TIMELINE PART 4

12/21/09 : December 21, 2009 Order Denying Defendant’s Motion for Summary Judgment and Granting Defendant’s Alternative Motion to Stay, U.S. District Court for Western District of Washington at Tacoma Case No. C09-5008, ORGANIC ENERGY CONVERSION COMAPNY, a Washington limited liability company v. FLAMBEAU RIVER PAPERS, LLC, a Wisconsin limited liability company; FOUNTAINHEAD ENGINEERING LTD., a Michigan limited liability company

A. The Wisconsin Action

On June 19, 2008, Flambeau, Johnson Timber Corporation and William Johnson (collectively “Wisconsin Plaintiffs”) filed a complaint against Organic Energy Conversion Company (“OECC”) in Price County Circuit Court in Wisconsin. Dkt. 6-2. Johnson Timber is a Wisconsin corporation, and Mr. Johnson is its principal shareholder and chief executive officer. Mr. Johnson, a resident of Wisconsin, is also the CEO of Flambeau, as well as the sole member of Summit Lake Management, LLC, which is the managing member of Flambeau.

According to the complaint, in February 2008, OECC and Flambeau entered into a non-binding memorandum of understanding (“MOU”), which called for Flambeau to make a payment of $600,000 to OECC that was to be used exclusively by OECC for the development and construction of a specified product. Under the MOU, OECC and Flambeau were to successfully test the product no later than April 1, 2008, and the product was to be delivered to Flambeau’s Park Falls, Wisconsin facility no later than May 1, 2008. Flambeau maintains that it paid the initial $600,000 to OECC for production and development of the product.

When it became apparent that OECC could not deliver the product as promised, Mr. Johnson met with individuals purporting to be authorized representatives of OECC in an attempt to find a business solution to the problem. Those discussions led to the signing of a term sheet, which expressed the parties’ desire to explore a joint-venture type relationship relating to the product. Under the term sheet, all equipment and other items necessary for completion of the product would be delivered to the Park Falls facility, and OECC would dispatch an authorized representative to the facility to “ensure the successful manufacture and assembly” of the product. The Wisconsin Plaintiffs maintain that the term sheet is a non-binding document “merely setting forth the good-faith intentions of the parties for the structure of the joint-venture relationship. The term sheet explicitly calls for subsequent agreements to be reached and entered into between OECC and one or more of the [Wisonsin] Plaintiffs, although it does not identify which specific parties are to be participants in the contemplated joint venture.” Id. at 7. The term sheet also calls for a subsequent operating agreement to be entered into as part of the joint venture relationship. The Wisconsin Plaintiffs maintain that the parties have not negotiated or entered into an operating agreement.

Additionally, the term sheet provided that once the operating agreement has been executed and the joint venture established, Mr. Johnson and/or one of the other Wisconsin Plaintiffs was to pay OECC $1 million in ten equal installments. The Wisconsin Plaintiffs maintain that, although no joint venture had been established, Mr. Johnson, “as a gesture of good faith,” caused the first installment to be made to OECC on May 2, 2008.

On May 28, 2008, Mr. Johnson received information from Butch Sadikay, who identified himself as a 50% owner of OECC, “caution[ing] Mr. Johnson from continuing to do business with OECC without further discussion between them.” Id. at 8. Based on this information, as well as a subsequent phone conversation, the Wisconsin Plaintiffs believed that “it [did] not appear … that the individuals who signed the MOU and the term sheet were authorized to do so on behalf of [OECC].” Id.

Flambeau contends that it demanded an accounting of the $600,000 because OECC never completed the product. Flambeau further maintains that OECC has requested an installment payment pursuant to the term sheet, and that OECC characterized the term sheet as a “binding contract.”

In the Wisconsin action, the plaintiffs seek a declaratory judgment that they owe no contractual obligations requiring payment to OECC. The Wisconsin Plaintiffs also seek an accounting for the $600,000 Flambeau allegedly paid to OECC. OECC asserted several affirmative defenses in its answer, including (1) lack of personal jurisdiction, (2) improper jurisdiction and venue because key discussions and agreements took place in Washington where key witnesses still reside, and (3) improper jurisdiction and venue because Flambeau signed a written agreement promising that disputes arising out of the terms of the parties’ relationship could only be commenced in Pierce County, Washington. Id., 14-15.

B. OECC’s Washington Action

On November 10, 2008, OECC filed a complaint against Flambeau and Fountainhead Engineering, Ltd. (“Fountainhead”), in Pierce County Superior Court in Washington. Dkt. 1, 9-13. On January 8, 2009, Defendants Flambeau and Fountainhead removed the Washington action to this Court. Id., 1-5. OECC alleges two causes of action: (1) breach of contract based on Flambeau’s and Fountainhead’s alleged breach of a mutual non-disclosure agreement (“MNDA”), and (2) conversion based on Flambeau’s and Fountainhead’s alleged conversion of OECC’s intellectual or other property. According to this complaint, OECC developed “valuable and confidential technology and process for non-thermal drying of biosolids and biomass.” Id. at 10. This technology and process was the subject of a confidential patent application filed with the United States Patent and Trademark Office on December 12, 2007. OECC agreed to give access to this patent application to Flambeau and Fountainhead for the purpose of furthering a possible business relationship between the parties to develop, manufacture and sell a non-thermal biomass dryer to the timber industry (referred to by the parties as the “Possible Transaction”). To that end, the parties entered into the MNDA, which is dated December 11, 2007. The MNDA provides in part:

Neither Party will use, or permit any of its Representatives to use, any of the other Party’s Confidential Information for any purpose other than in connection with the evaluation of the Possible Transaction, and neither Party will make any such Confidential Information available to any Person for any other 2 purpose whatsoever.

Dkt. 1 at 16.

The MNDA also includes a provision that requires “any legal proceedings arising out of the terms of [the MDNA] … be commenced in the courts located in Pierce County [Washington].” Id. at 21.

OECC alleges that Flambeau and Fountainhead “repudiated the existence of any business relationship with [OECC]” and claimed to have built their own non-thermal biomass dryer with the assistance of Mr. Johnson and Johnson Timber. OECC maintains that Defendants’ biomass dryer wrongfully uses OECC’s confidential information in violation of the MNDA. …

…[I]t is hereby ORDERED as follows:

1. Defendants’ motion for summary judgment (Dkt. 24) is DENIED.

2. Defendants’ motion to temporarily suspend proceedings (Dkt. 25) until after trial in Wisconsin and for a status conference immediately thereafter is GRANTED.

DATED this 21st day of December, 2009.

SEE ALSO:

Philip Bridges

Mr. Bridges has 30 years experience in pyrolysis/gasification applications related to the waste management business. Mr. Bridges is a owner/principal of Ambient Energy, LLC, which assists clients in developing waste stream solutions through pyrolysis/gasification technology.Michael Lindberg

Mr. Lindberg has been in the green industry for 10 years, with the last five at Ambient Energy, LLC. He has an extensive background in business development, financing, risk management, project costing and revenue forecasting.James N. Jory, Jr.

He has been an attorney in private practice, licensed in Washington State, and his areas of specialization included international business, business transactions, securities law, civil litigation and employment law.

![]() 12/29/09 : PC Fibre Technology, LLC registered w/ WDFI; Change of Registered Agent on 10/15/12, and 11/10/14, and 11/10/16 to Reclamation Technology Systems, LLC [RTS; formerly EARTH and Nature’s Choice Tissue, LLC] currently managed by Stephen Smith‘s GlenArbor Partners, LLC]

12/29/09 : PC Fibre Technology, LLC registered w/ WDFI; Change of Registered Agent on 10/15/12, and 11/10/14, and 11/10/16 to Reclamation Technology Systems, LLC [RTS; formerly EARTH and Nature’s Choice Tissue, LLC] currently managed by Stephen Smith‘s GlenArbor Partners, LLC]

Atty. William ‘Bill’ Cornelius

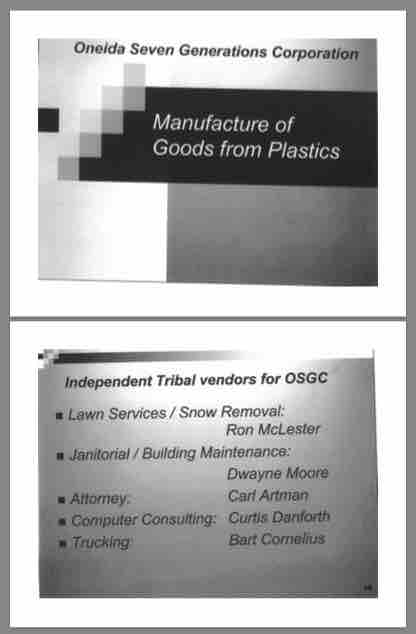

01/04/10 : January 4, 2010 GTC Annual Meeting & Report from OSGC:

The five board members include

William Cornelius, Chairman;

Jim VanStippen;

Mike Metoxen;

and Nathan King.

We currently have one vacant position. …OSGC continues to lease out the property under its control;

OSGC is continuing to work on various energy projects; IEP.

Material changes and developments since the last report in the business described: Badger Sheet Metal.

Any material pending legal proceedings to which the Corporation is a party; OSGC is pursuing legal action against Nature’s Way Tissue Corporation for the investment amount.

OSGC [subsidiary Glory, LLC] is also pursuing legal action against Nature’s Way Tissue Corporation for the back rent.

And; financial statements of the Corporation, including a consolidated balance sheet and consolidated statement of income and source and application of fund. Financial statements submitted under separate cover to Business Committee at the quarterly meeting October 28th, 2009. …

OSGC has partnered with MH Resources Corp. [Marc Hess] to form IEP [Development, LLC] which is currently vetting different renewable energy projects. OSGC secured a Wisconsin state grant that will help fund various projects[.] …

OSGC has executed a Life Settlement contract that will allow OSGC to receive seed money from outside resources beyond the Oneida Tribal budget.

• $1,227,880.01 MONEY JUDGMENT AGAINST TISSUE TECHNOLOGY, LLC on 09/06/13 : Judgment, Brown Co. Case No. 09CV439, Glory LLC v. Ron Van Den Heuvel & Tissue Technology LLC [and dismissed defendants: Partners Concepts Development Inc; Custom Paper Products Inc; Natures Choice Tissue LLC; Purely Cotton Products Corp; Eco Fibre Inc; ReBox Packaging Inc; Tissue Products Technology Corp; Patriot Project Services LLC; Chat LLC; Patriot Investments LLC; Patriot Services Inc; RVDH Inc; Waste Fiber Technology Inc; Recovering Aqua Resources Inc; RV Jet Inc; KYHKJG LLC; Patriot Paper Services Inc; Fibre Solutions LLC; Doc-U-Mince LLC; and dismissed third-party defendants: Ross J. Nova; Godfrey & Kahn.]

01/12/10 : Oneida Recycling Solutions, LLC registered w/ WDFI; Changed Registered Agent on 06/02/12 to Kevin Cornelius; Notice of Administrative Dissolution RETURNED UNDELIVERABLE on 01/18/17

01/12/10 : Oneida Recycling Solutions, LLC registered w/ WDFI; Changed Registered Agent on 06/02/12 to Kevin Cornelius; Notice of Administrative Dissolution RETURNED UNDELIVERABLE on 01/18/17

01/18/10 : Brown Co. Solid Waste Board Meeting Minutes re: OSGC Waste Gasification Initiative

In attendance:

• Marc Hess, IEP Development [Fmr. Chair of Town of Ledgeview, WI]

• Peter King III, Fmr. OSGC Project Manager [current ‘Managing Agent’ as of 2016]

• Peter King III, Fmr. OSGC Project Manager [current ‘Managing Agent’ as of 2016]

• Kevin Cornelius, Fmr. OSGC CEO

![]() • Todd Parczick, Alliance Construction & Design [Alliance GC; P2O Technologies, LLC]

• Todd Parczick, Alliance Construction & Design [Alliance GC; P2O Technologies, LLC]

• Tom Perock, Alliance Construction & Design [Fmr. Chair of Town of Lawrence, WI]

03/03/10 : IEP Services, LLC registered w/ WDFI; Registered Agent was Cory Albrecht, Marketer of of International Energy Partners of Caribou, Maine; IEP Services, LLC was administratively Dissolved on 03/12/13

03/03/10 : IEP Services, LLC registered w/ WDFI; Registered Agent was Cory Albrecht, Marketer of of International Energy Partners of Caribou, Maine; IEP Services, LLC was administratively Dissolved on 03/12/13

03/08/10 : Source of Solutions, LLC restored to Good Standing w/ WDFI; Change of Registered Agent

![]() 03/10/10 : The SEC filed a Motion for Order to Show Cause Why Defendants Troy Wragg & Mantria Corp. Should Not Be Held in Contempt of Court (granted); SEC filed Motion for Appointment of Receiver (granted), SEC v. Mantria Corp., Wragg, Knorr & McKelvy

03/10/10 : The SEC filed a Motion for Order to Show Cause Why Defendants Troy Wragg & Mantria Corp. Should Not Be Held in Contempt of Court (granted); SEC filed Motion for Appointment of Receiver (granted), SEC v. Mantria Corp., Wragg, Knorr & McKelvy

03/16/10 : Oneida Small Business, Inc. administratively Dissolved w/ WDFI

03/17/10 : ST Paper, LLC changed Registered Agent w/ WDFI as a Foreign LLC, and on 03/17/10, and on 03/29/16, and on 03/14/17 to G&K Wisconsin Service, LLC

04/09/10 : Tissue Depot, LLC registered w/ WDFI; Change of Registered Agent on 04/16/12, and 06/29/15 to Ronald H. Van Den Heuvel

- Rar Technology, LLC registered on 4/9/10 w/WDFI; Delinquent on 04/01/12; Change of Registered Agent on 04/16/12; Delinquent on 04/01/14; Change of Registered Agent on 06/29/15, and on 06/30/16, and on 06/27/17, and 03/16/19 to Kelly Yessman Van Den Heuvel, 2303 Lost Dauphin Road, P. O. Box 5515, De Pere, WI 54115

04/14/10 : All Nations Development Alliance, LLC registered w/ Minnesota Secretary of State: Manager: Mark Anthony Sweet; Registered Office: 7241 Ohms Ln. #275, Edina, MN, 55439; Principal Office: 350 N. Main Street, Suite 236, Stillwater, MN, 55082

04/14/10 : All Nations Development Alliance, LLC registered w/ Minnesota Secretary of State: Manager: Mark Anthony Sweet; Registered Office: 7241 Ohms Ln. #275, Edina, MN, 55439; Principal Office: 350 N. Main Street, Suite 236, Stillwater, MN, 55082

• Affiliated with All Nations Energy Alliance, LLC registered w/ WDFI; Registered Agent Mark Anthony Sweet; Principal Office: 2994 E. Service Road, Oneida, WI, 54155

THE EXACT SAME ADDRESS AS FORMER OBC TREASURER & CHAIR CRISTINA DANFORTH’s BUSINESS – WHITE EAGLE BAR & GRILL:

On 05/17/10 White Eagle II, LLC was Registered w/ WDFI, and renamed All Stars Pub & Grill, LLC on 04/03/12.

White Eagle Sports Bar & Grill was temporarily renamed All Stars Pub & Grill, and has reverted back to the name White Eagle Sports Bar & Grill.

04/24/10 : FILED – Complaint, Brown Co. Case. No. 10CV1153, Portfolio Recovery Associates, LLC v. Dan Hawk

04/24/10 : FILED – Complaint, Brown Co. Case. No. 10CV1153, Portfolio Recovery Associates, LLC v. Dan Hawk

• Named Registered Agent of Oneida Small Business, Inc. on 05/24/12 as DAN HAWK

• Named Registered Agent of Oneida Small Business, Inc. on 03/12/15 as DANIEL HAWK

FILED – April 24, 2010 SEC’s Proposed Order for Appointment of Receiver over Mantria Corp., SEC v. Mantria Corp., Wragg, Knorr & McKelvy

FILED – April 24, 2010 SEC’s Proposed Order for Appointment of Receiver over Mantria Corp., SEC v. Mantria Corp., Wragg, Knorr & McKelvy

04/30/10 : The Court appointed a Receiver over Defendant MANTRIA CORP. and its subsidiaries and affiliates, including [ETERNAGREEN GLOBAL CORP. and] SPEED OF WEALTH and its subsidiaries and affiliates, SEC v. Mantria Corp., Wragg, Knorr & McKelvy

05/26/10 : According to the May 26, 2010 OBC Regular Meeting Minutes:

05/26/10 : According to the May 26, 2010 OBC Regular Meeting Minutes:

XII. New Business

7. Oneida Seven Generations Corporation appointment recommendations

Sponsor: Rick Hill

Motion by Melinda Danforth to accept the recommendation of Tsyosha?aht Caterina Delgado to the Oneida Seven Generations, seconded by Ed Delgado.

Motion carried unanimously:Ayes: Melinda Danforth, Ed Delgado, Ron ‘Tehassi’ Hill Jr., Patty Hoeft, Kathy Hughes, Brandon Stevens

Not present: [OBC Treasurer] Tina Danforth [Caterina ‘Cathy’ Danforth’s sister]

Excused: Trish King

Motion by Melinda Danforth to appoint Nathaniel King [ Nathan King / Nate King – ONWI’s Director of Legislative Affairs] to the Oneida Seven Generations Corporation Board, seconded by Patty Hoeft.

Motion carried unanimously:Ayes: Melinda Danforth, Ed Delgado, Ron ‘Tehassi’ Hill Jr., Patty Hoeft, Kathy Hughes, Brandon Stvens

Not present: Tina Danforth

Excused: Trish King …

11. Post for one five-year term for Oneida Seven Generations Corporation due to the resignation of Jim VanStippen

Sponsor: Patty Hoeft

06/12/10 : Oneida Business Committee adopted OBC Resolution 06-23-10-B, ‘Department of the Interior / Bureau of Indian Affairs / Energy and Mineral Development Program / Office of Indian Energy and Economic Development Grant Program / Office of Indian Energy and Economic Development Grant Program to Assess, Evaluate and Promote Development of Tribal Energy and Mineral Resources FY2010’ re: BIOMASS ENERGY PROJECT

06/12/10 : Oneida Business Committee adopted OBC Resolution 06-23-10-B, ‘Department of the Interior / Bureau of Indian Affairs / Energy and Mineral Development Program / Office of Indian Energy and Economic Development Grant Program / Office of Indian Energy and Economic Development Grant Program to Assess, Evaluate and Promote Development of Tribal Energy and Mineral Resources FY2010’ re: BIOMASS ENERGY PROJECT

NOW THEREFORE IT IS FINALLY RESOLVED THAT, should the above proposal be awarded for the Oneida Biomass Energy Project, the Oneida Tribal administration is authorized to execute all agreements and perform all functions necessary for the completion of the project in accordance with Oneida Tribal administrative practice and applicable federal regulations.

06/22/10 : Oneida Energy, Inc. registered w/ WDFI; Restored to Good Standing on 07/01/14; Changes of Registered Agent on 07/21/15, and on 12/01/15 to OSGC Managing Agent Pete King III / King Solutions, LLC; Filed Notice of Dissolution on 04/12/17

06/22/10 : Oneida Energy, Inc. registered w/ WDFI; Restored to Good Standing on 07/01/14; Changes of Registered Agent on 07/21/15, and on 12/01/15 to OSGC Managing Agent Pete King III / King Solutions, LLC; Filed Notice of Dissolution on 04/12/17

06/24/10 : Oneida Recycling Solutions receives a WDNR air permit for 3400 Bay Ridge Court, Hobart, WI 54155 for NAICS 562920, Materials Recovery Facilities and SIC 4953 Refuse Systems. Kevin Cornelius listed as “Responsible Corporate Official” and Mark Verhaagh [of Alliance GC & P2O Technologies, LLC] as the “Facility Air Management/Air Permit Contact”

06/24/10 : Oneida Recycling Solutions receives a WDNR air permit for 3400 Bay Ridge Court, Hobart, WI 54155 for NAICS 562920, Materials Recovery Facilities and SIC 4953 Refuse Systems. Kevin Cornelius listed as “Responsible Corporate Official” and Mark Verhaagh [of Alliance GC & P2O Technologies, LLC] as the “Facility Air Management/Air Permit Contact”

07/05/10 : July 5, 2010 GTC Semi-Annual Meeting Packet Report from Oneida Seven Generations Corp. OSGC:

07/05/10 : July 5, 2010 GTC Semi-Annual Meeting Packet Report from Oneida Seven Generations Corp. OSGC:

The three members of Oneida Seven Generations Corporation Board of Directors include

[President] William Cornelius,

Mike Metoxen

and Nathan King.

We have two vacant board positions which have been posted and the application deadline is past.Per Article XIII – Reports of OSGC’s Corporate Charter we submit the following information:

A) The businss done and intended to be done by the Corporation. …

b. OSGC continues to lease out the property under its control;

i. OSGC is working on energy projects; …

B) Material changes and developments since the last report in the business described: None.

C) Any material pending legal proceedings to which the Corporation is a party;

a. OSGC is pursuing legal action against Nature’s Way Tissue Corporation; per the BC’s instruction

07/20/10 : Oneida Tribe of Indians / Oneida Nation of Wisconsin gave $500 to Friends of Green Bay Mayor Jim Schmitt for a table at Mayor Schmitt’s July 26, 2010 Luncheon

07/26/10 : William C. ‘Bill’ Bain gave $500 contribution to Scott Walker; Employer VOS Electric

![]()

07/26/10 : William C. Bain gave $500 contribution to Scott Walker; Employer VOS Electric

07/26/10 : William C. Bain gave $500 contribution to Scott Walker; Employer VOS Electric

![]()

07/28/10 : NewWay Global Energy, Inc. [NWGE] registered w/ WDFI; later renamed New Way Energy, Inc. on 08/27/15

07/28/10 : NewWay Global Energy, Inc. [NWGE] registered w/ WDFI; later renamed New Way Energy, Inc. on 08/27/15

![]() NWGE is Partners with Alliance Construction & Design / Alliance GC, Oneida-Kodiak, Dae Sung LLC; Registered Agent David J. Wolf of JWR, Inc.

NWGE is Partners with Alliance Construction & Design / Alliance GC, Oneida-Kodiak, Dae Sung LLC; Registered Agent David J. Wolf of JWR, Inc.

[Different company from Wolf Creek Holdings LLC’s New Way Global Energy, LLC registered w/ WDFI on 08/31/15]

See www.NewWayGlobal.net/thenewway/

![]() 08/03/10 : FILED – Brown Co. Case No. 2010CV2154, Ron Van Den Heuvel v. Horicon State Bank & Steven Eatough / Steve Eatau

08/03/10 : FILED – Brown Co. Case No. 2010CV2154, Ron Van Den Heuvel v. Horicon State Bank & Steven Eatough / Steve Eatau

08/05/10 : King Solutions, LLC changed Registered Agent w/ WDFI, and again on 06/08/15, and on 10/30/15 to Peter King III, Fmr. OSGC Project Manager for the dioxin-emitting waste incinerator, and named by the Oneida Business Committee as OSGC’s ‘Managing Agent’ in 2016 following the departure of Gene Keluche / Sagestone Management

ONWI Kalihwisaks newspaper: ‘Biomass project moves due to Village permit conditions’ – OSGC proposed moving its incinerator scheme proposal from the Village of Hobart to the re-zoned Oneida Industrial Park / Water Circle Place / Tower Foods site due to the permit restrictions imposed by the Village of Hobart Board

ONWI Kalihwisaks newspaper: ‘Biomass project moves due to Village permit conditions’ – OSGC proposed moving its incinerator scheme proposal from the Village of Hobart to the re-zoned Oneida Industrial Park / Water Circle Place / Tower Foods site due to the permit restrictions imposed by the Village of Hobart Board

08/08/10 to 09/10/10 : Oneida Tribal member community-wide email exchange about OSGC’s Project between GTC Member Leah Sue Dodge and OBC Member & OBC Liaison to OSGC Brandon Yellowbird Stevens

08/08/10 to 09/10/10 : Oneida Tribal member community-wide email exchange about OSGC’s Project between GTC Member Leah Sue Dodge and OBC Member & OBC Liaison to OSGC Brandon Yellowbird Stevens

Brandon Stevens later falsely claimed to the public at a community discussion meeting in 2013 that the email exchange which dozens of GTC Members had received in 2010 had never taken place.

Brandon Yellowbird Stevens – who’s part-ONWI and part-Three Affiliated Nations [Hidatsa, Mandan & Arikara] – is a habitual liar, in addition to being a felonious burglar … and a habitual criminal.

Thus, Brandon is a perfect pitch man for OSGC’s criminal fraud.

08/14/10 : William C. Bain gave $200 contribution to Scott Walker; Employer VOS Electric

08/14/10 : William C. Bain gave $200 contribution to Scott Walker; Employer VOS Electric

![]()

08/20/10 : FILED – Brown Co. Case No. 2010CV2318, SC Acquisition Company LLC [Mark Bartels of Stellpflug Law SC] v. Ronald H. Van Den Heuvel; Chris J. Hartwig; Hilliard Limited Partnership; [Ron’s sister] Ann Murphy; [Ron’s brother-in-law] Patrick Murphy; Brian A. Everson; [Oneida Tribe-owned] Bay Bank; Custom Paper Products Inc.; Partners Concepts Development Inc.; Eco Fibre Inc.; Nature’s Way Tissue Corp.; Tissue Products Technology Corp.; Oconto Falls Tissue Inc.; Tissue Technology LLC; Anchor Bank FSB; Wisconsin Public Service Corporation; Cordova Ventures; Industrial Technology Ventures LP; Stockhausen Inc.; Sterling Industrial Sales LLC; Yale Materials Handling Green Bay Inc.; ADT Security Services Inc.; State of Wisconsin Dept. of Workforce Development; United States of America; Other: SHF XII LLC [Stonehill Financial LLC]

[NOTE: Atty. Mark Bartels of SC Acquisition Company, LLC, is the ‘Registered Agent’ for One Law Group/Stellpflug Law; Nancy Stellpflug – wife of One Law Group/Stellpflug Law partner C. David Stellpflug who retired in January 2016 – is Secretary of VHC, Inc.]

09/08/10 : FILED – Brown Co. Case No. 2010CV2487, Horicon Bank v. [Kelly Van Den Heuvel’s company] KYHKJG LLC, Chris Hartwig & United States of America Internal Revenue Service

09/08/10 : FILED – Brown Co. Case No. 2010CV2487, Horicon Bank v. [Kelly Van Den Heuvel’s company] KYHKJG LLC, Chris Hartwig & United States of America Internal Revenue Service

- FILED – Brown Co. Case No. 10CV2489, Horicon Bank v. Steven Peters [Partner in Nature’s Way Tissue Corp.]

FILED – Brown Co. Case No. 10CV2490, Horicon Bank v. William C. ‘Bill’ Bain [Vos Electric] & [Sharad Tak’s] Tak Investments, LLP

![]() 09/09/10 : FILED – Brown Co. Case No. 10CV2506, Horicon Bank v. Ron Van Den Heuvel & RVDH Inc.

09/09/10 : FILED – Brown Co. Case No. 10CV2506, Horicon Bank v. Ron Van Den Heuvel & RVDH Inc.

09/13/10 FILED – Brown Co. Case No. 10CV2538, Horicon Bank v. Source of Solutions LLC & Nature’s Choice Tissue, LLC

09/13/10 FILED – Brown Co. Case No. 10CV2538, Horicon Bank v. Source of Solutions LLC & Nature’s Choice Tissue, LLC

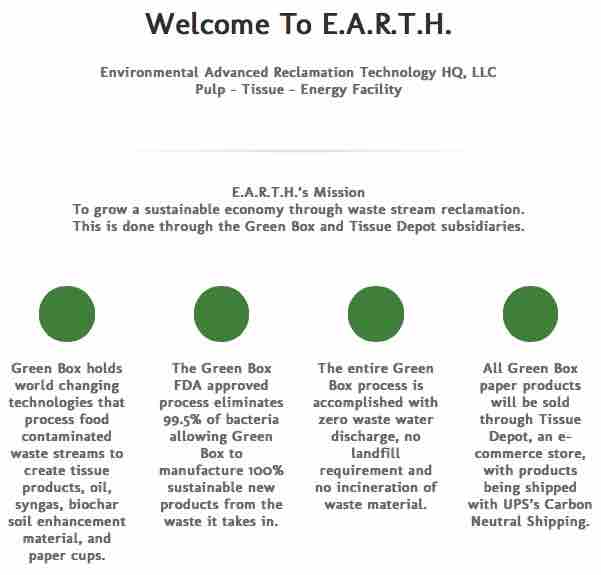

• Nature’s Choice Tissue, LLC was later renamed Environmental Advanced Reclamation Technologies HQ, LLC [using the acronym E.A.R.T.H. / EARTH]

• EARTH was later renamed RECLMATION TECHNOLOGY SYSTEM, LLC [RTS]

09/2010 : According to the April 24, 2012 Complaint for Violations of the Federal Securities Law, Virginia Securities Law, and Virginia Common Law, Jury Trial Demanded; U.S. District Court for the Eastern District of Virginia, Alexandria Division, Case No. 1:12CV451, Frank C. Carlucci III v. Michael S. Han & Envion Inc., regarding a ‘Plastics-to-Oil’ fraud scheme eerily similar to the fraud schemes of Abdul Latif Mahjoob / American Combustion Technologies Inc. / ACTI; Ron Van Den Heuvel / Green Box NA / Reclamation Technology Systems LLC / E.A.R.T.H.; Alliance GC / Alliance Construction & Design / P2O Technologies; Arland Clean Fuels / ACF Leasing / ACF Services / Generation Clean Fuels / Louis Stern / Eric Decator, et al.; and Oneida Seven Generations Corp. / OSGC & subsidiaries Oneida Energy Inc. and Green Bay Renewable Energy LLC:

20. In and around September and October 2010, Mr. Han approached Mr. Carlucci for an additional $20,000,000 investment [on top of the $12,093,000 Carlucci had already invested from March 2004 through April 2010]. In connection with soliciting this additional $20,000,000 investment, Mr. Han made the following representations to Mr. Carlucci in a number of face-to-face meetings at Mr. Carlucci’s residence, which were often arranged via telephone calls and emails to Mr. Carlucci from Mr. Han:

a. Envion had a ‘done deal with Gazprom,’ one of the world’s largest gas companies, pursuant to which Gazprom would invest millions in Envion in exchange for a ‘49% ownership interest in Envion.’ As part of the deal, Mr. Han represented that he would become the chief executive officer of Gazprom’s wholly owned waste disposal subsidiary that would fully utilize the technology;

b. Envion was close to a ‘deal’ with Petrobas, a Brazilian energy company, which was comprised of two parts: (1) an off-take agreement, under which Envion would provide Envion Oil Generators to Petrobas; and (2) a joint venture, under which Petrobas would invest ‘substantial sums of money’ in Envion;

c. Because a sizeable investment from Gazprom was a ‘done deal,’ Mr. Carlucci would get his investment back ‘in three weeks’;

d. Envion had a ‘backlog of 2,000 orders’ for its Envion Oil Generators;

e. The $20,000,000 would be used exclusively for two purposes: (i) for Envion to buy-out Mr. Han’s uncle (Uncle Ma) who was becoming anxious to realize an immediate return on his investment in Envion, and (ii) investment capital in and exclusively for the legitimate business purposes of Envion; and

f. Mr. Han reasserted that Envion had the exclusive patent for the Envion Oil Generator technology.

21. As Mr. Carlucci later came to find out, each of these representations was false and Mr. Han knew, or should have known, they were false at the time they were made.

22. At the same time that Mr. Han solicited Mr. Carlucci’s $20,000,000 investment, Mr. Han reasserted that ‘Envion would be the best return Mr. Carlucci would receive on any investment,‘ possibly up to ’50 times’ the amount Mr. Carlucci had invested. To support this representation, Mr. Han had previously presented Mr. Carlucci with a projection of the return Mr. Carlucci would receive. In connection with Mr. Han’s solicitation of the $20,000,000 investment, Mr. Carlucci asked if the projection was still valid, and Mr. Han responded affirmatively, ‘Yes, it is.’ No cautionary language, qualifications, or conditions accompanied this projection. As it turned out, this was false and misleading in that there was no reasonable basis for such projection.

23. In direct and reasonable reliance on Mr. Han’s representaton set forth in Paragraphs 20 and 22 above, Mr. Carlucci invested the additional $20,000,000 in Envion as evidenced by a convertible promissory note dated October 10, 2010 that acccrued interest at 8% annually and could be converted at any time by Mr. Carlucci into common stock of Envion – equity in the company.

24. Around the same time that Mr. Carlucci made the additional $20,000,000 investment, and without his knowledge, Mr. Han:

a. Closed Envion’s Washington D.C. headquarters and moved the company to West Palm Beach, Florida;

b. Purchased a personal residence in Palm Beach, Florida valued at approximately $3,500,000 and, on information and belief, made substantial and costly renovations to that residence. Further, on information and belief, Mr. Han had claimed a Florida Homestead Exemption over this newly purchased residence;

c. On information and belief, provided himself (Mr. Han) with a $5,000,000 annual salary for his employment with Envion that was not disclosed to Mr. Carlucci.

25. In the summer of 2011, Mr. Carluci’s prior investments in Envion were rolled into one convertible promissory note in the amount of $32,393,000. This convertible note, dated August 4, 2011, accrues interest at 5% annually and could be converted at any time by Mr. Carlucci into common stock of Envion – equity in the company.

10/07/10 : ONWI Kalihwisaks newspaper: Announcement of OSGC signing power purchase agreement with Wisconsin Public Service, Inc. [WPS, former employer of Marc Hess of MH Resources, International Energy Partners of Caribou, Maine & IEP Development], and that OSGC wanted to move the site of the incinerator project from the ONWI Reservation to Ashwaubenon, WI

10/07/10 : ONWI Kalihwisaks newspaper: Announcement of OSGC signing power purchase agreement with Wisconsin Public Service, Inc. [WPS, former employer of Marc Hess of MH Resources, International Energy Partners of Caribou, Maine & IEP Development], and that OSGC wanted to move the site of the incinerator project from the ONWI Reservation to Ashwaubenon, WI

After hearing community concerns about the project’s placement…

October 7, 2010 Letter to Oneida Business Committee from Yvonne Metivier regarding the BIA Loan Guarantee Program Regulations information and email from Phil Viles, Chief of the Division of Capital Investment, Office of Indian Energy & Economic Development, BIA, US Dept. of the Interior, clarifiying that should the loan for the OSGC Waste-to-Energy Pyrolysis Project go into default,

October 7, 2010 Letter to Oneida Business Committee from Yvonne Metivier regarding the BIA Loan Guarantee Program Regulations information and email from Phil Viles, Chief of the Division of Capital Investment, Office of Indian Energy & Economic Development, BIA, US Dept. of the Interior, clarifiying that should the loan for the OSGC Waste-to-Energy Pyrolysis Project go into default,

BIA is subrogated to all rights of the lender under the loan agreement with the borrower, and must pursue collection efforts against the borrower and any co-maker and guarantor, as required by law.

So, if we [the BIA] paid money under our guarantee, we would step into the shoes of the lender and ‘pursue collection efforts against the borrower.’

10/09/10 : Village of Ashwaubenon Public Works Committee meeting. Residents share their concerns with Ashwaubenon for the first time over OSGC’s proposed waste incinerator project.

10/15/10 : William C. Bain gave $500 contribution to Scott Walker; Employer VOS Electric

10/15/10 : William C. Bain gave $500 contribution to Scott Walker; Employer VOS Electric

![]()

According to Ashwaubenon Press, ‘Village Learns of Bio-Mass Plant on Packerland’

[Village President Mike] Aubinger asked if there was another plant somewhere that the Village could look at. [Todd] Parczick said no, this is the first plant of its kind in the United States.

Todd Parczick – Alliance Construction & Design / Alliance GC / P2O Technologies / Oneida-Kodiak Construction

10/27/10 : Questions prepared for Ed Delgado regarding OSGC’s Waste-to-Energy Pyrolysis Project to be asked at an OBC meeting regarding Oneida Energy, Inc. ownership, who will sign for the project loan agreement with Dougherty Mortgage, identities of investors and shareholders, business plan, and full explanation of funding.

10/27/10 : Questions prepared for Ed Delgado regarding OSGC’s Waste-to-Energy Pyrolysis Project to be asked at an OBC meeting regarding Oneida Energy, Inc. ownership, who will sign for the project loan agreement with Dougherty Mortgage, identities of investors and shareholders, business plan, and full explanation of funding.

10/28/10 : ProMaxx Technology, LLC registered w/ Nevada; Richard S. Toby, Manager; Norman Lee, Manager; Guy Kirkwood, Member; Re-registered 03/09/11; Registration expired 04/01/13; ProMaxx brochures & websites take credit for the exact same locations & projects claimed by Abdul Latif Mahjoob’s ACTI / ARTI / AREI / etc.

10/28/10 : ProMaxx Technology, LLC registered w/ Nevada; Richard S. Toby, Manager; Norman Lee, Manager; Guy Kirkwood, Member; Re-registered 03/09/11; Registration expired 04/01/13; ProMaxx brochures & websites take credit for the exact same locations & projects claimed by Abdul Latif Mahjoob’s ACTI / ARTI / AREI / etc.

11/05/10 : November 5, 2010 OSGC / OBC Meeting Agenda Packet; including letters from Wisconsin Department of Commerce; Stephen Manydeeds, BIA; Shannon Loeve, BIA; Roger Knight, BIA; and the Abdul Latif Mahjoob / ACTI ‘White Paper’

11/05/10 : November 5, 2010 OSGC / OBC Meeting Agenda Packet; including letters from Wisconsin Department of Commerce; Stephen Manydeeds, BIA; Shannon Loeve, BIA; Roger Knight, BIA; and the Abdul Latif Mahjoob / ACTI ‘White Paper’

11/10/10 : Northern Investments of WI, LLC administratively Dissolved w/ WDFI; Registered Agent Todd Parczick [Alliance Construction & Design; Alliance GC; P2O Technologies]; Started on 05/18/06

![]() 11/16/10 : Village of Hobart Board Meeting; “Standing room only” crowd is residents’ first opportunity to publicly discuss concerns about OSGC’s proposed waste incinerator.

11/16/10 : Village of Hobart Board Meeting; “Standing room only” crowd is residents’ first opportunity to publicly discuss concerns about OSGC’s proposed waste incinerator.

11/23/10 : Green Box NA, LLC registered w/ WDFI; Change of Registered Agent on 10/15/12, and 11/10/14, and 12/30/16 to Stephen A. Smith [GlenArbor Partners, LLC]

11/23/10 : Green Box NA, LLC registered w/ WDFI; Change of Registered Agent on 10/15/12, and 11/10/14, and 12/30/16 to Stephen A. Smith [GlenArbor Partners, LLC]

- Green Box Int, LLC registered w/ WDFI; Change of Registered Agent on 10/15/12, and 11/10/14, and 12/30/16 to Stephen A. Smith [GlenArbor Partners, LLC]

11/23/10 : Green Box NA, LLC registered w/ WDFI; Change of Registered Agent on 10/15/12, and 11/10/14, and 12/30/16 to Stephen A. Smith [GlenArbor Partners, LLC]

- Green Box Int, LLC registered w/ WDFI; Change of Registered Agent on 10/15/12, and 11/10/14, and 12/30/16 to Stephen A. Smith [GlenArbor Partners, LLC]

From the ‘Our History’ page:

100% Reclamation, 100% Sustainability

The entire Green Box presses reclaims 100% of waste it takes in; furthermore every Green Box facility is 100% sustainable… nothing goes to landfill, water table or atmosphere. The water table is further protected in the community as each Green Box eliminates 175,000 tons per year of organic waste stream to the landfills. Every facility also produces and uses its own energy.At Green Box, sustainability has and always will be top priority. Therefore, corporate social responsibility is an integral part of our corporate culture and is reflected in our day to day activities. For us corporate social responsibility means responsible business practices, something that encompasses ecological, economic and social aspects. The focus areas that make up Corporate Responsibility at Green Box include Sustainability, Social Responsibility, and Internal Operations.

We’re doing our part in creating a circular economy, creating a greener and sustainable future for everyone.

Green Box Environmental Biography

Green Box holds world changing technologies that process food contaminated waste streams to create tissue products, oils, diesel, ethanol, compressed syngas, synthetic fuels, sugars, biochar soil enhancement material, paper cups and electricity.While only a short time ago 100% reclamation of organics and food contaminated waste streams was only a dream, now is a reality. Envision a process with FDA approval that manufactures a napkin with ketchup on it into a new napkin, or used paper cups to new paper cups. Now imagine the same system reclaiming discarded tires into new tire carbon black, steel and pyro oil.

The process eliminates 99.5% of bacteria, odors and germs while achieving 100% sustainable new products from the waste it takes in.

The entire post-consumer process is accomplished with zero waste water discharge, no landfill requirement and no incineration of waste material.Every Green Box location has the reclamation capacity of 740 tons per day of food contaminated waste streams which reduces landfill use by 22.7 million cubic feet PER YEAR, EVERY YEAR!

Green Box Social Profile

• The entire Green Box process reclaims 100% of the waste it takes in; furthermore every Green Box facility is 100% sustainable… nothing goes to landfill, water table or atmosphere.

• The water table is further protected in the community as each Green Box eliminates 175,000 tons or 22.7 million cubic feet per year of organic waste stream to the landfills.

• Green Box eliminates bird and insect transferred plastics from our water ways, rivers, and oceans.

• Every facility produces and uses its own energy and will save over 1,100,000 trees each year of operation.

• The Green Box system eliminates bacteria, germs, poisonous gases, bacteria, and diseases spreading from birds and insects leaving landfills.

• Personal hygiene improves with 100% post-consumer tissue products from food contaminated paper product waste made with FDA approval.

• At Green Box, sustainability has and always will be top priority. Therefore, corporate social responsibility is an integral part of our corporate culture and is reflected in our day to day activities.

• For Green Box corporate social responsibility means responsible personal and business practices, something that the whole world needs and encompasses ecological, economic and social aspects, while acting in the best possible way for future generations.

• The focus areas that make up Corporate Responsibility at Green Box include Sustainability, Social Responsibility, and Environmental Stewardship with all Company Operations.

Meet Our Team

Ron Van Den Heuvel

Chairman, Green Box NA, LLC

Mr. Van Den Heuvel has founded several companies and has developed technology in the tissue products, alternative energy and recycled pulp industry. He brings over 30 years of tissue, alternative energy and recycled pulp manufacturing experience including construction, product development, process optimizations, and technology development. Most recently, Mr. Van Den Heuvel formed the companies Green Box NA, LLC and Green Box, LLC. Green Boxs strengths and point of differentiation in the market place is that it produces the most environmentally friendly recycled pulp for tissue and cup products made with 100% Post Consumer recycled materials. The Green Box Group has received FDA approval to produce 100% Post-Consumer recycled pulpfiber suitable for food contact use of recycled paper cup content up to 40% for hot and cold beverage containers.Daniel Platkowski

Director of Engineering

Daniel Platkowski has over 30 years of experience in the tissue industry. Mr. Platkowski is the President and founder of Pine Ridge Engineering, Inc. Prior to Pine Ridge Engineering, Platkowski worked for Fort Howard Corporation and as a result of the merger, Fort James Corporation for 25 years, where he held th postition of, Senior Vice President of Manufacturing. Platkowski joined Fort Howard in 1974 as a project engineer. In subsequent years, he was promoted to manufacturing positions of increasing responsibility, including Paper Machine Superintendent, Director of Paper Manufacturing and Mill Services, and later Vice President of Manufacturing, Human Resources and Saftey.

Pedro Fernandez / Pete Fernandez [Ron’s brother-in-law via Kelly’s sister Kim Yessman]

VP Sales Marketing

Mr. Pete Fernandez, who is fluent in Spanish, has been Vice President of Sales and Marketing for over 25 years for companies such as Bacardi USA, Cruzan, Ltd. and Incubrand Spirits Group. During his tenure at Bacardi, and Cruzan he was instrumental in creating and running special events throughout the country. His unique and innovative sales and marketing technique allowed him to build relationships in the liquor industry that lasted the duration of his career. With his excellent reputation with all the top distributors around the country, he positioned himself against some of the major liquor companies in the industry, building brands to the point of acquisition.Lee Reisinger

CEO, EARTH

President and founder of ReiTech Inc., a strategic consulting and project management firm. He was Director of Paper Engineering for the Procter & Gamble Company and has over 40 years in the pulp & paper sector. He led P&Gs Bounty paper towel business and commercialized the belt technology that made their business very profitable. He managed the design, construction and startup of a new diapers plant in Japan, a Duncan Hines Cookie plant in the US, and paper machines in Europe and North America. Subsequently, as a principal of a consulting and engineering firm, and then his own firm, he has led process development and strategic studies for several Fortune 200 companies in pulp and paper and has consulted on billion-dollar acquisitions.

Philip J. Reinhart

Director of Human Resources

Mr. Philip J. Reinhart joined Green Box NA in 2007 as Director of Human Resources. Prior to joining Green Box NA, Mr. Reinhart has experience with Sales and Operations, Strategic Planning and Human Resources including 18 years with Foot Locker, Inc. in both US Operations and with the international expansion of Foot Locker worldwide. His last position at Foot Locker was as Managing Director of Foot Locker Canada. Mr. Reinhart has a proven record of grant writing and working with the Economic Development Corporations throughout the United States.David Popejoy

Board Member

Bachelor of Science degrees in Mechanical Engineering and Bio-Engineering with a Minor in the Krannert School of Management, all from Purdue University. He is also a graduate from the Six Sigma and ISO 9000 courses at the University of Tennessee. He has over 25 years of professional experience working for Procter & Gamble Co. and Weyerhaeuser Co. in roles of increasing responsibility in manufacturing, sales, brand management, and general management. He has also been directly involved in private equity placement, restructuring projects, and new business start ups. More recently he started his own consulting company, Summit Peaks Inc., and joined Titan Wood Limited in the role of Executive Vice President-Sales and Marketing.

Simon Ahn

Board Member

Simon Ahn is an attorney and has been managing partner and counsel for the law firm of Ahn & Associates, LLC since 1996. He specializes in commercial real estate development and transactions, business immigration and international business law. Simon has personally negotiated and successfully transacted more than 2000 business and real estate transactions. Simon most recently has been working on next generation green energy technologies and he is the owner and CEO of Green Detroit Regional Center [EB-5 Immigrant Investor Program under USCIS] as well as Managing Partner for all SMS Investment Group, LLCs. He graduated with B.A. from the University of Chicago and attended Hofstra University School of Law with a full three year academic scholarship.Stephen A Smith of GlenArbor Partners, Reclamation Technology Systems LLC, and EcoHub USA LLC

Stephen Smith

Board Member

Stephen Smith is the President and Chief Executive Officer of GlenArbor Partners Inc., an investment advisory firm. Prior to his current role, Mr. Smith co-founded Bryanston Realty Partners LLC in 2004 with two other partners and served as a Principal and its Chief Operating Officer until 2011. Over that period the firm invested in the acquisition of numerous retailers including Mervyns, Albertsons, ShopKo and Marsh Supermarkets. Prior to co-forming Bryanston in 2004, Mr. Smith was a Managing Director of LaSalle Investment Management, a member of LaSalles Global Management and Investment Strategy Committees and an International Director of its parent Jones Lang LaSalle, Inc. (NYSE:JLL). He received an M.B.A. in Finance and Accounting from Northwestern Universitys J.L. Kellogg Graduate School of Management in Evanston, IL and an A.B. in Economics from Brown University in Providence, Rhode Island.

11/24/10 : November 24, 2010 Email from OSGC Board Member Paul Linzmeyer to Yvonne Metivier responding to the news that the OBC would be passing an OBC Resolution to proceed with the Ashwaubenon, Wisconsin location of OSGC’s Waste-to-Energy Pyrolysis project

11/24/10 : November 24, 2010 Email from OSGC Board Member Paul Linzmeyer to Yvonne Metivier responding to the news that the OBC would be passing an OBC Resolution to proceed with the Ashwaubenon, Wisconsin location of OSGC’s Waste-to-Energy Pyrolysis project

The only non-tribal OSGC Board member warned:

The only non-tribal OSGC Board member warned:

I tried,

but they

would not listen

to reason.

This is a

terrible mistake

and it will cost dearly.

12/07/10 : December 7, 2010 Document prepared for Ed Delgado regarding OSGC’s Waste-to-Energy Project noting concerns about loan financing documents and signatures, project logistics, OSGC reporting, and past multi-million dollar losses in Airadigm, Plexus and Nature’s Way Tissue Corp.

12/07/10 : December 7, 2010 Document prepared for Ed Delgado regarding OSGC’s Waste-to-Energy Project noting concerns about loan financing documents and signatures, project logistics, OSGC reporting, and past multi-million dollar losses in Airadigm, Plexus and Nature’s Way Tissue Corp.

12/08/10 : OBC adopted OBC Resolution 12-08-10-B, ‘Supporting Oneida Seven Generations Corp. & Oneida Energy in the Development of the Waste-to-Energy Project’

12/08/10 : OBC adopted OBC Resolution 12-08-10-B, ‘Supporting Oneida Seven Generations Corp. & Oneida Energy in the Development of the Waste-to-Energy Project’

Present: Rick Hill, Chairman, Kathy Hughes, Vice-Chair, Tina Danforth, Treasurer, Patty Hoeft, Secretary, Melinda Danforth, Council Member, Ed Delgado, Council Member, Ron “Tehassi” Hill Jr., Council Member, Trish King, Council Member, Brandon Stevens, Council Member

Others Present: Barb Skenandore, Dorothy Skenandore, Lois Strong, Winnifred L. Thomas, Rich VanBoxtel, Warren Skenandore, Jennifer Hill-Kelley, Carol Elm, Wes Martin, N. Dallas, Barb Dickson, Cheryl Stevens, Geraldine Danforth, Tanya Boucher, Pearl McLester, Tim Ninham, Dale Wheelock, Hugh Danforth

XI. Additions

4. Supporting Oneida Seven Generations and Oneida Energy in the Development of the Waste-to-Energy Project

Sponsor: Rick Hill

Motion by Tina Danforth to adopt resolution 12-08-10-B ‘Supporting Oneida Seven Generations and Oneida Energy in the Department of the Waste-to-Energy Project’ with the change of the last “Whereas, the project goals are consistent with Federal government policy and State of Wisconsin policy to develop viable renewable energy projects that environmentally-safe support local economies and create local jobs; Now therefore be it resolved, the Oneida Business Committee enthusiastically supports this project and will work with Oneida Seven Generations Corporation and Oneida Energy to help them realize the opportunity and to locate the facility on a site that is most desirable,” seconded by Melinda Danforth.

Motion carried with two opposed:

Ayes: Melinda Danforth, Cristina Danforth, Tehassi Ron Hill Jr., Trish King, Brandon Stevens

Opposed: Ed Delgado, Patty Hoeft; Excused: Kathy Hughes

For the record:

Ed Delgado said I am opposing because there are too many unanswered questions. I want to know what we are putting up for collateral. We don’t know and I need to know. I want to be assured that there are enough resources “garbage” to feed that generator because without enough garbage we will not be able to be successful. We have not seen any written agreements.For the record:

Patty Hoeft said I opposed the resolution because the Oneida Tribe’s positive relationship with most all neighboring local govemments and the Tribe’s reputation as a good neighbor and environmental steward have been put at risk by the decision of the Oneida Seven Generations Corporation to construct and operate a waste-to-energy gasification plant on Packerland Drive in the Village of Ashwaubenon. Despite the opposition to locating the project on the Packerland Drive site, there seems still to be support for the Oneida Tribe’s biomass energy project and I do support Oneida Seven Generations constructing and operating a biomass energy project, just not on the Packerland site. Many still hope that Oneida due to its mission to protect the environment will find a way to make alternative energy an option in Northeast Wisconsin that will help solve energy and environmental problems, improve our economy and create new jobs. This is one reason why Oneida can not afford to fail and as one reason why I believe we need to enter into this project in collaboration and cooperation with our neighbors. This project has potential of putting the Oneida Tribe in an environmental leadership role positively impacting the Tribe’s economy and positively helping the greater community in and around the Oneida Reservation.For the record:

Tina Danforth said I support the resolution because I represent Oneida not Hobart and I support alternative energy and tribal sovereignty and that’s for the record.

- Green Bay Press-Gazette: ‘Oneida Biomass Plant Site Opposed By Brown County Executive Tom Hinz’

Hinz’s objections come amid ongoing discussions with the Oneida Seven Generations Corp. that would make the county a provider of waste materials to fuel the plant. He said negotiations broke down in November after [OSGC] was told they would have to answer the County Board’s questions regarding the regulation, operation and location of the facility.

12/16/10 : OSGC hosts Open House information meeting for Village of Ashwaubenon residents, but picketing and protests by Ashwaubenon/Hobart residents is televised on local TV stations; Biomass Opposition Committee formed; later renamed Incinerator Free Brown County

12/16/10 : OSGC hosts Open House information meeting for Village of Ashwaubenon residents, but picketing and protests by Ashwaubenon/Hobart residents is televised on local TV stations; Biomass Opposition Committee formed; later renamed Incinerator Free Brown County

OSGC Counsel Carl Artman

2011 : Fmr. Asst. Sec. of Indian Affairs Carl J. Artman listed in OSGC’s FY2011 & FY2012 Reports as an ‘Independent Tribal Vendor’ hired as OSGC’s ‘Attorney’

According to the December 22, 2016 Green Box NA Green Bay LLC’s Revised 3rd Amended Disclosure Statement, U.S. Bankruptcy Court, 16-24179-beh, Green Box NA Green Bay LLC:

According to the December 22, 2016 Green Box NA Green Bay LLC’s Revised 3rd Amended Disclosure Statement, U.S. Bankruptcy Court, 16-24179-beh, Green Box NA Green Bay LLC:

After years of lab work, small batch trials and tinkering, [Ron Van Den Heuvel] began the quest to patent the processes which he had developed. Indeed, in 2011, he filed a process patent application, citing 32 separate claims, all related to the aforementioned reclamation of waste which would have been landfilled. He identified 27 municipalities around the country where plants using his process commercially could be built economically.

01/11/11 : January 11, 2001 OBC Regular Meeting Minutes re: Review of Dept. of Energy FONSI findings and Risk/Profit of OSGC Energy Project

01/11/11 : January 11, 2001 OBC Regular Meeting Minutes re: Review of Dept. of Energy FONSI findings and Risk/Profit of OSGC Energy Project

XIII. New Business/Requests …

2. Oneida biomass project assessment request

Sponsor: Vince DelaRosaMotion by Vince DelaRosa to direct the Environmental Health and Safety Division to perform a review of the Department of Energy (DOE) Environmental Assessment Report and the final outcome a Finding of No Significant Impact (FONSI) for the Oneida Seven Generations Corporation (OSGC) : Energy Recovery proposed project in Green Bay, Wisconsin and the two DNR reviews, seconded by Patty Hoeft.

Motion carried with two abstentions:Ayes: Vince DelaRosa, Patty Hoeft, David Jordan, Greg Matson, Paul Ninham, Brandon Stevens

Abstained: Melinda J. Danforth, Tina Danforth

Motion by Vince DelaRosa to direct the Treasurer to have the CFO review the investment and venture benefits for the Tribe’s risk and profit tolerance on the Oneida Seven Generations Corporation (OSGC): Energy Receovery proposed project in Green Bay, Wisconsin, seconded by Patty Hoeft.

Motion carried with three oppositions:Ayes: Vince DelaRosa, Patty Hoeft, David Jordan, Greg Matson, Brandon Stevens

Opposed: Melinda J. Danforth, Tina Danforth, Paul Ninham

02/03/11 : MH Resources Corp. changed Registered Agent w/ WDFI to Marc Hess; Notice of Administrative Dissolution on 01/18/17 RTND UNDELIVERABLE, and on 03/29/17

02/03/11 : MH Resources Corp. changed Registered Agent w/ WDFI to Marc Hess; Notice of Administrative Dissolution on 01/18/17 RTND UNDELIVERABLE, and on 03/29/17

Marc Hess was a consultant for OSGC / OEI / GBRE ‘energy’ schemes via IEP Development, LLC, which is affiliated w/ International Energy Partners of Caribou, Maine of which Hess was a Member; IEP Consulting Services; IEP Services; and IEP Ltd.

Marc Hess is also a Fmr. Chair of the Town of Ledgeview, WI.

02/15/11 : According to the November 16, 2016 Cliffton Equities, Inc.’s Objection to Debtor Green Box NA Green Bay LLC’s 1st Amended Disclosure Statement, filed by Atty. Brittany S. Ogden, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay LLC

02/15/11 : According to the November 16, 2016 Cliffton Equities, Inc.’s Objection to Debtor Green Box NA Green Bay LLC’s 1st Amended Disclosure Statement, filed by Atty. Brittany S. Ogden, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay LLC

First, the Debtor states that it has a pending patent, serial number 13/385,218 which was filed in February 2011. This appears to be the application for which [Ron Van Den Heuvel] had applied. …

However, the Debtor cannot have intellectual property rights in an application; only a granted patent vests such rights. Indeed, the Amended Disclosure Statement conjectures that “it is expected that the final process patent will be issued sometime in 2017.” …

Thus, the Debtor does not actually have any intellectual property rights and it cannot assert any corresponding value to the estate, as there is no value in an application for a patent.

Second, this particular application appears to have been rejected several times. There is no specific information listed in the Debtor’s bankruptcy about which steps it has taken to renew its application in this patent and why this time it is likely to be granted a patent. The Debtor also lists Patent Number 6,174,412 B1, which refers to processes related to tissue manufacturing and the conversion of cotton.

The Debtor’s information related to alleged intellectual property rights is insufficient and paints a thoroughly incomplete picture about the Debtor’s intellectual property.

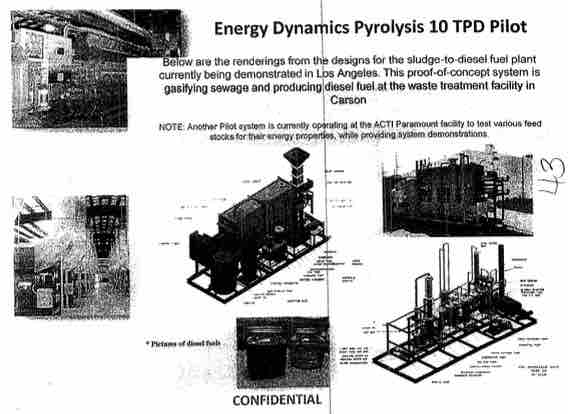

According to the March 20, 2013 Amended Complaint and Jury Trial Demand, Brown Co. Case No, 13CV463, Marco Araujo, M.D. v. Ronald Van Den Heuvel and Green Box N.A.; with Exhibit B – Confidential Brochure: ‘Green Box NA, LLC: Sound Path to biomass’s most efficient technologies’ which cites ACTI operating in Los Angeles [County]; Carson, CA; and Paramount, CA

According to the March 20, 2013 Amended Complaint and Jury Trial Demand, Brown Co. Case No, 13CV463, Marco Araujo, M.D. v. Ronald Van Den Heuvel and Green Box N.A.; with Exhibit B – Confidential Brochure: ‘Green Box NA, LLC: Sound Path to biomass’s most efficient technologies’ which cites ACTI operating in Los Angeles [County]; Carson, CA; and Paramount, CA

1. Plaintiff Marco Araujo, M.D. (“Araujo”) is an adult citizen of the United States of America … and is a licensed physician engaged in the practice of medicine in Brown County, Wisconsin.

2. Defendant, Ronald H. Van Den Heuvel (“Van Den Heuvel”), is an adult … who holds himself out as a businessman and entrepreneur.

3. Defendant Green Box NA Green Bay, LLC (“Green Box”), is a Wisconsin limited liability company having its principal offices located at 2077-B Lawrence Drive, De Pere, Wisconsin 54115 which claims to be engaged in the business of manufacturing.

4. In mid-February 2011, Van Den Heuvel began soliciting Araujo to invest in Green Box which was represented by Van Den Heuvel to be an existing manufacturing facility that had a reclamation process for organic solid waste which waste stream was remanufactured into commercially marketable products without any wastewater discharege, and without any waste material going to landfill.

5. In mid-February 2011, Van Den Heuvel invited Araujo to a reception at the Perini Building, 3060 South Ridge Road, Green Bay, Wisconsin 54304….

6. Van Den Heuvel gave Araujo a tour of the entire Perini Building, representing that Green Box was already operating inside that building, which was false.

7. Van Den Heuvel represented to Araujo that he needed his investment money to buy the Perini Building, which he was going to purchase in a short sale for around $3 Million.

8. In late February, Araujo and his family had dinner with Van Den Heuvel and his family. At that time, Van Den Heuvel stated that Araujo “will invest directly into Green Box NA Green Bay and he will be a shareholder” like himself.

9. Van Den Heuvel assured Araujo’s wife, in front of Araujo, “Don’t worry, he is my friend. No, he will be protected because I will take care of you and his girls. We will make millions for our girls.” Van Den Heuvel repeated these statements to Araujo several times.

10 . Van Den Heuvel represented to Araujo that Green Box had contracts with McDonalds, Inc. and that it was being paid by a company in Canada [Tim Horton’s] to accept its waste stream. Those representations were false.

![]() 03/07/11 : March 7, 2011 GreenAction for Health & Environmental Justice’s Evaluation of the Oneida Seven Generations Corporation Proposal for a Pyrolysis Gasification facility at the Oneida Nation of Wisconsin

03/07/11 : March 7, 2011 GreenAction for Health & Environmental Justice’s Evaluation of the Oneida Seven Generations Corporation Proposal for a Pyrolysis Gasification facility at the Oneida Nation of Wisconsin

…Emissions Source tests conducted at the Romoland [California] facility in June-July 2005 confirmed that this technology emits dioxin and other toxic air contaminants as well as other pollutants. [The] preliminary evaluation of the test results found some emissions exceeded those from typical garbage incinerators. …

We respectfully urge the Oneida Nation to reconsider this project that would pollute the environment and undermine true renewable energy efforts, and instead pursue safer, truly green and viable economic development projects.

03/09/11 : ProMaxx Technology, LLC re-registered w/ State of Nevada (Las Vegas); Richard S. Toby, Manager; Norman Lee, Manager; Guy Kirkwood, Member; Registration expired 04/01/13; ProMaxx brochures & websites take credit for the exact same locations & projects claimed by Abdul Latif Mahjoob’s ACTI / ARTI / AREI / etc.

03/09/11 : ProMaxx Technology, LLC re-registered w/ State of Nevada (Las Vegas); Richard S. Toby, Manager; Norman Lee, Manager; Guy Kirkwood, Member; Registration expired 04/01/13; ProMaxx brochures & websites take credit for the exact same locations & projects claimed by Abdul Latif Mahjoob’s ACTI / ARTI / AREI / etc.

On March 10, 2011 Incinerator Free Brown County / IFBC hosted a pro-recycling and anti-incineration public forum with Dr. Paul Connett, Ph. D. & Bradley Angel of Greenaction for Health & Environmental Justice

03/11/11 : March 11, 2011 Email from Oneida Law Office Chief Counsel Jo Anne House to OBC Member Ed Delgado and OBC Member & OSGC Liaison Brandon Stevens regarding the OSGC Pyrolysis Project’s BIA loan guarantee and second grant

03/11/11 : March 11, 2011 Email from Oneida Law Office Chief Counsel Jo Anne House to OBC Member Ed Delgado and OBC Member & OSGC Liaison Brandon Stevens regarding the OSGC Pyrolysis Project’s BIA loan guarantee and second grant

03/15/11 : March 15, 2011 Email from Ed Delgado to OBC and OBC Chief Counsel Jo Anne House requesting disclosure of the identity and ownership of Broadway Manufacturing, LLC which was listed in the application to the City of Green Bay for OSGC’s Waste-to-Energy (“Biomass”) Pyrolysis Project

03/15/11 : March 15, 2011 Email from Ed Delgado to OBC and OBC Chief Counsel Jo Anne House requesting disclosure of the identity and ownership of Broadway Manufacturing, LLC which was listed in the application to the City of Green Bay for OSGC’s Waste-to-Energy (“Biomass”) Pyrolysis Project

From: [Then-OBC Member] Ed Delgado

To: [OBC Member Brandon Stevens]; [OBC Chair Ed Delgado]; [OBC Chief Counsel Jo Anne House]; [Fmr. OBC Vice-Chair Kathy Hughes,] [then-OBC Member Melinda Danforth]; [Fmr. OBC Sec. Patty Ninham-Hoeft]; [Fmr. OBC Chair Rick Hill]; [Fmr. OBC Treas./Chair Cristina Delgado / Tina Danforth]; [OBC Member Patricia Farmer / Trish King]

Date: Tue, March 15, 2011 2:53:54 PM

CC: [Elaine Reed Doxtator]; [Yvonne Clark-Metivier]

Dear OBC,

Previously, I have expressed my concern that, according to the application to the City of Green Bay in regards to the Biomass project, an LLC by the name of Broadway Manufacturing LLC has recently been established as of January 13, 2011 (2 months ago).

As I have stated above, I have previously expressed my concern regarding who is and who owns this newly formed entity that will “develop, build and operate” the Biomass project, according to the documentation submitted to the Green Bay City Council.

In November of 2008, the General Tribal Council passed [GTC] Resolution 11-15-18-C. That Resolution, under the 3rd Resolve, directs that … “no agent of Tribe shall enter into any agreement with any corporation that prohibits full disclosure of all transactions (receipts and expenditures and the nature of such funds) and that such agreement is not biding to the Tribe.”

I am again requesting information which complies with the full disclosure requirements under GTC Resolution 11-15-08-C.

Thank you.

- GTC Resolution 11-15-08-A, Non-Confidentiality Information

![]() 03/18/11 : The SEC filed an Unopposed Motion to Stay Determination of Plaintiff’s Motion for Summary Judgment Against Setting Defendants Wragg, Knorr & McKelvy in light of settlement agreements, Civil Action No. 09-cv-02676-CMA-MJW, SEC v. Mantria Corp., Wragg, Knorr & McKelvy

03/18/11 : The SEC filed an Unopposed Motion to Stay Determination of Plaintiff’s Motion for Summary Judgment Against Setting Defendants Wragg, Knorr & McKelvy in light of settlement agreements, Civil Action No. 09-cv-02676-CMA-MJW, SEC v. Mantria Corp., Wragg, Knorr & McKelvy

03/21/11 : The SEC filed Unopposed Motions for Permanent Injunction & Other Relief as to Defendants Wragg & Knorr, Civil Action No. 09-cv-02676-CMA-MJW, SEC v. Mantria Corp., Wragg, Knorr & McKelvy

- The Court granted the SEC’s 03/18/11 Unopposed Motion to Stay Determination; SEC filed Unopposed Motion for Permanent Injunction and Other Relief as to Defendant Wayde M. McKelvy, SEC v. Mantria Corp., Wragg, Knorr & McKelvy

03/23/11 : OBC adopted OBC Resolution 03-23-11-C Support Energy Project,

03/23/11 : OBC adopted OBC Resolution 03-23-11-C Support Energy Project,

Renewable Energy Topic Area 3 – Development of a Renewable Energy Project for Power Production by Oneida Seven Generation[s Corporation]’ on “Indian Lands identified and committed to the proposed project is a fee simple parcel, identified as 1230 Hurlbut St., Green Bay, WI, 54303 and in the process of purchase by the [Oneida] Seven Generations Corporation

NOTE:

1230 Hurlbut St. is outside the Oneida Nation of Wisconsin’s Reservation boundaries.

03/25/11 : Green Box NA Green Bay, LLC registered w/ WDFI; Restored to Good Standing & changed Registered Agent on 02/04/13, and on 07/7/15, and on 03/31/17 to Stephen A. Smith [GlenArbor Partners, LLC]

![]() 03/29/11 : Court granted SEC’s Unopposed Motions for Permanent Injunction & Other Relief as to Defendants Wragg & Knorr, Civil Action No. 09-CV-02676, SEC v. Mantria Corp., Wragg, Knorr & McKelvy

03/29/11 : Court granted SEC’s Unopposed Motions for Permanent Injunction & Other Relief as to Defendants Wragg & Knorr, Civil Action No. 09-CV-02676, SEC v. Mantria Corp., Wragg, Knorr & McKelvy

03/31/11 : SEC filed Unopposed Motion for Permanent Injunction & Other Relief as to Defendants Wayde M. McKelvy, Civil Action No. 09-CV-02676, SEC v. Mantria Corp., Wragg, Knorr & McKelvy

04/01/11 : SEC filed Reply in support of its Motion for Summary Judgment against Defendant Mantria Corp., Civil Action No. 09-cv-02676 SEC v. Mantria Corp., Wragg, Knorr & McKelvy, which noted Mantria’s failure to respond to the instant Motion, which the SEC asserted amounts to admission of the facts of the Motion, and argued that the Court should grant summary judgment against Mantria as a result

04/05/11 Court granted SEC’s Unopposed Motion for Permanent Injunction and Other Relief as to Defendant Wayde M. McKelvy, Civil Action No. 09-cv-02676-CMA-MJW, SEC v. Mantria Corp., Wragg, Knorr & McKelvy

According to the March 20, 2013 Amended Complaint and Jury Trial Demand, Brown Co. Case No, 13CV463, Marco Araujo, M.D. v. Ronald Van Den Heuvel and Green Box N.A.

According to the March 20, 2013 Amended Complaint and Jury Trial Demand, Brown Co. Case No, 13CV463, Marco Araujo, M.D. v. Ronald Van Den Heuvel and Green Box N.A.

11. In late March 2011, Van Den Heuvel continued to solicit investment by Araujo in Green Box, promising him a mortgage on the Perini Building, and ten percent (10%) guaranteed interest to be paid quarterly, as well as a Uniform Commercial Code (“UCC”) filing on the machinery required to build the Green Box machines necessary to process the organic material.

12. In fact, Van Den Heuvel was unable to purchase the Perini Building, a fact he did not disclose to Araujo.

13. Between mid-March and April 5, 2011, Van Den Heuvel was visiting Araujo at Arajo’s clinic … twice and spoke on the telephone with Araujo several times to discuss what he represented as the operations of Green Box and to answer questions. During these conversations, Van Den Heuvel represented that Green Box was operational and Van Den Heuvel needed Araujo’s money to consolidate all Green Box operations in the Perini Building. Van Den Heuvel directed Araujo to block out time on his calendar for a grand opening ceremony for this purpose in the summer of 2011, but the ceremony never took place.

14. Green Box did not exist until March 25, 2011, at which time it was organized by Van Den Heuvel by filing for LLC status with the Wisconsin Department of Financial Institutions. Van Den Heuvel had a duty to inform Araujo of this, but he did not do so.

15. Van Den Heuvel created written advertising materials which he provided to Araujo as part of his efforts to convince Araujo to invest in Green Box.

16. Van Den Heuvel represented that the written were true, although they contained numerous falsehoods.

17. One brochure provided to Araujo by Van Den Heuvel as part of Van Den Heuvel’s campaign to solicit investment by Araujo in Green Box is titled “The Green Box Manufacturing Facility” and “E.A.R.T.H.’s Greenest Path Forward,” A copy of this document is attached as Exhibit A and referred to below as the “Manufacturing Facility Brochure.” …

65. Even After April 4, 2011, Van Den Heuvel continued to misrepresent the actual lack of operations and prospects of Green Box in an effort to dissuade Araujo from protecting his interests and property.

According to the July 2, 2015 Brown County Sheriff’s Dept. Search Warrants for Ronald Van Den Heuvel / Green Box NA Green Bay, LLC:

b. Your affiant is aware that Ronald H. Van Den Heuvel, doing business as Green Box NA Green Bay, LLC, received a $600,000 [GBNAGB] equity investment from Dr. Marco Araujo or about April 5, 2011, and within days, [RVDH] used the money to pay personal debts. Dr. Araujo received 600,000 membership units in exchange for his $600,000 equity investment.

c. Your affiant found that Ronald H. Van Den Heuvel represented to Dr. Marco Araujo that Araujo would be given a mortgage on the Perini Building, located at 3060 S. Ridge Road, Village of Ashwaubenon, Brown County, Wisconsin, which would, in part, be purchased with Araujo’s investment of $600,000. You[r] affiant is aware that the Perini building was never for sale but was used as a prop to induce Araujo into investing. Araujo stated that Ronald H. Van Den Heuvel, along with his wife, Kelly Lea Yessman Van Den Heuvel, brought Araujo to the Perini Building at 3060 S. Ridge Road. They showed Araujo office space in the second floor of the building where the Van Den Heuvels said conferences would be held and a white board would be utilized. Photographs of the Perini Building are prominently shown in promotional documents for Green Box.

d. According to the statement of Araujo and promotion materials generated by [GBNAGB], your affiant has found that [RVDH] presented [GBNAGB] as a functioning business which produced a product when, in fact, [GBNAGB] was not producing anything prior to Araujo’s investment and in fact, according to the DFI website, [GBNAGB] had been formed on March 26, 2011, just days before Araujo invested on April 5, 2011.

e. Your affiant has found that [RVDH] received Araujo’s wired money transfer into the account of Green Box Detroit LLC on April 5, 2011, based on a wire receipt provided by Marco Araujo. [RVDH] then transferred the $600,000 to his own RVDH Development account and proceeded to make payments for his own personal use; i.e. to [RVDH]’s ex-wife in the amount of $57,777.43 and $19,184.00 toward a Green Bay Packers Stadium box. Other examples of [RVDH]’s personal expenditures using Dr. Marco Araujo’s $600,000 are: $3,900 to pay [RVDH]’s American Express credit card bill; $2,870.85 for payment on [RVDH]’s ex-wife’s house in Savannah, Georgia; $6,409.50 on [RVDH]’s house in a gated community in Florida; $75,000 listed as expenses and loan payment, to name a few. [RVDH] himself provided an itemized list of information about where the $600,000 was spent. The document was used in the civil suit Araujo brought against [RVDH].

![]() 04/07/11 : Source of Solutions, LLC change of Registered Agent to Ron Van Den Heuvel w/ WDFI

04/07/11 : Source of Solutions, LLC change of Registered Agent to Ron Van Den Heuvel w/ WDFI

04/11/11 : APRIL 11, 2011 GTC SPECIAL MEETING re: OSGC’s Waste Incinerator proposal w/ non-Tribal presenters Abdul Latif Mahjoob of American Combustion Technologies, Inc. / American Renewable Energy Inc. / American Renewable Technologies, Inc. / American Renewable Energy Corp. [ACTI/AREI/ARTI/AREC]; Dan Guido & Mark Zimmerman [ERM]; and Shannon Loeve from the BIA, Division of Capital Investment, Office of Indian Energy & Economic Development

04/11/11 : APRIL 11, 2011 GTC SPECIAL MEETING re: OSGC’s Waste Incinerator proposal w/ non-Tribal presenters Abdul Latif Mahjoob of American Combustion Technologies, Inc. / American Renewable Energy Inc. / American Renewable Technologies, Inc. / American Renewable Energy Corp. [ACTI/AREI/ARTI/AREC]; Dan Guido & Mark Zimmerman [ERM]; and Shannon Loeve from the BIA, Division of Capital Investment, Office of Indian Energy & Economic Development

[NOTE: Shannon Loeve / Shannon Ward as of 2016 was re-employed as a Senior Vice-President with the Native American Bank NA having previously left NABNA to work for the BIA]

[NOTE: Shannon Loeve / Shannon Ward as of 2016 was re-employed as a Senior Vice-President with the Native American Bank NA having previously left NABNA to work for the BIA]

AUDIO EXCERPT:

TRANSCRIPT EXCERPTS:

Mike Debraska: I have a couple of questions here. Can everyone please turn to page 55 [of the meeting packet]? If you all go down to that fourth paragraph, where it starts out “the Oneida Business Committee has authorized two types of corporate entities,” jump down to the sixth sentence there. It says “the Oneida Tribe does not currently have laws regarding corporations in place.” Why on God’s green earth are we supporting [OSGC] when you guys don’t even have laws, rules or regulations to govern those people? That’s first, okay. Secondly, look at a couple lines down from there in that paragraph that says…in the second sentence, “however, in the case where the corporation has a small number of shareholders or in the case where the Tribe is the sole shareholder, liability” – LIABILITY – “may pass through the corporation to the Tribe.” You mean we’re responsible for their blunders and their errors? That’s my second point. I got about 20 others in here because I’ve spent about 14 hours going through this thing and picking it apart. On page 58, if you notice, on the bottom there, or, excuse me, go one page back to letter H. It says, “to elect or appoint officers or agents of the corporations and define their duties and set their compensation, provided that such elections or appointments comply with the laws of the Oneida Nation and policies of the corporation….” What laws?! You just told me on the page before you have no laws, rules or regulations governing these people! This is what I mean about conflicting information. Bad, bad news. I can’t make heads or tails of this and every time I’ve asked for information and had requests about Seven Gens, I’ve never gotten anything. I don’t think we should be giving them one more dime.

[Fmr. BC Chair] Rick Hill: Kathy Hughes?

[Fmr. BC Vice-Chair] Kathy Hughes: On the question, I guess the first one, about the Tribe having no corporate laws, that is basically correct. Unlike the State of Wisconsin, they do corporate charters and they have laws guiding their charters, but if you look at their charters, they are really very basic; it doesn’t have much information in them. Whereas, when Oneida grants a corporate charter, most of what you would expect to find in rules and regulations, you will find written out in the charter itself. It defines the makeup of the board. It defines the actions that the board can take, the author, the authority they have. It defines the oversight. GTC directed the Business Committee to refine those reporting requirements because you didn’t feel satisfied with the information that was being provided, or not being provided. That was the direction that was given approximately a year and a half ago. I’ve reported out to the GTC on two different occasions the progress we were making with re-writing those charters, Not just for Seven Gens, but for every one of our corporate charters. The re-writing further defined the reporting requirements. They are to submit a narrative to the GTC and to the Business Committee. They are to submit financial reports to the GTC and to the Business Committee, and they are to submit disclosure information to the Audit Committee. So your request to have more reporting done has been taken care of. We did the modifications to those corporate charters in February of this last year. Now, they haven’t come around to the cycle yet to do that first report to the GTC that will occur in July. We will know then, whether or not there is enough information being shared with the GTC and the membership according to those charters. Mike is correct, there are no tribal laws regulating our corporations, it’s in the charter itself.”

Rick Hill: Judy?