TIMELINE PART 3

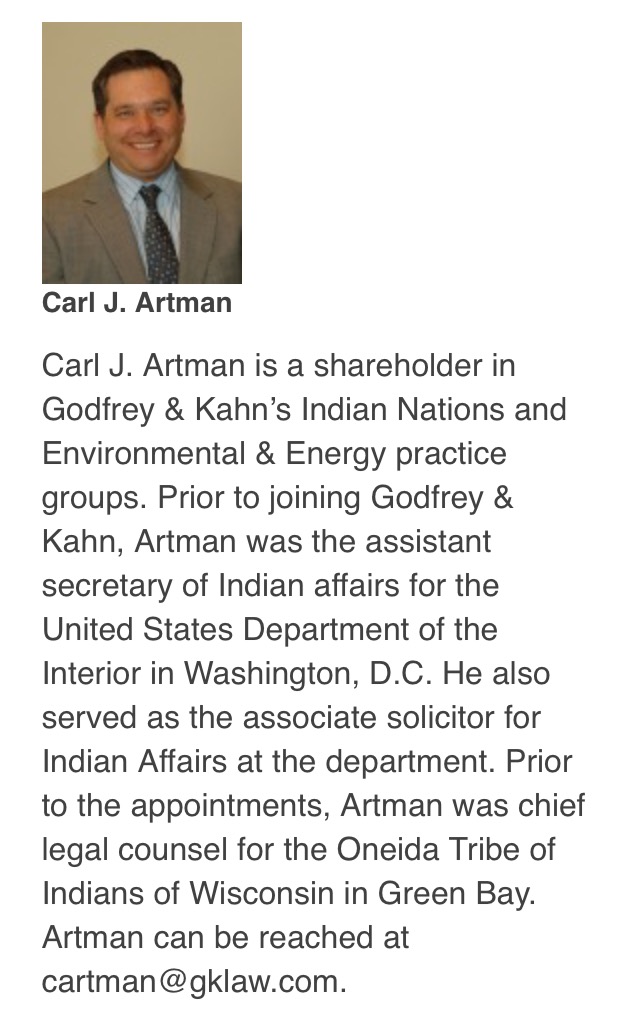

10/03/08 : ‘GODFREY & KAHN ANNOUNCES THE ADDITION OF CARL J. ARTMAN AS SHAREHOLDER IN ITS MILWAUKEE OFFICE; With extensive national experience, Artman will expand the firm’s Indian Nations Practice Group’

Milwaukee, Wisconsin (October 3, 2008) – The law firm of Godfrey & Kahn, S.C. is pleased to announce the addition of Carl J. Artman as shareholder in its Indian Nations and Environmental & Energy Practice Groups.

Prior to joining Godfrey & Kahn, Artman served as the Assistant Secretary of Indian Affairs and the Associate Solicitor for Indian Affairs for the United States Department of the Interior in Washington, D.C.

Prior to his appointments in Washington, Artman served as Chief Legal Counsel for the Oneida Tribe of Indians of Wisconsin in Green Bay.

“Carl will be a great addition to both our Indian Nations and Environmental & Energy Practice Groups,” said Rick Bliss, Managing Partner of Godfrey & Kahn.

“With his extensive background, Carl will be able to offer a broad range of legal services to a variety of our clients, especially in the area of Indian affairs. Carl has represented clients in environmental, corporate, emerging technologies, telecommunications and bankruptcy matters. We are very pleased to have him on board with us.”

Bliss noted that Artman plans to expand the firm’s Indian Nations practice. The mission of the firm’s Indian Nations Practice Group is to support tribal governments and their attorneys in protecting tribal sovereignty, enhancing tribal self-government and promoting the welfare of tribal members.

“Godfrey & Kahn supports organizations dedicated to improving the quality of life in Indian country and I am confident that Carl will be a great asset in accomplishing this mission,” added Bliss.

Artman currently serves on the Board of Directors for the Library of Congress’s American Folklife Center. He has also served on the Board of the Presidential Board of Advisors on Tribal Colleges and Universities, Oneida Nation Electronics, Qubit Technology Inc., Airadigm Communications, Inc. and Personal Communications Industry Association. His past involvement includes serving as Chairman of the Tribal Management Advisory Committee and the Tribal Budget Advisory Committee. He also served as a member of the U.S. Delegation to the United Nation’s Convention to Eliminate Racial Discrimination.

Artman received his J.D. degree from Washington University School of Law and his LLM from the University of Denver School of Law in Environment and Natural Resources. He received his MBA from the University of Wisconsin School of Business and his B.A. from Columbia College.

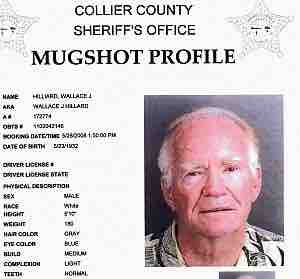

![]() 10/08/08 : October 8, 2008 Defendants’ Evergreen Development, LLC and Ronald Van Den Heuvel’s Notice of Retainer, signed by C. David Stellpflug, Stellpflug Law S.C., Brown Co. Case No. 08CV2265, [Wally Hilliard & Family] Hilliard Limited Partnership [Godfrey & Kahn] v. Ronald H. Van Den Heuvel & Evergreen Development, LLC

10/08/08 : October 8, 2008 Defendants’ Evergreen Development, LLC and Ronald Van Den Heuvel’s Notice of Retainer, signed by C. David Stellpflug, Stellpflug Law S.C., Brown Co. Case No. 08CV2265, [Wally Hilliard & Family] Hilliard Limited Partnership [Godfrey & Kahn] v. Ronald H. Van Den Heuvel & Evergreen Development, LLC

10/27/08 : KYHKJG, LLC registered w/ WDFI; Restored to Good Standing & changed Registered Agent to Kelly Van Den Heuvel, Principal Office: 2077-B Lawrence Dr., De Pere, WI on 03/27/12; Dissolved 12/27/16

10/27/08 : KYHKJG, LLC registered w/ WDFI; Restored to Good Standing & changed Registered Agent to Kelly Van Den Heuvel, Principal Office: 2077-B Lawrence Dr., De Pere, WI on 03/27/12; Dissolved 12/27/16

10/29/08 : October 29, 2008 DECISION, U.S. Court of Appeals, 7th Circuit, Cases Nos. 07-3863 & 07-3864, AIRADIGM COMMUNICATIONS INC.; Debtor, Airadigm Communications Inc. & Data Systems Inc., Appellants, v. Federal Communications Commission, Appellee…

10/29/08 : October 29, 2008 DECISION, U.S. Court of Appeals, 7th Circuit, Cases Nos. 07-3863 & 07-3864, AIRADIGM COMMUNICATIONS INC.; Debtor, Airadigm Communications Inc. & Data Systems Inc., Appellants, v. Federal Communications Commission, Appellee…

in which the Oneida Nation of Wisconsin’s ‘Oneida Economic Development Authority‘

[OEDA] LOST OVER $95 MILLION

on AIRADIGM…

and former Oneida Law Office

had served as Airadigm’s

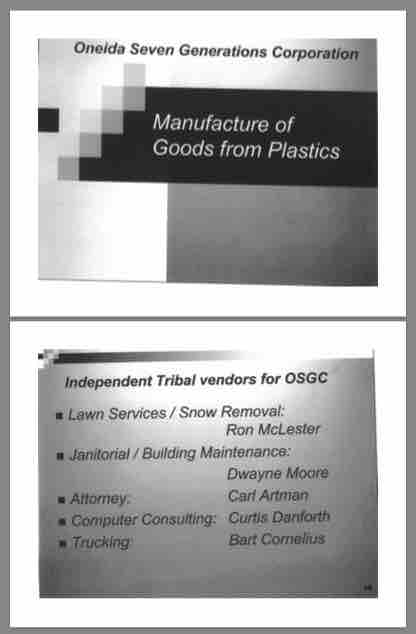

10/30/08 : CONFIDENTIAL – October 30, 2008 AUDIT of Oneida Seven Generations Corp. and subsidiaries by the ONWI Internal Audit Dept.,

10/30/08 : CONFIDENTIAL – October 30, 2008 AUDIT of Oneida Seven Generations Corp. and subsidiaries by the ONWI Internal Audit Dept.,

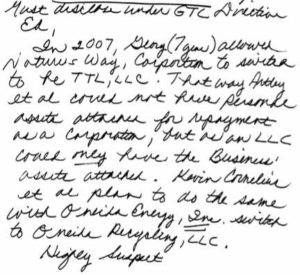

That ONWI Internal Audit Dept. Report was later referenced in non-Tribal OSGC Board member Paul Linzmeyer’s November 2011 Email to Fmr. OBC Chair Ed Delgado’s Elder Advisor Yvonne Metivier, Subject: “Actions ED should take” to protect GTC from Tribally-owned OSGC.

Fmr. OBC Chair Ed Delgado failed to heed the advice of non-Tribal OSGC Board member Paul Linzmeyer in 2011 – resulting in tens of millions of dollars in losses to GTC due the fraud schemes of OSGC and Ron Van Den Heuvel.

11/05/08 : November 05, 2008 Deposition of Ronald H. Van Den Heuvel by Atty. Ross Nova of Godfrey & Kahn [excerpt, pp. 13–16], Brown Co. Case No. 08CV2265, Hilliard Limited Partnership [Godfrey & Kahn] v. Ronald H. Van Den Heuvel & Evergreen Development, LLC

11/05/08 : November 05, 2008 Deposition of Ronald H. Van Den Heuvel by Atty. Ross Nova of Godfrey & Kahn [excerpt, pp. 13–16], Brown Co. Case No. 08CV2265, Hilliard Limited Partnership [Godfrey & Kahn] v. Ronald H. Van Den Heuvel & Evergreen Development, LLC

[Ron Van Den Heuvel]: I have that agreement with every one of them. I turn these into notes because it’s better for them. But all of them approved me entering into the bank debt that said we could not pay shareholders before the bank debt was paid. So I can’t just skirt this, turn it into a note, and now pay the note because, I mean, you can’t do that. It would be against the covenants with the banks. I mean, I can’t pay equity–– I can’t pay equity before I pay the bank debt. It’s just in the bank note.

[Atty. Ross Nova of Godfrey & Kahn]: You referred to sort of an understanding among the members of Evergreen [Development, LLC,] to renew these notes until the assets are sold. Is there anything in writing that evidenced this understanding you had with either Hilliard Limited Partnership or any other member of Evergreen Development, LLC, at any time?

[RVDH]: The only thing that’s in writing is the same thing that’s in Tissue Products Technology and in Eco-Fibre, and that is that I had a shareholders’ approval and board of directors’ approval when they were members of Eco-Fibre and when they were members of TPTC to enter into the bank debt that is still in place. And very clearly everyone understands they cannot get any money out of any of the companies directly or indirectly until the assets are sold.

[G&K]: Okay. That was actually a yes or no question, Mr. Van Den Heuvel, so I’m trying to make this go faster.

[RVDH]: Okay.

[G&K]: So I’ll ask the question one more time. You referred to an understanding that you had with the members of Evergreen Development, LLC, to renew various promissory notes until the assets of Evergreen Development were sold. Is that understanding reduced to writing?

[RVDH]: I don’t believe so, but I’m not sure.

[G&K]: Okay. What would you need to do to verify your understanding?

[RVDH]: I’d have to go through five years of e-mails.

[G&K]: Okay. I’ll just request that you do that to verify your understanding. So we understand, as you sit here today, you don’t know of any writing evidencing the understanding we’ve been referring to, and you’re going to let me know if your understanding is incorrect by reviewing e-mails so that the next time we meet, you can deny your understanding if it turns out you’re mistaken, correct?

[RVDH]: Incorrect. The bank documents and the two resolutions from the shareholders and the board of directors definitely says I cannot buy anybody out without paying them in full.

[G&K]: The shareholders and board of directors of what entity?

[RVDH]: Eco-Fibre [formerly Re-Box] and TPTC [Tissue Products Technology Corp.]

[G&K]: Okay. I’ll request copies of those documents.

[RVDH]: Okay.

[G&K]: Is there anything — any board of directors or members vote or writing evidencing an understanding between you and the members of Evergreen Development, LLC, to renew the promissory notes until the assets of Evergreen are sold?

[RVDH]: Other than the fact it just keeps happening. They understand. But no, I don’t think anything’s in writing. …

[G&K]: Is it your testimony then that you had an understanding with the Hilliard Limited Partnership that it would agree to renew the promissory note represented in Exhibit 1 until such time as the assets of Evergreen Development, LLC, were sold?

[RVDH]: Yes.

[G&K]: Okay. Was that ever put in writing?

[RVDH]: I’m not sure.

[G&K]: When was that understanding reached with Hilliard Limited Partnership?

[RVDH]: I talked to the guys many a time. And when we turned it from stock to a note, that was the understanding. I mean, they wanted on their balance sheet a note instead of stock so that they could value it, and I agreed to do it through an arm’s length transaction with full awareness that there was no way to pay it until the assets were sold and that I would work very diligently to sell the assets and not receive a wage from either one of the companies. I agreed to it.

[G&K]: With whom on behalf of Hilliard Limited Partnership did you reach this understanding to renew the promissory note represented by Exhibit 1?

[RVDH]: Mostly with Dan Hilliard, but I did talk to Neal Maccoux several times on it also.

[G&K]: And what role does Dan Hilliard play with Hilliard Limited Partnership?

[RVDH]: I don’t know.

[G&K]: Okay.

[Ron Van Den Heuvel]: He works for me though.

[Atty. Ross Nova of Godfrey & Kahn]: Okay. Do you know if Dan Hilliard‘s a member of Hilliard Limited Partnership? … [end of Exhibit excerpt]

11/07/08 : According to the September 20, 2016 Superseding Indictment, Docket No. 16-CR-064, USA v. Ron & Kelly Van Den Heuvel and Paul J. Piikkila

11/07/08 : According to the September 20, 2016 Superseding Indictment, Docket No. 16-CR-064, USA v. Ron & Kelly Van Den Heuvel and Paul J. Piikkila

3. On or about November 7, 2008, [Paul] Piikkila authorized two loans of $250,000 and $70,000, respectively, to KYHKJG, LLC.

11/13/08 : Daily Iberian, ‘Council delays decision on suit’

The parish contracted Bedminster [International] to develop and build a composting and waste management facility near the wastewater treatment plant in New Iberia, but could not reach an agreement on where the site would be located. The parish paid $77,028 to Bedminster for the first phase of the project, which included a study and report on the proposed project, but that was the only part of the project completed. The Parish Council voted to cancel its contract with Bedminster for an accelerated composting facility months ago, but Bedminster officials still have not signed off on it.

11/15/08 : GENERAL TRIBAL COUNCIL SPECIAL MEETING re: OSGC & CORPORATE ACCOUNTABILITY

- November 15, 2008 GTC MEETING MINUTES

- November 15, 2008 GTC MEETING AUDIO:

During the GTC Special Meeting re: Petitions by Madelyn Genskow, GTC voted to adopt the following Resolutions which OBC & OSGC HAVE IGNORED & REFUSED TO OBEY:

- GTC Resolution 11-15-08-A, Non-Confidentiality Information

Now Therefore Be It Resolved, that no committee or tribal attorney may force an Oneida committee, board or commission to keep secret from other tribal members information that is not of a confidential nature or force them to sign an agreement in order to serve on a committee, board or commission of the Oneida Tribe.

- GTC Resolution 11-15-08-B Directing Review of Corporate Charters

Now Therefore Be It Resolved that the [OBC] is directed to withhold future financial distributions to any corporation of the Tribe until the following actions have been taken

1. The [OBC] is directed to amend all corporate charters to require submission of annual and semi-annual reporting which contains the following information and/or documents:

a. the business done and intended to be done by the corporation

b. material changes and developments since the last report in the business, described,

c. any material pending legal proceedings to which the corporation is a party, and

d. financial statements of the corporation including a consolidated balance sheet and consolidated statement of income and source and application of funds.

2. The [OBC] is directed to review all corporate entities regarding finances and operations to determine the effectiveness and efficiencies of those corporate entities. A report on corporate entities is directed to be included in the Annual [GTC] meeting materials, or earlier if determined by the [OBC], to be needed.

- GTC Resolution 11-15-08-C, Treasurer’s Report to include all Receipts and Expenditures and the Amount and Nature of all Funds in the Treasurer’s Possession and Custody

Now Therefore Be It Resolved, that the Oneida General Tribal Council hereby directs that all Treasurer reports hereinafter include an independently audited annual statement that provides the status or conclusion of all the receipts and debits in possession of the Treasurer of the Tribe including, but not limited to, all corporations owned in full or in part by the Tribe, and

Be It Further Resolved, that the Oneida General Tribal Council hereby directs that all Treasurer’s reports to the Oneida General Tribal Council at the semi-annual and annual Oneida General Tribal Council meetings hereinafter include an independently audited annual financial statement that provides the status or conclusion of all receipts and debits in possession of the Treasurer of the Tribe and including, but not limited to component units (Tribally chartered corporations and autonomous entities, limited liability companies, state chartered corporations, any tribal economic development authority, boards, committees and commissions, vendors and consultants) owned in full or in part by the Tribe, and

Be It Further Resolved, that no “agent” of the Tribe shall enter into any agreement with any corporation that prohibits full disclosure of all transactions (receipts and expenditures and the nature of such funds) and that such an agreement is not binding to the Tribe, and

Be It Finally Resolved, that the Oneida General Tribal Council hereby directs implementation of this resolution at the next regular Oneida General Tribal Council meeting or at such special meeting of the Oneida General Tribal Council whereby a Treasurer’s report is requested.

- GTC Resolution 11-15-08-D, General Tribal Council Directives

Now Therefore Be It Resolved, that the [OBC] shall see to it that all Oneida [GTC] directives back to 1994 plus Resolution 07-06-93-A must be carried out by the end of fiscal year 2010.

Be It Further Resolved, Oneida General Tribal Council directs the Legislative Operating Committee to develop an amendment to the removal law which identifies that an elected official is subject to removal for failure to carry out a [GTC] directive and that this be presented to the Oneida General Tribal Council no later than the July 2009 semi-annual meeting.

The OBC & OSGC TREACHEROUSLY and TREASONOUSLY REFUSES TO COMPLY with GTC’s DIRECTIVES.

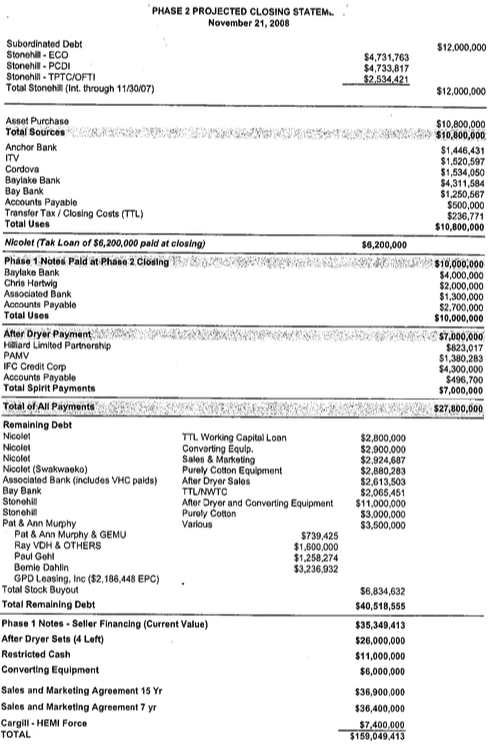

11/21/08: November 21, 2008 PHASE 2 PROJECTED CLOSING STATEMENT of RON VAN DEN HEUVEL’s company ENVIRONMENTAL ADVANCED RECLAMATION TECHNOLOGY HQ, LLC – E.A.R.T.H. – EXHIBIT from Ron Van Den Heuvel’s Responses to Plaintiff’s First Set of Requests to Admit, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

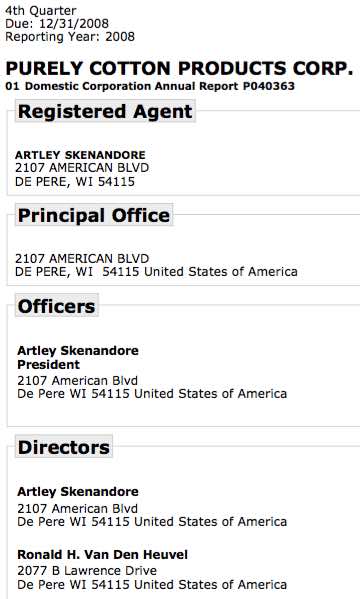

• MUST SEE LIST of Names and Amounts of Creditors regarding Subordinated Debt, Asset Purchases, Remaining Debt, including Various Banks including Anchor Bank; IFC Credit Corp.; Nicolet Bank; Baylake Bank; Associated Bank; Oneida Nation of Wisconsin-owned Bay Bank; Artley Skenandore Jr.’s Swakweko LLC; Hilliard Limited Partnership; Sharad Tak; Pat & Ann Murphy; Chris Hartwig; Stonehill Financial [SHF XII]

12/01/08 : December 1, 2008 Continued Deposition of Ronald H. Van Den Heuvel by Atty. Ross Nova of Godfrey & Kahn [excerpt], Brown Co. Case No. 08CV2265, Hilliard Limited Partnership [Godfrey & Kahn] v. Ronald H. Van Den Heuvel & Evergreen Development, LLC

Page 75:

[Ron Van Den Heuvel]: My office.

[Atty. Ross Nova of Godfrey & Kahn, counsel for Hilliard Limited Partnership]: Who was present?

[RVDH]: I wouldn’t know, but at one of these meetings Steve Peters was there. One of them I remember Andy [Hilliard] couldn’t make it because he was traveling somewhere. I don’t remember what meeting that was; but he maybe went to Africa. South Africa maybe. I shouldn’t say that, but that’s where my memory says he was at.

[G&K:] It was South Africa.

[RVDH]: It was, okay.

[G&K:] At any of the meetings regarding the alleged compromise and settlement referred to in 12 of your answer was anyone else present other than you, Steve Peters, Dan Hilliard, Andy Hilliard, and Neal Maccoux?

[RVDH]: No. It would be a combination of that group.

[G&K:] What date was this compromise and settlement reached?

[RVDH]: Right after the 4th of July, I want to say, sometime in that time period.

[G&K:] Before or after you signed the amended and restated promissory note?

[RVDH]: At or around that time. I can’t remember right when it was there. I know they wanted to review the mortgage, and we had given it to him a couple of … [page 75 ends]

Pages 77–78:

[Godfrey & Kahn:] Did you discuss the compromise and settlement with Andy — Andy Hilliard’s father [Wallace Hilliard] at all?

[Ron Van Den Heuvel:] Well, I didn’t. I said – I told him we had a tough situation going forward and financing was tough in this market; but I do believe that I used the term your boys are comfortable now that no assets will be sold underneath them without them being paid in full and/or that I’m diligently working hard and it’s a real project? And I showed him the off-take agreement signed by the Kraft family and Wausau Paper. They were fairly — I think everybody is very comfortable that this deal is progressing as fast as possible.

[G&K:] Did you have a conversation with the senior Hilliard [Wally] regarding the compromise and settlement referred to in paragraph 12 of your answer?

[RVDH:] The only thing I said to them is we came apart with a mortgage that should satisfy any issues that they had. I didn’t get into specifics. Wally and I were friends for a long time. I used to do all of his work, built all of his buildings as an architect, and did electrical work for him for years.

[G&K:] Did the Hilliard Limited Partnership agreement sign anything in writing documenting the compromise and settlement referred to in paragraph 12 of your answer?

[RVDH:] The only evidence I have that they did is they recorded the mortgage. So I don’t really have anything signed by them back because they always bring things for me to sign back to them and then they accepted it because they took the mortgage and filed it. So the mortgage went to them a couple times back and forth, and they wanted to talk about it and this and that. Finally, they agreed; and then shortly after they agreed they filed the mortgage.

[G&K:] When you say they agreed, who communicated to you that the Hilliard Limited Partnership agreed to the compromise and settlement contained in paragraph 12 of the answer?

[Ron Van Den Heuvel:] Well, Dan [Hilliard] negotiated or I shouldn’t say negotiated. Dan is the one who told me that they agreed, and basically a couple different times he said the mortgage was a good idea, and I know Dan is inside of our group working as hard as anybody to get this closed.

[Godfrey & Kahn:] Do you know what role Dan Hilliard has within Hilliard Limited Partnership? … [end of Exhibit excerpt]

![]() 12/08/08 : December 8, 2008 Defendants Evergreen Development, LLC, and Ronald Van Den Heuvel’s Responses to Plaintiff’s First Set of Requests to Admit, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership [by Godfrey & Kahn] v. Ron Van Den Heuvel & Evergreen Development, LLC

12/08/08 : December 8, 2008 Defendants Evergreen Development, LLC, and Ronald Van Den Heuvel’s Responses to Plaintiff’s First Set of Requests to Admit, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership [by Godfrey & Kahn] v. Ron Van Den Heuvel & Evergreen Development, LLC

NOW COME THE DEFENDANTS Evergreen Development, LLC, and Ronald Van Den Heuvel, by their attorneys, Stellpflug Law S.C., and hereby respond to Plaintiff’s First Set of Requests to Admit as follows:

1 . Admit that the attached hereto as Exhibit A is a true and correct copy of a Promissory Note in favor of the Plaintiff executed by the Defendants in the principal amount of Seven Hundred Fifty-Nine Thousand Six Hundred Thirty-Seven and 50/100 Dollars ($750,637.50)

RESPONSE: Admit.

2. Admit that no writing exists which relieves the Defendants from the terms of the Promissory Note.

RESPONSE: Deny. Defendants believe that there are e-mails between the parties that indicate an understanding that the Note is not payable until the sale of EcoFibre, Inc., is complete. Defendants are currently reviewing their files to locate said e-mails. Upon Defendants’ review of their files, this admission will be supplemented.

3. Admit that there is no oral agreement relieving the Defendants from their obligations under the Promissory Note.

RESPONSE: Deny. Defendant, Ronald Van Den Heuvel, on behalf of Evergreen Development, LLC, had discussions with the principals of Hilliard Limited Partnership wherein it was agreed that the Note would not be payable until such time as the sale of EcoFibre, Inc, was completed.

4. Admit that EcoFibre, Inc., is not a party to the Promissory Note.

RESPONSE: Admit.

5. Admit that the date of closing of the sale of EcoFibre, Inc., has not been set.

RESPONSE: Admit that a single date has not been set for the closing, but a time period for the closing has been set in that it is scheduled to close within the first quarter of 2009.

6. Admit that EcoFibre, Inc., does not have in place financing sufficient to complete the financing of its facility in DePere, Wisconsin.

RESPONSE: Admit that EcoFibre, Inc., does not have 100 percent financing in place but does have 50 percent in place at this time, with the expectation that the remaining financing will be in place within the first quarter of 2009.

7. Admit that there is no executed document by which proceeds of the sale of EcoFibre, Inc., will be paid directly to either Defendant.

RESPONSE: Admit.

8. Admit that there is no executed document by which proceeds of the sale of EcoFibre, Inc., will be paid directly to [Hilliard Family Partnership].

RESPONSE: Admit that no executed document is in place by which the proceeds of the sale of EcoFibre, Inc., will be paid directly to the Plaintiff. However, a payout sheet indicating where the proceeds of the sale will go and to whom has been drafted and is attached hereto indicating that the Plaintiffs will be paid out of said proceeds.

9. Admit that the debt of EcoFibre, Inc., exceeds the assets of EcoFibre, Inc.

RESPONSE: Deny that the debt of EcoFibre, Inc., exceeds its assets in that the sale of EcoFibre, Inc., will be paid directly to the Plaintiff. However, a payout sheet indicating where the proceeds of the sale will go and to who has been drafted and is attached hereto indicating that the Plaintiffs will be paid out of said proceeds.

10. Admit that interests secured by mortgages and/or other recorded documents in EcoFibre, Inc.’s, real property that are senior to the mortgage of the Plaintiff, exceed the value of that real property.

RESPONSE: Admit that the real property value of EcoFibre, Inc., is exceeded by other interests senior to the mortgage of the Plaintiff, but that when the total value of EcoFibre, Inc., which includes technology and intangibles, exceeds the debt of EcoFibre, Inc., including all secured interests including that of the Plaintiff.

11. Admit that there is no date certain by which the contemplated sale of EcoFibre, Inc., must be completed.

RESPONSE: Admit.

12. Admit it is possible that the sale of EcoFibre, Inc., will never occur.

RESPONSE: Admit.

13. Admit that more than one year has passed since the recording date of the mortgage referred to in Paragraph 12 of your Answer.

RESPONSE: Admit.

Dated this 8th day of December 2008.

STELLPFLUG LAW, S.C.

Attorneys for Defendants

By: C. David Stellpflug

12/21/08 : Daily Iberian, ‘Iberia sues to close Bedminster deal’

![]() 12/22/08 : December 22, 2008 Affidavit of Neal Maccoux w/ Exhibits in Support of Plaintiff’s Motion for Summary Judgment Against Defendants, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership [by Godfrey & Kahn] v. Ron Van Den Heuvel & Evergreen Development, LLC

12/22/08 : December 22, 2008 Affidavit of Neal Maccoux w/ Exhibits in Support of Plaintiff’s Motion for Summary Judgment Against Defendants, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership [by Godfrey & Kahn] v. Ron Van Den Heuvel & Evergreen Development, LLC

![]() 12/31/08 : December 31, 2008 Notice of Motion & Motion for Summary Judgment, and Brief w/ Exhibits in Support of Motion for Summary Judgment – including the December 31, 2008 Affidavit of Atty. Ross Nova, Godfrey & Kahn, S.C., re: Brown Co. Case No. 08CV2265, Hilliard Limited Partnership [by Godfrey & Kahn] v. Ron Van Den Heuvel & Evergreen Development, LLC

12/31/08 : December 31, 2008 Notice of Motion & Motion for Summary Judgment, and Brief w/ Exhibits in Support of Motion for Summary Judgment – including the December 31, 2008 Affidavit of Atty. Ross Nova, Godfrey & Kahn, S.C., re: Brown Co. Case No. 08CV2265, Hilliard Limited Partnership [by Godfrey & Kahn] v. Ron Van Den Heuvel & Evergreen Development, LLC

What the Defendents allege is that at some point prior to or contemporaneously with the execution of the promissory note, the Plaintiff orally agreed to modify the promissory note to provide for repayment upon the sale of a non-party business related to the Defendants, whenever that would occur, if ever. The Plaintiff sharply disputes this implausible allegation, but it immaterial. For reasons explained in this Brief, the promissory note cannot be modified by alleged oral agreements made prior to contemporaneously with the making of the promissory note. Because of the patrol evidence rule, a failure of consideration and the Statute of Frauds, any oral modification of the promissory note would be ineffective and any evidence in support thereof is inadmissible. Because the Defendants’ oral amendment defense must fail as a matter of law, the Plaintiff is entitled to summary judgmment. …

The oral “compromise and settlement” alleged by Defendants is utterly unsupported by consideration. This alleged oral modification would take the Note, whose principal value is over three quarters of a million dollars with a specific due date, and modify it to a payment date contingent upon the sale of a third party company, which Defendants agree may never happen! … As the Defendants have alleged, the Plaintiff received absolutely nothing in consideration for its oral “compromise and settlement” to modify a Note that would have paid Plaintiff an amount now worth $915,515.12 at a point in time that may never occur. …

The maker of the Note testified that the alleged “compromise and settlement” was entered into at various times between 2004 and 2008. … Assuming, arguendo, that the alleged “compromise and settlement” was entered into in 2006, the “compromise and settlement” cannot, by its terms, be completed within one year, threby making it subject to Wisconsin general Statute of Frauds … Thus, under Wisconsin law, the “compromise and settlement” is one that is significant enough that it must be in writing. The Statute of Frauds is, as its heart, an evidentiary requirement designed to prevent disputes and uncertainties about agreements between the parties. … A Statute of Frauds is, to put it plainly, designed to forestall exactly the kind of dispute that the Defendants attempt to raise in this case.

CONCLUSION

For the foregoing reason, the Court should grant summary judgment to the Plaintiff on its breach of contract claim and enter judgment against the Defendants in the amount of $929,592.45, plus the Plaintiff’s actual attorney’s fees and costs as allowed by the Note.

December 31, 2008 Defendants Evergreen Development, LLC and Ronald Van Den Heuvel’s Amended Answer to Complaint, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership [by Godfrey & Kahn] v. Ron Van Den Heuvel & Evergreen Development, LLC

December 31, 2008 Defendants Evergreen Development, LLC and Ronald Van Den Heuvel’s Amended Answer to Complaint, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership [by Godfrey & Kahn] v. Ron Van Den Heuvel & Evergreen Development, LLC

NOW COME THE DEFENDANTS Evergreen Development, LLC, and Ronald Van Den Heuvel, by Stellpflug Law, S.C., and hereby amend their answer to the Complaint of the Plaintiff as follows:

1. Defendants reallege and incorporate herein by reference Paragraphs 1 through 11, inclusive, and Paragraphs 13 and 14, inclusive, with like force and effect as if fully realleged herein.

2. As to Paragraph 12 of its original Answer, Defendants hereby amend that paragraph under Affirmative Defense in that it is hereby affirmatively alleged that at the time Plaintiff executed the Promissory Note or sometime prior thereto, Plaintiff and Defendants entered into an agreement whereby Defendants caused an affiliate, Eco Fibre, Inc., to execute a mortgage in favor of the Plaintiff to secure payment of the Promissory Note, and, in consideration of the same, Plaintiff agreed to refrain from any legal action and to postpone the due date of the Promissory Note until Eco-Fibre, Inc., completed the sale and expansion of their facility in DePere, Wisconsin, which has not yet occurred. The mortgage was recorded July 27, 2007 as Document No. 2324129, Brown County records.

WHEREFORE, Defendants hereby demand judgment as follows:

A. For dismissal of the Complaint with prejudice;

B. For an award of statuatory costs, disbursements and attorney fees as permitted by law;

C. For any and further relief that the Court may deem just and equitable.

DATED this 31st day of December, 2008

STELLPFLUG LAW, S.C.

By. Michael J. Kirschling

December 31, 2008 Letter from Atty. Ross Nova [G&K for Hilliard LP] to Judge Bischel, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership [by Godfrey & Kahn] v. Ron Van Den Heuvel & Evergreen Development, LLC

December 31, 2008 Letter from Atty. Ross Nova [G&K for Hilliard LP] to Judge Bischel, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership [by Godfrey & Kahn] v. Ron Van Den Heuvel & Evergreen Development, LLC

01/02/09 : January 2, 2009 Letter from Stellpflug Law to Judge Bischel, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

01/02/09 : January 2, 2009 Letter from Stellpflug Law to Judge Bischel, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

Enclosed please find our firm’s Notice of Motion and Motion to Withdraw as Attorneys for [Evergreen Development, LLC].

- January 2, 2009 Stellpflug Law, S.C.’s Notice and Motion to Withdraw as Attorneys, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

3. The ground for this motion is due to the clients having failed to substantially fulfill an obligation to the law firm regarding the law firm’s services and has been given reasonable warning that the lawyer will withdraw unless the obligation is fulfilled as more fully set forth in the accompanying affidavit.

- January 2, 2009 Affidavit of Michael J. Kirschling in Support of Motion to Withdraw as Attorneys, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

2. I was one of the attorneys for the Defendants Evergreen Development, LLC and Ronald Van Den Heuvel, in the above-entitled matter and I make this affidavit based upon personal knowledge.

3. Evergreen Development, LLC and Ronald Van Den Heuvel, both personally and as the managing member of the LLC, have failed to compensate the firm for its services incurred to date in representing the parties in this matter though they agreed they would provide such compensation.

4. The firm has made repeated requests of the LLC and Mr. Van Den Heuvel to pay the outstanding arrearages but to day, no payments have been forthcoming.

5. To continue representation of the LLC and Mr. Van Den Heuvel in this matter without payment for attorney fees incurred in continuing such representation will cause the firm undue financial hardship.

6. This affidavit is being submitted in Support of Motion to Withdraw as Attorneys.

According to the September 20, 2016 Superseding Indictment, Docket No. 16-CR-064, USA v. Ron Van Den Heuvel, Kelly Van Den Heuvel & Paul Piikkila:

According to the September 20, 2016 Superseding Indictment, Docket No. 16-CR-064, USA v. Ron Van Den Heuvel, Kelly Van Den Heuvel & Paul Piikkila:

5. On or about January 2, 2009, Piikkila authorized a loan of $240,000 to straw borrower [William C. Bain], a former relative of Ronald Van Den Heuvel by marriage. These funds were used to pay personal expenses of Ronald Van Den Heuvel and to pay off different loans obtained for Ronald Van Den Heuvel at different banks.

According to July 1, 2016 Paul Piikkila Plea Agreement in U.S. District Court, Eastern District of Wisconsin Case No. 16-CR-64, United States of America v. Paul J. Piikkila:

On January 2, 2009, Piikkila approved a loan of $240,000 to [William C. Bain]. [William ‘Bill’ Bain] is a former business partner of Ron’s [in Ron & Bill Investments, LLP] and a former brother-in-law. [William Bain] fully admits that he was recruited by Ron to be used as a straw borrower to obtain a loan in his name even though the money was not going to him and none of the responsibility for repaying the loans was on his shoulders since it was his understanding, and Piikkila’s, that Ron would be repaying the loan. All of the $240,000 was quickly disbursed. The large majority of it went to pay off earlier loan debts at other banks, either in Ron’s own name or in [William Bain]’s name because he had earlier served as a straw borrower to obtain loans for Ron at other banks. The money left over after these loan payments was used for personal debts of Ron’s.

01/05/09 : January 5, 2009 GTC Annual Meeting & Report from OSGC

01/05/09 : January 5, 2009 GTC Annual Meeting & Report from OSGC

The five board members include:

William Cornelius, Chairman

Jennifer Hill-Kelley, Secretary / Treasurer

Brenda Mendolla-Buckley

Jim VanStippen

Mike MetoxenVision: OSGC will be a profitable company generating a base income from real estate development opportunities. These properties will be utilized for the development of business ventures that will generate greater levels of income.

Mission: To promote and enhance economic diversification as a holding company for real estate assets, management of related assets or as a holding company for other business ventures to develop long-term income streams for the Oneida Tribe.

Goals: …

• Report annualized profits to the Oneida Business Committee and General Tribal Council, if needed. …Strategies:

1. Analyze each business venture and determine its viability based on a standard of accounting principals and industry standards. [end of report]

01/06/09 : January 6, 2009 Order for Withdrawal by Stellpflug Law as Counsel for Ron Van Den Heuvel, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

01/06/09 : January 6, 2009 Order for Withdrawal by Stellpflug Law as Counsel for Ron Van Den Heuvel, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

01/07/09 : OSGC-majority-shareholder company IEP Development, LLC registered w/WDFI; changed Registered Agent to Kevin I. Cornelius on 10/07/11; Administratively dissolved on 08/11/15

01/07/09 : OSGC-majority-shareholder company IEP Development, LLC registered w/WDFI; changed Registered Agent to Kevin I. Cornelius on 10/07/11; Administratively dissolved on 08/11/15

• IEP Development, LLC, is related to International Energy Partners [IEP ME] in Caribou, ME.

• See also CBEnergy.us.

• MARC HESS worked for the original IEP in Maine, for IEP Development, LLC in Wisconsin, and for his own Wisconsin company, MH Resources, LLC.

• More info about OSGC & IEP Dvmt. below regarding the 11/09/09 Wisconsin Dept. of Commerce [WIDoC] $2Million Award Contract #LEG-FY10-19812 to OSGC for an ‘energy project.’

- January 7, 2009 Letter from Judge Bischel to Attys. Kirschling & Nova, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

01/09/09 : January 9, 2009 Stipulation Permitting Stellpflug Law, S.C.’s Withdrawal as Attorneys for Ron Van Den Heuvel & Evergreen Development, LLC, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

01/09/09 : January 9, 2009 Stipulation Permitting Stellpflug Law, S.C.’s Withdrawal as Attorneys for Ron Van Den Heuvel & Evergreen Development, LLC, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

NOW COME the Defendants, Evergreen Development, LLC, and Ronald H. Van Den Heuvel (hereinafter collectively “Evergreen”), and Stellpflug Law, S.C., (hereinafter “Stellpflug”), who hereby stipulate that Stellpflug may withdraw as counsel for Evergreen in the above-entitled matter due to [Evergreen’s] failure to timely pay for services rendered by Stellpflug to date in this matter on its behalf.

02/11/09 : According to the September 20, 2016 Superseding Indictment, Docket No. 16-CR-064, USA v. Ron Van Den Heuvel, Kelly Van Den Heuvel & Paul Piikkila:

02/11/09 : According to the September 20, 2016 Superseding Indictment, Docket No. 16-CR-064, USA v. Ron Van Den Heuvel, Kelly Van Den Heuvel & Paul Piikkila:

6. On or about February 11, 2009, Piikkila authorized a loan of $30,000 to straw borrower [Steven Peters, partner in Nature’s Way Tissue Corp.]. Those funds were promptly used for the benefit of two of Ronald Van Den Heuvel’s business entities.

![]() 02/12/09 : FILED – Summons & Complaint, Brown Co. Case No. 09CV439, Glory LLC v. Ron Van Den Heuvel & Tissue Technology LLC [and dismissed defendants: Partners Concepts Development Inc; Custom Paper Products Inc; Natures Choice Tissue LLC; Purely Cotton Products Corp; Eco Fibre Inc; ReBox Packaging Inc; Tissue Products Technology Corp; Patriot Project Services LLC; Chat LLC; Patriot Investments LLC; Patriot Services Inc; RVDH Inc; Waste Fiber Technology Inc; Recovering Aqua Resources Inc; RV Jet Inc; KYHKJG LLC; Patriot Paper Services Inc; Fibre Solutions LLC; Doc-U-Mince LLC; and dismissed third-party defendants: Ross J. Nova; Godfrey & Kahn.]

02/12/09 : FILED – Summons & Complaint, Brown Co. Case No. 09CV439, Glory LLC v. Ron Van Den Heuvel & Tissue Technology LLC [and dismissed defendants: Partners Concepts Development Inc; Custom Paper Products Inc; Natures Choice Tissue LLC; Purely Cotton Products Corp; Eco Fibre Inc; ReBox Packaging Inc; Tissue Products Technology Corp; Patriot Project Services LLC; Chat LLC; Patriot Investments LLC; Patriot Services Inc; RVDH Inc; Waste Fiber Technology Inc; Recovering Aqua Resources Inc; RV Jet Inc; KYHKJG LLC; Patriot Paper Services Inc; Fibre Solutions LLC; Doc-U-Mince LLC; and dismissed third-party defendants: Ross J. Nova; Godfrey & Kahn.]

• $1,227,880.01 MONEY JUDGMENT for Glory, LLC against Tissue Technology, LLC on 09/05/13

February 12, 2009 Letter from Atty. Ross Nova [of Godfrey & Kahn for Hilliard LP] to Judge Bischel, Brown Co. Case 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

February 12, 2009 Letter from Atty. Ross Nova [of Godfrey & Kahn for Hilliard LP] to Judge Bischel, Brown Co. Case 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

02/16/09 : February 16, 2009 Letter from Judge Bischel to Ron Van Den Heuvel, Brown Co. Case 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

02/16/09 : February 16, 2009 Letter from Judge Bischel to Ron Van Den Heuvel, Brown Co. Case 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

02/25/09 : February 25, 2009 Letter from Ron Van Den Heuvel to Judge Bischel, Brown Co. Case 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

02/25/09 : February 25, 2009 Letter from Ron Van Den Heuvel to Judge Bischel, Brown Co. Case 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

03/13/09 : Source of Savings, Inc. Administratively Dissolved w/ WDFI; Principal Office 2079-A Lawrence Dr., De Pere, WI; Started on 03/11/03; Registered Agent Pedro ‘Pete’ Fernandez, husband of Kim Yessman, who is the sister of Ron Van Den Heuvel’s wife, Kelly Lea Yessman.

03/16/09 : VHC Arkansas, LLC, administratively Dissolved w/ WDFI; Registered Agent to Ron’s brother David Van Den Heuvel; Started as R&K Arkansas, LLC on 03/21/97, renamed PCDI Arkansas, LLC on 08/27/98, and VHC Arkansas, LLC on 12/11/98

03/19/09 : March 19, 2009 Affidavit of Atty. Ross Nova [G&K for Hilliard LP] w/ Exhibits, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

03/19/09 : March 19, 2009 Affidavit of Atty. Ross Nova [G&K for Hilliard LP] w/ Exhibits, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

- March 19, 2009 Letter from Ron Van Den Heuvel to Judge Sue E. Bischel, Circuit Court Branch III, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

Re: … Lawyer/Client – Privileged Information, confidentiality and conflict of interest

Dear Judge Bischel:

The following statements are true and complete and should warrant immediate attention.

1 . Godfrey and Kahn has a clearly [sic] understanding that Tak Investments, ST Paper, LLC and ST Holdings, LLC are technology and business partners with Tissue Technology, LLC [TTL] and that Ron Van Den Heuvel is an 83% owner of TTL.

2 . Without Mr. Van Den Heuvel or Tissue Technology, LLC having legal counsel present Godfrey and Kahn’s attorneys have met with Mr. Van Den Heuvel, Mr. Sharad Tak, owner of Tak Investments and ST companies, and the various companies on many occasions. Mr. Van Den Heuvel and Mr. Sharad Tak have understood any items stated or discussed in these meetings were covered as privileged information and under the client/lawyer confidentiality.

3 . Godfrey and Kahn clearly understands that ST Paper and Tak [Investments, LLC] shared the same office at 1555 Glory Road, Green Bay, WI 54304 with Tissue Technology. Godfrey knows this as they sent TTL notices and Tak/ST Paper invoices to that location.

4. Godfrey and Kahn clearly understand that they have drafted joint agreements for both ST Paper group and Ron Van Den Heuvel and Tissue Technology, LLC group.

5. Funds of Tissue Technology group and of Ron Van Den Heuvel have been used to pay fees of Tak Investment or ST Group due and owed to Godfrey and Kahn.

6. Godfrey and Kahn has directly requested and received numerous documents, letters and emails as well as other confidential information from Ron Van Den Heuvel (personally), Partners Concepts Development, Inc., Ecofibre, Inc., Tissue Products Technology Corp., Tissue Technology, LLC and Oconto Falls Tissue, Inc.

03/31/09 : Alliance Construction and Design LLC registered w/ WDFI; Renamed Alliance GC [for ‘Global Conservation’ ], LLC on 07/16/09; Changes of Registered Agent on 11/15/10, and 05/05/11, and 04/10/12, and 03/25/15

04/02/09 : FILED Brown Co. Case No. 2009CV980, Manchester Mortgage Co. LLC v. Ronald H. Van Den Heuvel, Kelly Y. Van Den Heuvel, George Washington Service Bank, Christopher J. Hartwig, John R. Petitjean, Mau & Assocates LLP, Anchorbank FSB, Hughes Socol Piers Resnick & Dym Ltd, IFC Credit Corp., Industrial Technology Ventures LP, State of Wisconsin, Jan Marie Summers Van Den Heuvel, VHC Inc.;

• 2013 MONEY JUDGMENT against Ron Van Den Heuvel for $3,751,642.32 and a second judgment against Ron Van Den Heuvel for $2,567,396.98

According to the May 8, 2015 10:00 a.m. to 12:59 p.m Supplemental Examination of Ronald H. Van Den Heuvel Before James O’Neil, Court Commissioner by Atty. Jonathan Smies of Godfrey & Kahn on behalf of Plaintiff Dr. Marco Araujo; Defendant Ron Van Den Heuvel represented by Atty. John Petitjean of Hinkfuss, Sickel, Petitjean & Wieting

According to the May 8, 2015 10:00 a.m. to 12:59 p.m Supplemental Examination of Ronald H. Van Den Heuvel Before James O’Neil, Court Commissioner by Atty. Jonathan Smies of Godfrey & Kahn on behalf of Plaintiff Dr. Marco Araujo; Defendant Ron Van Den Heuvel represented by Atty. John Petitjean of Hinkfuss, Sickel, Petitjean & Wieting

Starting on page 36:

[Godfrey & Kahn:] You live in a house; is that correct?

[Ron Van Den Heuvel:] Yes.

[G&K:] And at one time you did own that house, didn’t you?

[RVDH:] Yes.

[G&K:] And now it is the case that Manchester Mortgage [Company], LLC [Link 1], owns the property.

[RVDH:] Correct.

[G&K:] And do you pay rent then to Manchester Mortgage Company, LLC [Link 2]?

[RVDH:] No.

[G&K:] Do you have any kind of agreement with Manchester Mortgage Company, LLC, concerning your ability to live in the residence?

[RVDH:] I have a handshake.

[G&K:] What’s the nature of this handshake, as you call it?

[RVDH:] He holds three million shares in E.A.R.T.H., and as long as I’m working for the betterment of E.A.R.T.H., I stay in the property. If the shares ever go over $6 apiece, he gives me my house title back.

[G&K:] Who is he? Who are you referring to?

[RVDH:] Manchester Mortgage. Jim George is the president of it.

[G&K:] Does Mr. George then – Is it Manchester Mortgage Company, LLC, that has an interest in E.A.R.T.H. or Jim George?

[RVDH:] Manchester Mortgage. They bought the note from Citizens [Bank].

[G&K:] And your agreement with Mr. George, was this reduced to writing?

[RVDH:] No.

[G&K:] When did you come to this agreement?

[RVDH:] After.

[G&K:] So after Manchester Mortgage Company, LLC, obtained – presumably foreclosed on the house, bid at the sale –

[RVDH:] There were $65 million of debt against it.

[G&K:] There were $65 million of debt against your residence?

[RVDH:] Yes.

[G&K:] And Manchester Mortgage was the senior lender, senior secured lender?

[RVHD:] It bought the loan from Citizens Bank, foreclosed on the first, and everybody went off the back.

[G&K:] And after they obtained the property through the process and the courts, they then had an agreement with you, just a verbal – an oral agreement essentially that you would stay there rent free as long as – Can you explain what as long as – As long as what, I guess.

[RVDH:] I cut the lawn, remove the snow, keep the repairs up, pay the heating and lighting bills.

[G&K:] So you’re responsible to pay the utilities for the property. Are you responsible to pay the property taxes?

[RVDH:] Yes.

[G&K:] Have you paid any property taxes since the Manchester Mortgage Company took ownership of the property?

[RVDH:] Yes, twice.

[G&K:] And what years was that?

[RVDH:] ’11 and ’12. And I personally didn’t pay them.

[G&K:] Who paid them?

[RVDH:] Someone else. I don’t remember which person paid them each year.

[G&K:] Do you have a sense of how much – You did pay them for a number of years when you owned the house, right?

[RVDH:] Right.

[G&K:] And do you have a sense as to how much they were then at least?

[RVDH:] $48,000 a year.

[G&K:] But as you sit here today, you can’t remember who was willing to pay property taxes for 2011 and 2012 for the property you’re living in?

[RVDH:] No. I mean, I can go find out.

[G&K:] Do you think it was a family member or friend?

[RVDH:] Probably somebody that owed me money.

[G&K:] Was there any agreement written to reflect that payment on your behalf?

[RVDH:] No.

[G&K:] So –

[Atty. Petitjean:] Other than a tax receipt?

[RVDH:] I got a receipt from the courthouse.

[G&K:] So your understanding of this oral agreement you have with – between you and Manchester Mortgage Company, LLC, is that you are to maintain the property, cut the grass, plow the driveway, pay the utilities, pay the property taxes. And what else? Anything else that relates to the property?

[RVDH:] Nothing else to the property.

[G&K:] And were there any conditions concerning your role at E.A.R.T.H. and your ability to stay in the residence?

[RVDH:] No. At my dad’s funeral we talked about it a long time again and perfectly comfortable. He sees the share value going up. It’s on the board.

[G&K:] So if the shares –

[RVDH:] Hit $6 a share, I get the title back to the house.

[G&K:] Presumably, that would allow Manchester to liquidate their shares and/or do whatever they want. That’s their decision, I guess.

[RVDH:] It’s their shares.

[G&K:] How are those shares valued, if you know?

[RVDH:] Outside firms.

[G&K:] When was the last time you had an outside firm prepare a valuation of E.A.R.T.H.?

[RVDH:] Six months ago.

[G&K:] And what was the share price valuation at that time?

[RVDH:] Three something, $3 and some cents.

[G&K:] And how many shares are outstanding or issued of E.A.R.T.H.?

[RVDH:] A hundred million.

[G&K:] I just want to know, how many shares do you own of E.A.R.T.H.?

[RVDH:] I personally don’t own any of E.A.R.T.H.

[G&K:] It’s all through –

[RVDH:] That’s correct.

[G&K:] It’s all through – I have to go back.

[Ron Van Den Heuvel:] RVDH[, LLC] or PCDI. I personally don’t own any.

[G&K:] Indirectly through your ownership of those entities, what is your percentage of interest in E.A.R.T.H.?

[RVDH:] I wouldn’t be able to –

[G&K:] You have no sense as –

[RVDH:] No.

[G&K:] – you sit here today?

[Atty. Petitjean:] He’s already indicated he doesn’t own –

[G&K:] He doesn’t own directly, but he has an interest in entities that have a proportionate interest in –

[Atty. Petitjean:] And all those entities, he’s indicated, have numerous shareholders.

[RVDH:] It would be hard to figure out.

[G&K:] But it could be figured out. I mean, you –

[RVDH:] Schenck [S.C.] could do it.

[G&K:] But as you sit here, you don’t know if you have three or other entities. You don’t know if you have one percent or 80 percent of E.A.R.T.H.?

[Ron Van Den Heuvel:] I wouldn’t know. I mean, I know I have more than one percent, okay? But I couldn’t – I couldn’t venture a guess that would be worth putting under oath.

04/03/09 : April 3, 2009 Defendant’s pro se Reply Brief to Plaintiff’s Motion for Summary Judgment, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

04/03/09 : April 3, 2009 Defendant’s pro se Reply Brief to Plaintiff’s Motion for Summary Judgment, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

04/09/09 : FILED – Brown Co. Case No. 2009CV1050, Wisconsin Public Service Corporation v. Ronald H. Van Den Heuvel; Ann Murphy; Patrick Murphy; Chris J. Hartwig; Hilliard Limited Partnership; (Oneida Tribe-owned) Bay Bank; Eco Fibre Inc.; Baylake Bank; Fortress Credit Corp.; SHF XII LLC (Stonehill Financial LLC); Anchorbank FSB; Cordova Ventures; Industrial Technology Ventures LP; Yale Materials Handling Green Bay Inc.; Stockhausen Inc.; Sterling Industrial Sales LLC; Brian A. Everson; Hughes Socol Piers Resnick & Dym Ltd.; State of Wisconsin Dept. of Workforce Development; United States of America; Garnishees: Chase Bank; Spirit Construction Services Inc.; VOS Construction Services Inc.

04/09/09 : FILED – Brown Co. Case No. 2009CV1050, Wisconsin Public Service Corporation v. Ronald H. Van Den Heuvel; Ann Murphy; Patrick Murphy; Chris J. Hartwig; Hilliard Limited Partnership; (Oneida Tribe-owned) Bay Bank; Eco Fibre Inc.; Baylake Bank; Fortress Credit Corp.; SHF XII LLC (Stonehill Financial LLC); Anchorbank FSB; Cordova Ventures; Industrial Technology Ventures LP; Yale Materials Handling Green Bay Inc.; Stockhausen Inc.; Sterling Industrial Sales LLC; Brian A. Everson; Hughes Socol Piers Resnick & Dym Ltd.; State of Wisconsin Dept. of Workforce Development; United States of America; Garnishees: Chase Bank; Spirit Construction Services Inc.; VOS Construction Services Inc.

- 08/16/11 DEFAULT JUDGEMENT FOR MONEY:

• DEBTOR RON VAN DEN HEUVEL: $341,541.00

• DEBTOR ECO FIBRE, INC.: $368,734.49

04/10/09 : April 10, 2009 Letter from Atty. Ross Nova [G&K for Hilliard LP] to Judge Bischel, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

04/15/09 : Tak Investments, LLC filed Articles of Dissolution w/ WDFI; Started on 02/27/02

04/15/09 : Tak Investments, LLC filed Articles of Dissolution w/ WDFI; Started on 02/27/02

According to LinkedIn, Ron Van Den Heuvel’s sister – owner of Murphy Development, Inc. – Ann M. Murphy became a Consultant to Tak Investments, LLC, where her profile says that she:

Assists the owner [Sharad Tak] in decisions regarding investments.

04/16/09 : April 16, 2009 Decision of Judge Sue Bischel, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

ANALYSIS

It is difficult to precisely ascertain the nature of Mr. Van Den Heuvel’s defense. He appears to assert there is a material question of fact regarding another agreement between the parties. Mr. Van Den Heuvel appears to claim that there was an oral agreement between the parties that the plaintiff would not enfoce the note until some type of closing occurred regarding another business (Eco Fibre, Inc.). But this information is contained in Mr. Van Den Heuvel’s response brief. He has submitted no Affidavits or supporting documents in that regard.

It is a “well established principle” that parties against whom a properly supported motion for summary judgment is made may not rest upon mere allegations, but must, by affidavits or other statuatory means, set forth specific facts showing that there exists a genuine issue requiring a trial. … If the adverse party does not so respond, summary judgment, if appropriate, shall be entered against such party. … Thus, as the factual allegations are not properly supported, I must ignore them.

…I am satisfied that the complete failure to submit Affidavits or other supporting documents requires me to grant the Plaintiff’s Summary Judgment Motion.

CONCLUSION

For the foregoing reasons, the Plaintiffs’ Motion for Summary Judgment against defendant, Ronald Van Den Heuvel, is hereby granted.

- April 16, 2009 Letter from Judge Bischel to Atty. Nova & Mr. Van Den Heuvel re: Decision & Order, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

04/23/09 : April 23, 2009 Order for Judgment and Judgment by Judge Sue E. Bischel, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

05/11/09 : May 11, 2009 Letter from Godfrey & Kahn to Brown Co. Clerk of Courts, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

05/11/09 : May 11, 2009 Letter from Godfrey & Kahn to Brown Co. Clerk of Courts, Brown Co. Case No. 08CV2265, Hilliard Limited Partnership v. Ron Van Den Heuvel & Evergreen Development, LLC

Enclosed please find twenty-five (25) original Garnishment Summons and Complaints for Non-Earnings against Ronald Van Den Heuvel, along with four copies of each Garnishment, in the above referenced matter.

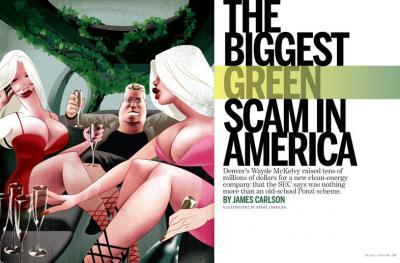

SPRING 2009 : According to 5280 Magazine [Denver, COLORADO]

‘The Biggest

in America’

by James Carlson

Denver’s Wayde McKelvy raised tens of millions of dollars for a new, clean-energy company that the SEC says was nothing more than an old-school Ponzi scheme

re: MANTRIA CORP. / ETERNAGREEN GLOBAL CORP. / BIOCHAR / PYROLYSIS PONZI SCHEME that was PRAISED BY BILL & HILLARY CLINTON and AL GORE

The spring day had been a warm one, but as Taylor Romero walked from his Centennial office across the parking lot to the Embassy Suites, the sun was setting and the air chilled. His employer, Wayde McKelvy, had been holed up in a room at the hotel for days. Romero knew this likely meant one thing—well, two things: booze and hookers. For as long as Romero had known McKelvy the guy exhibited hedonistic, self-destructive tendencies. Lately, though, he’d been on a Charlie Sheen–like tear. The 46-year-old McKelvy had taken to showing up at work drunk, holding the waist of whichever working girl he’d flown in. He was so blatant that even his wife, the mother of their twin girls, knew about it all. By then, late spring 2009, Donna McKelvy had grown accustomed to her husband and his prostitutes. What she could not abide, however, was the whore du jour banging up the Mercedes-Benz. She’d asked Romero to go to the Embassy and get the keys.

Romero took the elevator up and knocked. The way he remembered it, the door opened, and there, standing on a floor littered with empty Bud Light bottles, was McKelvy. The two men were not merely colleagues, they were friends. They plopped onto a couch, McKelvy dropping his 6-foot-4-inch, 250-pound frame. Romero learned the keys to the Benz were gone. And sure enough, so was the girl. While Romero stuck around, waiting, the two men discussed their dream of making a movie together. It would be dark and atmospheric; McKelvy already picked a tagline: What’s the Definition of Insanity?

Young with long dark hair, Romero is the kind of computer-programmer dude who wears flip-flops to work. He’d built a website for the Mantria Corporation, a new green company for which McKelvy was the lead investment broker and ultimately the sole money engine. This startup, as McKelvy had put it to anyone who’d listen, was a revolutionary investment opportunity. Mantria, so went the pitch to investors, was constructing the country’s first carbon-negative residential community, where energy-efficient housing would be built with sustainable materials, and the whole thing would be powered by alternative energy. As if that weren’t enough, Mantria was also supposedly on the verge of releasing an unprecedented technology that turned garbage into usable materials and produced something called biochar, a charcoal that when used as a fertilizer was carbon-negative. Operating from his hometown of Denver, McKelvy would raise close to $40 million from hundreds of investors, the majority of them from COLORADO.

After a while, a short Latina woman walked into the hotel room holding a bag of groceries and the car keys. Slurring, McKelvy yelled at Romero. Romero yelled back. Something about the family’s car and the prostitute. From a corner of the bottle-strewn room, the prostitute piped up: “Why are you talking about me like I’m not here!” She put down the keys, Romero grabbed them, and he split. Talk about the definition of insanity: “It was classic Wayde under pressure,” Romero says. “The bigger things get, the harder Wayde crashes.”

The crash had only just begun. In November 2009, some six months after that night in the hotel, the Securities and Exchange Commission (SEC) filed a civil lawsuit against McKelvy and his wife, and against the Philadelphia-based owners of Mantria. As far as the SEC was concerned, McKelvy had fleeced his investors out of tens of millions of dollars in a big, green Ponzi scheme.

The crash had only just begun. In November 2009, some six months after that night in the hotel, the Securities and Exchange Commission (SEC) filed a civil lawsuit against McKelvy and his wife, and against the Philadelphia-based owners of Mantria. As far as the SEC was concerned, McKelvy had fleeced his investors out of tens of millions of dollars in a big, green Ponzi scheme.

Multimillion dollar white-collar scams are as American as apple pie. See, most recently, Bernie Madoff, who wormed his way into Wall Street and decimated the portfolios of thousands of investors to the tune of $17 billion. Sentenced to life in prison, Madoff has become the infamous face of financial-market malfeasance nationwide. Coloradans, meanwhile, witnessed their own high-profile grifter. Denver hedge fund manager Sean Mueller ripped off 65 people, including John Elway, for some $71 million. Last December, Mueller was sentenced to 40 years in prison. But whereas Madoff’s and Mueller’s frauds could have occurred anywhere, during almost any era, McKelvy and Mantria’s “business plan” was based on a uniquely contemporary premise, and one that has been especially appealing for Coloradans.

The United States shouldn’t be dependent on foreign oil; the country must create a workforce for the 21st century; the environment must be protected: These are a few of the reasons the federal government has been nudging industry toward green, or clean, energy. The national trend has dovetailed nicely with progressive thinking in Colorado, where conservation and sustainability are rooted in the mountain lifestyle. Former Governor Bill Ritter lured numerous clean-tech companies to Colorado, including the world’s largest wind turbine manufacturer, Vestas. He successfully championed a bill that required the state to produce 30 percent of its electricity from renewable energy, the largest proportion in the Western states.

COLORADO is so synonymous with green power that in February 2009, President Obama chose to announce his $787 billion economic-stimulus package—filled with “clean-energy” provisions—in Denver. The venue the president chose was the Denver Museum of Nature and Science, where the roof is home to a solar-panel field, which was installed by a Boulder-based company, Namasté Solar. Indeed, one would be hard-pressed to imagine a place more perfect than Denver to exemplify the confluence of environmentalism and capitalism (not to mention the venture capitalism of Boulder). Arguably, no one is more primed for green investment opportunities—or susceptible to clean-energy con men—than Coloradans. “If you can show me how to save the world,” as a Denver-area woman who was one of the first Mantria investors puts it, “sign me up.”

Bill Clinton recognizing Troy Wragg, found guilty by the SEC of running a Ponzi scheme in 2011 & pled guilty in 2017 to the Mantria Corporation waste energy Ponzi scheme

It was just after Obama’s Denver appearance that McKelvy and his Philly-based Mantria partner, CEO Troy Wragg, were telling investors that the company was engaged in promising meetings with the president of Ivory Coast; that Mantria was hobnobbing with the Clinton Global Initiative; and that the company was “this close” to selling $240 million worth of its “systems.” To develop their audacious projects Wragg and McKelvy needed cash. Mantria investors, according to the SEC, were offered securities in the form of “promissory notes, stock, limited partnership interests, and so-called profits interest.” These contracts promised extraordinary returns over periods as short as eight months.

The reality, according to the SEC, was that Mantria produced virtually no revenue in its two years of operation. The purported $240 million deal vanished. Mantria’s product sales amounted to unloading one bag of biochar. It went for $97. The facts, so say the feds, show that every dime investors received was funded by new investors—in other words, a classic Ponzi scheme. McKelvy was not an employee or corporate officer of Mantria, but he was a rainmaker, persuading investors to empty their retirement accounts for the promise of 17 to “infinite” percent returns.

Since 2008, securities officials have targeted at least five alleged scams involving clean energy, prompting the Financial Industry Regulatory Authority to release an investor alert stating, “It seems like everybody’s going green these days—even fraudsters.” And according to the state and federal paper trail, Mantria is the biggest green scam to date in the United States: Investors lost some $35 million, more than all of the other green scams combined. In the SEC complaint, McKelvy is akin to the Madoff of green—with a touch of Tony Robbins. And there may be another similarity between McKelvy and Madoff, and, for that matter, the local Mueller crook: McKelvy appears to be another financial fraud halted too late due to regulatory bureaucracy.

Troy Wragg, a working-class kid from Philly turned scrappy entrepreneur, created Mantria in 2005 while in his early 20s. His espoused dream was that Mantria would develop a carbon-negative residential utopia. Big dreams from a relative nobody like Wragg needed capital. For about two years, he was in business with BridgePoint Ventures LLC, a Florida-based real estate management firm. Sometime around 2007, however, BridgePoint ended its partnership with Mantria. “We had a pretty unceremonious parting of ways,” says Edward dePasquale, a BridgePoint vice president. The way dePasquale explains it, Wragg’s Mantria was over-appraising real estate, and BridgePoint decided “that we didn’t want to deal with him in any way, shape, or form.” Fortunately for Wragg, one of BridgePoint’s affiliates, Wayde McKelvy, who ran an LLC called Speed of Wealth, saw an opportunity in Mantria, and that same year the two began working together.

The men complemented each other quite well. Wragg was a fast-talking, youthful city slicker from the East Coast; McKelvy, twice the kid’s age, was a rugged, charismatic Coloradan. He attended South High School, then the University of Northern Colorado, where he played offensive lineman on the football team and majored in business. According to three of McKelvy’s former UNC teammates, he was the champion of the freshman beer “chug-a-lug” contest; he had a “screw loose”; and he wasn’t above eating a handful of worms to get a laugh. Former teammate Don Barlass remembers that McKelvy “definitely enjoyed school, enjoyed football, and enjoyed life. If Wayde was around, you knew you’d be having fun.” None of McKelvy’s old pals would have pegged him as a guy to scam anyone. On Team Mantria, Wragg rattled off numbers and stats, whereas McKelvy talked about big-picture-type stuff, in rousing and sometimes blunt everyman language.

On calls with potential investors in spring 2008, the personalities of the new partnership clearly had found their rhetorical groove. The two men were soliciting funds for Mantria Financial LLC, set up ostensibly to finance purchases in the carbon-negative utopia. According to the pitch, this community, Legacy Ridge, in Dunlap, Tennessee, had everything. Ten miles of streams, 12 miles of bluff lines, a five-star restaurant, and two designer golf courses—all being built with sustainable materials and powered by alternative energy. Any investment, Wragg laid out, would earn 17 percent annually for the next two-and-a-half years, and then an additional half-percent equity stake in the company’s projected profits ($70 million) after another two-and-a-half years. The possibilities were astronomical. A $250,000 buy-in would bear a $456,250 profit.

Enter McKelvy: “What Troy and I know,” he said in his folksy Colorado baritone, “is that if we make you happy with your returns—and that’s our number one priority, by the way—that you will always invest with us and we will have an ongoing business.” No one on that call questioned McKelvy’s compensation package. He was pulling 12.5 percent off the top of every investment he brought in, which is a rate of commission double that of what is typical for a well-compensated financial broker. And although the SEC requires broker-dealers be licensed, McKelvy, along with Wragg, was not.

“For those of you waffling out there,” a caller on the teleconference said, “quit your waffling and get with the program. These guys know what they’re doing 110 percent.” Another caller added: “You can’t get a better education than from Wayde.”

In one of the calls, the former college football player sounded as if he were in a locker room at halftime, throwing down a gut-check challenge to his team: “A lot of things I hear out there. Number one: ‘It’s too good to be true.’ The first thing I say is, ‘Well then shouldn’t you jump in it right now?’ I’m sure you’ve heard that it’s too good to be true to get those kinds of returns in this market. Well folks, those of you who are invested with us know it’s not too good to be true. You get your checks. We keep coming out with better products.”

A stroll through The Venetian hotel and casino in Las Vegas is a walk of luxury. Marble pillars and gold-plated fixtures frame every hallway, painted murals adorn arched ceilings. Every turn seems to lead to the casino where you’re enticed to ooh and aah at the pretty possibilities; never mind the odds—bet big. It was here, at the Venetian, in December 2008, that Mantria investors gathered for what the partners described as a “big, end-of-year boot camp.”

They packed 100 to 200 strong into the ballroom, where projections of the Mantria logo—a large, oddly shaped M—were on every wall, looming over the audience. According to a handful of investors present for the gathering, McKelvy lurked in the back of the room while Wragg stood on stage in the spotlight. Mantria, he began, had undoubtedly delivered to investors unparalleled opportunities. None, however, were better than what he was about to present: What if you could help solve the climate crisis and eliminate the need for landfills? What would that look like for America? What about the world?

Well, after scouring the country, Wragg had discovered just such an opportunity. Mantria, he announced, was partnering with a company to develop technology that would produce biochar. What’s more, the technology would transform waste into usable products. It was a concept tailored for marketers. As Wragg repeated throughout his talk: “Trash into cash.” Romero, the computer programmer McKelvy had hired, noticed McKelvy standing at the back of Wragg’s presentation. To no one in particular, McKelvy repeatedly interjected his own version of the slogan he originally coined. “Sh¡t into cash,” he kept saying. “Sh¡t into cash.” Romero could tell that McKelvy was drunk.

After the presentation, audience members lined up to give video testimonials. “It’s been a mind-blowing experience,” one said. Another exclaimed, “I’m, like, having to take sleeping pills because I can’t sleep at night! Because I am so excited about what they’re talking about in our investment opportunities!”

Romero saw that McKelvy wasn’t as enthused. At dinner that first day, McKelvy appeared with a beer in hand, continuing to drink. Having seen his theatrics at Wragg’s speech, and now drinking into the late afternoon—Romero saw this as a possible sign of trouble. Romero was still in high school when a contact of his stepfather’s introduced him to McKelvy. It was the early 2000s, and McKelvy asked the kid to build a website for his wife’s insurance business. Romero jumped at the chance. Up to about 2003, he was paid well to develop the site. But then Romero watched McKelvy implode—drinking heavily and eventually filing for bankruptcy. Romero remembers McKelvy one day coming to him and saying, “Hey, we’re out of money.” Romero left for San Diego, where he remained until McKelvy wooed him back in 2008. Now, in Vegas, there was something in McKelvy’s demeanor; something of that old Wayde that Romero saw in the new Mantria Wayde.

Romero and other employees rode the strip of bright lights in stretch limos. At a VIP club, they were escorted past long lines into roped-off areas where, as Romero puts it, “top-shelf liquor is flowing like the nearby waterfall. It. Was. Crazy.” To employees like Romero, the party seemed a deserved celebration of the past year’s work and the future’s infinite possibilities. “We were going to save the planet,” Romero says, “and we were having a blast doing it.”

McKelvy didn’t attend the party on the strip. By the last day of the three-day boot camp, he was gone. He didn’t even show for his planned presentations. Outwardly, he had plenty of reasons to party and stick around. He had millions of reasons. He was becoming rich off of the commissions. He was well on his way to making $6 million over two-and-a-half years.

Business at Mantria boomed in the new year, 2009. The company was supposedly working on deals with New York and Colorado; the governments of Congo, West Africa, Liberia, Nigeria, and Ivory Coast; and with corporations like Cowboy Charcoal and John Deere. After standing on stage with Bill and Hillary Clinton in New York that year, Wragg employed what may have been stunningly transparent phrasing when he told investors, “It only adds another aura of credibility to what we’re doing.” McKelvy had already raised another $27 million.

Experts say Mantria’s technology could have achieved something similar to what was reported. But only with years of further tweaking. Hugh McLaughlin, the director of biocarbon research for Alterna BioCarbon in British Columbia, recalls witnessing Wragg tell a renewable energy conference that Mantria’s technology could generate biochar at a rate that would exceed scientific limits. Mantria’s promise, simply put, ridiculously outpaced reality. “Every fact about this thing,” McLaughlin says, “was exaggerated beyond any reasonable technical standards.” Yet only a few weeks after Vegas, during a January webinar with investors, McKelvy and Wragg projected a 53 percent annual return on a buy-in to the carbon-diversion systems.

Whatever melancholy – or was it pangs of conscience? – McKelvy might have been feeling in Vegas, was gone. Never mind the odds—bet big, was essentially what he told his investors: “I want you to go to your [401(k)] administrator tomorrow and ask them what it would take for you to roll out all your money. Don’t worry about anything they tell you. They’re going to try to frighten you. Don’t worry about that because [in] the mega-Webinar on February 10 I’m going to blow your mind.”

The mind-blower, investors learned on a teleconference, was that the U.S. Department of Agriculture was set to offer loan guarantees to Mantria, an FDIC-like endorsement backing investors’ money. A month later, in March 2009, Mantria announced a supposed letter of intent with the state of New York. But there were no deals with the Department of Agriculture and no letters of intent with any state governments.

That was right about the time McKelvy started living life as if he were the star of a Girls Gone Wild video. A source familiar with the McKelvy family says, “As soon as this guy smells money, he gets ready for alcohol and a bacchanalian orgy.” He also seemed to be the unhappiest man on the planet. McKelvy told Romero that he was being asked to raise more money than his original goal. McKelvy wanted investors to get their money back and to be done with this. But, he told Romero, “I’m at the point of no return.”

During this period, McKelvy’s bank account seemed as bipolar as his moods. Between January and September 2009, the account showed nearly $3 million in deposits. That account’s balance at the end of September 2009 was just $1,325.98. As he once said to his investors, “Bottom line is: I love cash flow. I like lifestyle.” There were stays at the Bellagio in Las Vegas, the Beverly Wilshire, and other high-end hotels. One bill alone, for the Wynn Las Vegas Resort, totaled $9,628.22. The VIP treatment at clubs. A BMW. A $7,000-a-month oceanside condo in Miami. It wasn’t just him: Donna McKelvy was routinely making $20,000 withdrawals. Though it was Wayde who doled out the biggest bucks. In one three-day spree in Las Vegas, he spent nearly $25,000 on three pieces of Cartier jewelry, which, Donna has said, wasn’t for her.

McKelvy and Donna met in the late 1980s at a party in Denver, just after graduating college. The two married not long after and had twin girls. Donna went into the insurance business, while he launched a string of business flops.

By the time of the jewelry purchases in summer 2009, his and Donna’s marriage had disintegrated. McKelvy had moved to Miami full-time. There’s a good chance the jewelry was for McKelvy’s new girlfriend, a woman named Angela. Obviously years younger than McKelvy, the woman had platinum-blond hair, fake breasts, and a backside so pronounced that people close to him speculated it was enhanced with implants. McKelvy’s friends whispered that there was something about Angela that was…no one could seem to quite put their finger on it.

Meanwhile, on investor calls, every offering was better than the last, each a galactic chance at wealth—and possibly the final one. In a summer teleconference, what McKelvy called his “heart-to-heart,” he talked about how a new deal netting 55 to 100 percent annualized return was the “biggest, most generous offer we’ve ever made.… You guys are sitting there with Mantria on the cusp of greatness, in my belief,” he said softly, sounding on the verge of tears. “In my heart of hearts, I believe that. We’re on the cusp of greatness here.”