![]()

![]()

![]()

![]()

![]()

![]()

UPDATES:

- August 24, 2017 ORDER

re: Circuit Rule 33,

U.S. 7th Circuit Court of Appeals,

Docket No. 17-2341,

[Oneida Nation of Wisconsin-owned]

Oneida Seven Generations Corp.

and subsidiary

Green Bay Renewable Energy, LLC

[OSGC & GBRE]

v.

City of Green Bay

Pursuant to Circuit Rule 33, briefing in this appeal is

SUSPENDED

pending further court order.

Previously:

• June 28, 2017 Court Documents for the U.S. 7th Circuit Court of Appeals, Docket No. 17-2341, [Oneida Nation of Wisconsin-owned] Oneida Seven Generations Corp. / OSGC & subsidiary Green Bay Renewable Energy, LLC / GBRE v. City of Green Bay

• June 6, 2017 Decision and Order Granting Motion to Dismiss, U.S. District Court for the Eastern District of Wisconsin, Case No. 16-CV-1700, [Oneida Nation of Wisconsin-owned] Oneida Seven Generations Corp. / OSGC & subsidiary Green Bay Renewable Energy, LLC / GBRE v. City of Green Bay

ALSO on 08/24/17:

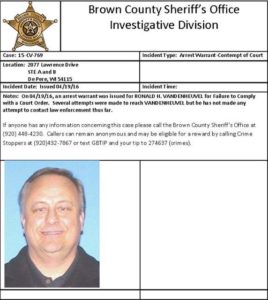

- Tissue Products Technology Corp.

changed Registered Agent to Ron Van Den Heuvel; TPTC was Organized w/ WDFI on 12/11/01 as Oconto Falls Tissue Technologies, Inc., but changed names 02/04/02; Registered Agent also changed on 04/11/07, and 05/20/09, and 11/11/14

- Tissue Technology, LLC changed Registered Agent to Ron Van Den Heuvel; TTL was organized 04/17/06; Registered Agent also changed on 05/19/09, and 06/29/15According to Advisory Notes provided to Oneida Eye by fmr. OBC Chair Ed Delgado‘s ‘Elder Advisor’ Yvonne Metivier:

Oneida Energy, Inc. (BIA can get $ back)

Oneida Recycling, LLC (BIA cannot get $) …4. Investors and Shareholders

(who will have oversite?)

Must disclose under GTC DirectiveEd,

In 2007, Glory [LLC / OSGC] allowed Nature’s Way [Tissue] Corporation to switch to be TTL, LLC. That way Artley [Skenandore Jr.] et al [i.e. Ron Van Den Heuvel & Steven Peters] could not have personal assets attached for repayment as a corporation, but as an LLC could only have the business’ assets attached. [OSGC CEO] Kevin Cornelius et al plan to do the same with Oneida Energy, Inc. switch to Oneida Recycling [Solutions], LLC.

Highly Suspect

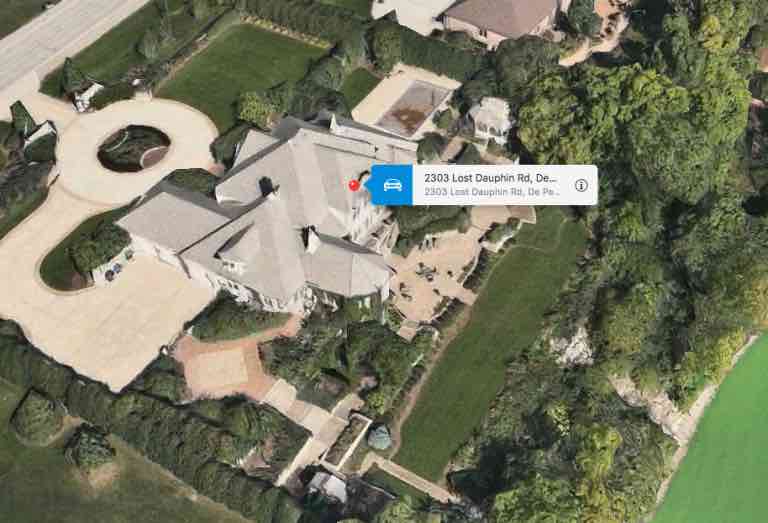

• According to WDFI.org, Oneida Recycling Solutions, LLC was Organized on 01/12/10 and officially Dissolved on 05/29/17; Principal Office: 1239 Flight-Way Dr., De Pere, WI 54115-9596; Registered Agent: Kevin I. Cornelius

_______________________

![]()

- August 29, 2017 Cease & Desist / Threat Letter Postmarked 08/30/2017 from ONWI Law Office / OLO Staff Attorney Krystal John to Oneida Eye Publisher Leah Sue Dodge re: use of the ONWI ‘Oneida Casino’ logo in a native news / educational / anti-crime blog

Dear Ms. Dodge,

The Oneida Casino was made aware of the Oneida Eye’s unauthorized use of the Oneida Casino’s logo on a recent blog entry discussing the July 2017 election. The Oneida Casino’s logo is proprietary to the Oneida Casino. As permission was not provided for the Oneida Eye’s use of the Oneida Casino’s logo, the Oneida Casino respectfully requests that the logo be removed from the blog page and that the Oneida Eye refrain from any future use of the Oneida Casino’s logo on its blog page.

If the Oneida Casino’s logo is not removed from the Oneida Eye’s blog page within three (3) business days from the date of this letter, the Oneida Casino may consider legal enforcement of its request for removal.

The Oneida Casino appreciates your understanding and your timely response to its noted concern.

Sincerely,

ONEIDA LAW OFFICE

By: Krystal L. John, Staff Attorney

Wisconsin State Bar No. 1093818CC: Interoffice with Return Receipt at Oneida Casino

Oneida Casino General Manager,

Louise Cornelius

More like…

‘NO-IDEA ABOUT LAW’ OFFICE.

Speaking of which…

August 31, 2017 Memorandum of Law in Support of Oneida Nation of Wisconsin’s Motion to Clarify Burden of Proof, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 1:16-cv-01217, Oneida Nation of Wisconsin v. Village of Hobart, Wisconsin

August 31, 2017 Memorandum of Law in Support of Oneida Nation of Wisconsin’s Motion to Clarify Burden of Proof, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 1:16-cv-01217, Oneida Nation of Wisconsin v. Village of Hobart, Wisconsin

Related:

See also…

- August 17, 2017

Complaint and Exhibits,

U.S. District Court for the Northern District of New York, Case No. 5:17-cv-913, Oneida Indian Nation of New York v. United States Department of the Interior [86 pages]

3. The [Oneida Indian Nation of New York] sues the Department [of the Interior] under the Administrative Procedure Act to overturn a series of final agency actions taken during the previous administration. By those actions, the United States first gave federal approval to and then federally recognized the change of name of the Oneida Tribe of Indians of Wisconsin (“the Wisconsin tribe”) to Oneida Nation,

causing confusion with

and damaging

[Oneida Indian Nation of NY]. The last of the challenged agency actions – the Department’s decision to change the Wisconsin tribe’s federally recognized name that is published in the Federal Register in the official list of federally recognized tribes – appears to have been approved by a Department official who was a member of and a former attorney for that Wisconsin tribe who thus had a disqualifying conflict of interest….5. As a result of the Department’s approval and recognition actions, the Wisconsin tribe is now claiming legal rights in the Oneida Nation name. The Wisconsin tribe also is insisting that [Oneida Indian Nation of NY] has lost trademark rights in the Oneida Nation name and more generally has now lost the right even to refer to itself as the Oneida Nation, a name by which the [Oneida Indian Nation of NY] has been known. …

7. The Department decided, without regard to any other facts, to automatically accept – for purposes of federal law and federal recognition – the decision of the Wisconsin tribe to change its name. By abdicating its duty to make an independent federal decision before federally approving and recognizing the name change, the Department entirely yielded federal decision-making responsibility to the Wisconsin tribe. …

10. Unless the Department’s actions are set aside, the potential for damage and unfairness to Indian tribes – and chaos – is enormous. Many tribes share common histories and have similar names and now are susceptible to the same misappropriation of identity that the [Oneida Indian Nation of New York] has suffered. …

C. Previous Efforts of the Wisconsin Tribe to Pass Itself Off in New York as the [Oneida Indian Nation of New York]

26. Beginning in the 1990s, the Wisconsin tribe sought to interfere in [Oneida Indian Nation of New York’s] affairs and to claim [OINNY]’s rights. For example, the Wisconsin tribe claimed an interest in revenues from the [Oneida Indian Nation of NY]’s casino in New York, claimed rights in the [Oneida Indian Nation of NY]’s reservation in New York, and asserted the power to settle the [Oneida Indian Nation of NY]’s land claim against the State of New York (then pending in the Northern District of New York).

27. The Wisconsin tribe also formed an entity that it named the “Oneida Preservation Committee,” which was named and acted to materially mislead the public into believing it was [an Oneida Indian Nation of NY] entity working in New York on behalf of the [OINNY]. The Committee was headed by a Wisconsin tribal official.

28. By confusing the public, causing it to believe that the Committee was the [Oneida Indian Nation of New York], and then intensifying local hostility to [OINNY] by threatening the [Oneida Nation of New York]’s non-Indian neighbors with the loss of their lands, the Wisconsin tribe intended for the Committee to pressure [OINNY] to settle its land claim case. The Committee flooded the area in and around the Oneida reservation in central New York with adversarial mailings and radio ads, knowing that references to Oneida, the Nation and Oneida Nation would be universally understood to refer to the [Oneida Indian Nation of New York]. Specifically, the Committee:

a. used the tribal name “Oneida,” omitting any Wisconsin reference;

b. falsely stated in writing that “[t]he Oneida Preservation Committee is charged by the [Oneida Indian Nation of NY] with working out a settlement that will not displace current residents”;

c. used stationery with a logo that mimicked the [Oneida Indian Nation of NY] logo;

d. used stationery with “New York” printed on it and used a New York return address and a New York postmark on mailings; and

e. stated in mailings that the committee spoke for “the Oneidas,” “the Oneida people” and “the people of the Oneida Nation.”

29. After a mid-1994 mailing, the [Oneida Indian Nation of NY] filed suit to stop the impersonation.

30. The Committee settled by agreeing to a “JUDGMENT AND PERMANENT CONSENT ORDER” that the court entered. The order applied to the Committee, its chair and “all other persons acting under them or on their behalf” and requires them, among other things, to use the following disclaimer in future documents and radio advertisements: “The Oneida Preservation Committee is not affiliated with or approved by the Oneida Indian Nation of New York.” The order required the disclaimer on any document or radio advertisement using the terms: “Oneida Nation,” “Oneida Indian Nation,” “Oneida Preservation Committee,” “the Oneida People,” “the Oneidas,” “the people of the Oneida Nation” and “the Oneida Indians.”

D. The Wisconsin Tribe’s Subsequent Strategy to Misappropriate and Assume the Oneida Nation Name Nationally

31. More recently, the Wisconsin tribe sought to misappropriate the historic Oneida Nation name and identity and to be something other than the Oneida Tribe of Indians of Wisconsin. Misappropriating the historic Oneida Nation name and eliminating any reference to Wisconsin is intended to convey the false message that the Oneida Nation actually left New York and now resides in Wisconsin and that the [Oneida Indian Nation of NY] on its reservation in New York is an offshoot of a true Oneida Nation that is located in Wisconsin. It also confuses the public and siphons away the goodwill that the [Oneida Indian Nation of New York] has created in its business and governmental relations.

32. The Wisconsin tribe wanted a federal imprimatur to be placed on the new name and to have the United States change the name by which the United States officially recognizes the Wisconsin tribe.

33. To that end, on November 10, 2010, the Wisconsin tribe’s government passed a resolution requesting that the Secretary of the Interior conduct a Secretarial election in which the tribe’s members could vote to amend the tribe’s constitution in several ways, including changing the tribal name from “Oneida Tribe of Indians of Wisconsin” to “Oneida Nation.” A Secretarial election is a federal election conducted by the Secretary of the Interior pursuant to federal regulations set forth in 25 C.F.R. Part 81. See 25 U.S.C. § 5123 (governs Secretarial approval of amendment of tribal constitutions).

34. By letter dated January 19, 2011, the Wisconsin tribe submitted the resolution to the Midwest Regional Office of the BIA and sought a decision by the Department to conduct a Secretarial election regarding the name change.

46. The Department appears to have acted under the direction of and notwithstanding the conflict of interest of the Acting Assistant Secretary. The Federal Register indicates that the revised list was published by or under the authority of “Lawrence S. Roberts, Acting Assistant Secretary – Indian Affairs.” 81 Fed. Reg. 26826 (May 4, 2016) …(bold and italics omitted); see 82 Fe3d. Reg. 4915, 4917 (Jan. 17, 2017) (most recent published list, under Mr. Roberts’ name, republishing Wisconsin tribe’s changed name). In 2016, the [Oneida Indian Nation of New York / OINNY], by counsel, made FOIA requests to the Department in Washington, D.C. for documents regarding Mr. Roberts’ recusal from decisions regarding the May 4, 2016 list. The Department neither produced documents nor indicated that it had no responsive documents.

47. Mr. [Larry] Roberts, who served during the prior administration and left the Department on January 20, 2017, could not be a neutral decision-maker. He is a member of the Wisconsin tribe, which had included Mr. Roberts’ name in a list provided to the Department in connection with the name-change election, titled “Final List of Registered Voters for the May 2, 2015 Secretarial Election Amending the Constitution and Bylaws of the Oneida Tribe of Indians of Wisconsin.” As a lawyer in private practice, Mr. Roberts had previously represented his tribe and had reason to believe he would continue to do so after leaving government service and returning to private practice. His interests could be substantially affected by the decision to change or not to change the name by which the United States officially recognizes his tribe, and his impartiality in the matter would reasonably be questioned.

PRAYER FOR RELIEF

WHEREFORE, the Oneida Indian Nation [of New York] prays for entry of judgment:

1. Declaring to be unlawful and setting aside the Acting Assistant Secretary’s decision to list the Oneida Tribe of Indians of Wisconsin as “Oneida Nation” in the May 4, 2016, Federal Register list of federally recognized Indian tribes and in subsequent lists;

2. Declaring to be unlawful and setting aside the Midwest Region’s earlier decisions to permit and approve the Wisconsin tribe’s constitutional name-change amendment;

3. Enjoining the Department from approving “Oneida Nation” as the name of the Wisconsin tribe or from listing that tribe as “Oneida Nation” in the official list published by the Department in the Federal Register;

4. Remanding the foregoing matters to the Department for proper administrative consideration, if the Court determines that the agency’s decisions are invalid only for reasons of lack of notice, process, reasoned explanation or absence of a neutral decision-maker; and

5. Awarding the Oneida Indian Nation [of New York] such other and further relief to which it may be entitled at law or in equity or as may otherwise be just and proper.

See also:

- USA Today/Green Bay Press-Gazette: Wisconsin Oneidas challenge New York Oneidas’ exclusive right to use trademarked names

DEVELOPING…

_______________________

QUESTION:

QUESTION:

WHAT IS…

CHEYBOYGAN ENERGY & BIOFUELS, LLC …

AND WHY DID RON VAN DEN HEUVEL ON AGAIN/OFF AGAIN

SOMETIMES ‘ATTORNEY’ TY C. WILLIHNGANZ ORGANIZE IT

ON MAY 24, 2013 [ARTICLES OF ORGANIZATION] WITH RON’s

E.A.R.T.H. AS ‘REGISTERED AGENT’ … THE EXACT SAME DAY

ONEIDA SEVEN GENERATIONS CORP. / OSGC CEO & SUBSIDIARY

GREEN BAY RENEWABLE ENERGY LLC CEO KEVIN CORNELIUS

SIGNED MASTER LEASE CONTRACTS WITH ACF LEASING LLC,

ACF SERVICES LLC & GENERATION CLEAN FUELS LLC…

FOR OSGC’s ‘PYROLYSIS’ SITES IN MENONA, WISCONSIN…

& CHEBOYGAN, MICHIGAN?

- ANSWER (zip file):

The CHEBOYGAN / CHEYBOYGAN ENERGY DOSSIER

Linking new people & businesses to the

RON VAN DEN HEUVEL / GREEN BOX NA

ABDUL LATIF MAHJOOB / ACTI

ALL NATIONS ENERGY ALLIANCE LLC

ALLIANCE CONSTRUCTION & DESIGN LLC

ONEIDA SEVEN GENERATIONS CORP.

GREEN BAY RENEWABLE ENERGY LLC

ONEIDA ENERGY INC.

ONEIDA ENERGY CORP.

GENERATION CLEAN FUELS LLC

WISCONSIN ECONOMIC

DEVELOPMENT CORP. / WEDC–, GAMING–, STATE– & FEDERAL–FUNDED

CRIMINAL FRAUD SCHEMES:

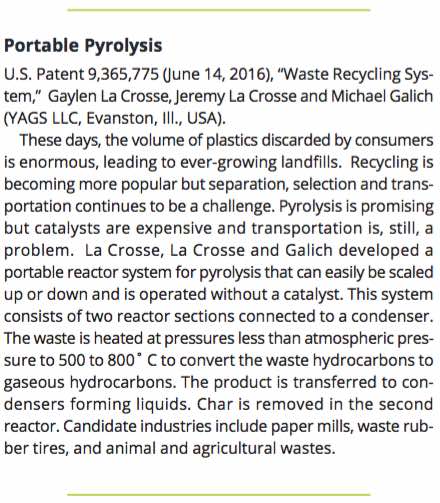

• GAYLEN LA CROSSE /

GAYLEN LACROSSE

• TERRY GAOUETTE

• AQUA 2MG, INC. / RECOVERING AQUA RESOURCES, INC.

• RECOVERING AQUA RESOURCES TECHNOLOGIES, INC.

• STEVEN PETERS

• ESTR, INC. /

ENVIRONMENTAL SYSTEMS TECHNOLOGY & RESEARCH

• JOSEPH WOLD, JR.

• GULF POINTE CAPITAL, LLC

• RUDOLPH TREBELS

/ RUDY TREBELS

• IFC CREDIT CORPORATION

• IFC CAPITAL FUNDING, LLC

• MARUBENI CORP.

• MARUBENI AMERICA CORP.

• MARUBENI GROUP

• PIC / POWER INDUSTRY CONSULTANTS

• RON VAN DEN HEUVEL

• KELLY VAN DEN HEUVEL

• MANCHESTER MORTGAGE CO., LLC

/ CITIZENS BANK

• JIM GEORGE

• ATTY. JOHN PETITJEAN

• VHC, INC.

• ONEIDA ENERGY, INC.

• ONEIDA SEVEN GENERATIONS CORP. / OSGC

• VETERANS CAPITAL CORP.

• ASC LEASE INCOME, LLC

• DAVID PENDELL

• MICHAEL S. FLAHERTY

• LOUIS STERN

• SPARTAN, INC.

• ERIC DECATOR

• ARLAND CLEAN FUELS, LLC

• ACF LEASING, LLC

• ACF SERVICES, LLC

• ACF IP, LLC

• GCF EQUIPMENT, LLC

• GENERATION CLEAN FUELS, LLC

• GREEN BAY RENEWABLE ENERGY, LLC

• KEVIN CORNELIUS

• ATTY. WILLIAM CORNELIUS

• CHEYBOYGAN ENERGY & BIOFUELS, LLC

• U.S. DEPT. OF INTERIOR / DOI

• BUREAU OF INDIAN AFFAIRS / BIA

• ONEIDA ENERGY CORP. / OEC

• ONEIDA ENERGY BLOCKER, INC.

• BRUSSELS PROPERTIES, LLC

• GREEN BOX NA MICHIGAN, LLC

• MICHIGAN STRATEGIC FUND

• MI GOV. RICK SNYDER

- Juneau County Star Times: Sports complex sparks lawsuit

The complaint also alleges that Woodside followed H&K’s recommendation to hire [Midwest] Engineering Services [Inc.] and Environmental Systems Technology & Research (ESTR) to design and install a wastewater treatment system to meet state Department of Natural Resources’ permit requirements.

The suit claims that neither company disclosed that ESTR planned to use a proprietary wastewater system, invented and patented by an ESTR principal, Gaylen LaCrosse, that later failed to meet DNR requirements.

The proprietary system had no track record of approval by state regulators for the planned application and was more expensive than other systems already backed and recommended by the DNR, the complaint alleges.

In addition, the complaint alleges that the companies attempted to hide that the proposed wastewater system had run afoul of DNR regulators and that H&K later incorrectly claimed that the [DNR] had issued the needed permit and that the company had also obtained related loans and grants.

ESTR later allegedly hired Midwest Engineering Services (MES) to assist with obtaining the DNR permit without notifying Woodside, according to the complaint.

The employee MES assigned to the project, Jeffrey Fischer, had previously surrendered his state license to work as a professional geologist after felony fraud convictions related to the state’s Petroleum Environmental Cleanup-up Fund and had no expertise in wastewater systems, the suit claims.

The suit also claims that H&K was negligent in not disclosing that a company executive, Terry Gaouette, had pleaded guilty to falsifying financial records of the Milwaukee Public Museum when he served as a top museum executive.

From the September 2016 issue of Plastics Engineering SPE Magazine:

July & August 2017 Roundup

From Oneida Eye’s

![]()

![]()

07/06/17 : July 6, 2017 Seventh Circuit Transcript Information Sheet by Michael B. Apfeld, U. S. 7th Circuit Court of Appeals, Docket No. 17-2341, Oneida Seven Generations Corp. / OSGC & subsidiary Green Bay Renewable Energy, LLC / GBRE v. City of Green Bay

07/09/17 : FOX 11 WLUK –

07/09/17 : FOX 11 WLUK –

Oneida Nation of Wisconsin / ONWI elects new Business Committee chair

Ron “Tehassi” Hill was elected to serve as Chairman of the Oneida Nation [of Wisconsin / ONWI] for the next three years.

Hill replaces Tina Danforth, who chose not to run this term.

[NOTE: Cristina Danforth was elected to the Oneida Gaming Commission / OGC, the legal counsel for which is Atty. William Cornelius, former President & Chair of Oneida Seven Generations Corp. / OSGC and Chair of OSGC-subsidiary Oneida Energy, Inc.

[NOTE: Cristina Danforth was elected to the Oneida Gaming Commission / OGC, the legal counsel for which is Atty. William Cornelius, former President & Chair of Oneida Seven Generations Corp. / OSGC and Chair of OSGC-subsidiary Oneida Energy, Inc.

The OGC oversees the ONEIDA NATION of WI-owned ONEIDA CASINO – not to be confused with the New York casinos of the ONEIDA INDIAN NATION of NY – and the OGC must approve all operational contracts entered into by the ONWI ONEIDA CASINO.

OSGC supposedly ‘leases’ buildings to the ONWI ONEIDA CASINO, including the business offices of the OGC itself…

OSGC supposedly ‘leases’ buildings to the ONWI ONEIDA CASINO, including the business offices of the OGC itself…

yet the ONWI ONEIDA CASINO pays for capital improvements to the buildings supposedly ‘owned’ by OSGC, for which Oneida Gaming Manager Louise King Cornelius’ nephew – OBC-appointed OSGC Managing Agent Pete King III of King Solutions, LLC– receives a salary to ‘oversee.’]

Approximately 1600 enrolled Oneida citizens participated in the election.

There are 10 days for the election to be challenged, the present Oneida Business Committee is expected to accept the election results on August 9, 2017.

The newly elected Oneida Business Committee will be sworn in during an inauguration ceremony on August 10th [2017].

Also elected to Vice Chairman is Brandon Yellowbird Stevens, who ran for this seat for the first time but has served several terms as a councilman.

Re-elected for the Treasurer was Trish King.

Debra Powless was elected to serve as Secretary.

Re-elected to the Council is Jenny Webster and David Jordan.

Newly elected council members are Kirby Metoxen, Daniel King-Guzman and Ernie Stevens III.

The entire Business Committee is the governing board of the Oneida Nation [of Wisconsin] and will serve for three year terms.

FALSE.

IN REALITY…

GENERAL TRIBAL COUNCIL / GTC

is the GOVERNING BODY of

ONEIDA NATION of WI / ONWI.

Oneida Nation of WI Constitution,

The governing body of the Oneida Nation shall be the General Tribal Council composed of all the qualified voters of the Oneida Nation.

THUS…

the OBC

is SUBORDINATE

to GTC.

NEVER FORGET.

07/10/17 : Green Bay Press-Gazette – Man sentenced to life, with eligibility in 45 years, in Oneida double homicide

A decade of violence perpetrated by a 20-year-old man preceded his slaying of a couple in the town of Oneida [Wisconsin] in September, a judge said at the man’s sentencing Monday afternoon.

Citing a pre-sentence report, Outagamie County Judge Mark McGinnis said Vance Reed had stabbed his mother 11 years ago, threatened to kill people in the past and at one point started questioning his school principal about what it feels like to kill someone.

“Seems like it’s been 10 years in the making,” McGinnis said of Reed’s brutal stabbing of Harry Brown Bear, 77, and his wife, Lorraine Brown Bear, 67, in the couple’s home. …

McGinnis pressed Reed on what pain he thought he had caused in the community and how others could know that Reed was truly sorry. The judge focused particularly on Reed’s use of the word “taken” instead of “killed” when describing the Brown Bears’ violent deaths.

“In September last year, for whatever reason, you killed — and I’m not going to substitute any word for it — you brutally killed two older, innocent people,” McGinnis said in handing down his sentence.

These were senseless acts that McGinnis said he couldn’t wrap his head around. Usually, there’s some conflict that precedes a homicide, he said.

In this case, there’s nothing.

“What makes sense, if any of this does, is that you were the guy who did it,” McGinnis told Reed. …

The murders terrorized the Oneida community, especially in the time between the homicides and Reed’s arrest, Outagamie County District Attorney Carrie Schneider said. They wondered whether the murderer was still around — and what they might do next.

- FOX 11 WLUK – Vance Reed sentenced in deaths of Oneida couple

The man convicted of a killing an Oneida couple was sentenced to 45 years in prison Monday.

Vance Reed stabbed Harry and Lorraine Brown Bear to death in their home on the Oneida [Nation of Wisconsin] Indian Reservation in October 2016.

During Reed’s sentencing, the judge said he is a danger to the community and will hurt someone again.

The judge said the murders were “completely senseless” and Reed needs rehabilitation.

Reed told police a heated argument started after he had been drinking, court documents said.

Reed pleaded no contest to two counts of First Degree Intentional Homicide in May.

Reed was 19 years old when he committed the murders. He will not be eligible for release until he is 64 years old.

Oneida Eye has received multiple reports that Oneida Nation in Wisconsin members, including Oneida Nation of WI High School Principal Artley Skenandore Jr., have made repeated – sometimes daily – requests to the Oneida Business Committee, the Oneida Housing Authority, and the Oneida Police Dept. (where Artley’s wife OPD Lieutenant Lisa Drew-Skenandore works) to gain access to the murder scene in order to take possession of Harry & Lorraine Brown Bears’ belongings, claiming that they had been ‘promised’ certain items by the Brown Bears.

July 10, 2017 Stipulated Protective Order of Chief Judge William C. Griesbach, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 1:16-cv-01217, Oneida Nation of Wisconsin / ONWI v. Village of Hobart, Wisconsin

July 10, 2017 Stipulated Protective Order of Chief Judge William C. Griesbach, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 1:16-cv-01217, Oneida Nation of Wisconsin / ONWI v. Village of Hobart, Wisconsin

July 10, 2017 United States’ Requests Regarding Evidentiary Hearing, U.S. District Court, Eastern District of Wisconsin, Docket No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel, Paul Piikkila, and Kelly Van Den Heuvel

July 10, 2017 United States’ Requests Regarding Evidentiary Hearing, U.S. District Court, Eastern District of Wisconsin, Docket No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel, Paul Piikkila, and Kelly Van Den Heuvel

![]()

![]()

07/11/17 : July 11, 2017 Notice of Rule 33 Mediation scheduled for July 27, 2017, U. S. 7th Circuit Court of Appeals, Docket No. 17-2341, Oneida Seven Generations Corp. / OSGC & subsidiary Green Bay Renewable Energy, LLC / GBRE v. City of Green Bay

07/12/17 : ![]()

![]() July 12, 2017 Order: Circuit Rule 33 – Briefing, U. S. 7th Circuit Court of Appeals, Docket No. 17-2341, Oneida Seven Generations Corp. / OSGC & subsidiary Green Bay Renewable Energy, LLC / GBRE v. City of Green Bay

July 12, 2017 Order: Circuit Rule 33 – Briefing, U. S. 7th Circuit Court of Appeals, Docket No. 17-2341, Oneida Seven Generations Corp. / OSGC & subsidiary Green Bay Renewable Energy, LLC / GBRE v. City of Green Bay

July 12, 2017 Response of the United States to Defendant Ronald Van Den Heuvel’s Motion for Severance of Counts, U.S. District Court, Eastern District of Wisconsin, Docket No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel, Paul Piikkila, and Kelly Van Den Heuvel

July 12, 2017 Response of the United States to Defendant Ronald Van Den Heuvel’s Motion for Severance of Counts, U.S. District Court, Eastern District of Wisconsin, Docket No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel, Paul Piikkila, and Kelly Van Den Heuvel

The defense memorandum in support of the motion to sever counts raises generic concerns over possible jury confusion, evidentiary overlap, and evidence admissible on some counts but not others. None of the defense arguments go beyond mere allegations to actually establish any reason to conclude that prejudice will necessarily result from one trial of all the counts in this indictment.

Without any analysis of the evidence, defendant Van Den Heuvel’s memorandum simply states that evidence of one of the two schemes alleged would not be admissible to prove the other scheme in separate trials. That may not necessarily be correct. On the face of the indictment, both schemes involve violations of the same statutes, allegations that Mr. Van Den Heuvel used others as straw borrowers to obtain loans for Mr. Van Den Heuvel and his business entities, and allegations that collateral controlled by Mr. Van Den Heuvel was used as security for the loans. With these points in mind, the United States does not concede that evidence of the one scheme could not be used to prove motive, intent, plan, absence of mistake, or lack of accident with regard to the other scheme…

The defense also asserts that the jury might be confused between schemes and convict the defendant in one scheme based on evidence of the other. That is theoretically possible but unlikely here because the charges are relatively simple (lying to get money) and they involve separate loans from separate financial institutions. When the evidence of separate counts is relatively short and simple and there is no reason established for concluding that the jury could not keep the evidence relevant to each count separate, there is no basis to sever counts under Rule 14(a).

![]() 07/13/17 : July 13, 2017 Amended Notice of Rule 33 Mediation scheduled for July 27, 2017, U. S. 7th Circuit Court of Appeals, Docket No. 17-2341, Oneida Seven Generations Corp. / OSGC & subsidiary Green Bay Renewable Energy, LLC / GBRE v. City of Green Bay

07/13/17 : July 13, 2017 Amended Notice of Rule 33 Mediation scheduled for July 27, 2017, U. S. 7th Circuit Court of Appeals, Docket No. 17-2341, Oneida Seven Generations Corp. / OSGC & subsidiary Green Bay Renewable Energy, LLC / GBRE v. City of Green Bay

According to a July 13, 2017 ‘Update Oneida’ Email to Oneida Nation of Wisconsin / ONWI Employees from Phil Wisneski in the Office of Intergovernmental Affairs & Communications / OIAC:

According to a July 13, 2017 ‘Update Oneida’ Email to Oneida Nation of Wisconsin / ONWI Employees from Phil Wisneski in the Office of Intergovernmental Affairs & Communications / OIAC:

On July 12, 2017 the Election Board conducted a recount of the votes cast for the positions of Business Committee Secretary and Judiciary – Appellate Court Judge. The recounts were conducted pursuant to Section 102.11 Section C of the Election Law which requires a manual recount to be completed upon request of a candidate (Section 102.11-7). The recounts were observed by an Attorney from the Law Office and an Oneida Police Officer to ensure proper procedure was followed.

The General Election results are tentative until all recounts have been completed. Per Election Law 2.11-5. A candidate may request the Election Board to complete a recount, provided the margin between the requesting candidate’s vote total and vote total for the unofficial winner was within two percent (2%) of the total votes for the office being sought or twenty (20) votes, whichever is greater. A candidate requests a recount by hand delivering a written request to the office of the [OBC] Secretary, or noticed designated agent, within five (5) business days after the election. Requests shall be limited to one (1) request per candidate.

• July 12, 2017 Oneida Nation of Wisconsin / ONWI General Election Updated Tentative Results PDF by the ONWI Election Board re: July 8, 2017 General Election Results Update following Recount Requests

Ballots of Milwaukee polling location were put through the AccuVote Tabulator machine and one ballot was spoiled due to an over vote in the Business Committee Council Members area. The manual recount of all the ballots cast in the 2017 General Election resulted in a change to the tentative results shown below.

*The outcome of the recount shows the Secretary winner has now changed.

*The vote numbers for Appellate Judge have changed but outcome remains the same.

These results continue to be tentative until the time period to request a recount or to challenge the Election results has expired and the results are certified by the Oneida Business Committee.

July 13, 2017 United States’ Response to Defendant Ronald Van Den Heuvel’s Motion to Compel Discovery of Thumb Drive, U.S. District Court, Eastern District of Wisconsin, Docket No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel, Paul Piikkila, and Kelly Van Den Heuvel

July 13, 2017 United States’ Response to Defendant Ronald Van Den Heuvel’s Motion to Compel Discovery of Thumb Drive, U.S. District Court, Eastern District of Wisconsin, Docket No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel, Paul Piikkila, and Kelly Van Den Heuvel

July 14, 2017 TAK Investments LLC’s Motion for Summary Judgment, U.S. District Court / Eastern Wisconsin, Green Bay Division Case No. 14-CV-1203, Tissue Technology LLC, Partners Concepts Development Inc., Oconto Falls Tissue Inc., and Tissue Products Technology Corp. v. TAK Investments LLC and Sharad Tak

July 14, 2017 TAK Investments LLC’s Motion for Summary Judgment, U.S. District Court / Eastern Wisconsin, Green Bay Division Case No. 14-CV-1203, Tissue Technology LLC, Partners Concepts Development Inc., Oconto Falls Tissue Inc., and Tissue Products Technology Corp. v. TAK Investments LLC and Sharad Tak

- July 14, 2017 TAK Investments LLC’s Memorandum of Law in Support of Motion for Summary Judgment, U.S. District Court / Eastern Wisconsin, Green Bay Division Case No. 14-CV-1203, Tissue Technology LLC, Partners Concepts Development Inc., Oconto Falls Tissue Inc., and Tissue Products Technology Corp. v. TAK Investments LLC and Sharad Tak

- July 14, 2017 TAK Investments LLC’s Proposed Findings of Fact in Support of its Motion for Summary Judgment, U.S. District Court / Eastern Wisconsin, Green Bay Division Case No. 14CV1203, Tissue Technology LLC, Partners Concepts Development Inc., Oconto Falls Tissue Inc., and Tissue Product Technology Corp. v. TAK Investments LLC and Sharad Tak

- July 14, 2017 Declaration of Sharad Tak in Support of TAK Investments LLC’s Motion for Summary Judgment, U.S. District Court / Eastern Wisconsin, Green Bay Division Case No. 14-CV-1203, Tissue Technology LLC, Partners Concepts Development Inc., Oconto Falls Tissue Inc., and Tissue Products Technology Corp. v. TAK Investments LLC and Sharad Tak

July 14, 2017 United States’ Response to Defendants Ronald and Kelly Van Den Heuvel’s Motions to Suppress Evidence on the Ground of an Overbroad Warrant, U.S. District Court, Eastern District of Wisconsin, Docket No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel, Paul Piikkila, and Kelly Van Den Heuvel

July 14, 2017 United States’ Response to Defendants Ronald and Kelly Van Den Heuvel’s Motions to Suppress Evidence on the Ground of an Overbroad Warrant, U.S. District Court, Eastern District of Wisconsin, Docket No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel, Paul Piikkila, and Kelly Van Den Heuvel

- July 14, 2017 United States’ Response to Defendant Kelly Van Den Heuvel’s Motion for Severance of Defendants, U.S. District Court, Eastern District of Wisconsin, Docket No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel, Paul Piikkila, and Kelly Van Den Heuvel

- July 14, 2017 United States’ Response to Defendants Ronald and Kelly Van Den Heuvel’s Motion to Compel Discovery of Grand Jury Materials, U.S. District Court, Eastern District of Wisconsin, Docket No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel, Paul Piikkila, and Kelly Van Den Heuvel

07/17/17 : FULL VIDEO – JULY 17, 2017 ONWI GENERAL TRIBAL COUNCIL SEMI-ANNUAL MEETING

07/17/17 : FULL VIDEO – JULY 17, 2017 ONWI GENERAL TRIBAL COUNCIL SEMI-ANNUAL MEETING

In the excerpt below, the OBC’s attorney – Chief Counsel Jo Anne House – admits that Oneida Seven Generations Corp. / OSGC Managing Agent

Peter J. King III / King Solutions, LLC, DID NOT HAVE THE AUTHORITY TO ENTER INTO A CONFIDENTIAL MUTLIMILLION DOLLAR ‘SETTLEMENT’ with Atty. Eric Decator and Arland Clean Fuels / Generation Clean Fuels / ACF / GCF …

but the OBC retroactively and surreptitiously approved the multimillion ‘settlement’ anyway instead of bringing the matter back to GTC for action as had been promised in the OBC’s Letter mailed to GTC members in late-October 2015 (strangely backdated September 23) after the OBC rejected ACF/GCF’s request in August 2015 for a $9 MILLION ‘settlement’ payment, with the OBC’s letter falsely telling GTC:

but the OBC retroactively and surreptitiously approved the multimillion ‘settlement’ anyway instead of bringing the matter back to GTC for action as had been promised in the OBC’s Letter mailed to GTC members in late-October 2015 (strangely backdated September 23) after the OBC rejected ACF/GCF’s request in August 2015 for a $9 MILLION ‘settlement’ payment, with the OBC’s letter falsely telling GTC:

The Oneida Business Committee received a request from [Eric Decator / Generation Clean Fuels / Arland Clean Fuels / GCF / ACF] to consider settlement. The complaint alleges $400 million in damages; the settlement offer was $9 million. We discussed this settlement in Executive Session on August 26, 2015, and rejected this offer. We believe that the Tribe has not damaged ACF in any way and was not a party to the contract. As a result, the settlement offer is too high to be considered. We do not make a counter-offer as we continue to believe that the Tribe will prevail in this matter. However, if a settlement offer is presented which we think fairly represents the risk and cost of continuing versus concluding this matter, we have committed to bringing that to the General Tribal Council for action.

BUT THAT’S OBVIOUSLY NOT WHAT HAPPENED.

A SECRET MULTIMILLION DOLLAR ‘SETTLEMENT’ WAS PAID…

WHICH ACTUALLY SEEMS MORE LIKE AN EXTORTION PAYMENT.

GTC MEMBERS HAVE BEEN TOLD VARIOUS VERSIONS OF EVENTS.

When Oneida Eye Publisher LEAH SUE DODGE inquired at the July 17, 2017 GTC Semi-Annual Meeting about what really happened, both the OBC and their attorney – OLO Chief Counsel Jo Anne House (who is oddly also GTC Parliamentarian) refused to answer for the record…

(a) exactly when did the

(a) exactly when did the

OBC retroactively approve

the unauthorized & costly

usurption of GTC’s authority

& violation of GTC’s rights by

OSGC ‘Managing Agent’

Pete King III and his sham

front King Solutions LLC?

and…

and…

(b) exactly where

did the OBC & OSGC

supposedly obtain

SECRET MULTIMILLIONS

to play with for what

to play with for what

looks & smells like

just another state &

federally funded

intentional tort

‘plastics-to-oil’

‘waste-to-energy’

‘green investment’

white-collar extortion

criminal fraud scheme…

criminal fraud scheme…

with a treasonous,

genocidal twist?

Oneida Eye sources estimate the

actual ‘settlement’ amount of Pete King III’s

OBC-approved ‘payment’ to COOK COUNTY,

EVANSTON, ILLINOIS-based

ARLAND CLEAN FUELS, LLC

ACF SERVICES, LLC

ACF LEASING, LLC

aka

GENERATION CLEAN FUELS, LLC

& ACF/ GCF principals

MICHAEL FLAHERTY

[of Door County, WI]

GAYLEN LACROSSE

[of Door County, WI]

LOUIS R. STERN

[of Cook County, IL]

ERIC DECATOR

[of Cook County, IL,

formerly of

COLORADO]

as being

between

$10 – $15 MILLION.

HOWEVER…

GENERAL TRIBAL COUNCIL / GTC

– the GOVERNING BODY of ONWI –

has the following authority,

in accordance with the

Oneida Nation of WI Constitution,

Powers of the General Tribal Council

The General Tribal Council of the Oneida Nation [of Wisconsin] shall exercise the following powers, subject to any limitations imposed by the statutes or the Constitution of the United States:

(c) To veto any sale, disposition, lease or encumbrance of tribal lands, interests in lands,

or other tribal assets of the Nation.

THUS…

the GTC

can VETO ANY ENCUMBRANCE

created by the OBC & OSGC

due to any ‘settlement’…

NEVER FORGET.

Witness this astounding display of Cognitive Dissonance later during the July 17, 2017 Semi-Annual ONWI GTC Meeting by ONEIDA TIMES Publisher Yvonne Metivier:

July 17, 2017 CH2E Nevada LLC’s Motion for Partial Summary Judgment against Abdul Latif Mahjoob & ACTI, U.S. District Court, District of Nevada/Las Vegas, Case No. 2:2015CV694, CH2E Nevada LLC v. Abdul Latif Mahjoob & American Combustion Technologies Inc. / ACTI [232 pages]

July 17, 2017 CH2E Nevada LLC’s Motion for Partial Summary Judgment against Abdul Latif Mahjoob & ACTI, U.S. District Court, District of Nevada/Las Vegas, Case No. 2:2015CV694, CH2E Nevada LLC v. Abdul Latif Mahjoob & American Combustion Technologies Inc. / ACTI [232 pages]

For the reasons stated above, CH2E [Nevada LLC] respectfully requests that the Court grant this Motion and enter judgment in CH2E’s favor and against ACTI on: (1) CH2E’s claim for breach of contract, with damages in the amount of $6,636,000.00; (2) ACTI’s counterclaim for breach of contract; and (3) ACTI’s counterclaim for unjust enrichment.

![]() 07/18/17 : July 18, 2017 Plaintiffs’ Stipulation to Enlarge Time, U.S. District Court / Eastern Wisconsin, Green Bay Division Case No. 14CV1203, Tissue Technology LLC, Partners Concepts Development Inc., Oconto Falls Tissue Inc., and Tissue Product Technology Corp. v. TAK Investments LLC and Sharad Tak

07/18/17 : July 18, 2017 Plaintiffs’ Stipulation to Enlarge Time, U.S. District Court / Eastern Wisconsin, Green Bay Division Case No. 14CV1203, Tissue Technology LLC, Partners Concepts Development Inc., Oconto Falls Tissue Inc., and Tissue Product Technology Corp. v. TAK Investments LLC and Sharad Tak

![]() 07/19/17 : July 19, 2017 Unopposed Motion and [Proposed] Order Granting Unopposed Motion to Withdraw the Appearance of Roger P. Thomasch as Counsel of Record, U.S. District Court / Nevada Case No. 2:15-cv-694, CH2E Nevada LLC v. [Abdul] Latif Mahjoob and American Combustion Technologies of California Inc. [ACTI]

07/19/17 : July 19, 2017 Unopposed Motion and [Proposed] Order Granting Unopposed Motion to Withdraw the Appearance of Roger P. Thomasch as Counsel of Record, U.S. District Court / Nevada Case No. 2:15-cv-694, CH2E Nevada LLC v. [Abdul] Latif Mahjoob and American Combustion Technologies of California Inc. [ACTI]

July 19, 2017 Defendant Ronald Van Den Heuvel’s Motion to Extend Time to file reply briefs to the USA’s responses relating to pre-trial motions to August 18, 2017, U.S. District Court, Eastern District of Wisconsin, Docket No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel, Paul Piikkila, and Kelly Van Den Heuvel

July 19, 2017 Defendant Ronald Van Den Heuvel’s Motion to Extend Time to file reply briefs to the USA’s responses relating to pre-trial motions to August 18, 2017, U.S. District Court, Eastern District of Wisconsin, Docket No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel, Paul Piikkila, and Kelly Van Den Heuvel

July 19, 2017 Proposed Order and Defendant Wayde McKelvy’s Unopposed Motion to Modify conditions of Pretrial Release, U.S. District Court for the Eastern District of Pennsylvania, Case No. 2:15-cr-398-JHS, United States of America v. Troy Wragg, Amanda Knorr & Wayde McKelvy re: Mantria Corp. / EternaGreen Global / Speed of Wealth ‘Waste-to-Energy’ Pyrolysis Ponzi Scheme

July 19, 2017 Proposed Order and Defendant Wayde McKelvy’s Unopposed Motion to Modify conditions of Pretrial Release, U.S. District Court for the Eastern District of Pennsylvania, Case No. 2:15-cr-398-JHS, United States of America v. Troy Wragg, Amanda Knorr & Wayde McKelvy re: Mantria Corp. / EternaGreen Global / Speed of Wealth ‘Waste-to-Energy’ Pyrolysis Ponzi Scheme

McKelvy’s daughters have a company, Contact TRACS, which provides marketing software for small businesses. McKelvy’s daughters plan to hold seminars to present their services to small businesses outside COLORADO beginning in September 2017. McKelvy seeks permission to travel outside COLORADO to assist his daughters in presenting Contact TRACS’ services to small businesses. McKelvy will inform Pretrial Services of his travel plans prior to leaving COLORADO.

According to Green Bay Press-Gazette,

According to Green Bay Press-Gazette,

Seven men face meth charges in federal court

Seven men have been named in a federal indictment accusing them of involvement in a drug ring that sold large quantities of methamphetamine in Green Bay. …

[Two are accused] of kidnapping, saying they confined and held someone for retaliation and used a firearm to threaten him. The press release provides no details of those charges, but court records indicate they held and beat a man whom they suspected of setting up one of their group and ripping him off at the Oneida Casino earlier this spring.

The case was investigated by the Brown County Drug Task Force, the North Central High Intensity Drug Trafficking Area Task Force, the Phoenix, Ariz., branch of the U.S. Postal Inspection Service, the Maricopa County Sheriff’s Office, the Scottsdale Police Department, and the Phoenix and Green Bay Divisions of the U.S. Drug Enforcement Administration.

The case is being prosecuted by Assistant U.S. Attorney Daniel R. Humble.

![]()

![]()

- July 19, 2017 Wisconsin Economic Development Corporation’s (WEDC) Amended Motion for Order Compelling Examination of Little Rapids Corporation Under Rule 2004, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay LLC

10. Since confirmation of the Debtor’s Plan, both the Debtor and Little Rapids have represented that all or substantially all of the Debtor’s personal property located in the Warehouse has been surrendered to Little Rapids and subsequently transferred to a third party (see Docket 255, ¶7).

11. WEDC has attempted for months to obtain particulars regarding the alleged surrender, both from counsel [of] the Debtor and Little Rapids, and both in writing and verbally; in response, WEDC has received only partial information.

- July 19, 2017 Order Granting Wisconsin Economic Development Corporation’s (WEDC) Motion for Rule 2004 Examination of Little Rapids Corporation, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay LLC

![]()

![]()

07/20/17 : July 20, 2017 Wisconsin Economic Development Corporation / WEDC’s Objection To Little Rapids Corporation’s Motion To Quash Or, In The Alternative, For Protective Order, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay LLC

2. The Debtor claimed in its Motion to Modify the Revised Third Amended Plan that “A contract has been entered into for the reacquisition of all of the equipment” which had allegedly been previously been abandoned (Docket 255, ¶7) (emphasis added). Yet as of the time of the filing of this Objection, not all of the Debtor’s property has been removed from Little Rapids’ warehouse …

[4]c. Little Rapids’ Motion makes a vague reference to potentially “privileged or other protected matters” which “may” require disclosure, but fails to state what those possibly could be, particularly if they merely involve a third-party salvage dealer [Tony Hayes, Hayes Salvage] …

- July 20, 2017 Little Rapids Corporation’s Motion to Quash Subpoena Duces Tecum Or, In The Alternative, For Protective Order, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay LLC

July 20, 2017 Defendant Kelly Van Den Heuvel’s Unopposed Motion to Extend Time to file reply briefs to the USA’s responses relating to pre-trial motions to August 18, 2017, U.S. District Court, Eastern District of Wisconsin, Docket No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel, Paul Piikkila, and Kelly Van Den Heuvel

July 20, 2017 Defendant Kelly Van Den Heuvel’s Unopposed Motion to Extend Time to file reply briefs to the USA’s responses relating to pre-trial motions to August 18, 2017, U.S. District Court, Eastern District of Wisconsin, Docket No. 16-CR-64, United States of America v. Ronald H. Van Den Heuvel, Paul Piikkila, and Kelly Van Den Heuvel

July 20, 2017 Order Granting Unopposed Motion to Withdraw the Appearance of Roger P. Thomasch as Counsel of Record, U.S. District Court / Nevada Case No. 2:15-cv-694, CH2E Nevada LLC v. [Abdul] Latif Mahjoob and American Combustion Technologies of California Inc. [ACTI]

July 20, 2017 Order Granting Unopposed Motion to Withdraw the Appearance of Roger P. Thomasch as Counsel of Record, U.S. District Court / Nevada Case No. 2:15-cv-694, CH2E Nevada LLC v. [Abdul] Latif Mahjoob and American Combustion Technologies of California Inc. [ACTI]

![]() 07/21/17 : July 21, 2017 Order granting motion to seal an exhibit attached to Plaintiff’s motion for summary judgment, U.S. District Court / Nevada Case No. 2:15-cv-694, CH2E Nevada LLC v. [Abdul] Latif Mahjoob and American Combustion Technologies of California Inc. [ACTI]

07/21/17 : July 21, 2017 Order granting motion to seal an exhibit attached to Plaintiff’s motion for summary judgment, U.S. District Court / Nevada Case No. 2:15-cv-694, CH2E Nevada LLC v. [Abdul] Latif Mahjoob and American Combustion Technologies of California Inc. [ACTI]

On July 19, 2017 the Election Board conducted a recount of the votes cast for the Gaming Commission positions and on July 20th for the positions of Business Committee Secretary and Business Committee Council Member. The Board continued with the recount process on July 21st. The recounts were conducted pursuant to Section 102.11 Section C of the Election Law which requires a manual recount to be completed upon request of a candidate (Section 102.11-7). The recounts were observed by an Attorney from the Law Office and an Oneida Police Officer to ensure proper procedure was followed. The manual recount of all the ballots cast in the 2017 General Election results shown below:

*The outcome of the recount of Gaming Commission has now resulted in a tie:

[Exiting OBC Chair] Cristina (Tina) Danforth –

537[Exiting OBC Vice-Chair] Melinda J. Danforth –

537

According to ONWI Election Law:

Section B. Tie

102.11-3. In the event of a tie for any office, and where the breaking of a tie is necessary to determine the outcome of an election, the Election Board shall conduct an automatic recount of the votes for each candidate receiving the same number of votes. Any recount conducted shall be the only recount allowed for the tied candidates.

102.11-4. For Business Committee positions, a run-off election between the candidates with the same number of votes shall be held if there remains a tie after the recount. Said run-off election shall be held within twenty one (21) calendar days after the recount. For all other positions, if there remains a tie after the recount, the Election Board shall decide the winner of the tied positions at least two (2) business days after, but no more than five (5) business days after the recount through a lot drawing, which shall be open to the public.

(a) The Election Board shall notify each of the tied candidates and the public of the date, time, and place of the drawing at least one (1) business day before the drawing. Notice to the tied candidates shall be in writing. Notice to the public shall be posted by the Election Board in the prominent locations.

(b) On the date and at the time and place the drawing was noticed, the Election Board Chairperson shall clearly write the name of each tied candidate on separate pieces of paper in front of any witnesses present. The pieces of paper shall be the same, or approximately the same, color, size, and type. The papers shall be folded in half and placed in a container selected by the Election Board Chairperson.

(c) The Election Board Chairperson shall designate an uninterested party to draw a name from the container. The candidate whose name is drawn from the container first shall be declared the winner. An Election Board member other than the Chairperson shall remove the remaining pieces of paper from the container and show them to the witnesses present.

![]() 07/24/17 : July 24, 2017 Order: Circuit Rule 33 – Briefing, U. S. 7th Circuit Court of Appeals, Docket No. 17-2341, Oneida Seven Generations Corp. / OSGC & subsidiary Green Bay Renewable Energy, LLC / GBRE v. City of Green Bay

07/24/17 : July 24, 2017 Order: Circuit Rule 33 – Briefing, U. S. 7th Circuit Court of Appeals, Docket No. 17-2341, Oneida Seven Generations Corp. / OSGC & subsidiary Green Bay Renewable Energy, LLC / GBRE v. City of Green Bay

- July 24, 2017 Defendant Wayde McKelvy’s Motion to Dismiss Counts 1-9 and Motion to Strike Count 10 of the Indictment, for Failure to State an Offense, U.S. District Court for the Eastern District of Pennsylvania, Case No. 2:15-cr-398-JHS, United States of America v. Troy Wragg, Amanda Knorr & Wayde McKelvy re: Mantria Corp. / EternaGreen Global / Speed of Wealth ‘Waste-to-Energy’ Pyrolysis Ponzi Scheme [37 pages]

- July 24, 2017 Proposed Order and Motion to Compel the Production of Documents by Defendant Wayde McKelvy (to produce the emails of Troy Wragg, Amanda Knorr, Dan Rink and Chris Flannery & make a copy of Troy Wragg’s hard drive available to McKelvy’s attorneys), U.S. District Court for the Eastern District of Pennsylvania, Case No. 2:15-cr-398-JHS, United States of America v. Troy Wragg, Amanda Knorr & Wayde McKelvy re: Mantria Corp. / EternaGreen Global / Speed of Wealth ‘Waste-to-Energy’ Pyrolysis Ponzi Scheme

![]()

![]()

- July 24, 2017 Court Minutes from Hearing re: Green Box NA Green Bay, LLC’s Motion to Modify the Confirmed Revised Third Amended Chapter 11 Plan of Reorganization, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay, LLC

- FULL AUDIO – July 24, 2017, 2:04 P.M. Hearing re: Green Box NA Green Bay, LLC’s Motion to Modify Plan [Run Time 02:36:10], U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay, LLC

[Atty. PAUL SWANSON, Trustee for GBNAGB]: Have you paid subtantial monies to these various entities to get these projects, get these studies, or whatever, rolling?

[STEPHEN A. SMITH of GBNAGB ‘Registered Agent’ GlenArbor Partners, Inc.]: Yes. [sighs]

[Atty. Swanson]: And how much time have you spent?

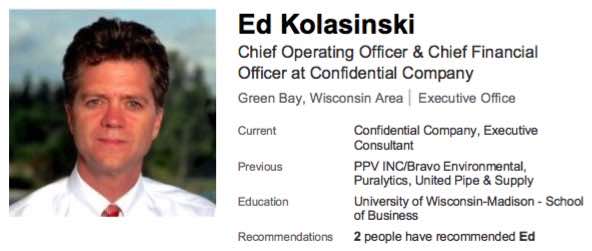

[Stephen Smith]: Too much. Um, I’ve spent, I mean, it’s been Ed [Kolasinski]‘s full-time job, times probably 50%, and it’s been virtually my full-time job for the last 3 or 4 months. I’ve had investments elsewhere.

[Atty. Swanson]: Now, let me back up just to uh, clarify and for full disclosure … that PCDI [Partners Concepts Development, Inc.] contract, who signed that?

[Stephen Smith of GlenArbor Partners]: Ron Van Den Heuvel.

[Atty. Swanson]: And, was that ‘personally guaranteed’?

[Stephen Smith]: Yes.

[Atty. Swanson]: By who?

[Stephen Smith]: By him.

[Atty. Swanson:] [softly gasps]

Who would take

Ron Van Den Heuvel’s

‘personal guarantee’?

[Stephen Smith]: I don’t know, but it wasn’t going to be my personal guarantee, though. That was really where that started, um, is um, the, the – When we approached the scrap dealer [TONY HAYES], he wanted a personal guarantee and I was not about to do that for this. I’ve got enough, probably way too much money in this project already and I wasn’t going to guarantee performance.

NOTE:

COURT RECORDS LIST TONY HAYES of DOOR COUNTY,

WISCONSIN as an ‘American Indian / Alaskan Native’ [see Door Co. Case No. 11FA160, In re: the marriage of Angela Hayes and Tony Hayes]

…but TONY HAYES IS NOT an Enrolled Member of Oneida Nation of Wisconsin / ONWI.

WDFI.org lists TONY HAYES as the Registered Agent for:

• FULL CIRCLE RECYCLERS, LLC [reg’d w/ WDFI on 01/10/2006; Principal Office: 1456 Shiloh Rd., Sturgeon Bay, WI, 54235; Dissolved on 05/29/2017]

An archive of SBISMetal.com lists the address

for Full Circle Recyclers, LLC as:

3751 Creamery Road, De Pere, WI, 54115

…across the street from Ron Van Den Heuvel’s son-in-law & bank-fraud stooge Patrick Hoffman’s business, The Creamery.

• STURGEON BAY IRON & SCRAP METAL, LLC [reg’d w/ WDFI on 08/06/2003; Principal Office: 1456 Shiloh Rd., Sturgeon Bay, WI, 54235; Notice of Administrative Dissolution on 07/17/2017]

• HOBART IRON & METAL, LLC [reg’d w/ WDFI on 07/24/2014; Principal Office: 1456 Shiloh Rd., Sturgeon Bay, WI, 54235; Notice of Administrative Dissolution on 07/17/2017]

Hobart Iron & Metal, LLC is located at 3807 W. Mason St, Hobart, WI, next to the ONWI-owned Ridgeview Plaza, across the street from the Brown County Waste Transfer Station.

HOWEVER…

TONY HAYES IS NOT a Licensed Waste Hauler in the State of Wisconsin, according to the WI Dept. of Natural Resources / WDNR official online database of Licensed Transporters.

AUDIO EXCERPT – Later during the 07/24/17 U.S. Bankruptcy Court Hearing re: Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay, LLC:

[Attorney BRIAN THILL of Murphy Desmond S.C. for WEDC]: Is there an arrangement between PCDI and Green Box for the purchase of the equipment?

[Steven Smith]: I have… Yes, I have complete control of that So, there’s no – there’s no contractual arrangement. I have the ability to sell that, uh, equipment, and, um, at – at whatever points I deem appropriate for whatever amounts I deem appropriate.

[Atty. Thill]: How do you know you have that authority?

[Stephen Smith]: It’s in the operating agreement of the company.

[Atty. Thill]: When’s the last time you saw that document?

[Stephen Smith]: Oh, in the last month or two? It’s been in place – it’s been in place for 2 (two) years.

[Atty. Thill]: Do you trust Ron Van Den Heuvel?

[Laughter & snickering]

[Atty. Thill]: So, what would stop Ron Van Den Heuvel from entering into some sort of amended agreement with Tony Hayes. He’s already signed one agreement, right?

[Stephen Smith]: Because he needs to get my approval to do so. It’s very well documented.

[Atty. Thill]: But, you yourself said you don’t –

I believe the word was that Tony Hayes himself was ‘notorious.’ Is that accurate?[Stephen Smith]: No, I didn’t say that.

[Atty. Thill]: Ok, I think your lawyer said that. Would you agree with your –

[Steven Smith]: I would never agree with my lawyer. I’m not nuts. No, I don’t know Tony Hayes. I’ve never met him. So if Tony Hayes is notorious, then – then, uh, that’s – that’s [Atty.] Paul [Swanson]’s opinion.

[Atty. Thill]: So you have no idea who the scrap dealer is?

[Stephen Smith]: No, no. That’s not – I didn’t say I don’t have idea who he is. We looked into it carefully. I’ve never met him. I’ve – um, we – I was fully aware of the transaction; I approved the transaction. Um, and, but your – your question is, “Do I know him?” No. “Is he ‘notorious’?” I don’t know. That’s all opinion.

A well-founded “opinion,” as it turns out:

TONY HAYES filed for Chapter 7 bankruptcy on July 23, 2013 [U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 13-29932-svk, Chapter 7, Tony Hayes aka Hayes Salvage]. Although the Order Discharging Debtor(s) was originally filed on October 28, 2013, it was later vacated on November 12, 2015 and the case closed on September 14, 2016.

Chapter 7 Trustee for Debtor / Tony Hayes was Attorney PAUL SWANSON, whose October 20, 2014 Complaint For Revocation of Discharge against Tony Hayes [U.S. Bankruptcy Court, Wisconsin Eastern District Adversary Proceeding No. 14-02563-svk, Paul G. Swanson v. Tony Hayes] states:

NOW COMES Paul G. Swanson, the Plaintiff and Chapter 7 Trustee, and respectfully represents as follows:

1. On July 23, 2013, the above named Debtor [Tony Hayes] filed a petition for relief under Chapter 7, Title 11 of the United States Code. The Debtor was granted a discharge herein on October 28,2013. The case is still open and the trustee is administering assets of the estate.

2. On July 23, 2013, the Debtor [Tony Hayes] filed his bankruptcy Schedules in this case listing all of his assets and all of his liabilities.

3. On August 22, 2013, the Debtor attended the first Meeting of Creditors wherein he testified under oath that he had listed all of his assets and that his Schedules were true and complete.

4. Among those assets listed are 100% interest in Sturgeon Bay Iron & Scrap Metal, LLC, Full Circle Recycling, LLC, and AAAAA Sanitation, LLC [for which the Registered Agent is Angela Hayes, Tony’s ex-wife]. The Trustee has, since he was appointed to the case, taken possession of the assets of the LLCs for the benefit of creditors as it appears there is substantial equity in the same even though the Debtor did not list a value but rather scheduled them as “indeterminate”.

5. Pursuant to 11 U.S.C. § 727(d)(1) or (2), the Trustee may request revocation of the discharge previously granted.

6. The Trustee is in the process of selling the assets of the Debtor’s wholly-owned LLC, Sturgeon Bay Iron & Scrap Metal, LLC and, as such, has taken possession of all the assets of that entity. In the course of the investigation by the Trustee and his counsel, certain facts have been revealed concerning missing assets from that entity.

7. Specifically, the entity had an interest in a Caterpillar mini excavator, a Lowboy semi trailer and approximately 20 metal dumpsters for the collection of scrap metal.

8. Through the investigation, it was determined that the Debtor [Tony Hayes] was in possession, personally, of these assets. Despite repeated demands upon the Debtor and his counsel for the return of the assets, the Debtor has failed to do so for no justifiable excuse. Such assets are rightfully the property of the LLC which is property of the estate. Such assets have a significant value.

9. Additionally, during the investigation it was also determined that the Debtor is the title owner to a 1996 Peterbilt semi tractor as the Trustee’s counsel observed him driving the same. Once again, despite repeated demands to turn over the semi tractor, the Debtor [Tony Hayes] has failed to do the same.

10. The 1996 Peterbilt semi tractor has, according to the records of the Department of Motor Vehicles, been titled in the Debtor’s name for years. The Debtor omitted the Peterbilt semi tractor from his schedules. The Peterbilt semi tractor has significant value.

11. Upon information and belief, after the date of the filing of the Petition and while the Debtor was still operating one or more of his LLCs, the entities took in substantial amounts of money, a significant amount of which is not accounted for. Trustee believes that the Debtor is withholding funds which are actually property of either Sturgeon Bay Iron & Scrap Metal, LLC or Full Circle Recycling, LLC, which rightfully belong to those LLCs, both of which are property of the state.

12. The Trustee alleges that the Debtor acquired property that is property of the estate, to wit, property of one of his LLCs and, despite repeated demands to do so, has failed to deliver or surrender of such property to the Trustee.

13. The Trustee has also ascertained that the Debtor materially misrepresented the value of his interest in Sturgeon Bay Iron & Scrap Metal, LLC to the Trustee when he knew that the business and its assets had a substantial value to the estate. The Trustee [ATTY. PAUL SWANSON] alleges that this representation or omission rises to the level of fraud and that the Debtor obtained his discharge through such fraud, contrary to 11 U.S.C. § 727 (d)(1).

14. The intentional undervaluation of substantial assets of the Debtor, to wit, his interest in his LLCs, in his Schedules constitutes fraud in fact as does the failure to disclose his ownership interest in a 1996 Peterbilt semi tractor.

15. Such fraud would have prevented the discharge had it been known and timely brought to the attention of the Court.

16. The Trustee did not know of the fraud until approximately July 2014, after the discharge was granted to the Debtor.

17. The Trustee asserts that this is a core proceeding in accordance with Bankruptcy Rule 7008.

Wherefore, the Plaintiff requests the following relief:

A. The discharge of the above-named debtor be revoked.

B. That the Debtor be ordered to account for all property in his hands that belongs to Sturgeon Bay Iron & Scrap Metal, LLC or any one of his LLCs and turn the same over to the Trustee for liquidation for the benefit of creditors of this estate.

C. For whatever further relief the Court deems equitable under the circumstances.

07/26/17 : According to an Email by the ONWI Communications Dept.:

07/26/17 : According to an Email by the ONWI Communications Dept.:

The results of the Oneida Gaming Commission in the 2017 General Election recount resulted in a tie between [exiting OBC Chair] Cristina Danforth and [exiting OBC Vice-Chair] Melinda Danforth.

The Election Board conducted a lot drawing for a tie within the [ONWI] Gaming Commission which had resulted from a requested recount. The lot drawing took place at noon on July 26, 2017, pursuant to the Election Law Section 102.11-4, and the winner of the lot drawing is Cristina “Tina” Danforth.

07/28/17 : Green Bay Press-Gazette website, Inability to raise funds delays Green Box NA reorganization,

07/28/17 : Green Bay Press-Gazette website, Inability to raise funds delays Green Box NA reorganization,

by Jeff Bollier

A $176 million reorganization plan for Green Box NA Green Bay has been delayed by an inability to raise the cash needed to pay creditors.

[Stephen A. Smith of] GlenArbor LLC, a [Cook County] Chicago [Illinois]-based investor in Green Box, originally told U.S. Bankruptcy Court for the Eastern District of Wisconsin Judge Beth Hanan the reorganization plan would be funded and able to pay $14 million to creditors by March 31, [2017]. In a June 1 [2017] motion, [GlenArbor LLC on behalf of Green Box NA Green Bay LLC] asked the court to push the date back to Sept. 30 [2017].

The reorganization would roll up De Pere businessman Ron Van Den Heuvel’s web of companies into a new company that would secure the equipment, technology and money needed to operate a system that would recycle waste that typically ends up in landfills into reusable products.

“Principals of the debtor, despite using their best efforts, were unable to raise the funds contemplated which were, in effect, the financing necessary to bridge the gap between confirmation of the plan and the roll up contemplated under the plan,” the motion reads.

GlenArbor plans to provide updated engineering reports, business plans and appraisals to reassure potential investors that the business is sound. It said even creditors understand failure to secure investors would mean no one gets paid.

“If the roll up does not come to fruition, it is unlikely that the various claims will be paid to any extent, if at all,” the motion states. “The investment bank’s study of the business plan and operations will provide a basis for potential investors to reasonably assess whether to invest in the project.”

GlenArbor has spearheaded the reorganization effort since Van Den Heuvel sought protection from creditors in April 2016. [Ron] Van Den Heuvel would retain an ownership stake in the revived venture, but he would not be involved in the company’s management.

When Green Box filed for bankruptcy, Van Den Heuvel listed less than $50,000 in assets and more than $10 million in debt. The company had been the subject of a string of lawsuits from unpaid creditors, including the Wisconsin Economic Development Corp. [WEDC].

The bulk of the $176 million sought to fund the new company would build a new sorting facility, expand existing operations, connect various parts of the operation, pay off creditors and ramp up operations.

If financing can be secured, the new company has agreed to pay:

» $605,000 in delinquent property, payroll and unemployment taxes Green Box owed to county, state and federal agencies.

» $13.1 million to secured claimants owed a total of $24.3 million, and

» $270,000 in legal fees and other administrative expenses.

From Oneida Eye’s ‘Documents’ page:

• AUDIO – July 24, 2017, 2:04 P.M. Hearing re: Green Box NA Green Bay, LLC’s Motion to Modify Plan [Run Time 02:36:10], U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay, LLC

![]() • May 20, 2015 Complaint, Brown Co. Case No. 15CV769, Dr. Marco Araujo [represented by GODFREY & KAHN], Cliffton Equities Inc. and Wisconsin Economic Development Corp. / WEDC v. [Ron Van Den Heuvel dba] Green Box NA Green Bay LLC

• May 20, 2015 Complaint, Brown Co. Case No. 15CV769, Dr. Marco Araujo [represented by GODFREY & KAHN], Cliffton Equities Inc. and Wisconsin Economic Development Corp. / WEDC v. [Ron Van Den Heuvel dba] Green Box NA Green Bay LLC

• September 30, 2011 Contract #WEDC FY12-21010, $1.3 Million Loan Agreement Between WEDC and Green Box NA Green Bay LLC, with exhibits, amendments and General Business Security Agreement with Ron Van Den Heuvel’s signed personal Unlimited Guaranty, along with the signature of Former Green Bay Mayor and Former WEDC CEO Paul Jadin, and renegotiation contract signed by WEDC Vice-President Jake Kuester

• According to the July 2, 2015 Brown County Sheriff’s Dept. Search Warrants for Ronald Van Den Heuvel / Green Box NA Green Bay, LLC:

8. Through documents and information provided by Araujo and his attorneys, your affiant became aware that the WISCONSIN ECONOMIC DEVELOPMENT CORPORATION [WEDC], a public/private entity operated in part by the State of Wisconsin, was a potential victim of fraudulent representation made by RONALD H. VAN DEN HEUVEL in order to obtain a loan from the WEDC for approximately $1.3 Million. Your affiant made a request from the WEDC and obtained all of WEDC’s documentation of the loan made to [RVDH] and [GBNAGB].

9. Your affiant is aware, through documents provided by [WEDC] and record and documents contained on a thumb drive provided by Guy LoCascio, a former contract accountant for [GBNAGB] and [RVDH], that [Ronald H. Van Den Heuvel]…doing business as Green Box NA Green Bay, LLC … made representations to [WEDC] in order to receive funds from them, and once funds were received, [RVDH] paid personal debts with the money.

10. Through your affiant’s investigation thus far, it has been found that Ronald H. Van Den Heuvel, doing business as Green Box NA Green Bay LLC, did supply fraudulent information in his application for funding from WEDC, based on your affiant’s review of the file provided by WEDC which contained documents and statements, the document provided by Araujo’s attorneys [GODFREY & KAHN] from Brown County cases 13CV463 and 15CV474 and documents contained on the thumb drive provided by Guy LoCascio. …

11. Your affiant found that [RVDH], doing business as [GREEN BOX NA GREEN BAY], failed to provide documentation, as promised, to WEDC, which would constitute proof of the required capital contributions of $629,000 from a related entity, E.A.R.T.H. … and $5,500,000 from VHC, Inc., and made material misrepresentations to WEDC about actually receiving the money as backing, despite the fact that money was never received. In addition, [RVDH] never listed VHC, Inc., which is comprised primarily of Van Den Heuvel family members, as having any ownership in [GBNAGB], despite the fact that [RVDH] represented to WEDC that VHC, Inc., contributed $5,500,000 of operating capital. …

19. Thames stated that he saw a year-end financial statement which showed that

Ronald H. Van Den Heuvel

owes VHC, Inc., and other

Van Den Heuvel family-owned

businesses approximately

$115,000,000.

Stephen Smith of Glen Arbor, LLC

GlenArbor LLC…

GlenArbor Equipment LLC…

GlenArbor Partners Inc. …

GlenArbor Capital LLC…

fka GREEN BOX WISCONSIN, LLC…

fka GREEN BOX NA WISCONSIN OP, LLC…

is also member of the Board of Managers of CHICAGO, IL-based intelligence & investigation firm PRESCIENT:

… a global risk management company that delivers full-spectrum intelligence and technology solutions to corporate, federal and international clients.

Licensed Private Detective Agency #117001731

Illinois

130 E. Randolph St., Ste. 3100

Chicago, IL 60601 …Virginia

7926 Jones Branch Dr., Ste. 1000

McLean, VA 22102 …

07/30/17 : Green Bay Press-Gazette front page –

08/01/17 : August 1, 2017 Government’s Response to Defendant Wayde Mckelvy’s Amended Motion to Dismiss Counts One through Eight of the Indictment Based on the Statute of Limitations, U.S. District Court for the Eastern District of Pennsylvania, Case No. 2:15-cr-398-JHS, United States of America v. Troy Wragg, Amanda Knorr & Wayde McKelvy re: Mantria Corp. / EternaGreen Global / Speed of Wealth ‘Waste-to-Energy’ Pyrolysis Ponzi Scheme

08/01/17 : August 1, 2017 Government’s Response to Defendant Wayde Mckelvy’s Amended Motion to Dismiss Counts One through Eight of the Indictment Based on the Statute of Limitations, U.S. District Court for the Eastern District of Pennsylvania, Case No. 2:15-cr-398-JHS, United States of America v. Troy Wragg, Amanda Knorr & Wayde McKelvy re: Mantria Corp. / EternaGreen Global / Speed of Wealth ‘Waste-to-Energy’ Pyrolysis Ponzi Scheme

- August 1, 2017 Government’s Response to Defendant Wayde Mckelvy’s Motion to Compel the Production Of Documents, U.S. District Court for the Eastern District of Pennsylvania, Case No. 2:15-cr-398-JHS, United States of America v. Troy Wragg, Amanda Knorr & Wayde McKelvy re: Mantria Corp. / EternaGreen Global / Speed of Wealth ‘Waste-to-Energy’ Pyrolysis Ponzi Scheme

On September 2, 2015, a federal grand jury in the Eastern District of Pennsylvania returned a ten-count indictment charging TROY WRAGG, AMANDA KNORR, and WAYDE MCKELVY with one count of conspiracy to commit wire fraud…, seven counts of wire fraud…, 1 count of conspiracy to commit securities fraud…, and one count of securities fraud…. The charges in the indictment stem from the defendants’ participation in the Mantria Ponzi scheme which collapsed in November 2009 when the SEC filed a motion for a temporary restraining order with the United States District Court in COLORADO.

In his motion, defendant MCKELVY requests the Court to order the government to produce all the e-mails of certain government witnesses. Quite frankly, the government’s desire to obtain these e-mails probably surpasses defense counsel’s desire to obtain these e-mails, because the government believes that these e-mails contain a significant amount of inculpatory evidence. Unfortunately, the government simply does not have and cannot obtain the e-mails requested by defense counsel. All e-mails in the government’s possession have been turned over in discovery. For this reason, the defendant’s motion must be denied.

In order to understand why the government does not have possession of these e-mails, it is necessary to review the investigative process. E-mails are typically obtained in a criminal investigation through the use of a search warrant. The first two government agencies to investigate Mantria were the COLORADO Division of Securities and the United States Securities and Exchange Commission (“SEC”). Because the SEC was able to quickly obtain a temporary injunction and, shortly thereafter, a permanent injunction, the SEC’s investigation of Mantria was abbreviated. Thus, the SEC did not obtain any of the e-mails at issue here. The FBI in Denver [COLORADO] then began a limited investigation of Mantria. This investigation was hampered by the untimely death of the assigned Assistant United States Attorney and the retirement of the FBI case agent. As a result, the FBI in Denver did not obtain the e-mails at issue here. In late 2014, the criminal investigation was transferred to the FBI in Philadelphia. By this point, five years after Mantria collapsed, the government simply could not obtain the necessary search warrants to seize the e-mails at issue here due to the lapse in time, even though there is no question that these e-mails would contain a significant amount of incriminating evidence. Consequently, the government does not have the e-mails requested by the defendant.

Here’s Mantria Corporation creep Troy Wragg receiving recognition from Bill & Hillary Clinton, and meeting with foreign officials to promote EternaGreen Global & Mantria Corp.:

08/04/17 : August 4, 2017 Proposed Findings of Fact and Conclusions of Law in Support of Defendant’s Motion to Dismiss Counts 1-9 of the Indictment, for Failure to State an Offense and in Support of Motion to Strike Parts of Count 10, U.S. District Court for the Eastern District of Pennsylvania, Case No. 2:15-cr-398-JHS, United States of America v. Troy Wragg, Amanda Knorr & Wayde McKelvy re: Mantria Corp. / EternaGreen Global / Speed of Wealth ‘Waste-to-Energy’ Pyrolysis Ponzi Scheme

08/04/17 : August 4, 2017 Proposed Findings of Fact and Conclusions of Law in Support of Defendant’s Motion to Dismiss Counts 1-9 of the Indictment, for Failure to State an Offense and in Support of Motion to Strike Parts of Count 10, U.S. District Court for the Eastern District of Pennsylvania, Case No. 2:15-cr-398-JHS, United States of America v. Troy Wragg, Amanda Knorr & Wayde McKelvy re: Mantria Corp. / EternaGreen Global / Speed of Wealth ‘Waste-to-Energy’ Pyrolysis Ponzi Scheme

The fact that Mantria Financial might have eventually declared bankruptcy at some indefinite point in the future is irrelevant. The defendant is essentially arguing that he cannot be convicted of murder because his victim would have eventually died of natural causes at some indefinite point in the future. Many legitimate banks suffer financial problems, that does not mean they are not banks. Here, there is no question that the defendant’s fraud scheme “affected” Mantria Financial as defined by the statute.