As previously noted . . .

OBC Chair Cristina Danforth,

OBC member Brandon Yellowbird Stevens,

and OBC Chief Counsel Jo Anne House

are trying to convince GTC that

Artley Skenandore Jr.’s ‘Nature’s Way Tissue Corp.’ fraud scheme…

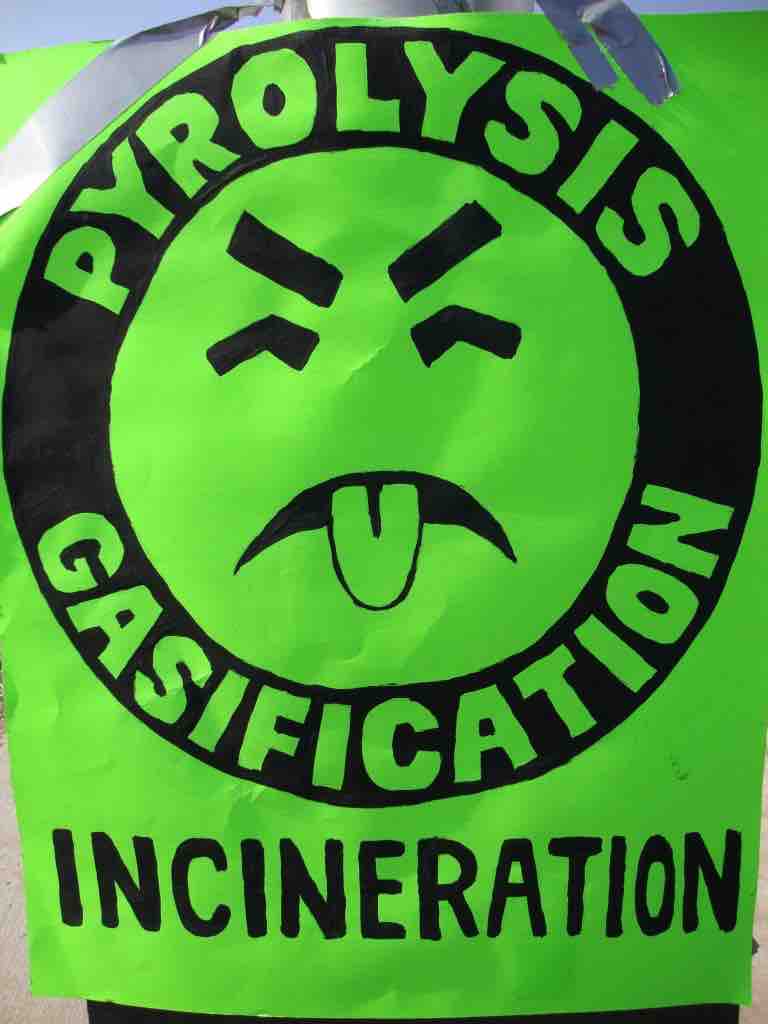

and OSGC’s ‘Green Bay Renewable Energy, LLC’ fraud scheme…

have nothing to do with each other…

but the TIMELINE proves Ronald H. Van Den Heuvel

is at the center of BOTH CRIMINAL FRAUD SCHEMES.

04/11/16 GENERAL TRIBAL COUNCIL MEETING excerpt:

08/10/16 GENERAL TRIBAL COUNCIL MEETING excerpt:

03/27/17 GENERAL TRIBAL COUNCIL MEETING excerpt:

04/23/17 GENERAL TRIBAL COUNCIL MEETING excerpt:

Brandon Stevens doubled down at the April 23, 2017 reconvened GTC Annual Meeting and said Ron Van Den Heuvel had nothing to do with Oneida Seven Generations Corp.’s and Oneida Energy Inc.’s GREEN BAY RENEWABLE ENERGY, LLC‘s PYROLYSIS ‘Waste-To-Energy’ scheme which was loaned $4 MILLION by WI Gov. Scott Walker‘s quasi-public/private Wisconsin Economic Development Corp. [WEDC] due to a total lack of due diligence on the part of WEDC’s legal counsel…

…yet GBRE is just OSGC’s version of Ron Van Den Heuvel‘s “patented” GREEN BOX NA, LLC PYROLYSIS ‘Waste-To-Energy’ scheme… which was loaned $1.2 MILLION by WEDC due to a total lack of due diligence on the part of WEDC’s legal counsel.

WATCH RON VAN DEN HEUVEL MAKE HIS OWN

PULP & PYROLYSIS ‘GREEN BOX NA’ PITCH

in his home town (kinda) of De Pere, WI at the April 05, 2014 City of De Pere Common Council Meeting asking for the City to issue Green Box NA Green Bay, LLC $125,000,000 in tax-free industrial development revenue bonds…

in his home town (kinda) of De Pere, WI at the April 05, 2014 City of De Pere Common Council Meeting asking for the City to issue Green Box NA Green Bay, LLC $125,000,000 in tax-free industrial development revenue bonds…

…as was also arranged for Green Box NA Michigan, LLC by Gov. Rick Snyder’s Michigan Strategic Fund, for a total of $250,000,000 [a quarter of a BILLION]:

But there’s this…

and this…

OOPS…

UH-OH …

September 20, 2016 Superseding Indictment [19 Counts], U.S. District Court, WI Eastern District, Case No. 16-CR-064, UNITED STATES OF AMERICA v. RONALD H. VAN DEN HEUVEL, KELLY YESSMAN – VAN DEN HEUVEL, and PAUL J. PIIKKILA [fmr. Horicon Bank Loan Officer and the Interim Controller of the Green Detroit Regional Center EB-5 Immigrant Investor Program that encouraged foreigners to invest in Ron Van Den Heuvel’s Green Box NA fraud scheme to obtain U.S. Visas from U.S. Customs & Immigration Services (USCIS)]

YIKES!

HMM…

Ron Van Den Heuvel and Kelly Yessman Van Den Heuvel’s trials were pushed back … to October 23.

The Van Den Heuvels are accused of illegally arranging a series of loans in connection with their business, Green Box [NA]. …

According to the federal indictment, [Paul] Piikkila approved a series of loans for the Van Den Heuvels [from 2008 to 2009] when he was a loan officer with Appleton’s Horicon Bank location.

Bank management reportedly told Piikkila not to approve loans for the Van Den Heuvels so they were made out in other names.

Despite these facts, convicted Thief and Con Artist and Fraudster Dan Hawk / Daniel Hawk – who has been the Registered Agent of Oneida Small Business, Inc. since (at least) 05/24/12 – motioned to amend Sherrole Benton‘s Main Motion to rescind General Tribal Council’s December 15, 2013 vote to Direct the Oneida Business Committee to Dissolve the Oneida Seven Generations Corp. / OSGC.

Despite these facts, convicted Thief and Con Artist and Fraudster Dan Hawk / Daniel Hawk – who has been the Registered Agent of Oneida Small Business, Inc. since (at least) 05/24/12 – motioned to amend Sherrole Benton‘s Main Motion to rescind General Tribal Council’s December 15, 2013 vote to Direct the Oneida Business Committee to Dissolve the Oneida Seven Generations Corp. / OSGC.

Dan Hawk / Daniel Hawk‘s Amendment was for OSGC to file suit against the City of Green Bay for having rescinded OSGC’s Conditional Use Permit (CUP) to build a version of Ron Van Den Heuvel‘s waste incinerator scheme in Green Bay.

HOWEVER, Sherrole Benton‘s Main Motion died after being tabled for more than 3 months, and GTC voted to leave it on the table to die. Thus, all of the Amendments voted on died with the Main Motion…

…including Dan Hawk‘s.

- November 14, 2016 Action Report [Draft] for General Tribal Council Meetings on:

- VIDEO – August 10, 2016 (Original Meeting)

- VIDEO – October 2, 2016 (1st Reconvened)

- VIDEO – November 14, 2016 (2nd Reconvened)

EXCERPT FROM AUGUST 10, 2016: Motion by Sherrole Benton to rescind the December 15, 2013 action dissolving the Oneida Seven Generations Corporation and restrict the corporation to commercial leasing activities. Seconded by Loretta Metoxen. Motion not voted on; item tabled.

Amendment to the main motion by Allen R. King to approve all of the BC recommendations for Items 4.A.1–4. Chairwoman Tina Danforth ruled this motion out of order.

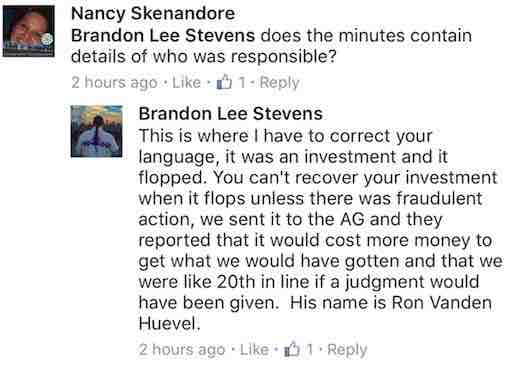

Amendment to the main motion by Nancy Skenandore that he as GTC want to know who are the leaders; who are the investors; who are the attorneys; who are the stockholders; who are the owners; who are the board members; how are they paid; what do they use for collateral; for this information be provided for the last 10 years; and to be reported at the next meeting. Seconded by Cathy Metoxen. Motion carried by show of hands.

Amendment to the main motion by Dan Hawk to allow Oneida Seven Generations Corporation to continue litigation with the City of Green Bay. Seconded by Sherrole Benton. Motion carried by show of hands. …

Motion by Frank Cornelius to table this item. Seconded by Linda Dallas. Motion carried by hand count: 845 support; 395 opposed; 16 abstentions.

EXCERPT FROM OCTOBER 2, 2016: Motion by [Oneida Business Committee Vice-Chair] Melinda J. Danforth to take the motion related to item 4.A.1. from the table. Seconded by Allen King. Motion failed by show of hands.

Despite those facts, Oneida Seven Generations Corp. / OSGC and its subsidiary Green Bay Renewable Energy, LLC / GBRE filed suit against the City of Green Bay on December 23, 2016 in federal court:

- U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 1:16-cv-01700, Oneida Seven Generations Corp. & Green Bay Renewable Energy, LLC v. City of Green Bay

As seen in the GTC Meeting video excerpt posted above, Oneida Eye’s Publisher also asked OBC Treasurer Trish King at the April 23, 2017 GTC Annual Meeting reconvention why the FY2016 Report reprinted word-for-word & number-for-number OSGC’s Report from the FY2012 Annual Meeting Packet…

As seen in the GTC Meeting video excerpt posted above, Oneida Eye’s Publisher also asked OBC Treasurer Trish King at the April 23, 2017 GTC Annual Meeting reconvention why the FY2016 Report reprinted word-for-word & number-for-number OSGC’s Report from the FY2012 Annual Meeting Packet…

except the FY2012 Report contained a disclaimer noting that it was based on FY2010 data:

Please note this information is from FY2010. As of the date of printing, Oneida Seven Generations [Corp.] had not provided audited financial statements.

The FY2016 OBC Treasurer’s Report OMITTED that very important disclaimer and the OBC and Finance Department refused to simply admit that OSGC’s rosy FY2016 Report contained unsubstantiated data that was SEVEN YEARS OLD.

The actions of OSGC, the Finance Department, and the OBC Treasurer intetionally publishing ‘material misrepresentations’ about OSGC’s finances amount to CRIMINAL FRAUD.

OSGC’s Report did not include the $5-6 MILLION LOSS on GREEN BAY RENEWABLE ENERGY LLC‘s Waste Pyrolysis project in Green Bay…

nor was there any mention of the $12-15 MILLION SECRET SETTLEMENT OSGC Managing Agent Peter J. King III admitted he gave – WITHOUT PERMISSION FROM GTC – to Eric Decator’s Generation Clean Fuels/Arland Clean Fuels Plastics Pyrolysis project that GTC prohibited OSGC from conducting anywhere within the boundaries of the Oneida Nation of Wisconsin Reservation.

Add the $4-5 MILLION LOSS on Nature’s Way Tissue, Corp. as reprinted in the FY2016 Report.

SO FAR, OSGC HAS LOST $21–25 MILLION

on Ron-related Pulp & Pyrolysis ‘investments’ that we (kinda) know of.

OBC Treas. Trish King said she needed clarification, and Oneida Eye’s Publisher tried to help explain how anyone could confirm that the financial data for OSGC in the Treasurer’s FY2016 Report was actually from FY2010…

and… of course … ‘retiring’ OBC Vice-Chair Melinda J. Danforth had to buffalo butt her way over the attempted clarification.

Speaking of ‘Buffalo Butt’ Danforth…

Rumor has it that the OBC is currently spending its day-to-day activities trying to trick the U.S. Department of Housing & Urban Development / HUD into funding a new job…

- Housing Division Director [click to see Job Description reposted on April 25, 2017]

A ‘parachute position’ created & designed by OBC specifically for Melinda Danforth at the Oneida Housing Authority / OHA, because she’s leaving OBC politics behind…

…but HUD reportedly told the OBC that if they tried to use federal money to pay for both Melinda’s new dream job and for the existing Housing Authority Executive Director position, then ALL OF OHA’s HUD FUNDING WOULD BE YANKED.

After that news, Melinda Danforth decided to file a Petition to run for the single position opening on the Oneida Gaming Commission…

(OGC – where OSGC‘s Fmr. Pres. & Chair William ‘Bill’ Cornelius is ‘legal counsel’)

…thus running against ‘retiring’ OBC Chair Cristina Danforth.

However, the OBC & Finance Dept. are said to be looking under the couch cushions to find ways to fund Melinda’s cushy new role.

(Tough luck to anyone else who might apply.)

Developing . . .

- May 23, 2017 Federal Indictment, U.S. District Court for the Eastern District of Wisconsin, Case No. 17CR92, United States of American v. Jay L. Fuss [Fmr. Oneida Housing Authority Construction Supervisors]

THE GRAND JURY CHARGES:

1 . Beginning in approximately Septemer 2012, and continuing thereafter until at least May 2013, in the State and Eastern Districe of Wisconsin,

JAY L. FUSS

as an agent of an Indian tribal governement that received benefits in excess of $10,000 in a one-year period from a federal grant program, did knowingly obtain by fraud, and convert without authority to his own use, and intentionally misapply, property valued at $5,000 or more that was under the care, custody, and control of the Indian tribal government and its agency.

See also: Whistleblower Report to FBI about alleged HUD Funding & Materials Theft from Oneida Housing Authority, as well as claims of retaliatory physical violence:

• February 21, 2016 Dawn M. Delebreau Privacy Act Release Form & Report to U.S. Sen. Tammy Baldwin regarding FBI investigation of Case No. 194B-MW477598

• Sauk Co. Case No. 2013CF208, State of Wisconsin vs. Spencer A. Cornelius; Substantial Battery / Intend Bodily Harm (Felony; Repeater), regarding Spencer Cornelius’ brutal assault on fellow OHA employee Jonathan Delabreau during an OHA training trip to the Wisconsin Dells when harassment & intimidation of Jonathan just wasn’t enough to satisfy Spencer’s bloodlust, and was allegedly done in order to please Spencer’s and Jonathan’s boss, former OHA Construction Superintendent Jay Fuss. That assault was not the first time Spencer Cornelius has violently attacked people as seen by Brown Co. Case No. 2009CF630

Related: