11/08/17 : Green Bay Press-Gazette / USA TODAY –

Menominee tribe plans to sue EPA

& Army Corps over Back 40 mine

by Paul Srubas

KESHENA, WI – The Menominee [Indian] Tribe [of Wisconsin / MITW] intends to sue the U.S. government for giving up its authority over a proposal to build an open-pit sulfide mine in the Upper Peninsula.

The tribe, represented by a national activist law firm, has issued a 60-day notice of intent to sue the U.S. Environmental Protection Agency and U.S. Army Corps of Engineers over the proposed Back 40 mine on the Menominee River. The river flows into Green Bay and serves as the border between Wisconsin and the Upper Peninsula of Michigan.

The 60-day notice is a required step under the Clean Water Act, according to Janette Brimmer, a lawyer for Earthjustice, the same nonprofit firm that represented the Standing Rock Sioux in their actions against the Dakota Access Pipeline.

If the EPA and Army Corps of Engineers take back authority from the Michigan Department of Environmental Quality, the Menominees would drop the legal action, Brimmer said.

Michigan and New Jersey are the only states that have sought and received permission from the EPA to administer the Clean Water Act. In other states, the Corps of Engineers oversees discharge permits and rules governing dredging or filling wetlands.

Under the Clean Water Act, the EPA may delegate that authority to the states, but it isn’t a blanket rule, Brimmer said. Interstate waters, or even on waters that potentially could support interstate commerce, must remain under federal jurisdiction, she said.

But Michigan’s Department of Environmental Quality has already granted three permits to Aquila Resources, which needs just one more permit to dig an open-pit mine for gold, zinc, copper and silver in the Lake Township in the Upper Peninsula.

The Canadian-based company already has invested more than $70 million in site acquisition, development and research in the project. Michigan has issued it a nonferrous metallic mineral mining permit, an air use permit and pollutant discharge and elimination system permit. It still needs a wetlands permit to proceed. …

[MITW Chair Gary] Besaw said the tribe notified the Corps and the EPA in August that Michigan doesn’t legally have authority in the application process. The Corps sent the tribe a letter in September saying it lacked the authority to re-assume jurisdiction, and after failing to hear from the EPA, the tribe hired Earthjustice. …

The interstate nature of the Menominee River, and its potential as a means of interstate or foreign commerce, means it and its related wetlands can’t be delegated to state authority, according to the notification letter Earthjustice sent to the Corps and EPA.

“The Corps’ own study in 1979 and subsequent recommendation by its counsel finds this to be true, beginning with extensive use of the Menominee River and its tributaries for commerce associated with logging and power generation through present-day use for recreation, tourism and fishing,” the letter states. “The entirety of Menominee River and its adjacent wetlands are not delegable, nor could they have been delegated, to the State of Michigan for Section 404 permitting and therefore the State of Michigan cannot exercise Section 404 jurisdiction for the Back Forty Project permitting.”

11/07/17 : WiscNews –

National environmental firm to represent Wisconsin tribe in mine suit

by Steven Verburg

The Menominee Indian Tribe of Wisconsin on Monday formally challenged plans for a huge mine just over the state line in Michigan’s Upper Peninsula in a case the tribal chairman said has national significance. …

A leading national environmental law firm representing the Keshena-based tribe filed a 60-day notice of intent to sue the federal government.

The tribe says it has been deprived of treaty rights that are supposed to protect its cultural and historical sites because the federal government has delegated to the state of Michigan too much authority for permitting mines like the one proposed amid tribal burial mounds along the Menominee River.

“We tell the state of Michigan we want our rights, and the state says ‘We don’t have a treaty with you,’” tribal chairman Gary Besaw said.

Such disputes could become widespread if more states seek the extra authority under the encouragement of Trump administration officials like Environmental Protection Agency administrator Scott Pruitt, Besaw said.

“We know Scott Pruitt with EPA is actually pursuing that mantra of … delegating to states,” Besaw said. “We want Aquila and the potential investors of Aquila to know that we aren’t going down without a fight.”

The tribe has hired the San Francisco-based Earthjustice to represent it. Earthjustice has represented the Standing Rock Sioux against the Dakota Access Pipeline, sued the EPA over the pace of enforcement of pollution laws in poor areas and gone to court to ban the pesticide chlorpyrifos, which is linked to developmental disorders.

“This puts the federal government on notice,” Besaw said. “If we continue to be ignored we will pursue federal litigation.”

Earthjustice filed the 60-day notice with Pruitt, the EPA Regional office in Chicago, acting secretary of the Army Ryan McCarthy and Army Corps of Engineers officers in Detroit and Washington, D.C. The Army Corps is involved in permitting disturbances of wetlands and waterways, while the EPA administers water and air quality. …

The Michigan Department of Environmental Quality has said it invited tribes to participate in the Aquila permitting process. But Besaw has said only under federal law would the Menominee have a formal, enforceable channel to influence decisions. …

Earthjustice attorney Janette Brimmer said the wetlands along Menominee River that runs by the mine site and forms part of the border between the two states should be regulated by the federal government because it is a commercially navigable interstate waterway.

“The Clean Water Act makes it very clear that the authority to dig up and potentially pollute the Menominee River and its wetlands cannot be delegated down to a single state,” Brimmer said in a statement. “The waters and wetlands that will be affected by this huge, potentially very damaging industrial project do not ‘belong’ only to the State of Michigan. They must be protected for everyone, and it’s the EPA and the Corps’ mandatory duty to assume jurisdiction over the permit application.”

Previously on Oneida Eye:

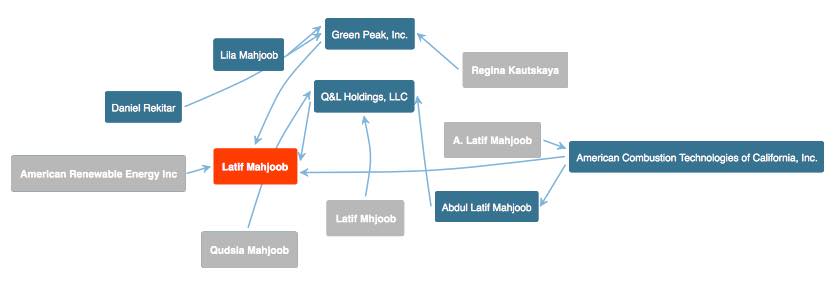

November 2, 2017 CH2E Nevada LLC’s Motion for Status Conference, U.S. District Court / Nevada Case No. 15-CV-694, CH2E Nevada LLC v. [Abdul] Latif Mahjoob and American Combustion Technologies of California Inc. [ACTI]

November 2, 2017 CH2E Nevada LLC’s Motion for Status Conference, U.S. District Court / Nevada Case No. 15-CV-694, CH2E Nevada LLC v. [Abdul] Latif Mahjoob and American Combustion Technologies of California Inc. [ACTI]

…Plaintiff CH2E Nevada LLC (“CH2E”), by and through undersigned counsel, respectfully requests that the Court hold a status conference to address the following topics: (1) whether American Combustion Technologies of California, Inc. (“ACTI”) must produce its expert for his deposition as it agreed to do; and (2) the Court’s preferred method for CH2E to address ACTI’s threatened bankruptcy and fraudulent conveyances to its new company, ARTI [American Renewable Technologies Inc.] – a company about which Latif Mahjoob actively misled CH2E at his deposition. …

8. CH2E believes that ACTI is filing this bankruptcy as a litigation tactic to avoid paying any judgment to CH2E. After the commencement of this litigation, ACTI’s founder, Latif Mahjoob, started a new company called American Renewable Technologies Inc. (“ARTI”). When asked about ARTI at his November 4, 2015 deposition, Dr. Mahjoob testified that ARTI was not a pyrolysis company like ACTI, but instead was a “gas to liquid fuel” company:

[Atty. TOMASCH for CH2E NEVADA LLC]

Q. Okay. What is American Renewable Energy [sic], Inc.?[ABDUL LATIF MAHJOOB]

A. It’s a company I own.Q. What does it do?

A. It customer [sic] gas to liquid fuel. We take natural gas and turn it into liquid fuel.

Q. It’s not a pyrolysis unit – process?

A. No, not really. …

________________

Exhibit C, November 4, 2015 Deposition of Latif Mahjoob, continues:

Q. Is that located – where is that located?

A. At the same place.

Q. Same place?

A. Yes.

Q. So when you were talking about the number of employees you have, does – were you including the people that work for – or do work for American Renewable Energy?

A. Right now everybody works for American – American –

Q. ACTI?

A. ACTI. American Renewable Energy is a brand new company, and – and it’s for gas to liquid. And the reason we have it separated because it’s not combustion, and the customer doesn’t want combustion in there.

