Be sure to see

our revamped GALLERY!

09/04/18 : September 4, 2018 Evidentiary Hearing minutes, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

10:16 am The Court FINDS that Mr. Van Den Huevel has knowingly and voluntarily given up his right to have an attorney represent him.

10:21 am Further inquiry as to competence, mental alertness and competence to make the decision to represent himself.

The Court notes the record is to reflect that his wife is shaking her head no in the back of the Courtroom.

The Court inquires as to any question of competence.

Mr. Krueger requests further questioning, not a formal evaluation.

Mr. LeBell responds that both criteria are satisfied.

Mr. Krueger responds, does not see need for further evaluation.

The Court inquires as to blood sugar levels and documentation.

Mr. LeBell responds.10:24 am The Court is satisfied that defendant is not suffering from any mental incompetence or impairment.

The Court finds that Defendant has freely and voluntarily waived his right to have counsel represent him and ACCEPTS his waiver of right to counsel.

Mr. LeBell is to supplement record with any evidence of Defendant’s physical condition today.10:25 am Motion to remove Mr. LeBell as legal counsel is GRANTED.

The Court would like Mr. LeBell to remain on this case as stand-by counsel.

The Court will enter an order clarifying the responsibilities of stand-by counsel.10:26 am The Court takes a recess.

10:44 am The Court resumes.

The Court DENIES Defendant’s Motion for change of venue at this time. …4:24 pm … The Court inquires if Defendant would like to reconsider his Motion to dismiss court appointed counsel.

Defendant WITHDRAWS his Motion to dismiss court appointed counsel. GRANTED.

Mr. LeBell is re-appointed as counsel of record for Defendant.

08/31/18 : August 31, 2018 Reply Brief for Defendant Ron Van Den Heuvel’s Motion for Change of Venue, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

[V]irtually every event that has occurred in the defendant’s cases, as well as matters relating to the defendant, but not specifically part of the court filings, is described in the blog or is easily accessible through a link conveniently provided by the blog’s author. There is virtually no need for access to PACER in this case because the Oneida Eye has provided the same service to the public. PACER, at least, offers the reader the documents in a non-editorialized fashion.

The blogger from the Oneida Eye has depicted [Ron] Van Den Heuvel as the virtual

Anti-Christ. Contrary to the claim of the government, the pretrial coverage is not simply routine press offerings. They, in concert, paint a vivid picture of the defendant’s alleged criminal conduct.

![]()

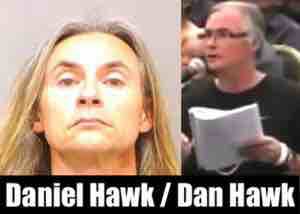

It should be noted that – contrary to the caption in this and previous court filings by Atty. Robert LeBell – the Defendant’s REAL NAME is Ronald H. Van Den Heuvel / Ronald Hewry Van Den Heuvel.

When confronted by Oneida Eye on 8/10/18 in front of U.S. Atty. Matthew Krueger about using the wrong middle initial (‘D’), defense attorney Robert LeBell blamed his secretary – yet Attorney LeBell continues to submit court filings using the WRONG NAME for his client.

Of course, Ron Van Den Heuvel doesn’t spell his court-appointed attorney’s name correctly, either…

08/22/18 : August 22, 2018 Defendant Ron Van Den Heuvel Pro Se Motion to Dismiss court-appointed counsel Atty. Robert LeBell, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

I. Failure to communicate

Attorney Robert LaBell [sic] has failed to adequately communicate with the defendant, severely prejudicing the defendant’s ability to prepare for trial and aid in his own defense.II. Failure to investigate

The defendant asserts that Attorney Robert LaBell [sic] has failed to review numerous documents, or obtain expert assistance on technical matters of which the defendant’s case relies heavily on, that would aid in the proper defense of the defendant.

![]()

- August 22, 2018 Defendant Ron Van Den Heuvel Pro Se Motion for Return of Property, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

The Defendant contends that the failure by the government to return Defendant’s server from where it was seized to the Defendant has allowed for the illegal sharing of documents. These emails and documents have been illegally taken, in some instances altered and given to the government and the Oneida Eye.

![]()

08/20/18 : August 20, 2018 Memorandum in Support of Defendant Ron Van Den Heuvel Motion for Change of Venue, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

It respectfully suggested that the court change venue to Milwaukee. Jury management for the Eastern District of Wisconsin in Milwaukee has advised that it seeks to secure jurors from a geographical area close in proximity to the city. Milwaukee jurors would not have been infected with the same taint as prospective jurors form [sic] Green Bay.

![]()

08/09/18 : August 9, 2018 Motion by Thomas W. Patton to Withdraw as Defendant-Appellant Ron Van Den Heuvel’s Appointed Counsel on Appeal of 16-CR-64, U.S. 7th Circuit Court of Appeals, Appellate Case No. 18-1147, United States of America, Plaintiff-Appellee v. Ronald H. Van Den Heuvel, Defendant-Appellant

Based upon his thorough and conscientious review of the entire record of the proceedings in the district court below, and from communications with the Defendant-Appellant, the undersigned attorney has concluded that there exists no non-frivolous issue that can be raised in this appeal on behalf of the Defendant-Appellant. …

Wherefore, Thomas W. Patton respectfully requests the entry of an order granting him leave to withdraw as the Defendant-Appellant’s appointed counsel on appeal in the above-entitled cause.

![]()

- August 9, 2018 Brief in Support of Motion by Thomas W. Patton to Withdraw as Defendant-Appellant Ron Van Den Heuvel’s Appointed Counsel on Appeal of 16-CR-64, U.S. 7th Circuit Court of Appeals, Appellate Case No. 18-1147, United States of America, Plaintiff-Appellee v. Ronald H. Van Den Heuvel, Defendant-Appellant [152 pages w/ Exhibits including 01/05/18 Sentencing Hearing transcript]

SUMMARY OF ARGUMENT

Van Den Heuvel cannot raise any argument regarding the motion to suppress because it has been waived for direct appeal in this case. He waived the issue by withdrawing the motion in the district court and by entering into a unconditional guilty plea.

Any argument challenging Van Den Heuvel’s conviction would be frivolous where he entered into an unconditional, knowing, and voluntary plea of guilty, pursuant to a plea agreement, and the district court substantially complied with Federal Rule of Criminal Procedure 11 when accepting his plea. The Rule 11 colloquy in this case was thorough and adequately advised Van Den Heuvel. Furthermore, the district court did not err by denying Van Den Heuvel’s motion to withdraw the guilty plea. He was not coerced into the plea because it contained an agreement to dismiss charges against his wife and he did not provide any evidence that he was actually innocent of the conspiracy he pled guilty to.

The district court did not abuse its discretion by denying Van Den Heuvel’s motion to adjourn the sentencing hearing and did not err in denying counsel’s motion to withdraw as attorney. Both motions were made a few days prior to sentencing and were not supported by evidence or adequate reasons for granting.

Any argument challenging Van Den Heuvel’s sentence would be frivolous where his sentence was not imposed in violation of the law, was not the result of an incorrect application of the guidelines, and was not unreasonable. The district court did not err by imposing a term or the conditions of supervised release.

![]()

- August 9, 2018 Notice: Counsel for the defendant has filed a motion for leave to withdraw under Circuit Rule 51(b), U.S. 7th Circuit Court of Appeals, Appellate Case No. 18-1147, United States of America, Plaintiff-Appellee v. Ronald H. Van Den Heuvel, Defendant-Appellant

On August 9, 2018, your attorney filed a brief stating that your appeal is frivolous and requesting permission to withdraw from the case.

1. You have 30 days from the date at the top of this notice to present any argument that you believe shows that your conviction or sentence is invalid. …

![]()

- August 9, 2018 Defendant Ronald Van Den Heuvel’s Local Rule 12c Statement, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

![]()

08/07/18 : Green Bay Press-Gazette / USA TODAY– Ron Van Den Heuvel wants to dismiss court-appointed attorney Robert LeBell, federal prosecutors claim it’s a stall tactic

July 31, 2018 USA’s Response to Defendant Ron Van Den Heuvel’s 07/20/18 Motion & Memo w/ Exhibit re: Van Den Heuvel’s attempt to get out of jail for a few months by demoting Ron’s court appointed counsel Robert LeBell to being the co-counsel of Ron’s on/off-again ‘attorney’ Ty Willihnganz, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

July 31, 2018 USA’s Response to Defendant Ron Van Den Heuvel’s 07/20/18 Motion & Memo w/ Exhibit re: Van Den Heuvel’s attempt to get out of jail for a few months by demoting Ron’s court appointed counsel Robert LeBell to being the co-counsel of Ron’s on/off-again ‘attorney’ Ty Willihnganz, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

Excerpt of Exhibit A, Brown Co. Jail telephone conversation transcript:

Ron Van Den Heuvel: I need, I need that, I need that thing so bad that I got a couple, a couple people think that it’ll get me 12-14 weeks out of here. So…

Michael Garsow: Oh, wow.

Ron Van Den Heuvel: Yep.

![]()

- July 20, 2018 Defendant Ronald Van Den Heuvel’s Memorandum of Law, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

The Department of Justice and prosecution know for certain that millions of illegally gained private documents from the general search have been given to the Oneida Eye. This allows Google to pick them up for the social media.

![]()

- July 20, 2018 Defendant Ronald Van Den Heuvel’s Notice of Motion and Motion to Dismiss the Use of Defendant’s Court Appointed Counsel, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

Defendant’s counsel and the late attorney, Mike Fitzgerald had on multiple occasions requested the return of over 290,000 pages of documents and the defendant’s server which were both taken 2077A and 2077B offices in the raid. To date, the server has not been returned. Through due diligence, the defendant located the PCDI server. Failure by the defendant’s counsel to report the email hacking incident allowed for the breach to continue unchecked. The 1,700 pages presented by the DOJ is clear proof that this theft of emails and delivery of them to the DOJ and the Oneida Eye did occur.

![]()

- 07/06/2018: Green Bay Press-Gazette / USA TODAY –

Green Box owner

Ron Van Den Heuvel jailed

for witness intimidation and

unauthorized spending

by Jonathan Anderson

[original version]

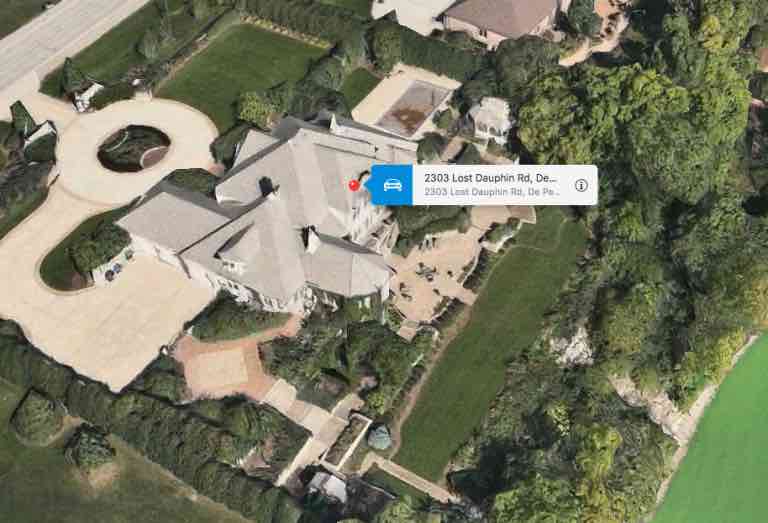

[Ron] Van Den Heuvel has been convicted of conspiracy to commit bank fraud for using straw borrowers to obtain loans under false pretenses for personal use and to keep his business, Green Box NA, and associated businesses afloat. He was sentenced in January to three years in prison, but he was allowed to remain free under certain conditions while additional federal charges — wire fraud and money laundering — remain pending.

U.S. District Court Judge William Griesbach had required Van Den Heuvel to notify the government of any financial transactions larger than $500, file monthly reports disclosing income and bank statements and disclose his legal and financial troubles to potential investors.

Prosecutors alleged that Van Den Heuvel in May paid $3,500 in cash to Oneida Golf and Country Club without the government’s approval and had previously paid nearly $15,000 to the club between September 2017 and February 2018.

The government also alleged that Van Den Heuvel failed to submit bank account statements as required, even though prosecutors believe that Van Den Heuvel has numerous accounts under his control but not in his name. …

Van Den Heuvel also was accused of engaging in “subtle intimidation of witnesses in recent contacts,” selling a van without authorization and attempting to sell a pyrolysis machine that is the subject of claims from multiple creditors.

Van Den Heuvel is charged in federal court with 14 counts of wire fraud and money laundering related to $9 million collected from investors in his now-bankrupt Green Box recycling business. The case is scheduled to go to trial on November 13.

[updated version]

Ron Van Den Heuvel, the De Pere businessman accused of bilking millions from investors, was jailed Friday after authorities alleged he committed more fraud and intimidated witnesses while free on bond.

“Fraud has continued,” U.S. District Court Judge William Griesbach said. “He’s continued to commit crimes.”

Van Den Heuvel was sentenced to three years in prison in January for conspiracy to commit bank fraud and, in a second case, also faces 14 counts of wire fraud and money laundering for allegedly deceiving investors out of $9 million in his now-bankrupt Green Box recycling business. …

Court records show Van Den Heuvel and his family spent more than $18,000 in total at the club between September and May — all while he claimed to be indigent and in need of a public defender.

Van Den Heuvel, who took the witness stand to testify, said he told the lender the $20,000 loan would be used for business expenses.

Receipts show most if not all of the money was used to buy equipment, golf lessons and food such as shrimp cocktails and tacos for Van Den Heuvel’s wife and children.

Van Den Heuvel’s wife also transferred the title of a van worth $2,500 to help pay down a debt.

Krueger said Van Den Heuvel also failed to submit bank account statements as required. Investigators believe that Van Den Heuvel has numerous accounts under his control even though not all are in his name.

- July 6, 2018 Bond Review Hearing Minutes re: Government’s Motion for Revocation or Modification of Release Order of Ron Van Den Heuvel, U.S. District Court, Eastern District of Wisconsin, Case Nos. 17-CR-160 and 16-CR-64, United States of America v. Ronald H. Van Den Heuvel

#LockedHimUp

- 07/09/18: ABC 2 WBAY – “Fraud has continued”: WEDC funding recipient Ron Van Den Heuvel’s release revoked in fraud case

On July 6, the court ordered a bond hearing. There was testimony that Van Den Heuvel had received a $20,000 loan and spent thousands of dollars at Oneida Golf and Country Club.

“The Court is satisfied that fraud has continued and the defendant has shown disregard for the orders of this Court,” reads the federal court records. “The Court finds the temptation to flee or take steps to avoid responsibility of facing trial is strong.”

Van Den Heuvel still faces prosecution for a federal indictment on 14 counts of wire fraud and money laundering.

Prosecutors say he fraudulently obtained more than $9 million in loans and investments for his eco-friendly “Green Box” business plan.

The indictment alleges that Van Den Heuvel claimed that Green Box could turn post consumer waste into usable consumer products and energy. …

Van Den Heuvel allegedly defrauded a range of victims, including individual acquaintances, the Wisconsin Economic Development Corporation (WEDC), a Canadian private investment firm, and Chinese investors in the EB-5 immigrant investor program.

In October of 2011, WEDC provided Green Box NA Green Bay, LLC with a loan of $1,116,000 to purchase equipment to create 116 jobs in the “Green Box” operation.

Instead, the indictment says he submitted false certifications claiming to have spent the funds properly.

In January of 2012, WEDC also awarded Green Box with a $95,000 grant to reimburse the company for costs to train new workers. Van Den Heuvel is accused of submitting fraudulent time records for training that never happened.

Counts 1-10 of the indictment charge Van Den Heuvel with executing the scheme to defraud by use of interstate wire communications. Maximum penalty on each count includes not more than 20 years in prison, a fine of $250,000 or both, plus a mandatory $100 special assessment and a period of supervised release.

Counts 11-14 charge Van Den Heuvel with unlawful financial transactions involving the ill-gotten gains. The maximum penalty for each individual count includes not more than 5 years in prison a fine of $250,000 or both. Plus a mandatory $100 special assessment and a term of supervised release not to exceed three years.

- 07/11/18 : Wisconsin State Journal – WEDC writes off $1.1 million loan to convicted De Pere businessman Ron Van Heuvel

- Milwaukee Journal Sentinel / USA TODAY – Wisconsin jobs agency WEDC writes off $1.1 million loan owed by De Pere businessman Ron Van Den Heuvel jailed for defrauding investors

- FOX 11 WLUK – WEDC to write off loan to failed De Pere business Green Box NA Green Bay LLC owned by Ron Van Den Heuvel

See also:

• July 11, 2018 WI State Senator Dave Hansen Press Release,

WEDC’s Continued Failure, Green Box Edition

• July 11, 2018 WI State Senator Jennifer Shilling Press Release,

Can’t pay back $1 million loan? WEDC says ‘No worries’; Walker’s troubled job agency leaves taxpayers with the bill, again

• July 11, 2018 Democratic Party of Wisconsin Press Release,

Walker’s WEDC foots taxpayers with $1 million loan given to conman in exchange for zero jobs; WEDC’s mismanagement casts more doubt on Foxconn deal

July 3, 2018 USA’s Motion for Revocation or Modification of Release Order of Defendant Ronald Van Den Heuvel w/ Exhibits, U.S. District Court, Eastern District of Wisconsin, Cases No. 16-CR-64 and 17-CR-160, United States of America v. Ronald H. Van Den Heuvel [27 pages]

July 3, 2018 USA’s Motion for Revocation or Modification of Release Order of Defendant Ronald Van Den Heuvel w/ Exhibits, U.S. District Court, Eastern District of Wisconsin, Cases No. 16-CR-64 and 17-CR-160, United States of America v. Ronald H. Van Den Heuvel [27 pages]

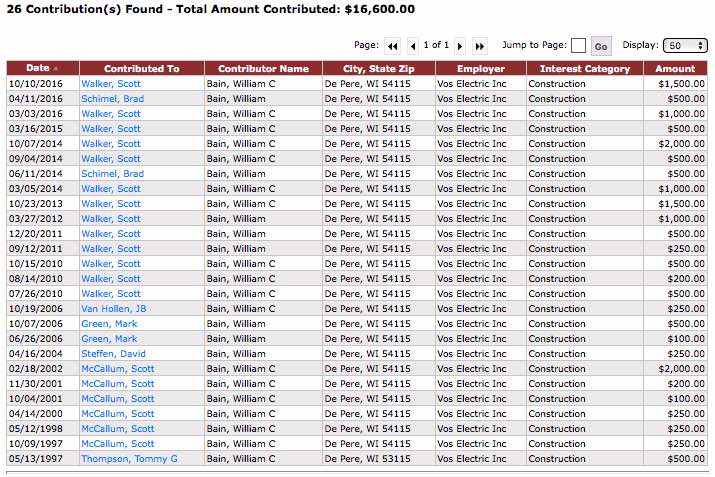

[Ron] Van Den Heuvel appears to keep bank accounts and assets out of his name to avoid detection. First, the government’s investigation has found numerous bank accounts that Van Den Heuvel controlled but titled in the names of entities or other individuals, often with his wife Kelly Van Den Heuvel having signatory authority. …

This pattern suggests that Van Den Heuvel is likely using bank accounts in others’ names without disclosing the accounts to Pretrial Services. …

The government recently learned that Van Den Heuvel attempted to persuade a company located in Boise, Idaho [Dynamis Energy] to purchase a pyrolysis machine[.] …

In recent weeks, Van Den Heuvel has contacted individuals after learning that they made statements to investigating agents. In several cases, Van Den Heuvel apparently had no legitimate reason to contact the witnesses but rather made the contact for the purpose of conveying his awareness of their cooperation with law enforcement. …

First, on June 18, 2018, the United States submitted to Pretrial Services the report of interview of Oneida Golf & Country Club employee M.J. The United States also provided Van Den Heuvel’s counsel with a copy of the report. That same day, Van Den Heuvel called M.J. to “thank” her and express apologies for her having to speak with the investigative agent, whom he described as an “asshole.”

Second, that same day, June 18, 2018, Van Den Heuvel sent a text message to a witness [Mason Kashat] whose statement had been disclosed to Van Den Heuvel in discovery. They spoke by phone the next day and Van Den Heuvel claimed he had nearly closed a deal and would be able to repay Ma.K. soon. Van Den Heuvel also added that he had read Ma.K.’s “testimony” and was “not mad” at Ma.K. or his partner, who had also made a statement to investigators.

[A]lso on June 18, 2018, Van Den Heuvel called [Brian Glimes], who previously worked for Van Den Heuvel at a sorting and pulping facility. Van Den Heuvel claimed he called to relay that he planned to purchase the facility. But then Van Den Heuvel went on to say he got a “cute note” from the FBI, which reflected that B.G. had used his own money to pay for business expenses at Van Den Heuvel’s request. This apparently referred to a statement that Van Den Heuvel read in a report of interview that B.G. had given. …

[I]n April 2018, very shortly after receiving information in discovery about [Alex Knapp]’s cooperation with the government, Van Den Heuvel called A.K. According to A.K., Van Den Heuvel screamed and cursed at him because A.K. had forwarded an email from Van Den Heuvel to the government. …

[Ron] Van Den Heuvel has not provided meaningful disclosure of his finances to Pretrial Services. He and his family must be using some bank accounts, but he has not disclosed any account records. It appears that the only financial records Van Den Heuvel has produced are records he generated himself. Given his bank fraud conviction and the pending charges in this case, the Court should be highly skeptical of records he produces. That is why obtaining records from third-party financial institutions is so important. The government’s investigation has identified dozens of bank accounts opened by the Van Den Heuvels at numerous banks over the years. Because they switch accounts so frequently, however, Pretrial Services has no effective way to monitor Van Den Heuvel if he does not disclose his financial records. …

Given the evidence that Van Den Heuvel violated release conditions and committed additional crimes, detention is warranted on the ground that Van Den Heuvel is “unlikely to abide by any condition or combination of conditions of release.” … Van Den Heuvel has demonstrated his inability to comply with even simple conditions of release, such as seeking Pretrial Services’ approval for financial transactions. The evidence suggest this inability flows from intractable dishonesty. … These patterns are longstanding with Van Den Heuvel, who was convicted of defrauding Horicon Bank and now faces charges for another convoluted fraud scheme in Case No. 17-CR-160.

[Ron] Van Den Heuvel has displayed no sign of stopping his fraudulent conduct. …

This reinforces the conclusion that [Ron] Van Den Heuvel is a persistent, unrepentant fraudster, even after being convicted of bank fraud and sentenced to three years of imprisonment.

In sum, the Court cannot find that Van Den Heuvel would comply with new release conditions. The defense will likely propose home confinement or restrictions on Van Den Heuvel’s ability to communicate with witnesses or engage in financial transactions. His track- record, however, provides no basis to believe he would comply with those conditions. In addition, the burden on Pretrial Services to try to monitor his compliance would be unreasonable. …

The nature and circumstance of the offense charged, although not a violent crime, is very serious, with fraud loss amounts exceeding $9 million. If convicted of the whole scheme, Van Den Heuvel would be exposed to the potential of lengthy incarceration. This creates an increased likelihood of flight and of Van Den Heuvel engaging in extreme actions, as he has already shown a willingness to contact witnesses inappropriately. …

Numerous witnesses, both victims and individuals who worked with Van Den Heuvel, will testify that Van Den Heuvel made false representations about the Green Box process and how lenders and investors’ funds would be used. Representations about how the funds would be used were also reduced to writing in agreements. Financial records and receipts of expenditures show, in concrete and undisputable fashion, how Van Den Heuvel quickly diverted huge sums of investors’ and lenders’ funds to unauthorized purposes to fuel his lavish lifestyle. This overwhelming evidence increases the risk that Van Den Heuvel will flee or act dangerously towards others. …

Van Den Heuvel has demonstrated increasingly erratic behavior, as shown by his inappropriate contacts with witnesses. Further, Van Den Heuvel is relatively sophisticated and well-traveled with an uncanny ability to persuade people to lend him large sums of money. His wife and children recently visited the Cayman Islands. … As the trial in this case approaches and Van Den Heuvel runs out of ways to delay incarceration, there is a significant risk that he may seek to flee. …

[W]itnesses have stated that Van Den Heuvel can become verbally aggressive and that he physically assaulted one witness. Specifically in August 2011, former business partner [Howard Bedford] confronted Van Den Heuvel regarding his fraudulent misuse of funds, and Van Den Heuvel responded by punching H.B. in the head. H.B. states that he took himself to a hospital afterwards and was diagnosed with a concussion. More recently, Van Den Heuvel was verbally abusive towards A.K., and he has engaged in subtle intimidation of witnesses in recent contacts.

Taken together, the Court could also base detention on the finding that no condition or combination of conditions will assure that Van Den Heuvel will not flee or pose a danger to the safety of another person or the community. …

The above discussion … shows why Van Den Heuvel cannot show that he is unlikely to flee, given the significant incarceration he faces, his ability to access funds, and his familiarity with international travel. Nor can he show he is unlikely to be dangerous to others, given his persistent fraud schemes and aggressive behavior to individuals who have been confronted him and cooperated with the government. …

Given Van Den Heuvel’s disregard for his conditions of release, it is appropriate for the Court to follow through with its initial plan of having him begin to serve his sentence in Case No. 16-CR-64. …

Once Uponzi Time . . .

![]() • UpNorthLive.com

• UpNorthLive.com

Multi-million dollar investment

lands jobs for Cheboygan

– by Marc Schollett /

WPBN – Traverse City, MI

Thu, 29 May 2014 00:33:33 GMT —

More than 130 workers could be on the job at Cheboygan’s Great Lakes Tissue Company thanks to a $150 million investment. Green Box NA, LLC is investing close to $350 million dollars, split between facilities in Cheboygan and Detroit.The project will take restaurant paper waste from around the Detroit area, and after some pre-processing, transfer the material to Cheboygan in the form of bails and pellets for final processing into both commodity and value-added, finished product components. This process is supposed to keep the paper from restaurants, which they probably waste a lot of, out of landfills and reuse the paper or it will be recycled. Chairman of Greenbox [sic / Green Box NA], Ron Van Den Heuvek [sic / Ron Van Den Heuvel], says they are looking to revitalize Great Lakes Tissue Company Mill by acquiring them and installing $150 Million in new equipment. The Cheboygan facility’s operation will include production of bath, facial, napkin and towel tissue products, as well as biofuels, fuel pellets and soil enhancements.

The project should be up and running in the next 18 months. “Today’s projects will help strengthen and revitalize these Michigan communities and help growing companies generate new job opportunities,” said [Michigan Economic Development Corp.] MEDC President and CEO Michael A. Finney. “We should all applaud these investments in Michigan’s future.”

According to the April 6, 2015 Plaintiffs–Appellants’ Brief in Cook County IL Case No. 2014-L-2768, ACF Leasing LLC, ACF Services LLC and Generation Clean Fuels LLC v. Green Bay Renewable Energy LLC, Oneida Seven Generations Corp. and the Oneida Tribe of Indians of Wisconsin [n/k/a Oneida Nation WI], w/ Exhibits:

Louis Stern and Kevin Cornelius signed the [Generation Clean Fuels, LLC] Agreements in May and June, 2013. …

Throughout the negotiations of the Agreements, OSGC and the Tribe representatives repeatedly represented to ACF that they are acting on behalf of the Tribe/OSGC and referred to the Tribe, OSGC and GBRE as though they were one and the same. … Kevin Cornelius and Bruce King repeatedly corresponded with ACF regarding the Project, utilizing OSGC email addresses and OSGC letterhead and utilized OSGC’s office. … Kevin Cornelius and Bruce King represented to ACF that GBRE was only a vehicle for tax purposes, that the Agreements were with the Tribe/OSGC and that Kevin Cornelius had authority to enter into the Agreements and waive sovereign immunity on behalf of the Tribe, OSGC and GBRE. …

In reliance on the representations of Kevin Cornelius, Bruce King, and William Cornelius that they had they permission of the Tribe and OSGC to enter into the Agreements, ACF continuously performed a variety of tasks to meet its obligations under the Agreements once they were executed. … In fact, Kevin Cornelius and Bruce King sent numerous documents related to the Project to Eric Decator in Illinois, but none of these documents referred to GBRE, which was consistent with ACF’s understanding that the actual parties to the Project were OSGC/the Tribe.

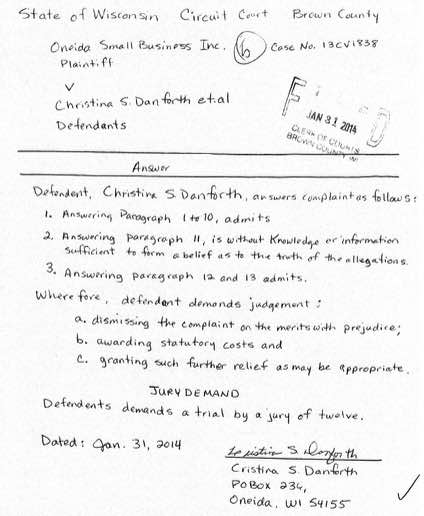

08/30/13 : According to the April 6, 2015 Plaintiffs–Appellants’ Brief in Cook. Co. Case No. 2014-L-2768, GCF/ACF v. ONWI & OSGC et al., and Exhibits:

08/30/13 : According to the April 6, 2015 Plaintiffs–Appellants’ Brief in Cook. Co. Case No. 2014-L-2768, GCF/ACF v. ONWI & OSGC et al., and Exhibits:

On August 30, 2013, Bruce King [CFO of OSGC/Treasurer of GBRE], Cathy Delgado [Cristina Danforth’s sister and OSGC Board member], William Cornelius [Oneida Gaming Commission attorney and OSGC Chairman & Board President], Brandon Stevens [Oneida Business Committee member] and Michael Galich [ACF/GCF co-Owner] went to ACF’s plant in Bakersfield, California to examine the type of machines that would be utilized in the Project. …Based on all of the foregoing meetings, telephone conferences and visits to ACF’s plant by the Tribe and OSGC, ACF believed it was negotiating the Project with the Tribe and OSGC. …ACF relied upon the representations of the Tribe/OSGC that they were acting on behalf of the Tribe/OSGC.

- 09/03/13:

Green Box NA Georgia Macon Ethanol LLC registered w/ WDFI; Registered Agent listed as Ron Van Den Heuvel’s ‘umbrella company’ of fraud Environmental Advanced Reclamation Technology HQ, LLC [a/k/a EARTH; f/k/a Nature’s Choice Tissue Corp., renamed Reclamation Technology Systems / RTS]; GBNAGME was Administratively Dissolved 09/14/15

THAT SAME DAY . . .

- NBC 26 WGBA: Oneida Seven Generations Corp. CEO Kevin Cornelius steps down

JUST DAYS LATER . . .

09/06/13 : Judgment, Brown Co. Case No. 09CV439, Glory LLC v. Ron Van Den Heuvel & Tissue Technology LLC [and dismissed defendants: Partners Concepts Development Inc; Custom Paper Products Inc; Natures Choice Tissue LLC; Purely Cotton Products Corp; Eco Fibre Inc; ReBox Packaging Inc; Tissue Products Technology Corp; Patriot Project Services LLC; Chat LLC; Patriot Investments LLC; Patriot Services Inc; RVDH Inc; Waste Fiber Technology Inc; Recovering Aqua Resources Inc; RV Jet Inc; KYHKJG LLC; Patriot Paper Services Inc; Fibre Solutions LLC; Doc-U-Mince LLC; and dismissed third-party defendants: Ross J. Nova; Godfrey & Kahn.] – MONEY JUDGMENT AGAINST TISSUE TECHNOLOGY, LLC: $1,227,880.01

09/06/13 : Judgment, Brown Co. Case No. 09CV439, Glory LLC v. Ron Van Den Heuvel & Tissue Technology LLC [and dismissed defendants: Partners Concepts Development Inc; Custom Paper Products Inc; Natures Choice Tissue LLC; Purely Cotton Products Corp; Eco Fibre Inc; ReBox Packaging Inc; Tissue Products Technology Corp; Patriot Project Services LLC; Chat LLC; Patriot Investments LLC; Patriot Services Inc; RVDH Inc; Waste Fiber Technology Inc; Recovering Aqua Resources Inc; RV Jet Inc; KYHKJG LLC; Patriot Paper Services Inc; Fibre Solutions LLC; Doc-U-Mince LLC; and dismissed third-party defendants: Ross J. Nova; Godfrey & Kahn.] – MONEY JUDGMENT AGAINST TISSUE TECHNOLOGY, LLC: $1,227,880.01

Glory, LLC changed Registered Agent w/ WDFI – previously Kevin Cornelius; currently OSGC Managing Agent Pete King III

Glory, LLC changed Registered Agent w/ WDFI – previously Kevin Cornelius; currently OSGC Managing Agent Pete King III

- Oneida-Kodiak Construction, LLC changed Registered Agent w/ WDFI

RELATED . . .

Mrs. [Sheri] Cornelius’ Class

Hello! I’m so happy to be teaching at CES [Cherokee Elementary School]! I grew up here and graduated from the Cherokee school system and I am the daughter of Lee and Peggy Jenks. I moved away and met my husband and raised our children in Green Bay WI. I then went back to to school to get my teaching degree. I knew that I wanted to return home and teach at the same school that I graduated from. I love teaching and I am really happy to be home again.

• May 26, 2016 –

• May 26, 2016 –

Tribe looking into

waste-to-energy program

The Eastern Band of Cherokee Indians

in North Carolina is currently looking into

a waste-to-energy process known as

pyrolysis at the Tribal Transfer Station

– by Scott McKie /

Cherokee One Feather

A machine currently located at the Tribal Transfer Station off of Olivet Church Road looks like something out of “Charlie and the Chocolate Factory”, but it is the future of waste disposal and energy production according to the Tribe’s energy program coordinator.

The machine is running a two-week demonstration of pyrolysis (thermal distillation) which converts recycled bottles, old tires and other waste into a synthesis gas known as Pyrogas. “This process has been around since World War II,” said Cameron Cooper, who garnered three grants from the Department of Energy and Mineral Development for the Eastern Band of Cherokee Indians totaling over $750,000 to study this process. …

The machine that is being used for the two-week demonstration came from American Renewable Technologies Inc. [ARTI] based in Los Angeles. …

The second part of the grant is the two-week demonstration itself, and the third portion of the grant will allow for a prolonged demonstration and allow Cooper and staff to experiment with different feed stocks and municipal solid wastes. …

Cooper said the reason for the two-week demonstration is easy. “I wanted to bring it here for the Cherokee people to see. I want them to come out here to kick the tires so to speak. I didn’t want them to get the wrong impression that it was an incinerator. I didn’t just want to submit a business plan. I wanted people to feel it, touch it, smell it, see it.”

REALITY CHECK :

Abdul Latif Mahjoob

- December 5, 2016 Order Granting Plaintiff’s Motion to Compel Defendants Mahjoob et al. to Produce Documents, U.S. District Court, District of Nevada/Las Vegas, Case No. 2:2015CV694, CH2E Nevada LLC v. Abdul Latif Mahjoob & American Combustion Technologies Inc. / ACTI

This action arises out of a business dispute. … Plaintiff purchased specialized equipment from [Abdul Latif Mahjoob & American Combustion Technologies Inc. / ACTI], which allegedly did not perform as promised. …

Additionally, [Abdul Latif Mahjoob & ACTI] did not provide certain documents that Plaintiff asserts they were contractually required to provide. … Plaintiff therefore brought claims for fraudulent inducement, negligent misrepresentation, breach of contract, breach of warranty, and revocation…

The Court agrees with Plaintiff. Plaintiff’s complaint alleges that Defendants provided equipment that, “as designed and manufactured,” cannot “function at the levels promised and warranted by Defendants.” … The information Plaintiff seeks is relevant and necessary to determining whether manufacturing defects exist.

- November 2, 2017 CH2E Nevada LLC’s Motion for Status Conference w/ Exhibits re: “[American Combustion Technologies Inc.] ACTI’s threatened bankruptcy and fraudulent conveyances to its new company, ARTI [American Renewable Technologies Inc.]“, U.S. District Court / Nevada Case No. 15-CV-694, CH2E Nevada LLC v. [Abdul] Latif Mahjoob and American Combustion Technologies of California Inc. [ACTI]

8. CH2E believes that ACTI is filing this bankruptcy as a litigation tactic to avoid paying any judgment to CH2E. After the commencement of this litigation, ACTI’s founder, Latif Mahjoob, started a new company called American Renewable Technologies Inc. (“ARTI”). When asked about ARTI at his November 4, 2015 deposition, Dr. Mahjoob testified that ARTI was not a pyrolysis company like ACTI, but instead was a “gas to liquid fuel” company:

Q. Okay. What is American Renewable Energy [sic], Inc.?

A. It’s a company I own.

Q. What does it do?

A. It customer [sic / converts ] gas to liquid fuel. We take natural gas and turn it into liquid fuel.

Q. It’s not a pyrolysis unit – process?

A. No, not really.

[Ex. C (Mahjoob Dep. Tr.) at 174:10-16. 9.]However, publicly available information demonstrates that Dr. Mahjoob is now using ARTI to carry on the pyrolysis business of ACTI, the assets of which he is depleting in an attempt to avoid paying any judgment in this case. Indeed, ARTI is holding itself out as ACTI with respect to its experience as a pyrolysis company—including with respect to the pyrolysis equipment ACTI sold to ARTI.

See Ex. D (ARTI Website, available at

https://www.americanrenewabletech.com).

- May 24, 2018 TEXT ONLY Chapter 7 Trustee’s Report of No Distribution, U.S. Bankruptcy Court / California Central District Case No. 17-bk-23617, Chapter 7, American Combustion Technologies of California Inc. /ACTI

I, Elissa Miller (TR), having been appointed trustee of the estate of the above-named debtor(s), report that I have neither received any property nor paid any money on account of this estate; that I have made a diligent inquiry into the financial affairs of the debtor(s) and the location of the property belonging to the estate; and that there is no property available for distribution from the estate over and above that exempted by law. Pursuant to Fed R Bank P 5009, I hereby certify that the estate of the above-named debtor(s) has been fully administered. I request that I be discharged from any further duties as trustee. Key information about this case as reported in schedules filed by the debtor(s) or otherwise found in the case record: This case was pending for 7 months. Assets Abandoned (without deducting any secured claims): $2,056,146.04, Assets Exempt: Not Available, Claims Scheduled: $11,049,423.32, Claims Asserted: Not Applicable, Claims scheduled to be discharged without payment (without deducting the value of collateral or debts excepted from discharge): $11,049,423.32. Filed by Trustee Elissa Miller (TR).

- Letter dated September 12, 2017 and ‘signed’ with rubber stamp marked ‘A.L. Mahjoob’ on behalf of American Combustion Technology Inc. and mailed to Oneida Eye Publisher Leah Sue Dodge:

Latif Mahjoob

American Combustion Technology Inc.

Compton, CA 90220

09/12/2017Dear Leah Sue Dodge:

It has come to ACTI’s attention that a defaming comment was posted on www.youtube.com under the username “Oneida Eye” that has been linked to Ms. Dodge. ACTI asks that Ms. Dodge immediately remove all comments made about Latif Mahjoob and ACTI or legal action will be taken for defamation of character. …

Your failure to remove all the defaming material will result in an immediate legal action against you.

Sincerely,

A. L. Mahjoob (rubber stamped)

Latif Mahjoob

American Combustion Technology Inc.Cc: James Kawahito, attorney.

PROBLEM:

Beyond the fact that the letter does not contain a valid signature, Oneida Eye is not aware of any companies owned by Abdul Latif Mahjoob that are named “American Combustion Technology Inc.“

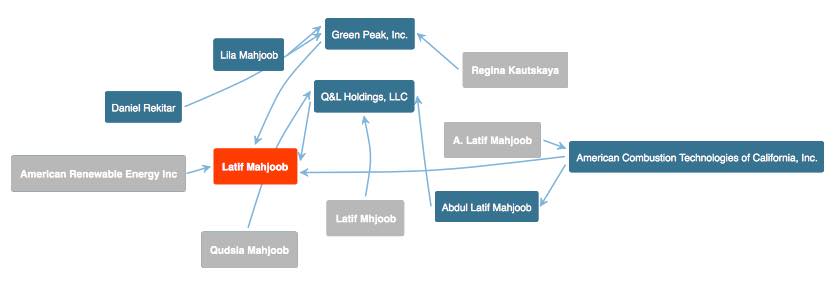

The only companies owned by Abdul Latif Mahjoob that Oneida Eye is aware of include:

- Arian Engineering & Combustion Systems, Inc. [AECS] registered w/ the Illinois Sec. of State; Registered Agent & President A. Latif Mahjoob

- American Combustion Technologies, Inc. / ACTI

- American Combustion Technologies of California, Inc. / also ACTI

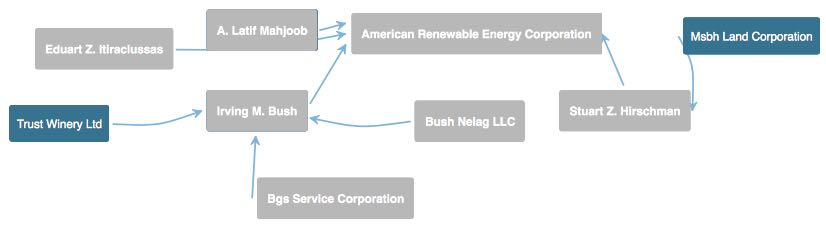

- American Renewable Energy Corp. / AREC in Kansas City, MO; President, Director, Treasuer – Stuart Z. Hirschman; President – Eduart Z. Itiraclussas; Secretary – Irving M. Bush; Director – A. Latif Mahjoob

- Green Peak, Inc. in Nevada; President & Director – Latif Mahjoob; Treasurer – Lila Mahjoob; Director – Daniel Rekitar; Member – Regina Kautskaya

- Q & L Holdings, LLC in California; Members – Abdul Latif Mahjoob; Qudsia Mahjoob (age 61)

Perhaps the threat letter was sent to Oneida Eye by one of Abdul Latif Mahjoob’s relatives:

- Arian Mahjoob

- Qays Mahjoob

Related?:

Related?:

- Leagle.com: April 6, 2016 Decision, Docket No. B259878, Court of Appeals of California, Second District, The People of California v. Qays Mahjoob

04/25/2018:

DOE Office of Indian Energy

The Office of Indian Energy, in partnership with Western Area Power Administration, hosted a webinar on best practices for tribal energy business structures, including their advantages and disadvantages, goals associated with different business models, and examples of various models. Tribal leaders and community members will also learn how to select the best structure for their goals, existing codes, and laws.

Our tribal case study today is from the Eastern Band of Cherokee Indians. We have two individuals presenting their project: Cameron Cooper and Kevin Cornelius. Mr. Cooper was formerly the energy coordinator for the Eastern Band of Cherokee Indians. While serving as the energy coordinator he started a waste energy project to look at reducing waste-hauling and convert those waste _____ into energy. Mr. Cooper is presently serving as the retail development specialist for the Eastern Band of Cherokee Indians. This position supports retail development efforts by providing research data and marketing of the commercial interests of the Eastern Band of Cherokee Indians. Mr. Cooper still plays an integral role in the energy initiative and has oversight of the waste energy project that has been funded through multiple grants awarded by the Division of Energy and Metal Development.

Mr. Kevin Cornelius works for the Red Fern LLC to develop green energy projects.Over the past five years Red Fern has worked with multiple tribes on feasibility studies to determine the viability of using a variety of heat ducts for conversion to renewable energies. …

Mr. Cornelius was CEO of [Oneida Seven Generations Corp. / OSGC] and he completed thermal conversion technology demonstration projects and had the technology completely vetted and received EPA and State of Wisconsin DNR permits. …

Sheri & Kevin Cornelius

Sheri & Kevin Cornelius

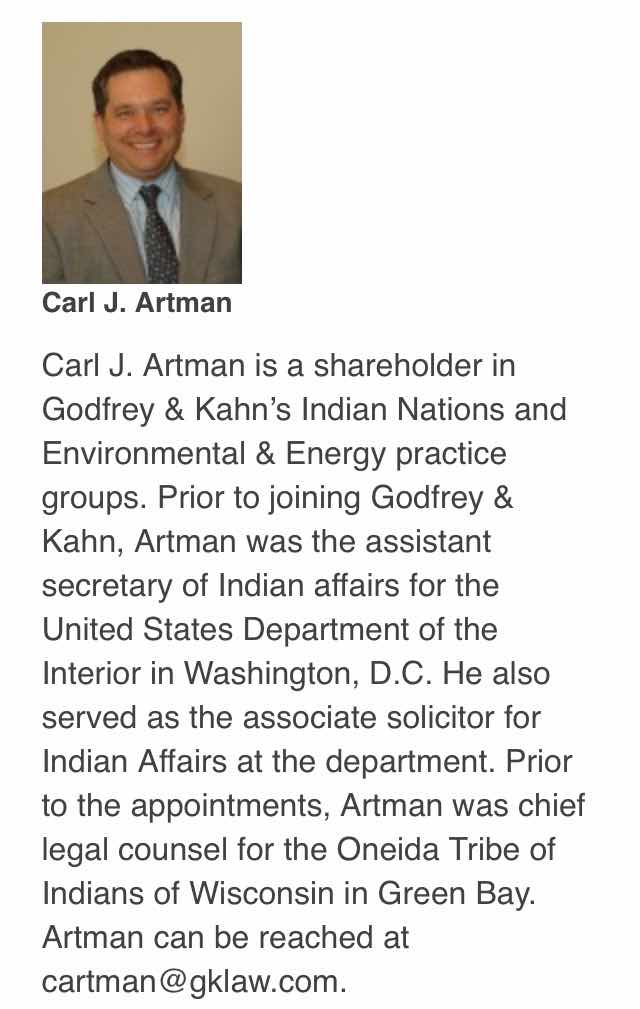

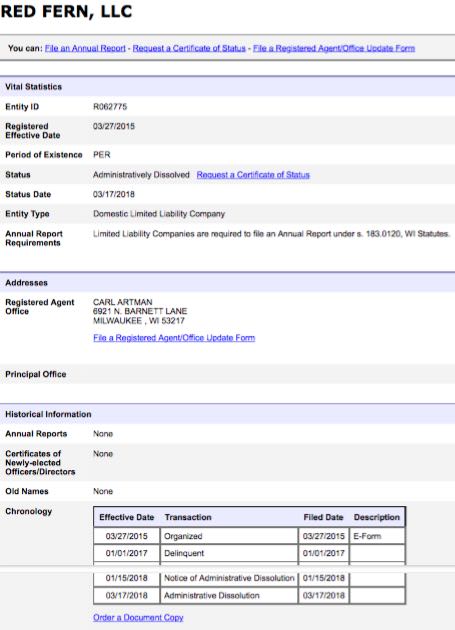

[NOTE: According to WDFI.org, RED FERN, LLC was Organized on 03/27/15 and was recently Administratively DISSOLVED on 03/17/18, its address listed as 6921 N. Barnett Lane, Milwaukee, WI, and its final ‘Registered Agent’ listed as Fmr. Asst. Sec. for Indian Affairs / Fmr. Oneida Nation WI Chief Counsel / Oneida Seven Generations Corp. (OSGC) ‘Independent Tribal Vendor’ Attorney / GODFREY & KAHN S.C. Shareholder – CARL J. ARTMAN – owner of ARTMAN LAW, LLC, and currently ‘teaching’ at Arizona State University Sandra Day O’Connor College of Law, and whose ‘legal’ representations involving various ONWI & OSGC business ventures have resulted in OVER $100 MILLION in LOSSES.

CARL ARTMAN is also Former ONEIDA NATION WI CHIEF COUNSEL, and he is the first cousin of Wisconsin Bar-licensed attorney and current ONWI CHIEF COUNSEL JO ANNE HOUSE]

CARL ARTMAN is also Former ONEIDA NATION WI CHIEF COUNSEL, and he is the first cousin of Wisconsin Bar-licensed attorney and current ONWI CHIEF COUNSEL JO ANNE HOUSE]

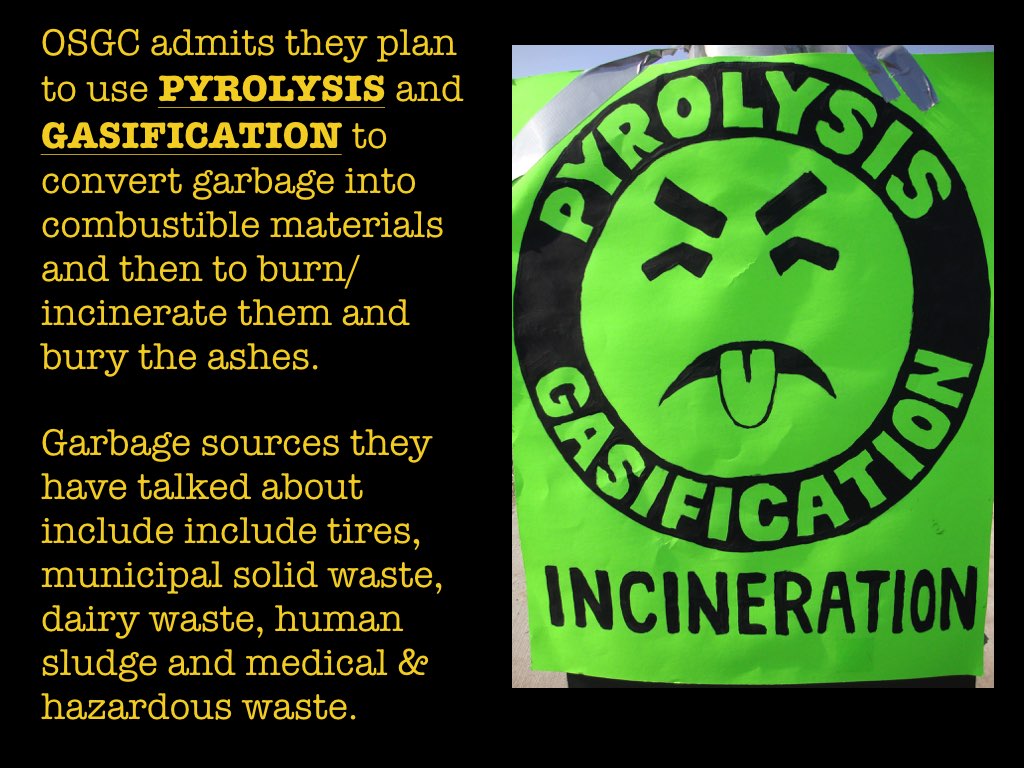

Cameron Cooper: And so one of the things I’m easily started looking at was well, if I can put municipal solid waste through, what it’s getting out on the back end is a synthetic gas, and that synthetic gas appears to be, you know, pretty reliable and comparable to natural gas. And I was like, “Well heck, if I can do that then I can run generators and I can run electricity.” So, you know, bright-eyed and bushy-tailed, that’s the way I started looking at this project. Well, as I started kind of researching it more I run into Kevin Cornelius, who you’ll hear from here in a little bit, and they were looking at this stuff in the Oneida region in Wisconsin. And so as was talking to him, you know, he kind of even broadened my horizons even more that, “Cameron, I mean plastics is the way to go.” You know, plastics is oil, as it’s created from oil anyway, so if we can break it back down to it’s baser form or what it just was created from then we can recapture that and sell the byproduct.

And so what you find is even with this municipal solid waste, where there’s plastics, and the real kicker, tires; all three of those put together, you can create biofuels from all three, and each one of them have some other byproducts that are valuable to several different markets.

One of the things we’ve really found this past go-around is that tires have valuable byproducts. And so when we got to this point for us—and I feel like I need to explain this for everybody in the room is, you know, we came up with a goal within our strategic energy plan and we moved forward with that goal, and that goal was to see what was out there, not only to help offset tribal costs, but to offset, you know, or to create money and generate revenue, ’cause that’s how I look at stuff, there’s always a way to potentially help your tribe out in several different classes.

And so one of the things we noticed right off the bat when he started talking to me about plastics, and even tires and municipal solid waste, immediately I started saying, “Well, we have it.” All right? So in Western North Carolina, as I talked about it being mountainous, the western-most counties, so west of Asheville, North Carolina—if you’re a Google person and like to get on Google Maps, look up Asheville, North Carolina, and to the west of Asheville pretty much every county past Buncombe County, which is where Asheville sits, is they’re hauling their trash. So they’re transferring it. They have transfer stations and they’re hauling it to – Georgia is pretty much the biggest spot that they’re tipping their municipal solid waste, and that’s everything from plastics to tires to just regular municipal solid waste. And so there’s tipping fees involved in that, there is hauling fees involved in that, and, you know, for us as a tribe it’s pretty much about, you know, a $300,000.00 haul bill a year. And so, you know, immediately I was like, “Well, if we can offset that and create electricity off of that, or even create oil products or even other potential byproducts, that would be great.”

And so as we started coming up with this idea in our head, well, we’ve got to figure out a way to vet this, because there is nobody – and I challenge each and every one of you on this call to get on Google and look up waste energy projects. You’re going to see a million different leads and what you’re going to find out is nobody is doing this the correct way or the right way in any facet. Everybody’s idea is kind of the same, but it’s all different, and everybody holds everything close to the chest. And the reason why is because the technology is not patent-able. The reason why is because it is so basic. I mean in reality I like to joke with people and I say—when I show you, and you’ll see a picture of it in the next slide or two, I like to equate it to, you know, we’re here in the mountains, so we tend to love our moonshine here in Western North Carolina. And one of the things about that is that this to me is a glorified still, a glorified moonshine still is what I like to call it.

And so when you look at it from that perspective, everybody holds everything close to their chest. So we had to go out there and figure out a way that we could vet this to our people. Not only that, but to see if it looks true and if it holds a value there. And so what we did is we worked with the Department of Energy and Mineral Development, Michael Stephenson there, you know, he really helped us get our feet underneath us as we went through a waste characterization study to look at our waste and to see how much plastics was in there, ’cause that was kind of the focused when we started, was to look and see how much plastic stream we had coming through our transfer station.

And then with the second grant we went out there to demo version to get the demo version here so that everybody could kind of kick the tires, so to speak, and see that it wasn’t detrimental to the environment. And that’s the cool thing about this process, at no point does feedstock every come in contact with an open flame. Everything is degraded over an amount of time, and so you have what they call a retort time, where your byproduct is sitting there breaking down and then basically you condense that gas into usable items.

And so with the third grant we just prolonged the demonstration project to really start looking at feedstocks and then what we’re getting out of that third grant was an actual business model or a business plan. And I think you can go to the next slide there, James.

And so to reiterate this, this is the thermal conversion unit. And as you can see, you see where it says “feedstock hopper.” This is a dual _____ system; you want this thing completely oxygen-deprived as much as possible. You do not want oxygen in this. And so they go as far as proving to your constituency or even paper that you’re trying to sell this to, that there is no open flame to feedstock. Where you see the upper and lower retort auger chambers, those are internal. So the feedstock goes into that, and that big blue bin basically is the chamber. And underneath that is a low-burning natural gas or propane burner.

But here’s the neat thing, it’s a self-sustaining system. So once the system is up and running and you’re running it 24/7 you can basically produce enough gas that it runs itself to heat that chamber. But on top of that, through the pyrolysis process the feedstock, as it breaks down, creates its own heat. And so it’s actually heating up as it’s breaking down as well. And so then you have the discharge valves, where it comes out, and then after that point, like I said, it goes through what I consider a glorified distiller, so you can siphon off whatever gases or byproducts that may be available.

The one thing that we found with our tire study is that there is a lot of carbon, and that carbon we have found at this point appears to be carbon black. Now it might not be the most purified form of carbon black, but it’s pretty close. And so with that being said, what that gives us is another byproduct that is pretty valuable out there on the market. And I’d say it can go anywhere from, what is it, $0.49 a pound now?

Kevin Cornelius: _____ to $1.96 a pound.

Cameron Cooper: Yeah, up to $1.96 a pound. And if it’s pure, if we can figure out a process to create pure carbon black, I mean you’re talking, what is it 500—yeah, go ahead. I’ll let Kevin kind of talk about the carbon black.

Kevin Cornelius: So just a little bit with the tires, when we went through the process, we’re trying to get the best carbon black. And that’s something when we started, the system is not designed to handle tires, and so we had to make some modifications for it to run without jamming up with the carbon black in it. And we’ve been able to do that. We get – on our test results we’re about 92-percent pure carbon black. For it to have the high value we’ve got to be at 99-percent. And some of it has some graphene in it, but it’s not a pure graphene. So if we’re looking at how we can refine the carbon black, the value of that can increase to quite a bit if we can get the higher-value carbon black. But the problem is getting from that 92-percent to the 90-percent, and we’ve done that through – or we’re working on that through different temperatures and different residence time of the tires. But it does work well.

So what we’ve done is we’ve really taken a system and made changes to it so that it can run tires through effectively. The system itself is only designed to run 100 pounds per hour, and we’re running at 75 pounds per hour. So even though the tires with the carbon black is difficult, we’re still almost running it as efficient as you can run the machine if you were just running what it was intended to do.

So with that I think what we’re looking at is working with the tribe to say how can we go forward with – the tribe owns the intellectual property because we’ve been doing all this testing and modifications on their behalf, and so now we want to look at how can we combine and take this to the next step.

Cameron Cooper: The reason why I kind of want to get it detailed a little bit more so on the project itself is so that I can show people kind of where we’re at as far as moving forward with the structure, because this has a lot of moving parts, as we’ve kind of found out over the past couple years in looking at this project. And as I said before, earlier, there’s nobody to turn to, there’s nobody I can go out here and say, “Build me one and get it up and running tomorrow.” We’re having to do this. And nobody wants to do that. There’s no tribe out here that I’ve ever seen to have an appetite that won’t just be the first on the block to do anything. We’re kind of a monkey-see monkey-do so to speak for lack of a better phrase. And so in reality, you know, we’ve kind of had to figure out a lot of this stuff as we’ve went along.

But as you can see in this picture, the one thing I want you to notice too which makes this business venture even more kind of—another moving part, is the fact that I hope that you can see the scale there, and underneath, where that says “dual discharge valve,” that’s a wheelbarrow. Now the most efficient part of this system would be that you would want a one-ton unit. This one that’s in this picture is pretty much the one that we have here, which is a 100-pound unit. A one-ton unit you’re probably looking at I’d say around about 15-percent larger than what we’re looking at in this picture right now, which means it’s very mobile.

And so that’s one of the other things that we’re looking at too, is how do we make this mobile and potentially go out here to Indian Country or anybody else that may need or have a landfill that’s overfilled, ’cause we can put already-processed landfill waste back through this system. Or plastics that are sitting out here or, you know, case-in-point, one of the examples I think that we would want to go after eventually is the fact that China has recently said that they no longer want our recyclable plastics. And so you’re going to have an influx of plastics sitting somewhere and this machine is definitely a machine that can take that load and produce something from it. And so that’s kind of where we’re at. So next slide, James.

Which brings us to _____ just kind of explained to at this point is, you know, LLC/Section 17. Well, we’ve looked at both, and it took us an education period of about five years for our tribe to get to the point where our constituency understood what Section 17 and LLC means. Let’s see, hold on just a second. I was bringing up something I needed to look at real quick so I can explain this next part.

So anyway, what we’re looking at is kind of from an LLC standpoint, because we kind of feel like we’re behind the ball; we’ve got some extenuating circumstances here in Western North Carolina, as our only pretty much income for the Tribe itself and its operation is its casino operation. We enjoy a 200-mile radius of no competition in Western North Carolina. We’re within 75-percent of the entire USA population within a day’s drive. So needless to say, we kind of like we say we’re sitting in the catbird seat in Western North Carolina with our casino, which is great. But there’s impending doom on the horizon for the Tribe as we’re looking—as Georgia is looking to potentially get some formed of organized gaming. And so on the horizon we have tried to prove to our constituency that we do need to diversify our economy and one of those ways is Section 17.

Well, we did a summit of Section 17, which basically said, you know, “Hey, Tribe, you can set this up how you want. It comes down to you setting up and you can put in it what you want to.” And then you have other tribes out there at _____ Summit that say, “We have a Section 17 but we’ve shelved it. We’re primarily using an LLC structure.” And so as a tribe right now we’re kind of in that crunch point where we don’t have really time to sit down for a Section 17, though I do believe that we will exercise that later down the road because I think it is something that we can shelf and have for future purposes.

So right now we have set up an LLC code as of this year. Earlier this year we set it up, so as of next month and our next council session we are going to be hopefully putting a board together to, you know, come force with LLC plan for the LLC and obviously to request money for that LLC. And so as we move forward in this project we’ve gotten to a point where like we know at this point we’re just going to have to pretty much jump off the deep end with this technology and invest in it.

And that’s one reason, even though, you know, I know some of you probably think it would be a lead and they’d potentially be able to help us from a granting perspective, and that is true, I think this is definitely something up that road, but I just don’t think that we’re ready yet. And so what we’ve got to have is we’ve got to have a buy-in from an LLC standpoint of the tribe’s going to have to set up an initiative for this because of so many moving parts and the upswing of it potentially having, you know, from the different byproducts that we can produce off of this machine. So it needs to be more of a business decision as opposed to a government entity or a government decision.

And so I put LLC code there because obviously I just said that we’ve created one, and so that’s definitely an option that we’re looking at, and that may be the best option for us as far as just this project is concerned. However, that’s where the other moving part comes in and where a joint venture for us may make sense underneath the LLC parent company and spinning off a subsidiary LLC, which would be a joint venture with Red Fern. And the reason why we’d have to do that is even though the tribe owns the studies from DEMD and the reports and everything that goes along with that, Red Fern pretty much has the technology in hand, and so they’re the experts in the field for us. And so there’s probably most likely going to have to be some form of a joint venture or there’s going to have to be an outright buying out of Red Fern for the technology purposes.

The reason why I put Boys Club there, Boys Club is our – it was a service set way back in like I think the ’50s is whenever it was started, and it was actually done through the state. And it kind of laid in the weeds and nobody really thought about it as we started talking about Section 17 five years ago, and now all of a sudden it’s come to the forefront. Well that charter was actually set up through the state. It’s its own corporate charter, even though it’s a 501(c)3. And what they do is they provide bus service for our local school. They also provide mechanic work for our local area and they also have charter bus service as well, and they provide most of the fuel for the tribal vehicle fleet.

And so they have a lot of the technology that this wasted energy could utilize or even help kind of put out there. So we’ve put Boys Club in the mix because their current board, which is not necessarily a business-oriented board as much as it is a community board, though it is a legitimate board, because of the 501(c)3 they’re kind of looking at that we could potentially change the structure so the Boys Club can be less of a breakeven 501(c)3. We could keep that arm of it, but we need to create an LLC part of it so that we can go after. So that’s potentially another factor for us to exercise and look at to see if it’s the way we want to take this venture. And so it’s definitely an option.

But I think what this whole time what I’m trying to get across is that with the project that we have there are so many different moving parts as far as the byproducts that are available is that we’re going to have to look at a mix of a joint venture. We’re also going to have to look at a mix of whether we do it with our tribal LLC or whether the Boys Club actually creates their own LLC and they kind of have that infrastructure that would be needed for this venture and there would be less buy-in from the LLC. So it’s one of those things, it’s kind of like a flip of the coin, but we’re really not just flipping the coin; we’ve really got to see which one is going to make more sense. And that’s where we are in our stage. And so it took a lot of planning to get to this point, but in reality we’re kind of at that precipice, we’ve got to make that next step, and so what we’re really trying to do is create a model that makes sense, that can be explained to our public but also can be explained to either our LLC board, which is pending, or the Boys Club pending board.

And so at that point I’ve pretty much said all I need to say. I’ll let Kevin kind of take over from here to kind of fill in any gaps that I’ve left.

Kevin Cornelius: So part of the reason why we would look at a joint venture is, as I mentioned before, our system wasn’t really designed to take tires, and working with the Tribe, we’ve modified it so we’ll take tires. The Tribe collects 50 to 60 tons of tires and with the Tribe’s help we’ve created a front-end system that will do a proper feed and when we distill the oil, as it comes out at the back end, you know, we’re getting the naphtha, the kerosene, the gasoline, the diesel, and what that dose is tires are made with sulfur so that they don’t catch fire. Because naphtha is one of our byproducts, we’re able to separate and really get a clean sulfur. And that’s got value; it’s not a lot, but still, it’s got value.

So the point for us to work with the Tribe is our system can take 50 to 60 tons of tires per year, they have 50 to 60 tons of tires per year and they have a site where we can do it without having to go through a lot of hurdles. So it makes it beneficial for us because they have the site, they have the tires. We as a corporation can go through the state and get certified as a tire collection facility and therefore get reimbursed for the tires they collect, along with the selling of the byproducts. So it makes those benefits to us along with the Tribe.

Cameron Cooper: And one of the things I forgot to mention is, and if you’ve kind of seen the vision here, if I’ve explained it well enough, is the ability to build capacity with this project. We’re just solely talking about our waste stream on the Eastern Band of Cherokee Indians. So the 300,000 haul bill I was talking about earlier, that includes all the potential municipal solid waste we get now, that includes the tires we get now as well. And so in reality this is not including going out to the other surrounding counties and asking them to bring their waste to us to cut down on their haul bill, but on top of that, going ahead and collecting the tipping fees that they’re currently paying. And we could charge them probably the same tipping fees that they’re paying the Georgia landfill now and, you know, _____ _____, but it would still be cheaper for them because they’re having to haul it less—or they’re having to haul it less of a distance.

And so, you know, that’s just kind of where we’re at in our business structure moving forward and what our options are. So, you know, as far as a case study I would like to say that we’re in the infancy of looking at moving forward with a structure; however, our tribe is technically in infancy looking at that type of LLC. Though our casino has its own separate board and entity, you know, we’ve never expanded into looking at what seems to be the trend right now in Indian country, which is a diversification move. And so that’s kind of where we’re at. …

James Jensen: … A question for the Eastern Band Cherokee project, how soon are you ready to commercialize?

Cameron Cooper: I think initially as soon as we get the LLC or whatever structure we’re going to go within place. I’d say we’re within a year of making sure that the market—that we vet the market out there who would buy the byproducts, to make sure that we have a quality product to sell and make sure that we have vendors out here in our area that are willing to buy those products. I think once we have that year underneath our belt, I’d say that within two years after that they should be—we would move from a 100-pound unit up to one-ton units. And I think the overall initial business plan would be that we would own three one-ton units. This would just be for our area, for our purposes at this point, before we’d make it mobile or anything of that nature. And we would own three one-ton units: one devoted to tires, one devoted to plastics, and one devoted to municipal solid waste, and each one would have their own form of byproducts.

So I think commercialization is just right around the corner, as soon as we have a structure and we can get an LLC or the Boys Club to buy into that structure.

James Jensen: Great. A few more questions on the details of the project. And if you don’t want to make it public that’s certainly understandable. But how much did it cost to build the system and how much electricity is it producing?

Cameron Cooper: I’ll let Kevin answer that one.

Kevin Cornelius: Yeah. We don’t really want to talk about how much it cost us. For a 100-pound unit, tires, we can produce right around 54 to 55 kw of energy. The system uses 12 kw. And if we added a second unit of that size then—it’s about 54 kw off of 100 pounds of tires.

04/17/18 : USA TODAY / Green Bay Press-Gazette

Judge William Griesbach: Green Box owner Ron Van Den Heuvel must disclose fraud conviction to potential investors

[U.S. Judge William] Griesbach said his intent in imposing the conditions was to protect the public and ensure anyone who chooses to give Van Den Heuvel money knows with whom they’re dealing.

“With a mandatory disclosure, then at least people who want to deal with Mr. Van Den Heuvel can do so with eyes wide open,” Griesbach said. “The goal is to ensure there are no more victims. …”

Griesbach’s conditions were imposed as part of the wire fraud and money laundering case, which is scheduled to go to trial on [November 13, 2018].

- April 17, 2018 Motion Hearing Minutes re: Government’s Motion to Amend Conditions of Release of Ron Van Den Heuvel, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64 and 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

- April 17, 2018 Order Setting Conditions of Release of Ron Van Den Heuvel, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64 and 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

Defendant shall seek approval by U.S. Probation for any transactions involving $500.00 or more, either personally or on behalf of his business entities.

Defendant must provide full disclosure to any party he is attempting or soliciting to conduct business with:

a) that he has been convicted of bank fraud and sentenced to a term of 3 years imprisonment.

b) that he is facing an additional 14 counts for wire fraud and money laundering.

c) that he has court appointed counsel in these matters and has been determined to be indigent.Defendant must submit monthly financial reports to Pretrial Services to include:

a) any amount and source of monthly income received.

b) current assets and any disposal of assets which are in his name, or over which he has control or is able to convey.

c) provide copies of account statements from any bank or financial institution held in his name or over which he has control.

04/12/18 : USA TODAY / Green Bay Press-Gazette

Feds: Ron Van Den Heuvel continues fraudulent pitches; concerned Ron Van Den Heuvel could continue to defraud investors even after conviction

Federal authorities are concerned that Ron Van Den Heuvel’s conviction for bank fraud and another 14 additional counts of fraud have not deterred him from continuing to solicit investments under false pretenses.

U.S. Attorney Matthew Krueger has asked U.S. Judge William Griesbach to impose a new restriction on Van Den Heuvel’s conditions of release: A $500 cap on any financial transaction unless the U.S. Probation Office pre-approves it. Griesbach will decide whether to impose the condition during a hearing next week.

The request was made in the government’s second fraud case against Van Den Heuvel, filed in September 2017. Federal prosecutors allege he defrauded investors in companies connected to Green Box N.A. out of $9 million between 2011 and 2015.

In his motion, Krueger said the government continues to investigate several transactions and pitches to investors that started in summer 2016 and continued through March when Van Den Heuvel told his probation officer he intended to conduct “several complicated and sizable financial transactions in the near future.”

Van Den Heuvel has already been convicted of bank fraud in a case filed in April 2016. He was found guilty of using straw borrowers to obtain loans under false pretenses to keep his businesses afloat. He was sentenced in January to three years in prison but is awaiting notice from the U.S. Department of Corrections on when he will begin his prison term. …

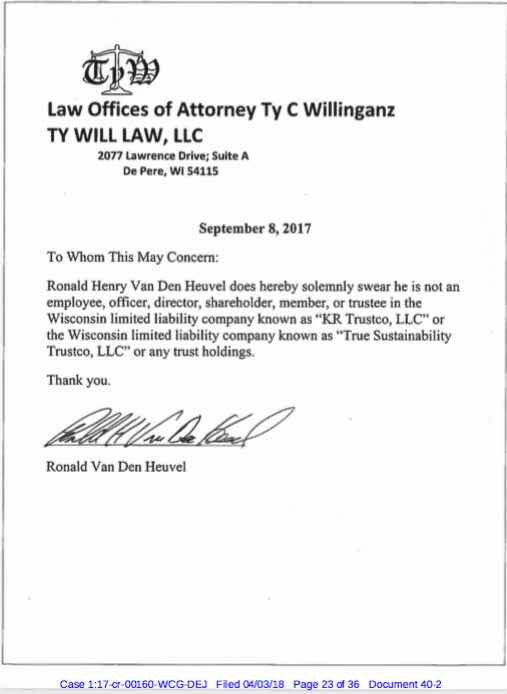

One person [Ron] encouraged to invest in his companies was sent documents that included a resume with false statements and letter on Van Den Heuvel’s attorney [Ty Willihnganz’s] letterhead with the attorney’s last name misspelled. …

![]()

![]()

![]()

04/03/2018:

- April 3, 2018 USA’s Motion to Amend Defendant Ronald Van Den Heuvel’s Conditions of Release w/ Exhibits [129 pages] U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

I. BACKGROUND

Defendant Ronald Van Den Heuvel has been under court supervision since April of 2016, when he was first indicted in case number 2016-CR-64. Van Den Heuvel has now been sentenced in that case for conspiracy to commit bank fraud, and he is under a court order to pay $316,445.47 in restitution to the victim (2016-CR-64, Dkt. 184). Van Den Heuvel was also sentenced to a term of 36 months’ imprisonment, but he has not yet been remanded to the custody of the Bureau of Prisons.

Van Den Heuvel was indicted a second time in September of 2017 in this case (2017- CR-160), in which he faces charges of wire fraud and money laundering. The Court imposed the same conditions of release and supervision in this case as in the first one, which include a requirement that Van Den Heuvel refrain from violating any federal, state, or local laws (2017- CR-160, Dkt. 5).

In recent months, the Government has learned about multiple questionable financial transactions initiated by Van Den Heuvel since he has been under court supervision. The Government has not completed its investigation of these transactions. Given their frequency, size, and indicia of fraud, however, the Government seeks to update the Court about these transactions and to modify Van Den Heuvel’s conditions of release to prevent this conduct going forward. In the Government’s view, a modification of Van Den Heuvel’s conditions of release is necessary to protect the public as well as Van Den Heuvel’s previously identified victims, who are statutorily entitled to restitution.

The information that follows is based upon interviews with witnesses, a review of documents provided by those witnesses, and information received from the U.S. Probation Office. The Government has consulted with the U.S. Probation Office and that Office has agreed that, given the complexity of Van Den Heuvel’s transactions, the Government should present this material directly to the Court.

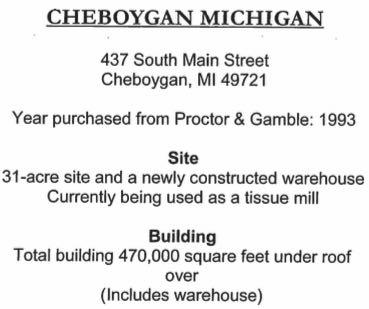

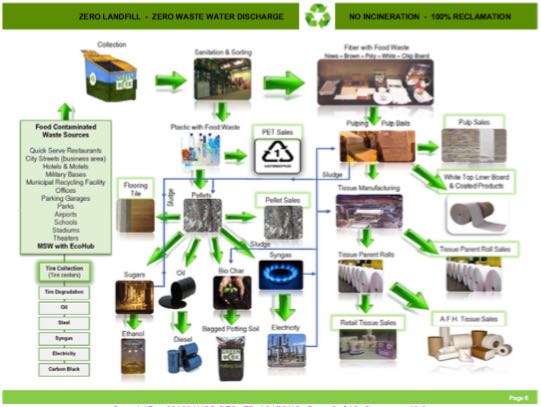

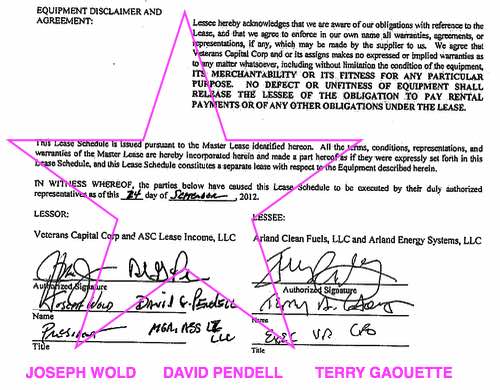

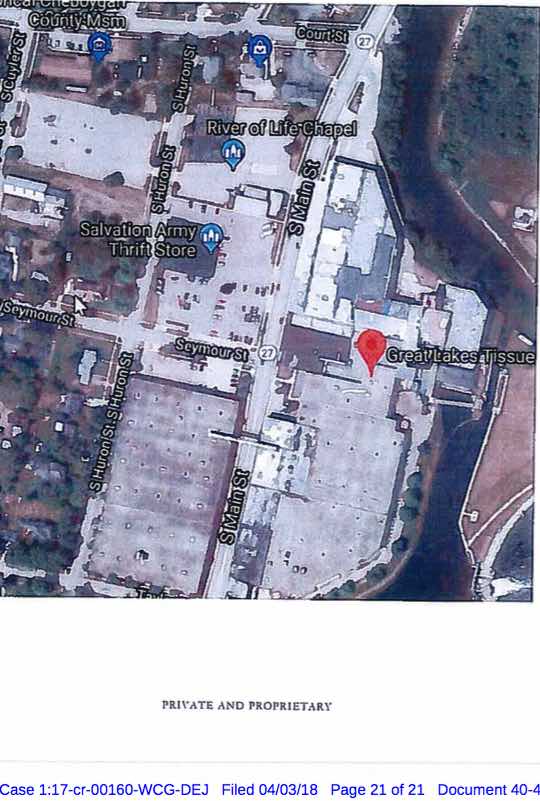

II. Transactions/Attempted Transactions Involving John Lozo

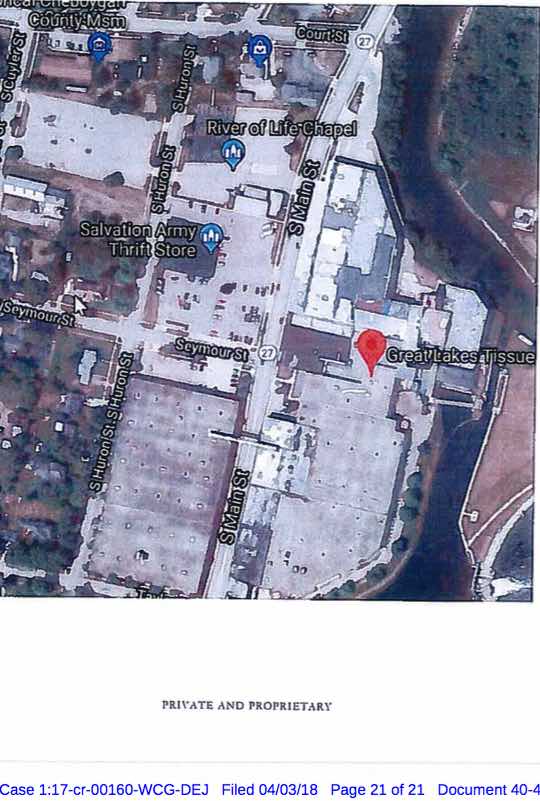

Beginning in the summer of 2016, and continuing into early 2018, Van Den Heuvel negotiated with a man named John Lozo in an effort to solicit funds for various projects or equipment. Van Den Heuvel sent Lozo a plethora of information during those negotiations, some of which was false or highly misleading. For example, on June 7, 2017, Van Den Heuvel sent Lozo and others an “Executive Summary” of the “Great Lakes Tissue” project in Cheboygan, Michigan, which promised “world changing technologies that process food contaminated waste streams to create” various products. (Exhibit A) The “Executive Summary” included financials, which represented, in part, that $7.7 million in “EB5 Funds were paid” for equipment for the project. Van Den Heuvel’s solicitation of EB-5 funds and subsequent misuse of those funds are part of the wire-fraud scheme alleged in case number 2017-CR-160. The Government’s tracing of the EB-5 funds indicates that Van Den Heuvel received substantially less than $7.7 million, and that the funds were mostly not used for equipment for the Cheboygan, Michigan project. The owner of Great Lakes Tissue in Cheboygan, Michigan, has informed law enforcement that neither he nor Great Lakes Tissue has received funds from Van Den Heuvel.

As another example, on September 11, 2017, Van Den Heuvel sent Lozo an email with several attachments, including (a) a letter, purporting to be on attorney Ty Willihnganz’s letterhead, but with Willihnganz’s name misspelled; (b) a “consulting agreement” dated March 16, 2017, purporting to promise Van Den Heuvel $47,000 per month for five years; and (c) a resume for Van Den Heuvel containing several false statements, such as that “Green Box has partnered with Cargill Inc.” (all parts of Exhibit B) As alleged in the 2017 indictment, Cargill had long ago terminated its agreement with Green Box, although Van Den Heuvel falsely claimed otherwise in soliciting funds for his companies.

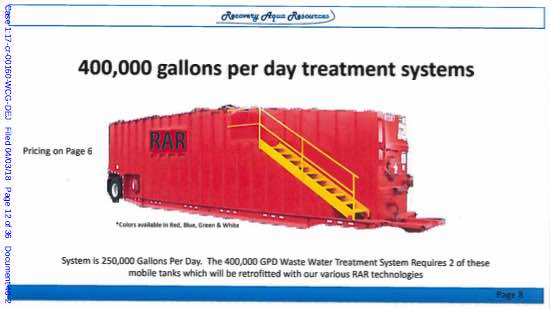

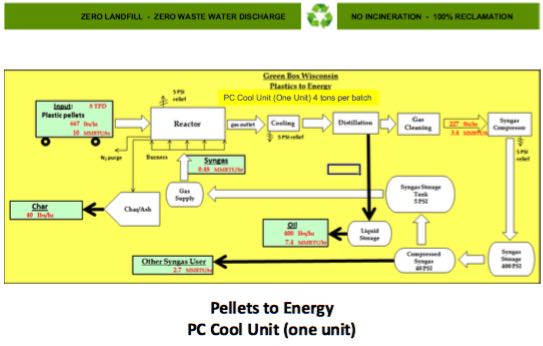

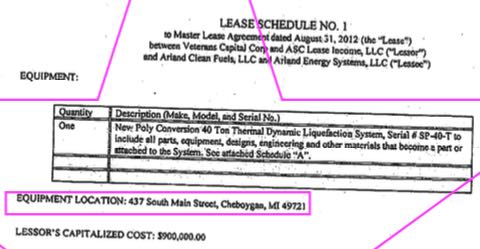

Van Den Heuvel’s communications with Lozo included efforts in late 2017 to sell, or obtain an investment in, pyrolysis machines manufactured by Kool Manufacturing. Lozo served as a broker in that potential transaction, and helped to arrange a “demonstration” of a pyrolysis machine for potential investors/buyers, run by Van Den Heuvel, in November of 2017. (Incidentally, Van Den Heuvel attempted to charge $5,000 for that November 2017 demonstration.) The Kool pyrolysis machines are also part of the wire-fraud scheme charged in case number 2017-CR-160; as noted in that indictment, Van Den Heuvel fraudulently obtained funds from victim Cliffton Equities, as well as other entities, to purchase those machines. When Van Den Heuvel’s company Green Box NA Green Bay filed for bankruptcy in 2016, the Kool machines were also listed as assets of the estate, which meant that they were subject to the bankruptcy court’s supervision until the bankruptcy case was ultimately terminated on December 29, 2017. As a result, court permission would have been required for Van Den Heuvel to sell the Kool units or pledge them to new investors; no such permission was obtained. In materials that Van Den Heuvel sent to Lozo, he often changed the spelling of the machines, calling them “Cool Units” rather than “Kool Units,” perhaps in an effort to suggest these were different machines. For example, Power Point presentations that Van Den Heuvel sent to Lozo on September 11, 2017 contain this new spelling. (E.g., Exhibit C) Lozo has confirmed, however, that the pyrolysis machines in question were manufactured by “Kool.”

The Government is not aware whether Van Den Heuvel successfully obtained any funds through his work with Lozo. It is clear, however, that Van Den Heuvel has continued to make materially false statements in an effort to obtain “loans” or “investments,” including statements that are closely related to his charged misconduct.

III. Transactions/Attempted Transactions Involving Knapp, Kashat, and Kalet

Aside from his work with Lozo, Van Den Heuvel has been soliciting funds (in the form of “loans” or “investments”) from several other people. Two individuals named Mason Kashat and Alex Knapp, both of New York, have loaned substantial sums to Van Den Heuvel in the past several months. According to Kashat and Knapp, they jointly loaned Van Den Heuvel approximately $60,000, receiving in exchange an equity stake in a company called Purely Cotton, a lien against the proceeds of one of Van Den Heuvel’s lawsuits (against Sharad Tak), and a “personal guarantee” from Van Den Heuvel. According to Knapp, he also made two smaller loans to Van Den Heuvel, for approximately $7,500 (to “Tissue Technology Inc. and Purely Cotton Products Corp.”) and $20,000 (to “PCDI MI”), between July and December of 2017. Those two smaller loans are already in default. Van Den Heuvel pledged Purely Cotton assets as collateral for Knapp’s loans, in addition to a long list of other equipment. That equipment consisted primarily of “after dryers,” which, according to a knowledgeable witness, Van Den Heuvel does not currently own or control. Knapp also received an equity stake in Purely Cotton, a lien against proceeds from a Tak lawsuit, and a “personal guarantee” from Van Den Heuvel.