Ron Van Den Heuvel & his extended ripped-off family

10/18/2017 UPDATE:

- GreatLakesEcho.org /

Capital News Service:

Major ‘recycling’ scam in Michigan & Wisconsin sparks indictment,

by Eric Freedman

A bogus scheme to build an eco-friendly “green energy” waste processing facility in Detroit defrauded lenders and investors — including Chinese investors hoping to qualify for U.S. visas — of $4,475,000, according to a federal grand jury in Milwaukee.

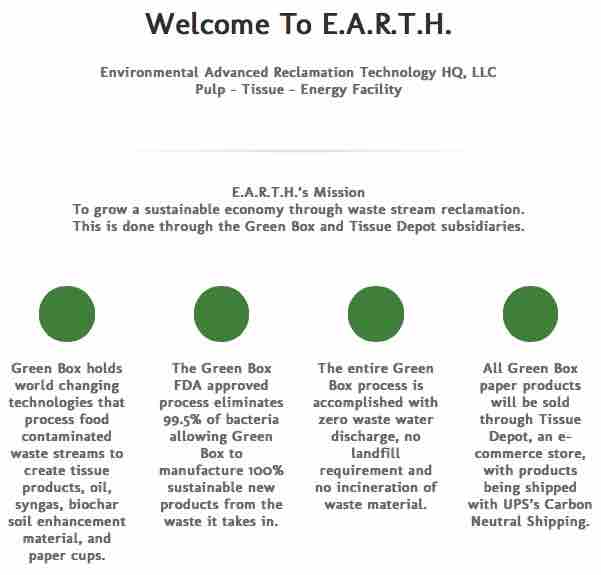

Project promoter Ronald Van Den Heuvel promised the victims that his Green Box-Detroit would build and operate a facility to recycle paper, process other waste and produce synthetic fuel, the indictment charged. …

In a related civil suit against Van Den Heuvel and Green Box-Detroit, the Securities and Exchange Commission (SEC) said, “He claimed that he had developed a breakthrough recycling process that could turn post-consumer waste into usable products. He represented that the Green Box process would be both environmentally friendly and profitable, and would allow Green Box-Detroit to repay investors.”

But it was a scam because Van Den Heuvel never acquired the promised facility or equipment and used the money for other purposes, the indictment said.

His defense lawyer, Robert LeBell of Milwaukee, didn’t respond to requests for comment.

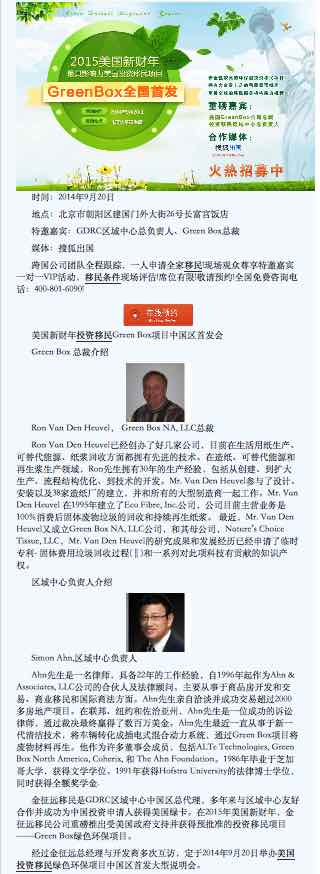

The primary victims of the Detroit project were nine investors from China who poured $4,475,000 into the failed endeavor. They’d hoped to become permanent residents — green card-holders — by investing at least $500,000 each under the U.S. Citizenship and Immigrant Services [USCIS]

EB-5 Immigrant Investment Program.Van Den Heuvel worked through Green Detroit Regional Center, which is owned by a Georgia law firm that is authorized to operate in Wayne, Livingston, St. Claire, Lapeer and Macomb counties, court documents said. The center finds “foreign clients, mainly from China and South Korea, to invest in large alternative energy projects,” according to its website.

The Green Box-Detroit project was portrayed as creating 35 direct and indirect jobs per each Chinese investor.

“Green Detroit Regional Center promoted the EB-5 investments in Green Box Detroit based on Van Den Heuvel’s representations,” the SEC suit said. It said the chief executive officer of the Green Detroit Regional Center, Georgia lawyer Simon Ahn, marketed the project to investors through immigration consultants in China. Neither Ahn nor Green Detroit Regional Center have been charged or sued by the SEC.

Ahn said, “If the charges are true, it is completely shocking to learn about the extent that Ron Van Den Heuvel hid the truth from me,” the center and investors.

“All of us visited the plants in Wisconsin many times, including the potential site in Detroit, and everything checked out fine. All the financials from a recognized accounting firm indicated that everything was proceeding on track, Ahn said.

The SEC suit said Van Den Heuvel falsely told investors that the MEDC [Michigan Economic Development Corp.] had approved tax exempt bonds for the project. However, the MEDC rejected the request after discovering five tax liens, one construction lien, two state tax warrants, four civil judgments and three civil lawsuits, according to court documents.

“Van Den Heuvel did not satisfy MEDC’s concerns. He did not provide additional information to the MEDC, and did not provide a satisfactory explanation for the issues that it had raised,” the SEC suit said.

As opposed to the WEDC, which did absolutely NO background check on Ron Van Den Heuvel whatsoever before loaning his ‘green energy’ fraud scheme $1.2 MILLION…

and instead went out of their way to look every which other way…

(the ol’ Joe Paterno move)…

and loaned OSGC $4 MILLION to do the exact same thing Ron fraudulently claimed GREEN BOX NA GREEN BAY LLC could do, but under a different name – GREEN BAY RENEWABLE ENERGY LLC [more accurately – ‘GREEN BOX ONEIDA NATION’].

What has Gov. Walker’s scary clown show WEDC been up to lately?

10/25/17 : Wisconsin State Journal

10/25/17 : Wisconsin State Journal

Foxconn contract contained ‘nuclear bomb’ that left taxpayers exposed, WEDC board member says; A key vote on the pending Foxconn contract was delayed last week because the state wouldn’t have been able to recoup taxpayer funds if the Taiwanese company didn’t fulfill its end of the deal, according to a member of the board overseeing the negotiation.

“We could have given [Foxconn] all this money and we wouldn’t have been able to get it back,” [Wisconsin Economic Development Corp. / WEDC board member Sen. Tim Carpenter, D-Milwaukee] said.

The state is planning to give the company $3 billion in refundable tax credits[.] …

Carpenter said the problem was “more than a technical issue.” …

Democrats on the Legislature’s Joint Audit Committee urged [WEDC CEO Mark] Hogan to release the contract details publicly before the board votes on it. Carpenter has asked that the WEDC board be allowed to review the contract before voting, but as is common practice, the board will only vote on a staff review and summary of the deal.

[WEDC CEO Mark] Hogan declined to change the process[.] …

The audit committee had been scheduled to meet Tuesday to discuss the latest state audit of WEDC, made public in May. The nonpartisan Legislative Audit Bureau reviewed 133 awards and found for a third consecutive biennial audit that the agency did not annually verify job-related information as required by law.

October 17, 2017 Debtor Green Box NA Green Bay LLC’s Consent to Motion to Dismiss, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay LLC

October 17, 2017 Debtor Green Box NA Green Bay LLC’s Consent to Motion to Dismiss, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay LLC

5. Ultimately, Mr. Van Den Heuvel was indicted in the U.S. District Court for the Eastern District of Wisconsin on certain charges alleged by the SEC. Immediately thereafter, the Investment Banker withdrew from the engagement as it became apparent that the project was too closely associated with Mr. Van Den Heuvel, at least in its eyes, in order to spend any further time on it, as no assurances could be given to it that the government’s investigation would not somehow involve the entity into which the assets were to be rolled.

6. Lacking any immediate additional funds to continue to finance the roll up or engage a new investment banker, the Debtor has determined that there is no other option at this time for continuing with the proposed roll up and, therefore, there is no point to continuing this Chapter 11 case.

7. Significant sums of money invested post-petition in this project will be lost by investors other than Mr. Van Den Heuvel. No assets, other than assets which are fully pledged over their value to secured creditors remain. The major asset owned by the Debtor is the real estate, subject to the Motion for Relief from Stay and the Motion to Dismiss. There appears to be no equity in it.

QUESTION:

QUESTION:

WHAT IS…

CHEYBOYGAN ENERGY & BIOFUELS, LLC …

AND WHY DID RON VAN DEN HEUVEL’s ON-AGAIN/OFF-AGAIN

SOMETIMES ‘ATTORNEY’ TY C. WILLIHNGANZ ORGANIZE IT

ON MAY 24, 2013 [ARTICLES OF ORGANIZATION] WITH RON’s

E.A.R.T.H. AS ‘REGISTERED AGENT’ … THE EXACT SAME DAY

ONEIDA SEVEN GENERATIONS CORP. / OSGC CEO & SUBSIDIARY

GREEN BAY RENEWABLE ENERGY LLC CEO KEVIN CORNELIUS

SIGNED MASTER LEASE CONTRACTS WITH ACF LEASING LLC,

ACF SERVICES LLC & GENERATION CLEAN FUELS LLC…

FOR OSGC’s ‘PYROLYSIS’ SITES IN MONONA, WISCONSIN…

& CHEBOYGAN, MICHIGAN?

- ANSWER (zip file):

The CHEBOYGAN / CHEYBOYGAN ENERGY DOSSIER - INCLUDING:

- May 24, 2013 Master Lease Agreement between Green Bay Renewable Energy LLC and ACF Leasing, ACF Services, Generation Clean Fuels, for a Pyrolysis projects including Cheboygan, Michigan, signed by GBRE Chairman & OSGC CEO Kevin Cornelius resulting in Cook County IL Case # 14-L2768, ACF Leasing LLC, ACF Services LLC & Generation Clean Fuels LLC v. Green Bay Renewable Energy, LLC, Oneida Energy Inc. & Oneida Energy Blocker Corp.

- May 24, 2013 Articles of Organization for CHEYBOYGAN ENERGY & BIOFUELS, LLC, 2077B Lawrence Dr., De Pere, WI 54115; Organizer signature: Ty. C. Willihnganz; Initial Registered Agent: Environmental Advanced Reclamation Technology HQ LLC [E.A.R.T.H.]; Current Registered Agent: Ron Van Den Heuvel

- May 24, 2013 Master Lease Agreement between Green Bay Renewable Energy LLC and ACF Leasing, ACF Services, Generation Clean Fuels, for a Pyrolysis projects including Cheboygan, Michigan, signed by GBRE Chairman & OSGC CEO Kevin Cornelius resulting in Cook County IL Case # 14-L2768, ACF Leasing LLC, ACF Services LLC & Generation Clean Fuels LLC v. Green Bay Renewable Energy, LLC, Oneida Energy Inc. & Oneida Energy Blocker Corp.

Consider also:

August 14, 2013 Pressure Letter from Louis Stern (Generation Clean Fuels) to Oneida Seven Generations Corp. / OSGC Board re: Waste to Energy Project

August 14, 2013 Pressure Letter from Louis Stern (Generation Clean Fuels) to Oneida Seven Generations Corp. / OSGC Board re: Waste to Energy Project

As you know, you and we have devoted substantial amounts of time, effort and money to developing the Project. We understand that you have devoted in excess of $5.8 million to the Project. We have also devoted thousands of hours and over $3.0 million to the Project. Now that the Project is about to be financed, it would be a horrible waste of all those hours and dollars to abandon it at this point. …

Over the past 18 months we have worked diligently with Kevin Cornelius, Bruce King and your lawyers and advisors to structure and develop the Project and to obtain financing for it. We have appreciated all the time, effort and great ideas that your team has provided for these activities. Because of the close working relationship we have developed with your team, we have Made many concessions, which have increased your potential benefit and reduced (if not eliminated) your risks with respect to this Project.

• Leasing the equipment for the Project to you at a substantial discount to its market price.

• Agreeing to defer almost half of the Project cost owed to us for as long as 9 years.

• Lending GBRE $870,000 to fund half of the required debt service reserve fund.

• Guaranteeing the entire amount of the loan. In addition, I am personally guaranteeing $3.0 million of the loan.

• Providing OSGC with a royalty of 11% of gross revenues off the top.

• Providing OSGC with a $250,000 development fee at Closing.

• Depositing $2.2 million in cash as additional collateral for the loan.

We need to know as soon as possible whether you plan to complete the Project. We have many other customers who would like to acquire equipment from us. We have been deferring these customers because of our commitment to you. However, if you do not tell us by August 23, 2013, that you are planning to complete the Project, we will need to divert our assets and attention to servicing our other customers. At this point, even if you decided to complete the Project, we would need to reconsider whether we would still be willing to do the Project on the same basis (including all of the concessions outlined above).

We hope to hear from you soon and look forward to a long and mutually beneficial relationship.

Sincerely yours,

Louis Stern

cc:

Bruce King

Craig Aderhold [Wisconsin Bank & Trust]

Joseph Kavan, Esq. [Kutak Rock LLP]

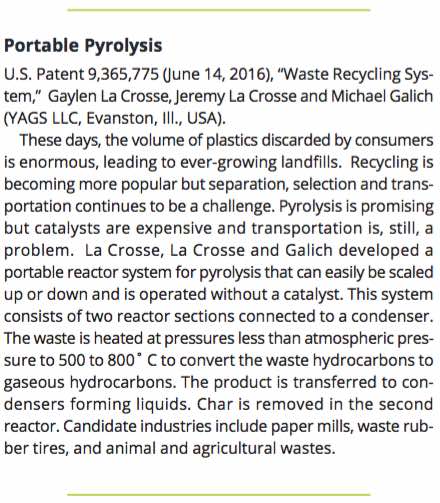

From the September 2016 issue of Plastics Engineering SPE Magazine:

10/10/17 :

Ron Van Den Heuvel, 63, [pleaded guilty to conspiracy to commit bank fraud] in federal court[.] Sentencing is set for Jan. 5.

Meanwhile, Van Den Heuvel also entered a not guilty plea on 14 new charges – 10 counts of wire fraud and four counts of unlawful financial transactions – that prosecutors filed last month. No trial date was set in that case.

Ron Van Den Heuvel faces up to five years in federal prison and a $250,000 fine. … Van Den Heuvel also agreed to pay restitution of $316,445.79. …

Judge Griesbach clarified with Van Den Heuvel that the elements of the conspiracy count include that he knowingly entered into the conspiracy. …

As for the newest case, prosecutors allege Van Den Heuvel raised more than $9 million from investors, including the Wisconsin Economic Development Corp. [WEDC], for his company, Green Box [NA Green Bay LLC], but used some of the money on personal items, including a car and Packers tickets. If convicted of all 14 counts, he faces up [to] 240 years in prison and more than $2.5 million in fines.

Assistant U.S. Attorney Matthew Krueger said prosecutors have more than 700,000 pages of evidence to turn over to the defense in the case, so no trial date was set. Instead, the parties return to court Dec. 13 for a status conference.

- USA TODAY / Green Bay Press-Gazette: De Pere ‘businessman’ Ron Van Den Heuvel pleads guilty to conspiracy to commit bank fraud in Green Box case

U.S. District Court Judge William Griesbach accepted [Ron Van Den Heuvel’s] plea agreement and found Van Den Heuvel, 63, guilty of one count of conspiracy to commit bank fraud. …

The terms of the plea agreement will keep Van Den Heuvel out of jail until a Securities and Exchange Commission fraud case against him is resolved. The agreement calls for him to pay Horicon Bank $316,445 in restitution. The other 18 counts were dismissed but can be factored in at sentencing. …

Prosecutors said Tuesday [the prison sentencing] range will be between 33 and 41 months, though Griesbach can ignore all guidelines and recommendations in deciding the sentence.

Van Den Heuvel will be sentenced at 9:30 a.m. Jan. 5 [2018]. …

[Judge] Griesbach told [Ron Van Den Heuvel] the court was “not going to play games” when it came to intent since intent is inherent in a conspiracy to defraud a bank. When Griesbach asked whether he was guilty of conspiring to commit bank fraud, Van Den Heuvel paused before answering, “Yes, sir.”

After accepting Van Den Heuvel’s guilty plea, Griesbach pivoted to the SEC’s 14-count complaint that Van Den Heuvel defrauded investors out of $9 million. The complaint includes 10 counts of conspiracy to commit wire fraud by making false statements and four counts of conducting unlawful financial transactions.

Van Den Heuvel entered not guilty pleas to all 14 counts.

For each wire fraud charge, Van Den Heuvel faces a maximum of 20 years in prison and a $250,000 fine. The unlawful transactions charges each carry a maximum of 10 years in prison and a fine equal to twice the value of the transactions in question.

The Press-Gazette link continues to inexplicably host a wildly misleading video suggesting that ‘Green Box is ready to emerge from bankruptcy,’ which is demonstrably false given that the October 3, 2017 Second Renewed Motion of Ability Insurance Company for Relief from Automatic Stay Pursuant to 11 U.S.C. §362(d) or, In the Alternative, Motion to Dismiss Pursuant to 11 U.S.C. §1112(b), U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay LLC plainly states:

7. Debtor [Green Box NA Green Bay, LLC] did not successfully “roll up” the Plan by September 30, 2017. …

8. Cause exists for relief from the automatic stay pursuant to Section 362(d)(1) of Bankruptcy Code. Specifically:

A. Debtor has failed to facilitate the “roll up” within the time period allowed in the confirmed Plan.

B. Debtor has no equity in the Real Estate, as evidenced by the terms of the Plan.

C. Debtor’s reorganization attempts have failed, so the Real Estate is no longer necessary for its successful reorganization.

D. Debtor consented to relief from the automatic stay in the Plan. …

9. Debtor’s failure to facilitate the “roll up” evidences the absence of a reasonable likelihood of rehabilitation.

10. Debtor has also failed to effectuate substantial consummation of its confirmed Plan.

11. Debtor is in material default with respect to its confirmed Plan.

12. Each of the above constitutes cause for dismissal of this action pursuant to 11 U.S.C. §1112.

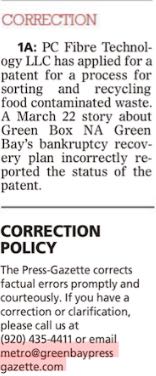

Soon after the Press-Gazette first published its phony claims about the Green Box Investment Fraud Scheme the failing newspaper issued the following Correction when Oneida Eye’s Publisher contacted them with facts DESTROYING THE GBPG’s LUDICROUS FRONT PAGE ‘FAKE NEWS’ CLAIM THAT GREEN BOX NA IS “READY TO EMERGE FROM BANKRUPTCY”:

PC Fibre Technology LLC has applied for a patent for a process for sorting and recycling food contaminated waste. A March 22 story about Green Box NA Green Bay’s bankruptcy recovery plan incorrectly reported the status of the patent.

Ya’ think?!

So why does Green Bay Press-Gazette Editor Robert Zizzo insist on continuing to publish falsehoods that seem designed to try to help Ron Van Den Heuvel’s fraud scheme duplicitously entice low-info or foreign victims?

Contact the Press-Gazette at 920-435-4411 or metro@greenbaypressgazette.com and ask him yourself.

- October 4, 2017

Ron Van Den Heuvel

Bank Fraud Plea Agreement

U.S. District Court, WI Eastern District Docket No. 16-CR-064, United States of America V. Ronald H. Van Den Heuvel, Paul J. Piikkila, and Kelly Y. Van Den Heuvel

- 10/05/17 : ABC 2 WBAY, De Pere ‘businessman’ reaches plea deal in bank fraud case

- Wisconsin State Journal, ‘Businessman’ accused of defrauding Wisconsin Economic Development Corp. / WEDC pleads guilty to bank fraud

- Green Bay Press-Gazette, De Pere ‘businessman’ Ron Van Den Heuvel will plead guilty to bank fraud

See also:

• September 20, 2016 Superseding Indictment, U.S. District Court, WI Eastern District Docket No. 16-CR-064, United States of America V. Ronald H. Van Den Heuvel, Paul J. Piikkila, and Kelly Y. Van Den Heuvel

• July 1, 2016 Paul Piikkila Plea Agreement, U.S. District Court, U.S. District Court, WI Eastern District Docket No. 16-CR-064, United States of America V. Ronald H. Van Den Heuvel, Paul J. Piikkila, and Kelly Y. Van Den Heuvel

Related:

• UNPAID $1.2 Million Judgement against Ron Van Den Heuvel’s Tissue Technology, LLC in Brown Co. Case No. 2009CV439, [OSGC subsidiary] Glory LLC v. Tissue Technology LLC

• October 16, 2012 Transcript of Motion Hearing, Brown Co. Case No. 09-CV-439, Glory LLC v. Tissue Technology LLC

• January 27, 2013 Decision & Order of the Wisconsin Tax Appeals Commission, various dockets, Steven Peters, Ronald Van Den Heuvel & Artley Skenandore Jr. v. WI Dept. of Revenue [re: Oneida Seven Generations Corp. / OSGC venture NATURE’S WAY TISSUE CORP.]

That Decision and Order states:

[Artley] Skenandore had no expertise in the paper industry. Nevertheless, he was made president [of Nature’s Way Tissue Corp.]

Nature’s Way Tissue Corp. fraud scheme principals: OSGC, Artley Skenanadore Jr., Ron Van Den Heuvel, and Steven Peters (who was also a ‘straw borrower’ in Ron’s bank fraud scheme during the same time period that Nature’s Way Tissue Corp. violated state tax laws and cost ONWI over $4 million dollars)

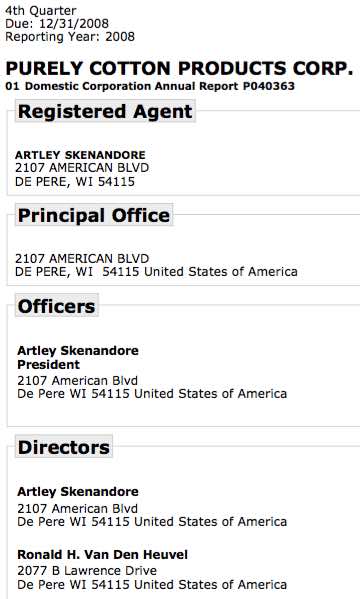

In fact, Artley Skenandore Jr. was also made the President of PURELY COTTON PRODUCTS CORP. / PCPC, according to to records obtained from the Wisconsin Dept. of Financial Institutions / WDFI:

On February 25, 2016, Purely Cotton Products Corp.’s ‘Registered Agent’ was changed from Artley Skenandore Jr. to Ron Van Den Heuvel:

- August 7, 2017 United States’ Brief for Evidentiary Hearing re: Motions to Suppress Evidence from Brown County Sheriff’s Office Search Warrants, U.S. District Court, Eastern District of Wisconsin, Docket No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel, Paul Piikkila, and Kelly Van Den Heuvel

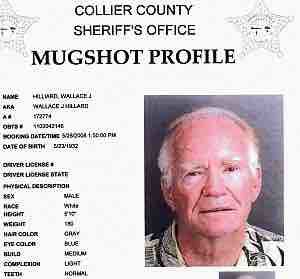

[The July 2, 2015 Brown County Sheriff’s] affidavit established that the defendants’ enterprise was permeated with fraud. …

The large quantity of materials seized reflects not officer misconduct, but rather the pervasive, complex, and long-term nature of the defendants’ fraudulent activities. …

This case arose from federal investigations regarding the defendants pursuing two schemes to defraud banks by obtaining loans through straw borrowers. Separately, the BCSO was investigating Ronald Van Den Heuvel for defrauding investors and lenders by promoting his Green Box businesses. Federal agencies also subsequently began investigating Ronald Van Den Heuvel’s Green Box scheme;

that investigation is ongoing and has not led to charges yet. …Count 1 charges Ronald Van Den Heuvel, Paul Piikkila, and Kelly Van Den Heuvel with participating in a scheme to defraud Horicon Bank from January 1, 2008 through September 30, 2009, by obtaining nine loans through six straw borrowers …

The SIX STRAW BORROWERS included #1) WILLIAM BAIN / BILL BAIN, Ron’s business partner and former brother-in-law and VP of Vos Electric Inc.; #2) STEVEN PETERS, Ron’s business partner with Artley Skenandore Jr. and Oneida Seven Geneations Corp. / OSGC in the Nature’s Way Tissue Corp. fraud scheme; #3) JULIE GUMBAN, Ron & Kelly’s live-in nanny; and #4) PATRICK HOFFMAN, Ron’s son-in-law and low-level employee.

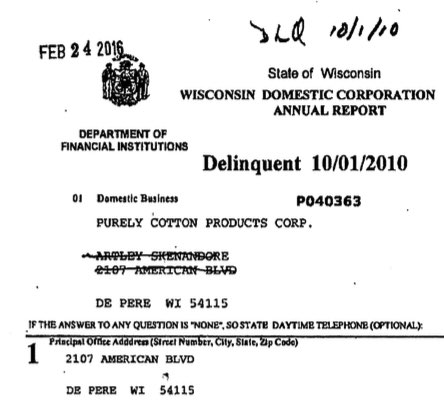

From left to right: Ronald Van Den Heuvel, Carly Fiorina, Patrick Hoffman, and Ron’s daughter Kristie Van Den Heuvel–Hoffman at husband Patrick’s business, The Creamery Cafe in DePere, WI. Ron told the Green Bay Press-Gazette in April 2013 that he and Ted Cruz shared “Christian values.”

Left: Vos Electric Inc. VP William Bain and wife Cynthia Bain, sister of Nature’s Way Tissue Corp. VP and STRAW BORROWER #5) DEBRA STARY, about whom Paul Piikkila’s JULY 1, 2016 PLEA AGREEMENT says “[s]he didn’t want to be on the Board [of Nature’s Way Tissue Corp.], but [Ron] Van Den Heuvel browbeat her until she agreed,” that Piikkila “didn’t know if Stary and Van Den Heuvel had a romantic relationship,” but that Debra Stary “was very close to [Ron] Van Den Heuvel and would do anything he asked,” and that eventually “her family had an intervention to get her to quit working for [Ron Van Den Heuvel].”

Paul Piikila’s Plea Agreement also states that “[Ron] Van Den Heuvel was intimidating and Piikkila once saw [Ron] punch Howard Bedford … because Van Den Heuvel approached [Ken Dardis] and asked him to invest $30,000 [but] Bedford told him not to invest [and] Van Den Heuvel needed the money immediately for the Waste Fiber facility.”

STRAW BORROWER #6) KYHKJG, LLC, is the Kelly Van Den Heuvel-owned ‘company’ which Julie Gumban says she was told the money borrowed under her name would be ‘invested’ in (which is in addition to Kelly’s other sham ‘companies’ registered on WDFI.org: HHK, LLC; and HHKRK, LLC; and KYHK, LLC.

The August 7, 2017 United States’ Brief goes on to say:

Kelly Van Den Heuvel is expressly alleged to be involved with three of those loans. … Counts 2 through 13 charge Ronald Van Den Heuvel with specific executions of the scheme to defraud and false statements regarding the Horicon Bank loans. Kelly Van Den Heuvel is also charged in Counts 10 and 11 regarding the loan to her live-in nanny [Philippine-national Julie Gumban]. …

Courts have applied this “permeated by fraud” doctrine to approve of broad search warrants when there was probable cause to believe an enterprise was fraudulent. …

This doctrine applies here because the [July 2, 2015 Brown Co. Sheriff’s Office] affidavits establish ample cause to believe that Ronald Van Den Heuvel conducted his businesses through

a long series of

interlocking

fraudulent

maneuvers.

[Attorney Jonathan Smies of law firm Godfrey & Kahn SC:]

Do your brothers expect you to repay them these cash gifts. I guess you call them gifts given the federal income tax limit.[Ron Van Den Heuvel:] They were given some shares, so they want to make sure Green Box is – for a lot of reasons. They want to clean up the environment, and they want it to do the jobs. So they have a lot of reasons to see it come through.

[Attorney Smies of Godfrey & Kahn:] They have interest in Green Box NA, LLC, succeeding?

[Ron Van Den Heuvel:] No, they don’t.

[Attorney Smies of Godfrey & Kahn:] Which Green Box entity do they have interest in?

[Ron Van Den Heuvel:] Certain family members and certain trust for their kids are in E.A.R.T.H. [Environmental Advanced Reclamation Technology HQ, LLC – which was previously known as Nature’s Choice Tissue, LLC – and now known as Reclamation Technology Systems, LLC].

[Attorney Smies of Godfrey & Kahn:] I see. You have members of your family and/or their trusts that have some interest in the E.A.R.T.H. entity?

[Ron Van Den Heuvel:] And a lot of friends.

IX. NEW BUSINESS

A. Post one (1) vacancy on Oneida Gaming Commission with a term end date of 8/31/22

Requestor Kathleen Metoxen, Records Tech II/BC Support Office

Sponsor: Lisa Summers, Secretary

?????

- September 12, 2017 Letter from Oneida Gaming Commission / OGC Exec. Dir. Tamara VanSchyndel to Records Clerk Lee Cornelius re: OGC’s 09/07/17 acceptance of recently ‘elected’ Commissioner Cristina Danforth’s RESIGNATION effective 09/25/17

The Gaming Commission took official action on Friday, September 7, 2017 to accept the resignation of Commissioner Cristina S. Danforth effective Monday, September 25, 2017.

The Gaming Commission would like to initiate the posting of the vacant Commissioner position. Upon closing the posting the Gaming Commission may provide their recommendation of the vacant Commissioner position.

?????

According to the ONWI Gaming Ordinance 501.6-13:

501.6-13: Vacancies. Any vacancy in an unexpired term of office, however caused, must be filled by appointment by the Oneida Business Committee of a person qualified pursuant to sections 501.6-5 and 501.6-6 pursuant to the Comprehensive Policy Goveringing Board, Committees and Commissions.

DEVELOPING…

RECENT EVENTS:

07/09/17 : WFRV – Oneida Business Committee election results

Ron “Tehassi” Hill was elected to serve as Chairman of the Oneida Nation [of Wisconsin / ONWI] for the next three years.

Hill replaces Tina Danforth, who chose not to run this term.

[NOTE: Cristina Danforth was elected to the Oneida Gaming Commission / OGC, the legal counsel for which is Atty. William Cornelius / Bill Cornelius, former President & Chair of Oneida Seven Generations Corp. / OSGC and Chair of OSGC-subsidiary Oneida Energy, Inc.

[NOTE: Cristina Danforth was elected to the Oneida Gaming Commission / OGC, the legal counsel for which is Atty. William Cornelius / Bill Cornelius, former President & Chair of Oneida Seven Generations Corp. / OSGC and Chair of OSGC-subsidiary Oneida Energy, Inc.

The OGC oversees the ONEIDA NATION of WI-owned ONEIDA CASINO – not to be confused with the New York casinos of the ONEIDA INDIAN NATION of NY – and the OGC must approve all operational contracts entered into by the ONWI ONEIDA CASINO.

OSGC supposedly ‘leases’ buildings to the ONWI ONEIDA CASINO, including the business offices of the OGC itself…

yet the ONWI ONEIDA CASINO pays for capital improvements to the buildings supposedly ‘owned’ by OSGC, for which Oneida Gaming Manager Louise King Cornelius’ nephew – OBC-appointed OSGC Managing Agent Pete King III of King Solutions, LLC – receives a salary to ‘oversee.’

OSGC is supposedly so broke that – due to the health & safety threats posed to Oneida Casino employees by OSGC’s negligence – the Oneida Casino had to pay $208,000 to replace the roof on the Oneida Casino Warehouse despite the fact that the Casino has long paid over $15,000 per month to lease that building from OSGC. Even given the cushy arrangement OSGC had wih the Oneida Casino, the sham company still failed to keep its building safe, just like it failed to keep the Travel Center free of dangerous mold due to shoddy construction which the Oneida Casino paid to remediate.

So where did OSGC-subsidiary Green Bay Renewable Energy, LLC get an estimated $10 – $15 MILLION to pay a secret ‘settlement’ (that looks more like an EXTORTION) to Generation Clean Fuels LLC principals Eric Decator, Louis Stern, Michael Flaherty, and Gaylen La Crosse – the latter being Ron Van Den Heuvel’s partner in Recovering Aqua Resources, Inc. & Recovering Aqua Resources Technologies, Inc.?]

_____________________

07/17/17 : General Tribal Council Meeting

_____________________

*The outcome of the recount of Gaming Commission has now resulted in a tie:

[Exiting OBC Chair] Cristina (Tina) Danforth–

537[Exiting OBC Vice-Chair] Melinda J. Danforth–

537

501.6-6. Unless pardoned for activities under subsection (a) and/or (d) by the Tribe, or pardoned for an activity under subsection (a) and/or (d) by another Federally-recognized Indian Tribe for an action occurring within the jurisdiction of the Federally-recognized Indian Tribe, or pardoned for an activity under subsection (a) and/or (d) by the State or Federal government, no individual may be eligible for election or appointment to, or to continue to serve on, the Commission, who: …

(b) Has been determined by the Tribe to be a person whose prior activities, criminal record if any, or reputation, habits, and associations pose a threat to the public interest….

‘Related’:

‘Related’:

- Brown Co. Case No. 2013CF92,

Wisconsin v. Nelson W. Ninham

1. Possession of THC

2. OWI (2nd)

3. Operate with Restricted Controlled Substance (2nd)

- Brown Co. Case No. 2013CT144,

Wisconsin v. Nelson W. Ninham

1. Possession of THC (2nd+ Offense)

2. OWI (2nd)

- Brown Co. Case No. 2009CT1633,

Wisconsin v. Nelson W. Ninham

1. Cause injury while under Influence

- Brown Co. Case No. 2006CM804,

Wisconsin v. Nelson W. Ninham

1. Possession of THC

2. Possess Drug Paraphernilia

- Brown Co. Case No. 2003CM1853,

Wisconsin v. Nelson W. Ninham

1. Disorderly Conduct

2. Battery

- Outagamie Co. Case No. 2001CM1348,

Wisconsin v. Nelson W. Ninham

1. 4th Degree Sexual Assault

_____________________

07/26/17 : From an Email by the ONWI Communications Dept.:

The results of the Oneida Gaming Commission in the 2017 General Election recount resulted in a tie between [exiting OBC Chair] Cristina Danforth and [exiting OBC Vice-Chair] Melinda Danforth.

The Election Board conducted a lot drawing for a tie within the [ONWI] Gaming Commission which had resulted from a requested recount. The lot drawing took place at noon on July 26, 2017, pursuant to the Election Law Section 102.11-4, and the winner of the lot drawing is

Cristina “Tina” Danforth.

_____________________

08/17/17 : August 17, 2017 ONWI Business Committee Special Meeting Minutes

08/17/17 : August 17, 2017 ONWI Business Committee Special Meeting Minutes

For the record: Secretary Lisa Summers stated Cristina (Danforth) was taking her oath of office for two boards and it was for the Commission on Aging and the Gaming Commission.

_____________________

![]()

08/29/17 : August 29, 2017 Cease & Desist / Threat Letter Postmarked 08/30/2017 from ONWI Law Office / OLO Staff Attorney Krystal John to Oneida Eye Publisher Leah Sue Dodge re: use of the ONWI ‘Oneida Casino’ logo in a native news / educational /

08/29/17 : August 29, 2017 Cease & Desist / Threat Letter Postmarked 08/30/2017 from ONWI Law Office / OLO Staff Attorney Krystal John to Oneida Eye Publisher Leah Sue Dodge re: use of the ONWI ‘Oneida Casino’ logo in a native news / educational /

crime-fighting blog

Dear Ms. Dodge,

The Oneida Casino was made aware of the Oneida Eye’s unauthorized use of the Oneida Casino’s logo on a recent blog entry discussing the July 2017 election. The Oneida Casino’s logo is proprietary to the Oneida Casino. As permission was not provided for the Oneida Eye’s use of the Oneida Casino’s logo, the Oneida Casino respectfully requests that the logo be removed from the blog page and that the Oneida Eye refrain from any future use of the Oneida Casino’s logo on its blog page.

If the Oneida Casino’s logo is not removed from the Oneida Eye’s blog page within three (3) business days from the date of this letter, the Oneida Casino may consider legal enforcement of its request for removal.

The Oneida Casino appreciates your understanding and your timely response to its noted concern.

Sincerely,

ONEIDA LAW OFFICE

By: Krystal L. John,

Staff Attorney

Wisconsin State Bar No. 1093818CC: Interoffice with Return Receipt at Oneida Casino

Oneida Casino General Manager,

Louise Cornelius

09/22/17 : USA TODAY / Milwaukee Journal Sentinel:

Matthew Krueger nominated by President Trump to be U.S. Attorney for Eastern District of Wisconsin

09/27/17 : September 27, 2017 Plea Agreement, U.S. District Court for the Eastern District of Wisconsin, Case No. 17-CR-92, United States of America v. Jay L. Fuss [Fmr. Oneida Housing Authority Construction Supervisor]

09/27/17 : September 27, 2017 Plea Agreement, U.S. District Court for the Eastern District of Wisconsin, Case No. 17-CR-92, United States of America v. Jay L. Fuss [Fmr. Oneida Housing Authority Construction Supervisor]

See also: Whistleblower Report to FBI about alleged HUD Funding & Materials Theft from Oneida Housing Authority, as well as claims of retaliatory physical violence:

• February 21, 2016 Dawn M. Delebreau Privacy Act Release Form & Report to U.S. Sen. Tammy Baldwin regarding FBI investigation of Case No. 194B-MW477598

• Sauk Co. Case No. 2013CF208, State of Wisconsin vs. Spencer A. Cornelius; Substantial Battery / Intend Bodily Harm (Felony; Repeater), regarding Spencer Cornelius’ brutal assault on fellow OHA employee Jonathan Delabreau during an OHA training trip to the Wisconsin Dells when harassment & intimidation of Jonathan just wasn’t enough to satisfy Spencer’s bloodlust, and was allegedly done in order to please Spencer’s and Jonathan’s boss, former OHA Construction Superintendent Jay Fuss. That assault was not the first time Spencer Cornelius has violently attacked people as seen by Brown Co. Case No. 2009CF630

Previously on Oneida Eye:

Previously on Oneida Eye:

September 18, 2017 Press Release:

Members of Oneida Nation of WI electorate file Petition to retain CA law firm Gross & Klein LLP as legal representation for General Tribal Council

Wisconsin tribe members seek to recover losses & damages from ‘green’ fraud schemes

Oneida, WI – On Monday, September 18, 2017, at 8:00 a.m., enrollees of the Oneida Nation of Wisconsin (ONWI) delivered to the ONWI Business Committee (OBC) Secretary’s Office a Petition signed by 124 members of the General Tribal Council (GTC – the Tribe’s governing body) in order to convene a special GTC meeting to hear a presentation from Gross & Klein LLP and to vote on retaining the California law firm’s services with the aim of recovering millions of dollars in losses and damages from ‘green energy’ fraud schemes.

On July 17, 2017, the ONWI GTC adopted new requirements for the OBC’s processing of GTC petitions and the scheduling of GTC meetings: “General Tribal Council petitions submitted to the Tribal Secretary’s Office shall be processed and a General Tribal Council meeting be convened within 120 days of receipt by the Tribal Secretary’s Office.”

On June 28, 2017, ONWI-chartered Oneida Seven Generations Corporation (OSGC) and its Delaware-registered subsidiary, Green Bay Renewable Energy LLC (GBRE), filed an appeal with the 7th Circuit Court (Case #17-2341) following U.S. District Court Judge William Griesbach’s June 6, 2017 Order granting the dismissal of OSGC & GBRE’s December 23, 2016, lawsuit against the City of Green Bay in the Eastern District of WI (Case #16-C-1700). Chief Judge Griesbach’s August 24, 2017 Order stated, “Pursuant to Circuit Rule 33, briefing in this appeal is SUSPENDED pending further court order.”

OSGC & GBRE’s lawsuit stems from the City’s Common Council’s 2012 vote to rescind a Conditional Use Permit for OSGC to build a facility purported to safely and profitably convert trash to electricity and other products. Some ONWI members contend that the endeavor was another version of long-time OSGC-associate and Lawrence / De Pere, WI, resident Ron Van Den Heuvel’s international “Green Box Investment Fraud Scheme” currently under investigation by the Brown County Sheriff’s Office and five federal agencies.

OSGC & GBRE are represented by the Wisconsin law firm of Godfrey & Kahn S.C., which successfully sued Green Box NA Green Bay LLC for breach of contract on behalf of individual investor Dr. Marco Araujo (Brown Co. Case # 13-CV-463), and prevailed on appeal (WI Court of Appeals, District III, Appeal # 2014AP2846).

Araujo was later joined in another lawsuit against Green Box NA Green Bay LLC (Brown Co. Case #15-CV-769) with GBNAGB creditors as Co-Plaintiffs, including the Wisconsin Economic Development Corp. (WEDC). From 2009 to 2011 the WI Dept. of Commerce and quasi-public WEDC loaned $1.2 million to Green Box NA Green Bay, LLC, $2 million to OSGC, and another $2 million loan to OSGC subsidiary Oneida Energy, Inc.

In July 2015, the Brown County WI Sheriff’s Office issued Search Warrants for Van Den Heuvel and Green Box NA Green Bay LLC, and GBNAGB subsequently filed bankruptcy in April 2016 (USBC, Eastern WI, Docket #16-24179).

Ron Van Den Heuvel and his wife, Kelly Van Den Heuvel, also face federal bank fraud charges for schemes using straw borrowers (USDC, Eastern WI, Docket # 16-CR-64). Co-conspirator Paul Piikkila, a former loan officer and former Interim Director of the Green Detroit Regional Center’s EB-5 Immigrant Investor program regarding another Green Box NA endeavor in Michigan, has already pled guilty for his role.

Additional counts were added regarding fraudulent loan applications by Ron’s son-in-law / employee using two vehicles owned by Green Box NA parent-company Reclamation Technology Systems (RTS), formerly known as Environmental Advanced Reclamation Technologies HQ LLC (EARTH, previously known as Nature’s Choice Tissue Corp., a different entity than either Nature’s Way Tissue Corp. – in which OSGC was Ron’s partner – and a different company than the ‘other EARTH,’ Everett Advanced Reclamation Technology HQ LLC, which was administratively dissolved on September 16, 2017). RTS is currently under the management of Stephen A. Smith of Chicago-based Glenarbor LLC / Glenarbor Partners Inc.

Gross & Klein LLP has focus areas in representing Native American tribes and in complex civil litigation and cases involving antitrust and trade law, as well as in cases involving environmental and natural resource issues.

“General Tribal Council will have an opportunity to select its own legal representation, as guaranteed by the ONWI Constitution, and have attorneys advocate for the interests and rights of the full ONWI membership. In order to have someone look out for all of us, GTC needs to hire legal representation that isn’t related to any of us,” said petition organizer Leah Sue Dodge.

Watch below as Oneida Eye’s Publisher confronts the ONWI Business Committee at the reconvened April 23, 2017 GTC Annual Meeting about OBC Treasurer Trish King and the ONWI Finance Department publishing a FRAUDULENT OSGC CORPORATE REPORT in the FY2017 GTC ANNUAL MEETING PACKET, which was reprinted word-for-word & number-for-number from the FY2012 GTC Annual Meeting Packet…

…yet the FY2012 Report contained a disclaimer noting that it was based on FY2010 data…

Please note this information is from FY2010. As of the date of printing, Oneida Seven Generations [Corp.] had not provided audited financial statements.

…but THERE WAS NO DISCLAIMER in the FY2017 GTC Packet that OSGC’s report reused information that was SEVEN YEARS OLD:

The fraudulently ‘recycled’ FY2012 OSGC Report admits:

In FY2008, a $4,000,000 loss was written off due to the closing of Nature’s Way [Tissue Corp].

Watch current OBC Vice-Chair Brandon Stevens claim that OSGC’s Nature’s Way Tissue Corp. partner “Ron Van Dan Heuvel was not a part of [OSGC’s pyrolysis] plans”…

…and during the July 17, 2017 GTC Semi-Annual Meeting as Fmr. OBC Chair Cristina Danforth continues to voice her support OSGC’s failed & fraudulent pyrolysis endeavors despite the fact that GTC voted on May 5, 2013 to prohibit OSGC from engaging in pyroysis on the ONWI Reservation and voted on December 15, 2013 to direct the OBC to DISSOLVE OSGC after they were caught doing it anyway:

Why is Fmr. OBC Chair Tina Danforth – who is also President of the Native American Finance Officers Association (NAFOA) and Board member of the Native American Bank NA (NABNA) – such a devoted pyrolysis cheerleader?

An AUGUST 15, 2011 DOCUMENT

provided by ONEIDA TIMES Publisher YVONNE METIVIER re: Statements made by former OSGC Secretary MIKE METOXEN to former OBC Chair EDWARD DELGADO about four (4) Wisconsin-registered corporate entities formed by OSGC for purpose of the “biomass grant project” named the following OSGC subsidiaries:

• Oneida Recycling Solutions, LLC

• Broadway Manufacturing, LLC, and

Italicized notes at the end of the Memo state

the “biomass pyrolysis device”

was being sold to OSGC by…

…and the notes said that the seller of the biomass pyrolysis device was in delinquent status with WDFI as of 04/04/11.

HOWEVER . . .

Oneida Eye believes “Alliance Energy Alliance, LLC” is a typo and was actually in reference to a company that the Oneida Nation of WI’s General Tribal Council was never informed even existed –

– which was registered w/ WDFI on 05/13/09 and delinquent as of 04/01/11; Registered Agent Mark Anthony Sweet; Principal Office:

2994 E. Service Road, Oneida, WI, 54155.

MEANING THAT COMPANY SHARES

THE EXACT SAME ADDRESS AS

ONEIDA BUSINESS COMMITTEE

CHAIR & FORMER OBC TREASURER

CRISTINA DANFORTH’s

OWN PERSONAL FAMILY BUSINESS

. . .

MARK ANTHONY SWEET is also the listed as being the Manager of…

ALL NATIONS DEVELOPMENT ALLIANCE, LLC

registered w/ Minnesota Secretary of State on 04/04/10;

Registered Office: 7241 Ohms Ln. #275, Edina, MN, 55439; Principal Office: 350 N. Main Street, Suite 236, Stillwater, MN, 55082.

THINK

ABOUT THAT

OBC & OSGC tried

to convince the ONWI

General Tribal Council

to borrow millions in loans

to buy a ‘machine’ from

a company located in

a rez bar owned by

Cristina Danforth

(fmr. OBC Treasurer,

exiting OBC Chair)

whose sister

Caterina ‘Cathy’ Delgado

was on

OSGC’s

Board of Directors

which the OBC ‘oversees.’

Cristina Danforth obtained & defaulted in bankruptcy on loans against her drinking establishment …

(and secret energy company headquarters) from…

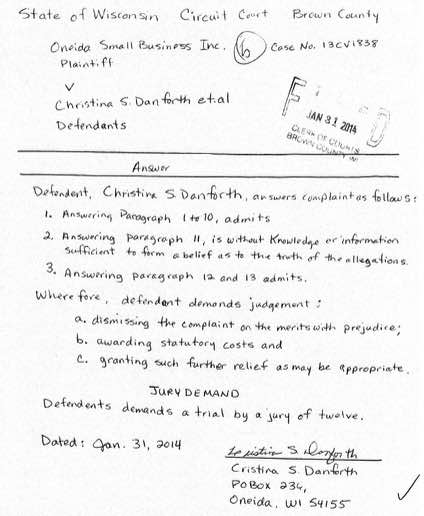

According to court documents in Brown County Case No. 2013CV1838, Oneida Small Business, Inc. v. White Eagle Sports Bar & Grill, LLC, Paul Danforth, and Cristina Danforth:

On November 18, 2009, Defendant, White Eagle Sports Bar & Grill, LLC, delivered to Plaintiff a Business Note for consideration. The Note was in the sum of $48,925.16. On August 18, 2006, Defendants, White Eagle Sports Bar & Grill, LLC, Cristina Danforth and Paul Danforth, signed a General Business Security Agreement pledging assets of the LLC as collateral on the Business Note and on August 18, 2006, Defendant, Cristina Danforth, married to Paul Danforth at the time, signed a Continuing Guaranty (Unlimited), personally guaranteeing the loans of White Eagle Sports Bar & Grill, LLC.

…As of November 13, 2013, the date of Plaintiff’s Summons and Complaint, there is owed the sum of $54,358.80, comprised of principal, accrued interest and late charges. Interest against the principal accrues at 4.0% interest.

…Cristina Danforth, in her Answer to the Summons and Complaint in this case, did not deny she was in default on the note.

As a result of the defaults in payment, Plaintiff, as it is entitled to do under the note, has declared the indebtedness immediately due and payable and demands payment in full and surrender of the business assets which secures repayment of the indebtedness.

…In her answer, Defendant, Cristina Danforth, failed to state any valid counter claim or defense relating to her failure to make payments on the note as they became due.

Excerpt from Defendant Tina Danforth’s handwritten Answer (with her own name misspelled TWICE):

Defendents [sic] demands

a trial by a jury of twelve.

[Oneida Eye suspects that Tina Danforth will eventually get to have at least one trial by jury.]

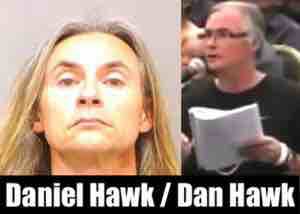

Watch as OSBI Registered Agent Dan Hawk and OSGC & GBRE’s counsel – Attorney Joe Nicks of Godfrey & Kahn SC encourage the ONWI GTC to sue OSGC’s victim – the City of Green Bay – rather than file lawsuits against the fraudsters who utilized ONWI officials & Tribally-owned OSGC’s corporate officers & executives to defraud the ONWI General Tribal Council of tens of millions of dollars in what can only be described as Racketeering Influenced Corrupt Organization / RICO activities.

Note that the vote to allow and encourage OSGC & GBRE to foolishly (or malfeasantly) file suit against the City of Green Bay was merely an ‘Amendment’ to a Main Motion which was itself tabled for over three months and thus died according to Robert’s Rules of Order as used by the GTC…

which means the Amendment to sue Green Bay died with it.

But did OSGC & GBRE let that stop them?

Of course not!

![]()

![]()

![]()

Here’s how that sandwich went down:

- December 23, 2016 Complaint & Jury Demand, U.S. District Court, Eastern District of Wisconsin, Docket No. 16-CV-1700, Oneida Seven Generations Corporation & Green Bay Renewable Energy, LLC v. City of Green Bay

________________

- February 7, 2017 Defendant’s Motion to Dismiss Plaintiffs’ Complaint, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 1:16-cv-01700, OSGC & GBRE v. City of Green Bay

- February 7, 2017 Memorandum with Exhibits in Support of Defendant’s Motion to Dismiss Plaintiffs’ Complaint, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 1:16-cv-01700, OSGC & GBRE v. City of Green Bay

• February 7, 2017 Declaration of Leah Sue Dodge in Support of Defendant’s Motion to Dismiss Plaintiffs’ Complaint for Lack of Capacity to Sue, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 1:16-cv-01700, OSGC & GBRE v. City of Green Bay

• February 7, 2017 Declaration of Gregg J. Gunta in Support of Defendant’s Motion to Dismiss Plaintiffs’ Complaint for Lack of Capacity to Sue, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 1:16-cv-01700, OSGC & GBRE v. City of Green Bay

________________

- February 28, 2017 Plaintiffs’ Response in Opposition to Defendant’s Motion to Dismiss the Complaint, U.S. District Court, Eastern District of Wisconsin, Case#1:16-cv-1700, OSGC & GBRE v. City of Green Bay

• February 28, 2017 Affidavit of Amber C. Coisman w/ Exhibits A–G, U.S. District Court, Eastern District of Wisconsin, Case#1:16-cv-1700, OSGC & GBRE v. City of Green Bay

• February 28, 2017 Affidavit of Lisa Summers w/ Exhibit A, U.S. District Court, Eastern District of Wisconsin, Case#1:16-cv-1700, OSGC & GBRE v. City of Green Bay

________________

- March 14, 2017 Reply in Support of Defendant’s Motion to Dismiss Plaintiffs’ Complaint, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 1:16-cv-01700, OSGC & GBRE v. City of Green Bay

• March 14, 2017 Second Declaration of Gregg J. Gunta in Support of Defendant’s Motion to Dismiss the Complaint for Lack of Capacity to Sue, OSGC & GBRE v. City of Green Bay

________________

- June 6, 2017 Decision and Order Granting Motion to Dismiss, U.S. District Court for the Eastern District of Wisconsin, Case No. 16-CV-1700, OSGC & GBRE v. City of Green Bay

CONCLUSION

For the reasons set forth above, the City’s motion to dismiss pursuant to Rule 12(b)(6) for failure to state a claim is granted.

But did OSGC & GBRE let that stop them?

Of course not!!

- June 28, 2017 Court Documents for the U.S. 7th Circuit Court of Appeals, Docket No. 17-2341, Oneida Seven Generations Corp. / OSGC & subsidiary Green Bay Renewable Energy, LLC / GBRE v. City of Green Bay

________________

- August 24, 2017 ORDER re: U.S. Seventh Circuit Court Rule 33, Court of Appeals Docket No. 17-2341, Oneida Seven Generations Corp. and OSGC subsidiary Green Bay Renewable Energy, LLC / GBRE v. City of Green Bay

Pursuant to Circuit Rule 33, briefing in this appeal is SUSPENDED pending further court order.

Some local media outlets even reported on it… eventually:

- September 11, 2017 Green Bay Press-Gazette:

Oneida Tribe appeals ruling in lawsuit against Green Bay over waste-to-energy plant

Oh, look! What do we have here?

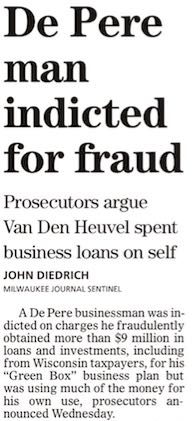

- September 20, 2017 U.S. Dept. of Justice Press Release, ‘De Pere Businessman Indicted for $9 Million Green Energy Fraud’

United States Attorney Gregory J. Haanstad, of the Eastern District of Wisconsin announced that the grand jury indicted Ronald Van Den Heuvel (age: 62) of De Pere, on wire fraud and money laundering charges today. The indictment alleges that Van Den Heuvel fraudulently obtained over $9 million in loans and investments for his eco-friendly “Green Box” business plan but diverted much of the funds to his own purposes.

From 2011 through 2015, Ronald Van Den Heuvel was a businessman in the Green Bay area promoting his Green Box process. The indictment alleges that Van Den Heuvel claimed that the Green Box process could turn post-consumer waste from sources like fast food restaurants completely into usable consumer products and energy. Van Den Heuvel obtained over $9 million in loans and investments, having falsely pledged to use the funds for Green Box operations. Van Den Heuvel spent much of the funds to pay old debts and personal expenses, including a new Cadillac Escalade, pricey Green Bay Packers tickets, and court-ordered support payments to his ex-wife.

As alleged in the indictment, Van Den Heuvel defrauded a range of victims, including individual acquaintances, the Wisconsin Economic Development Corporation (WEDC), a Canadian private investment firm, and Chinese investors in the EB-5 immigrant investor program. In October 2011, the WEDC provided Green Box NA Green Bay, LLC, one of Van Den Heuvel’s companies, with a loan of $1,116,000. The funds were to be used solely to purchase certain equipment to allow for the creation of 116 jobs in a Green Box operation in De Pere, Wisconsin. Instead, Van Den Heuvel diverted large amounts of WEDC funding to his own ends and then submitted false certifications claiming to have spent the funds properly. In addition, in January 2012, the WEDC awarded Green Box NA Green Bay, LLC with a $95,500 grant to reimburse the company for the costs of training new workers. To draw the grant funds, Van Den Heuvel submitted fraudulent time records for training that never happened.

Separately, the United States Securities and Exchange Commission (SEC) announced today that it filed a civil lawsuit against Van Den Heuvel and Green Box Detroit, LLC, in the United States District Court for the Eastern District of Wisconsin. The SEC alleges that Van Den Heuvel violated securities laws by defrauding the Canadian investment firm and EB-5 investors. The case is United States Securities and Exchange Commission v. Ronald Van Den Heuvel and Green Box NA Detroit, LLC, Case No. 17-CV-1261.

Counts One to Ten of the indictment charge Van Den Heuvel with executing the scheme to defraud by use of interstate wire communications, in violation of Title 18, United States Code § 1343. On each of these counts, the maximum penalty is imprisonment for not more than twenty years, a fine of not more than $250,000, or both, plus a mandatory $100 special assessment and a period of supervised release not to exceed three years.

Counts Eleven through Fourteen charge Van Den Heuvel with unlawful financial transactions involving the ill-gotten gains, in violation of Title 18, United States Code § 1957. On each of these counts, a convicted defendant would face imprisonment for not more than 5 years, a fine of not more than $250,000, or both, plus the mandatory $100 special assessment and a term of supervised release not to exceed three years.

The criminal case leading to the indictment is being investigated by the Federal Bureau of Investigation and the Federal Deposit Insurance Corporation. The case will be prosecuted by Assistant United States Attorneys Mel S. Johnson, Matthew D. Krueger, and Rebecca L. Taibleson.

An indictment is only a charge and is not evidence of guilt. The defendant is presumed innocent and is entitled to a fair trial at which the government must prove him guilty beyond a reasonable doubt.

#####

For Additional Information Contact: Public Information Officer Dean Puschnig 414-297-1700

[READ USDOJ INDICTMENT BELOW AFTER SEC COMPLAINT]

- September 19, 2017 Complaint, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CV-1261, U.S. Securities and Exchange Commission [SEC] v. Ronald Van Den Heuvel & Green Box NA Detroit LLC

COMPLAINT

The United States Securities and Exchange Commission alleges as follows:

Nature of the Action

1. This case involves misrepresentations and the misappropriation of millions of dollars of investor funds by defendant Ronald Van Den Heuvel. He took advantage of investors who believed that they were investing in a new way to recycle post-consumer waste.

2. Van Den Heuvel lured investors with promises that he would use their funds for an eco-friendly recycling process called the Green Box Process. He claimed that the Green Box Process would take food-contaminated waste and convert it into usable products, such as recycled paper. Van Den Heuvel represented that he would use investor funds to buy equipment, open a Green Box facility, and ultimately help to create a green solution for post-consumer waste.

3. In reality, Van Den Heuvel misappropriated a substantial percentage of the funds contributed by investors. Instead of using investor funds to implement the Green Box Process, Van Den Heuvel used a significant portion of their investments for improper purposes, such as a Cadillac Escalade, payments to his ex-wife, overdue taxes, Green Bay Packers tickets, and cash for himself.

4. Van Den Heuvel took advantage of foreign investors who put their trust in him. In particular, in 2012 and 2014, Van Den Heuvel raised over $3 million from a Canadian asset management firm named Cliffton Equities. Van Den Heuvel promised to use its investment to buy and operate specific pieces of equipment, but in reality, he spent the money as he pleased.

5. Van Den Heuvel also exploited investors from China. Between 2014 and 2015, Van Den Heuvel and his company (Green Box NA Detroit, LLC) raised approximately $4,475,000 in investment proceeds from at least nine investors from China. The investors made their investments through the EB-5 immigrant investor program, which is a U.S. government immigration program for foreign nationals seeking permanent U.S. residency.

6. Van Den Heuvel promised to use the funds from the EB-5 investors from China to develop a Green Box facility in Michigan. In reality, Van Den Heuvel misappropriated millions of dollars, using investor funds to pay unrelated business and personal expenses.

7. Van Den Heuvel made other misrepresentations about the Green Box Process in order to attract funds from investors. He touted a relationship with Cargill and the ability to use a key additive when, in reality, Cargill had terminated the relationship and sued his company. He claimed that tax-exempt bonds would provide approximately $95 million to $125 million in financing when, in reality, he knew that the State of Michigan had all but denied the application. He represented that his company held seven patents when, in reality, it held only one. He also told different investors that their funds had purchased the same pieces of equipment.

8. Based on Van Den Heuvel’s representations, the investors believed that they were investing in a new, environmentally-friendly project to recycle waste. In reality, they unwittingly provided the financing for Van Den Heuvel’s improper spending spree.

Jurisdiction and Venue

9. The Court has jurisdiction over this action pursuant to Sections 20 and 22 of the Securities Act of 1933 [15 U.S.C. §§ 77t and 77v], and Sections 21 and 27 of the Securities Exchange Act of 1934 [15 U.S.C. §§ 78u and 78aa]. Defendants have, directly or indirectly, made use of the means and instrumentalities of interstate commerce, of the mails, or of the facilities of a national securities exchange in connection with the acts, practices and courses of business alleged in this Complaint.

10. Venue is proper in this judicial district pursuant to Section 22 of the Securities Act [15 U.S.C. § 77v], and Section 27 of the Exchange Act [15 U.S.C. § 78aa] because the defendants are inhabitants within this district, transact business within this district, and many of the acts, transactions and courses of business constituting the violations alleged in this Complaint occurred within the jurisdiction of this district.

Defendants

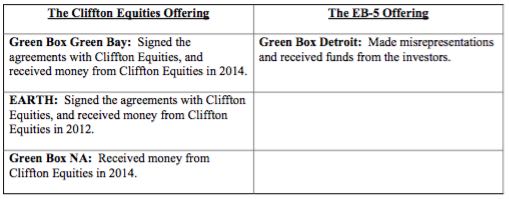

11. This case involves fraud committed by Van Den Heuvel, who used entities that he controlled to help perpetrate his fraud. A number of his “Green Box” companies played a role, some of which have similar names. Defendant Green Box NA Detroit, LLC played a role in the investments by the EB-5 investors. At least three of his other companies – (1) Green Box NA Green Bay, LLC; (2) Environmental Advanced Reclamation Technology HQ, LLC; and (3) Green Box NA, LLC – played a role in the investments by Cliffton Equities. For the sake of clarity, the following table provides a high-level summary of the basic role played by the entities:

12. Defendant Ronald Van Den Heuvel, age 63, resides in De Pere, Wisconsin. During the relevant period, Van Den Heuvel was the Chairman of: (1) Green Box NA Green Bay, LLC; (2) Environmental Advanced Reclamation Technology HQ, LLC; (3) Green Box NA, LLC; and (4) Green Box NA Detroit, LLC.

13. Defendant Green Box NA Detroit, LLC (“Green Box Detroit”) is a Michigan limited liability company. Green Box Detroit was formed in 2014 and is headquartered in De Pere, Wisconsin. Van Den Heuvel was the Chairman and CEO of Green Box Detroit, and he owned and controlled Green Box Detroit during the relevant period.

Other Entities – the Cliffton Equities Offering

14. Green Box NA Green Bay, LLC (“Green Box Green Bay”) is a Wisconsin limited liability company. Green Box Green Bay was formed in 2011 and is headquartered in De Pere, Wisconsin. Van Den Heuvel owned and controlled Green Box Green Bay during the relevant period. Green Box Green Bay was a signatory on the Loan and Investment Agreement with Cliffton Equities dated September 20, 2012, as well as an amended agreement in 2014 and related notes in 2012 and 2014. In April 2016, Green Box Green Bay filed for Chapter 11 bankruptcy protection in the United States District Court for the Eastern District of Wisconsin.

15. Environmental Advanced Reclamation Technology HQ, LLC (“EARTH”) (n/k/a Reclamation Technology Systems, LLC) is a Wisconsin limited liability company. EARTH was formed by Van Den Heuvel in 2008 and is headquartered in De Pere, Wisconsin. Van Den Heuvel owned and controlled EARTH during the relevant period. EARTH was the purported parent company of: (1) Green Box Green Bay, (2) Green Box Detroit, and (3) Green Box NA. EARTH was a signatory on the Loan and Investment Agreement with Cliffton Equities dated September 20, 2012, as well as an amended agreement in 2014 and related notes in 2012 and 2014.

16. Green Box NA, LLC (“Green Box NA”) is a Wisconsin limited liability company. Green Box NA was formed by Van Den Heuvel in 2010 and is headquartered in De Pere, Wisconsin. Van Den Heuvel owned and controlled Green Box NA during the relevant period. Green Box NA is the entity that received most of the funds invested by Cliffton Equities in 2014.

The Facts

17. This case involves fraudulent offerings by Van Den Heuvel. First, Van Den Heuvel defrauded Cliffton Equities. Second, Van Den Heuvel and his company (Green Box Detroit) defrauded EB-5 investors from China and a domestic company that promoted the investments. The two offerings share a common thread: Van Den Heuvel lied about what he would do with their money.

18. Van Den Heuvel enticed investors with promises that he would use their funds to invest in an eco-friendly recycling process called the Green Box Process. He pitched Green Box as an environmentally-responsible way to deal with solid waste, and make money for investors along the way. He claimed that he had created the Green Box Process over a period of years.

19. Van Den Heuvel touted the Green Box Process as a world-changing technology that allowed 100% reclamation of food-contaminated waste. The Green Box facilities allegedly would recycle food-contaminated waste, such as garbage from fast-food restaurants, cafeterias, concession stands, stadiums, and theme parks. The Green Box Process allegedly would transform post-consumer waste into usable products such as recycled paper napkins, facial tissue, and brown and white paper pulp, as well as fuel pellets that could be used to create synthetic gas, electricity, and biodiesel fuel. He claimed that the Green Box Process would result in total solid waste reclamation with zero wastewater discharge and zero landfill deposits.

20. In reality, the Green Box Process largely became a vehicle for Van Den Heuvel to attract money from investors, and then spend it as he pleased.

The Cliffton Equities Offering

21. Cliffton Equities, Inc. is a Canadian company based in Montreal, Canada. Cliffton Equities manages assets for its principals. Cliffton Equities invested with Van Den Heuvel in 2012 and 2014, and is the victim of his fraud. Cliffton Equities was a signatory on the Loan and Investment Agreement dated September 20, 2012, as well as an amended agreement in 2014.

22. Van Den Heuvel defrauded Cliffton Equities in connection with its investments in 2012 and 2014. He made promises to Cliffton Equities about what he would do with its money. Van Den Heuvel represented that he would use the funds from Cliffton Equities to purchase equipment for the Green Box Process, and to pay expenses related to that equipment.

23. In reality, Van Den Heuvel misappropriated a significant portion of the money that Cliffton Equities invested. Instead of using the funds as he had promised, Van Den Heuvel spent its money by paying unrelated business and personal expenses.

Misappropriation of the 2012 Investment

24. In 2012, Van Den Heuvel began communicating with Cliffton Equities about a possible investment in the Green Box Process for his facility in De Pere, Wisconsin. The principals of Cliffton Equities learned about the opportunity by reading a post that Van Den Heuvel had made on an investment website available to the general public. In the post, Van Den Heuvel sought funding for the Green Box Process.

25. Van Den Heuvel told Cliffton’s principals that a certain piece of equipment, known as a pyrolysis or liquefaction unit, was the missing link in the Green Box Process to convert food and plastic waste from the paper pulping process into oil, gas and other useful products.

26. Van Den Heuvel told the principals of Cliffton Equities that he would use its money to purchase and install sorting equipment and a pyrolysis unit made by a particular manufacturer. The principals of Cliffton Equities were attracted by the promises of Van Den Heuvel that he would use their funds to purchase equipment for an eco-friendly manufacturing process.

27. Based on Van Den Heuvel’s representations, Cliffton Equities agreed to invest $2 million in 2012.

28. On or about September 20, 2012, Cliffton Equities entered into a Loan and Investment Agreement (the “Loan and Investment Agreement”) with Green Box Green Bay and EARTH, two entities controlled by Van Den Heuvel. Van Den Heuvel executed the agreement on behalf of Green Box Green Bay and EARTH in his capacity as Chairman.

29. The Loan and Investment Agreement provided that Cliffton Equities would loan $2 million to Green Box Green Bay and EARTH.

30. The Loan and Investment Agreement specified what Van Den Heuvel, through Green Box Green Bay and EARTH, could do with the money invested by Cliffton Equities.

31. The Loan and Investment Agreement provided that “Green Box intends to purchase a pellet processing liquefaction pyrolysis unit (the ‘Equipment’) with funds provided by Lender [defined as Cliffton Equities, Inc.] pursuant to this Agreement.” The Loan and Investment Agreement also provided that Cliffton Equities “agreed to provide,” and Green Box Green Bay and EARTH “agreed to accept,” financing “for purchase of the Equipment.”

32. The Loan and Investment Agreement included a provision about “Use of Loan Proceeds.” The Loan and Investment Agreement provided: “Borrowers [defined as EARTH and Green Box Green Bay] will use the proceeds of the Loan solely for the purposes of purchasing and installing the sorting and liquefaction Equipment, which shall include the purchase price of the equipment, taxes, shipping, installation, and any accessories or improvements necessary to operate the Equipment at Green Box’s facility and working capital to operate sorting, liquefaction and pulping equipment.”

33. Cliffton Equities, Green Box Green Bay, and EARTH also entered into a related agreement that reiterated that the $2 million would be used to purchase a specific piece of equipment. The Security Agreement dated September 20, 2012 stated that Cliffton Equities was providing $2 million “for the purpose of purchasing the Collateral,” and the “Collateral” was defined as a particular “pellet processing liquification pyrolysis unit.” The Security Agreement even identified the equipment by serial number.

34. The Loan and Investment Agreement provided that, upon the occurrence of certain conditions, the outstanding principal would be converted into an equity interest in EARTH in the form of membership units. The conversion into an equity interest would take place if EARTH or certain of its affiliates received $40 million of new debt financing or new equity, or upon the one-year anniversary of the notes, whichever came first.

35. The Loan and Investment Agreement entitled Cliffton Equities to a share of future profits. The Loan and Investment Agreement provided that Cliffton Equities would receive “one-half of the future income generated from pellet processing liquification pyrolysis units (‘LPPUs’) installed at each of the first four (4) geographic locations constructed in the United States after the date of this Agreement.”

36. Green Box Green Bay and EARTH also executed two Promissory Notes (the “2012 Notes”) in favor of Cliffton Equities in connection with the Loan and Investment Agreement. Each of the two 2012 Notes provided that Green Box Green Bay and EARTH would pay $1 million to Cliffton Equities (for a total of $2 million). The 2012 Notes were payable upon the first to occur of (1) EARTH or certain of its affiliates receiving $40 million of new debt financing or new equity; or (2) the one-year anniversary of the notes. Each of the 2012 Notes provided that it would accrue interest at a rate of 8% per year. The 2012 Notes also provided for the monthly payment of interest.

37. Van Den Heuvel executed the 2012 Notes on behalf of Green Box Green Bay and EARTH in his capacity as Chairman of each entity.

38. Cliffton Equities represented in the Loan and Investment Agreement that it was an accredited investor under the Securities Act of 1933. The 2012 Notes also stated that they could not be transferred or resold except as permitted under the Securities Act of 1933.

39. Cliffton Equities invested $2 million in 2012, including $1 million on September 21, 2012 and $1 million on September 28, 2012. Cliffton Equities sent the funds to EARTH.

40. Van Den Heuvel misused the money invested by Cliffton Equities in 2012. In fact, Van Den Heuvel began misappropriating the money within a few days of receipt. Van Den Heuvel misappropriated at least approximately $874,000 of the $2 million that Cliffton Equities invested in 2012.

41. Van Den Heuvel used money invested by Cliffton Equities in 2012 to make unauthorized payments, including at least approximately:

(a) $89,000 to purchase a Cadillac Escalade;

(b) $88,600 for rent for facilities unrelated to the Cliffton Equities investment;

(c) $78,900 for cash withdrawals;

(d) $70,000 to repay investors in other Van Den Heuvel companies;

(e) $65,500 to pay overdue taxes to the State of Wisconsin and the IRS;

(f) $52,200 to pay taxes on Van Den Heuvel’s personal residence;

(g) $44,500 to pay his ex-wife;

(h) $13,300 to pay for a residence in Georgia for his ex-wife;

(i) $40,100 for personal and other charges unrelated to the investment by Cliffton Equities, including credit card payments for stores and restaurants, and dental bills;

(j) $31,700 to pay an accounting firm;

(k) $25,000 to pay his mother-in-law; and

(l) $25,000 for tickets for the Green Bay Packers.

42. In addition, approximately $250,700 of the funds invested by Cliffton Equities in 2012 were garnished to pay an outstanding judgment. Van Den Heuvel never disclosed to Cliffton Equities that its funds could be subject to garnishment.

43. Van Den Heuvel sent interest payments to Cliffton Equities for only a few months. He made the interest payments in part with the principal contributed by Cliffton Equities.

Misappropriation of the 2014 Investment

44. In 2014, Van Den Heuvel raised more money from Cliffton Equities. Once again, Van Den Heuvel claimed a need for more equipment. And once again, Van Den Heuvel misappropriated much of the money that Cliffton Equities had invested.

45. In or about early 2014, Van Den Heuvel told Cliffton Equities that he needed more money for more equipment. He represented that he had used its 2012 investment to purchase a pyrolysis unit, but claimed that the unit was not working properly. Van Den Heuvel asked Cliffton Equities for more capital, and said that it could recoup its 2012 investment by financing the purchase of new equipment. He promised to use the next investment to purchase a different type of pyrolysis unit, called a “Kool unit,” from a different manufacturer. He claimed that the new unit could process old tires in addition to food and plastic waste, and thus was superior to the unit purchased in 2012.

46. In emails and phone calls, Van Den Heuvel told Cliffton Equities that he would use a future investment by Cliffton Equities to purchase two Kool units from the other manufacturer, and that they would cost approximately $650,000 each.

47. Based on Van Den Heuvel’s representations, Cliffton Equities agreed to invest more money in 2014. As before, they entered into an agreement that memorialized Van Den Heuvel’s representations about what he would do with the investment.

48. On or about June 19, 2014, Cliffton Equities entered into an Amended Loan and Investment Agreement (the “Amended Loan and Investment Agreement”) with Green Box Green Bay and EARTH. Van Den Heuvel executed the agreement on behalf of Green Box Green Bay and EARTH in his capacity as Chairman of each entity.

49. The Amended Loan and Investment Agreement provided that Cliffton Equities would loan up to $4,577,944.98 to Green Box Green Bay and EARTH. That figure included the original $2 million under the 2012 Notes and accrued interest, among other things.

50. As before, the Amended Loan and Investment Agreement specified what Green Box Green Bay and EARTH could do with the money from Cliffton Equities.

51. The Amended Loan and Investment Agreement provided that “Green Box intends to purchase baled tire and plastic pellet thermal degradation units, more specifically described in the Amended Restated Security Agreement (the ‘Equipment’) with funds provided by Lender [defined as Cliffton Equities] pursuant to this Agreement.” The Amended and Restated Security Agreement, in turn, identified specific pieces of equipment that Van Den Heuvel would purchase with the investor’s capital as “[a]ny tire or pellet liquefaction thermal degradation units purchased from Kool Manufacturing Company using Loan proceeds, together with all parts and accessories hereafter acquired or received by Grantor [defined as EARTH, Green Box Green Bay, and a third Van Den Heuvel-related entity].”

52. The Amended Loan and Investment Agreement included a provision about “Use of Additional Loan Proceeds.” The Amended Loan and Investment Agreement provided: “Borrowers will use the Additional Loan Proceeds solely for the purposes of (a) purchasing and installing the Equipment, which shall include the purchase price of such equipment, taxes, shipping, installation, and any accessories or improvements necessary to operate the Equipment at Green Box’s facility and working capital to operate the Equipment, and (b) providing funds to complete the Eco Fibre Capitalization, including restarting the Eco Fibre, Inc. facility and providing working capital funds for such facility’s operations.”

53. The Amended Loan and Investment Agreement provided that Cliffton Equities could convert its outstanding loan to membership units in Green Box Green Bay at any time.

54. Green Box Green Bay and EARTH also executed an Amended and Restated Promissory Note (the “2014 Note”) in favor of Cliffton Equities in connection with the Amended Loan and Investment Agreement. The 2014 Note provided that Cliffton Equities had agreed to loan up to $4,577,944.98 to Green Box Green Bay and EARTH. The 2014 Note was payable in 18 months. The 2014 Note provided that it would accrue interest at a rate of 12% per year. The 2014 Note also provided for the monthly payment of interest.

55. Van Den Heuvel executed the 2014 Note on behalf of Green Box Green Bay and EARTH in his capacity as Chairman of each entity.

56. Cliffton Equities represented in the Amended Loan and Investment Agreement that it was an accredited investor under the Securities Act of 1933.

57. Cliffton Equities invested approximately $1,149,940 from June to December, 2014, above and beyond the $2 million that it had invested in 2012. Cliffton Equities sent the funds to two entities controlled by Van Den Heuvel. Cliffton Equities sent most of the funds to Green Box NA, and sent the remaining funds (approximately $99,980) to Green Box Green Bay.

58. Van Den Heuvel misused the money that Cliffton Equities invested in 2014. He spent only a fraction of the funds to purchase one of the promised pyrolysis units. He used a significant portion of the funds to pay unrelated business and personal expenses.

59. In June 2014, Cliffton Equities sent approximately $300,000 to Green Box NA. Van Den Heuvel wired $295,000 of the $300,000 to the manufacturer as a down payment for the first unit. The next day, the manufacturer returned $75,000 as a rebate that Van Den Heuvel never disclosed to Cliffton Equities. Van Den Heuvel, in turn, commingled the funds from the rebate with an account with an existing balance of approximately $8,000. Van Den Heuvel then used the commingled funds to pay for equipment unrelated to the units ($54,451), to pay an intellectual property valuation firm ($7,500), and to pay cash to himself ($3,000).

60. In August 2014, Cliffton Equities sent approximately $99,980 to Green Box Green Bay. Van Den Heuvel, in turn, commingled the funds with approximately $19,000 of other funds. He then used approximately $71,500 to pay the mortgage on the facility operated by Patriot Tissue, a paper converting facility controlled by Van Den Heuvel. He also used approximately $30,000 to pay the former owner of the Patriot Tissue facility.

61. In November and December, 2014, Cliffton Equities sent approximately $750,000 to Green Box NA. Van Den Heuvel, in turn, commingled the funds with approximately $845,000 received from EB-5 investors from China. Van Den Heuvel then misappropriated at least $1 million of the commingled funds, including at least approximately:

(a) $325,000 to repay the individual who promoted the EB-5 investments in connection with the loans he extended to Green Box entities unrelated to the investment by Cliffton Equities;

(b) $233,000 for the benefit of Patriot Tissue, the other paper converting facility controlled by Van Den Heuvel;

(c) $160,000 to pay the former owner of Patriot Tissue;

(d) $170,000 for personal and other expenses unrelated to the investment by Cliffton Equities;

(e) $72,000 to purchase equipment unrelated to the new units, sorting or pulping operations, or Green Box Detroit;

(f) $3,050 for charitable contributions; and

(g) $40,300 for tickets for the Green Bay Packers.

62. Van Den Heuvel never disclosed to Cliffton Equities that its money would be commingled with funds from investors in Green Box Detroit, a separate project in another state.

63. Van Den Heuvel made false and misleading statements to Cliffton Equities about how he would spend its investment. Van Den Heuvel promised to spend its funds to purchase equipment and related expenses, but in reality, he used much of the money to make improper payments that Cliffton Equities never authorized.

64. Van Den Heuvel knew, or was reckless in not knowing, that his representations about how he would use the funds from Cliffton Equities were false and misleading. Van Den Heuvel repeatedly misappropriated the funds from Cliffton Equities. He spent a substantial portion of its money for unauthorized purposes, and often did so within days or weeks of receiving the funds. The misappropriation of investor funds was repeated, substantial, and almost immediate.