Mao Peng, led tax-evading luxury car export scam in which at least 22 Native Americans were straw buyers or identity theft victims.

BACKGROUND:

- March 6, 2015 Criminal Complaint & Affidavit in Support, U.S. District Court, Eastern District of Wisconsin, Case No. 15-MJ-1812, United States of America v. Mao Peng re: Native American straw buyer / luxury cars tax avoidance fraud schemes

[See text below]

- May 29, 2015 Information / Background Allegations To All Counts, U.S. District Court, Eastern District of Wisconsin, Case No. 15-CR-113, United States of America v. Mao Peng

Below are updates to Oneida Eye’s December 14, 2014 post about the Milwaukee Journal Sentinel’s reporting, Secret Service Eyes Kenosha Couple & Oneida Tribe Members In Money Laundering Car Scam.

From the Milwaukee Journal Sentinel:

The order by U.S. District Court Judge J.P. Stadtmueller is the latest development in the case, in which straw buyers purchased and exported more than 400 luxury cars worth nearly $30 million to China and Korea. The Milwaukee Journal Sentinel first reported on the investigation in December.

At the center of the scheme is Mao Peng, 25, a Kenosha man who fled to China with his wife, Min Ai, more than two years ago — around the time the Secret Service seized 31 vehicles owned by Peng or his Longen Trading company. The couple were arrested in March in a Los Angeles Chinese restaurant shortly after they returned to the United States.

Peng is being held without bail and Ai is free on a signature bond. Both are charged with felony wire fraud in U.S. District Court in Milwaukee; Peng also is charged with identity theft.

Peng and Ai are accused of using about 22 American Indians, including members of the Oneida tribe, as straw buyers to purchase 154 luxury cars for $9.1 million “when in fact Peng’s and Ai’s Longen Trading was the true buyer,” according to an affidavit by Special Agent Jeffery Ferris of the Secret Service. Longen Trading and Peng avoided more than $500,000 in state and local taxes because tribal members do not pay those taxes if they live on a reservation and the product is delivered to the reservation, prosecutors say. At least two of the tribal members did not give Peng permission to use their identities, Ferris noted.

- June 29, 2015: Seized luxury cars to be auctioned today

Officials hope to generate enough money from the auction to pay the $515,000 to the state and to deposit additional funds in the U.S. Treasury’s forfeiture fund. The tax money is owed because federal prosecutors say Peng sometimes used Oneida Indians as straw buyers in order to avoid paying state taxes.

- October 29, 2015: Kenosha man sentenced to prison for car export scheme

Mao Peng, the Kenosha man who masterminded a scheme to export hundreds of cars to China while evading more than $500,000 in states taxes, was sentenced to 27 months in federal prison this week.

U.S. District Court Judge J.P. Stadtmueller also ordered Peng, 26, to pay more than $515,964 restitution. In addition, the government will keep $1.2 million and 29 luxury cars it seized form him more than two years ago. …

The scheme, which operated out of a small Kenosha warehouse, involved using straw buyers who purchased the cars while signing documents pledging they were being bought for personal use and would not be exported. Among his straw buyers were members of the Oneida tribe who used their standing as tribal members who lived on the reservation to not pay Wisconsin state taxes on the purchases.

From the Green Bay Press Gazette:

- Friday November 6, 2015: Gas drive-offs linked to illegal car sales

Mao Peng, 26, of Shorewood was sentenced to three years in federal prison and ordered to pay more than $500,000 in restitution in the case. He was guilty of conspiracy to commit wire fraud, identity theft and misuse of the U.S. Automated Export System in a scheme designed to evade sales taxes on millions of dollars’ worth of luxury vehicles he illegally exported to China, according to court records.

Peng either recruited or stole the identities of Native Americans to take advantage of their exemption from sales taxes and used the “straw buyers” either with or without their permission to conceal his purchases from dealers barred from selling vehicles for export.

The buyers purchased 154 luxury vehicles for $9.1 million, according to the government. At least 70 of the vehicles were purchased without the buyers’ knowledge, through identity theft, government records say.

Peng evaded about $516,000 in state and local taxes through the scheme, according to the government. …

“How we became involved was we were investigating a rash of gas drive-offs, believe it or not,” said [Green Bay Police] Det. Lt. Gary Richgels.

Detectives pouring over gas station security video in 2013 noticed an unusually high number of luxury cars involved in gas drive-offs between January and August 2013, Richgels said. …

Through investigation, police learned the man’s identity, that he was from Oneida, was age 36 and was a low-level criminal with a lengthy burglary record. Eventually, Green Bay investigators linked up with state and federal agents, who connected the vehicles with Peng’s operation. …

Oneida police also were involved in the investigation, and Oneida tribal members were among those recruited or had their identities stolen for the purchases, according to court records.

One man, identified in Peng’s criminal complaint as “O.A.,” told investigators Peng recruited him to use his Oneida tribal tax exempt status to buy vehicles and also to try to recruit other tribal members to do the same. O.A. said he believed the operation was legal but later learned Peng had bought vehicles under O.A.’s name without telling him.

In one case, a vehicle had been purchased in his name in Michigan while O.A. was confined to jail, court documents say.

That led him to suspect Peng’s operation was illegal, and he cut all ties to it, court records say. O.A. told investigators he knew of about 20 other Native Americans who had been tricked into believing the straw purchases were legitimate.

‘Tricked’? Yeah, right.

Treated to some fast cash, more like, although any actual identity theft by other Tribe members and Tribal employees is obviously very disturbing for possible victims, and Oneidas who were not involved in the scam have reported that local car dealerships had refused to sell them vehicles during the Secret Service’s investigation into purchases that had been made in the Green Bay area.

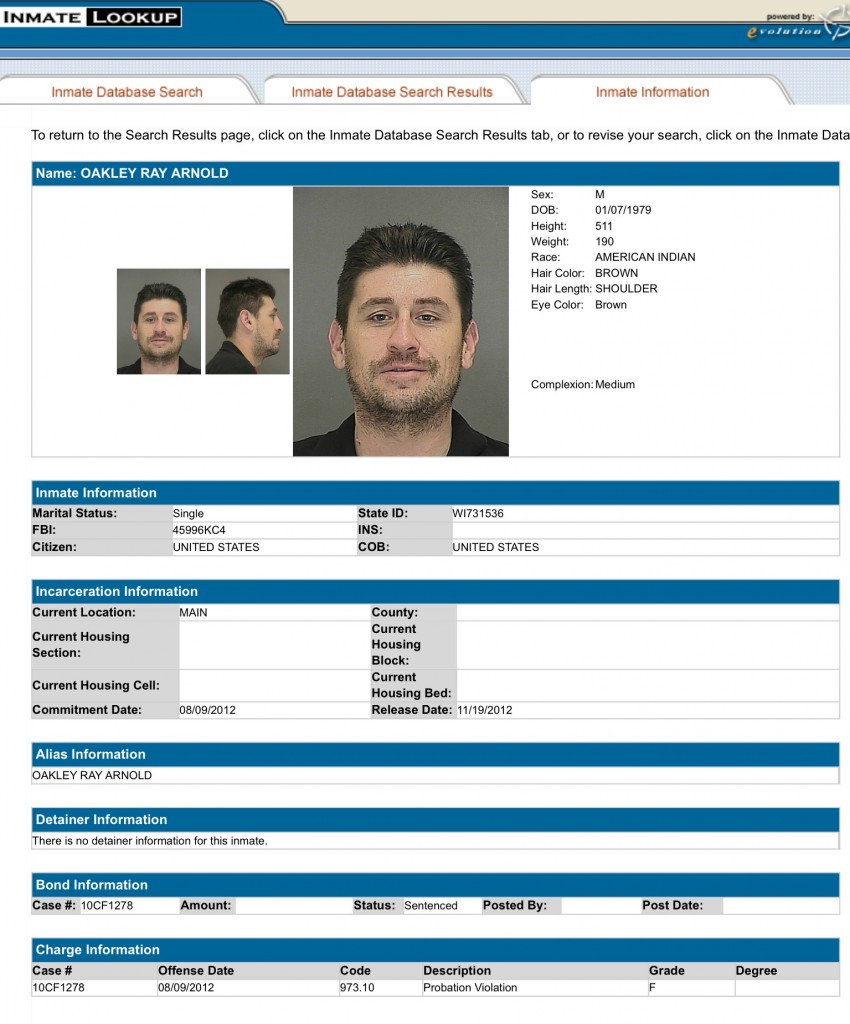

Oneida Eye has learned that several Oneida Tribe members believe that “O.A.” is 36-year-old Tribe member Oakley Arnold whose middle-name is listed in records as ‘Ray’ and ‘Rae’, and whose Wisconsin Circuit Court Access rap sheet includes convictions for ‘Theft’ as far back as 1996.

Oakley Arnold was also convicted in Brown Co. Case 2010CF1278 for ‘Negligent Handling of a Weapon’ and ‘Disorderly Conduct’ for which he served jail time, on January 10, 2011, the following was ordered:

No contact with victim. Per 12/02/11 Court Order, [Oakley Arnold] may have inadvertent, non-physical and non-verbal contact with Jonas H. during employment at the Oneida Casino.

Records in that case also show that his probation was eventually revoked on October 1, 2012, and he was sentenced to jail for 8 months.

It is believed that Oakley Arnold was most recently working as a Parking Valet at the Oneida Casino.

An active warrant for ‘Operating While Revoked’ was recently issued for Oakley Arnold on October 23, 2015, in Brown Co. Case No. 2015CT1386.

If Oakley Arnold’s driver’s license was suspended & revoked, how could he have been approved by the Oneida Gaming Commission to access & operate customers’ vehiciles as a Parking Valet? Did the OGC drop the ball, or was it the Oneida Gaming Personnel Services Dept. and/or the Oneida Human Resources Dept.?

(Or was Oakley Arnold given special treatment? His maternal Aunt is Fmr. Oneida Appeals Commissioner Sandra Skenadore, which makes Oakley Arnold the ex-nephew-in-law of current Oneida Judiciary Chief Justice Gerald ‘Jerry’ Hill)

Oneida Tribe members wonder if employees of the Oneida Casino or of Oneida Retail may have been actively involved with Oakley Arnold in Mao Peng’s scam, or if Oneida Tribe members, employees and customers were victimized as a result of Oneida Casino & Oneida Retail employees’ actions.

If you have information, contact the Green Bay Police or the Brown County or Outagamie County Sheriff’s Department.

- March 6, 2015 Criminal Complaint & Affidavit in Support, U.S. District Court, Eastern District of Wisconsin, Case No. 15-MJ-1812, United States of America v. Mao Peng re: Native American straw buyer / luxury cars tax avoidance fraud schemes

Background

1. I am a Special Agent with the United States Secret Service (“Secret Service”), and have been so employed since 2011. I am currently assigned to the Milwaukee Resident Office. My duties as a Special Agent with the Secret Services include investigating financial crimes such as identity fraud, check fraud, credit card fraud, bank fraud, wire fraud, currency-counterfeiting offenses, and money laundering. During my employment with the Secret Service, I have conducted several investigations that have resulted in seizures of criminally derived property, including monetary instruments.

2. As a Special Agent, I have conducted investigations into wire fraud, money laundering, and other complex financial crimes. In the course of those investigations, I have used various investigative techniques, including reviewing physical and electronic surveillance, conducting undercover operations, obtaining and reviewing financial records, and working with cooperating sources of information. In the course of those investigations I have also become familiar with techniques that criminals use to conceal the nature, source, location, and ownership of proceeds of crime and to avoid detection by law enforcement of their underlying acts and money laundering activities.

3. All the information contained in this affidavit is based on my personal knowledge, including what I have learned through my training and experience as a law enforcement officer, my review of documents and other records obtained in the course of this investigation, and information I have obtained in the course of this investigation from witnesses having personal knowledge of the events and circumstances described herein and from other law enforcement officers, all of whom I believe to be truthful and reliable. Because I am submitting this affidavit for the limited purpose of establishing probable cause for issuance of a criminal complaint, I have not included every fact I know about this investigation.

4. I make this affidavit in support of criminal complaints against:

a. Mao Peng (DOB 09/XX/89), charging Peng with conspiracy to commit wire fraud, in violation of 18 U.S.C. § 1349, and conspiracy to commit identity theft, contract to 18 U.S.C. § 1028(a)(7), all in violation of 18 U.S.C. § 371; and

b. Min Ai (DOB 10/XX/89), charging Ai with conspiracy to commit wire fraud in violation of 18 U.S.C. § 1349.

Introduction

Overview as to why Peng and his co-conspirators sought to purchase luxury vehicles, for export, using straw buyers

5. According to financial records obtained in this investigation, Mao Peng (“Peng”), his wife Min (“Ai”), and a company they controlled began purchasing luxury vehicles via straw buyers for export to China and elsewhere in October 2011 and continued doing so through approximately June 2014.

6. Peng initially purchased vehicles for export himself on the false and fraudulent pretenses that he was not purchasing the automobiles for other persons or entities and that he did not intend to export the automobiles from the United States.

7. In the course of this investigation, I have learned that after BMW, Mercedes, and Porsche manufacturers learned that Peng had exported vehicles that Peng had purchased from their dealerships, all three of those manufacturers placed Peng on “Auto-Exporter” lists, which prohibited dealerships from selling new automobiesl to Peng.

[Footnote: Many automobiles manufacturers maintained an “Auto-Exporters” list, which is updated regularly, and which is accessible by their dealers. The list includes names of individuals, their associates, and companies identified as having been engaged in the export of luxury vehicles from United States. Luxury automobile manufacturers typically require their dealers to confirm that a prospective vehicle purchaser’s name is not on the list and prohibit their dealers from selling a vehicle to a person on the list.

8. After BMW, Mercedes, and Porsche had prohibited Peng from purchasing new automobiles himself, Peng created a shell company, Longen Trading Limited Liability Company (“Longen Trading”).

9. According to records I obtained from the State of Wisconsin, Longen Trading was registered as a domestic limited liability company in the sate of Wisconsin on or about December 21, 2011. Peng is listed as the registered owner of Longen Trading, but, in a statement to law enforcement agents in connection with making a stolen vehicle report, Ai has described herself as a co-owner of Longen Trading. Until at least February 19, 2014, Longen Trading conducted business at 9508 70th Street, Kenosha, Wisconsin, and at 5647 77th Street, Kenosha Wisconsin. In a Longen Trading bank application dated September 10, 2013, Longen Trading reported $12,000,000 in gross revenue and $1,000,000 in annual profits.

10. Peng began recruiting persons as straw buyers to facilitate his purchases of new luxury automobiles. According to witness statements, Peng recruited coconspirators Y.D [Yuxlan Du], T.S., and J.K., both to serve as straw buyers themselves and to recruit others, including Native Americans residing within Wisconsin and New York, to serve as straw buyers to help Peng, Ai, and their co-conspirators fraudulently purchase luxury vehicles for export purposes.

11. Business records that I obtained in the course of this investigation reflect that Peng and Y.D. [Yuxuan Du] created other shell companies, CN-Mart Limited Liability Company (“CN-Mart”) and DYX Auto Mart Limited Liability Company (“DYX Auto Mart”). Peng and [Yuxuan Du] also conducted business as United Auto Purchasers (“UAP”) and United Auto Brokers (“UAB”) in order to disguise and conceal the true sources of funds and the purchasers of vehicles from persons in China.

12. Since in or about October 2011, Peng, Ai, and Du, acting through their companies, Longen Trading, CN-Mart, DYX Auto Mart, UAP, and UAB, purchased more than 400 new luxury automobiles, having a combined value exceeding $29 million, in the names of more than 100 straw buyers, on the false pretenses that the straw buyer was the true buyer and often on the false pretense that the vehicles were not being purchased for the purpose of being exported from the United States. In fact, Peng, Ai, and Y.D. caused or attempted to cause, substantially all the vehicles that they caused to be purchased through straw buyers to be exported from the United States to either China or Korea.

[Footnote: Automobile manufacturers generally have contractural agreements with their dealerships that new automobiles made for sale within the United Staes may not be sold to individuals or companies intending to export the new automobiles outside the Untied States. Dealerships, in turn, often require the purchaser of a vehicle to sign an “agreement not to export” under which the purchaser affirmatively represents that the purchaser is not purchasing the vehicle for export.]

13. Peng paid for the luxury vehicles purchased through the straw-buyer transactions using accounts controlled by Pent, Ai, and Du, including accounts held in the name of Longen Trading and CN-Mart.

14. Based on the facts and evidence set forth below, I submit that there exists probable cause to believe that, between in or about May 2012 and July 2013, in the Eastern District of Wisconsin and elsewhere, Peng, his wife Ai, Longen Trading, and others conspired to devise and execute a scheme to defraud state and local tax authorities and others, which scheme involved materially false and fraudulent representations as well as the use of interstate wire facilities, all in violation of 18 U.S.C. § 1349.

15. Specifically, between in or about May 2012 and July 2013, Peng, Ai, Longen Trading, and others conspired to engage in a scheme to defraud the State of Wisconsin and local sales tax authorities of sales taxes on the purchase, by Peng and Ai’s company Longen Trading, of approximately $9,132,106.94.

16. As a part of the scheme, Peng, Ai, Longen Trading, and others used as straw buyers persons who identified themselves as Native Americans and who, under appropriate circumstances, would have been exempt from paying sales taxes on vehicle purchases within the State of Wisconsin. Peng and Ai did so on the false pretense that the Native American straw buyer was the true purchaser of each of those 154 luxury vehicles when, in fact, Peng and Ai’s company Longen Trading was the true buyer of those luxury vehicles.

17. As a part of the scheme, Peng and coconspirators created email accounts in the names of some of the Native American straw buyers and used those email accounts to communicate to vehicle dealerships in a way that would deceive the dealerships into believing that the dealership was communicating with the named straw buyer. Peng, Longen Trading, and co-conspirators used these email addresses to transmit straw buyer’s driver’s licenses, Native American tax exemption documents, and in many cases, fraudulently created documents such as altered bank statements and altered vehicle insurance bearing the straw buyer’s personal identifying information, sometimes without those straw buyers’ knowledge and permission.

18. By using Native American straw buyers in connection with the purchase of those approximately 154 luxury vehicle purchase transactions, Peng, Ai, and Longen Trading evaded the payment of approximately $515,964.04 in state and local sales taxes, which Longen Trading, as the true buyer, was legally obligated to pay in connection with the purchase of each of those approximately 154 luxury vehicles.

Overview of Peng’s conspiracy to purchase luxury vehicles via identity theft

19. Based on the facts and evidence set forth below, I further submit that there exists probable cause to believe that, between in or about June 2012 and June 2014, in the Eastern District of Wisconsin and elsewhere, Peng and others conspired to engage in identity theft, contrary to 18 U.S.C. § 1028(a)(7), all in violation of 18 U.S.C. § 371.

20. Specifically, between in or about June 2012 and June 2014, Peng conspired with others to purchase approximately 71 luxury vehicles , having a total purchase price of approximately $4,212,945.06, using a means of identification belonging to another person, without that person’s knowledge or permission and without lawful authority, in connection with purchasing a vehicle via a transaction that involved wire fraud and that occurred in the affected interstate and foreign commerce.

21. As a part of the scheme, Peng used, or caused co-conspirators to use, a means of identification belonging to a past or prospective straw buyer, without that person’s permission, in order to purchase approximately 71 luxury vehicles when, in fact, Peng and a company that Peng controlled was the true buyer of those luxury vehicles.

22. As a part of the scheme, Peng and others conspired to purchase vehicles via such identity theft transactions at dealerships that did not require the purported buyer to be physically present at the dealership in order to consummate the vehicle purchase transaction.

23. Peng and a company he controlled then caused, or attempted to cause, those vehicles to be exported to China or Korea.

Facts supporting finding of probable cause that Peng and Ai conspired to engage in wire fraud scheme, involving the use of Native American straw buyers, to evade payment of sales taxes in connection with the purchase [of] luxury vehicles on behalf of Peng and Ai’s company Longen Trading

24. Peng and his co-conspirators recruited, or fraudulently used the identities of, approximately 22 persons, who had identified themselves to be persons of Native American descent, to serve as straw buyers, in connection with the straw purchases of approximately 154 vehicles, for the purpose of evading sales taxes in connection with straw purchases.

25. Sales of personal property that were actually made to a person of Native American descent who was an enrolled member of a federally recognized tribe to be exempt from state sales tax under Wisconsin law under some circumstances. According to the Wisconsin Department of Revenue’s Fact Sheet 2103, under Wisconsin law, sales of taxable products to a Native American are generally not subject to Wisconsin sales or use tax if: (a) the sales take place on the tribal members’s tribal reservation, and (b) the tribal member resides on that reservation. Likewise, where a Native American, who is an enrolled member of a Tribe and lives on that Tribe’s tribal reservation, purchases tangible personal property from a retailer that is located off the tribal reservation but that delivers the tangible personal property to the Native American purchaser on his tribal reservation, the purchase is not subject to Wisconsin sales or use tax because the Native American buyer takes possession of the tangible personal property on the tribal reservation.

26. To date, I have interviewed approximately 22 person who identified themselves as Native Americans regarding approximately 21 Native Americas in whose names, and using whose means of identification, were used in one or more luxury vehicle purchase transactions, for Peng or Longen Trading. Two of those Native Americans stated that they did not agree to serve as straw buyers for any luxury vehicle transactions even though their personal identification information was used for that purpose.

27. According to witness statements made in the course of those interviews, in connection with those straw purchases using Native American straw buyers, Peng and his co-conspirators caused the Native American straw buyers to falsely and fraudulently represent themselves to be the true buyers of the vehicle, and, in some cases, that they did not intend to export this vehicle, in order to compete the straw purchase.

28. In addition, according to those witness statements, Peng and his co-conspirators caused those Native American straw buyers to use their status as Native Americans living or purporting to live on a tribal reservation in order to fraudulently avoid payment of Wisconsin state sales taxes in connection with the straw purchase of the vehicle, which sales taxes otherwise would have been due and payable in connection with that sale.

29. According to cooperating co-conspirator J.K., beginning in or about May 2012, Peng specifically recruited Native Americans, and caused J.K. to recruit Native Americans, to serve as straw buyers as part of the scheme so that Peng could evade payment of sales taxes in the course of the straw purchases of the luxury automobiles.

30. During May 2012, according to documents seized during the February 2014 execution of the search warrants in this matter, Peng emailed J.K. documents for J.K. to use to recruit Native American straw buyers. According to seized documents, Peng also used ads on Craigslist to solicit Native Americans to serve as straw buyers and to contact Peng at the email account mpeng98@gmail.com, an account that I know Peng to have used from other evidence obtained in this investigation.

31. During May of 2012, according to both witnesses J.K. and O.A [Oakley Arnold], Peng, J.K., and [Oakley Arnold] met to discuss recruiting Native Americans to serve as straw buyers for the purpose of evading payment of Wisconsin sales taxes in connection with the straw purchase of luxury vehicles. During that meeting, Peng told [Oakley Arnold], a self-identified Native American, that using Native American straw buyers to evade payment of state sales taxes was legal. Peng also told [O. Arnold] that O.A. would receive “discounts” if he used his Native American tax exemption form to purchase cars and avoid WI sales taxes. Peng went further and told [Oakley Arnold] that if [Arnold] recruited other Native Americans to serve as straw buyers for Peng, it would work like a “pyramid scheme” in that Peng would pay [Arnold] money from each of those prospective straw buyers’ purchases. Peng promised to [Arnold] that all the vehicles purchased via the straw-buyer transactions would be retitles in the name of Longen Trading shortly after each straw-purchase.

32. J.K. stated that he knew of 13 Native Americans who had been recruited to buy luxury vehicles in their names to evade sales taxes of the purchases. Peng instructed the Native Americans regarding how to obtain a tax exemption certificate from their respective tribal reservation headquarters.

33. As noted above, the vehicles purchased by Native American straw buyers were supposed to have been delivered to the Native American reservation in order for that vehicle purchase transaction to appear, on its face, to qualify for a sales tax exemption. According to several cooperating witnesses, the vehicles were so delivered initially but soon thereafter Peng intercepted the vehicles before they were delivered to the reservations so that Peng could have the vehicles delivered to a port for export to China more expeditiously.

34. Several self-identified Native Americans who had served as straw buyers for Peng and whom I interviewed in the course of this investigation stated that Peng had promised them that he would re-title the vehicles that they purchased into the name of Longen Trading. Several of those witnesses further stated that they would never have purchased vehicles if they had known the vehicles were not going to be re-titles from their name.

35. However, evidence obtained during the February 19, 2014 searches of Peng’s and Ai’s residence and warehouse revealed vehicle titles from purchases dating back to 2012 tat were never used to re-title the vehicles even though some of the titles bore endorsements of straw purchasers, which endorsements reflected those straw buyers’ intention and belief that the vehicles were to be re-titles to Longen Trading.

36. Vehicle purchase record indicate that Peng and others caused at least 154 known luxury vehicles, valued at approximately $9,132,106.94, to be purchased by Native American straw buyers for Longen Trading. No sales taxes were ultimately charged in connection with at least 100 of those luxury vehicles transactions, according to records obtained in this investigation. Assuming that no tax was paid in connection with any of those 154 transactions, I estimate th athlete lost sales tax revenue would be $515,964.04.

37. I believe that all, or substantially all, of those 154 luxury vehicle transactions involved the use of interstate wirings in some manner, such as: wire transfers to make vehicle payments; interstate email correspondence, sometimes involving the use of accounts created in the name of straw buyers to deceive dealers in various states as to the identity of the party with which the dealership was communicating; and wire transfers originating from China, ultimately to bank accounts in Wisconsin, to fund the transactions.

38. Bank records indicate that Min Ai was involved in this wire fraud conspiracy to use Native American straw buyers to evade payment of sales taxes in connection with the straw purchase of luxury vehicles for Peng and Ai’s company, Longen Trading. Specifically, during fall 2012 records from Min Ai’s Chase Bank account ending in digits 2030 reflect that three sales-tax refund checks, which had been issued in the name of known Native American straw buyers, were endorsed “paid in the order of Min Ai,” bore Ai’s signature, and were deposited into her Chase account. Ai is the only authorized signer on the account.

39. Bank records also reflect that this Chase Bank account of Ai, ending in digits 2030, received transfers from Longen Trading accounts as well as other known auto-exporter accounts. Likewise, the account received incoming wire transfers from accounts in China, listed as “payments for tuition,” but which appeared to exceed the tuition that Ai was in fact paying at UW-Milwaukee tuition. For example, she received (3) wire payments totaling $140,000 over the course of one month during the fall 2012.

40. Min Ai’s Chase credit card ending 0368 was used from January 2013 to August 2013 to make down payments on vehicles purchased by Native American straw buyers. Min Ai was the only name on the account, and Peng had other accounts available to him for the down payments for purchases of vehicles. However, I do know from information that I obtained in the course of this investigation that Pend did sometimes use the credit card issued in the name of another person – namely, a credit card that had been issued to witness J.K., without J.K.’s knowledge or permission.

41. Peng, Ai, and Longen Trading were residents of Wisconsin at all material times were required to make sales tax payments to the State of Wisconsin at all material times were required to make sales tax payments to the State of Wisconsin on the purchases of vehicles for their benefit, eve if made through straw buyers.

Facts supports finding of probable cause that Peng conspired to engage in conspiracy to purchase luxury vehicles via identity theft

42. Between in or about June 2012 and June 2014, in the Eastern District of Wisconsin and elsewhere, Peng and others conspired to engage in identity theft, contrary to 18 U.S.C. § 1028(a)(7), all in violation of 18 U.S.C. § 371.

43. Specifically, between in or about June 2012 and June 2014, Peng conspired with others to purchase approximately 71 luxury vehicles, having a total purchase price of approximately $4,212,945.06, using a means of identification belonging to another person, without that person’s knowledge or permission and without lawful authority, in connection with purchasing a vehicle via a transaction that involved wire fraud and that occurred in and affected interstate and foreign commerce.

44. As a part of the scheme, Peng used, or caused co-conspirators to use, a means of identification belonging to at least 23 past or prospective straw buyers, without those persons’ permission, in order to purchase approximately 71 luxury vehicles when, in fact, Peng and a company that Peng controlled was the true buyer of those luxury vehicles.

45. According to many witnesses I have interviewed in the course of this investigation, in connection with some such identity theft-transactions, Peng or one of his co-conspirators obtained identification information and documentation, including copies of driver’s licenses, from prospective straw buyers or from persons who had served as straw buyers on prior occasions.

46. T.S. and J.K. also admitted that Peng and [Yuxulan Du] maintained identification documents, including copies of straw buyers’ driver’s licenses, and vehicle transaction paperwork in Peng and Y.D.’s “Dropbox” account.

47. According to [Oakley Arnold], Peng had a financial incentive to purchase luxury vehicles via identity theft, as opposed to using a straw buyer, because he could thereby avoid having to pay a fee – which typically ranged from $300 to $10,000 – for using the nominal buyer’s identity. Common sense also suggests that Peng would further benefit by avoiding having to recruit the straw buyer.

48. According to T.F., Peng and Y.D. identified and targeted dealerships that did not require the straw purchaser to be present for the purchase. Such dealerships were willing to simply send the vehicle purchase documents to Peng or [Yuxulan Du] for signature, in the name of the ID-theft victim which Peng or Y.D. would then sign and return to the dealership. For example, Peng and Y.D. targeted BMW of Lincoln, NE. They arranged with a salesman there to simply provide an ID theft victim’s driver’s license and tell the salesman to complete the vehicle purchase transaction in that person’s name.

49. Peng or one of his co-conspirators then telephonically contacted a dealership and provided the ID-theft victim’s personal means of identification, while purporting that victim to be the true buyer. They thereby tricked dealerships into believing that the dealership was speaking with the identified person, when in fact the dealership was speaking with Peng or one of his co-conspirators.

50. I know from transaction records I have obtained from auto dealerships and from email message I have obtained in the course of this investigation that Peng and his co-conspirators also created email addresses in the names of such unwitting straw buyers. Peng and his co-conspirators used these email addresses to communicate to dealerships across the United States, purporting themselves to be the true buyers of the vehicles. Often, the ID-theft victims’ government-issued identification card was emailed to the dealerships to finalize the purchase of the vehicle, without the victim’s consent.

51. During the execution of a search warrant at the Longen Trading warehouse on February 19, 2014, co-conspirator T.S. was found operating a computer using a program that reflected that he had been using twenty (20) different email addresses bearing others’ names to communicate with different dealerships. T.S. admitted Peng and T.S. had created and used email addresses created in the name of the straw buyer without telling them. They claimed they had to do this otherwise most dealerships wouldn’t allow the sale of the vehicles if they knew the true purchaser was [Mao] Peng or [Yuxulan] Du.

52. On those occasions, the dealership completed the vehicle purchase paperwork in the name of the ID theft victim whose means of identification Peng had already provided to the dealership, and the dealership then mailed the paperwork to an address requested by Peng. Peng or one of his co-conspirators then forged the signature of the ID theft victim on the vehicle-purchase documents and mailed those documents back to the dealership.

53. More than 23 persons interviewed in the course of this investigation have reported that they never signed paperwork or presented themselves at the dealership of rate purchase of the vehicles that Longen Trading then took possession of and either exported or attempted to export.

54. For example, ID theft victim [Oakley Arnold], a self-identified Native American who had served as a straw buyer had two vehicles purchased in his name while he was in jail between July 31, 2012, and September 4, 2012. His family would visit him in jail and tell him that he received dealership paperwork and license plates. A total of six vehicles were purchased using his means of identification without his permission. When shown vehicle-purchase paperwork for a purchase completed in his name on August 17, 2012, and using his means of identification, at a dealership in Farmington Hills, Michigan, [Arnold] confirmed that he had not authorized the transaction; that the signature on the purchase paperwork was not his; and that he had not traveled to Michigan to close on the purchase on that date because he was in jail.

55. Likewise, ID-theft victim A.S. originally saw purchasing vehicles for Peng and Y.D. as an opportunity to make extra money. After A.S. had provided his Illinois driver’s license to V.S., who recruited on behalf of Peng and co-conspirators, A.S. awaited further instructions. A.S. received a call from co-conspirator T.S> who said that a vehicle purchase was set up in his name at an IL dealership. A.S. got cold feet and decided not to go to the dealership to complete the transaction. But Peng and [Du] nonetheless bought the vehicle in A.S.’s name and without A.S.’s knowledge or approval. The dealership corresponded with Peng, who used A.S.’s name. When the dealership asked for signatures on certain documents, Peng directed them to Y.D.’s address, and the paperwork was forged in A.S.’s name without his knowledge or permission.

56. When US Customs seized the vehicle purchased in A.S.’s name along with another vehicle purchased by Peng and [Du] in the name of another victim, Peng emailed the dealership requesting the bill of sale for the two vehicles. The dealership responded by telling Peng that the dealership had sent those documents to the customers in whose name the vehicles had been purchased but provided Peng with the phone number of the Secret Service’s Milwaukee Office in case he had any questions. Shortly thereafter, Peng contacted me using one of Peng’s known phone numbers.

Examples of Statements of Native American Witnesses Regarding Peng’s Use of Them as Straw Buyers, and Peng’s Subsequent Unauthorized Use of these Witnesses’ Identities, to Purchase Vehicles Without Their Permission

Statement of Native American Straw Buyer [Oakley Arnold]

57. On February 24, 2014, Secret Service agents and Oneida Police Department officers interviewed O.A., the first Native American whom Peng had recruited through J.K.

58. O.A. stated that Peng had recruited O.A to buy new luxury vehicles for Peng. Peng told O.A. that Peng wanted O.A> to make those purchases without paying any sales taxes. Peng convinced O.A. that the scheme was lawful and told O.A. that O.A. would be issued tax forms that would enable O.A. to purchase the vehicles without paying sales taxes. Peng also told O.A. that the business operated “like a pyramid scheme,” in that if O.A. then recruited other Native Americans who did not have to pay sales taxes on vehicle purchases to serve as straw buyers, Peng would pay O.A. for recruiting those additional Native American straw buyers.

59. According to [Oakley Arnold], Peng directed O.A> to go to Oneida [Nation of WI]’s Reservation Office to secure tribal identities and tax-exemption forms that would enable O.A. to buy vehicles without paying sales taxes. Peng also directed O.A. to provide Peng with copies of O.A.’s Wisconsin driver’s license, tribal identification, and tax exemption form, all of which O.A. then provided to Peng. Peng then called dealerships around the country to secure purchase of vehicles in O.A.’s name. But, as described below, O.A. had not approved all those vehicle purchases.

60. [Oakely Arnold] learned that Peng had caused an email address to be created in O.A’s name and that Peng had used that email address to help arrange the purchase of new luxury vehicles from dealerships. Specifically, when O.A. was inside J.K.’s apartment, O.A. saw documentation with his email address on it. O.A. questioned J.K. about it, and J.K. told O.A. that Peng and J.K. had used those email accounts, opened in O.A.’s name to correspond with dealerships. Specifically, J.K. told [Oakley Arnold]: “What do you have to worry about, like you can correspond directly with dealerships” and “like you have anything to worry about on your information being used, your credit is horrible anyway.”

61. [Oakley Arnold] also learned that Peng had caused vehicles to be purchased in O.A.’s name without O.A.’s consent and that Peng had caused forged documents in O.A.’s name to be created without O.A.’s consent and that Peng had caused forged documents in O.A.’s name to be created without O.A.’s consent. Specifically, O.A. learned that, while O.A. was confined in jail, a vehicle had been purchased in O.A.’s name, without O.A.’s consent, in Michigan. O.A. stated that O.A. also had received license plates, titles to vehicles, and other vehicle paperwork, for other vehicles and from dealerships in various states even though O.A. had no knowledge of some of those vehicle purchases and even though O.A> had not consented to the purchase of those vehicles in O.A.’s name.

62. O.A. told Peng that O.A. did not believe Peng’s business to be lawful, and O.A. quit serving as a straw buyer for Peng.

63. O.A. stated that O.A. knew of approximately 20 Native Americans who had served as straw buyers for Peng who were tricked into believing the practice of straw buying was legitimate.

tatement of Native American Straw Buyer A.D.

64. On February 26, 2014, Wisconsin Department of Transportation Investigator James Bartnik, and I interviewed A.D. A.D. stated that, during 2012, Peng had recruited A.D. to serve as a straw buyer for Peng because, as a Native American, A.D. could purchase new luxury automobiles without paying Wisconsin sales taxes.

65. Peng’s co-conspirator, J.K., asked A.D. whether A.D. had any computer software that J.K. could use to forge documents. That request led A.D. to believe that the straw-buying scheme was fraudulent, so A.D. then quit serving as a straw buyer for Peng and J.K.

66. On one particular occasion, Peng and J.K. called A.D. to tell A.D. that Peng had set up a vehicle-purchase in A.D.’s name. Peng and J.K. kept increasing the amount of money they would pay A.D. to go to the dealership to sign for the vehicle, but A.D. refused. A.D. stated that Peng and J.K. then caused the vehicle to be purchased, in A.D.’s name but without A.D.’s consent, because A.D. later received vehicle information regarding the vehicle purchase in A.D.’s mail.

67. A.D. was shown paperwork regarding other vehicle purchases conducted in A.D.’s name. A.D. stated that the signatures on papers relating to the purchases were not A.D.’s signatures. A.D. stated that A.D. had purchased four vehicles on behalf of Peng, but A.D. now believes that Peng had caused other vehicles to be purchased in A.D.’s name without A.D.’s consent. In that regard, Wisconsin DOT records reveal that, as of January 2014, A.D. had eight 2013 Porsche and BMW vehicles titled in A.D.’s name and that none of those vehicles had liens.

Peng’s Unauthorized Use of Other Straw-Buyers’ Identities to Purchase Vehicles as Part of the Straw-Buyer and Export-Fraud Scheme and Conspiracy

Statement of Victim A.J.

68. Between February 24, 2014, and February 26, 2014, I interviewed approximately eight additional Native Americans who gave similar accounts of having been recruited by Peng to purchase vehicles. All eight Native Americans who had served as straw buyers for Peng stated that Peng had caused additional luxury vehicles to be purchased in their names without their consent.

69. Secret Service agents interviewed A.J. on March 6, 2014. A.J. stated that A.J. was a high school classmate of Peng. Peng had recently contacted A.J. about an opportunity to make money by purchasing luxury vehicles on Peng’s behalf. A.J. agreed and purchased a Range Rover LR4 from Fields Land Rover of Madison, Wisconsin, on January 24, 2014. A.J. stated that A.J. was paid $500 for this transaction.

70. But A.J. stated that A.J. did not know of any other deals that had been set up in his name. A.J. was unaware of the email address wiXXXXXX@gmail.com that had been used to communicate with luxury dealerships to arrange purchases of luxury vehicles in A.J.’s name. A.J. was unaware that A.J.’s Wisconsin deriver’s license had been sent using this email address to dealerships in attempts to purport A.J. being the true buyer. A.J. was provided a copy of the paperwork used to purchase a 2014 BMW X6, VIN ending in 10983, at the Husker Auto Group Inc., Lincoln, Nebraska. A.J. became upset and stated that A.J. had no knowledge of this purchase, that A.J. was not compensated for it, and that A.J. had not given permission to Peng, Y.D. or others acting on their behalf to purchase the 2014 BMW X6, VIN ending 10983, using A.J.’s personal identifiers, or to provide A.J.’s Wisconsin driver’s license to Husker Auto Group Inc. A.J. also stated that A.J. did not know the phone number of 608-776-8XXX, which was used on the vehicle purchase paperwork of the BMW X6, VIN ending 10983.

Statement of Victim A.S.

71. On March 17, 2014, I contacted A.S. A.S. stated that A.S. had been recruited by F.F., whom I know to have been recruited, in turn, by V.S. A.S. further stated that F.F. had told A.S. that A.S. could earn money quickly by purchasing vehicles on behalf of another person. A.S. provided F.F. with a picture of A.S.’s Illinois driver’s license, but A.S. stated that A.S. would have to think about the venture because it did not seem legal. Several weeks later, A.S. was contacted by V.S. who informed A.S. that a luxury vehicle purchase had been set up in A.S.’s name at a dealership in Peoria, Illinois. This alarmed A.S> because A.S. had not agreed to take part in any such purchase. A.S. was contacted by a male subject from the number 262-955-0XXX. The subject begged A.S. to follow through with the transaction, but A.S. refused. On or about March 13, 2014, A.S. received a vehicle title in the mail from Husker Auto Group Inc., indicating that A.S. was the owner of a BMW X6, VIN ending 11024.

72. A.S. stated that A.S. had no knowledge of this deal and had never consented for A.S.’s personal identification to be used to purchase a vehicle in A.S.’s name. A.S. confirmed that A.S. had never received any payment for any services from Peng or others working on Peng’s behalf. A.S. also stated that A.S. does not know the phone number of 630-667-3XXX, which was used on the vehicle purchase paperwork of the BMW X6, VIN ending 11024.

73. The phone number of 262-955-0XXX belongs to T.S. a known co-conspiritor of Peng’s, who provided his phone number to Secret Service agents on February 19, 2014.

Statements of Some Peng’s Co-conspirtors about Peng’s Conduct of the Straw-Buyer and Export Fraud Scheme and Conspiracy

Statement by Co-conspirator J.K.

74. On February 26, 2014, Oneida Police Department, Wisconsin Department of Criminal Investigations, Wisconsin Department of Transportation, and the Secret Service executed a state search warrant at the resident of Peng’s suspected co-conspirator, J.K.

75. J.K. was arrested for suspected violations of Wisconsin State Statutes 342.06 (Title Fraud), 342.32(1) (Counterfeiting Vehicle Titles), 943.201(1) (Identity Theft, and 939.31 (Conspiracy).

76. J.K. was advised of J.K.’s Miranda rights, which J.K. waived orally and in writing. J.K. agreed to speak with agents at the Oneida Police Department. During the interview, J.K. described Peng as greedy and willing to use any means possible to maximize Peng’s profits. Peng had multiple funding sources that Peng had used to purchase vehicles. Peng also used his own funds to buy new luxury automobiles via straw buyers for export to China.

77. J.K. stated that Peng had solicited J.K. to recruit Native Americans to serve as straw buyers because Native Americans did not have to pay sales taxes on purchases of vehicles. J.K. knew of 13 Native Americans who had been recruited to buy luxury vehicles in their names to evade sales taxes on the purchases. Peng instructed the Native Americans regarding how to obtain a tax exemption certificate from their respective tribal reservation headquarters.

78. Peng then contact, or caused a co-conspiritor such as J.K. to contact, auto dealerships around the country, either via email or telephone, in the name of the straw buyer, to arrange the purchases of vehicles. Straw buyers provided photos of their driver’s licenses to Peng or to one of Peng’s associates. Peng then created email accounts using a straw buyer’s identity. Peng or one of Peng’s associates then used that email account to communicate with dealerships under the pretense that Peng’s or the associate’s identity was that of the straw buyer.

79. J.K. received Chinese computer programs from Peng, which Peng told J.K. that Peng also used, to forge various documents, such as bank statements and vehicle insurance certificates. Peng provided these forged documents, or caused these forged documents to be provided, to auto dealerships in the names of straw buyers for the purpose of convincing the dealership to sell a vehicle to Peng on the false and fraudulent pretense that the straw buyer was the true purchaser.

80. In some cases, Peng forged vehicle insurance documents in the names of straw buyers, and provided those forged insurance documents to auto dealerships. According to J.K., Peng did so, at least in part because vehicle insurance was difficult to obtain for some straw buyers because some of them had poor driving records.

81. Peng told J.K. that, in order to export vehicles from the United States, Peng had forged vehicle titles that Peng then caused to be presented at the port with the vehicles Peng had caused to be purchased because the law requires that the vehicles title or the MSO accompany vehicles exported form the United States.

82. J.K. admitted that J.K. had conspired with Peng and straw buyer E.Z. to export to China a vehicle purchased through the straw-buyer scheme, and then report that vehicle as having been stolen to law enforcement and E.Z.’s insurance company. J.K. stated that J.K. did not know what Peng and J.K. would actually receive on the insurance claim for the vehicle, but J.K. stated that Peng and J.K. preliminarily estimated that Peng would receive $30,000 if the insurance company actually paid out the claim. J.K. stated that J.K. had spoken with E.Z. as recently as February 26, 2014 to help E.Z. prepare E.Z> for the deposition that E.Z. was to give on February 27, 2014, in connection with the false and fraudulent insurance claim that E.Z. had made on behalf of Peng, J.K., and E.Z.’s background in insurance adjusting.

Statements by Co-conspirator Y.D.

83. On February 19, 2014, Kenosha Police Department and Wisconsin Department of Criminal Investigations identified Y.D. and conducted a lawful traffic stop on the black 2012 Mercedes C300 bearing Wisconsin registration plate number 545VBY that [Yuxulan Du] was driving. Y.D. was detained pursuant to Wisconsin State Statute Sections 342.06 (Title Fraud) and 939.31 (Conspiracy).

84. [Yuxulan Du] was advised of his Miranda rights, which Y.D. waived orally and in writing. Y.D. agreed to speak with agents at the Kenosha Police Department.

85. Y.D. stated that Y.D. had met Peng four years ago and had started purchasing vehicles for Peng over two years ago. Y.D. bought the new vehicles at luxury dealerships for the purpose of exporting the vehicles to countries like China and Russia. Y.D. admitted that he had moved to Delaware and had continued purchasing vehicles for Peng in Delaware. Y.D. had difficulties purchasing vehicles in Delaware because most dealerships required financing. At Peng’s request, Y.D> moved back to the Milwaukee, Wisconsin area where Y.D. and Peng entered into a partnership.

86. Y.D. stated that Y.D. and Peng, through straw buyers, purchased new luxury vehicles from dealerships and sold the vehicles to “wholesalers,” where they wound up in China or Russia. Y.D> and Peng shared several bank accounts that received money from persons in China. The money was filtered through Peng’s Citi Bank account and then to other bank accounts of Peng and/or Y.D., or other trusted members of the group. Y.D. stated that this was the first time he was ever “busted” and that “it was a situation that was too good to be true, and probably something wrong with it.”

87. On March 3, 2014, [Yuxulan Du] contacted Secret Service agents. Y.D> stated that he never was a part of the Native American aspect of the scheme, and that scheme was all Peng’s doing. The dealerships did not allow deals to Native Americans that involved case purchases of specific model vehicles. Y.D. stated that three United States banks had shut Y.D.’s accounts down for money laundering. The money originated in China and was layered through many banks throughout the process. Y.D. stated that he had a bank account in China, but the account was not in Y.D.’s own name because Y.D> would have needed to be present to conduct certain transactions. Peng also had a bank accounts that Peng used in China.

Statements by Co-conspirator T.S.

88. On February 19, 2014, Secret Service agents executed a search warrant at the warehouse located at 5467 77th Street, Kenosha, Wisconsin.

89. Present at the location was T.S., whom agents had previously identified as a co-conspirator in the suspected straw-buyer and export-fraud scheme and conspiracy. T.S. was working on a laptop, which T.S. stated belonged to Peng, and was using an email program and over 10 different email addresses in the names of straw buyers to solicit vehicle dealerships.

90. T.S. was arrested for suspected violations of Wisconsin State Statute Sections 342.06 (Title Fraud) and 939.31 (Conspiracy).

91. T.S. was advised of T.S.’s Miranda rights, which T.S. waived orally and in writing. T.S. agreed to speak with agents at the Kenosha Police Department.

92. During the interview, T.S. admitted to being employed by Peng and Y.D. and to securing purchases of new luxury automobiles with the intention of exporting the vehicles to China. T.S. was recruited by Peng and Du, and participated in the scheme to fraudulently use straw buyers, false information, and false documents in order to purchase luxury automobiles on the false and fraudulent pretenses that the straw buyers were the true purchasers of the vehicles and that the vehicles were not intended for export.

93. T.S. further admitted that both Peng and [Du] had recruited T.S. to find Native Americans to serve as straw buyers because Native Americans did not have to pay sales taxes on the purchases of new vehicles and could thereby help evade the payment of sales taxes in connection with the straw purchases of luxury vehicles.

94. T.S. admitted that, in connection with the straw-buyer scheme and conspiracy, T.S. had created and used email addresses, tow to of which T.S. recalled being: stXXXXXXXX@gmail.com, in the name of J.S., and vaXXXXXXXX@gmail.com, in the name of V.S., both of whom are known straw buyers.

95. T.S. admitted that T.S. had used these email addresses to initiate and to engage in email correspondence with dealerships across the United States and in the State and Eastern District of Wisconsin while pretending to be J.S>., V.S., and other legitimate purchasers of vehicles. T.S. did so in order to facilitate the straw purchases of vehicles from those dealerships for the purpose of exporting those vehicles from the United States.

96. T.S. provided verbal and written consent for Secret Service to login into the vaXXXXXXXX@gmail.com account and T.S. provided the password to access it. As set forth below, I then accessed that account and confirmed T.S.’s statement that T.S. had used the vaXXXXXXXX@gmail.com to purchase vehicles using V.S.’s identity.

Conclusion

97. For the reasons set forth above, I submit that there exists probable cause to believe that Mao Peng (DOB 09/XX/89) has engaged both (a) conspiracy to commit wire fraud, in violation of 18 U.S.C. § 1348, and (b) conspiracy to commit identity theft, contrary to 18 U.S.C. § 1028(a)(7), all in violation of 18 U.S.C. § 371.

98. For the reasons set forth above, I further submit that there exists probable cause to believe that Min Ai (DOB 10/XX/89) has engaged in conspiracy to commit wire fraud, in violation of 18 U.S.C. § 1349.

See also: