See Oneida Eye’s Documents page – as well as our Media page – for updates.

- November 14, 2016 Action Report draft for General Tribal Council Meetings on:

- VIDEO – August 10, 2016 (Original Meeting)

- VIDEO – October 2, 2016 (1st Reconvened)

- VIDEO – November 14, 2016 (2nd Reconvened)

EXCERPT FROM AUGUST 10, 2016: Motion by Sherrole Benton to rescind the December 15, 2013 action dissolving the Oneida Seven Generations Corporation and restrict the corporation to commercial leasing activities. Seconded by Loretta Metoxen. Motion not voted on; item tabled.

Amendment to the main motion by Allen R. King to approve all of the BC recommendations for Items 4.A.1-4. Chairwoman Tina Danforth ruled this motion out of order.

Amendment to the main motion by Nancy Skenandore that we as GTC want to know who are the leaders; who are the investors; who are the attorneys; who are the stockholders; who are the owners; who are the board members; how are they paid; what do they use for collateral; for this information be provided for the last 10 years; and to be reported at the next meeting. Seconded by Cathy Metoxen. Motion carried by show of hands.

Amendment to the main motion by Dan Hawk to allow Oneida Seven Generations Corporation to continue litigation with the City of Green Bay. Seconded by Sherrole Benton. Motion carried by show of hands.

EXCERPT FROM AUGUST 10, 2016: Motion by Frank Cornelius to table this item. Seconded by Linda Dallas. Motion carried by hand count: 845 support; 395 opposed; 16 abstentions.

EXCERPT FROM OCTOBER 2, 2016: Motion by [Oneida Business Committee Vice-Chair] Melinda J. Danforth to take the motion related to item 4.A.1. from the table. Seconded by Allen King. Motion failed by show of hands.

Therefore, the Amendment “to allow [OSGC] to continue litigation with the City of Green Bay” remained tabled and unadopted by GTC since August 10, 2016, as did the Main Motion to “rescind” GTC’s December 15, 2013 Directive to dissolve OSGC.

Moreover, the Main Motion remained ‘on the Table’ for longer than a quarterly time interval (3 months), thus – in accordance with Robert’s Rules of Order – the Main Motion and all of its Amendments have died.

However, GTC’s December 15, 2013 Directive to fully dissolve OSGC stands.

Despite those facts, here’s this pile o’ reindeer shiz courtesy of OSGC… and Godfrey & Kahn S.C.…

- December 23, 2016 Complaint & Jury Demand, U.S. District Court, Eastern District of Wisconsin, Case#1:16-cv-1700-WCG, Oneida Seven Generations Corporation & Green Bay Renewable Energy, LLC v. City of Green Bay

Compare OSGC & GBRE’s narrative with that of the 2nd Amended Disclosure Statement of OSGC’s and Oneida High School Principal Artley Skenandore’s fraudulent & failed ‘renewable energy’-related Nature’s Way Tissue Corp. scheme partner Ron Van Den Heuvel’s fraudulent & failed Green Box NA Green Bay, LLC, which – just like OSGC and its subsidiary Oneida Energy Inc. – also received funding from Gov. Scott Walker’s Wisconsin Economic Development Corp. / WEDC:

- December 1, 2016 Green Box NA Green Bay LLC’s 2nd Amended Disclosure Statement, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay LLC

The difference?

Unlike OSGC, which hired Godfrey & Kahn to defend OSGC & GBRE’s version of Ron Van Den Heuvel’s & Abdul Latif Mahjoob’s fraudulent incinerator schemes against the City of Green Bay…

Godfrey & Kahn client Dr. Marco Araujo sued OSGC’s ‘renewable energy’ scheme partner Ron Van Den Heuvel’s Green Box NA Green Bay LLC for “numerous misrepresentations attempting to defraud its creditors”…with none other than Gov. Scott Walker’s Wisconsin Economic Development Corporation / WEDC as one of Araujo’s Co-Plaintiffs.

- May 20, 2015 Complaint in Brown Co. Case No. 15CV769, Dr. Marco Araujo, Cliffton Equities Inc. & Wisconsin Economic Development Corp. (WEDC) v. Green Box NA Green Bay LLC

Let that sink in.

Many questions have been raised as to why WEDC ever even funded Ron Van Den Heuvel in the first place:

- July 20, 2015 Green Bay Press-Gazette: WEDC seeks records on De Pere business’ unpaid loans

The Wisconsin Economic Development Corp., Montreal-based Cliffton Equities Inc. and De Pere-area physician Dr. Marco Araujo sued Green Box NA [Green Bay, LLC,] and its president, Ronald Van Den Heuvel, on May 20 seeking repayment of more than $5.7 million in loans. They claim Green Box is near insolvency, worry it cannot cure its many defaults and suspect the company offered the same collateral to multiple financiers.

“Van Den Heuvel’s casual commingling of assets and collateral among his many entities gives rise to a real concern that he will dispose of plaintiff’s collateral improperly or that collateral may not exist,” the plaintiffs’ initial complaint states.

On Monday, Van Den Heuvel’s attorney John Petitjean told Circuit Court Judge Thomas Walsh that Van Den Heuvel cannot provide many documents court-appointed receiver Michael Polsky has requested because Brown County Sheriff’s Office deputies executed a search warrant at Green Box’s De Pere offices and removed five truckloads of documents and computer equipment from Green Box’s offices in the last month.

The newspaper version included the following:

WEDC provided the $1.1 million loan to Green Box NA LLC in 2011 in exchange for a pledge to create 115 jobs by Dec. 31, 2014.

The company stopped making payments in 2013, got the loan terms restructured in 2014 and WEDC declared the company in default in 2, [2015]. …

Brown County court records indicate that SC Acquisitions LLC of Winnetka, Ill., sought repayment of $28.3 million in a 2010 mortgage foreclosure case filed against four Van Den Heuvel companies – EcoFibre Inc., Custom Paper Products Inc., Partners Concepts Development Inc., and Tissue Products Technology Corp.

The company’s struggle to repay existing debt didn’t stop Van Den Heuvel from continuing to pursue loans from WEDC. …

A WEDC statement on Green Box indicates it authorized Green Box’s 2011 loan less than a month after the quasi-public agency was created [by Gov. Scott Walker].

Media reports echoed the questions & concerns of elected Wisconsin officials such as State Assembly Minority Leader Peter Barca & State. Sen. Julie Lassa who were themselves WEDC Board members but couldn’t get answers, with Lassa saying at the September 9, 2015 Joint Legislative Audit Committee meeting:

[WEDC] had invited Green Box as late as [2015] to participate in a ‘trade trip’ to Tanzania, even though that Green Box is being investigated and it might be something like a Ponzi scheme or a check-kiting organization.

- May 20, 2015, Letter by WI State Sen. Julie Lassa and WI State Assembly Minority Leader Peter Barca to U.S. Attorney General Loretta Lynch requesting a federal criminal investigation into Gov. Scott Walker’s Wisconsin Economic Development Corporation (WEDC)’s loan to Building Committee, Inc. (BCI), due to “possible violations of federal law”

- September 9, 2015 Testimony of Wisconsin State Senator Julie Lassa as a WEDC Board member regarding Ron Van Den Heuvel’s Green Box NA ‘Ponzi scheme’ and her request with Rep. Peter Barca for a federal investigation of possible fraud at WEDC

- September 9, 2015 testimony of Wisconsin Representative Peter Barca as WEDC Board member on recent scandals including “possible pay-to-play corruption, …stonewalling board members from receiving key financial information, a failure to prevent and report fraud, and a failure to create economic growth.”

- September 21, 2015 Letter to United States Attorney General Loretta Lynch from 42 Enrolled Members of the Oneida Tribe of Indians of Wisconsin asking the U.S. Department of Justice to investigate possible Fraud against the Oneida Tribe of Indians of Wisconsin by Ron Van Den Heuvel & Green Box NA / Environmental Advanced Reclamation Technology HQ LLC (E.A.R.T.H.); Latif Mahjoob & American Combustion Technologies (of California) Inc. (ACTI); and Oneida Seven Generations Corporation & its subsidiaries, IEP Development LLC, Oneida Energy Inc., and Green Bay Renewable Energy L

- November 6, 2015 Letter from U.S. Senator Tammy Baldwin to U.S. General Attorney Loretta Lynch requesting review of May 20, 2015 Letter by WI Sen. Julie Lassa & WI Rep. Peter Barca, and September 21, 2015 Letter from 42 Enrolled Members of the Oneida Tribe of Indians of Wisconsin asking for U.S. Department of Justice investigations of Wisconsin Economic Development Corporation (WEDC), and how the Oneida Tribe of Indians of Wisconsin became the target of criminal waste gasification scams by WEDC recipients Oneida Seven Generations Corp./Green Bay Renewable Energy, Oneida Energy Inc., and Ron Van Den Heuvel’s Green Box NA Green Bay, and how Artley Skenandore’s Swakweko LLC and Abdul Latif Mahjoob’s American Combustion Technologies Inc./ACTI were involved

- Wisconsin Gazette: 2016 Rewind: Another year, another WEDC scandal

There’s a reason why critics say Gov. Scott Walker’s “job creation” agency is really a corporate welfare agency that gives away millions to political donors without holding them accountable for creating jobs in return for the money. Discoveries of corruption and malfeasance are uncovered at the Wisconsin Economic Development Corporation on a fairly regular basis, and 2016 was no different.

Well, it was different in one respect: Someone who fraudulently took money from WEDC was actually charged with a crime, although it was not for defrauding the state’s taxpayers. Instead, De Pere businessman Ron Van Den Heuvel was indicted for fraudulently borrowing $700,000 from [Horicon] Bank (whose motto is: “the natural choice”). An accomplice in the scam turned state’s evidence in exchange for a reduced sentence.

Van Den Heuvel, a longtime Republican donor, got even luckier with WEDC, which handed him over $1.2 million. Due to his political connections, Van Den Heuvel never underwent a background check. If he had, WEDC, which was headed by Walker at the time, would have learned that he owed millions in legal judgments to banks, business partners, state tax officials and even a jeweler.

Van Den Heuvel’s modus operandi was borrowing money to pay for equipment and operations of seven businesses that he claimed to operate. But the money actually supported a lavish lifestyle that included a luxurious house, a Florida residence, expensive cars, a luxury box at Lambeau Field, a private plane, and a live-in nanny, who told authorities that she was never paid. She also said Kelly Van Den Heuvel ran up large debts on her credit cards. …

That isn’t to say that WEDC did nothing about the scandal. WEDC CEO Mark Hogan enacted a gag order to prevent WEDC board members from talking about its operations.

Following a backlash, Hogan cited feedback from “various board members” in announcing that he would withdraw the order, which would have barred WEDC board members from talking to reporters or sharing information about the agency, which is taxpayer-funded.

Why didn’t WEDC perform better – if any – due diligence or background checks on sketchy ‘green energy’ schemes like those of OSGC & Ron Van Den Heuvel…

…especially given that a basic online search of Wisconsin court cases reveals a multitude of lawsuits involving Ron Van Den Heuvel – including OSGC’s lawsuit against Ron Van Den Heuvel – not to mention the January 7, 2013 WI Tax Appeals Commission Decision and Order in the case of Steven Peters, Ronald Van Den Heuvel and Artley Skenandore vs. WI Dept. of Revenue involving OSGC as Ron’s business partner?

Answer:

You’d have to ask WEDC’s Chief Counsel Hannah Renfro… formerly of Godfrey & Kahn.

Oh, by the way…

- June 11, 2013 ‘Financing Green Energy: Developing Tribal Energy Resources and Economies’ PowerPoint by John Clancy & Brian Pierson of Godfrey & Kahn at the Sandia Resort & Casino Hotel in Albuquerque, New Mexico

Click to view Godfrey & Kahn’s presentation encouraging tribe’s to finance ‘green energy’ schemes like those of Ron Van Den Heuvel’s various Green Box NAs / EcoHub USA / E.A.R.T.H. / RTS, and Oneida Seven Generations Corporation and OSGC subsidiaries Oneida Energy, Inc. and Green Bay Renewable Energy, LLC.

Guess who else was shoveling that stuff to tribes alongside G&K?

9:00 a.m. Round-Table Discussion: Economic and Energy Challenges and Opportunities for Indian Country – Tex G. Hall, Mandan, Hidasta & Arikara, Chairman-Mandan, Hidasta & Arikara Nation; …Ernie Stevens [Jr.], Oneida Nation, Board-Chairman National Indian Gaming Association; …Tina Danforth, Delegate-Native American Finance Officers Association and Treasurer-Oneida Tribe of Indians of Wisconsin…

1:30 p.m. Session 3: Funding Development on Tribal Lands: EB-5 Foreign Investment, New Market Tax Credits, DOE Programs and Equity and Debt Partners…

Here’s excerpts from OSGC Head Cheerleader OBC Chair Cristina Delgado-Danforth’s Report when she was OBC Treasurer about her presentation promoting OSGC’s waste energy scheme at that same June 10–13, 2013 Native American Finance Officers Association / ‘NAFOA Energy Summit’ in Albuquerque, New Mexico; OBC Chair Cristina Danforth is the President of the NAFOA Board as well as a member of the Board of Directors of the Native American Bank NA and the Native American Bancorporation Co. in the State of Colorado:

I was asked to be a speaker at the NAFOA Energy Summit…. The source of my inspiration was the Oneida Seven Generations Corporation Gasification Plant.

Despite our own trials and tribulations with the OSGC project, many of the other Tribes in attendance were eager to learn more. It was a great opportunity to highlight a project OSGC has been working on for some time….

Even though our own Sevens Gens Corporation has been the target of negative press and conversations, they are the only entity connected to our Tribe that thought outside the box and did their best to make something happen that would generate additional revenues for our Tribe. Even though we all do not see the value in their work, they did the best they could with what they had. [OSGC’s] project may not be welcome on our reservation but other Tribes liked the idea and wanted to learn more. It is just unfortunate for us that we were unable to bring this technology to light.

Gee… could there be an ulterior personal financial motive for OBC Chair & Native American Bank NA Board member Cristina Danforth shilling dioxin-emiting incinerators to other tribes, despite the fact that OBC Resolution 11-08-00-B, Dioxin and Other Persistant Organic Pollutants, says the following?

WHEREAS, the ability of our Native community to be protected from the [e]ffects of dioxin poisoning is critical to the future of our tribal nations and all life that sustains us, and…

WHEREAS, tribal communities and families continue to be disproportionately exposed to dioxin and other persistent organic pollutants. Many of our tribal members are more susceptible to these dangerous toxins due to our land-based culture and subsistence practices, and…

WHEREAS, dioxin has been classified as a “known human carcinogen” with the “highest” level of certainty by the International Agency for Research on Cancer, and acknowledged by the World Health Organization that dioxin exposure is linked to severe health effects…

NOW, THERE, BE IT RESOLVED: that the Oneida Tribe of Indians of Wisconsin requests that the United States State Department pursue ending the production and release of Dioxin and other Persistent Organic Pollutants in the United States.

REMEMBER…

The Native American Bank NA makes money when tribes borrow millions from the BIA for boondoggles like Ron Van Den Heuvel’s & OSGC’s ‘renewable energy’ fraud schemes, and the Native American Bank NA Annual Report 2015 says:

2014 … We became a dominant institution in the utilization of BIA loan guarantees, accounting for nearly 30% of all dollars under this type of guarantee in the country.

For the second year in a row we received a Bank Enterprise Award in the amount of $265,496 and a Performance Lending Award from the US Department of Interior, Office of Indian Energy and Economic Development Division of Capital Investment.

Yet, a Report in the 2017 GTC Annual Meeting Packet says the Oneida Nation of Wisconsin has seen a 70% “Decrease of the Equity Value” of its investment in NABNA, and a “Total Return to Nation” of $0…

Tina Danforth with NAFOA Board enjoying themselves in Cuba … doing, uh, ‘economic development research.’

…and OBC Chair Tina Daforth’s is so busy with for her NABNA & NAFOA gigs that she misses ~50% of OBC Meetings, and her frequent absences combined with the incompetence and/or negligence of her staff recently resulted in a loss to the Oneida Nation of Wisconsin of $4+ MILLION for failing to simply respond to an email from the federal government.

Maybe Tina was too busy planning for her ‘work’ trip to Cuba with NAFOA.

REMEMBER ALSO…

Selling ‘renewable enrgy’ fraud schemes to other tribes and getting them to go into big debt with BIA loans was a big part of OSGC’s ‘business model,’ as stated in EXHIBIT B of the November 2009 Legislative Award Agreement in WI Dept. of Commerce Contract #LEG FY10-19812 which states:

[The] 2009 Wisconsin Act 28 authorizes the Department to make an annual grant of $1,000,000.00 in each of the year 2009-11 biennium [for a total of $2 million] to Oneida Seven Generations Corporation from funds encumbered in the appropriation under section 20.143 (kj) in the statutes of previous years but not disbursed for grants to Oneida Small Business Inc. and Project 2000 from the gaming economic diversification grant and loan program. …

[OSGC] is the majority shareholder in IEP Development, LLC, a consulting firm specializing in cooperative energy research & development and advisory due diligence to independent energy projects and economic development. …

In conjunction with joint venture partner AITI [or ACTI? as in American Combustion Technology, Inc..]? or is it another one of Abdul Latif Mahjoob’s many fronts?], IEP can acquire rights to manufacture and assemble the products and has exclusivity to market the waste-to-energy systems to tribal, municipal and county governments throughout the United States. Power purchase agreements will comprise approximately 90% of the revenue stream from the IEP system. …

The company is working with the Bureau of Indian Affairs for project financing. The Oneida Tribe will set aside approximately 50 acres for the project for a value of $1.2 million. OSGC will manage the lease of this property as well as commit $800,000 of value in the way of office staff, office space, administration costs and money.

OSGC’s now defunct subsidiary IEP Development, LLC used the same logo as International Energy Partners, LLC of Caribou, Maine, and one of the original IEP’s members, Marc Hess, owned the recently defunct MH Resources Corp. about which the 2010 GTC Annual Report says:

OSGC has partnered with MH Resources Corp. to form IEP which is currently vetting different renewable energy projects.

Great job with the ‘vetting’ there!

What is OSGC’s and Ron Van Den Heuvel’s fraud scheme partner Abdul Latif Mahjoob’s American Combustion Technologies, Inc. / ACTI up to lately…

other than changing names to American Renewable Energy Inc. / AREI, and American Renewable Technologies, Inc. / ARTI and working with new sketchy fronts like ProMaxx Advanced Fuels and Gander Corporation?

ACTI is being sued… for FRAUD:

- December 5, 2016 Order Granting Plaintiff’s Motion to Compel Defendants Mahjoob et al. to Produce Documents, U.S. District Court, District of Nevada/Las Vegas, Case No. 2:2015CV694, CH2E Nevada LLC v. Abdul Latif Mahjoob & American Combustion Technologies Inc. / ACTI

This action arises out of a business dispute. … Plaintiff purchased specialized equipment from Defendants, which allegedly did not perform as promised. …

Additionally, Defendants did not provide certain documents that Plaintiff asserts they were contractually required to provide. … Plaintiff therefore brought claims for fraudulent inducement, negligent misrepresentation, breach of contract, breach of warranty, and revocation….

The Court agrees with Plaintiff. Plaintiff’s complaint alleges that Defendants provided equipment that, “as designed and manufactured,” cannot “function at the levels promised and warranted by Defendants.” … The information Plaintiff seeks is relevant and necessary to determining whether manufacturing defects exist.

Speaking of ‘defects’ and a lack of ‘due diligence,’ did we forget to mention…?

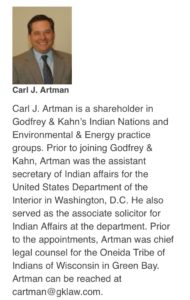

Carl J. Artman, who was also “Vice President co-ordinating legal affairs, corporate development and government relations” of Airadigm Communications Inc. with the Oneida Tribe of Indians of Wisconsin as an investor, was made a “shareholder in [Godfrey & Kahn’s] Indian Nations and Environmental & Energy Policy Groups” just weeks before the Oneida Nation of Wisconsin LOST OVER $95 MILLION on its investment in the wireless carrier:

- October 29, 2008 Decision, U.S. Court of Appeals, Seventh Circuit, Case Nos. 07-3863 & 07-3864, AIRADIGM COMMUNICATIONS INC., Debtor, Airadigm Communications Inc. and Data Systems Inc., Appellants v. Federal Communications Commission, Appellee

Additionally, Carl Artman was also an ‘Independent Tribal Vendor’ as an enrolled ONWI member serving as ‘Attorney’ for Oneida Seven Generations Corp. according to OSGC’s FY2011 & FY2012 Reports regarding the ‘plastics-to-oil’ scheme.

Artman Law, LLC was registered with the WI Dept. of Financial Institutions on June 17, 2013 … five weeks after GTC voted to prohibit OSGC and its subsidiaries from engaging in ‘waste-to-energy’ or ‘plastic-to-oil’ anywhere on the ONW Reservation.

Former Oneida Law Office Chief Counsel Carl Artman was succeeded by his first cousin, current OLO Chief Counsel Jo Anne House, who has demonstrated a similar level of business acumen & ethics.

Let’s put it this way…

…even Fmr. OBC Chair Ed Delgado – who’s no hero by any stretch of the imagination – outright refused to recommend Carl Artman to the OSGC Board after OSGC’s own Attorney applied for an open position, saying “there’s things in his history that I question”:

REMEMBER LASTLY…

Who really makes the most money on these fraudulent ‘renewable energy’ boondoggles – whether by defending Ron Van Den Heuvel’s fraud schemes against the City of Green Bay on behalf of OSGC & GBRE, or by suing OSGC’s partner Ron Van Den Heuvel for defrauding investors?

THE LAWYERS.

Just ask this guy.

For consideration:

- Courthouse News Service: Law Firms Connected to Ponzi Fraud Owe Big Bucks

Heavy-hitting law firms Greenberg Traurig and Quarles & Brady will together pay $77.5 million to settle a class action that accused them of aiding a $900 million Ponzi scheme. …The class said that [the law firms] created “a facade of legitimacy” that allowed the Ponzi scheme to continue.

- Gross & Klein LLP: Federal Court Has Jurisdiction Over Paskenta Band of Nomlaki Indians Lawsuit Against Former Tribal Officials, Senior Employees For Defrauding Tribe of Millions

(CORNING, Calif. – Aug. 14, 2015) A federal judge ruled today that the U.S. District Court, Eastern District of California, has subject matter jurisdiction over a lawsuit filed by the Paskenta Band of Nomlaki Indians under the federal Racketeer Influence and Corruption (RICO) Act and other state and federal laws against former Tribal officials and senior employees accused of defrauding the Tribe of tens of millions of dollars. The court rejected claims by defendants that the Tribe’s lawsuit is an intra-tribal dispute and therefore the Court had no jurisdiction to hear any of the Tribe’s claims.

“We are gratified by the Court’s decision. The Tribe brought this action to hold responsible a group of individuals who, for well over a decade, conspired to steal tens of millions of dollars from the Tribe,” the Paskenta Band of the Nomlaki Indians Tribal Council said in a statement. “That stolen money, much of which the Ringleaders used to pay for a lifestyle of private jet travel, sports cars, and luxury homes, could and should have been used to improve the welfare of the Tribe’s members. The Court’s decision today makes clear that these individuals and others who benefited from their scheme will be held responsible for the harms they caused.”

The Tribe’s co-lead counsel Stuart Gross, of Gross Law P.C., added, “With a single sentence, the Court rejected the argument that this case is an intra-tribal dispute over tribal membership and governance over which the Court lacks jurisdiction. The decision sends a clear message that tribal officials who steal from the tribes they are supposed to serve can and will be held responsible for their actions in federal courts. The defendants misleadingly defended their conspiracy to defraud the Tribe through arguing the federal courts had no power to review actions that violate federal and Tribal law. The opposite is true; and we are pleased the Court rejected defendants’ attempt to avoid liability on this basis.”

Start with the fact that Ron Van Den Heuvel’s fraud schemes have created over $100 Million debt and related tax problems for his estranged family’s company, VHC, Inc. which they’re currently dealing with in U.S. Tax Court:

In its March 2015 petition, VHC said that it owned debt and not equity in relative Ron Van Den Heuvel’s spinoff businesses and that the IRS wrongly increased VHC’s taxable income during the period while disallowing deductions for the debt, which a series of bad deals had rendered illiquid.

Though VHC declined Ron’s solicitations to invest in businesses under his control, VHC began issuing debt in the form of promissory notes to Ron’s acquired companies for equipment and overhead costs.

Shortly before 2000, VHC issued a line of credit to Ron’s cotton fiber plant for the installation of a key machine, thinking the transaction was secured by the fact that United Arab Emirates Investment Ltd. had made an offer on the plant that would have far exceeded the amount of the company’s debt. However, UAEI withdrew from the deal at the last minute after the Sept. 11, 2001, terror attacks, saying the status of a Middle Eastern company in the U.S. had become too risky.

About the same time, Enron, one of the debtor’s key backers, filed for bankruptcy.

VHC gave the company even more money after the two collapses to help it get back on its feet, but a series of bad deals would prevent repayment for years, causing VHC to declare the bad-debt deductions on each year’s tax returns, according to the petition.

Related litigation:

- United States Tax Court Docket No. 2153-15, VHC, Inc. & Subsidiaries, et al v. Commissioner of the Internal Revenue Service

- Oconto County Case No. 2014CV156, Tissue Technology LLC v. ST Paper LLC [represented by Atty. Jonathan Thomas Smies of Godfrey & Kahn]

- Scheduling conference on April 11, 2017 at 8:30 am.

- Brown County Case No. 2016CV1137, Daniel J. Platkowski v. Ron Van Den Heuvel; Howard Bedford; Tissue Technology LLC; Glen Arbor LLC; Quotient Partners [dismissed defendants: GlenArbor Equipment LLC; Reclamation Technology Systems LLC; Stonehill Converting LLC; Horicon Bank]

- Scheduling conference on January 31, 2017 at 8:30 am.

- October 28, 2016 First Amended Complaint, Brown Co. Case No. 16CV1137, Daniel J. Platkowski v. Ron Van Den Heuvel; Howard Bedford; Tissue Technology LLC; Glen Arbor LLC; Quotient Partners [dismissed defendants: GlenArbor Equipment LLC; Reclamation Technology Systems LLC; Stonehill Converting LLC; Horicon Bank]

Consider objections by the U.S. Securities & Exchange Commission and Cliffton Equities, Inc., to Green Box NA Green Bay LLC’s Amended Disclosure Statements & Reorganization Plans:

- December 12, 2016 Objection of the Securities & Exchange Commission to Debtor Green Box NA Green Bay LLC’s Second Amended Plan & Disclosure Statement, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay LLC

Responding to the sweeping injunction proposed by [GBNAGB] has turned into a game of Whack-A-Mole. …

The real motivation behind this Plan is to impermissably restrict the lawful police and regulatory actions of the SEC, not to engage in a legitimate business.

- November 16, 2016 Cliffton Equities, Inc.’s Objection to Debtor Green Box NA Green Bay LLC’s 1st Amended Disclosure Statement, filed by Atty. Brittany S. Ogden, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay LLC

First, the Debtor states that it has a pending patent, serial number 13/385,218 which was filed in February 2011. This appears to be the application for which [Ron Van Den Heuvel] had applied. (See Amended Disclosure Statement), … However, the Debtor cannot have intellectual property rights in an application; only a granted patent vests such rights. Indeed, the Amended Disclosure Statement conjectures that “it is expected that the final process patent will be issued sometime in 2017.” … Thus, the Debtor does not actually have any intellectual property rights and it cannot assert any corresponding value to the estate, as there is no value in an application for a patent.

Second, this particular application appears to have been rejected several times. There is no specific information listed in the Debtor’s bankruptcy about which steps it has taken to renew its application in this patent and why this time it is likely to be granted a patent.

The Debtor also lists Patent Number 6,174,412 B1, which refers to processes related to tissue manufacturing and the conversion of cotton. The Debtor’s information related to alleged intellectual property rights is insufficient and paints a thoroughly incomplete picture about the Debtor’s intellectual property. …

- November 16, 2016 Objection of the United States Securities and Exchange Commission (SEC) to Debtor Green Box NA Green Bay LLC’s Proposed Plan and Disclosure Statement, filed by Senior Bankruptcy Counsel Atty. Angela D. Dodd, SEC Chicago Regional Office, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay LLC

The Debtor’s Plan is no plan at all but a wish, and its greatest wish is that the SEC and other governmental agencies would go away. The Plan purports to discharge the Debtor in contravention of Section 1141(d)(3)(A) and enjoin actions against the Debtor and non-debtors that would impermissibly restrict the SEC from pursuing actions for violations of the federal securities laws. …

I. The SEC is Investigating Whether Ronald Van Den Heuvel or the Green Box-related Entities Violated the Federal Securities Laws.

The SEC is currently investigating whether Ronald Van Den Heuvel, entities he founded or operated, or their officers, directors, owners, or employees, violated the antifraud provisions of the federal securities laws. The Commission is examining, among other things, whether Van Den Heuvel or others, including [Reclamation Technology Systems, LLC] and [GBNAGB], made misrepresentations to investors in the course of securities offerings, and whether money raised through offerings was misused. Part of this inquiry focuses on whether Van Den Heuvel and his companies, including RTS and [GBNAGB], followed corporate formalities, or if they commingled the assets and liabilities of the various entities. …

Van Den Heuvel has been involved in several securities offerings relating to his “Green Box” paper-recycling process since 2012. [GBNAGB] and its parent company, Environmental Advanced Reclamation Technology HQ, LLC (“EARTH,” a/k/a Reclamation Technology Systems, LLC (“RTS”)) [f/k/a Nature’s Choice Tissue, LLC, formed in 2011], appear to be responsible for one set of offerings. In addition, another subsidiary of EARTH, Green Box NA Detroit, LLC (“Green Box Detroit”), appears to have participated in a different offering made to investors participating in the EB-5 immigrant investor program administered by the United States Customs and Immigration Service (“USCIS”). It also appears that EARTH offered several different types of guaranties of the EB-5 investments in Green Box Detroit, including guaranteeing, through Van Den Heuvel, the refund of EB-5 investors’ $500,000 investments should their visa application be denied. In addition, EARTH, through Van Den Heuvel, appears to have represented to EB-5 investors that it had pledged up to $40 million of its assets as security for their investments related to Green Box Detroit. …

- Click for full-color PDF of fraudulent Green Box NA Detroit, LLC, prospectus that Ron & co-conspirators used to entice foreign victims via the Green Detroit Regional Center EB-5 Immigrant Investment Program [takes awhile to download, but so worth it]

IMAGES FROM GREEN BOX NA EB-5 WEB ADS:

RELATED:

- 07/20/2015 Buzzfeed.com: How A Ponzi Scheme Hoodwinked Immigration Authorities – U.S. Visa Program For Wealthy Investors Marred By Fraud; America’s multibillion-dollar immigrant investor program is overseen by an agency that many say is not equipped to smell out financial fraud.

A report released in February by Congress’s U.S.-China Economic and Security Review Commission agreed, singling out EB-5 as especially vulnerable to fraud and laying the blame in part on USCIS. “Given that USCIS is tasked primarily with customs and immigration matters, it is questionable whether this federal agency has the capability to properly oversee the economic dimension of the EB-5 application process at the local level,” the report says.

This is what allowed Luca International Group, a California oil company, to fleece Chinese investors out of $8 million dollars, as the SEC charged this month. The investors thought their money was going toward oil rigs in Texas and Louisiana when in fact, the SEC charged, it was simply being used to prop up a huge Ponzi scheme and fund the lavish lifestyles of the company’s owners. Luca also paid former president George W. Bush $200,000 to speak at a conference designed to encourage Chinese investors to put their money in American oil. …

By the time the SEC began to suspect that Luca was a pyramid scheme, the company had already obtained approval from USCIS to solicit funds and netted $8 million from Chinese investors. The company trumpeted this approval on one of its websites, calling itself “USCIS approved” and boasting that it “can get you a green card with a $500,000 investment.”

To get USCIS approval for projects and so-called regional centers — corporate middlemen set up to facilitate the investments — companies have to submit detailed business plans and documentation attesting to the financial health of the businesses involved. Often, as in Luca’s case, both the regional centers and the projects themselves are set up by the same people. According to the SEC, Luca’s entire operation was a pyramid targeting Chinese and Chinese-American investors, which evidently went unnoticed by USCIS. …

Several people in the EB-5 industry interviewed by BuzzFeed News welcome [reform] proposals, but many are also skeptical that they will fully resolve the program’s structural flaws. Beyond USCIS’s competency, Gibson, the financial advisor, said that most EB-5 listings do not have to be publicly registered, meaning they receive less scrutiny from the SEC than other securities. “So the doorway is open to people who want to misrepresent the safety of their projects, and that invites fraud,” Gibson said. Neena Dutta, a New York immigration attorney specializing in EB-5, also said there is a common practice among lawyers of charging unethical “finder’s fees” from projects seeking investors while also representing the investors themselves.

The result, according to industry insiders, is that the EB-5 program tends to attract people with less-than-honest intentions. As Dutta put it: “There are a lot of shady people in this world.”

That’s on TOP of the federal bank fraud charges against Ron and his wife – Kelly Yessman Van Den Heuvel – for criminal schemes using straw borrowers (including the Van Den Heuvels’ son-in-law, Patrick Hoffman; Ron’s business partner, William C. ‘Bill’ Bain; and even the Van Den Heuvel’s foreign-national nanny/housemaid, Julie Gumban) to defraud banks & credit unions, for which the Van Den Heuvels’ co-conspirator Paul J. Piikkila has already pled guilty:

- November 16, 2016 Wisconsin Economic Development Corporation’s Objection to Debtor Green Box NA Green Bay LLC’s 1st Amended Disclosure Statement, filed by Atty. Brian P. Thill, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay LLC

…[W]hat the 1st Amended [Disclosure Statement] fails to mention is that a Superceding Indictment in the [federal bank fraud] action was filed on September 20, 2016, specifically identifying transactions involving both assets and employees other than Ronald Van Den Heuvel of EARTH [Environmental Advanced Reclamation Technology HQ LLC, now known as Reclamation Technology Systems LLC (RTS), which is Green Box NA Green Bay LLC’s] parent company upon whom the Debtor’s First Amended Chapter 11 Plan is wholly dependent, in Counts 14 through 19.

- September 20, 2016 Superceding Indictment [19 Counts], U.S. District Court, WI Eastern District, Case No. 16-CR-064, UNITED STATES OF AMERICA v. RONALD H. VAN DEN HEUVEL, [his wife] KELLY YESSMAN VAN DEN HEUVEL and PAUL J. PIIKKILA [Horicon Bank Loan Officer and the Interim Controller of the Green Detroit Regional Center EB-5 Immigrant Invesutor Program]

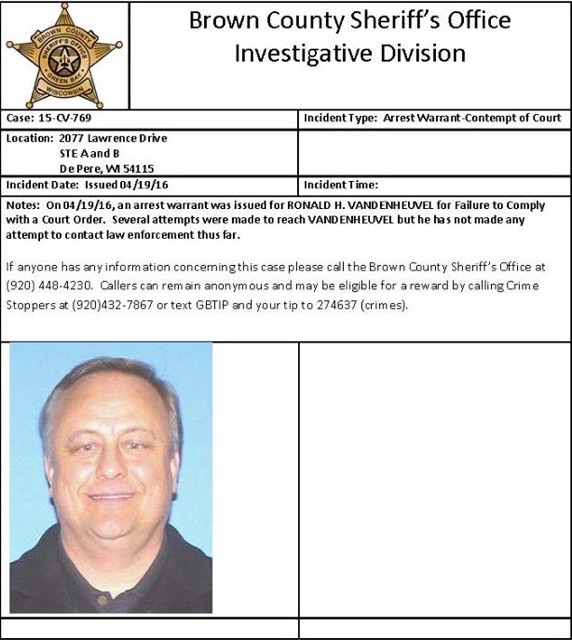

Add in the fact that Ron Van Den Heuvel is still under criminal investigation by the Brown County Sheriff’s Dept. and no less than five federal agencies:

7. As part of the follow up investigation into Araujo’s initial complaint, your affiant became aware that several other individuals and business entities may have also been victimes of fraudulent representations made by Ronald H. Van Den Heuvel as part of a plan to solicit investment into Green Box NA Green Bay, LLC and other related entities. Your affiant became aware, through the review of CCAP and documents provided by Araujo’s attorneys [GODFREY & KAHN], that many other entities had complained about Van Den Heuvel and Green Box NA Green Bay, LLC’s potentially fraudulent activities and that those allegations were set forth as part of another civil lawsuit, Brown County case 15CV474.

8. Through documents and information provided by Araujo and his attorneys, your affiant became aware that the [WEDC], a public/private entity operated in part by the State of Wisconsin, was a potential victim of fraudulent representation made by [RVDH] in order to obtain a loan from the WEDC for approximately $1.3 Million. Your affiant made a request from the WEDC and obtained all of WEDC’s documentation of the loan made to [RVDH] and [GBNAGB].

9. Your affiant is aware, through documents provided by [WEDC] and record and documents contained on a thumb drive provided by Guy LoCascio, a former contract accountant for [GBNAGB] and [RVDH], that [RVDH]…doing business as Green Box NA Green Bay, LLC,…made representations to [WEDC] in order to receive funds from them, and once funds were received, [RVDH] paid personal debts with [WEDC] money.

10. Through your affiant’s investigation thus far, it has been found that [RVDH], doing business as [GBNAGB], did supply fraudulent information in his application for funding from WEDC, based on your affiant’s review of the file provided by WEDC which contained documents and statements, the document provided by Araujo’s attorneys from Brown County cases 13CV463 and 15CV474 and documents contained on the thumb drive provided by Guy LoCascio. …

12. Through your affiant’s investigation, based on Marco Araujo’s statements and documents as part of Brown County cases 13CV463 and 15CV474 civil case, it has been found that [RVDH], doing business as [GBNAGB], made material misrepresentations in the course of soliciting and receiving a [GBNAGB] equity investment from Dr. Marco Araujo.

13. Your affiant met with a citizen witness, Daniel H. Thames…who provided information and a written statement. Your affiant learned from Daniel H. Thames that through the course of his employment with [GBNAGB] he performed various office and accounting tasks. Through his employment at [GBNAGB], Thames observed that [RVDH] would take investors’ money and use the money to pay personal bills. Thames said [RVDH] instructed Thames to list certain expenditures in such a way as to mask the true use of the various payments. Thames witnessed [RVDH] receive foreign investor money through a federal EB-5 program. The invested money would be deposited into an account for a related entity, Green Box NA Detroit LLC.

14. According to information from Thames and other witnesses, similar to [GBNAGB], Green Box NA Detroit, LLC, is represented as an operating entity, but in fact, it does not have any existing production or even any actual physical location in or around Detroit. Thames is aware of the nature of representations being made by [RVDH] to his investors, and specifically is aware that [RVDH] represents that the Green Box facilities are operational, when in fact, there is no operating Green Box facility, nor does the technology behind Green Box’s purported business model function as represented by [RVDH].

15. Thames indicated that once money was deposited into the Green Box NA Detroit account, [RVDH] would order the subsequent disbursement of the foreign investor money into [RVDH]’s personal account from which [RVDH] paid for his ex-wife’s house in Savannah, Georgia. Thames said [RVDH] used foreign investor money to pay for a Green Bay Packers Stadium box. Thames said [RVDH] would get behind in his alimony payments to his ex-wife. He is ordered to by $2,000.00 per week. When threatened with court action, [RVDH] would use EB-5 money to get current with the alimony payments. Thames said he was instructed by [RVDH] to e-mail the lady at the bank, instructing her to transfer funds from the account where the investors’ money had been deposited to accounts other than that of the investors’ intended entity. Thames said [RVDH] would use EB-5 money to pay for insurance for his current wife and children. Thames told me that [RVDH] would write checks out from the business account of Green Box in an employee’s name and ask that employee to go to the bank, cash the check, and bring the cash back to [RVDH]. [RVDH] would use the cash for personal purchases and, for example, a trip to Las Vegas.

16. Thames witnessed [RVDH] give tours to potential investors, and [RVDH] would make statements which are false, including stating the Green Box process is a fully functional process with fully functioning facilities across the USA, when there are none. …

18. Thames said prior to October 2014, membership units in Green Box had no specific value.

19. Thames stated that he saw a year-end financial statement which showed that [RVDH] owes VHC, Inc., and other Van Den Heuvel family-owned businesses approximately $115,000,000. Thames identified people and businesses listed on the [RVDH] presented in civil courts showing how Marco Araujo’s investment of $600,000 was spent. Of the $600,000, at least $280,000 was used for [RVDH]’s personal expenditures. Thames has seen tangible evidence of the aforementioned information on the shared drive of the office computer at 2077 Lawrence Drive, Suites A and B, City of De Pere, Brown County, Wisconsin. …

27. On June 24, 2015, your affiant conducted an internet of Tami Phillips…who provided information verbally, and in the form of a statement. In that statement Phillips indicated that she began working for [RVDH], at E.A.R.T.H. and Green Box, in December 2010. Phillips left for a time but returned in April 2012 and worked in the Green Box offices at 2077 Lawrence Drive, Suites A and B. While working as an accountant for Green Box, Phillips was instructed by [RVDH] to document financial entries on a balance sheet with numbers [RVDH] quoted to her. Phillips said she knew the numbers were not real because there was no actual business or product being produced by Green Box or E.A.R.T.H. at any time. …

29. Your affiant learned, from promotional documents supplied by Marco Araujo, that [RVDH] made claims that the holds seven (7) patents involved in the process of waste reclamation when, in fact, he holds none. The patent application for the reclamation technology and process relative to the Green Box operations, which was made August 16, 2012, is now labeled as abandoned. [RVDH] still makes reference to the patents held by Green Box in his promotional documents distributed to potential investors, both domestic and foreign, but a search conducted by your affiant on the U.S. Patent and Trade Office reveals no patents held by [RVDH] or Green Box for the type of activities allegedly conducted by Green Box companies.

- January 29, 2016 WI State’s Reply to Defendant’s Motion for Return of Property, Brown Co. Case No. 2015CV1614, In the Matter of the Return of Property to Ronald Van Den Heuvel

The affidavits presented by the State demonstrate that Mr. Van Den Heuvel was soliciting investment and loans from others for his various Green Box entities under the guise that these entities were operational. The affidavits demonstrate that Mr. Van Den Heuvel’s Green Box entities were not operational. The affidavits demonstrate multiple material misrepresentations Mr. Van Den Heuvel made to investors and lenders for the purposes of obtaining investments and loans for Green Box. The affidavits demonstrate that once Mr. Van Den Heuvel obtained investments and loans, he converted the proceeds for his own personal use. The affidavits were based upon information obtained from individuals who had been victimized by Mr. Van Den Heuvel or had been employed by Mr. Van Den Heuvel. …

The affidavits demonstrate probable cause to support the conclusion that Mr. Van Den Heuvel made a series of fraudulent representations to others as part of his plan to solicit investment and loans into his various business entities, including his various Green Box entities. … These alleged misrepresentations include: pledging encumbered property as unencumbered property…; guaranteeing property interests in real estate owned by others…; claiming ownership of unowned patents on technology for his Green Box entities as legitimate and accurate. … The affidavits demonstrate allegations that Mr. Van Den Heuvel represents to investors and lenders that his Green Box entities are fully functional business enterprises with fully functional facilities throughout the United States., when there are none. … The affidavits also allege that Mr. Van Den Heuvel represents to investors and lenders that the technology behind the Green Box entities purported business model exists, when in fact it does not. … The affidavits contain allegations demonstrating that once Mr. Van Den Heuvel obtains investments and loans from others for his Green Box entities, he uses the funds for personal expenditures and personal debts. … These specific investment and loan conversion allegations include: Dr. Marco Araujo’s $600,000 equity investment into Green Box, WEDC’s $1,300,000 loan for Green Box, foreign EB-5 investments into Green Box, Ken Dardis’ $500,000 investment into Green Box, Dodi Management, LLC’s $100,000 investment into Green Box. The affidavits also include allegations that Mr. Van Den Heuvel instructs employees to manipulate Green Box financial records and transfer business funds and assets between his various business and personal accounts. … Ultimately, the affidavits clearly demonstrate probable cause supporting the existing of a pervasive scheme Mr. Van Den Heuvel employed to defraud investors and lenders. …

Multiple witnesses and victims throughout the United States provided information about Mr. Van Den Heuvel and his Green Box entities. Voluminous records were obtained and analyzed by law enforcement to corroborate information and identity Mr. Van Den Heuvel’s criminal conduct.

Watch Atty. Simon Ahn of the Green Detroit Regional Center introduce Ron Van Den Heuvel’s Green Box NA sales pitch to potential EB-5 Immigrant Investor Program victims:

Watch Ron Van Den Heuvel make his pitch in his home town at the April 15, 2014 City of De Pere Common Council Meeting asking for the City to issue Green Box NA Green Bay LLC $125,000,0000 in industrial development revenue bonds, as was also arranged for Green Box NA Michigan LLC by Gov. Rick Snyder’s Michigan Strategic Fund:

Would you trust this guy?

As Oneida Eye has previously reported, various partners of Ron Van Den Heuvel – including George Gitschel, who threatened to sue Oneida Eye’s Publisher–have tried to run this same scheme elsewhere, including California, Colorado, and Texas under the names Organic Energy Corp. & EcoHub Houston, the website of the latter being nearly identical to that of Ron’s EcoHub USA:

- ABC News 8, WFAA – Dallas, TX: City junket to Europe leads to more waste for South Dallas

Texans fought back:

Here’s a promo video of OSGC’s & Ron’s partners Alliance Construction & Design /Alliance Global Conservation, which share principal Todd Parczick with OSGC’s & GBRE’s ‘plastic-to-oil’ scheme partners Broadway Manufacturing, LLC and P2O Technologies, LLC.:

Here’s a supposed ‘demonstration’ video featuring OSGC’s & Ron’s partner Abdul Latif Mahjoob of American Combustion Technologies Inc. (ACTI) /American Renewable Technology Inc. (ARTI) / American Renewable Energy Inc. (AREI), among other fronts:

https://youtu.be/DphDHG8fY-k

Compare Ron Van Den Heuvel’s claims about Green Box NA with this Mantria Corporation / EternGreen Global Corp. promo video:

Here’s Mantria Corporation creep Troy Wragg receiving recognition from Bill & Hillary Clinton, and meeting with foreign officials:

Mantria Corp. victims fought back:

Consider the following actions by the U.S. Government against the Mantria Corp. / EternaGreen Global Corp. scheme:

- August 5, 2011 Order Granting Plaintiff’s Motion for Summary Judgment Against Defendant Mantria Corporation by Federal Judge Christine M. Arguello in Civil Action 2009-CV-02676-CMA-MJW, Securities Exchange Commission v. Mantria Corporation, Troy Wragg, Amanda Knorr, Speed of Wealth LLC, Wayde McKelvy, and Donna McKelvy

Throughout the course of this scheme, Mantria, Wragg, Knorr, and McKelvy made material misrepresentations in connection with offers and sales of Mantria’s securities, including that: (1) Mantria generated millions of dollars in annual profits when, in fact, Mantria generated no profits; (2) Mantria is the world’s largest manufacturer and distributor of biochar and that Mantria’s biochar operations were very profitable when, in fact, Mantria never sold any biochar and never made any revenues from biochar; (3) Mantria built the world’s first biorefinery plant in New Mexico when, in fact, Mantria never built or operated such a facility; (4) Mantria’s biochar manufacturing facility in Tennessee is producing $6.2 million annually when, in fact, the facility never generated revenue; (5) Mantria paid investors through profitable ventures when, in fact, it paid investor returns using investors’ money; (6) Mantria was not a Ponzi scheme when, in fact, it was; and (7) McKelvy reviewed Mantria’s books when, in fact, McKelvy did not regularly look at Mantria’s books and did not know what Mantria did with its books. …

The SEC has also presented considerable evidence that Mantria, through Wragg, Knorr, and McKelvy, made material misrepresentations and omissions concerning the probable returns on investment and the risks inherent in the securities offerings, all in an effort to foster the above-described fraudulent scheme to the detriment of Mantria’s investors who relied on such information when making their investment decisions. Additionally, the SEC has presented evidence that Mantria, through its officers (Wragg and Knorr), had the requisite scienter, whether by way of an intent to deceive, manipulate or defraud, or by engaging in conduct that was an extreme departure from the standards of ordinary care, such that it misled buyers, and the danger of misleading buyers was so obvious that Mantria, through its officers, must have been aware of it. For example, not only did Defendant Mantria, through the other Defendants, entice victim investors to purchase unregistered securities with illusory promises of improbably high rates of return, Mantria, through its agent’s, Defendant McKelvy’s, presentation at various Mantria investment seminars, encouraged potential investors to liquidate their traditional investments, including the equity in their homes, and to borrow as much money as possible to fund their investments with Mantria.

- September 2, 2015 Unsealed Federal Indictment, U.S. District Court, Eastern Pennsylvania, Case No. 15-cr-398-JHS, UNITED STATES OF AMERICA v. TROY WRAGG, AMANDA KNORR, and WAYDE MCKELVY re: the expansive MANTRIA CORP. / ETERNAGREEN GLOBAL CORP. / SPEED OF WEALTH ‘BioChar’ Pyrolysis Ponzi Scheme

By the end of 2008, Mantria curtailed the modest improvements of the real estate to focus on “green energy” projects. Mantria acquired an interest in Carbon Diversion, Inc., a company which initially held a license to manufacture “biochar,” a charcoal-like product. Mantria began construction on a “biochar” facility in Dunlap, Tennessee. While investors were told that the Dunlap facility was a full production facility, the Dunlap facility was merely a facility which Mantria used to test and refine the machines, called carbon diversion systems, Mantria was developing to make the biochar. Mantria used the Dunlap facility as a showpiece for investors and potential customers. The machines did not consistently produce biochar of a sufficient quality to sell on the market. Moreover, the Dunlap facility was built in a remote location and lacked the logistical infrastructure to transport the tons of biochar necessary for the facility to be profitable. Consequently, Mantria planned to build a second biochar facility in Hohenwald, Tennessee which had better logistical access. The Hohenwald biochar facility, however, was never built. Mantria also solicited investments for a factory in Carlsbad, New Mexico, which would manufacture the machines to make biochar. The Carlsbad facility was also never built. …

Defendants TROY WRAGG, AMANDA KNORR, and WAYDE MCKELVY omitted the following material facts in their representations to investors. …

That Mantria did not have a patent for the technology for the biochar process or for the systems sales. In fact, the license which they had used was revoked in December 2008.

That Mantria was under SEC investigation.

- September 3, 2014 U.S. Justice Dept. statement re: Indictment Charges Three People with Running $54 Million “Green Energy” Ponzi Scheme

As the founders of the Mantria Corporation, Wragg and Knorr allegedly promised investors huge returns for investments in supposedly profitable business ventures in real estate and “green energy.” According to the indictment, Mantria was a Ponzi scheme in which new investor money was used to pay “earnings” to prior investors since the businesses actually generated meager revenues and no profits. …

“The scheme alleged in this indictment offered investors the best of both worlds – investing in sustainable and clean energy products while also making a profit,” said U.S. Attorney Memeger. “Unfortunately for the investors, it was all a hoax and they lost precious savings. These defendants preyed on the emotions of their victims and sold them a scam. This office will continue to make every effort to deter criminals from engaging in these incredibly damaging financial crimes.” …

“As alleged, these defendants lied about their intentions regarding investors’ money, pocketing a substantial portion for personal use,” said Special Agent in Charge Sweeney Jr. “So long as there are people with money to invest, there will likely be investment swindlers eager to take their money under false pretenses. The FBI will continue to work with its law enforcement and private sector partners to investigate those whose greed-based schemes rob individuals of their hard-earned money”. …

March 2, 2017 UPDATE:

- NBC 10 WCAU – Philadelphia: Temple University Graduate Admits to Running $54M Green-Energy Ponzi Scheme; The scam allegedly ran from 2005 until 2009, even after the Securities and Exchange Commission filed a civil lawsuit against Wragg and Knorr’s Bala Cynwyd-based Mantria Corp.

A Temple University graduate admitted Thursday that he ran a $54 million Ponzi scheme built on false promises of green energy technology that would turn trash into fuel and “carbon-negative” housing developments, neither of which were ever fully developed.

Troy Wragg, now living in Georgia, pleaded guilty in federal court in Philadelphia on Thursday to conspiracy and securities fraud. His college girlfriend, Amanda Knorr, pleaded guilty last year, while Wayde McKelvy, a 54-year-old securities salesman from Colorado, is scheduled to go on trial in September [2017].

- Philadelphia Inquirer: Two years out of Temple, he built a $54 million Ponzi scheme

Their 2015 indictment came six years after the Securities and Exchange Commission filed suit against the company in Colorado, shut down the firm, and obtained a court order barring its principals from raising new funds. Various people linked to the company and its associated entities have agreed to a $6 million settlement with investors.

- Minneapolis Star Tribune: Man admits to running $54M green-energy Ponzi scheme

Prosecutors say the trio lied to investors, saying their “biochar” technology and “carbon-negative” housing in Tennessee made millions of dollars, but they had almost no earnings, and the three used the money to repay earlier investors and kept some for themselves. …

The company had a site testing the production of biochar in Dunlap, Tennessee, but prosecutors say the company never had a patent for the technology to sell the systems and lied about how much it was producing.

Watch Atty. Joe Nicks of Godfrey & Kahn advise GTC members on how to phrase the dead motion by con-man Dan Hawk of Oneida Small Business Inc. for OSGC & GBRE to foolishly continue litigation against the City of Green Bay:

Of course, it’s possible Dan Hawk’s true motive is the fact that the $2 Million OSGC/GBRE received from WEDC in 2009 (when Fmr. Green Bay Mayor Paul Jadin chaired WEDC) was actually from gaming compact money that was normally given to and disbursed by Oneida Small Business Inc. (which Dan & his wife Judy Cornelius Hawk were inexplicably put in charge of), and maybe Dan only wants more money to be able to loan to Dan & Judy’s adult children…

…or Oneida Business Committee members who fail at business…

…or deadbeat Tribe members whose business has to be threatened with legal action, like Pete King III’s sham King Solutions LLC…

…or OBC members who fail to make loan payments, have their failed business taken to court by OBSI and lose, and then claim bankruptcy to avoid paying anything back, like OBC Chair Cristina Danforth (who was OBC Treasurer at the time and who is currently President of the Native American Finance Officers Association / NAFOA Board of Directors and is also a member of the Board of Directors of both the Native American Bank, NA & the Native American Bancorporation Co.).

As OSGC’s Managing Director Peter King III of King Solutions LLC – who is the nephew of Oneida Casino Gaming General Manager Louise King Cornelius – has made clear…

Pete feels that he has the right & power to make executive “business decisions” and use unaccounted amounts of Tribal funds to pay off ‘undisclosed’ multi-million settlements (that look more like extortion racket sums), despite the fact that the Oneida Business Committee deceitfully told GTC in writing that any settlement decision would come before GTC for action:

The Oneida Business Committee received a request from the plaintiffs to consider settlement. The complaint alleges $400 million in damages; the settlement offer was $9 million. We discussed this settlement in Executive Session on August 26, 2015, and rejected this offer. We believe that the Tribe has not damaged ACF in any way and was not a party to the contract. As a result, the settlement offer is too high to be considered. We do not make a counter-offer as we continue to believe that the Tribe will prevail in this matter. However, if a settlement offer is presented which we think fairly represents the risk and cost of continuing versus concluding this matter, we have committed to bringing that to the General Tribal Council for action.

But that’s clearly not what happened, as (kind of) explained below during Pete King III’s reply to a question by a GTC member as to why Peter, on behalf of OSGC’s subsidiaries GBRE & Oneida Energy Inc., secretely entered into an undisclosed settlement agreement (some have said for as much as $15 Million) without any information coming to GTC for discussion and/or action as had been promised to GTC in writing by the Oneida Business Committee:

Interestingly, the GTC member who asked Peter King III about his unilateral secret “business decision” – Michael T. Debraska – probably now knows exactly how many millions of the Tribe’s dollars Pete swiped to fund OSGC, GBRE & Oneida Energy Inc.’s shakedown payoffs to ACF Leasing, ACF Services, and Generation Clean Fuels (among others? who knows?)… given that Mike was recently hired as a Senior Policy Advisor to OBC Chair Cristina Danforth.

Atty. Eric R. Decator, owner & counsel of Generation Clean Fuels, LLC – the guy OSGC Managing Agent Pete King III gave undisclosed millions of GTC’s money to. Seems legit.

If OSGC’s Managing Director – who is also a Board member of ONW-owned Bay Bank/Bay Bancorporation – can get away with blithely admitting he simply made a unilateral “business decision” to take undisclosed millions of dollars from the Tribal treasury to make secret settlement payments that GTC members didn’t find out about until after the settlement arrangements were made, and without anything actually being brought before GTC for consideration and action as the OBC had stated in writing…

…then why wouldn’t Peter King III feel that he has the right & power & financing – without GTC’s official allowance or approval – to sue the City of Green Bay in order to try to recover those untold millions of dollars Pete surreptitiously paid off to OSGC’s ‘business partners’ & related investors… including individual Tribe members, executives & officials?

As seen in the November 14, 2016 GTC Meeing Action Report draft, one of the proposed Amendments was for GTC to finally have access to information that that the OBC, the Oneida Law Office under OBC Chief Counsel Jo Anne House, and OSGC have long kept hidden from GTC:

…we as GTC want to know who are the leaders; who are the investors; who are the attorneys; who are the stockholders; who are the owners; who are the board members; how are they paid; what do they use for collateral; for this information be provided for the last 10 years; and to be reported at the next meeting.

Yet GTC still doesn’t know the answers to those questions, because the OBC, the OLO, and OSGC intentionally keep GTC in the dark…

…after OLO Chief Counsel Jo Anne House reneged on her February 15, 2011 Oneida Law Office legal opinion which said that GTC Members would have access to OSGC’s disclosure reports (in which OSGC fails to fully disclose important information, such as the inadvertantly released Disclosure Report & Narrative Report as of December 31, 2011 which failed to even mention the existence of OSGC-subsidiaries Oneida Energy Blocker Inc. and Green Bay Renewable Energy LLC, the latter of which was registered in the State of Delaware on December 15, 2011…

…and OBC & OLO hide, shield & defend at all costs the actions of OSGC’s officers, executives, and employees, of which Peter King III was one [as the pyrolysis Project Manager], even when OSGC violates local zoning ordinances and clearly violated GTC’s May 5, 2013 directive that OSGC not engage in waste-to-energy on the Oneida Nation of Wisconsin reservation.

Listen to the ridiculous answers Fmr. OBC Secretary Patty Hoeft and Fmr. OBC Chair Ed Delgado gave to simple questions by Oneida Eye’s Publisher after OSGC was caught with that illegal open flame operation…

…including Fmr. Sec. Patty Hoeft admitting that OSGC had simply refused to answer when the Oneida Business Committee had asked OSGC the same question just days before the December 15, 2013 GTC Meeting about the petition to dissolve OSGC…

…and Fmr. OBC Chair Ed Delgado giving a plainly false answer about the legitimacy of OSGC’s & GBRE’s scheme partners:

Watch as both Fmr. OBC Sec. Patricia Hoeft and Fmr. OBC Chair Edward Delgado openly admit that the Oneida Nation of Wisconsin lacks adequate regulations, laws, and oversight of its own corporations:

Yet Ed Delgado failed to heed the warnings and advice of non-Tribal member Paul Linzmeyer whom Ed nominated to the OSGC Board, but didn’t get adequate answers to basic questions about OSGC:

- November 25, 2011 Email from OSGC Board member Paul Linzmeyer to Fmr. OBC Chair Ed Delgado’s Elder Advisor Yvonne Metivier, Subject: “Actions ED should take” to protect the Oneida Nation of Wisconsin from Tribally-owned Oneida Seven Generations Corp. which Ed Delgado failed to do, resulting in millions of dollars in losses to the Oneida Tribe on the schemes of Ron Van Den Heuvel

[Ed] must read the [CONFIDENTIAL October 30, 2008 OSGC AUDIT by the Tribe’s INTERNAL AUDIT DEPT.] as it appears that [OSGC] is still not in compliance with the issues brought up there …. While my previous emails may have seemed to soften my stance on [OSGC] after reading the 2008 audit I am very concerned. [Ed] should order a followup to the 2008 audit and then have an independent counsel review how the tribal law was violated and possible action. (much of this is business 101)…

I am very concerned about this whole mess.

Watch ONWI Chief Financial Officer Larry Barton admit that OSGC subsidiary Oneida-Kodiak Construction LLC (of which OSGC owns 51%) did not submit its financial records for the McGladrey & Pullen audit on the financial impact of OSGC’s dissolution because the Oneida-Kodiak Construction LLC’s books were being held captive by Oneida-Kodiak’s 49% shareholder Alliance Construction & Design, as stated in the September 21, 2015 letter signed by 44 Enrolled Oneida Nation WI Members to Fmr. U.S. Atty. Gen. Loretta Lynch asking for a criminal investigation of OSGC, its subsidiaries, and its business partners:

Principals of Alliance Construction & Design, Inc. & Alliance GC, LLC, own 49% of OSGC-subsidiary Oneida-Kodiak Construction, LLC, and Alliance was working on OSGC/GBRE’s pyrolysis waste energy project on Hurlbut Street in the City of Green Bay, but is now refusing to allow OSGC or OBC to have access to Oneida-Kodiak Construction’s financial records due to an ongoing “dispute,” according to what OTIW CFO Larry Barton has told OTIW members.

OTIW members are concerned as to why the OBC, OLO and OSGC aren’t aggressively seeking access to Oneida-Kodiak’s corporate financial records by pursuing legal action against Alliance Construction & Design, Inc./Alliance Global Conservation, LLC, just like OBC, OLO, and OSGC seem unaware of or disinterested in obtaining Glory, LLC’s $1.2 million judgment from Ron Van Den Heuvel.

…and watch Larry the CFO Guy admit that not even he – despite being Chief Financial Officer of the Oneida Nation in Wisconsin – knows nor has full access to information about the identities of OSGC’s businesses & partnerships, nor individual investor lists:

And things haven’t gotten any better since.

In many ways, it’s far worse.

For starters…

The Oneida Business Committee & Oneida Law Office do not update the ONW ‘Litigation Updates’ page, and when the OBC do give information to GTC it is often false.

Here’s a perfect recent example of the sparse – and false – information the GTC Members receive from OSGC:

- January 16, 2017 GTC Meeting Packet materials re: OSGC Business Investment Report as of January 2015 audited financial statements (WARNING: Believe any of it at your own risk):

Oneida Seven Generations

Total Nation’s Investment $1,938,586

Increase in Equity Value $2,313,164

Total Return to Nation $541,296In Fiscal Year 1996, the Nation formed Seven Generations Corporation. Seven Generations is a tribally chartered, tribally owned corporation. The function and purpose of the corporation is to promote and enhance business and economic diversification directly or as a holding company for real estate assets, management of related assets, or other business ventures of the Oneida Nation to develop long term income streams for the corporate stockholders. From the statements received through September 30, 2011, Seven Generations has $17,090,328 of assets and total equity of $9,344,146 in the corporation. In accordance with the Charter, any potential returns to the Nation would be determined by the board at the annual shareholder meeting, at the shareholder’s discretion.

In Fiscal Year 2005, the Nation approved a $2,000,000 investment into of Seven Generations to become a 20% owner in Nature’s Way (Glory LLC). Nature’s Way was a paper converting company that has ownership of a tissue patent. In Fiscal Year 2008, a $4,000,000 loss was written off due to the closing of Nature’s Way [Tissue Corp.]. Oneida Seven Generations is currently in litigation against Nature’s Way principals of the corporation. Seven Generations has since regained control of the property and are currently leasing the facility to Schneider International.

In Fiscal Year 2005, the Nation approved a $490,000 investment in the formation of an LLC (Oneida Generations LLC) which established the Nation as a 49% shareholder. Seven Generations contributed $510,000 to Oneida Generations, LLC establishing themselves as a 51% shareholder. The limited liability company was established to construct and manage the travel mart facility located at HWY 29 and HWY 32. The retail and gaming operations located at the facility are owned and operated by the Nation.

LET IT BE NOTED:

FIRST…

Those numbers do NOT include OSGC’s current debts to the Tribe.

SECOND….

There is absolutely NO record of OSGC being “currently in litigation against Nature’s Way principals of the corporation”… whether in Brown County, state court, federal court, nor at the Oneida Judiciary kangaroo farm…

…AT ALL.

However…

Nature’s Way Tissue Corp.’s ‘principals’ include both Ronald Henry Van Den Heuvel and Oneida Nation High School Principal and Nature’s Way CEO; President; Registered Agent; and Partner (via Swakweko, LLC), Artley Murray Skenandore, Jr. (who is the husband of Oneida Police Dept. Lt. Lisa Drew-Skenandore):

- January 7, 2013 WI Tax Appeals Commission Decision and Order in the case of Steven Peters, Ronald Van Den Heuvel and Artley Skenandore vs. WI Dept. of Revenue

Mr. Skenandore had no expertise in the paper industry. Nevertheless, he was made president. …

…Mr. Skenandore was the Chief Executive Officer of Nature’s Way [Tissue Corp]. He was listed on the signature card of the checking accounts of Nature’s Way and signed all of the checks. He agreed with Mr. Van Den Heuvel and Mr. Peters to pool all of the funds coming in for use at whatever entity needed it most. He made the recommendations with the controller on what and whom to pay. He admitted that he allowed the monies to be pooled and used for other purposes than paying the withholding taxes. …

First, [Artley Skenandore] was the President of Nature’s Way. We have previously stated that a President necessarily has the requisite authority, and nothing in this case showed otherwise, the contractual arrangement with Mr. Van Den Heuvel notwithstanding. Second, as the quote from the accountant in the previous section shows, Mr. Peters and Mr. Skenandore had numerous meetings where the two decided to pay other obligations, and Mr. Skenandore admitted on the stand to ‘carrying over’ the withholding tax liability.

Mr. Skenandore’s defense was that he relied on the parent company for expertise in the paper business, but that is unconvincing and does not excuse paying other creditors first. The testimony was that Nature’s Way had money coming in from the parent company, just not enough to pay all of the creditors. Clearly, he and Mr. Peters determined which bills to pay out of the money that was coming in. …

IT IS HEREBY ORDERED that the Department’s assessment to…Mr. Skenandore is affirmed [regarding withholding tax periods beginning December 1, 2006, and ending March 31, 2009].

In fact…

OSGC subsidiary Glory, LLC – for which Pete King III is currently the Registered Agent – has never seriously attempted to collect its outstanding judgment against Ron & Kelly Van Den Heuvel’s Tissue Technology, LLC, for $1,227,880.01…

…as awarded in 2013 in Brown Co. Case No. 2009CV439, Glory LLC v. Ronald H. Van Den Heuvel & Tissue Technology LLC [and dismissed defendants: Partners Concepts Development Inc; Custom Paper Products Inc; Natures Choice Tissue LLC; Purely Cotton Products Corp; Eco Fibre Inc; ReBox Packaging Inc; Tissue Products Technology Corp; Patriot Project Services LLC; Chat LLC; Patriot Investments LLC; Patriot Services Inc; RVDH Inc; Waste Fiber Technology Inc; Recovering Aqua Resources Inc; RV Jet Inc; KYHKJG LLC; Patriot Paper Services Inc; Fibre Solutions LLC; Doc-U-Mince LLC; and dismissed third-party defendants: Ross J. Nova; Godfrey & Kahn.]

Is that what OSGC Managing Director Peter King III means by “currently in litigation against Nature’s Way [Tissue Corp.] principals of the corporation”?

Questions:

- How will OSGC’s ‘undisclosed settlement’ of millions of dollars taken out of Tribal coffers by Pete King III be reflected/hidden in the Oneida Nation of Wisconsin/ONW’s Tribal Budget as presented to General Tribal Council by OBC Treasurer Trish King?

- What gives OSGC & GBRE the right to instigate litigation against the City of Green Bay after GTC directed the OBC to dissolve OSGC…

…and especially after GTC allowed motions to rescind dissolution & continue litigation to lapse over three meetings over three months, rejecting calls to take the motions off the table, and thus allowing the main motion & amendments to die on the table?

Free Legal Advice:

- GTC shouldn’t allow OSGC & GBRE to hire Godfrey & Kahn to sue the City of Green Bay for refusing to allow OSGC & GBRE to perpetrate what appears to be just one facet of a fraud scheme in the wide-ranging criminal enterprises of OSGC’s partner, Ron Van Den Heuvel, whom Godfrey & Kahn has successfully sued for fraud on behalf of their client, Dr. Marco Araujo, with the Wisconsin Economic Development Corporation/WEDC as Araujo’s Co-Plaintiff…

- …especially given that Ron & his wife Kelly Yessman Van Den Heuvel have been charged with several counts of bank fraud, to which their co-conspirator, Paul Piikkila, has pled guilty as a former Horicon Bank loan officer and the Interim Controller of the Green Detroit Regional Center EB-5 Immigrant Investor Program which promoted Ron’s Green Box NA Detroit LLC scam to multple foreign investors, among other things the Van Den Heuvel’s are under investigation for by the Brown County Sheriff’s Department and no less than five federal agencies.

- Instead, GTC and the City of Green Bay should confront what appears to be a treasonous criminal fraud scheme against GTC, the City of Green Bay, the State of Wisconsin, and the U.S. Government, perpetrated in part from the highest levels of the Oneida Nation of Wisconsin’s government, institutions and corporations … conspiring with Ronald H. Van Den Heuvel & Abdul Latif Mahjoob … which has cost (and will likely continue to cost) GTC millions of wasted dollars and countless opportunities.

- Accordingly, the City of Green Bay should file a countersuit against OSGC, GBRE, Oneida Energy Inc., Godfrey & Kahn, Ron Van Den Heuvel & Abdul Latif Mahjoob for attempting to perpetrate criminal fraud schemes against GTC and the Green Bay City Common Council.

- Finally, GTC should hire outside counsel to oversee quick dissolution of OSGC, and subequently hold individual Tribal officials & executives involved in negligence, fraud, abuse, and/or cover-ups meaningfully accountable, while simultaneously adopting enforceable corporate transparency, accountability & ethics laws to prevent hubris from further squandering GTC’s resources and ONW’s reputation.

Will GTC & Green Bay fight back…

against OSGC, Ron, Godfrey & Kahn

…together?

- January 10, 2016 Comment from Clean Water Action Council of Northeast Wiscsonin President Dean Hoegger and Incinerator Free Brown County Chairman John Filcher

Citizens believe OSGC lawsuit continues to misrepresent the facts.

The Oneida Tribe’s Oneida Seven Generations Corporation’s recent lawsuit filing with Green Bay Renewable Energy is reminiscent of the misinformation campaign it waged when it was attempting to locate its gasification incinerator in area communities. The latest lawsuit libelously claims citizens made false accusations against OSGC, claiming that OSGC had lied to the (Green Bay) Plan Commission.

OSGC should not be heard to lecture the City about credibility and truth after OSGC conveniently gave a highly illegal campaign contribution to the mayor of Green Bay after receiving a permit. This irony about credibility carries over into the latest lawsuit, where OSGC’s unclear pleadings allege citizen groups lied about … something, to somebody somewhere, at some undefined point in time which apparently had no impact because the pleadings suggest the City arbitrarily and irrationally rescinded the permit.