UPDATE:

Cristina Danforth, Brandon Yellowbird Stevens, and Attorney Jo Anne House want GTC to believe that Artley Skenandore Jr.’s ‘Nature’s Way Tissue’ fraud scheme & OSGC’s ‘Green Bay Renewable Energy’ fraud scheme have nothing to do with each other.

The facts show that Ronald H. Van Den Heuvel is at the center of BOTH criminal fraud schemes.

We’ve added TIMELINE PAGES

to prove it.

Brandon Yellowbird Stevens recently claimed to GTC Members on Facebook that the Oneida Nation in Wisconsin complained 10 YEARS AGO to the Wisconsin State Attorney General about being ripped off by Ron Van Den Heuvel and losing $4 MILLION via Nature’s Way Tissue Corp.

But then Brandon Stevens acted like he didn’t know Oneida Seven Generations Corp. [OSGC] subsidiary ‘Green Bay Renewable Energy, LLC’ [GBRE] is part of Ron Van Den Heuvel’s international GREEN BOX NA fraud scheme …

which was funded by Governor Scott Walker’s Wisconsin Economic Development Corp. [WEDC] …

and GBRE is ‘GREEN BOX ONEIDA NATION’…

and was also funded by Gov. Scott Walker’s Wisconsin Economic Development Corp. [WEDC].

- 4/23/17 GENERAL TRIBAL COUNCIL MEETING EXCERPT – BRANDON STEVENS TELLS GTC that RON VAN DEN HEUVEL HAD “NOTHING TO DO WITH” OSGC’S PYROLYSIS PLAN:

GREEN BOX NA and GBRE BOTH PARTNERED

with ABDUL LATIF MAHJOOB’s company ACTI.

BOTH CLAIMED THEY’D DO the SAME THING

SOMEHOW USING the SAME GREEN BAY AREA

MUNICIPAL SOLID WASTE ‘FEEDSTOCK’:

1. Sourcing and Collecting biomass: waste streams…

2. Sorting …

3. Pulping Technology center …

4. Pelletizing the by-products …

5. Producing energy: either electricity, bio-diesel or both.

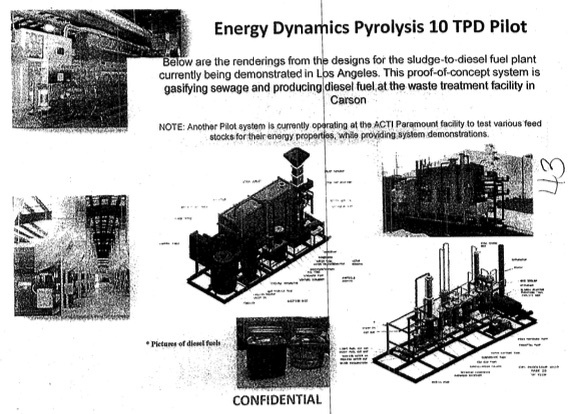

THE ‘CONFIDENTIAL’ INVESTOR’S BROCHURE FOR GREEN BOX NA, LLC says:

Below are the renderings from the designs for the sludge-to-diesel fuel plant currently being demonstrated in Los Angeles. This proof-of-concept system is gasifying sewage and producing diesel fuel at the waste treatment facility in Carson.

Note: Another Pilot system is currently operating at the ACTI Paramount [CA] facility to test various feed stocks for their energy properties, while providing system demonstrations.

OSGC INVITED THE OWNER OF ACTI,

ABDUL LATIF MAHJOOB, TO SPEAK

AT THE APRIL 11, 2011 GTC MEETING

ABOUT ‘WASTE-TO-ENERGY’ PLANS.

BRANDON STEVENS VISITED DEMO MODELS IN

CALIFORNIA MENTIONED IN BROCHURES OF

RON VAN DEN HEUVEL’s GREEN BOX NA, LLC …

THE SAME TECHNOLOGY TOUTED BY GCF/ACF!

According to the April 6, 2015 Plaintiffs–Appellants’ Brief in Cook. Co. Case No. 2014-L-2768, GCF/ACF v. ONWI & OSGC, et al., plus Exhibits:

On August 30, 2013, Bruce King (CFO of OSGC/Treasurer of GBRE), Cathy Delgado (OSGC Board member), William Cornelius (OSGC Board President), Brandon Stevens (Tribe Business Committee member) and Michael Galich went to ACF’s plant in Bakersfield, California to examine the type of machines that would be utilized in the Project[.]

Watch Ron Van Den Heuvel make his pitch in his home town at the April 15, 2014 City of De Pere Common Council Meeting asking for the City to issue Green Box NA Green Bay, LLC $125,000,000 in tax-free industrial development revenue bonds, as was also arranged for Green Box NA Michigan, LLC by Gov. Rick Snyder’s Michigan Strategic Fund, for a total of $250,000,000 [a quarter of a Billion]:

THE PROBLEM IS…

RONALD VAN DEN HEUVEL IS A FRAUD

BEING INVESTIGATED FOR VARIOUS SCHEMES:

- September 20, 2016 Superseding Indictment [19 Counts], U.S. District Court, WI Eastern District, Case No. 16-CR-064, UNITED STATES OF AMERICA v. RONALD H. VAN DEN HEUVEL, KELLY YESSMAN – VAN DEN HEUVEL, and PAUL J. PIIKKILA [fmr. Horicon Bank Loan Officer and the Interim Controller of the Green Detroit Regional Center EB-5 Immigrant Investor Program that encouraged foreigners to invest in Ron Van Den Heuvel’s Green Box NA fraud scheme to obtain Visas]

4/11/2017 – WLUK: Van Den Heuvels’ bank fraud trial rescheduled

The trial date for a De Pere…man and his wife accused of bank fraud has been pushed back again.

Ron Van Den Heuvel and Kelly Yessman Van Den Heuvel were scheduled to go on trial July 31, but at a hearing Tuesday, that was pushed back to [October, 23, 2017].

They are accused of bank fraud for allegedly illegally arranging a series of loans regarding the operations for a company known as Green Box [NA].

Their former banker, Paul Piikkila, agreed to plead guilty and testify against the Van Den Heuvels. His sentencing has not been set.

Ron Van Den Heuvel and Kelly Yessman Van Den Heuvel’s trials were pushed back Tuesday from July 31 to October 23.

The Van Den Heuvels are accused of illegally arranging a series of loans in connection with their business, Green Box [NA]. …

According to the federal indictment, [Paul] Piikkila approved a series of loans for the Van Den Heuvels [from 2008 to 2009] when he was a loan officer with Appleton’s Horicon Bank location.

Bank management reportedly told Piikkila not to approve loans for the Van Den Heuvels so they were made out in other names.

‘Straw borrowers’ for Ron & Kelly Van Den Heuvels’ bank fraud scheme include Steven Peters – Ron Van Den Heuvel’s employee and a Partner with Ron, Artley Skenandore Jr. & OSGC in NATURE’S WAY TISSUE CORP. [More info below in this post]

Judge for yourself:

- November 15, 2008 GTC MEETING MINUTES

- November 15, 2008 GTC MEETING AUDIO:

During the GTC Special Meeting re: Petitions by Madelyn Genskow, GTC voted to adopt the following Resolutions…

which OBC & OSGC HAVE IGNORED & REFUSED TO OBEY:

- GTC Resolution 11-15-08-A, Non-Confidentiality Information

Now Therefore Be It Resolved, that no committee or tribal attorney may force an Oneida committee, board or commission to keep secret from other tribal members information that is not of a confidential nature or force them to sign an agreement in order to serve on a committee, board or commission of the Oneida Tribe.

But the OBC tried to force GTC’s elected representative Frank Cornelius Sr. to sign a ‘confidentiality agreement’ to be allowed to work with the OBC on OSGC’s dissolution and have refused to include him in the process as the OBC was ordered to do by GTC on 12/15/13.

•••

- GTC Resolution 11-15-08-B Directing Review of Corporate Charters

Now Therefore Be It Resolved that the [OBC] is directed to withhold future financial distributions to any corporation of the Tribe until the following actions have been taken

1. The [OBC] is directed to amend all corporate charters to require submission of annual and semi-annual reporting which contains the following information and/or documents:

a. the business done and intended to be done by the corporation

b. material changes and developments since the last report in the business, described,

c. any material pending legal proceedings to which the corporation is a party, and

d. financial statements of the corporation including a consolidated balance sheet and consolidated statement of income and source and application of funds.

2. The [OBC] is directed to review all corporate entities regarding finances and operations to determine the effectiveness and efficiencies of thoe corporate entities. A report on corporate entities is directed to be included in the Annual [GTC] meeting materials, or earlier if determined by the [OBC], to be needed.

But OSGC failed to inform GTC of the existence of OSGC subsidiary-Green Bay Renewable Energy, LLC until after OSGC & GBRE sued the City of Green Bay.

•••

- GTC Resolution 11-15-08-C, Treasurer’s Report to include all Receipts and Expenditures and the Amount and Nature of all Funds in the Treasurer’s Possession and Custody

Now Therefore Be It Resolved, that the Oneida General Tribal Council hereby directs that all Treasurer reports hereinafter include an independently audited annual statement that provides the status or conclusion of all the receipts and debits in possession of the Treasurer of the Tribe including, but not limited to, all corporations owned in full or in part by the Tribe, and

Be It Further Resolved, that the Oneida General Tribal Council hereby directs that all Treasurer’s reports to the Oneida General Tribal Council at the semi-annual and annual Oneida General Tribal Council meetings hereinafter include an independently audited annual financial statement that provides the status or conclusion of all receipts and debits in possession of the Treasurer of the Tribe and including, but not limited to component units (Tribally chartered corporations and autonomous entities, limited liability companies, state chartered corporations, any tribal economic development authority, boards, committees and commissions, vendors and consultants) owned in full or in part by the Tribe, and

Be It Further Resolved, that no “agent” of the Tribe shall enter into any agreement with any corporation that prohibits full disclosure of all transactions (receipts and expenditures and the nature of such funds) and that such an agreement is not binding to the Tribe, and

Be It Finally Resolved, that the Oneida General Tribal Council hereby directs implementation of this resolution at the next regular Oneida General Tribal Council meeting or at such special meeting of the Oneida General Tribal Council whereby a Treasurer’s report is requested.

But the OBC entered into a non-disclosure contract paying $12,000.00/week to Ernie Stevens Sr.’s former business partner Gene Keluche (owner of Sagestone Managament in Colorado) when the OBC hired Gene Keluche & Sagestone Mgmt. as OSGC’s ‘Managing Agent’ in December 2013 without consulting either GTC or GTC’s elected representative, Frank Cornelius Sr.

Even worse, OSGC’s new ‘Managing Agent’ Peter J. King III told GTC on August 10, 2016 that he made a “business decision” to give untold millions of GTC’s dollars in secret non-disclosure settlement payments and Pete King III and the OBC refuse to inform GTC how much was given to whom, where the settlement money came from, and who allowed Pete King III to give away millions of GTC’s dollars in what looks like an extortion scheme shakedown.

•••

- GTC Resolution 11-15-08-D, General Tribal Council Directives

Now Therefore Be It Resolved, that the [OBC] shall see to it that all Oneida [GTC] directives back to 1994 plus [GTC Resolution 07-06-93-A] must be carried out by the end of fiscal year 2010.

Be It Further Resolved, Oneida General Tribal Council directs the Legislative Operating Committee to develop an amendment to the removal law which identifies that an elected official is subject to removal for failure to carry out a [GTC] directive and that this be presented to the Oneida General Tribal Council no later than the July 2009 semi-annual meeting.

But the OBC never did carry out all of GTC’s directives, and instead made OBC members’ removal more difficult.

The current OBC recently proposed exempting themselves from the Tribe’s ‘Code of Ethics’ in order to prevent GTC from removing dolts & crooks from the OBC.

•••

All of this proving that OBC & OSGC OPENLY DEFY GTC’s Directives, and some OBC members resent the fact that GTC has more power & authority than OBC.

Especially Brandon Yellowbird Stevens and current OBC Sec. Lisa Summers who’ve made it very clear for years that they either don’t understand, or else they simply reject the basic concept of “NO MEANS NO.”

03/27/17 GENERAL TRIBAL COUNCIL MEETING – Oneida Eye Publisher Leah Sue Dodge asks the Oneida Business Committee to be honest about the true costs of OSGC’s losses, litigation, and secret multi-million dollar settlements that have cost General Tribal Council over $25 Million

> How can tribally-owned companies file suit

> against municipalities in federal court

> on behalf of criminal fraud schemes…

> without tribal company & tribal gov’t officials

> risking being charged with criminal fraud

> and countersued for criminal fraud?

> PROTIP: THEY CAN’T.

CLICK the π PIE to REVEAL

OSGC’s & GBRE’s

$e¢ret Ingredient for $u¢¢e$$ !!!

- March 14, 2017 Reply in Support of Defendant’s Motion to Dismiss Plaintiffs’ Complaint, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 1:16-cv-01700, Oneida Seven Generations Corp. & Green Bay Renewable Energy, LLC v. City of Green Bay

OSGC’s arguments against dismissal are rife with contradiction. OSGC invokes federal court jurisdiction, but assert that this Court lacks authority to determine whether OSGC has the capacity to bring this Complaint. … OSGC claims that it exhausted the state law remedies before repairing to federal court and that state law remedies were inadequate, but admit that state law remedies could have reversed the exact land-use decision of which OSGC complains. … OSGC complains that the decision to revoke its conditional use permit violated due process, but assert a constitutionally protected interest in their building permit. … But the most glaring contradictions are the two favorable state court decisions as Exhibits A and B to a Complaint for deprivation of due process. … This is more than the Constitution and §1983 can bear. Plaintiffs fail to state a claim, fail to establish subject matter jurisdiction, and fail to prove corporate capacity to sue. For any one of the following, independent reasons, the Complaint should be dismissed.

A. The Business Committee cannot cure OSGC’s lack of capacity by resolution. This Court is authorized to find as much, or if the Court lacks authority, should dismiss the Complaint.

Despite having brought this complaint in federal court, OSGC now argues that a federal court cannot decide whether OSGC has capacity to bring this suit. … Although they fail to name it, OSGC has invoked the “tribal exhaustion rule.” As explained by the Seventh Circuit, “[t]he concept of federal court abstention in cases involving Indian tribes known as the ‘tribal exhaustion rule’ generally ‘requires that federal courts abstain from hearing certain claims relating to Indian tribes until the plaintiff has first exhausted those claims in tribal court.” Jackson v. Payday Financial, LLC …. This rule plainly does not apply where a plaintiff has voluntarily submitted its claim to the Court’s authority.

In Altheimer & Gray v. Sioux Manufacturing Corporation, the Seventh Circuit held that the doctrine of tribal exhaustion did not bar a federal court from deciding a contract dispute filed against tribal defendants where the defendants had, “explicitly agreed to submit to the venue and jurisdiction of federal and state courts.” … see also Stifel, Nicolaus & Co., Inc. v. Lac du Flambeau Band of Lake Superior Chippewa Indians …. While the defendants in Altheimer and Stifel agreed by contract, OSGC has just as clearly “agreed to submit to the venue and jurisdiction” of this Court by selecting this forum. OSGC cannot ask the Court to hear its Complaint and deny the Court’s authority in the same action.

[Footnote: Additionally, the Seventh Circuit has recognized, but not resolved, a circuit split as to whether the doctrine of tribal exhaustion applies at all where there is no pending tribal court action. Jackson v. Payday Financial, LLC….

The courts of appeals that have addressed this issue have reached opposite conclusions. In Garcia v. Akwesasne Housing Authority … the Court of Appeals for the Second Circuit held that tribal exhaustion was not required absent an ongoing tribal proceeding…. But see, e.g., United States v. Plainbull … (rejecting the Government’s argument that “the district court abused its discretion by abstaining from the merits of this case because there was no concurrent action pending in the tribal courts” because “[w]hether a tribal action is pending, however does not determine whether abstention is appropriate.”)

…The cases cited by Plaintiffs do not inform this issue because, in both cases, a tribal authority had previously adjudicated the issue. Iowa Mut. Ins. Co. v. LaPlante … (declining jurisdiction over personal injury claim previously adjudicated in Blackfeet Tribal Court because “tribal appellate courts must have the opportunity to review lower tribal court decisions”); Charles Mix v. U.S. DOI … (declining jurisdiction over a land-use decision affirmed by the Bureau of Indian Affairs and the Interior Board of Indian Appeals because the Eighth Circuit lacked jurisdiction to review decisions of the Interior Board of Indian Appeals). It remains an open question in the Seventh Circuit as to whether a federal court may decide tribal issues where no tribal court action is pending. It is a question this Court need not answer because Plaintiffs have voluntarily submitted to the authority of the Court.]

But even if OSGC was correct that the Court must abstain from deciding OSGC’s capacity, Business Committee Resolution No. 02-22-17-E (the “Resolution”) would not become binding authority. Courts abstaining in deference to tribal jurisdiction do not simply adopt the tribal court decision—they dismiss. Iowa Mut. Ins. Co. v. LaPlante … (affirming district court’s decision to abstain, but remanding for a determination on whether to dismiss or stay pending further tribal court proceedings). If this Court cannot decide whether OSGC has capacity to bring this lawsuit, the lawsuit must be dismissed.

This Court can and should decide whether OSGC lacks capacity to sue, and not by reference to the Resolution. OSGC’s reliance on the Resolution ignores the fundamental problem with OSGC’s capacity – the Oneida General Tribal Council, not the Business Committee, voted to dissolve OSGC and then affirmed that OSGC cannot continue litigation against the City. … OSGC acknowledges that the powers of the Business Committee are “subject to General Tribal Council review.” … see also … Constitution and By-Laws of the Oneida Nation (2015), Article III, § 3 (The business committee may only “perform such duties as may be authorized by the General Tribal Council.”). As the subordinate entity, the Business Committee cannot interpret its own authority to override the will of the General Tribal Council.

B. The adequacy of OSGC’s state law remedies is not determined by its alleged losses.

OSGC does not dispute that to state a claim for procedural or substantive due process, it must show that its state law remedies were inadequate. … see also Bettendorf v. St. Croix County … (“Where a claimant has availed himself of the remedies guaranteed by state law, due process is satisfied unless he can show that such remedies were inadequate.”); River Park, Inc. v. City of Highland Park … (“Labels [procedural or substantive due process] do not matter.”).

Rather, OSGC argues that the inadequacy of its state law remedies can be “readily inferred from the facts alleged.” … Specifically, OSGC complains that state law remedies did not provide “timely re-issuance of the CUP” or “appropriate compensation for the significant damages it suffered as a result of the City’s wrongful actions.” … According to OSGC, the appellate judgments were untimely because they did not arrive in time to allow OSGC to take advantage of grants and other incentives that made the project economically viable. … Thus, OSGC argues that its state law remedies were inadequate by counting its alleged damages.

But adequacy of state law remedies is not measured by damages. Hudson v. Palmer … Rather, adequacy refers to whether the state law provides sufficient process to meet constitutional requirements. … Barry Aviation, Inc. v. Land O’ Lakes Municipal Airport Com’n (“The fact that a plaintiff ‘might not be able to recover under [state law] remedies the full amount of which he might receive in a § 1983 action is not determinative of the adequacy of state remedies”) (citations omitted). In land-use decisions, the opportunity to seek certiorari review is sufficient process to meet constitutional requirements. … OSGC’s alleged losses (including lost grants, contracts, and permits) do not undermine the adequacy of its available state law remedies.

For the same reason, OSGC cannot escape the holdings of Donohoo v. Hanson, … Harding v. City of Door, … and Minneapolis Auto Parts Co. v. City of Minneapolis, … all finding no due process violation where plaintiffs had the opportunity for appellate review and prevailed. OSGC attempts to distinguish those cases on the basis that in those cases, “plaintiffs actually received the permit it sought during or as a result of the state court proceedings.” … This distinction fails legally and factually.

Legally, the relief ultimately granted in a state court proceeding does not determine whether OSGC’s due process rights were violated. Due process is, of course, concerned with process. See CEnergy-Glenmore Wind Farm No. 1, LLC v. Town of Glenmore … (“Due process requires only a state court remedy, not a guaranteed win by the applicant’s contractual deadline.”). Regardless of the outcome, OSGC had the “opportunity to apply for a writ” and, again, this is sufficient to satisfy due process. River Park … (emphasis added).

Factually, the distinction fails because OSGC also prevailed in state court. The only reason it has not “receive the permit it sought during or as a result of the state court proceedings” is that it has failed to enforce the state court judgments. … Again though, even if OSGC had lost, its opportunity to apply for a writ of certiorari satisfied due process. …

C. “Procedural obstacles” do not excuse OSGC from pursuing its state law remedies and its failure to do so bars its federal due process claims.

OSGC does not dispute that a plaintiff with available state law remedies against a land-use decision must pursue those remedies before repairing to federal court. … Instead, OSGC simultaneously argues that it “exhausted” those remedies and that “procedural and practical obstacles” barred it from pursing those remedies.

[Footnote: Technically, the requirement that Plaintiffs repair to state court is “not because the owner must ‘exhaust’ state remedies.” River Park, Inc. v. City of Highland Park…. “Rather the idea in zoning cases is that the due process clause permits municipalities to use political methods to decide, so the only procedural rules at stake are those local law provides, and these rules must be vindicated in local courts.” … The upshot, however, is the same. Plaintiffs cannot state a claim for due process violations based on an objectionable land-use decision without pursuing state law remedies. ….]

OSGC cannot have it both ways – either OSGC pursued available state remedies or it did not. OSGC admits that it did not: “Could OSGC eventually have placed this dispute in a posture in which the City was under an enforceable order to re-issue the CUP? Probably…” …

OSGC attempts to hedge this admission by arguing that the path to enforcing the judgment was “unclear” and untimely. … These arguments go to adequacy of state law remedies – not whether those remedies were “exhausted.” In any event, the arguments are without merit.

Specifically, OSGC argues that it could not enforce its state court judgments because “the judgment of the appellate courts did not ‘require’ the City to do anything” and, according to OSGC, Wisconsin law “limits the reviewing court’s authority in a certiorari proceeding.” … This is patently false. Obviously a certiorari court has the authority to reverse a circuit court, which must then proceed in accordance with the judgment. …

OSGC also complains that it could not enforce the judgment until the record was remitted to the circuit court and because of this delay, the “unique confluence of circumstances that would have allowed construction of the facility had disappeared.” … Again, “[t]he fact that a plaintiff might not be able to recover under state law remedies the full amount of which he might receive in a § 1983 action is not determinative of the adequacy of the state remedies.” …

If OSGC was not satisfied with the outcome of certiorari review, it also could have sought a writ of mandamus to compel the issuance of the building permit. Indeed, OSGC initially filed exactly such a writ of mandamus, but voluntarily dismissed it. … The opportunity to file a writ of mandamus defeated plaintiffs’ due process claims in CEnergy-Glenmore and the opportunity, along with the opportunity to enforce its judgment, defeats OSGC’s claim here. …

Neither Guerro v. City of Kenosha Housing Authority nor Hanlon v. Town of Milton excuse OSGC’s failure to fully pursue its state court remedies. Guerro denied equitable relief as outside the scope of a certiorari action. … Despite the relief sought being unavailable on certiorari, Guerro nevertheless reinforced that “a litigant cannot claim a deprivation of due process until he or she has, in fact, pursued the post deprivation process provided.” … In Guerro, the “post deprivation process provided” was certiorari under Wis. Stat. § 68.13. … Here, the available post deprivation process also includes enforcement of the state court judgments and OSGC failed to pursue them.

Likewise, Hanlon held that claim preclusion does not bar plaintiffs who have pursued a certiorari action from pursuing a § 1983 action. … It does not address, let alone excuse, any prerequisites to stating a claim under § 1983, pursuit of state law remedies. … Such a holding could not be reconciled with CEnergy-Glenmore … (denying due process claims under § 1983 where plaintiffs “ignored potential state law remedies.”).

Finally, OSGC states that “the City apparently recognizes that OSGC filed a request for an administrative appeal, filed a Notice of Claim, filed a certiorari action in state court, and pursued that action all the way to the Wisconsin Supreme Court.” … Any facts cited by the City are “recognized” only for the limited purpose of supporting its Motion to Dismiss, under which all allegations in the Complaint “must be accepted as true.” Killingsworth v. HSBC Bank Nevada, N.A. ….

The statutory framework is in place for OSGC to enforce the appellate judgments. Any “procedural obstacles” do not excuse OSGC from taking advantage of available state court remedies – “The due process clause requires that a claimant receive adequate process, not the most advantageous process available to him….” Bettendorf v. St. Croix County….

D. OSGC’s investment on the CUP does not transform the CUP into a protectable property interest.

OSGC does not dispute that a conditional use permit is not a constitutionally protected property interest. … Instead, OSGC claims its “combined interests” are “sufficient to warrant due process protection.” … The “combined interests” are the assets OSGC acquired in reliance on the CUP – “a building permit from the City, air permits from the state and federal regulators, contractors from third-parties, and various grants and tax-credits.” … see also … Complaint, ¶ 4 (“Thereafter, and in reliance on the CUP, OSGC invested significant funds developing the project. OSGC completed a substantial environmental permitting process with both state and federal regulators. Eventually, OSGC obtained all necessary permits to being construction of the facility.”) In other words, OSGC asks the court to find that its investments made in reliance on the CUP give rise to a protectable property interest independent of the CUP.

Wisconsin courts do not recognize this theory. Rainbow Springs Gold Co., Inc. v. Town of Mukwonago … (finding no property interest in a revoked conditional use permit despite plaintiff losing the use of a recreational resort facility, a convention center, two golf courses, a haunted hotel, and a full-service restaurant all operated in reliance on the CUP).

Nor do the cases cited by OSGC. OSGC misquotes Bd. of Regents v. Roth as holding that property interests “essentially encompass[] any ‘legitimate claim of entitlement.’” … Rather, Roth established that a “legitimate claim of entitlement” is a threshold attribute of a protected property interest. … (“To have a property interest in a benefit, a person … must [] have a legitimate claim of entitle to it.”). Roth further established that protected property interests “are created and their dimensions are defined by existing rules or understandings that stem from an independent source such as state law—rules or understandings that secure certain benefits and support claims of entitlement to those benefits.” … (finding no property interest.)

Consistent with Roth, in the cases cited by OSGC, courts found a protected property interest where the interest relied on state laws. Building Height Cases … (protecting investments made in reliance on an ordinance); Peninsula Props., Inc. v. City of Sturgeon Bay … (protecting building permits sought pursuant to state law); River Park, Inc. v. City of Highland Park … (protecting a zoning designation where state law required the City to grant plaintiff’s zoning application).

Unlike these interests, OSGC’s alleged interest was not made in reliance on state law – it was made “in reliance on the CUP.” … The CUP cannot “support claims of entitlement” … because “[a] conditional use permit is not property.” ….

E. OSGC has not alleged a violation of procedural due process.

To support its claim for procedural due process, OSGC cites to Owen v. Lash … and Zinerman v. Burch …. Its reliance on these cases is misplaced. The due process claim in Lash and Zinerman and was for deprivation of liberty where plaintiffs were involuntarily detained in state prison and a state mental health facility, respectively. As explained in Mathews, due process is “a flexible concept that varies with the particular situation.” …. The process owed in a deprivation of liberty is not the same as what is owed in land-use decisions. Again, all that is owed in land-use decisions is “the opportunity to apply for a writ.” River Park, Inc. v. City of Highland Park…. Thus, even if, as alleged, the City did not provide “a meaningful hearing prior to revoking the CUP” …. the opportunity for certiorari review was a sufficient procedural safeguard. … see also CEnergy-Glenmore Wind Farm No. 1, LLC v. Town of Glenmore … (“[A] post-deprivation remedy is sufficient to satisfy due process in such situations [land-use decisions].”).

OSGC outlines additional steps the City could have taken, including that “the City should have devised a manner to consider that decision that would have prevented a fabricated reason for it.” … Whatever process OSGC had in mind by this, procedural due process does not turn on what additional process the city could have provided. The Seventh Circuit has rejected such arguments as “speculative” and “irrelevant.” Bettendorf v. St. Croix County[.] Where the plaintiffs in Bettendorf complained that another procedure would have provided “more or better process” than it received in state court proceedings, the Seventh Circuit denied his claim, holding “[t]he due process clause requires that a claimant receive adequate process, not the most advantageous process available to him.” ….

The theme throughout OSGC’s Complaint and arguments is that OSGC is not dissatisfied with the process they received – it is dissatisfied with its losses. In Shipyard Development, LLC v. City of Sturgeon Bay, this Court denied just such a claim: “[I]t is clear from its complaint that Shipyard is not seeking notice and a hearing on its right to a prompt determination. Shipyard wants money for the losses it claims to have sustained as a result of the delay. Shipyard’s claims are not for a denial of procedural protections.” ….

F. OSGC has not alleged a violation of substantive due process.

As an initial matter, OSGC accuses the City of conflating substantive due process with procedural due process and cites River Park, Inc. v. City of Highland Park as an example of a case relied on by the City that involved only procedural due process claims. … This criticism ignores that the Seventh Circuit applied River Park to claims for substantive and procedural due process in CEnergy-Glenmore. … (“[R]egardless of how a plaintiff labels an objectionable land-use decision (i.e., as a taking or as a deprivation without substantive or procedural due process), recourse must be made to state rather than federal court.”) (citing River Park … (“Labels do not matter. A person contending that state or local regulation of the use of land has gone overboard must repair to state court.”) Thus, the requirements of River Park apply to both substantive and procedural due process claims. That said, the City agrees that substantive and procedural due process claims are distinct insofar as substantive due process claims are “very limited” and a more “difficult undertaking, especially if the claim involves zoning or other real property regulatory actions by a governmental body.” Bettendorf … see also Donohoo v. Hanson … (“To prevail on a claim that defendants deprived him of substantive due process, Donohoo’s burden is even greater [than for a procedural due process claim].”)

OSGC attempts to distinguish CEnergy-Glenmore by citing the loss of its building permit and “significant funds spent in reliance on the town’s actions.” … As to the building permit, the loss of a building permit clearly does not entitle plaintiffs to a claim for substantive due process. Harding v. County of Door … (finding no substantive due process violation for withdrawal of building permit). As to the “significant funds,” OSGC has put the cart before the horse. Before it can state a claim for damages under section 1983, OSGC must first allege a constitutional violation. Instead, OSGC asks the Court to find a violation based on the measure of its losses. OSGC repeats this theme throughout its bulleted list of grievances. … The “magnitude” of OSGC’s damages is not a proxy for arbitrariness.

The only Seventh Circuit case OSGC cites as having found a violation of substantive due process is Peninsula Properties, Inc. v. City of Sturgeon Bay[.] There, plaintiffs presented a viable case for substantive due process violations by alleging that the City “refused to act as a means to coerce a citizen to take unwarranted action.” … OSGC has not alleged conduct that amounts to coercion. … Nor does the conduct support an inference “that the City intentionally sought to harm OSGC.” … The worst that might be said about the allegations is that the City yielded to political pressure, an allegation that decidedly does not support a claim for procedural due process. River Park … (“the due process clause permits municipalities to use political methods to decide [land-use matters]”).

G. The Complaint has not alleged a claim or standing on behalf of GBRE.

Plaintiffs argue that by referring to OSGC and its subsidiary GBRE collectively, they are excused from showing that GBRE is independently entitled to relief. … According to Plaintiffs, the facts alleged on behalf of OSGC were alleged for both entities and the City is free to parse out the distinctions in discovery. …

Exactly this style of “vague drafting” was rejected by the Eastern District in Holmes v. City of Racine… (citing Lujan v. Defs. Of Wildlife…). There, multiple plaintiffs pursued RICO claims against multiple defendants, but the plaintiffs’ complaint failed to make clear which defendants harmed which plaintiffs. … The court found this insufficient to confer standing:

Here is what is clear: each plaintiff must allege facts that, taken as true, would show a claim for relief that is plausible on its face. In other words, the Court will not allow them to escape dismissal simply by pleading a host of facts which they then incorporate into claims against all or groups of the defendants…. [A]bsent factual allegations that would establish facial plausibility of RICO claims against specific defendants by specific plaintiffs, the Court will be obliged to dismiss the RICO portions of the plaintiffs’ amended complaint.

Id. (citing Ashcroft v. Iqbal…) … This reasoning applies with equal force here – Plaintiffs’ Complaint failed to establish facial plausibility of claims against the City “by specific plaintiffs” and must be dismissed for lack of standing.

The reasoning from Holmes also renders GBRE’s claim deficient for purposes of Rule 8(a)(2). Where a complaint fails to show damages sufficient to confer standing, it also necessarily fails to “show[] that the pleader is entitled to relief,” fails to “give the defendant fair notice of what the… claim is and the grounds upon which it rests,” and fails to satisfy Rule 8. Bell Atlantic Corp. v. Twombly … (citing Fed. R. Civ. P. 8(a)(2)).

Dated this 14th day of March, 2017.

GUNTA LAW OFFICES, S.C.

Attorneys for Defendant, City of Green Bay

From Oneida Eye’s Documents and Media pages:

03/02/2017:

- WCAU – Temple University Graduate Admits to Running $54M Green-Energy Ponzi Scheme; The scam ran from 2005 until 2009, even after the Securities & Exchange Commission (SEC) filed a civil lawsuit against Mantria Corporation

A Temple University graduate admitted Thursday that he ran a $54 million Ponzi scheme built on false promises of green energy technology that would turn trash into fuel and “carbon-negative” housing developments, neither of which were ever fully developed.

Troy Wragg, now living in Georgia, pleaded guilty in federal court in Philadelphia on Thursday to conspiracy and securities fraud. His college girlfriend, Amanda Knorr, pleaded guilty last year, while Wayde McKelvy, a 54-year-old securities salesman from Colorado, is scheduled to go on trial [September 11, 2017].

- Philadelphia Inquirer: Two years out of Temple, he built a $54 million Ponzi scheme

Their 2015 indictment came six years after the Securities and Exchange Commission filed suit against [Mantria Corp. / EternaGreen Global Corp.] in Colorado, shut down the firm, and obtained a court order barring its principals from raising new funds. Various people linked to the company and its associated entities have agreed to a $6 million settlement with investors.

- Minneapolis Star Tribune: Troy Wragg admits to running $54M green-energy Ponzi scheme

[Mantria Corporation] had a site testing the production of biochar in Dunlap, Tennessee, but prosecutors say the company never had a patent for the technology to sell the systems and lied about how much it was producing.

- February 28, 2017 OSGC’s & GBRE’s Response in Opposition to City of Green Bay’s Motion to Dismiss the Complaint, U.S. District Court, Eastern District of Wisconsin, Case#1:16-cv-1700, Oneida Seven Generations Corporation & Green Bay Renewable Energy, LLC v. City of Green Bay

- February 7, 2017 Memorandum in Support of City of Green Bay’s Motion to Dismiss OSGC’s & GBRE’s Complaint, U.S. District Court, Eastern District of Wisconsin, Green Bay Division, Case No. 1:16-cv-01700, Oneida Seven Generations Corporation & Green Bay Renewable Energy, LLC v. City of Green Bay

- December 23, 2016 Complaint & Jury Demand by OSGC & GBRE against the City of Green Bay, U.S. District Court, Eastern District of Wisconsin, Docket No. 16-CV-1700, Oneida Seven Generations Corporation & Green Bay Renewable Energy, LLC v. City of Green Bay

- 08/14/2015 Gross & Klein LLP: Federal Court Has Jurisdiction Over Lawsuit Against Former Tribal Officials, Senior Employees For Defrauding Tribe of Millions

(CORNING, Calif. – August 14, 2015) A federal judge ruled today that the U.S. District Court, Eastern District of California, has subject matter jurisdiction over a lawsuit filed by the Paskenta Band of Nomlaki Indians under the federal Racketeer Influence and Corruption (RICO) Act and other state and federal laws against former Tribal officials and senior employees accused of defrauding the Tribe of tens of millions of dollars. The court rejected claims by defendants that the Tribe’s lawsuit is an intra-tribal dispute and therefore the Court had no jurisdiction to hear any of the Tribe’s claims.

“We are gratified by the Court’s decision. The Tribe brought this action to hold responsible a group of individuals who, for well over a decade, conspired to steal tens of millions of dollars from the Tribe,” the Paskenta Band of the Nomlaki Indians Tribal Council said in a statement. “That stolen money, much of which the Ringleaders used to pay for a lifestyle of private jet travel, sports cars, and luxury homes, could and should have been used to improve the welfare of the Tribe’s members. The Court’s decision today makes clear that these individuals and others who benefited from their scheme will be held responsible for the harms they caused.”

The Tribe’s co-lead counsel Stuart Gross, of Gross Law P.C., added, “With a single sentence, the Court rejected the argument that this case is an intra-tribal dispute over tribal membership and governance over which the Court lacks jurisdiction. The decision sends a clear message that tribal officials who steal from the tribes they are supposed to serve can and will be held responsible in federal courts. The defendants misleadingly defended their conspiracy to defraud the Tribe through arguing the federal courts had no power to review actions that violate federal and Tribal law. The opposite is true; and we are pleased the Court rejected defendants’ attempt to avoid liability on this basis.”

In another significant win for the Plaintiffs, U.S. District Judge Garland E. Burrell, Jr., also denied the defendants’ attempt to dismiss the Tribe’s restitution claims, including those filed against Abettor Defendants Umpqua Bank and Umpqua Holdings Corp., Cornerstone Community Bank and Cornerstone Community Bancorp, Associated Pension Consultants and Patriot Gold & Silver Exchange, as well as others that allegedly assisted in the theft of Tribal funds. In addition, the Court provided the Tribe with an opportunity to amend its claims against the Abettor Defendants.

“The Court’s decision affirms the Tribe’s ability to pursue claims against all of the twenty-plus named defendants. This includes those who alleged to have directly participated in the RICO conspiracy, as well as those who assisted and benefited from it. To the extent the Court has asked the Tribe to amplify its allegations concerning some of those claims, we intend to do so,” said the Tribe’s co-counsel Andrew M. Purdy of the Joseph Saveri Law Firm, Inc.

In March 2015, the Tribe filed the lawsuit in federal court charging its former treasurer and three former senior officials with defrauding the Tribe of tens of millions of dollars in Tribal moneys. . The 200-plus page complaint alleges in detail that these four individuals used vote-rigging, bribery, and extortion to take control of the Tribe and its principal non-casino business entity during this far-reaching, decade-long scheme.

Also named in the lawsuit are individuals, including several family members of the four defendants, and businesses that participated in the conspiracy and/or aided and abetted the illegal activity. These include Umpqua Bank, Umpqua Holdings Corp., Cornerstone Community Bank, and Cornerstone Community Bancorp—all of which allegedly assisted the Ringleaders in their theft of Tribal moneys on deposit—as well as Garth Moore Insurance & Financial Services, Associated Pension Consultants, Inc., Haness & Associates, LLC, and their principals, who are alleged to have facilitated conversion of millions of dollars through unauthorized retirement compensation schemes. Additionally, Patriot Gold & Silver Exchange and its owner, Norman R. Ryan, are alleged to have substantially assisted defendant John Crosby in converting approximately $160,000 of the Tribe’s money through purchases of gold.

03/22/2017 UPDATE:

LOOK WHAT CRAWLED OUT FROM BENEATH THE BLARNEY STONE… dripping in flop sweat to try to make Green Box NA seem semi-legit to low-info locals and potential domestic & foreign fraud victims.

- Green Bay Press-Gazette: Green Box ready to emerge from bankruptcy by Jeff Bollier

A Chicago company’s $176 million reorganization plan for Green Box NA Green Bay would pay nearly $14 million in unpaid taxes and debts to untangle founder Ron Van Den Heuvel’s web of lawsuits and unpaid bills.

GlenArbor LLC, an investor in Green Box, has spearheaded efforts to pull the De Pere-based company out of bankruptcy since Van Den Heuvel sought protection from creditors in April 2016. Its plan calls for the creation of a new company that would secure the equipment, intellectual property and money needed to operate a complex system for recycling waste that typically ends up in landfills.

Green Box and two related companies under the new company’s umbrella, Reclamation Technology Systems and PC Fibre Technology LLC, would provide the equipment, technology, know-how, space and materials needed to convert food-contaminated paper products, plastics, tires and other materials into sanitized raw materials suitable for making new products.

Van Den Heuvel would retain an ownership stake in the revived venture, but he would not be involved in the company’s management, according to a reorganization plan filed in U.S. Bankruptcy Court for the Eastern District of Wisconsin.

When Green Box filed for bankruptcy, Van Den Heuvel listed less than $50,000 in assets and more than $10 million in debt. The company had been the subject of a string of lawsuits from unpaid creditors, including the Wisconsin Economic Development Corp.

[Ron Van Den Heuvel] is also scheduled for trial in July on federal bank fraud charges. Van De Heuvel, his wife, Kelly [Yessman Van Den Heuvel], and a banker [Paul Piikkila] are accused of a scheme in which they used employees and relatives to borrow more than $1 million from Horicon Bank in 2008 and 2009. The bank claimed it lost more than $750,000 on the loans.

[Paul Piikkila, who has already pled guilty and agreed to testify about Ron & Kelly Van Den Heuvel’s bank fraud schemes, was ALSO the Interim Controller of the Green Detroit Regional Center EB-5 Immigrant Investor Program that promoted Ron Van Den Heuvel’s Green Box NA Detroit LLC investment fraud scheme to foreign victims. “Employees & Relatives” of the Van Den Heuvel’s who were ‘straw borrowers’ include:

- Patrick Hoffman – Ron & Kelly’s son-in-law;

- Steven Peters – Ron’s employee and partner with Ron, Artley Skenandore, Jr. & OSGC in Nature’s Way Tissue Corp.;

- William C. Bain – Ron’s business partner in Ron & Bill Investments, LLC and Ron’s former brother-in-law;

- Julie Gumban – Ron & Kelly’s 2004-2010 live-in nanny from the Philippines who sued Ron & Kelly Van Den Heuvel – twice.

More info below about Kelly Van Den Heuvel’s actions to manipulate Julie Gumban.]

“They got everything pretty well lined up but it’s been so difficult because of everything swirling around it,” Green Box bankruptcy attorney Paul Swanson said. “It’s a great concept and I think we’ve demonstrated it could go and really be successful.”

[![]()

![]()

![]()

![]()

![]() ]

]

U.S. Bankruptcy Court Judge Beth Hanan laid out the terms of the reorganization in a Feb. 17 court filing. GlenArbor still has to secure funding to pay off claimants and launch the operation before the case can formally be resolved.

Stephen A Smith President & CEO of GlenArbor Partners Inc. & Registered Agent of RTS and Ecohub-USA LLC

GlenArbor’s Stephen A. Smith declined to comment until the agreement is made official. Van Den Heuvel also declined to comment.

Under the reorganization plan, Van Den Heuvel would retain ownership of 6.35 percent of Green Box and a 55.6 percent of Reclamation Technology Systems.

Green Box would focus on operating, servicing and selling machines that convert plastics and used tires into oil, black carbon, synthetic gas and other re-usable materials through a process called pyrolysis. Reclamation Technology Systems sorts and processes food contaminated waste to create pulp, tissue and other products. PC Fibre Technology owns the patent for that process.

[DOES IT REALLY NOW? SINCE WHEN?

• October 18, 2016 United States Trustee’s Objection to the Debtor’s Disclosure Statement, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay, LLC

6. According to the Disclosure Statement, the FDA approved the paper recycling process. However, although the process may be feasible, the Debtor has not provided any evidence that the process is profitable.

7. The Disclosure Statement provides that the patent for the technology needed to process food-contaminated waste was filed in 2011 but has not yet been approved. The Debtor states that approval of the process patent is not expected until 2017.

…WHOOPS!!! {UPDATE SEE BELOW FOR GBPG’s CORRECTION}]

Back to the Green Bay Puff Piece-Gazette:

Green Box would have a 30 percent stake in the new company created to bring together the disparate parts of the businesses. Green Box would use its share of the profits and revenue from pyrolysis operations to pay off nearly $1.1 million in unsecured claims against Green Box.

GlenArbor owns 3.75 percent of Green Box and 25.8 percent of RTS.

Building a new company

The bulk of the $176 million sought to fund the new company would build a new sorting facility, expand existing operations, connect various parts of the operation, pay off creditors and ramp up operations.

If financing can be secured, the new company has agreed to pay:

»$605,000 in delinquent property, payroll and unemployment taxes Green Box owed to county, state and federal agencies.

»$13.1 million to secured claimants owed a total of $24.3 million, and

»$270,000 in legal fees and other administrative expenses.

In exchange for the payments, investors agreed to give up claims to various machinery Van Den Heuvel offered as collateral to secure financing from various sources and transfer it to RTS and Green Box. The equipment is needed to operate the new company.

The Wisconsin Economic Development Corp. would receive $650,000 in exchange for giving up its security interest in some of the equipment in question, but it also agreed to defer repayment of the $1.1 million loan WEDC gave Green Box. The new company would assume responsibility for the loan.

The new company faces a March 31 deadline to finance all the disparate parts of the operation, though the deadline can be extended into the second quarter if necessary.

_________________

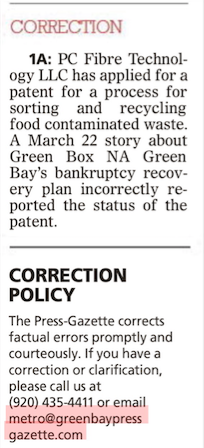

03/24/2017 UPDATE:

PRESS-GAZETTE PUBLISHED A CORRECTION AT THE ONEIDA EYE PUBLISHER’S REQUEST…

DESTROYING GBPG’s LUDICROUS FRONT PAGE ‘FAKE NEWS’ CLAIM THAT GREEN BOX NA IS “READY TO EMERGE FROM BANKRUPTCY”

PC Fibre Technology LLC has applied for a patent for a process for sorting and recycling food contaminated waste. A March 22 story about Green Box NA Green Bay’s bankruptcy recovery plan incorrectly reported the status of the patent.

Ya’ think?!

SO WHAT ‘PATENT’ DID OSGC SUPPOSEDLY

INVEST (at least) $2 MILLION IN…

ONLY TO LOSE (at least) $4 MILLION…

as stated in the Oneida Nation in Wisconsin’s

FY2012 and FY2017 Annual Reports to ONWI’s General Tribal Council?

They both say:

In Fiscal Year 2005, the Tribe approved $2,000,000 in the investment of Seven Generations to become a 20% owner in Nature’s Way (Glory LLC). Nature’s Way [Tissue Corp.] was a paper converting company that has ownership of a tissue patent. In FY2008, a $4,000,000 loss was written off due to the closing of Nature’s Way. Oneida Seven Generations is currently in litigation against Nature’s Way principals of the corporation.

IF PC FIBRE TECHNOLOGY, LLC HAS NEVER HAD A PATENT AS OSGC HAS CONTINOUSLY CLAIMED TO ONWI’s GENERAL TRIBAL COUNCIL…

NATURE’S WAY TISSUE CORP. & OSGC HAVE BEEN NOTHING BUT FRONTS FOR RON VAN DEN HEUVEL’s CRIMINAL FRAUD SCHEMES SINCE AT LEAST 2005.

TWELVE YEARS…

OVER $25 MILLION DOLLARS GONE…

BUT NOW OSGC & GBRE ARE SUING THE CITY OF GREEN BAY IN FEDERAL COURT CLAIMING “THE CITY INTENTIONALLY TRIED TO HARM OSGC” ?!?!

What GlenArbor LLC & Green Box NA investors should expect:

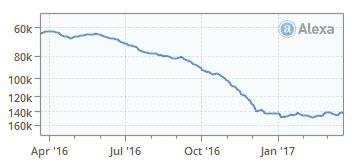

Kinda like the Press-Gazette’s Alexa.com Rankings:

- 03/10/2017 Wisconsin State Journal: Lawmakers reintroduce bipartisan bill to make WEDC fruad a felony by Matt DeFour

A bipartisan proposal making it a felony to defraud the Wisconsin Economic Development Corp. was reintroduced Friday, almost two years after the Wisconsin State Journal reported on a failed $500,000 loan to a Milwaukee businessman who lied on his application.

The bill, co-sponsored by Rep. Samantha Kerkman, R-Salem Lakes, and Sen. Dave Hansen, D-Green Bay, would make defrauding the state’s flagship job-creation agency a Class E felony punishable by up to 10 years in prison and five years of extended supervision and/or a $50,000 fine. Offenders and their companies would also be ineligible for WEDC benefits for seven years and could be liable for damages.

A similar bill passed the Assembly last session but never received a hearing in the Senate Committee on Economic Development, Commerce and Local Government. The previous chairman of that committee, former Sen. Rick Gudex, died last year. His successor, Sen. Dan Feyen, R-Fond du Lac, didn’t respond to a request for comment.…

The State Journal reported in May 2015 that WEDC had given a $500,000 loan to a struggling Milwaukee construction company in 2011 without a thorough review and at the urging of Gov. Scott Walker’s top aides, including then Administration Secretary Mike Huebsch. …

The company had been sued three times in the previous five years, though owner William Minahan claimed in an application for $4.3 million in WEDC funds it faced no lawsuits. Minahan also misrepresented the extent of his partnership with a La Crosse company and UW-Milwaukee.

Minahan had stiffed creditors, including a luxury car dealership that leased him a Maserati, and told them he could pay them back with money he was getting from the state. The loan was supposed to fund a business venture to make energy efficiency upgrades to credit unions.

WEDC successfully sued Minahan’s now-defunct company Building Committee Inc., but the loan has not been repaid. Minahan has not been charged with a crime.

In another 2011 case, the state loaned $1.2 million to Green Box LLC owned by De Pere-area businessman Ron Van Den Heuvel to help the company create 116 jobs as part of a more than $13 million project to turn fast-food wrappers and other waste paper into synthetic fuel and paper products while producing zero waste.

Van Den Heuvel, who now faces unrelated bank fraud charges, falsely told WEDC he hadn’t faced any lawsuits in the previous five years. A Brown County Sheriff’s Office investigator testified Van Den Heuvel used the money to pay off personal and business debts, such as Green Bay Packers box seats, trips to Las Vegas and $2,000 weekly alimony payments to his ex-wife.

When Walker and the Republican Legislature created WEDC in 2011, they didn’t create specific criminal penalties for defrauding WEDC similar to laws against bank fraud.

“unrelated”?

UNRELATED?!

NO MENTION OF BANK FRAUD CO-CONSPIRATOR PAUL PIIKKILA’S DUAL ROLE IN THE EB-5 IMMIGRANT INVESTOR FRAUD SCHEME OFFERING OF GREEN BOX NA DETROIT, LLC?

DESPITE THE FACT THE SECURITIES & EXCHANGE COMMISSION HAS SAID THE FOLLOWING IN COURT FILINGS:

- November 16, 2016 Objection of the United States Securities and Exchange Commission (SEC) to Debtor Green Box NA Green Bay LLC’s Proposed Plan and Disclosure Statement, filed by Senior Bankruptcy Counsel Atty. Angela D. Dodd, SEC Chicago Regional Office, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay LLC

The SEC is currently investigating whether Ronald Van Den Heuvel, entities he founded or operated, or their officers, directors, owners, or employees, violated the antifraud provisions of the federal securities laws. The Commission is examining, among other things, whether Van Den Heuvel or others, including [Reclamation Technology Systems, LLC] and [GBNAGB], made misrepresentations to investors in the course of securities offerings, and whether money raised through offerings was misused. Part of this inquiry focuses on whether Van Den Heuvel and his companies, including RTS and Green Box NA Green Bay LLC, followed corporate formalities, or if they commingled the assets and liabilities of the various entities. …

Van Den Heuvel has been involved in several securities offerings relating to his “Green Box” paper-recycling process since 2012. [GBNAGB] and its parent company, Environmental Advanced Reclamation Technology HQ, LLC (“EARTH,” a/k/a Reclamation Technology Systems, LLC (“RTS”)) [f/k/a Nature’s Choice Tissue, LLC, formed in 2011], appear to be responsible for one set of offerings. In addition, another subsidiary of EARTH, Green Box NA Detroit, LLC (“Green Box Detroit”), appears to have participated in a different offering made to investors participating in the EB-5 immigrant investor program administered by the United States Customs and Immigration Service (“USCIS”). It also appears that EARTH offered several different types of guaranties of the EB-5 investments in Green Box Detroit, including guaranteeing, through Van Den Heuvel, the refund of EB-5 investors’ $500,000 investments should their visa application be denied. In addition, EARTH, through Van Den Heuvel, appears to have represented to EB-5 investors that it had pledged up to $40 million of its assets as security for their investments related to Green Box Detroit. …

NO MENTION IN THE WISCONSIN STATE JOURNAL NOR IN THE GREEN BAY PRESS-GAZETTE ABOUT $4 MILLION IN COMBINED WIDoC/WEDC LOANS TO OSGC & ONEIDA ENERGY INC. IN ORDER FOR OSGC & GBRE TO PERPETRATE THE EXACT SAME FRAUD SCHEMES AS JUST MORE OF RON VAN DEN HEUVEL’S MULTIPLE FRONT COMPANIES…

…DESPITE THE FACT THAT OSGC & GBRE ARE CURRENTLY SUING THE CITY OF GREEN BAY IN FEDERAL COURT IN DEFENSE OF RON VAN DEN HEUVEL’S FRAUDULENT CLAIMS?

CONSIDER THE FOLLOWING & DECIDE FOR YOURSELF:

BY BURYING THE LEDE & REFUSING TO FOLLOW LEADS…

ARE WI STATE JOURNAL & GREEN BAY PRESS-GAZETTE …

PURPOSEFULLY PUBLISHING ‘FAKE NEWS’?

- July 1, 2016 Paul Piikkila Plea Agreement in U.S. District Court, Eastern District of Wisconsin Case No. 16-CR-64, United States of America v. Paul J. Piikkila

The evidence to prove this charge comes from several sources. All involved personnel from the Horicon Bank and all individuals serving as straw borrowers to obtain loans have been interviews. Records have been obtained from the Horicon Bank and other banks which made loans for the benefit of Ron Van Den Heuvel, which loans from Horicon were used to repay. To avoid confusion between the two Van Den Heuvels, this offer of proof will refer to them as Ron and Kelly, respectively.

During the period of the scheme, Paul Piikkila was employed as a loan officer for Horicon Bank (hereinafter, “the bank”) working at the Appleton, Wisconsin branch. He had authority to make loans up to a $250,000 limit. Any loans he proposed above that limit needed to be approved by the bank’s Business Lenders Committee.

Ron is a member of a wealthy and prominent family in Green Bay. During the scheme, he represented himself to be a businessman in the Green Bay area. He operated and controlled at least seven business entities that he used interchangeably.

During the period of the scheme, Kelly Van Den Heuvel was the wife of Ron and was also the owner and operator of KYHKJG, LLC. She is still married to Ron.

In late 2007 or early 2008, Ron approached Piikkila about issuing loans from the bank to Ron or his business entities. All of the witnesses who know Ron characterize him as a charismatic individual who seems to have the ability to get other people to do what he wants. He often convincingly describes his grand plans for major businesses with will make all participants millionaires.

On or about January 17, 2008 Piikkila authorized a loan of $250,000 from the bank to RVDH, Inc., one of Ron’s business entities. Ron signed the business note for RVDH, Inc.

About two months later, on or about March 20, 2008 Piikkila proposed to the loan committee that the bank loan $7,100,000 to Source of Solutions, LLC, another of Ron’s business entities. Members of the loan committee, who were Piikkila’s superiors at the bank, did due diligence to look into Ron’s creditworthiness. They found that he had a number of judgments against him and that bankers at other banks which Ron had done business advised Horicon Bank against making any loans to Ron. As a result, the loan committee would not approve this loan. Piikkila tried to restructure it a couple of times but that did not change the committee’s decison. Piikkila’s superiors at the bank instructed him that the bank did not wish to make any loans to Ron or his businesses so Piikkila should not.

That led Piikkila to authorize a series of loans to other people for Ron’s benefit or the benefit of his companies. The paperwork on these loans was put together in a way that prevented the bank from realizing that Piikkila was authorizing these loans in violation of the instructions not to loan money to Ron or his businesses. It was also in violation of Piikkila’s loan limits. His first loan was to one of Ron’s entities, RVDH, in January of 2008 already reached Piikkila’s limit to loan to any one individual. The subsequent loans for the benefit of Ron through various straw borrowers drastically exceeded that limit.

Steven C. Peters – Ron’s employee, and bank fraud straw borrower, and a partner with Ron, Artley, and OSGC in Nature’s Way Tissue Corp.

The first such loan was on or about September 12, 2008, when Piikkila approved a loan of $100,000 to [Steven Peters.] [Steven Peters] was an employee of Ron’s at the time [and partner with Ron, Artley Skenandore Jr., and Oneida Seven Generations Corp. of the Nature’s Way Tissue Corp. fraud scheme that resulted in a $4,000,000 LOSS to OSGC]. These proceeds were immediately transferred to two of Ron’s business entities. [Steven Peters], who also obtained two other loans from Horicon for Ron, fully admits that he was recruited by Ron to be used as a straw borrower. He denies that he received any reward for doing so but did it as a favor for Ron who was his friend and employer. [Steven Peters] fully admits that he, Ron, and Piikkila all had the understanding that none of the money was going to him and that he had no obligation to pay back the loan since they understood that Ron was responsible for that.

On or about November 7, 2008, Piikkila authorized two separate loans to Kelly’s company, KYHKJG. One loan was for $250,000. The second loan was $70,000, therefore exceeding Piikkila’s loan limit.

On January 2, 2009, Piikkila approved a loan of $240,000 to [William C. Bain]. [William ‘Bill’ Bain] is a former business partner of Ron’s and a former brother-in-law. [William Bain] fully admits that he was recruited by Ron to be used as a straw borrower to obtain a loan in his name even though the money was not going to him and none of the responsibility for repaying the loans was on his shoulders since it was his understanding, and Piikkila’s, that Ron would be repaying the loan. All of the $240,000 was quickly disbursed. The large majority of it went to pay off earlier loan debts at other banks, either in Ron’s own name or in [William Bain]’s name because he had earlier served as a straw borrower to obtain loans for Ron at other banks. The money left over after these loan payments was used for personal debts of Ron’s.

On or about February 11, 2009, another loan was made to [Steven Peters] of $30,000. All of that money was quickly transferred to business entities belonging to Ron.

On or about May 15, 2009, a third loan was made to [Steven Peters]. It was for $129,958. That was meant to consolidate the amounts remaining due on the loans earlier obtained in the name of [Steven Peters].

On the same date, May 15, 2009, Piikkila approved a loan of $25,000 to [Juile Gumban]. [Julie Gumban] was a nanny for Ron and Kelly’s children. She comes from the Philippines and does not speak English well. The money borrowed in her name was immediately distributed to make a payment on the [Steven Peters] loan, make a payment on the [William Bain] loan, and to transfer money to Ron’s company, RVDH, and Kelly’s company, KYHKJG. [Julie Gumban] states that she was pressed to take out this loan by Ron and Kelly for whom she worked. It was her vague understanding that this money could be used by her to invest in Kelly’s company, but none of the money was used for that purpose. [Julie Gumban] states that Kelly brought her to the Ron’s office to sign the loan papers with Piikkila.

On or about September 11, 2009, Piikkila approved a loan of $240,000 to Source of Solutions [LLC]. The loan application was signed off on by [Debra Stary]. She served for years as an administrative assistant and jack-of-all-trades for Ron. The witnesses associated with Ron’s businesses all agreed that [Debbie Stary] had no real authority in the company and just acted at Ron’s direction. She was made an officer of Source of Solutions shortly before this loan was taken out. None of the money went to Source of Solutions. Much of the money was transferred to Ron’s other business entities. Some was used to pay for personal expenses of Ron and Kelly, including the Packers luxury box they regularly rented. Lump sum payments were made to employees, including $5,000 to [Debbie Stary]. Payments were made against the other Horicon loans. Piikkila was repaid for having personally covered a short-fall of Ron’s in a different account at Horicon Bank.

The last loan was on or about September 25, 2009 where Piikkila approved a $10,000 loan to Tissue Technology [LLC], another of Ron’s entities. $1,000 was deposited into the Tissue Technology account and the remaining $9,000 was taken out in cash.

A number of categories of evidence tend to prove that Ron acted with fraudulent intent by obtaining these loans through the submission of information he knew to be false.

Of course, he had a motive since these practices allowed him to obtain large quantities of money which he could use for his own purposes. All of the witnesses agree that Ron and Kelly Van Den Heuvel lived a high-end-life style including an expensive house, another residence in Florida, expensive automobiles, a live-in nanny, expansive use of credit cards, and a private plane. all this despite little evidence of actual business activity by any of Ron’s business entities.

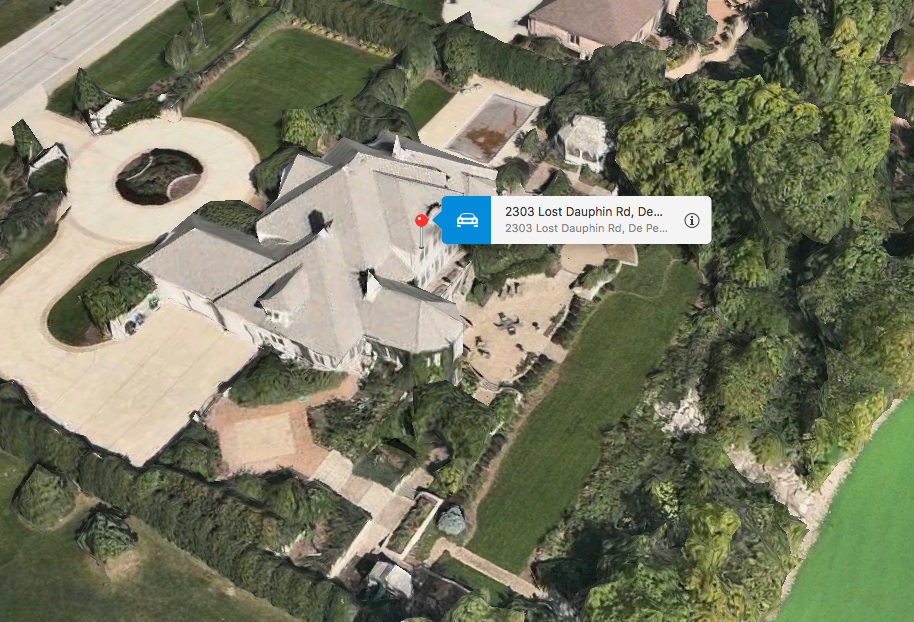

Ron & Kelly Van Den Heuvel’s criminal lair

The reason for obtaining the loans through straw borrowers was apparent from the circumstances. It had to be done that way because the bank would not loan any money to Ron or his entities. So, it was necessary to put the loans in the names of the straw borrowers, always at amounts of $250,000 or less so that Piikkila did not need to obtain authorization from his superiors at the bank.

The straw borrowers all state that Ron caused them to serve in the role as straw borrowers and that it was all done with Piikkila’s knowledge. On the [Bill Bain] loan, there is even a written proposal from Ron to Piikkila about the terms which should be used for that loan.

The fact that Ron was responsible for these loans, rather than the straw borrowers, is supported by the fact that whatever collateral was offered as security for these loans was collateral owned or controlled by Ron, not the straw borrowers.

Once the bank started to try to collect on this collateral after there was default on the loans, the bank representatives learned that the collateral was often inadequate as security for the loans. Property was not worth what it was represented to be worth. Properties were already encumbered such that the bank had inferior position in terms of foreclosing on certain properties. Ownership of some of the collateral was in dispute and it appears that Ron pledged collateral that he did not necessarily own.

Each of the loans was purportedly for some general business purpose such as the purchase of equipment or operating capital. However, the loan proceeds consistently went to pay off old loans, often obtained by the straw borrowers for Ron’s benefit, or to pay off Ron’s personal expenses, not any stated business purpose.

There are various written and oral communications from Ron after the banks started looking into collecting on these loans which show that he acknowledged responsibility for repayment, corroborating the point that these were really his loans, not those of the straw borrowers. That includes email that Ron exchanged with various bank personnel and the straw borrowers, talks he had with invdividuals tasked by the bank to collect on the loans, and a written repayment agreement he had with [Steven Peters] acknowledging Ron’s responsibility to repay [Steven Peter]’s loans. [William Bain] communicated with Ron about settling his debt to the bank. All of the memo lines on the various [Bill Bain] checks which went to pay off earlier loans refer to the payment of Ron’s earlier loans or notes. Prior to the Source of Solutions loan, Ron and Piikkila exchanged emails making it plain that Ron was the true applicant for that loan.

Other apparent misleading information provided by Ron to [Paul] Piikkila and put into [Horicon Bank]’s records included grossly inflated financial statements. [Julie Gumban] had come to this country and had been working as a nanny for Kelly and Ron. Her financial statement claimed that she had assets of nearly $280,000, including $208,000 in real estate. It claimed that she had salaries and bonuses totalling $65,000 a year. However, she states that Ron and Kelly were not really paying her and were months behind in her salary.

As a guarantor for the January, 2008 loan of $250,000 to RVDH, Ron submitted a financial statement to Piikkila. That financial statement included assets of more than $115,000,000, a net worth of more than $94,000,000, and an annual income of $2,320,306. The evidence in this case is full of instances in which Ron failed to pay various debts for which he is responsible. That would indicate that this financial statement is dramatically false. If it is true, Ron was failing to repay amounts he easily pay just from money he claimed to have in various cash accounts.

Kelly Van Den Heuvel culpably participated in the scheme, especially as to the loans to KYHKJG and [Julie Gumban]. Of course, she shared Ron’s motive for acquiring money to maintain their lifestyle.Kelly Yessman Van Den Heuvel – Ron’s wife and his Co-Conspirator, and the Registered Agent of KYHKJG, LLC, and KYHK, LLC, and HHK, LLC, and HHKRK, LLC. [Smells like a bunch of B.S.]

As for the [Julie Gumban] loan, it seems that Kelly [Van Den Heuvel] was primarily responsible for that one. [Julie Gumban] states that Kelly is the person who physically brought her into Ron’s office to close that loan with Piikkila. Kelly told Piikkila that [Julie Gumban] was paid $50,000 a year but [Julie Gumban] says she was not being paid and, in fact, Kelly was running up debts on [Julie Gumban’s] credit cards. Prior to the issuance of the loan, Piikkila was communicating by email with Kelly about how the money was going to be disbursed. As noted above, none of it was disbursed for the benefit of [Julie Gumban]

The purposes of the [Julie Gumban] loan were misrepresented in the bank’s records. [Julie Gumban] was supposedly to invest in KYHKJG [LLC] but none of the money was used for that purpose.[Julie Gumban] agrees that Kelly asked her to take out the loan to invest in KYHKJG.

[Julie Gumban] agrees that her financial statement was false and she did not know where the money went.

With the exception of the [Julie Gumban] loan, which paid off the proceeds of the Source of Solutions [LLC] loan, none of these loans were paid off. After attempting to use the collateral to collect the amounts due, the bank wrote off all the loans except the [Julie Gumban] loan for a total loss of approximately $553,000.

This information is provided for the purpose of setting forth a factual basis for the plea of guilty. It is not a full recitation of the defendant’s knowledge of, or participation in, this offense.

- November 16, 2016 Cliffton Equities, Inc.’s Objection to Debtor Green Box NA Green Bay LLC’s 1st Amended Disclosure Statement, filed by Atty. Brittany S. Ogden, U.S. Bankruptcy Court, Wisconsin Eastern District Docket No. 16-24179-beh, Chapter 11, Green Box NA Green Bay LLC

First, the Debtor states that it has a pending patent, serial number 13/385,218 which was filed in February 2011. This appears to be the application for which [Ron Van Den Heuvel] had applied. (See Amended Disclosure Statement), … However, the Debtor cannot have intellectual property rights in an application; only a granted patent vests such rights. Indeed, the Amended Disclosure Statement conjectures that “it is expected that the final process patent will be issued sometime in 2017.” … Thus, the Debtor does not actually have any intellectual property rights and it cannot assert any corresponding value to the estate, as there is no value in an application for a patent.

Second, this particular application appears to have been rejected several times. There is no specific information listed in the Debtor’s bankruptcy about which steps it has taken to renew its application in this patent and why this time it is likely to be granted a patent.

The Debtor also lists Patent Number 6,174,412 B1, which refers to processes related to tissue manufacturing and the conversion of cotton. The Debtor’s information related to alleged intellectual property rights is insufficient and paints a thoroughly incomplete picture about the Debtor’s intellectual property. …

13. Your affiant met with a citizen witness, Daniel H. Thames…who provided information and a written statement. Your affiant learned from Daniel H. Thames that through the course of his employment with [GBNAGB] he performed various office and accounting tasks. Through his employment at [GBNAGB], Thames observed that [RVDH] would take investors’ money and use the money to pay personal bills. Thames said [RVDH] instructed Thames to list certain expenditures in such a way as to mask the true use of the various payments. Thames witnessed [RVDH] receive foreign investor money through a federal EB-5 program. The invested money would be deposited into an account for a related entity, Green Box NA Detroit LLC.

14. According to information from Thames and other witnesses, similar to [GBNAGB], Green Box NA Detroit, LLC, is represented as an operating entity, but in fact, it does not have any existing production or even any actual physical location in or around Detroit. Thames is aware of the nature of representations being made by [RVDH] to his investors, and specifically is aware that [RVDH] represents that the Green Box facilities are operational, when in fact, there is no operating Green Box facility, nor does the technology behind Green Box’s purported business model function as represented by [RVDH].

15. Thames indicated that once money was deposited into the Green Box NA Detroit account, [RVDH] would order the subsequent disbursement of the foreign investor money into [RVDH]’s personal account from which [RVDH] paid for his ex-wife’s house in Savannah, Georgia. Thames said [RVDH] used foreign investor money to pay for a Green Bay Packers Stadium box. Thames said [RVDH] would get behind in his alimony payments to his ex-wife. He is ordered to by $2,000.00 per week. When threatened with court action, [RVDH] would use EB-5 money to get current with the alimony payments. Thames said he was instructed by [RVDH] to e-mail the lady at the bank, instructing her to transfer funds from the account where the investors’ money had been deposited to accounts other than that of the investors’ intended entity. Thames said [RVDH] would use EB-5 money to pay for insurance for his current wife and children. Thames told me that [RVDH] would write checks out from the business account of Green Box in an employee’s name and ask that employee to go to the bank, cash the check, and bring the cash back to [RVDH]. [RVDH] would use the cash for personal purchases and, for example, a trip to Las Vegas.

16. Thames witnessed [RVDH] give tours to potential investors, and [RVDH] would make statements which are false, including stating the Green Box process is a fully functional process with fully functioning facilities across the USA, when there are none. …

18. Thames said prior to October 2014, membership units in Green Box had no specific value.

19. Thames stated that he saw a year-end financial statement which showed that [RVDH] owes VHC, Inc., and other Van Den Heuvel family-owned businesses approximately $115,000,000. Thames identified people and businesses listed on the [RVDH] presented in civil courts showing how Marco Araujo’s investment of $600,000 was spent. Of the $600,000, at least $280,000 was used for [RVDH]’s personal expenditures. Thames has seen tangible evidence of the aforementioned information on the shared drive of the office computer at 2077 Lawrence Drive, Suites A and B, City of De Pere, Brown County, Wisconsin. …

27. On June 24, 2015, your affiant conducted an internet of Tami Phillips…who provided information verbally, and in the form of a statement. In that statement Phillips indicated that she began working for [RVDH], at E.A.R.T.H. and Green Box, in December 2010.Phillips left for a time but returned in April 2012 and worked in the Green Box offices at 2077 Lawrence Drive, Suites A and B. While working as an accountant for Green Box, Phillips was instructed by [RVDH] to document financial entries on a balance sheet with numbers [RVDH] quoted to her. Phillips said she knew the numbers were not real because there was no actual business or product being produced by Green Box or E.A.R.T.H. at any time. …