TIMELINE PART 13

- CLICK HERE FOR TIMELINE PART 1

- CLICK HERE FOR TIMELINE PART 2

- CLICK HERE FOR TIMELINE PART 3

- CLICK HERE FOR TIMELINE PART 4

- CLICK HERE FOR TIMELINE PART 5

- CLICK HERE FOR TIMELINE PART 6

- CLICK HERE FOR TIMELINE PART 7

- CLICK HERE FOR TIMELINE PART 8

- CLICK HERE FOR TIMELINE PART 9

- CLICK HERE FOR TIMELINE PART 10

- CLICK HERE FOR TIMELINE PART 11

- CLICK HERE FOR TIMELINE PART 12

![]()

![]() 01/02/18 : WLUK – Ron Van Den Heuvel wants to withdraw guilty plea in bank fraud case

01/02/18 : WLUK – Ron Van Den Heuvel wants to withdraw guilty plea in bank fraud case

After two motions to delay the sentencing were denied by Judge William Griesbach, Van Den Heuvel’s attorney filed a motion Tuesday to withdraw his plea, and requested a hearing. …

At the October plea hearing … Van Den Heuvel was … admonished by Judge Griesbach at one point, who told Van Den Heuvel that if the guilty plea was accepted, he couldn’t later argue he was innocent.

- January 2, 2018 Defendant’s Motion to Vacate Plea, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel

- January 2, 2018 Defendant’s Memorandum in Support of Motion to Vacate Plea, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel

- January 2, 2018 Declaration of FDIC Special Agent Sara Hager w/ Exhibits A–C, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel

- January 2, 2018 United States’ Sentencing Memorandum, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel

First, [Ron] Van Den Heuvel’s offense was highly planned and elaborately deceitful. Van Den Heuvel was a sophisticated actor who knew how banks operate, having formed numerous business entities, obtained loans from various banks, and even served on the board of directors for a bank. …

Second, the size, scope, and complexity of Van Den Heuvel’s offense compels significant consequences. Through the use of straw borrowers, Van Den Heuvel obtained no fewer than nine additional loans, totaling over $1 million. … And, Van Den Heuvel went to considerable lengths to conceal that he was actually behind the loans. … This was a long-term, calculated scheme to deceive the bank.

Third, Van Den Heuvel repeatedly manipulated and abused the trust of vulnerable people in his life. Van Den Heuvel put forward not only his business associate Steve Peters and family friend William Bain to obtain loans from Horicon Bank. Van Den Heuvel also took advantage of Julie Gumban, the nanny for his children. … As a live-in nanny, Gumban was dependent upon the Van Den Heuvels for food, shelter, and wages. … The Van Den Heuvels exploited Gumban’s vulnerable position by using her credit cards and convincing her to take out a loan at Horicon Bank. … Van Den Heuvel also roped in his administrative assistant Deb Stary, a subordinate who likely felt compelled to follow her boss’s orders. … And Van Den Heuvel involved his wife, who helped secure two loans for KYHKJG, LLC, and the loan to Gumban, and as a result, was indicted as a co-conspirator. … That was not the last time Van Den Heuvel would enlist his family in fraud. In 2013, Van Den Heuvel offered a job to his son-in- law [Patrick Hoffman] but did not pay him for several months of work. … Van Den Heuvel then convinced his son-in-law to approach several banks with forged pay stubs, which falsely inflated his salary, to seek loans on Van Den Heuvel’s behalf. … Van Den Heuvel’s claim to be a selfless family man simply does not match reality.

Fourth, contrary to Van Den Heuvel’s claim to be driven by “a desire to create and/or maintain functioning corporations,” his offense was driven by greed. Witnesses consistently described the Van Den Heuvels as living a high-end lifestyle that included:

• A riverfront, five-bedroom residence worth at least $1.9 million

• A second home in Florida

• Luxury automobiles, such as two Cadillac Escalades

• A live-in nanny

• Private schools for their children

• Country club memberships

• Frequent dining at expensive restaurants

• Annual trips to Las Vegas

• A private jetThe Van Den Heuvels lived that life even as his businesses failed to generate any significant income. … Earlier in his career, Van Den Heuvel may well have been a successful businessman, able to support that life and engage in philanthropy. Tellingly, most of the charitable efforts Van Den Heuvel cites date from the 1990s. … But by the mid-2000s, Van Den Heuvel’s fortunes had changed, and he was not generating much income. … Rather than scale back his expenses, Van Den Heuvel sought to maintain the image by borrowing money. To keep just ahead of creditors, he kept on borrowing and then pressed others to borrow for him. All the while, Van Den Heuvel continued living far beyond his means, projecting a false image of success and philanthropy. For example, Van Den Heuvel cites his work for the March of Dimes. … Although that service is admirable, at least one of Van Den Heuvel’s contributions to the March of Dimes came from investors’ funds that he represented would be used to promote his Green Box business plan. See Sara Hager Declaration (Jan. 2, 2018). Thus, Van Den Heuvel’s offense was quite like a Ponzi scheme, seeking loan after loan to maintain a mirage of success.

Finally, this offense is especially serious because it targeted a federally insured financial institution. … Congress … provided stiffer sentences for frauds that affect financial institutions. … Van Den Heuvel has thus made a practice of manipulating financial institutions for his personal gain. This makes Van Den Heuvel’s fraud more serious than frauds against other types of victims. If anything, criminal history category I understates Van Den Heuvel’s criminality. … Many other offenders in criminal history category I are first-time offenders who engaged in a one-off offense. That description does not remotely fit Van Den Heuvel. Thus, the Court should consider that Van Den Heuvel has a long history of manipulating others for his personal gain. …

The need for both specific and general deterrence also supports a term of imprisonment. Van Den Heuvel has shown a disturbing, serial pattern of manipulating others over a long period of years. As noted, several years after the Horicon Bank fraud scheme, Van Den Heuvel attempted to defraud other banks through his son-in-law [Patrick Hoffman]. … A period of incarceration is appropriate to prevent Van Den Heuvel from engaging in fraud and to send him a message that such conduct results in real consequences. Likewise, a significant sentence is necessary to deter others in the community who would be tempted to view banks as opportunities to engage in scams. The potential for general deterrence is increased by the fact that Van Den Heuvel and this case are well known in the Green Bay area. Indeed, a light sentence would send the troubling message that crime pays.

01/03/18 : WLUK – Prosecutors oppose Van Den Heuvel’s request to withdraw guilty plea

After two motions to delay the sentencing were denied, Van Den Heuvel filed a motion Tuesday, asking to withdraw his plea.

But in a 14-page response filed Wednesday, federal prosecutors call the motion “delay tactics and gamesmanship” and say it should be denied.

Prosecutors point out Judge William Griesbach had a lengthy conversation with Van Den Heuvel about the his [sic] plea, it being voluntary, and the evidence being used as the basis for the conviction. Van Den Heuvel agreed on all points, prosecutors note.

January 3, 2018 United States’ Opposition to Motion to Vacate Plea, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel

January 3, 2018 United States’ Opposition to Motion to Vacate Plea, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel

- Included in the PDF of the U.S.’s Opposition to Motion to Vacate Plea is a full transcript of the Tuesday, October 10, 2017 Change of Plea Hearing [26 pages]

By now claiming to have pleaded guilty involuntarily, Van Den Heuvel is stating, in effect, that he perjured himself at the plea colloquy.

- January 3, 2018 United States’ Opposition to Motion to Adjourn Sentencing, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel

January 3, 2018 Ron Van Den Heuvel’s Renewed Motion to Adjourn Sentencing, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel

January 3, 2018 Ron Van Den Heuvel’s Renewed Motion to Adjourn Sentencing, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel

01/04/18 : January 4, 2018 TEXT ONLY ORDER as to Ronald H. Van Den Heuvel DENYING MOTION to Withdraw Plea of Guilty and DENYING MOTION to Adjourn sentencing filed by Ronald H Van Den Heuvel, signed by Chief Judge William C Griesbach on 01/04/2017, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel [written decision to follow]

- January 4, 2018 Court-appointed Defense Attorney Robert LeBell Motion to Withdraw, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel

A De Pere businessman will be sentenced as scheduled Friday in a bank fraud case, a judge ruled Thursday – but the defense attorney subsequently asked to withdraw from the case.

Ron Van Den Heuvel has filed three motions to delay the sentencing and one motion to withdraw his guilty plea on a count of conspiracy to commit bank fraud. Federal Judge William Griesbach previously denied two motions to postpone the hearing, and today denied the two most recent motions, according to court records.

After Judge Griesbach entered the order, defense attorney Robert LeBell filed a motion asking to withdraw from the case.

“AS GROUNDS THEREFORE it is maintained that a breakdown in communications has occurred to the extent that further competent representation cannot be provided,” LeBell wrote.

![]()

- January 4, 2018 United States’ Notice of Intent to Withhold Acceptance of Responsibility Recommendation, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel

The United States of America, by and through its attorneys, Gregory J. Haanstad, United States Attorney, and Matthew D. Krueger, Assistant United States Attorneys, hereby gives notice in advance of sentencing that it no longer recommends that the defendant Ronald Van Den Heuvel receive credit for acceptance of responsibility under U.S.S.G. § 3E1.1.

01/05/18 : January 5, 2018 Sentencing Minutes, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel

01/05/18 : January 5, 2018 Sentencing Minutes, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel

- FOX 11 WLUK –

Ron Van Den Heuvel sentenced for bank fraud scheme

GREEN BAY (WLUK) – After multiple legal maneuvers failed to delay Friday’s hearing, Ron Van Den Heuvel was sentenced to three years in federal prison and three years supervised release in a bank fraud scheme.

The owner of De Pere-based Green Box was also ordered to pay $316,445.79 in restitution. …

Judge William Griesbach noted there wasn’t one lapse of judgement; there were seven loans which used straw borrowers to funnel him money. He called Van Den Heuvel’s actions “flagant fraud” which required punishment.

Van Den Heuvel, his wife and Paul Piikkila, who worked at Horicon Bank, were charged with conspiracy to commit bank fraud after illegally obtaining loans for Van Den Heuvel’s business. Piikkila agreed to testify in the case and reached a plea deal. He will be sentenced Feb. 7. The charges against Kelly Van Den Heuvel were dismissed as part of the plea deal with her husband.

Ron Van Den Heuvel pleaded guilty to one count – [which is why] more than a dozen other charges were dismissed – at a hearing in October. …

In the weeks leading up to Friday’s hearing, Van Den Heuvel and his attorney filed three motions to the delay the sentencing, arguing newly discovered evidence would have an impact on the case. Also, Van Den Heuvel tried to withdraw his plea, and his attorney tried to leave the case. Judge Griesbach met privately in chambers with Van Den Heuvel and his attorney for more than 20 minutes Friday before the judge instructed attorney Robert LeBell to finish the hearing today.

Judge Griesbach noted Van Den Heuvel did not own up to his actions, saying there was “little hope of rehabilitation” when he isn’t honest with himself about what he did. …

He also faces prosecution in a second case, which is still pending. A scheduling conference will be held March 16 [2018]. In that case, prosecutors allege Van Den Heuvel raised more than $9 million from investors, including the Wisconsin Economic Development Corp., for his company, Green Box, but used some of the money on personal items, including a car and Packers tickets. If convicted of all 14 counts, he faces up 240 years in prison and more than $2.5 million in fines.

Green Bay Press-Gazette –

Green Bay Press-Gazette –

Ron Van Den Heuvel sentenced to 3 Years in federal prison on bank fraud charges

by Jeff Bollier

GREEN BAY – De Pere businessman Ron Van Den Heuvel will spend three years in prison for using straw borrowers to defraud Horicon Bank and three credit unions.

U.S. District Court Judge William Griesbach on Friday sentenced Van Den Heuvel, 63, on one count of conspiracy to commit bank fraud. Van Den Heuvel will also serve three years of supervision after his release from prison. He will also be required to pay $316,445 in restitution to Horicon Bank.

Griesbach sentenced Van Den Heuvel after denying his request to delay Friday’s hearing for reasons that included a claim that new evidence would exonerate Van Den Heuvel and his attorney’s request to withdraw as counsel.

The judge chastised Van Den Heuvel for trying to delay the 2-year-old case at the last minute.

“Intent to defraud was part of your plea (to the charge),” Griesbach said. “I cannot accept that you lied under oath simply to advance the proceedings. It’s gamesmanship. It will not be tolerated.”

According to court records, Van Den Heuvel worked with Horicon Bank loan officer Paul Piikkila to obtain more than $1 million in loans for Green Box, a recycling company he owned at the time, under the names of Van Den Heuvel’s employees [Steven Peters] and a former relative [William ‘Bill’ Bain]. Prosecutors portrayed the employees and relative as straw borrowers who did not receive the money and were not expected to repay it.

Horicon Bank reported losing more than $700,000 as a result of loans that were issued between Jan. 17, 2008, and Sept. 25, 2009.

Van Den Heuvel claimed one straw borrower, [Julie Gumban] his [Phillipine] live-in housekeeper, reinvested tens of thousands of dollars she earned from investments in his companies. But prosecutors pointed out Van Den Heuvel falsified income statements so the nanny could secure a loan and credit cards that Van Den Heuvel used to pay his expenses.

In another case, he made his administrative assistant [Debra Stary, Bill Bain’s sister in law who Ron ‘browbeat into being VP of OSGC’s Nature’s Way Tissue Corp.,] a board member in one of his limited liability companies [Source of Solutions, LLC] one month before she sought a loan for more than $200,000 via Piikkila and Horicon.

Horicon Bank Executive Vice Presidents Allen Schwab and Jay Vanden Boogart testified during the hearing that Van Den Heuvel’s conspiracy worried customers, left prospective employees concerned about working for the company and hurt Horicon’s employees, who own 25 percent of the bank.

“Horicon sustained a substantial loss beyond the amount of restitution,” Schwab said. “We have sustained a reputational loss, especially in the Fox Valley market. Google ‘Horicon‘ and this fraud case comes up. Customers come in to ask about if their investments are safe.”

Piikkila had been told by bank management to no longer loan money to Van Den Heuvel, according to court documents. He has pleaded guilty to his role in the straw borrower scheme and is scheduled for sentencing next month [February 7, 2018].

Done with delays

Van Den Heuvel pleaded guilty in October to the single fraud charge as part of a plea agreement that dismissed 18 other charges. Charges against his wife, Kelly Van Den Heuvel, were also dismissed under the agreement.After rejecting Van Den Heuvel’s attempt to withdraw his plea, Griesbach said a prison term was warranted based on Van Den Heuvel’s continued insistence that he’d done nothing wrong.

He said Van Den Heuvel’s family support, business acumen, his claims of trying to benefit those who borrowed money on his behalf, and his support of local nonprofits made his decision to conspire to defraud banks all the more disturbing.

“Mr. Van Den Heuvel presents himself as a selfless entrepreneur and philanthropist even today,” Griesbach said. “It is a lie. He can’t admit (his role) to himself, his family or this court. He has delayed the proceedings with motions that are frivolous. It tells us he’s still not gotten the message that what he believes is a lie.”

More charges ahead

Van Den Heuvel will be required to report to prison even as a Securities and Exchange Commission fraud case continues in federal court. In that case, Van Den Heuvel has pleaded not guilty to 14 counts in that case of defrauding Green Box investors out of $9 million.Van Den Heuvel [has long claimed to investor victims that he] spent years developing Green Box and its related companies’ system for converting food-contaminated trash and other waste into new paper products, reusable plastics and other materials.

The effort fell apart as financiers, investors and the Wisconsin Economic Development Corp. filed civil lawsuits against Van Den Heuvel and the limited liability companies under which the business was controlled.

Hisprimarycompany[sic] Green Box NA [Green Bay, LLC –– which is just one of many ‘Green Box’ fronts under actual ‘parent’ company Nature’s Choice Tissue Corp. / aka E.A.R.T.H. / aka Reclamation Technology Systems, LLC ––] filed for federal bankruptcy protection in April 2016. According to court documents, [GBNAGB] had less than $50,000 in assets and more than $10 million in debt.A U.S. Bankruptcy Judge dismissed the [Green Box NA Green Bay, LLC] Chapter 11 reorganization case on [December 27, 2017] based on the investors’ inability to restart the business and the court’s inability to identify assets that could be sold to restart the business and repay Van Den Heuvel’s investors.

The creditors can still individually use state and federal laws to try to recoup their losses, the judge wrote.

01/06/18 :

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

01/08/18 : WBAY – De Pere Businessman Ron Van Den Heuvel sentenced to federal prison for bank fraud

- January 8, 2018 Order Denying Motions to Vacate Plea, Adjourn Sentencing, and for Withdrawal of Counsel, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel

…a “package deal” can be improper and unfairly coercive if the government believes the spouse is wholly innocent of the crime charged and used a phony charge to coerce the defendant to plead guilty. …

Here, there is no suggestion that the government did not believe Kelly Van Den Heuvel was guilty of the crimes with which she was charged, and the information contained in the presentence report supports the government’s belief.

January 8, 2018 Oneida Nation of WI’s Response to Registrant Oneida Indian Nation of NY’s Motion for Suspension of Trademark Cancellation Proceedings, U. S. Patent and Trademark Office Trademark Trial and Appeal Board, Cancellation No. 92066411, Oneida Nation of Wisconsin v. Oneida Indian Nation of New York

January 8, 2018 Oneida Nation of WI’s Response to Registrant Oneida Indian Nation of NY’s Motion for Suspension of Trademark Cancellation Proceedings, U. S. Patent and Trademark Office Trademark Trial and Appeal Board, Cancellation No. 92066411, Oneida Nation of Wisconsin v. Oneida Indian Nation of New York

01/10/18 : Beaver Dam Daily Citizen: De Pere man Ron Van Den Heuvel sentenced to prison for defrauding Horicon Bank

The conspiracy occurred in 2008 and 2009 during which [Ron] Van Den Heuvel held himself out as a successful businessman in the Green Bay area. In January 2008, Van Den Heuvel persuaded Horicon Bank loan officer Paul Piikkila to approve a $250,000 loan to one of Van Den Heuvel’s companies. Thereafter, Horicon Bank officials instructed Piikkila not to loan any additional funds to Van Den Heuvel or his businesses because Van Den Heuvel posed too great a credit risk. To skirt that instruction, Van Den Heuvel and Piikkila arranged a series of loans, totaling more than $1 million to straw borrowers for the benefit of Van Den Heuvel and his business entities. The straw borrowers had no intention of paying back the loans and believed that Van Den Heuvel would be responsible for the loans.

The straw borrowers included Van Den Heuvel’s live-in nanny, who depended upon the Van Den Heuvels for her livelihood. Another straw borrower was Van Den Heuvel’s administrative assistant, whom he named an officer of a limited liability company for the purpose of taking out the loan. The loans generally were not used for the business purposes represented on the loan applications. Van Den Heuvel failed to repay many of the loans. Horicon Bank incurred substantial losses even after trying to recover the collateral pledged for the loans.

01/16/18 :

TUESDAY, 6 PM

JANUARY 16, 2018

__________________

General Tribal Council

SPECIAL MEETING

Oneida Eye Publisher

Leah Sue Dodge’s Petition

was on the Agenda:

Purpose: For GTC to hear a presentation from the law firm of GROSS & KLEIN, LLP about GTC’s options to recover millions of dollars in losses & damages in accordance with the ONWI Constitution, Article IV, Powers of the General Tribal Council, Section 1. (b): “To employ legal counsel, the choice of counsel and fixing of fees,” and for GTC to discuss and vote on retaining GROSS & KLEIN, LLP, which has agreed to represent GTC at a 20% discount.

The PDF above also contains a 2nd page adding more details to the letter below.

What’s worse than vexation without explanation?

Exploitation without Representation

______________________________________

GTC must RETAIN a LAW FIRM focused on

TRIBAL, ENVIRONMENTAL & BUSINESS LAW

to RESEARCH, ADVOCATE, and LITIGATE CLAIMS for

LOSSES & DAMAGES due to FRAUD, NEGLIGENCE & ABUSE

______________________________________

The Oneida Business Committee hires non-tribal attorneys.

Oneida Seven Generations Corp. hires non-tribal attorneys.

The Oneida Constitution GUARANTEES General Tribal Council’s RIGHT to hire non-tribal attorneys to protect GTC’s shared interests and to defend GTC against fraud, negligence, abuse, and exploitation.

GTC has long endured a lack of true ‘due diligence’ at several levels: fiscal, corporate, legislative, legal, judicial, and PR / communications.

GTC has risked 100’s of millions of dollars from lack of accountability by tribal corporations and the OBC and Oneida Law Office, as well as outside attorneys whose ‘real clients’ are the OBC & OSGC – not GTC.

GTC has suffered tens of millions of dollars in losses & damages from complex ‘green energy’ fraud schemes, but various culprits are finally now being sued and prosecuted in local, state, and federal courts!

GTC must exercise its CONSTITUTIONAL RIGHT to retain experienced and successful outside representation to research & recommend ways to recover tens of millions of dollars and advise GTC how we can best protect our health, safety, and welfare, and defend GTC against fraud, negligence, abuse, exploitation & corruption … foreign and domestic.

In order to have someone look out for all of us, GTC needs to retain excellent outside legal representation that isn’t related to any of us.

I trust and recommend Attorney Stuart G. Gross.

Leah Sue Dodge, Tribal ID #9705

Publisher, OneidaEye.com

Excerpt:

Potential Service to the GTC

We understand that members of the GTC are concerned regarding events that have occurred in connection with certain Tribe-owned businesses and, more generally, potential malfeasance by Tribal officials, Tribal agents, and others. We are not in a position to render an opinion on the substance of these concerns, at this stage. However, the experience of other tribes strongly supports the conclusion that it is in the interest of the Tribe and its members that such concerns be independently and expeditiously addressed. Unaddressed, such concerns can, at best, lead to deep fissures within a tribe and, at worst, lead to criminal corruption and even violence among members.

As special outside counsel to the GTC, the firm is prepared to conduct an independent, thorough, and impartial investigation into the substance of such concerns, and, if appropriate and requested by the GTC, pursue claims on behalf of the Tribe against any individual or entity determined to have committed violations of federal or state law against the Tribe. The Firm is further prepared to provide the GTC with assistance, as needed, in developing the appropriate internal oversight mechanisms and regulations to ensure that any problems uncovered in the investigation are not repeated in the future.

Under Article IV, Section 1(c) of the Tribe’s constitution, we understand that the GTC is empowered to engage legal counsel on behalf of the Tribe. Accordingly, the GTC would define the scope of the Firm’s representation and would have control over that representation. This includes the decision whether to pursue claims on behalf of the Tribe in federal or state court and against whom such claims would be pursued.

The Tribe is entitled to pursue claims under federal and state law to the same extent as any other entity; Congress has, in fact, specifically provided federal courts with the jurisdiction to hear claims by federally-recognized Indian tribes for violations of federal law. Such claims could, as appropriate, include claims for damages under federal racketeering laws, as well as claims under state law for fraud, professional negligence, and breach of fiduciary duties.

In short, the Firm, as special counsel, would get to the bottom of matters that have eroded the trust of Tribe members in those acting on the Tribe’s behalf and those with whom the Tribe does business. The Firm can further, if instructed by the GTC, pursue appropriate recovery from any individual or entity who is found to have illegally harmed the Tribe, regardless of any position held by the person within the Tribe or at any third party organization.

Oneida Eye Publisher Leah Sue Dodge

and Atty. Stuart Gross of Gross & Klein

were PREVENTED from even giving

General Tribal Council presentations at the

Jan. 16, 2018 GTC Special Meeting after

an Amendment to delete them from the

Agenda was made by ONWI Land Office

Manager Lori Elm and seconded by

ONWI PR Director Bobbi Webster,

and 700+ of about 1,700 attendees

voted to support unethical censorship

and ongoing corruption & fraud …

so here’s the Petitioner’s

PROHIBITED slideshow

By eliminating Leah Sue Dodge’s Agenda item and presentation to GTC, Lori Elm and Bobbi Webster also helped the Oneida Business Committee and Oneida Law Office to further avoid finally addressing this information from OLO Chief Counsel Jo Anne House’s analysis of the Petition in the GTC Meeting Packet regarding the SECRET MULTIMILLION DOLLAR ‘SETTLEMENT’ paid to Ron Van Den Heuvel’s associates at Generation Clean Fuels LLC by Green Bay Renewable Energy, LLC, about which the OBC, OLO and OSGC have told GTC multiple untruths regarding what looks like a possible extortion arrangement to benefit unscrupulous insiders and reimburse some ‘investors’:

“Upon receipt of the petition submitted by Ms. Dodge, a legal review of the settlement agreement and the actions of the Oneida Nation was conducted. [OSGC-owned, Delaware-registered Green Bay Renewable Energy, LLC, which – like GBRE’s executives & officers – lacks ‘sovereign immunity’] was sent correspondence by the Oneida Law Office that requested the unredacted settlement agreement based on the commitments made by the Oneida Business Committee to the General Tribal Council predating entering into the agreement that the corporation was, or should have been, aware of at the time of entering into the agreement. The settlement agreement resolved all issues between Green Bay Renewable Energy LLC, as well as to other subsidiaries of OSGC [that also – like their executives & officers – lack ‘sovereign immunity’], for a specific sum paid to ACF Leasing LLC and its attorneys. The case was dismissed soon thereafter.

“As identified above the amount of the settlement is subject to a confidentiality clause. However, after a legal review it was determined that the General Tribal Council has a right to be made aware of the amount of the settlement. That right is subject to maintaining confidentiality within the General Tribal Council. As a result, the amount of the settlement will be reported by the Oneida Business Committee and will not be included in this written opinion. Members, upon being made aware of the amount of the settlement, are notified that the amount must be maintained confidential and should not be released to news reports, placed on social media sites, or other public forums.

“OSGC is continuing to press its claims of damages against the City of Green Bay regarding failure to issue a use permit and allowing the conditional use permit to lapse. This initial step of this litigation was decided in the corporation’s favor when the Wisconsin Supreme Court decided that City of Green Bay erred in not issuing a permit.**

“OSGC then filed a lawsuit for damages against the City of Green Bay. The claim was dismissed by the trial court determining that the corporation failed to exhaust its administrative remedies and that it was not precluded from doing so because OSGC alleged the business opportunity had closed with the lapse of various tax incentives and financing opportunities. The corporation appealed the decision and accepted an opportunity to settle the matter with the City of Green Bay in lieu of further litigation. As of the drafting of this opinion, those settlement discussions are ongoing. The corporation has been reminded that any settlement agreement is prohibited from containing a confidentiality clause.”

Generations Clean Fuels had to reimburse private investors after lawsuits were filed by Tina Fritsch, wife of Mike Fritsch who shared office space with Alliance Construction, and David J. Wolf whose NewWay Energy, LLC was a partner with Alliance/P2O Technologies, LLC. Both Fritsch and Wolf had been guaranteed 700% returns on a $250,000 ‘investment’ as seen in court documents:

- April 5, 2014 Plaintiff’s Brief in Support of Summary Judgment, Brown Co. WI Case No. 13CV1065, Tina Fritsch v. Generation Clean Fuels, LLC

- Other Filings & Exhibits regarding Brown Co. Case No. 2013CV1065, Tina Fritsch v. Generation Clean Fuels, LLC (50 pages)

- Royalty Agreement between Generation Clean Fuels, LLC, and David J. Wolf, an exact copy of which was signed by Tina Fritsch

QUESTIONS:

OTHER THAN AN UNDISCLOSED

BIA-BACKED GUARANTEED LOAN,

SAY FOR $20+MILLION OR SO…

(using WHAT as ‘COLLATERAL’?)

…WHERE COULD OSGC SUBSIDIARY

GREEN BAY RENEWABLE ENERGY LLC

EVER BE ABLE TO COME UP WITH

$10+MILLION TO PAY OUT AN

‘UNDISCLOSED SETTLEMENT’

TO RON’S 20-YEAR ASSOCATES

AT GENERATION CLEAN FUELS, LLC

GIVEN THAT GBRE PEFORMED ZERO

‘REVENUE GENERATING ACTIVITY’

DURING ITS ENTIRE EXISTENCE?

Generation Clean Fuels had to reimburse private investors after lawsuits were filed by Tina Fritsch, wife of Mike Fritsch who shared office space with Alliance Construction, and David J. Wolf whose NewWay Energy, LLC was a partner with principals of Alliance GC and P2O Technologies, LLC.

Both Fritsch and Wolf had been guaranteed 700% returns on a $250,000 ‘investment’ as seen in court documents:

- April 5, 2014 Plaintiff’s Brief in Support of Summary Judgment, Brown Co. WI Case No. 13-CV-1065, Tina Fritsch v. Generation Clean Fuels, LLC

- Other Filings & Exhibits regarding Brown Co. Case No. 2013-CV-1065, Tina Fritsch v. Generation Clean Fuels, LLC (50 pages)

- Royalty Agreement between Generation Clean Fuels, LLC, and David J. Wolf, an exact copy of which was signed by Tina Fritsch

______________________

Did Oneida Nation WI officials & corporate executives and their families make their own ‘Royalty Agreement’ side-investments in GCF / ACF Leasing / ACF Services excpecting to become some of the 70+’millionaires’ Ron Van Den Heuvel claimed in a deposition to have made in the Green Bay area?

______________________

Was GCF / ACF’s $400 Million lawsuit against ONWI, OSGC & GBRE, and subsequently Oneida Energy Inc. and individuals who do not have ‘sovereign immunity’…

and the OBC’s fraudulent Letter to GTC mailed in October 2015 – but dated September – which FALSELY stated that any settlement decision would be presented to GTC for action…

and the OBC’s ‘retro-active’ approval of OSGC & GBRE Managing Agent Peter King III‘s unauthorized & undiscolosed multimillion dollar ‘Settlement Agreement’ with GCF / ACF…

actually all just another complex scheme to improperly reimburse ONWI officials & corporate executives or their families and other ‘investors’ for their own ‘Royalty Agreement side-investments’ – without the majority of GTC ever knowing about it – in what amounts to a ‘green energy’ RICO fraud & extortion schemes using Tribal and Wisconsin gaming compact monies – in addition to federal funds?

______________________

Did ONWI-owned Bay Bank – the Board of which includes OSGC Managing Agent Pete King III and former OSGC Board member & current ONWI Legislative Affairs Director Nathan King – ever ‘write off’ any fraudulent loans used for Ron Van Den Heuvel and his several bank fraud scheme ‘straw borrowers’…

including Bill Bain whose son-in-law Matthew Olson who is partners via Crosskeys Investors, LLC with Nature’s Way Tissue Corp. President Artley Skenandore Jr. and having a sweetheart land leasing deal for ONWI-owned property, including where the BP gas station / A&W restaurant operates under the name De Pere Superstore?

According to the USDOJ’s January 2, 2018 United States’ Sentencing Memorandum in U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel

First, [Ron] Van Den Heuvel’s offense was highly planned and elaborately deceitful. Van Den Heuvel was a sophisticated actor who knew how banks operate, having formed numerous business entities, obtained loans from various banks, and even served on the board of directors for a bank. …

Second, the size, scope, and complexity of Van Den Heuvel’s offense compels significant consequences. Through the use of straw borrowers, Van Den Heuvel obtained no fewer than nine additional loans, totaling over $1 million. … And, Van Den Heuvel went to considerable lengths to conceal that he was actually behind the loans. … This was a long-term, calculated scheme to deceive the bank.

Third, Van Den Heuvel repeatedly manipulated and abused the trust of vulnerable people….

…Van Den Heuvel continued living far beyond his means, projecting a false image of success and philanthropy. For example, Van Den Heuvel cites his work for the March of Dimes. … Although that service is admirable, at least one of Van Den Heuvel’s contributions to the March of Dimes came from investors’ funds that he represented would be used to promote his Green Box business plan. See Sara Hager Declaration (Jan. 2, 2018). Thus, Van Den Heuvel’s offense was quite like a Ponzi scheme, seeking loan after loan to maintain a mirage of success.

![]()

![]()

(CORNING, Calif. – August 14, 2015) A federal judge ruled today that the U.S. District Court, Eastern District of California, has subject matter jurisdiction over a lawsuit filed by the Paskenta Band of Nomlaki Indians under the federal Racketeer Influence and Corruption (RICO) Act and other state and federal laws against former Tribal officials and senior employees accused of defrauding the Tribe of tens of millions of dollars. The court rejected claims by defendants that the Tribe’s lawsuit is an intra-tribal dispute and therefore the Court had no jurisdiction to hear any of the Tribe’s claims.

“We are gratified by the Court’s decision. The Tribe brought this action to hold responsible a group of individuals who, for well over a decade, conspired to steal tens of millions of dollars from the Tribe,” the Paskenta Band of the Nomlaki Indians Tribal Council said in a statement. “That stolen money, much of which the Ringleaders used to pay for a lifestyle of private jet travel, sports cars, and luxury homes, could and should have been used to improve the welfare of the Tribe’s members. The Court’s decision today makes clear that these individuals and others who benefited from their scheme will be held responsible for the harms they caused.”

The Tribe’s co-lead counsel Stuart Gross, of Gross Law P.C., added, “With a single sentence, the Court rejected the argument that this case is an intra-tribal dispute over tribal membership and governance over which the Court lacks jurisdiction. The decision sends a clear message that tribal officials who steal from the tribes they are supposed to serve can and will be held responsible in federal courts.The defendants misleadingly defended their conspiracy to defraud the Tribe through arguing the federal courts had no power to review actions that violate federal and Tribal law. The opposite is true; and we are pleased the Court rejected defendants’ attempt to avoid liability on this basis.”

01/23/18 : January 23, 2018 Trademark Trial and Appeal Board’s Decision to Suspend Trademark Cancellation Proceedings pending final disposition of the civil action [17-CV-913, U.S. District Court for Northern District of New York], U. S. Patent and Trademark Office Trademark Trial and Appeal Board, Cancellation No. 92066411, Oneida Nation of Wisconsin v. Oneida Indian Nation of New York

01/23/18 : January 23, 2018 Trademark Trial and Appeal Board’s Decision to Suspend Trademark Cancellation Proceedings pending final disposition of the civil action [17-CV-913, U.S. District Court for Northern District of New York], U. S. Patent and Trademark Office Trademark Trial and Appeal Board, Cancellation No. 92066411, Oneida Nation of Wisconsin v. Oneida Indian Nation of New York

02/01/18 : February 1, 2018 Oneida Nation of WI’s Motion for Reconsideration of the Board’s Order Suspending Proceedings, U. S. Patent and Trademark Office Trademark Trial and Appeal Board, Cancellation No. 92066411, Oneida Nation of Wisconsin v. Oneida Indian Nation of New York

02/12/18 : Green Bay Press-Gazette / USA Today: Green Bay to pay Oneida Seven Generations Corp. $2.5 million to settle lawsuit over waste-to-energy plant

- ABC 2 WBAY: Green Bay to pay Oneida Seven Generations Corp. $2.5 million in waste-to-energy plant lawsuit settlement

- FOX 11 WLUK: Green Bay could pay Oneida Seven Generations Corp. $2.5M to settle suit on waste-to-energy plant

The City Council’s Finance Committee is expected to discuss the settlement proposal at its Tuesday meeting, according to the agenda. And then the full City Council would have to approve the deal.

Once the payment has been made, the lawsuit would be dismissed, according to the five-page settlement agreement[.]

Mayor Jim Schmitt, OSGC Managing Agent Pete King III, and John Breuninger of [OSGC subsidiary] Green Bay Renewable Energy signed the document last month.

ASK YOURSELF:

Why isn’t Green Bay’s insurance company paying the $2.5 Million ‘settlement’?

Maybe the insurance company didn’t want to fund a RICO Extortion Fraud Scheme just because some people in City Hall wanted to intentionally lose the bogus lawsuit in order to cover-up their own misdeeds?

WTF MAYOR SCHMUCK?!

Previously:

02/13/18 : ![]() February 13, 2018 Ron Van Den Heuvel’s Motion to Obtain Sealed Transcript of October 26, 2017 Hearing, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel

February 13, 2018 Ron Van Den Heuvel’s Motion to Obtain Sealed Transcript of October 26, 2017 Hearing, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel

02/13/18 : February 16, 2018 Defendant Paul Piikkila’s Motion to Seal Sentencing Memorandum, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Paul Piikkila

![]() 02/19/18 : VIDEO – February 19, 2018 City of Green Bay Common Council meeting excerpt

02/19/18 : VIDEO – February 19, 2018 City of Green Bay Common Council meeting excerpt

Aldermen voting to support $2.5 Million ‘settlement’/ransom to RICO extortion fraud scheme Oneida Seven Generations Corp.:

- Tom DeWane • Barbara Dorff • Bill Galvin • Joe Moore • David Nennig • Randy Scannell • Tom Sladek • Mark Steuer • John Vander Leest • Chris Wery

Aldermen voting against $2.5 Million ‘settlement’/ransom to RICO extortion fraud scheme Oneida Seven Generations Corp. – which one of the City’s insurers refuses to fund:

- Andy Nicholson

- Guy Zima

02/20/18 : February 20, 2018 Order Granting Defendant Paul Piikkila’s Motion to File Sentencing Memorandum Under Seal, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Paul Piikkila

- February 20, 2018 Sentencing Minutes for Paul Piikkila, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald Van Den Heuvel, Paul Piikkila, Kelly Van Den Heuvel

- February 20, 2018 Status Conference Hearing Minutes re: Ronald Van Den Heuvel, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Ronald Van Den Heuvel

02/21/18 : WLUK – Former Horicon Bank loan officer Paul Piikkila sentenced in bank fraud case

The former bank loan officer who helped arrange illegal loans to Ron Van Den Heuvel was sentenced to three years on probation.

Paul Piikkila, who worked for Horicon Bank, was convicted of conspiracy to defraud for approving a series of loans worth more than $1 million to straw borrowers after the bank told him not to lend more money to Van Den Heuvel.

At Tuesday’s sentencing in federal court, he was also ordered to help pay the $316,445.47 in restitution that Van Den Heuvel has been ordered to pay.

February 21, 2018 Oneida Indian Nation of NY’s Opposition to Oneida Nation of WI’s Motion for Reconsideration of the Board’s Order Suspending Proceedings, U.S. Patent and Trademark Office Trademark Trial and Appeal Board, Cancellation No. 92066411, Oneida Nation of Wisconsin v. Oneida Indian Nation of New York

February 21, 2018 Oneida Indian Nation of NY’s Opposition to Oneida Nation of WI’s Motion for Reconsideration of the Board’s Order Suspending Proceedings, U.S. Patent and Trademark Office Trademark Trial and Appeal Board, Cancellation No. 92066411, Oneida Nation of Wisconsin v. Oneida Indian Nation of New York

02/22/18 : February 22, 2018 Trademark Trial and Appeals Board’s Order Granting Oneida Indian Nation of NY’s Motion to Suspend Proceedings, U.S. Patent and Trademark Office Trademark Trial and Appeal Board, Cancellation No. 92066411, Oneida Nation of Wisconsin v. Oneida Indian Nation of New York

02/22/18 : February 22, 2018 Judgment in a Criminal Case, U.S. District Court, Eastern District of Wisconsin, Case No. 16-CR-64, United States of America v. Paul J. Piikkila

02/23/18 : February 23, 2018 USDOI Reply in Support of Motion to Dismiss w/ Exhibits, U.S. District Court for the Northern District of New York, Case No. 5:17-CV-913, Oneida Indian Nation of New York v. United States Department of the Interior

02/23/18 : February 23, 2018 USDOI Reply in Support of Motion to Dismiss w/ Exhibits, U.S. District Court for the Northern District of New York, Case No. 5:17-CV-913, Oneida Indian Nation of New York v. United States Department of the Interior

02/25/18 : YouTube.com/user/GeorgeWebb

See also: Twitter.com/GeorgWebb (‘e’ omitted)

https://youtu.be/dkecV9ynljI

02/26/18 : February 26, 2018 Oneida Indian Nation of NY’s Letter informing of U.S. Patent & Trademark Office Trademark Trial & Appeal Board’s Order w/ Exhibit, U. S. District Court for the Northern District of New York, Case No. 5:17-CV-913, Oneida Indian Nation of New York v. United States Department of the Interior

02/26/18 : February 26, 2018 Oneida Indian Nation of NY’s Letter informing of U.S. Patent & Trademark Office Trademark Trial & Appeal Board’s Order w/ Exhibit, U. S. District Court for the Northern District of New York, Case No. 5:17-CV-913, Oneida Indian Nation of New York v. United States Department of the Interior

- USA TODAY / Milwaukee Journal Sentinel:

Matthew Krueger is the new U.S. Attorney in the Eastern District of Wisconsin after nomination by President Trump, action by Senate

02/27/18 : February 27, 2018 Summons and Complaint, Brown Co. Case No. 18-CV-245, Ronald Van Den Heuvel v. Philip Reinhart, Steve Smith [Stephen Smith] & Ed Kolasinski

03/02/18 : March 2, 2018 Joint Motion to Amend Discovery, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 16-CV-1217, Oneida Nation of Wisconsin v. Village of Hobart, Wisconsin

03/02/18 : March 2, 2018 Joint Motion to Amend Discovery, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 16-CV-1217, Oneida Nation of Wisconsin v. Village of Hobart, Wisconsin

03/05/18 : March 5, 2018 TEXT ONLY ORDER granting Joint Motion to Amend Discovery Schedule by Oneida Nation of WI, signed by Chief Judge William C. Griesbach on 03/05/2018. All discovery is to be completed no later than April 13, 2018. Dispositive motions are to be filed no later than May 29, 2018. U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 16-CV-1217, Oneida Nation of Wisconsin v. Village of Hobart, Wisconsin

03/07/18 : March 7, 2018 TEXT ORDER granting Oneida Indian Nation of NY’s letter request for Oral Arguments re US DOI’s Motion to Dismiss for Lack of Subject Matter Jurisdiction and Failure to State a Claim, U. S. District Court for the Northern District of New York, Case No. 5:17-CV-913, Oneida Indian Nation of New York v. United States Department of the Interior

03/07/18 : March 7, 2018 TEXT ORDER granting Oneida Indian Nation of NY’s letter request for Oral Arguments re US DOI’s Motion to Dismiss for Lack of Subject Matter Jurisdiction and Failure to State a Claim, U. S. District Court for the Northern District of New York, Case No. 5:17-CV-913, Oneida Indian Nation of New York v. United States Department of the Interior

It is hereby ORDERED that ORAL ARGUMENTS … are set for 4/12/2018 at 12:00 PM in Albany before U.S. District Judge Mae A. D’Agostino. [time changed to 2:00 PM]

03/15/18 : March 15, 2018 Complaint – Jury Trial Demanded by Plaintiff Menominee Indian Tribe of Wisconsin v. Defendants Purdue Pharma LP et al, U.S. District Court, Eastern District of Wisconsin, Case No. 18-CV-414, The Menominee Indian Tribe of Wisconsin v. Purdue Pharma LP, et al

03/15/18 : March 15, 2018 Complaint – Jury Trial Demanded by Plaintiff Menominee Indian Tribe of Wisconsin v. Defendants Purdue Pharma LP et al, U.S. District Court, Eastern District of Wisconsin, Case No. 18-CV-414, The Menominee Indian Tribe of Wisconsin v. Purdue Pharma LP, et al

![]()

- March 15, 2018 Plea Agreement by Fmr. Menominee Tribal Police Officer Basil O’Kimosh Jr., U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-200, United States of America v. Basil L. O’Kimosh, Jr.

03/16/18 : WLUK: Fired Menominee Tribal Police Officer Basil O’Kimosh Jr. convicted in sexting case with teenage girl

GREEN BAY (WLUK) – A former Menominee tribal police officer was convicted Friday of having inappropriate social media contact with a teenage girl.

Basil O’Kimosh Jr. will be sentenced June 11.

The count results in a potential sentence of 15-to-30 years in prison but the parties have agreed to recommend the minimum of 15 years, according to the plea agreement filed Thursday.

According to the criminal complaint, the girl told investigators O’Kimosh first contacted her on Facebook. In the complaint, the girl goes on to say the two continued to communicate frequently on Snapchat while O’Kimosh was working the overnight shift. She says it continued even after O’Kimosh, 39, learned she was only 15. The complaint states O’Kimosh admitted to sending sexual pictures, but denies any intent of having the girl perform sex acts on him.

The Menominee Tribal Police department fired O’Kimosh after learning of the allegations.

MENOMINEE (WLUK) — The Menominee Tribe is suing major companies that manufacture and distribute opioid drugs.

“Menominee continues to endure the most catastrophic effects of this opioid epidemic. We need to hold these manufacturers and distributors accountable,” Menominee Tribal Chairman Douglas Cox said in a news release.

The tribe is going after pharmaceutical companies including Purdue Pharma L.P., Teva Pharmaceutical Industries Ltd., and Allergan PLC, and distributors McKesson Corp., Cardinal Health Inc., and AmerisourceBergen Corp.

They’re accused of marketing prescriptions in a way that hides or minimizes the risk of addiction, as well as failing to abide by the laws that are meant to prevent abuse of prescribed drugs.

March 16, 2018 Telephone Status Conference Minutes, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

March 16, 2018 Telephone Status Conference Minutes, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

The matter is scheduled for a Telephone Scheduling Conference on April 20, 2018 at 3:00 pm. The parties are to be prepared to set a date for trial at that time.

![]() 03/19/18 : March 19, 2018 Decision and Order of Dismissal, U.S. District Court / Eastern Wisconsin, Green Bay Division Case No. 14-CV-1203, Tissue Technology LLC, Partners Concepts Development Inc., Oconto Falls Tissue Inc., and Tissue Products Technology Corp. v. TAK Investments LLC and Sharad Tak

03/19/18 : March 19, 2018 Decision and Order of Dismissal, U.S. District Court / Eastern Wisconsin, Green Bay Division Case No. 14-CV-1203, Tissue Technology LLC, Partners Concepts Development Inc., Oconto Falls Tissue Inc., and Tissue Products Technology Corp. v. TAK Investments LLC and Sharad Tak

03/20/18 : March 20, 2018 Judgment in a Civil Case, U.S. District Court / Eastern Wisconsin, Green Bay Division Case No. 14-CV-1203, Tissue Technology LLC, Partners Concepts Development Inc., Oconto Falls Tissue Inc., and Tissue Products Technology Corp. v. TAK Investments LLC and Sharad Tak

- March 20, 2018 Docket Entry Notification of March 21, 2018 Status Hearing reset to May 31, 2018, U.S. District Court, Northern District of Illinois, Eastern Division, Docket No. 17-CV-108, RNS Servicing, LLC v. Spirit Construction Services, Inc., Steven Van Den Heuvel, ST Paper, LLC and Sharad Tak

![]() 03/27/18 : March 27, 2018 Stipulation to Dismiss Appeal by Appellants OSGC and GBRE LLC and Appellee City of Green Bay, U.S. Seventh Circuit Court of Appeals Docket No. 17-2341, Oneida Seven Generations Corp. and OSGC subsidiary Green Bay Renewable Energy, LLC / GBRE v. City of Green Bay

03/27/18 : March 27, 2018 Stipulation to Dismiss Appeal by Appellants OSGC and GBRE LLC and Appellee City of Green Bay, U.S. Seventh Circuit Court of Appeals Docket No. 17-2341, Oneida Seven Generations Corp. and OSGC subsidiary Green Bay Renewable Energy, LLC / GBRE v. City of Green Bay

03/28/18 : March 28, 2018 Order dismissing appeal pursuant to Federal Rule of Appellate Procedure 42(b), U.S. Seventh Circuit Court of Appeals Docket No. 17-2341, Oneida Seven Generations Corp. and OSGC subsidiary Green Bay Renewable Energy, LLC / GBRE v. City of Green Bay

03/29/18 :

![]() March 29, 2018 TAK Investments, LLC’s Amended Affirmative Defenses and Counterclaim, U.S. District Court / Eastern Wisconsin, Green Bay Division Case No. 14-CV-1203, Tissue Technology LLC, Partners Concepts Development Inc., Oconto Falls Tissue Inc., and Tissue Products Technology Corp. v. TAK Investments LLC and Sharad Tak

March 29, 2018 TAK Investments, LLC’s Amended Affirmative Defenses and Counterclaim, U.S. District Court / Eastern Wisconsin, Green Bay Division Case No. 14-CV-1203, Tissue Technology LLC, Partners Concepts Development Inc., Oconto Falls Tissue Inc., and Tissue Products Technology Corp. v. TAK Investments LLC and Sharad Tak

03/30/18 : March 30, 2018 Order, U.S. Tax Court Docket No. 21583-15, VHC Inc. and Subsidiaries v. Commissioner of Internal Revenue Service [IRS]

ORDERED that, on or before April 20, 2018, the parties shall file a written status report (preferably a joint status report), informing the Court of the differences in the above-referenced Computations for Entry of Decision.

04/03/18 : April 3, 2018 USA’s Motion to Amend Defendant Ronald Van Den Heuvel’s Conditions of Release w/ Exhibits, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel [129 pages]

04/03/18 : April 3, 2018 USA’s Motion to Amend Defendant Ronald Van Den Heuvel’s Conditions of Release w/ Exhibits, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel [129 pages]

I. BACKGROUND

Defendant Ronald Van Den Heuvel has been under court supervision since April of 2016, when he was first indicted in case number 2016-CR-64. Van Den Heuvel has now been sentenced in that case for conspiracy to commit bank fraud, and he is under a court order to pay $316,445.47 in restitution to the victim (2016-CR-64, Dkt. 184). Van Den Heuvel was also sentenced to a term of 36 months’ imprisonment, but he has not yet been remanded to the custody of the Bureau of Prisons.

Van Den Heuvel was indicted a second time in September of 2017 in this case (2017- CR-160), in which he faces charges of wire fraud and money laundering. The Court imposed the same conditions of release and supervision in this case as in the first one, which include a requirement that Van Den Heuvel refrain from violating any federal, state, or local laws (2017- CR-160, Dkt. 5).

In recent months, the Government has learned about multiple questionable financial transactions initiated by Van Den Heuvel since he has been under court supervision. The Government has not completed its investigation of these transactions. Given their frequency, size, and indicia of fraud, however, the Government seeks to update the Court about these transactions and to modify Van Den Heuvel’s conditions of release to prevent this conduct going forward. In the Government’s view, a modification of Van Den Heuvel’s conditions of release is necessary to protect the public as well as Van Den Heuvel’s previously identified victims, who are statutorily entitled to restitution.

The information that follows is based upon interviews with witnesses, a review of documents provided by those witnesses, and information received from the U.S. Probation Office. The Government has consulted with the U.S. Probation Office and that Office has agreed that, given the complexity of Van Den Heuvel’s transactions, the Government should present this material directly to the Court.

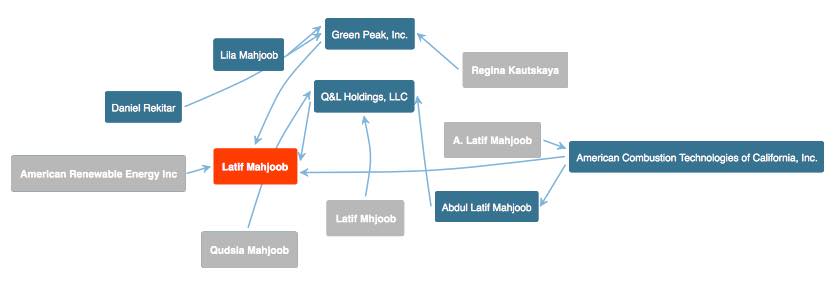

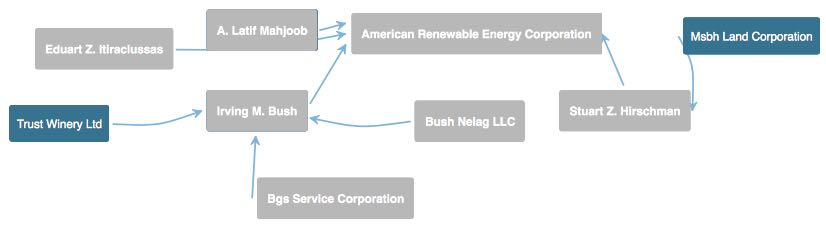

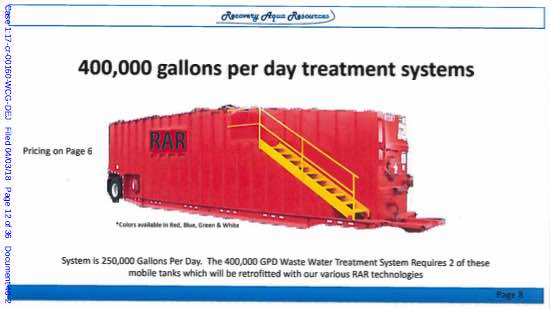

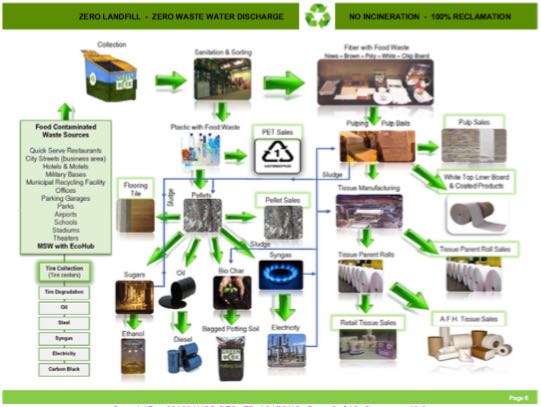

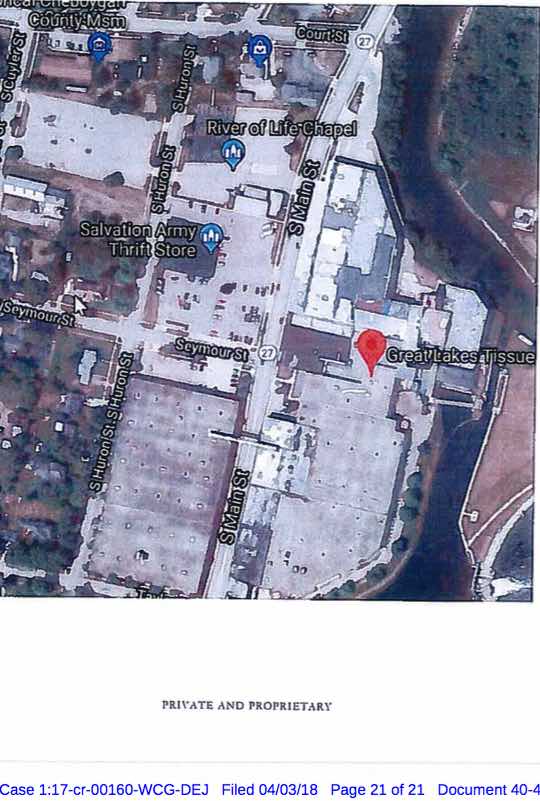

II. Transactions/Attempted Transactions Involving John Lozo

Beginning in the summer of 2016, and continuing into early 2018, Van Den Heuvel negotiated with a man named John Lozo in an effort to solicit funds for various projects or equipment. Van Den Heuvel sent Lozo a plethora of information during those negotiations, some of which was false or highly misleading. For example, on June 7, 2017, Van Den Heuvel sent Lozo and others an “Executive Summary” of the “Great Lakes Tissue” project in Cheboygan, Michigan, which promised “world changing technologies that process food contaminated waste streams to create” various products. (Exhibit A) The “Executive Summary” included financials, which represented, in part, that $7.7 million in “EB5 Funds were paid” for equipment for the project. Van Den Heuvel’s solicitation of EB-5 funds and subsequent misuse of those funds are part of the wire-fraud scheme alleged in case number 2017-CR-160. The Government’s tracing of the EB-5 funds indicates that Van Den Heuvel received substantially less than $7.7 million, and that the funds were mostly not used for equipment for the Cheboygan, Michigan project. The owner of Great Lakes Tissue in Cheboygan, Michigan, has informed law enforcement that neither he nor Great Lakes Tissue has received funds from Van Den Heuvel.

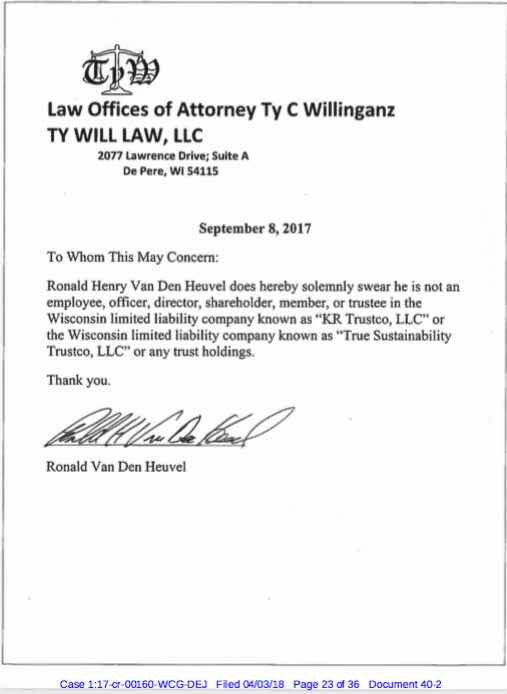

As another example, on September 11, 2017, Van Den Heuvel sent Lozo an email with several attachments, including (a) a letter, purporting to be on attorney Ty Willihnganz’s letterhead, but with Willihnganz’s name misspelled; (b) a “consulting agreement” dated March 16, 2017, purporting to promise Van Den Heuvel $47,000 per month for five years; and (c) a resume for Van Den Heuvel containing several false statements, such as that “Green Box has partnered with Cargill Inc.” (all parts of Exhibit B) As alleged in the 2017 indictment, Cargill had long ago terminated its agreement with Green Box, although Van Den Heuvel falsely claimed otherwise in soliciting funds for his companies.

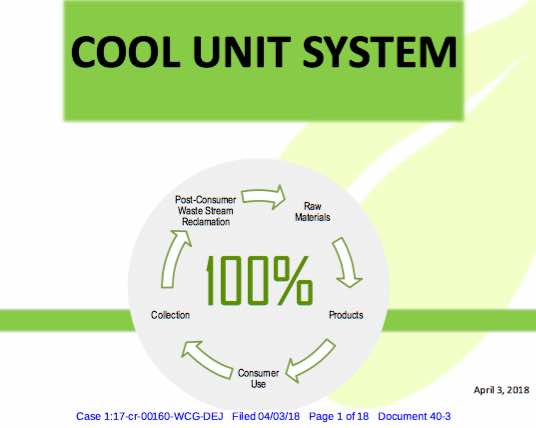

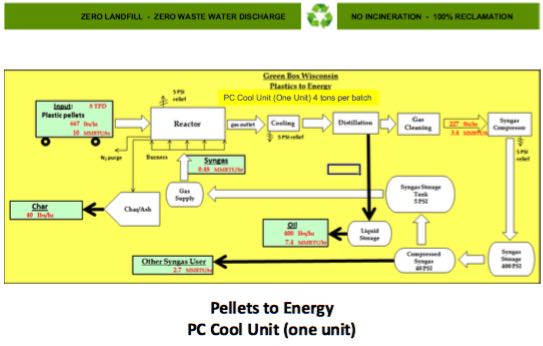

Van Den Heuvel’s communications with Lozo included efforts in late 2017 to sell, or obtain an investment in, pyrolysis machines manufactured by Kool Manufacturing. Lozo served as a broker in that potential transaction, and helped to arrange a “demonstration” of a pyrolysis machine for potential investors/buyers, run by Van Den Heuvel, in November of 2017. (Incidentally, Van Den Heuvel attempted to charge $5,000 for that November 2017 demonstration.) The Kool pyrolysis machines are also part of the wire-fraud scheme charged in case number 2017-CR-160; as noted in that indictment, Van Den Heuvel fraudulently obtained funds from victim Cliffton Equities, as well as other entities, to purchase those machines. When Van Den Heuvel’s company Green Box NA Green Bay filed for bankruptcy in 2016, the Kool machines were also listed as assets of the estate, which meant that they were subject to the bankruptcy court’s supervision until the bankruptcy case was ultimately terminated on December 29, 2017. As a result, court permission would have been required for Van Den Heuvel to sell the Kool units or pledge them to new investors; no such permission was obtained. In materials that Van Den Heuvel sent to Lozo, he often changed the spelling of the machines, calling them “Cool Units” rather than “Kool Units,” perhaps in an effort to suggest these were different machines. For example, Power Point presentations that Van Den Heuvel sent to Lozo on September 11, 2017 contain this new spelling. (E.g., Exhibit C) Lozo has confirmed, however, that the pyrolysis machines in question were manufactured by “Kool.”

The Government is not aware whether Van Den Heuvel successfully obtained any funds through his work with Lozo. It is clear, however, that Van Den Heuvel has continued to make materially false statements in an effort to obtain “loans” or “investments,” including statements that are closely related to his charged misconduct.

III. Transactions/Attempted Transactions Involving Knapp, Kashat, and Kalet

Aside from his work with Lozo, Van Den Heuvel has been soliciting funds (in the form of “loans” or “investments”) from several other people. Two individuals named Mason Kashat and Alex Knapp, both of New York, have loaned substantial sums to Van Den Heuvel in the past several months. According to Kashat and Knapp, they jointly loaned Van Den Heuvel approximately $60,000, receiving in exchange an equity stake in a company called Purely Cotton, a lien against the proceeds of one of Van Den Heuvel’s lawsuits (against Sharad Tak), and a “personal guarantee” from Van Den Heuvel. According to Knapp, he also made two smaller loans to Van Den Heuvel, for approximately $7,500 (to “Tissue Technology Inc. and Purely Cotton Products Corp.”) and $20,000 (to “PCDI MI”), between July and December of 2017. Those two smaller loans are already in default. Van Den Heuvel pledged Purely Cotton assets as collateral for Knapp’s loans, in addition to a long list of other equipment. That equipment consisted primarily of “after dryers,” which, according to a knowledgeable witness, Van Den Heuvel does not currently own or control. Knapp also received an equity stake in Purely Cotton, a lien against proceeds from a Tak lawsuit, and a “personal guarantee” from Van Den Heuvel.

Van Den Heuvel and Kashat also worked with a man named Mike Kalet, a broker in New York, to obtain additional funding for projects proposed by Van Den Heuvel. In connection with these projects, Knapp, Kashat, and Kalet all received written materials from Van Den Heuvel. For example, Kalet received a document entitled “Great Lakes Tissue Executive Summary 12 1 17,” which seeks to justify a $7.5M loan for “PCDI Michigan” to support the “Great Lakes Tissue Company.” (Exhibit D) That “Executive Summary” appears to be an updated version of the “Executive Summary” that Van Den Heuvel sent Lozo in June of 2017. (Exhibit A) The December 2017 version contains questionable representations, including that Kelly Van Den Heuvel (the defendant’s wife) is the President of Tissue Technology, LLC and of PCDI Michigan, and that she has a net worth of $29 million. Kalet also received a document entitled “Great Lakes Tissue Ron Van Den Heuvel Resume,” dated June 6, 2017. (Exhibit E) That “resume” appears to be an updated version of the “resume” that Van Den Heuvel sent to Lozo in September of 2017. (part of Exhibit B) While the resume sent to Lozo falsely represented that Green Box was “partnered with Cargill Inc.,” the resume sent to Kalet claimed that “Tissue Technology has partnered with Cargill Inc.” (emphasis added) and that Van Den Heuvel’s companies hold “Exclusive Intellectual Property Rights” in Cargill’s “Enhanced Fibre Additive (EFA) Patent and System Design, Equipment and Software.” In fact, Cargill terminated its EFA license agreement with Green Box in October 2013, and has not, to the Government’s knowledge, renewed that license agreement with Tissue Technology or any other company affiliated with Van Den Heuvel. Finally, Van Den Heuvel also informed Kalet that he had already prevailed in at least one lawsuit against Sharad Tak and was simply waiting for a determination of damages. At least with respect to the federal case involving Van Den Heuvel and Tak, that is untrue; to the contrary, Tak has prevailed in that matter.

Again, the Government is not aware whether Van Den Heuvel successfully obtained any funds through his work with Kalet. These misrepresentations, however, are similar to those alleged in the 2017 indictment against Van Den Heuvel. Relying on Van Den Heuvel’s representations, Kalet, in turn, sent misleading materials to other potential investors.

IV. New Transactions Proposed to Probation

On March 23, 2018, Van Den Heuvel met with U.S. Probation Officer Mitchell Farra to inform Farra about Van Den Heuvel’s intent to conduct several complicated and sizeable financial transactions in the near future. Van Den Heuvel provided Farra with an organizational chart summarizing the companies involved in these transactions. (Exhibit F) Given Van Den Heuvel’s pattern of conduct in the past year, and the nature of the newly proposed transactions, the Government has serious concerns about the legitimacy of these transactions. The proposed transactions are listed below, as well as some of the related inconsistencies that explain the Government’s concern:

- Proposed Transaction: In April 2018, Van Den Heuvel plans to sell 5% of his stock in Tissue Technology to a man named “Ray McDonial,” who owns a hedge fund in Dallas, Texas. As part of this deal, Van Den Heuvel will receive $1M on the closing date and then $1M per year for the following 4 years for a total of $5M.

- In preparing the pre-sentence report for Case Number 2016-CR-64, Van Den Heuvel represented that he owns 83 million shares of Tissue Technology, contained in KR Trustco, a trust controlled by other individuals. Van Den Heuvel also stated that the trust and its holdings are subject to ongoing litigation. Van Den Heuvel represented that the Tissue Technology stock is not publicly traded and has no currently ascertainable value. Given those facts, the legitimacy of a $5M sale of Tissue Technology stock is questionable.

- In addition, according to “Executive Summary” sent to Kalet, Kelly Van Den Heuvel is the “president” of Tissue Technology and potentially owns 74% of the company. (Exhibit D) Kelly’s role in this transaction is unclear.

- Proposed Transaction: In the second week of May 2018, Van Den Heuvel will sell $1M in stock in Purely Cotton to Great Lakes Tissue. This transaction will result in Van Den Heuvel receiving $2M in royalties on patents he owns.

- Van Den Heuvel has repeatedly misrepresented information about “patents” he “owns” to potential investors, including EB-5 investors.

- Ownership and control of these entities is unclear:

- According to the organizational chart provided by Van Den Heuvel (Exhibit F), Great Lakes Tissue and Purely Cotton already have the same owner; both are subsidiaries of Tissue Technology. As a result, it is unclear what this sale entails or how it would generate royalties for Van Den Heuvel.

- According to the “Executive Summaries” sent to both Lozo and Kalet, by contrast, PCDI owns or will own Great Lakes Tissue. (Exhibits A, D) The “Executive Summary” sent to Kalet also represents that Kelly Van Den Heuvel is the president of PCDI.

- The company called “Great Lakes Tissue” in Cheboygan, Michigan is owned by Clarence Roznowski, not by Van Den Heuvel or one of his companies. Roznowski has no plans to buy any stock in Purely Cotton and is, in fact, unsure whether Purely Cotton has any assets.

- In addition, Van Den Heuvel pledged Purely Cotton equity to Kashat and Knapp as collateral for their (unpaid) loans. It is not clear how this equity stake differs from the $1M in Purely Cotton stock that Van Den Heuvel now proposes to sell.

- Proposed Transaction: In June, Van Den Heuvel will sell 5% of his ownership in Partners Concepts Development, Inc. (PCDI) to a man named Kaoumi in Ghana. Van Den Heuvel estimates this will be a $6M sale.

- In preparing the pre-sentence report for Case Number 2016-CR-64, Van Den Heuvel represented that he owns 65 million shares of PCDI, contained in KR Trustco [LLC], a trust controlled by other individuals. Van Den Heuvel also stated that the trust and its holdings are subject to ongoing litigation. Van Den Heuvel represented that the PCDI stock is not publicly traded and has no currently ascertainable value. Given those facts, the legitimacy of a $6M sale of PCDI stock is questionable.

- The “Executive Summary” sent to Kalet claimed that Kelly Van Den Heuvel is the President of PCDI. (Exhibit D) Her role in this transaction is unclear.

- Proposed Transaction: Van Den Heuvel has, or will be entering into, ten-year consulting agreements with Great Lakes Tissue Company and True Sustainability to receive $38,000 per month in salary.

- In preparing the pre-sentence report for Case Number 2016-CR-64, Van Den Heuvel represented that his monthly income consisted entirely of $4,099 in social security income.

- According to the organizational chart provided to Probation, both True Sustainability [Trustco LLC] and Great Lakes Tissue are subsidiaries of Tissue Technology, Inc. (Exhibit F) Van Den Heuvel represented in the pre-sentence report that he owns 83 million shares of Tissue Technology; according to “Executive Summary” sent to Kalet, Kelly Van Den Huevel is the “president” of Tissue Technology and potentially owns 74% of the company. (Exhibit D) And another of Van Den Heuvel’s proposed transactions entails selling 5% of Tissue Technology stock to a man named Ray McDonial.

- The company called “Great Lakes Tissue” in Cheboygan, Michigan is owned by Clarence Roznowski, who has informed law enforcement that he has no intention of hiring Van Den Heuvel as a consultant or paying him $38,000/month.

- It is thus unclear who controls these companies or has agreed to pay Van Den Heuvel a total of $4.56M to “consult” for them.

- Proposed Transaction: Van Den Heuvel has a royalty agreement with PC Fibre Box in which he will receive $48,000 per month in royalties on his intellectual property.

- In preparing the pre-sentence report for Case Number 2016-CR-64, Van Den Heuvel represented that his monthly income consisted entirely of $4,099 in social security income.

- Van Den Heuvel has repeatedly misrepresented information about “patents” he “owns” to potential investors.

- According to the organizational chart provided by Van Den Heuvel (Exhibit F), PC Fibre is a subsidiary of EARTH / RTS / The Green Box Companies. Edward Kolasinski, a current executive of RTS, has indicated that a royalty agreement with PC Fibre does exist, but that PC Fibre is currently generating no profits and none are projected in the near future.

- Proposed Proposed Transaction: Van Den Heuvel plans to withdraw $1M from a company called Patriot Services Inc., which will earn a $1M profit this year.

- The Government has only very limited information about this company. In preparing the pre-sentence report for Case Number 2016-CR-64, Van Den Heuvel did not disclose any income, potential income, or ownership interest in a company called Patriot Services.

As outlined above, each of the proposed transactions has indicia of illegitimacy. Van Den Heuvel’s representations about these businesses and transactions appear to differ depending on his audience. The Government is concerned that should these “transactions” go forward, Van Den Heuvel will defraud new victims and/or risk depriving pre-existing victims of restitution, including the $316,445.47 he has already been ordered to pay.

IV. CONCLUSION

For the aforementioned reasons, the Government proposes that Van Den Heuvel’s conditions of release be modified to include a prohibition on [Ron] Van Den Heuvel engaging in any financial transactions with a dollar value over $500 without obtaining pre-approval from the United States Probation Office, and a requirement that Van Den Heuvel provide access to all financial information requested by the United States Probation Office.

Dated at Milwaukee, Wisconsin, this 3rd day of April, 2018.

Respectfully submitted,

MATTHEW D. KRUEGER

United States Attorney

By: s/Rebecca Taibleson

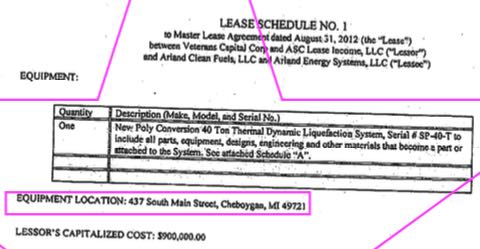

Images from court Exhibits of Ron Van Den Heuvel’s various fraudulent ‘green energy’ / ‘recycling’ / ‘waste-to-electricity’ / ‘pyrolysis’ presentations for a project at

437 SOUTH MAIN STREET

CHEBOYGAN, MI 49721:

Filtration unit patented by Generation Clean Fuels, LLC owner

and Ron’s Recovering Aqua Resources partner Gaylen LaCrosse :

See also:

FLASHBACK:

Master Lease Agreement

between Arland Energy Systems, LLC and Arland Clean Fuels, LLC / aka Generation Clean Fuels, LLC and Naples, FL-based ASC Lease Income, LLC and Veterans Capital Corp. of which Joseph E. Wold Jr. is President.

Veterans Capital Corp. was to lease a

“poly conversion liquefaction machine”

for Oneida Seven Generations Corp. / OSGC

and for OSGC wholly-owned subsidiary

Green Bay Renewable Energy, LLC / GBRE

that was to be located & operated at

437 South Main Street

CHEBOYGAN, MI 49721

after being manufactured by

after being manufactured by

Spartan, Inc. of Bakersfield, CA,

of which the President was

ACF / GCF Principal Louis Stern

and its Vice-President Charles Hinson,

a co-patent holder with Gaylen La Crosse.

On May 24, 2013 and June 10, 2013 ACF / GCF CEO Louis Stern signed Master Lease & Service Agreements with OSGC CEO / GBRE Chair Kevin Cornelius resulting in ACF / GCF filing a $400 Million lawsuit against the Oneida Nation of Wisconsin which appears to be an extortion racket designed to defraud the ONWI General Tribal Council of MULTIMILLIONS.

Louis Stern & Ron Van Den Heuvel’s 20-year

business partner Gaylen LaCrosse are co-owners

of Arland Clean Fuels aka Generation Clean Fuels

which sued Oneida Nation WI for $400 Million

& got an undisclosed multimillion ‘settlement‘

To defend their criminal fraud scheme, OSGC & GBRE have engaged in malicious litigation against the City of Green Bay at the behest of OSGC / GBRE counsel and co-conspirators…

GODFREY & KAHN S.C.

QUESTION:

QUESTION:

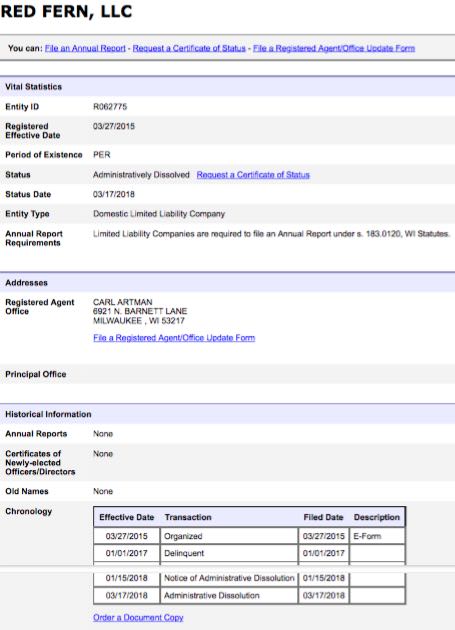

WHAT IS…

OF WHICH RON VAN DEN HEUVEL IS REGISTERED AGENT…

AND WHY DID RON’s WAREHOUSE-RESIDING ‘ATTORNEY’

(WHEN NOT SUSPENDED) TY C. WILLIHNGANZ ORGANIZE IT

ON MAY 24, 2013 [ARTICLES of ORGANIZATION] WITH RON’s

E.A.R.T.H. AS ‘REGISTERED AGENT’ … THE EXACT SAME DAY

ONEIDA SEVEN GENERATIONS CORP. CEO & OSGC SUBSIDIARY

GREEN BAY RENEWABLE ENERGY LLC CEO KEVIN CORNELIUS

SIGNED MASTER LEASE CONTRACTS WITH ACF LEASING LLC,

ACF SERVICES LLC & GENERATION CLEAN FUELS LLC…

FOR OSGC’s ‘PYROLYSIS’ SITES IN MONONA, WISCONSIN…

& IN CHEBOYGAN, MICHIGAN?

04/05/18 :  April 5, 2018 Letter from Oneida Indian Nation of NY requesting leave to file 4 pages of documents detailing a step-by-step process DOI personnel follow to obtain higher-level approvals for changing the names of Indian tribes in the list the DOI publishes in the Federal Register, U. S. District Court for the Northern District of New York, Case No. 5:17-CV-913, Oneida Indian Nation of New York v. United States Department of the Interior

April 5, 2018 Letter from Oneida Indian Nation of NY requesting leave to file 4 pages of documents detailing a step-by-step process DOI personnel follow to obtain higher-level approvals for changing the names of Indian tribes in the list the DOI publishes in the Federal Register, U. S. District Court for the Northern District of New York, Case No. 5:17-CV-913, Oneida Indian Nation of New York v. United States Department of the Interior

04/12/18 : April 12, 2018 TRANSCRIPT of Hearing re: U.S. Dept. of Interior Motion to Dismiss, U.S. District Court for the Northern District of New York, Case No. 5:17-CV-913, Oneida Indian Nation of New York v. United States Department of the Interior

- USA TODAY / Green Bay Press-Gazette –

Feds: Ron Van Den Heuvel continues fraudulent pitches; concerned Ron Van Den Heuvel could continue to defraud investors even after conviction

Federal authorities are concerned that Ron Van Den Heuvel’s conviction for bank fraud and another 14 additional counts of fraud have not deterred him from continuing to solicit investments under false pretenses.

U.S. Attorney Matthew Krueger has asked U.S. Judge William Griesbach to impose a new restriction on Van Den Heuvel’s conditions of release: A $500 cap on any financial transaction unless the U.S. Probation Office pre-approves it. Griesbach will decide whether to impose the condition during a hearing next week.

The request was made in the government’s second fraud case against Van Den Heuvel, filed in September 2017. Federal prosecutors allege he defrauded investors in companies connected to Green Box N.A. out of $9 million between 2011 and 2015.

In his motion, Krueger said the government continues to investigate several transactions and pitches to investors that started in summer 2016 and continued through March when Van Den Heuvel told his probation officer he intended to conduct “several complicated and sizable financial transactions in the near future.”

Van Den Heuvel has already been convicted of bank fraud in a case filed in April 2016. He was found guilty of using straw borrowers to obtain loans under false pretenses to keep his businesses afloat. He was sentenced in January to three years in prison but is awaiting notice from the U.S. Department of Corrections on when he will begin his prison term. …

One person [Ron] encouraged to invest in his companies was sent documents that included a resume with false statements and letter on Van Den Heuvel’s attorney [Ty Willihnganz’s] letterhead with the attorney’s last name misspelled. …

04/17/18 : USA TODAY / Green Bay Press-Gazette –

Judge William Griesbach: Green Box owner Ron Van Den Heuvel must disclose fraud conviction to potential investors

[U.S. Judge William] Griesbach said his intent in imposing the conditions was to protect the public and ensure anyone who chooses to give Van Den Heuvel money knows with whom they’re dealing.

“With a mandatory disclosure, then at least people who want to deal with Mr. Van Den Heuvel can do so with eyes wide open,” Griesbach said. “The goal is to ensure there are no more victims. …”