Q. Okay. So when you told me earlier how many employees you have, you were focusing on the ACTI process?

A. That’s true.

Q. Okay. And then another name I’ve seen is Arian Energy & Combustion. Is that also related?

A. That was – that was – it was the original name, and we changed it because Arian didn’t sound very good.

Q. That was the name back in, like, 1990 when you formed the new ACTI?

A. Yes.

Q. Okay. It didn’t last long?

A. No. We changed it right away because people thought we were saying something else.

Q. But the – the predecessor entity was called ACTI, right?

A. Yes.

Q. So let’s see. You bought the predecessor entity, ACTI?

A. We actually established the ACTI, changed the Arian to ACTI.

Q. But there was – there was a Minnesota outfit, right? Isn’t that what you told me earlier?

A. No, it was in –

MR. KAWAHITO [Atty. for Mahjoob]: Wisconsin.

THE WITNESS [Abdul Latif Mahjoob]: Wisconsin.

BY MR. THOMASCH:

Q. Minnesota, Wisconsin. It’s all the same, right? All right. It was in Wisconsin, and it was called ACT?A. Yeah, “ACTI,” yeah.

Q. Yeah, okay. And that was this fellow — what’s his name, Siborz Veeny (phonetic) [Saboor Zafari]?

A. Right.

Q. And he sold that to you?

A. Yeah. I – I purchased it from him.

Q. Okay. And when you purchased, you were going to name it Arian Energy or Arian Engineering?

A. No. It’s the opposite. I had Arian, and then I purchased the – the ACTI and basically –

Q. Just took that name?

A. Right. Took that name.

Q. Okay. Does ACTI prepare formal financial statements?

A. Yes.

Q. Do you – are they certified?

A. Yes.

Q, Who are your accountants?

A. I have an accountant in Los Angeles.

Q. By the name of?

A. Aram – Aram and something. I forgot his name.

Q. And he does certify your statements?

A. Yes.

Q. Every year?

A. Every year.

Q. And when that happens, does he certify for ACTI as separate from, let’s say, American Renewable Energy? You got a ACTI set of financials?

A. Okay. So for the record, it’s – American Renewable Energy is not even active yet, so –

Q. Fair enough.

A. Yeah. So he – he would do two different companies.

Q. Okay.

A. If you asked him to do. …

________________

9. However, publicly available information demonstrates that Dr. Mahjoob is now using ARTI to carry on the pyrolysis business of ACTI, the assets of which he is depleting in an attempt to avoid paying any judgment in this case. Indeed, ARTI is holding itself out as ACTI with respect to its experience as a pyrolysis company—including with respect to the pyrolysis equipment ACTI sold to ARTI.

See Ex. D (ARTI Website, available at

https://www.americanrenewabletech.com).

- November 3, 2017 American Combustion Technologies of California, Inc. [ACTI]’s Form 309C, Notice of Chapter 7 Bankruptcy Case — No Proof of Claim Deadline (Meeting of Creditors scheduled for December 11, 2017), U.S. Bankruptcy Court / California Central District Case No. 17-bk-23617, Chapter 7, American Combustion Technologies of California Inc. /ACTI

- November 3, 2017 American Combustion Technologies of California, Inc. [ACTI]’s Form 201, Voluntary Petition for Non-Individuals Filing for Bankruptcy, U.S. Bankruptcy Court / California Central District Case No. 17-bk-23617, Chapter 7, American Combustion Technologies of California Inc. [ACTI]

- November 6, 2017 Order Denying CH2E Nevada LLC’s Motion for Status Conference re: “ACTI’s threatened bankruptcy and fraudulent conveyances to its new company, ARTI [American Renewable Technologies Inc.]”, U.S. District Court / Nevada Case No. 15-cv-694, CH2E Nevada LLC v. [Abdul] Latif Mahjoob and American Combustion Technologies of California Inc. [ACTI]

Previously:

Letter dated September 12, 2017 and ‘signed’ with rubber stamp by Abdul Latif Mahjoob of ‘American Combustion Technology Inc.‘ sent to Oneida Eye Publisher Leah Sue Dodge

Letter dated September 12, 2017 and ‘signed’ with rubber stamp by Abdul Latif Mahjoob of ‘American Combustion Technology Inc.‘ sent to Oneida Eye Publisher Leah Sue Dodge

Latif Mahjoob

American Combustion Technology Inc.

Compton, CA 90220

09/12/2017Dear Leah Sue Dodge:

It has come to ACTI’s attention that a defaming comment was posted on www.youtube.com under the username “Oneida Eye” that has been linked to Ms. Dodge. ACTI asks that Ms. Dodge immediately remove all comments made about Latif Mahjoob and ACTI or legal action will be taken for defamation of character. …

Your failure to remove all the defaming material will result in an immediate legal action against you.

Sincerely,

A. L. Mahjoob (rubber stamped)

Latif Mahjoob (typed)

American Combustion Technology Inc.Cc: James Kawahito, attorney.

PROBLEM:

Beyond the fact that the letter does not contain a valid signature, Oneida Eye is not aware of any companies owned by Abdul Latif Mahjoob that are named “American Combustion Technology Inc.“

The only companies owned by Abdul Latif Mahjoob that Oneida Eye is aware of include:

- Arian Engineering & Combustion Systems, Inc. [AECS] registered w/ the Illinois Sec. of State; Registered Agent & President A. Latif Mahjoob

- American Combustion Technologies, Inc. / ACTI

- American Combustion Technologies of California, Inc. / also ACTI

- American Renewable Energy, Inc. / AREI

- American Renewable Technologies, Inc. / ARTI

ALSO…

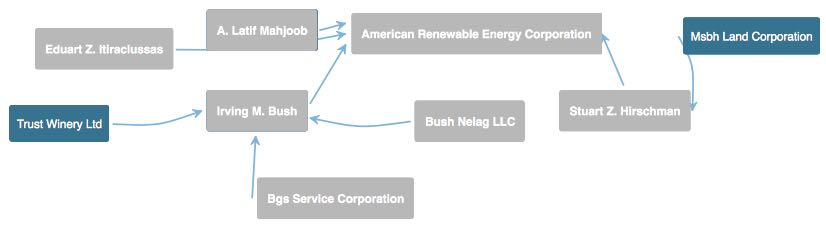

- American Renewable Energy Corp. / AREC in Kansas City, MO; President, Director, Treasuer – Stuart Z. Hirschman; President – Eduart Z. Itiraclussas; Secretary – Irving M. Bush; Director – A. Latif Mahjoob

- Green Peak, Inc. in Nevada; President & Director – Latif Mahjoob; Treasurer – Lila Mahjoob; Director – Daniel Rekitar; Member – Regina Kautskaya

- Q & L Holdings, LLC in California; Members – Abdul Latif Mahjoob; Qudsia Mahjoob (age 61)

Perhaps the threat letter was sent to Oneida Eye by one of Abdul Latif Mahjoob’s relatives:

- Arian Mahjoob

- Qays Mahjoob

Related?:

Related?:

- Leagle.com: April 6, 2016 Decision, Docket No. B259878, Court of Appeals of California, Second District, The People of California v. Qays Mahjoob

On April 4, 2013, Geraldine B. and her eight-year-old daughter Grace spent the day at Disneyland. Geraldine and Grace returned to their car, a 2000 Toyota Camry, and left Anaheim around midnight. An hour later, at roughly 1 a.m. on April 5, 2013, Geraldine was stopped at a red light at an intersection near her house. The road she was travelling on had two lanes running in each direction, with a center lane in the middle for turn lanes. Geraldine was waiting to turn left; her car was in the left pocket turn lane on the correct side of the double yellow line. Geraldine saw a car driving toward her on the opposite side of the road in the lane closest to the center of the road. The car had its headlights on. The oncoming car hit Geraldine’s car head on, propelling her car out of the turn lane to the side of the road, and causing the driver’s side airbag to deploy. Geraldine and Grace both sustained serious injuries as a result of the crash and were taken by paramedics to U.C. Irvine Medical Center. Doctors performed surgery on Geraldine’s foot. Grace required immediate abdominal surgery and a subsequent surgery on her back. …

The laboratory test revealed defendant’s blood alcohol concentration was 0.22 percent.

24-year old Qays Mahjoob—nicknamed Matt—thought he was coming to see a 13-year-old girl. The decoy invites him inside.

Decoy: Hello? Are you comin’? How was the drive?

Mahjoob suddenly hears a walkie-talkie in the background.

Qays Mahoob: What’s that?

Decoy: What’s what?

Mahjoob: That sound?

Decoy: What sound?

It was the decoy’s walkie-talkie. Instructions to her from inside the house were mistakenly broadcast in the driveway.

Mahjoob gets spooked, but he circles around and comes in anyway.

Decoy: Okay. Why did you go away?

Mahjoob: ‘Cause I thought it had something to do with the police.

Decoy: (laughs) Yeah, I’m not that retarded.

Mahjoob: Oh.

Online, Mahjoob—screen name longbeachdude19– thought he was chatting with a 13-year-old girl.

He tells her that he will perform oral sex on her.

(chat log) longbeachdude19: “I will show u heaven,” he writes. “I love it. I can do that all day.”

Mahjoob asks if she’s performed oral sex, asks if she’s good at it, and other specifics we can’t tell you about here.

And remember, he’s chatting with someone who said she was 13.

Decoy: What have you been up to?

Majhoob: Not much.

Decoy: Did it take you that long to come back? Do you wanna have a seat or something?

Mahjoob: Gimme a tour. (laughs)

Decoy: Gimme a tour? Oh, I see. Well, this is the hot tub.

Mahjoob: Cool.

Decoy: We could hang out here.

Hansen: Hey man, how are you? Matt, I need to talk with you for a minute.

Mahjoob: I know what—

Hansen: Matt, why don’t you have a seat right over there.

But talking is not what he has in mind.

When he is confronted by police, they ask him put his hands up. He doesn’t respond fast enough, and the result is a taser shot.

Hansen: Why was it necessary to use the taser on this guy?

Sgt. Lee DeBrabander: He’s already demonstrated that he’s not going to listen to the orders of the police officers. A lot of these guys, they are confronted with the reality that they are about to be exposed for what they did. And a lot of them may try violence to get away. The taser was used to prevent any injury to him and also to any police officers.

At the processing center, police find condoms in his car.

He’s pleaded not guilty to an attempted lewd act on a child.

- October 26, 2017 Wisconsin Economic Development Corporation / WEDC’s Limited Objection to Motions to Dismiss filed by Ability Insurance Company and Paper Holdco LLC, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179, Chapter 11,

Green Box NA Green Bay LLC

12. Substantial questions currently surround the actions of the Debtor’s principal [Ron Van Den Heuvel] immediately prior to the filing of this case (see generally attached Crim. Indictment).

13. Current management of the Debtor [Stephen Smith / GlenArbor LLC / GlenArbor Partners Inc.] has readily admitted that it lacks all relevant documentation necessary for or related to the Debtor’s business[.]

14. Conversion of this case is necessary to investigate potential pre-petition fraudulent transfers, preferences, and unknown property of the Debtor.

15. This case was filed on April 27, 2016. To the extent it is dismissed, the statute of limitations for any such actions will be reduced by approximately eighteen (18), resulting in potentially irreparable harm and loss of entire claims.

- September 19, 2017 Indictment, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

See also:

- September 19, 2017 Complaint, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CV-1261, U.S. Securities & Exchange Commission / SEC v. Ron Van Den Heuvel and Green Box NA Detroit LLC

- November 1, 2017 Paper Holdco, LLC’s Modification of its Motion to Dismiss in Reply to Wisconsin Economic Development Corporation / WEDC’s Limited Objection to the Motion, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay LLC

In reply to the [Wiscsonsin Economic Development Corp. / WEDC’s] limited objection, Paper Holdco hereby modifies its requested relief in the Motion and requests the Court to convert this [Green Box NA Green Bay LLC Chapter 11 bankruptcy] case [to Chapter 7] instead of dismissing it.

- AUDIO – November 1, 2017, 10:07 A.M. Hearing re: Paper Holdco’s Motion to Dismiss and Ability Insurance Company’s Motion for Relief from Stay and/or Motion to Dismiss [Runtime – 39 minutes], U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179, Chapter 11, Green Box NA Green Bay, LLC

- November 1, 2017 Court Minutes & Order, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179, Chapter 11, Green Box NA Green Bay LLC

NATURE OF HEARING: (1) Ability Insurance Company’s motion for relief from stay or, in the alternative, dismissal and (2) Paper Holdco LLC’s motion to dismiss

JUDGE: Beth E. Hanan; APPEARANCES: Nicholas Hahn, appearing for the debtor-in-possession; Michele McKinnon, for Ability Insurance Company; Angela Dodd, for the Securities and Exchange Commission; Brittany Ogden, for Cliffton Equities, Inc.; Brian Thill, for Wisconsin Economic Development Corporation; Jonathan Smies, for Crossgate Partners, LLC and Advanced Resources Materials, LLC; Christopher Camardello, for Varde/Paper Holdco, LLC; Laura Steele, for the United States Trustee

The court held a joint hearing on Ability’s motion for relief from stay or, in the alternative, dismissal (Doc. No. 301), filed on October 3, 2017, and Paper Holdco LLC’s motion to dismiss (Doc. No. 306), filed on October 5. On October 17, the debtor filed a consent to the motions to dismiss (Doc. No. 317). WEDC filed a limited objection to the motions on October 26 (Doc. No. 330), arguing for conversion, rather than dismissal. Just prior to the hearing, Paper Holdco, LLC joined in WEDC’s request for conversion, rather than dismissal (Doc. No. 335).

Ability’s request for relief from the stay

The court concluded that Ability was no longer subject to the automatic stay by virtue of confirmation of the debtor’s plan, see 11 U.S.C. section 1141, as well as the express terms of the plan, Article 4.1. The court will enter an order acknowledging that there is no automatic stay in effect, to allow Ability to proceed with a foreclosure action in state court. Attorney McKinnon will upload a proposed order.

Requests for dismissal vs. conversion

Counsel for the debtor and Ability argued that dismissal was in the best interest of the creditors and the estate and that conversion would serve no purpose. Counsel for WEDC and Paper Holdco argued in favor of conversion. The other parties participating in the hearing voiced no position on either option. The court questioned what property would exist in a chapter 7 estate for a trustee to administer if this case were converted. Under 11 U.S.C. section 1141(b), the confirmation of the plan in this case vested all of the property of the estate in the debtor; conversion will not re-vest any of that property in a chapter 7 estate, see 11 U.S.C. section 348. Attorney Thill [for WEDC] suggested that there may be fraudulent transfers and preferences that a chapter 7 trustee could discover. Attorney Hahn claimed that the existence of such transfers was mere speculation. The court cautioned Attorney Thill that he would need to provide facts to support his argument, citing In re T.S.P. Indus., Inc., 120 B.R. 107, 111 (Bankr. N.D. Ill. 1990) (“Neither the motion to alter the Court’s prior judgment nor the original motion to convert or dismiss should be used as a pretext for a fishing expedition, especially when the lake looks so barren. The mere possibility that a claim might be found is not reason enough to convert a case, appoint a trustee and incur administrative expenses that will almost certainly never be paid. That result would not be in the best interests of creditors or the estate.”).

The court considered and decided against holding an evidentiary hearing, but stated that it would consider the matter on briefs, which may include evidentiary affidavits. Based on the discussion at the hearing, both movants (Ability and Paper Holdco) consented to the continuance of the matter past the 15-day deadline in which the court ordinarily must issue a decision on a motion to dismiss, see 11 U.S.C. section 1112(b)(3), to allow the parties to brief the issue. Accordingly, the court ORDERED the following briefing schedule:

1. Briefs by WEDC and Paper Holdco arguing in favor of conversion must be filed by November 20, 2017.

2. Responses by any parties advocating dismissal rather than conversion must be filed by December, 4, 2017.

3. Reply briefs by WEDC and Paper Holdco must be filed by December, 11, 2017. The court will issue a ruling on the matter once briefing is concluded.

FLASHBACK:

20 YEARS AGO TODAY…

EXPOSÉ of RONALD’s PAY-to-PLAY…

November 2, 1997:

November 2, 1997:

Milwaukee Journal Sentinel –

Businessman’s support may have been against law

by Daniel Bice

Businessman Ronald Van Den Heuvel says he donated money through Wisconsin residents to Gov. Tommy Thompson’s campaign for several years while living in Georgia – an apparent violation of state election laws.

In a recent interview, Van Den Heuvel was questioned about $10,000 in campaign donations that he and his wife [Jan Marie Summers Van Den Heuvel] made one day before the state approved a large issue of tax-free bonds for one of his businesses. Van Den Heuvel responded by saying he had given similar amounts in the past.

When asked why reporters had not spotted those earlier donations on Thompson’s financial reports, Van Den Heuvel said, “Yeah, you may not have because when I was a Georgia resident, I gave it to people here.”

Those Wisconsin individuals, whom he did not name, then turned the money over to Thompson, he said. Van Den Heuvel, owner of VOS Electric in Green Bay and other businesses, said he moved to Wisconsin three years ago.

“I didn’t want to do it as a non-resident, which is fine,” he said. “You got to do some separate things if you’re a non-resident. I didn’t want to do that.”

Kevin Kennedy, executive director of the state Elections Board, said state law specifically bars people from laundering campaign donations or knowingly accepting laundered funds. Kennedy said it could be either a civil or criminal offense, depending on whether prosecutors believe they can prove the campaign money was given or received in intentional violation of the law.

Kevin Keane, spokesman for the governor, said the governor and his campaign were unaware of any laundered money. If Van Den Heuvel did pass money through others to Thompson, Keane said, the governor will return the money immediately once it is identified.

C. David Stellpflug, Van Den Heuvel’s lawyer, called the Journal Sentinel to say that his client was talking about giving money to political parties. But in his interview, Van Den Heuvel was critical of parties, specifically saying he did not give to the Republican National Committee.

“To me, parties – they kind of get in the way,” Van Den Heuvel said. “I like to know the person and what kind of person that person is.”

- 11/02/1997 – The Journal Times:

Donations to Thompson’s campaign led to favors

- Investigative Reporters & Editors:

Moneyed Interests

- 11/02/1997 – Milwaukee Journal Sentinel:

It pays to know Wisconsin Gov. Tommy Thompson

It pays to know Wisconsin Gov. Tommy Thompson

by Steve Schultze

and Daniel Bice

Like others before him, Ron Van Den Heuvel, a Green Bay-area entrepreneur, found the route to state largess with the help of Gov. Tommy G. Thompson.

Van Den Heuvel hit the jackpot in late September when an obscure state board awarded $24 million worth of tax-free bond financing to help him reopen an Oconto Falls tissue factory – the largest such approval this year and among the largest ever made by the state.

The award culminated nearly a year’s effort that included a formal application through the Commerce Department. But Van Den Heuvel worked informal channels to Thompson as well. And last May – the day before an initial financing award was made by the state – Van Den Heuvel and his wife [Jan Marie Summers Van Den Heuvel] donated a total of $10,000 to the governor’s campaign fund. Van Den Heuvel said he had been asked for the donation by Thompson’s fund-raiser in November 1996.

When asked by reporters last month about the campaign donations, Thompson moved quickly to return the money.

The subsidy will save Van Den Heuvel’s company at least $2 million in short-term financing costs, Van Den Heuvel said. The financing covers nearly half of the $52 million cost of renovating the Oconto Falls factory.

The circumstances of the case and others reviewed by the Journal Sentinel in an eight-month investigation suggest a trend in which donors and well-connected firms enjoy a close and mutually beneficial relationship with the Thompson administration.

“You don’t pay, you don’t play,” said a veteran lobbyist, speaking of state government generally, including the governor and legislators.

Most public attention has focused on Thompson’s upbeat personality and bulldog tenacity in achieving his goals during his unprecedented 11 years as governor. The newspaper’s investigation found another side of the Thompson story: an administration marked by the strong appearance of favoritism.

Thompson has relied on a close-knit group of lobbyists, corporate executives and friends to pull the strings of government, with many moving in and out of state jobs, the paper found. Some of those who were Thompson’s closest staff advisers now work as private consultants and lobbyists, trading on their access to the governor and blurring the line between government and private interests. …

As governor, Thompson has raised record sums, more than $6.5 million in his last run for governor and almost $15 million overall since his first gubernatorial bid in 1986.

The method for getting campaign money from firms interested in state help includes pleas made at opportune times.

In the Oconto Falls case, fund-raiser Prange called on Van Den Heuvel last November for a donation, a few months after Van Den Heuvel’s request for state aid had first been broached, according to Van Den Heuvel and state Commerce Department records. Prange was aware of Van Den Heuvel’s pending request for state financing aid when he asked for a donation, Van Den Heuvel said. Prange had approached him for donations in previous years.

“I made that $10,000 commitment to him in November (of 1996), OK?” said Van Den Heuvel. He claimed he’d been a longtime large donor to Thompson’s campaign, but the governor’s campaign finance records show just two other, smaller donations from Van Den Heuvel before the big donations were made last May.

Thompson insisted he never personally solicits donations and knows few details of how his campaign operation functions, despite his aggressive hands-on approach to campaigning and governing. But interviews with Thompson insiders, phone records and his own campaign records suggest the governor has taken a much more active role in his campaign money-raising machine.

The governor’s Capitol phone records, dating to January 1996, show 32 calls to fund-raiser Prange’s line at the governor’s campaign office, 26 calls to the state party or to state GOP chairman Dave Opitz, and 60 calls to the four businessmen who coordinate Thompson’s fund-raising strategy. They are Fred Luber, chief executive of Milwaukee’s Super Steel Products Corp.; J. Carleton “Sandy” MacNeil, a Mequon investment broker; Butch Johnson, president of Johnson Timber in Hayward; and San Orr Jr., chief executive of Wausau Paper Mills.

Thompson regularly phones and meets with those who run his fund-raising operation, including Klauser and other informal advisers outside of government. Although Klauser downplays his role, Klauser has expanded his campaign role since he left state government late last year to return to political consulting and lobbying, Thompson said. The governor only occasionally turns to Klauser for policy advice, he said, though others said Klauser’s policy role remained large. …

Allegations of influence peddling in the Thompson administration are the subject of an ongoing state Justice Department investigation. The investigation has focused on whether state favors have been granted in exchange for political donations. That probe started early this year with utility deals but has broadened to include other areas of state government, according to persons close to the case. The department declined to comment.

A Case Study

The Oconto Falls paper mill financing provides a case study on how influence works in the Thompson administration and who can help get deals done.

Last year, Van Den Heuvel’s Re-Box Packaging Co. hired investment banker P. Nicholas Hurtgen, a former top aide to Thompson and the brother-in-law of Thompson’s paid fund-raiser, Phil Prange. Hurtgen was hired as the project’s financial adviser, but he also helped open doors for Van Den Heuvel with the governor and other administration officials.

At a face-to-face meeting with Thompson in his Capitol office last January, the governor made a point of telling Van Den Heuvel that granting state aid wasn’t his call, but he encouraged him anyway. “I told him to work with (Commerce Secretary) Bill McCoshen. I’m almost positive of it.

He also said: “I encourage people, that’s my style,” Thompson added. ” ‘Sounds good! Let’s do it! Let’s get it done!’ That’s Tommy Thompson,” he said.

Van Den Heuvel says he recalled Thompson saying to him: “I think it’s a hell of an idea.”

Van Den Heuvel said that he and his wife, Jan, donated a total of $10,000 to the governor’s campaign account earlier this year — the checks were delivered May 15, one day before Re-Box Packaging won state approval for $9 million in tax-free bonds. That approval was intended for financing to build a De Pere factory for Re-Box.

Van Den Heuvel and two partners also each gave $500 to the governor three days before the state’s five-member Volume Cap Allocation Council voted on the financial aid. Three other partners gave a total of $2,100 between late April and June.

An hour after the newspaper asked Thompson about the donations, Thompson’s press secretary, Kevin Keane, said the Van Den Heuvels’ donations would be returned because “we are just not comfortable about” the timing of the cash gifts. Van Den Heuvel later confirmed that $10,000 of his donations were returned. Keane said the other donations might be returned.

Before using the $9 million in state financing, Van Den Heuvel decided to drop his aid application for the De Pere plant and apply for even more aid for PCDI Oconto Falls Tissue Inc., the tissue-mill project. The council that awarded the earlier sum readily agreed to authorize the $24 million in financing aid.

Commerce Department staffers who reviewed the Oconto proposal, however, declined to make any recommendation on the request, also noting the large sum, if approved, would “significantly impact” the amount of tax-free bonding authority available for other projects. Numerous other projects proposed by other firms were not funded by the council.

Van Den Heuvel made the project switch, he said, because the Oconto Falls mill offered the opportunity to get government financing aid for a much larger portion of that project’s overall costs than the $9 million financing offered him for the De Pere project.

Van Den Heuvel, Thompson and other administration officials say the project was approved on its merits and there was no link between the campaign cash and the state aid.

“None whatsoever,” Thompson said. “Absolutely none.”

The donations “wouldn’t have anything to do with” the state aid, Van Den Heuvel said.

Officials said the Oconto Falls mill will provide 160 jobs in an area hit hard by this year’s plant closure. The $24 million in financing aid, while large, was far less than the total of $70 million that Van Den Heuvel originally requested for the De Pere Re-Box project, state officials noted. …

However, lobbyists for major firms and interest groups who do business with the state, and business executives interviewed by the newspaper, said the fund-raising events are sold as prime opportunities to bend the governor’s ear on state issues – often worth millions to major players in issues ranging from utility regulation to Indian gaming. The fund-raisers often include discussion of those issues. …

A second lobbyist said Thompson’s fund-raising machine “systematically and methodically” milked firms with state business for donations. “Everybody understands if you go and ask the government to do something, you are going to have to make contributions.”

Both lobbyists asked not to be named, saying they feared retribution for speaking out.

State phone records also showed top aides to the governor, with whom he regularly confers, made numerous calls to the Thompson campaign office and GOP fund-raisers.

Klauser, in his last three months as Thompson’s top aide, called Prange 19 times, his phone records show. And Commerce Secretary McCoshen, who oversees a wide range of state subsidy programs for businesses, including the Oconto Falls financing, called Prange and the governor’s campaign office 21 times since January 1995.

State phone records show a series of calls during the period Van Den Heuvel was negotiating for his state financing aid, including a string of calls linking Thompson, his campaign, top state officials and Hurtgen, Van Den Heuvel’s project manager.

Thompson acknowledged that he might have talked to Hurtgen, his former aide, about Van Den Heuvel’s request for state financing aid.

“Possibly could have,” Thompson said. “I don’t know.”

Hurtgen declined to comment. Matthews and McCoshen said their calls to Hurtgen were not related to the Van Den Heuvel project.

“I’ve been a supporter of Gov. Thompson for a long time. I happen to think he’s the best governor,” Van Den Heuvel said.

…AND RECENTLY?

- May 8, 2015, 10:00 a.m. to 12:59 p.m Supplemental Examination of Ronald H. Van Den Heuvel Before James O’Neil, Court Commissioner, Brown Co. Case No. 13-CV-463, Dr. Marco Araujo v. Ronald H. Van Den Heuvel and Green Box NA Green Bay LLC

- May 15, 2015, 10:07 a.m. to 11:04 p.m. Supplemental Examination of Ronald H. Van Den Heuvel before James O’Neil, Court Commissioner, Brown Co. Case No. 14-CV-463, Dr. Marco Araujo v. Ronald H. Van Den Heuvel & Green Box NA Green Bay LLC

- May 20, 2015 Complaint in Brown Co. Case No. 15CV769, Dr. Marco Araujo, Cliffton Equities LLC & Wisconsin Economic Development Corp. (WEDC) v. Green Box NA Green Bay LLC

- August 25, 2015 Court of Appeals Decision, Appeal No. 2014-AP-2846, Dr. Marco Araujo v. Ronald H. Van Den Heuvel and Green Box NA Green Bay LLC

- January 29, 2016 State of Wisconsin’s Reply to Defendant’s Motion for Return of Property, Brown Co. Case No. 2015CV1614, In the Matter of the Return of Property to Ronald Van Den Heuvel

- February 15 & 17, 2016 Transcript of Deposition of Ron Van Den Heuvel from Brown County Case No. 15CV769, Dr. Marco Araujo, Cliffton Equities LLC & Wisconsin Economic Development Corp. (WEDC) v. Green Box NA Green Bay LLC

- July 1, 2016 Paul Piikkila Plea Agreement, U.S. District Court, WI Eastern District Docket No. 16-CR-064, United States of America v. Ronald H. Van Den Heuvel, Paul J. Piikkila, and Kelly Y. Van Den Heuvel

September 20, 2016 Superseding Indictment for ‘Straw Borrower’ Bank Fraud Scheme [19 Counts], U.S. District Court, WI Eastern District Docket No. 16-CR-064, United States of America v. Ronald H. Van Den Heuvel, Paul J. Piikkila, and Kelly Y. Van Den Heuvel

September 20, 2016 Superseding Indictment for ‘Straw Borrower’ Bank Fraud Scheme [19 Counts], U.S. District Court, WI Eastern District Docket No. 16-CR-064, United States of America v. Ronald H. Van Den Heuvel, Paul J. Piikkila, and Kelly Y. Van Den Heuvel

September 19, 2017 Complaint, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CV-1261, United States Securities and Exchange Commission [SEC] v. Ronald Van Den Heuvel & Green Box NA Detroit LLC

September 19, 2017 Complaint, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CV-1261, United States Securities and Exchange Commission [SEC] v. Ronald Van Den Heuvel & Green Box NA Detroit LLC

COMPLAINT

The United States Securities and Exchange Commission alleges as follows:

Nature of the Action

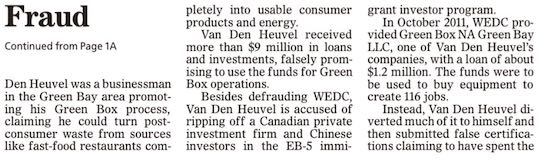

1. This case involves misrepresentations and the misappropriation of millions of dollars of investor funds by defendant Ronald Van Den Heuvel. He took advantage of investors who believed that they were investing in a new way to recycle post-consumer waste.

2. Van Den Heuvel lured investors with promises that he would use their funds for an eco-friendly recycling process called the Green Box Process. He claimed that the Green Box Process would take food-contaminated waste and convert it into usable products, such as recycled paper. Van Den Heuvel represented that he would use investor funds to buy equipment, open a Green Box facility, and ultimately help to create a green solution for post-consumer waste.

3. In reality, Van Den Heuvel misappropriated a substantial percentage of the funds contributed by investors. Instead of using investor funds to implement the Green Box Process, Van Den Heuvel used a significant portion of their investments for improper purposes, such as a Cadillac Escalade, payments to his ex-wife, overdue taxes, Green Bay Packers tickets, and cash for himself.

4. Van Den Heuvel took advantage of foreign investors who put their trust in him. In particular, in 2012 and 2014, Van Den Heuvel raised over $3 million from a Canadian asset management firm named Cliffton Equities. Van Den Heuvel promised to use its investment to buy and operate specific pieces of equipment, but in reality, he spent the money as he pleased.

5. Van Den Heuvel also exploited investors from China. Between 2014 and 2015, Van Den Heuvel and his company (Green Box NA Detroit, LLC) raised approximately $4,475,000 in investment proceeds from at least nine investors from China. The investors made their investments through the EB-5 immigrant investor program, which is a U.S. government immigration program for foreign nationals seeking permanent U.S. residency.

6. Van Den Heuvel promised to use the funds from the EB-5 investors from China to develop a Green Box facility in Michigan. In reality, Van Den Heuvel misappropriated millions of dollars, using investor funds to pay unrelated business and personal expenses.

7. Van Den Heuvel made other misrepresentations about the Green Box Process in order to attract funds from investors. He touted a relationship with Cargill and the ability to use a key additive when, in reality, Cargill had terminated the relationship and sued his company. He claimed that tax-exempt bonds would provide approximately $95 million to $125 million in financing when, in reality, he knew that the State of Michigan had all but denied the application. He represented that his company held seven patents when, in reality, it held only one. He also told different investors that their funds had purchased the same pieces of equipment.

8. Based on Van Den Heuvel’s representations, the investors believed that they were investing in a new, environmentally-friendly project to recycle waste. In reality, they unwittingly provided the financing for Van Den Heuvel’s improper spending spree. …

- September 19, 2017 Indictment, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CV-1261, United States Securities and Exchange Commission [SEC] v. Ronald Van Den Heuvel & Green Box NA Detroit LLC

INDICTMENT

THE GRAND JURY CHARGES:

1. Beginning at least by March 8, 2011, and continuing at least through August 2015 in the State and Eastern District of Wisconsin and elsewhere,

RONALD H. VAN DEN HEUVEL

knowingly devised and participated in a scheme to defraud lenders and investors, and to obtain money from lenders and investors by means of materially false and fraudulent pretenses, representations, and promises related to his “Green Box” business plan, which scheme is more fully described below.

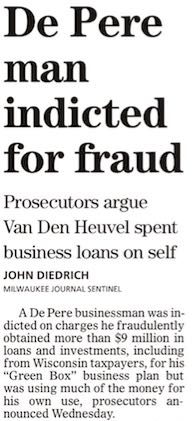

2. As a result of his scheme, Van Den Heuvel fraudulently obtained more than $9,000,000 from a range of lenders and investors, including individual acquaintances, the Wisconsin Economic Development Corporation (“WEDC”), a Canadian institutional investor, and Chinese investors who participated in the EB-5 immigrant investor program.

Background

3. At all times material to this indictment:

a. Defendant Ronald H. Van Den Heuvel purported to be a businessman in De Pere, Wisconsin. Earlier in his career, Van Den Heuvel had some success in the recycling and paper-making industry. By the end of 2010, however, Van Den Heuvel did not own or control any facilities that generated any significant revenue. Around then, Van Den Heuvel began promoting his “Green Box” business plan to obtain funds in the scheme.

b. As represented by Van Den Heuvel, the Green Box business plan was to purchase the equipment and facilities necessary to employ proprietary processes that could convert solid waste into consumer products and energy, without any wastewater discharge or landfilling of byproducts.

c. As part of his scheme, Van Den Heuvel formed and controlled numerous business entities, including ones identified below, that he used interchangeably for business and personal purposes.

d. Environmental Advanced Reclamation Technology HQ, LLC (“EARTH”) was the operating name of Everett Advanced Reclamation Technology HQ, LLC, which Van Den Heuvel formed as a Wisconsin limited liability corporation. Van Den Heuvel represented EARTH as the holding company for his other entities.

e. Green Box NA, LLC (“Green Box NA”) is a Wisconsin limited liability corporation that Van Den Heuvel formed and controlled.

f. Green Box NA Green Bay, LLC (“Green Box-Green Bay”) was a Wisconsin limited liability corporation that Van Den Heuvel formed and represented as pursuing the Green Box business plan in De Pere, Wisconsin.

g. Green Box NA Detroit, LLC (“Green Box-Detroit”) was a Michigan limited liability corporation that Van Den Heuvel formed and represented as pursuing a Green Box operation in Detroit, Michigan, that would sort waste and create fuel products.

The Scheme

Van Den Heuvel’s scheme was essentially as follows:

4. Beginning by at least March 8, 2011, and continuing through at least August 2015, Van Den Heuvel obtained funds from lenders and investors under materially false pretenses, representations, and promises, including the following:

a. Van Den Heuvel represented and promised that he would use, and had used, the lenders’ and investors’ funds to advance the Green Box operations. In many instances, Van Den Heuvel entered into agreements with lenders and investors that dictated specific uses for the funds, such as the purchase of particular equipment.

b. Van Den Heuvel produced false financial statements that grossly inflated his personal wealth and his companies’ assets, including its intellectual property.

c. Van Den Heuvel promised potential investors or lenders that their funding would allow him to acquire critical equipment and begin full-time Green Box operations quickly.

d. Van Den Heuvel falsely claimed to have entered into agreements with major companies when, in truth, Van Den Heuvel never had such agreements or they had been terminated.

e. Van Den Heuvel falsely represented that particular business entities had title and control of property where Green Box operations would occur when, in fact, those entities lacked title and control of the property.

f. Van Den Heuvel provided security interests in the same equipment to multiple investors and lenders, misleading them about the existence and value of their security interests.

5. Soon after receiving funds from lenders or investors, Van Den Heuvel diverted significant portions of the funds to purposes that did not advance the Green Box business plan, let alone the specific uses dictated in funding agreements. In the course of diverting the funding, and to conceal the diversion:

a. Van Den Heuvel opened numerous bank accounts at different financial institutions and in different business entities’ names.

b. Van Den Heuvel made multiple transfers of the funds between the bank accounts.

c. Van Den Heuvel converted large amounts of investors’ and lenders’ funds to cash.

d. Van Den Heuvel used significant amounts of the lenders and investors’ funds to pay personal expenses, creditors, and legal obligations that were unrelated to the Green Box business plan.

e. Van Den Heuvel also used substantial amounts of the lenders’ and investors’ funds to further promote the scheme. For example, Van Den Heuvel paid employees and consultants to prepare Green Box promotional materials, valuations, and financial statements that were based upon misleading assumptions Van Den Heuvel provided. Van Den Heuvel used those materials to obtain additional loans and investments.

6. As part of the scheme, Van Den Heuvel took steps to conceal how he had misused lenders’ and investors’ funds, lull lenders and investors into a false sense of security, and deter them from taking action to recoup their funds. Such steps included the following:

a. Van Den Heuvel claimed that new investments of tens and hundreds of millions of dollars were imminent, and that he would use those new investments to pay earlier lenders and investors.

b. Van Den Heuvel falsely represented to lenders and investors that their funds had been used for the intended purposes.

c. When lenders or investors questioned why the Green Box operations were not proceeding, Van Den Heuvel provided false excuses and did not reveal that he had diverted much of the funding. …

- September 20, 2017 U.S. Dept. of Justice Press Release, ‘De Pere Businessman Indicted for $9 Million Green Energy Fraud’

United States Attorney Gregory J. Haanstad, of the Eastern District of Wisconsin announced that the grand jury indicted Ronald Van Den Heuvel (age: 62) of De Pere, on wire fraud and money laundering charges today. The indictment alleges that Van Den Heuvel fraudulently obtained over $9 million in loans and investments for his eco-friendly “Green Box” business plan but diverted much of the funds to his own purposes.

- September 20, 2017 U.S. Securities and Exchange Commission Litigation Release No. 23938, Securities and Exchange Commission v. Ronald Van Den Heuvel, et al., No. 17-cv-1261 (E.D. Wis. filed Sept. 19, 2017), ‘Businessman Charged with Stealing Investor Funds for Packers Tickets’

The SEC’s investigation was conducted by BeLinda Mathie, James O’Keefe, and Jean Javorski, and supervised by Steven Klawans and David Glockner of the Chicago Regional Office. The litigation will be led by Steven Seeger.

- September 20, 2017 Notice of Appearance of Asst. U.S. Atty Rebecca Taibleson, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

- Milwaukee Journal Sentinel /

USA TODAY article as published in the

Green Bay Press-Gazette:

De Pere businessman Ronald Van Den Heuvel indicted for ‘green energy’ fraud

- October 4, 2017 Ronald H. Van Den Heuvel Plea Agreement, U.S. District Court, Eastern District of Wisconsin, Docket No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel, Paul Piikkila, and Kelly Van Den Heuvel

- October 10, 2017 Change of Plea Hearing Minutes, U.S. District Court, Eastern District of Wisconsin, Docket No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel, Paul Piikkila, and Kelly Van Den Heuvel

- October 10, 2017 Minute Entry for Arraignment Proceedings, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

- October 10, 2017 Order Setting Conditions of Release, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CR-160, United States of America v. Ronald H. Van Den Heuvel

- Wisconsin State Journal:

‘Businessman’ accused of defrauding Wisconsin Economic Development Corp. / WEDC pleads guilty to bank fraud

Ron Van Den Heuvel, 63, [pleaded guilty to conspiracy to commit bank fraud] in federal court, with prosecutors agreeing to dismiss 18 other counts. Sentencing is set for Jan. 5.

Meanwhile, Van Den Heuvel also entered a not guilty plea on 14 new charges – 10 counts of wire fraud and four counts of unlawful financial transactions – that prosecutors filed last month. No trial date was set in that case.

Ron Van Den Heuvel faces up to five years in federal prison and a $250,000 fine. … Van Den Heuvel also agreed to pay restitution of $316,445.79. …

Judge Griesbach clarified with Van Den Heuvel that the elements of the conspiracy count include that he knowingly entered into the conspiracy. …

As for the newest case, prosecutors allege Van Den Heuvel raised more than $9 million from investors, including the Wisconsin Economic Development Corp., for his company, Green Box, but used some of the money on personal items, including a car and Packers tickets. If convicted of all 14 counts, he faces up 240 years in prison and more than $2.5 million in fines.

Assistant U.S. Attorney [Matthew] Krueger said prosecutors have more than 700,000 pages of evidence to turn over to the defense in the case, so no trial date was set. Instead, the parties return to court Dec. 13 for a status conference.

- Green Bay Press-Gazette / USA TODAY:

De Pere ‘businessman’ Ron Van Den Heuvel pleads guilty to conspiracy to commit bank fraud in Green Box case

U.S. District Court Judge William Griesbach accepted [Ron Van Den Heuvel’s] plea agreement and found Van Den Heuvel, 63, guilty of one count of conspiracy to commit bank fraud. …

The terms of the plea agreement will keep Van Den Heuvel out of jail until a Securities and Exchange Commission fraud case against him is resolved. The agreement calls for him to pay Horicon Bank $316,445 in restitution. The other 18 counts were dismissed but can be factored in at sentencing. …

Prosecutors said Tuesday [the prison sentencing] range will be between 33 and 41 months, though Griesbach can ignore all guidelines and recommendations in deciding the sentence.

Van Den Heuvel will be sentenced at 9:30 a.m. Jan. 5 [2018]. …

[Judge] Griesbach told [Ron Van Den Heuvel] the court was “not going to play games” when it came to intent since intent is inherent in a conspiracy to defraud a bank. When Griesbach asked whether he was guilty of conspiring to commit bank fraud, Van Den Heuvel paused before answering, “Yes, sir.”

After accepting Van Den Heuvel’s guilty plea, Griesbach pivoted to the SEC’s 14-count complaint that Van Den Heuvel defrauded investors out of $9 million. The complaint includes 10 counts of conspiracy to commit wire fraud by making false statements and four counts of conducting unlawful financial transactions.

Van Den Heuvel entered not guilty pleas to all 14 counts.

For each wire fraud charge, Van Den Heuvel faces a maximum of 20 years in prison and a $250,000 fine. The unlawful transactions charges each carry a maximum of 10 years in prison and a fine equal to twice the value of the transactions in question.

- Great Lakes Echo / Capital News Service:

Major ‘recycling’ scam in Michigan & Wisconsin sparks indictment

A bogus scheme to build an eco-friendly “green energy” waste processing facility in Detroit defrauded lenders and investors — including Chinese investors hoping to qualify for U.S. visas — of $4,475,000, according to a federal grand jury in Milwaukee. …

Van Den Heuvel worked through Green Detroit Regional Center, which is owned by a Georgia law firm that is authorized to operate in Wayne, Livingston, St. Claire, Lapeer and Macomb counties, court documents said. The center finds “foreign clients, mainly from China and South Korea, to invest in large alternative energy projects,” according to its website.

“Green Detroit Regional Center promoted the EB-5 investments in Green Box Detroit based on Van Den Heuvel’s representations,” the SEC suit said. It said the chief executive officer of the Green Detroit Regional Center, Georgia lawyer Simon Ahn, marketed the project to investors through immigration consultants in China. Neither Ahn nor Green Detroit Regional Center have been charged or sued by the SEC.

Ahn said, “If the charges are true, it is completely shocking to learn about the extent that Ron Van Den Heuvel hid the truth from me,” the center and investors.

“All of us visited the plants in Wisconsin many times, including the potential site in Detroit, and everything checked out fine. All the financials from a recognized accounting firm indicated that everything was proceeding on track, Ahn said.

The SEC suit said Van Den Heuvel falsely told investors that the MEDC [Michigan Economic Development Corp.] had approved tax exempt bonds for the project. However, the MEDC rejected the request after discovering five tax liens, one construction lien, two state tax warrants, four civil judgments and three civil lawsuits, according to court documents.

October 30, 2017 Plaintiff U.S. Securities & Exchange Commission / SEC’s Request for Clerk’s Entry of Default Against Defendant Green Box NA Detroit LLC, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CV-1261, U.S. Securities & Exchange Commission [SEC] v. Ronald Van Den Heuvel and Green Box NA Detroit LLC

October 30, 2017 Plaintiff U.S. Securities & Exchange Commission / SEC’s Request for Clerk’s Entry of Default Against Defendant Green Box NA Detroit LLC, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CV-1261, U.S. Securities & Exchange Commission [SEC] v. Ronald Van Den Heuvel and Green Box NA Detroit LLC

The SEC filed the Complaint in this action on September 19, 2017, and promptly served [Green Box NA Detroit LLC]. A process server served Green Box Detroit with a copy of the summons and the Complaint through its registered agent on September 25, 2017. The SEC, in turn, filed a return of service on September 29, 2017. …

…Green Box Detroit had an obligation to file an answer within 21 days of service of the summons and the Complaint. That is, Green Box needed to file its answer by October 16. That deadline has now passed. Accordingly, the SEC respectfully requests the clerk’s entry of default against Green Box [NA Detroit LLC.]

- PACER: October 31, 2017 Clerk’s Entry of DEFAULT as to Green Box NA Detroit LLC, U.S. District Court, Eastern District of Wisconsin, Case No. 17-CV-1261, U.S. Securities & Exchange Commission [SEC] v. Ronald Van Den Heuvel and Green Box NA Detroit LLC

October 31, 2017 DEFAULT JUDGMENT against Tissue Technology LLC and Ron Van Den Heuvel, Brown Co. Case No. 16CV1137, Daniel J. Platkowski v. Ron Van Den Heuvel; Howard Bedford [rep’d by Godfrey & Kahn]; Tissue Technology LLC; Glen Arbor LLC; Quotient Partners [dismissed defendants: GlenArbor Equipment LLC; Reclamation Technology Systems LLC; Stonehill Converting LLC; Horicon Bank]

October 31, 2017 DEFAULT JUDGMENT against Tissue Technology LLC and Ron Van Den Heuvel, Brown Co. Case No. 16CV1137, Daniel J. Platkowski v. Ron Van Den Heuvel; Howard Bedford [rep’d by Godfrey & Kahn]; Tissue Technology LLC; Glen Arbor LLC; Quotient Partners [dismissed defendants: GlenArbor Equipment LLC; Reclamation Technology Systems LLC; Stonehill Converting LLC; Horicon Bank]

November 3, 2017 Plaintiffs’ Post Trial Brief, U.S. District Court / Eastern Wisconsin, Green Bay Division Case No. 14-CV-1203, Tissue Technology LLC, Partners Concepts Development Inc., Oconto Falls Tissue Inc., and Tissue Products Technology Corp. v. TAK Investments LLC and Sharad Tak

November 3, 2017 Plaintiffs’ Post Trial Brief, U.S. District Court / Eastern Wisconsin, Green Bay Division Case No. 14-CV-1203, Tissue Technology LLC, Partners Concepts Development Inc., Oconto Falls Tissue Inc., and Tissue Products Technology Corp. v. TAK Investments LLC and Sharad Tak

From a macro prospective, [Sharad] Tak took a position in this case that he believed would exonerate him from having to pay the investment notes. However, that position taken to its logical conclusion put Mr. Tak in jeopardy of having committed bank fraud. That fraud takes two forms. First, Mr. Tak claims to have issued the “worthless” notes so Ron Van Den Heuvel could use them to obtain financing from conventional sources. That is, he willingly executed the “worthless” notes for Mr. Van Den Heuvel to present to lending institutions to obtain more financing. … Second, Mr. Tak executed documents granting his approval of the use of the Notes as collateral by lending institutions, notes that he claims were of no value but were nevertheless utilized to secure borrowing. … Of course, his testimony in this regard is not worthy of any belief as he was clearly motivated to lie so as not to have to pay the plaintiffs the money he had promised on behalf of his company. Sharad Tak is a liar and his testimony should be disregarded in its entirety. He lied to the Court on repeated occasions leaving the only reasonable version of facts upon which this Court can rely to be those presented by the plaintiffs. Despite the fact that the strict falsus in uno inference has been abandoned, the modified doctrine applies here. When a witness’ falsehoods have been so pervasive, as have Mr. Tak’s, that his entire testimony is tainted, the trier of fact can reject the entirety of the witness’ testimony. … Mr. Tak’s lies were pervasive and central to the substance of the case thereby enabling the modified falsus in uno analysis. It is respectfully requested that this Court order judgment in favor of the plaintiffs on the four Notes with interest and attorney’s fees.

FACTS

Ron Van Den Heuvel and Sharad Tak are the principals of the respective parties herein. Their stories and clashes have been recounted numerous times in the various pleadings submitted to this Court. Their business relationship commenced in 2005 when they talked about various projects including the building of tissue mills in De Pere, Wisconsin, the State of Utah and Oconto Falls, Wisconsin. In fact, the parties prepared a document on December 27, 2005 describing the scope of their anticipated projects. … This yielded a memorandum of understanding executed by the same parties on May 5, 2006. … They executed a joint business development agreement on the same date. … At trial, the defense tried to hone in on the fact that these were non-binding agreements–which is true. However, the documents were submitted in order to demonstrate the background that brought the parties to the execution of the Final Business Terms Agreement and the four Promissory Notes on April 16, 2007. … The four Notes, termed the “Investment Notes”, were executed in anticipation of some rather significant construction projects that would benefit Mr. Van Den Heuvel’s construction company, Spirit Construction. … The scope of the project was as significant as $550 to $600 million. … Nevertheless, all of the documents taken together serve as the backbone for what became the Final Business Terms Agreement. … This background is vitally important to understanding why the four Investment Notes were issued, how and why they relate to the Final Business Terms Agreement and how those Notes were to be terminated should the parties enter into the overarching construction contracts they had anticipated.

The parties’ agreements were paired down in scope as they neared the April 16, 2007 closing at which time the defendant was to complete the purchase of the assets of the Oconto Falls tissue mill. It is clear that the financing of the project was cut substantially immediately before the closing by Goldman Sachs. … Because of that reduction in funding and the fact that there were various outstanding loans that needed to be satisfied at or before closing, Ron Van Den Heuvel and his companies made certain agreements, including with Mr. Van Den Heuvel’s brothers, to ensure that Sharad Tak received clean title. … It was clear that the Investment Notes and the Final Business Terms Agreement were to further reflect the agreement between the parties, to wit: Sharad Tak and his companies and Ron Van Den Heuvel and his companies, to clear title as well as to prospectively govern their conduct. … As set forth in the Closing Statement, …there were various parties who were not paid out of closing, but were paid outside of closing and were otherwise given security for the loans in order to have the deal go through. This included certain side deals that satisfied debts with Nicolet Bank, Johnson Bank, Associated Bank, William Bain, Mr. Van Den Heuvel’s brothers’ companies and others. …

…Not only should Mr. Tak’s testimony be disregarded as disingenuous, deceitful and even criminal – his testimony as to the meaning of the documents is not consistent with the Wisconsin requirement that the documents must be read so as to make sense.

CONCLUSION

It is time for the Defendant’s charade to end. Mr. Tak has lied to this Court in brazen fashion. He has tried in every way to avoid his legal obligations and promises. The Plaintiffs are entitled to judgment in this case as of December 1, 2017 in the amount of $ $34,191,050.00 along with actual attorney’s fees as called for in the Notes. It is respectfully requested that the Court so order.

Dated this 3rd day of November, 2017.

TERSCHAN, STEINLE, HODAN & GANZER, LTD.

ATTORNEYS FOR PLAINTIFFS,

BY: /S/MICHAEL J. GANZER

STATE BAR NO. 1005631

See also:

Neither a bank fraud

Straw Borrower

nor a money laundering

Straw Campaign Donor be.

- November 7, 2017 Opinion,

U.S. Tax Court

Docket Nos. 4756-15, 21583-15,

VHC Inc. and Subsidiaries v.

Commissioner of Internal Revenue [IRS]

Beginning in 2000 [William Bain], a VHC shareholder and former brother-in-law, served as a straw borrower for Ronald H. by obtaining loans on behalf of Ronald H. at different banks. In 2000 he obtained a loan for $125,000 from Associated Bank and a loan for $250,000 through Nicolet Bank. In 2002 he used his personal credit to obtain a $500,000 loan of which Ronald H. used the proceeds to buy out an EcoFibre shareholder.

In 2004 VHC advanced approximately $120,000 for Ronald H. to pay three years of past-due property taxes on his home. In 2005 VHC advanced funds for Ronald H. to reduce the principal owed on his home by $2 million.

Between 1998 and 2001 VHC began having conversations with Ronald H.’s banks, individual lenders, and investors on the status of his related companies. Local Green Bay bankers called David to discuss their lending activities with the companies and whether there was a real prospect of repayment.

VHC negotiated with banks on behalf of Ronald H. and his related companies and agreed to pay his debts at banks and provide substitute collateral. David met with Associated Bank and told the bank that VHC would purchase a bankrupt steel company that Associated Bank held and that VHC would guarantee Ronald H.’s loans with the bank. In order for VHC to receive a long-term loan from Associated Bank, VHC agreed to guarantee Ronald H.’s and his related companies’ debts and to provide as collateral buildings that VHC owned. …

From as early as 2000 the record establishes that Ronald H. could not obtain loans from some outside lending institutions. Starting in 2000 W. Bain served as a straw borrower for Ronald H. because he was unable to obtain loans himself. Between 1998 and 2001 VHC began having conversations with Ronald H.’s banks, individual lenders, and investors on the status of his companies and whether there was a real prospect of repayment.

VHC continued to advance funds to Ronald H. and his related companies despite knowing that by 2000 banking institutions and other third-party creditors were no longer lending to him and the companies. VHC recorded on its spreadsheet that from 2000 through 2013 it continued making substantial advances to Ronald H. and his related companies. The financial institutions that made loans to Ronald H. sought guaranties from VHC whereas VHC had no guaranties, collateral, or recourse for failure to repay. This factor suggests that the advances were not debt.

- Law360: Tax Court Backs IRS’ Rejection Of $92M Bad-Debt Deduction

by Natalie Olivo

The U.S. Tax Court on Tuesday upheld the IRS’ disallowance of $92 million in bad-debt deductions claimed by a Wisconsin holding company with stakes in paper mill enterprises, finding the debt at issue was not bona fide.

Family-owned VHC Inc. had contended the company owned debt and not equity in a spinoff business operated by a relative, referred to as Ronald H. in the opinion and Ron Van Den Heuvel in VHC’s petition, and that the Internal Revenue Service wrongly disallowed deductions related to the debt, which a series of bad deals had rendered illiquid. However, in sustaining the IRS’ disallowance of related deductions for the 2004 through 2013 tax years, Tax Court Judge Kathleen Kerrigan narrowed in on the debt itself, noting that “there is no bad-debt deduction without bona fide debt.”

In finding that the debt did not hold up under scrutiny, Judge Kerrigan said VHC began issuing debt in the form of promissory notes to Van Den Heuvel’s acquired companies in 1997, notes that purported to reflect advances.

Van Den Heuvel and his companies routinely failed to comply with the terms of the promissory notes and VHC failed to enforce them, Judge Kerrigan said, but VHC continued to advance funds despite an increasing outstanding balance.

“VHC did not intend to create a bona fide debtor-creditor relationship, and the economic circumstances that existed during the time VHC made its advances establish that it did not reasonably expect repayment,” Judge Kerrigan said. “VHC is not entitled to related-party bad-debt deductions for the advances it made to Ronald H. and his related companies during the tax years at issue.”

In its March 2015 petition, VHC had said that although it declined Van Den Heuvel’s solicitations to invest in businesses under his control, the company began issuing debt in the form of promissory notes to his acquired companies for equipment and overhead costs.

Shortly before 2000, VHC issued a line of credit to Van Den Heuvel’s cotton fiber plant for the installation of a key machine, thinking the transaction was secured by the fact that United Arab Emirates Investment Ltd. had made an offer on the plant that would have far exceeded the amount of the company’s debt. However, UAEI withdrew from the deal at the last minute after the Sept. 11, 2001, terror attacks, saying the status of a Middle Eastern company in the U.S. had become too risky.

About the same time, Enron, one of the debtor’s key backers, filed for bankruptcy.

VHC gave the company even more money after the two collapses to help it get back on its feet, but a series of bad deals would prevent repayment for years, causing VHC to declare the bad-debt deductions on each year’s tax returns, according to the petition.

In 2007, however, it appeared that the debt would be repaid with an offer on the mill from Goldman Sachs-backed ST Paper, to purchase Van Den Heuvel’s assets. Believing the deal would bear fruit, VHC waived its bad-debt deduction for its 2006 returns. However, VHC recanted when it learned that under a new arrangement, ST Paper would execute the sale in the form of promissory notes rather than cash payments.

Judge Kerrigan noted on Tuesday that because she concluded the advances did not constitute bona fide debt, she did not need to address whether VHC had shown that the advances became partially worthless.

VHC had argued that if the Tax Court concluded that the advances did not represent bona fide debt, then it was entitled to business expense deductions related to guarantees of the Van Den Heuvel company debts.

However, Judge Kerrigan ruled that the advances were not deductible. She also rejected several other alternative arguments that VHC had put forward, including its contention that it was entitled to deductions because it paid interest from 2009 to 2013 on a bona fide debt.

Counsel for VHC declined to comment, and the IRS does not comment on pending litigation.

VHC is represented by Robert E. Dallman, Daniel B. Geraghty, Robert M. Romashko and Patrick S. Coffey of Husch Blackwell LLP.

The IRS is represented by Christa A. Gruber, Lauren N. May and Danielle R. Dold.

The consolidated cases are VHC Inc. and subsidiaries v. Commissioner of Internal Revenue, docket numbers 4756-15 and 21583-15, in the U.S. Tax Court.

MEANWHILE…

ONEIDA NATION of WISCONSIN

v.

VILLAGE of HOBART, WISCONSIN

November 2, 2017 Order Denying the Village of Hobart’s Civil L.R. 7(H) Expedited Non-Dispositive Motion to Clarify the Court’s October 23, 2017 Decision and Order on Burden of Proof, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 16-CV-1217, Oneida Nation v. Village of Hobart, Wisconsin

November 2, 2017 Order Denying the Village of Hobart’s Civil L.R. 7(H) Expedited Non-Dispositive Motion to Clarify the Court’s October 23, 2017 Decision and Order on Burden of Proof, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 16-CV-1217, Oneida Nation v. Village of Hobart, Wisconsin

- November 1, 2017 Civil L.R. 7(H) Expedited Non-Dispositive Motion to Clarify the Court’s October 23, 2017 Decision and Order on Burden of Proof, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 16-CV-1217, Oneida Nation of WI v. Village of Hobart, WI

The body of the [October 23, 2017 Decision & Order on Burden of Proof], however, also contained the following language: “The entire [Village of Hobart] is in Indian country as that term has been defined by Congress and the Supreme Court, and thus all of the activities the Village seeks to regulate occurred in Indian country absent proof of diminishment.” … Moving forward, the Village anticipates the Nation may argue this language bars the Village from asserting the many defenses and counterclaims it has filed, in this case, other than the ones based on diminishment. Importantly, however, any such findings fall well outside the scope of Nation’s Motion, as it did not request any declaration, finding, or ruling on these issues, and the Village did not have any corresponding opportunity to respond to any such request or argument. Instead, the Nation’s Motion was limited to the narrow issue of clarifying the parties’ respective burdens of proof as they continue to litigate this matter further, and any order flowing from this Motion should be limited accordingly. Dispositive motions are due 30 days following the close of discovery on March 12, 2018, or 30 days following any extension to the close of the discovery date. … The Village anticipates that further discovery before this deadline, including the above-discussed expert witness reports and extensive briefing and legal arguments, will have a significant impact on any analysis of all claims and defenses asserted in this case. As a result, any decision on those key issues should not be made until the parties have conducted that discovery and actually requested summary judgment on their respective claims and defenses.

Furthermore, the questions of whether the Village is entirely located in Indian country, whether the activities the Village seeks to regulate occurred in Indian country, and exactly what that means in terms of enforcing the precise ordinance involved in this case are the issues at the very heart of the parties’ current lawsuit, and they should not be settled in the Court’s discussion of a procedural motion clarifying the parties’ respective burdens of proof. This is a particularly salient point given this Court’s prior language in this lawsuit that the “notion of Indian country is less than clear, however, especially where as here the entire Village of Hobart is within the area the Nation identifies as Indian country.” (Decision and Order…) See also United States v. Lara … (2004) (“Federal Indian policy is, to say the least, schizophrenic. And this confusion continues to infuse federal Indian law and our cases.”).

Therefore, the Village respectfully requests an order from the Court clarifying that its October 23, 2017 Decision and Order on Burden of Proof is limited to the three actual Orders found on the last page of the decision. … In the event the Court denies this Motion, the Village respectfully requests the issuance of a briefing schedule for a motion to reconsider so the potentially dispositive language found in the body of the decision may be fully briefed to the Court.

See also:

- FOX 11 WLUK: Judge rules in Oneida Nation of WI’s favor as lawsuit over Hobart permit request continues

- Courthouse News Service: Judge Advances Wisconsin Tribe’s Challenge to Event Permits

- October 23, 2017 Decision & Order on Burden of Proof, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 16-CV-1217, Oneida Nation of Wisconsin / ONWI v. Village of Hobart, Wisconsin

IT IS THEREFORE ORDERED that the Nation’s motion to clarify (ECF No. 59) is GRANTED.

IT IS FURTHER ORDERED that the parties bear the following burdens of proof, whether such matters are the subject of expert reports or otherwise: