer A. Cornelius

Prilimnary heraing …

Defendant Spencer A. Cornelius in court with attorney Thoms Steinman. Defendant Spencer A. Cornelius in custody. Kevin R. Calkins appeared for the State of Wisconsin. Court states case and State states apperances. State calls Officer Kristi Siedl-LDPD-S&T. Witness ID’s DE. Record to reflect ID. Atty. Steinman does not cross-exam. Witness excused. State rests. No testimony from Atty. Steinman. Court finds probable cause and binds over for trial. Bond continued. Arraignment scheduled for November 11, 2013 at 1:oo pm.

10/30/13 : Britney Van Den Heuvel gave $250 contribution to Scott Walker; Employer: VOS Electric

10/30/13 : Britney Van Den Heuvel gave $250 contribution to Scott Walker; Employer: VOS Electric

![]()

11/07/13 : VIDEO – November 7, 2013 OBC Regluar Meeting excerpt re: flooding in Oneida Tribal Cemetery [Click to watch on YouTube]

11/07/13 : VIDEO – November 7, 2013 OBC Regluar Meeting excerpt re: flooding in Oneida Tribal Cemetery [Click to watch on YouTube]

11/08/13 : Milwaukee Journal Sentinel: Menominee offered Oneida inducements to support Kenosha casino

The Oneida tribe will collect at least $3 million annually in banking fees and has the “right of first refusal” to finance the first phase of a Menominee casino in Kenosha in exchange for its support of the project, according to the newly released agreement.

In addition, the Menominee [Tribe of Indians of Wisconsin / MITW] is promising not to advertise the Kenosha casino, which it hopes to build with Hard Rock International, north of Milwaukee. That promise is intended to protect the market for the Oneida tribe’s casino near Green Bay. The Oneida casino is in the middle of a $27.9 million expansion.

The Oct. 17 agreement was posted on OneidaEye.com, a small website maintained by Leah Sue Dodge, a member of the Oneida tribe and critic of the tribe’s leadership. As a tribal member, Dodge said, she obtained a copy of the agreement from the tribal secretary’s office.

The Oneida [Business Committee] announced its endorsement of the controversial Kenosha casino project on Oct. 17, the same day it signed its agreement with the Menominee. Details of the agreement were kept confidential initially.

Winning the Oneida endorsement was vital to the Menominee because Gov. Scott Walker has repeatedly said he would approve an off-reservation casino in Kenosha only if each of the state’s other 10 tribes also agreed to the project. Walker has unilateral veto power over the off-reservation casino, which the federal government approved in August. …

Dodge, who disclosed the agreement, was critical of the Oneida for even considering participating in the loan arrangement, saying the tribe doesn’t have the funds to do so. “The elders are very concerned about this,” she said.

CLICK HERE FOR TIMELINE PART 7

- CLICK HERE FOR TIMELINE PART 5

- CLICK HERE FOR TIMELINE PART 4

- CLICK HERE FOR TIMELINE PART 3

- CLICK HERE FOR TIMELINE PART 2

- CLICK HERE FOR TIMELINE PART 1

https: